Key Insights

The South America canned fruit market is projected for significant expansion, forecast to reach 661.49 million by 2025. This market is expected to witness a Compound Annual Growth Rate (CAGR) of 5.36% from the base year 2025 through 2033. Key growth drivers include heightened consumer demand for convenient, ready-to-eat food solutions, the appeal of preserved fruits for extended shelf life and year-round accessibility, and rising disposable incomes across the region. The inherent versatility of canned fruits, essential in desserts, salads, and as pantry staples, further supports market growth. Peach, pineapple, and mandarin orange segments are anticipated to lead demand, driven by their popularity and adaptability in diverse culinary applications. Additionally, a growing preference for healthier options is influencing consumers towards canned fruits packed in natural juices or water, reducing consumption of those in heavy syrups.

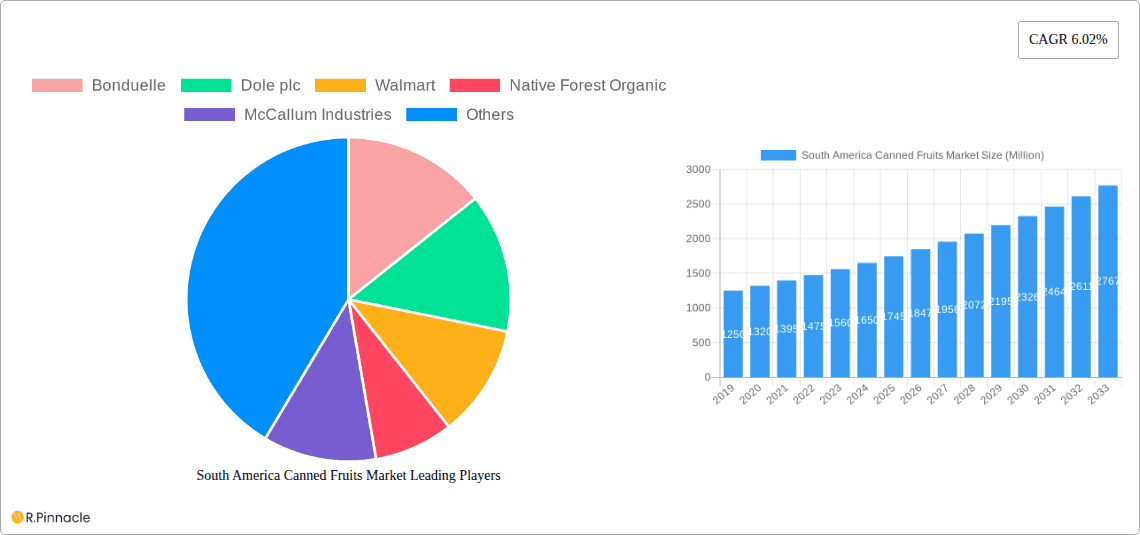

South America Canned Fruits Market Market Size (In Million)

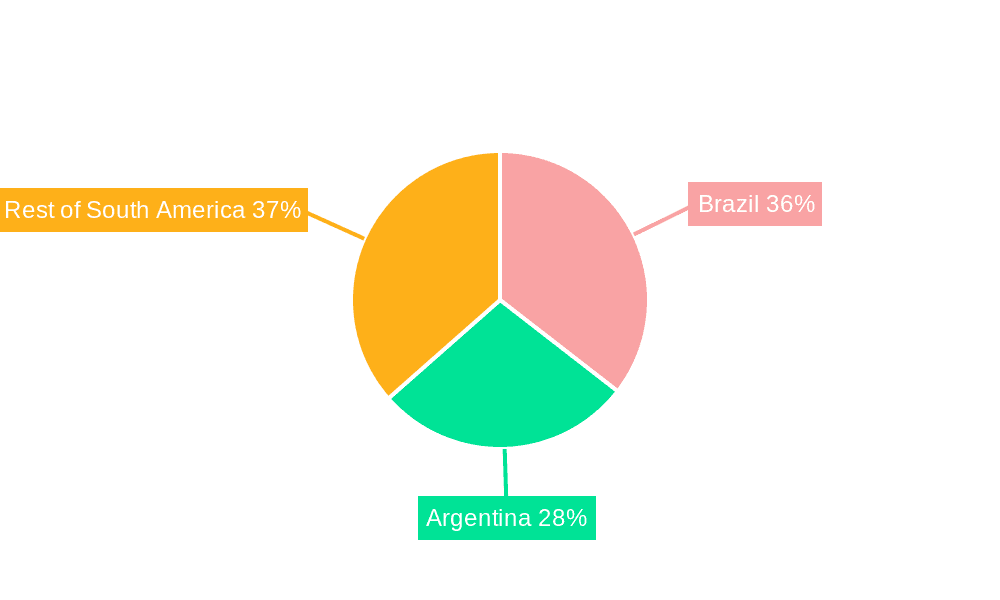

The distribution network for canned fruits in South America is dynamic. Supermarkets and hypermarkets currently lead sales, with online retail demonstrating substantial growth, mirroring the broader e-commerce surge and consumer demand for convenience. Convenience stores also offer vital immediate product access. Brazil and Argentina are prominent revenue contributors, attributed to their robust agricultural sectors and large consumer bases. The "Rest of South America" segment shows considerable growth potential as economies advance and consumer preferences converge with those of leading markets. Strategic initiatives from key market participants, encompassing product innovation, market penetration strategies, and collaborations, are crucial for securing market share and mitigating challenges like fluctuating raw material costs and intense competition. The market's adaptability to evolving consumer tastes and dietary trends ensures its continued relevance and growth.

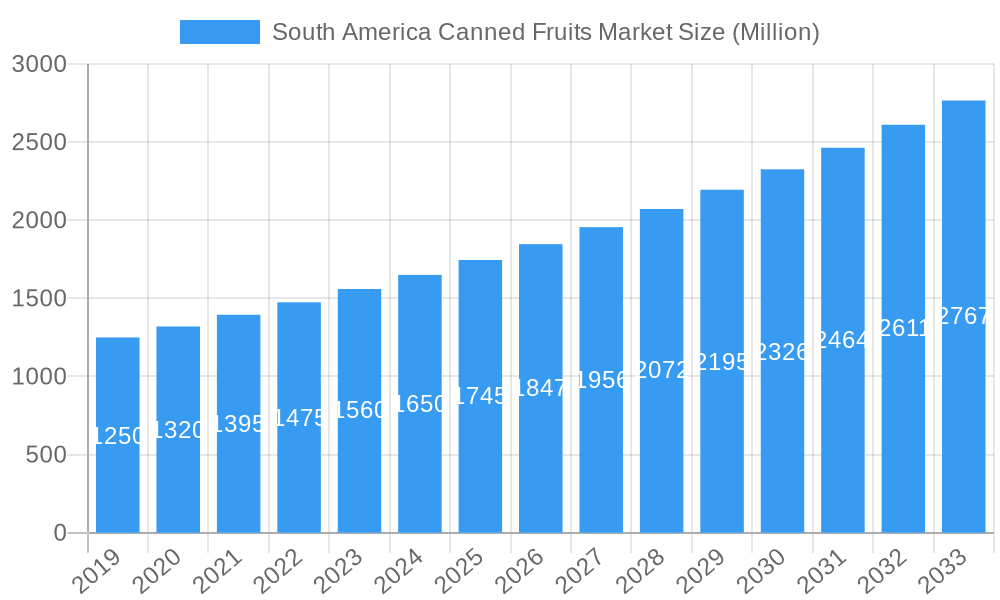

South America Canned Fruits Market Company Market Share

South America Canned Fruits Market: In-Depth Analysis and Future Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the South America Canned Fruits Market, offering critical insights for stakeholders navigating this dynamic sector. With a study period spanning 2019 to 2033, a base year of 2025, and a detailed forecast period from 2025 to 2033, this report leverages granular data and expert analysis to deliver actionable intelligence. Explore market structure, dynamics, regional dominance, product innovations, and key players shaping the future of canned fruits in South America.

South America Canned Fruits Market Market Structure & Innovation Trends

The South America canned fruits market exhibits a moderate to high concentration, with a few key players holding significant market share. Bonduelle, Dole plc, and The Kraft Heinz Company are prominent entities influencing market dynamics. Innovation is a crucial driver, with companies focusing on developing value-added products that cater to evolving consumer preferences for health and convenience. Regulatory frameworks, while generally supportive of food processing, can vary across countries, impacting trade and production. Product substitutes, such as fresh fruits, frozen fruits, and fruit purees, present a constant competitive challenge, necessitating continuous product differentiation and quality enhancement. End-user demographics lean towards urban populations with growing disposable incomes, seeking convenient and long-shelf-life fruit options. Mergers and acquisitions (M&A) activities, while not extensive, can reshape market landscapes, with past deal values often in the tens to hundreds of millions of USD, impacting market share and competitive intensity.

South America Canned Fruits Market Market Dynamics & Trends

The South America canned fruits market is poised for robust growth, driven by several intertwined factors. A burgeoning middle class with increasing disposable incomes across the region is a primary growth catalyst. This demographic shift translates into higher consumer spending on packaged foods, including canned fruits, which are perceived as a convenient and shelf-stable alternative to fresh produce, especially in areas with less developed cold chain infrastructure. The expanding food processing industry, supported by favorable government policies aimed at boosting agricultural exports and value-added products, further fuels market expansion. Technological advancements in canning and preservation techniques are enhancing product quality, extending shelf life, and improving nutritional content, making canned fruits more appealing to health-conscious consumers.

Consumer preferences are evolving, with a growing demand for healthier options, leading to increased interest in canned fruits with no added sugar, natural sweeteners, and added functional ingredients like antioxidants and vitamins. This trend is evident in product launches by major players. For instance, the increasing adoption of e-commerce platforms and online grocery shopping is creating new distribution channels, making canned fruits more accessible to a wider consumer base. The competitive landscape is characterized by both established global brands and local producers, each vying for market share through product innovation, competitive pricing, and strategic marketing campaigns. Market penetration for canned fruits varies across countries, with higher rates in more developed economies within South America. The CAGR for the South America Canned Fruits Market is projected to be approximately 4.5% over the forecast period, driven by these dynamic factors. The market's resilience is also attributed to its ability to cater to diverse dietary needs and provide affordable fruit options throughout the year.

Dominant Regions & Segments in South America Canned Fruits Market

The South America canned fruits market is dominated by Brazil, which consistently represents the largest share due to its substantial population, strong agricultural base, and well-developed food processing industry. Argentina also holds a significant position, benefiting from its robust fruit cultivation and export capabilities. The Rest of South America segment, while fragmented, collectively contributes substantially, with countries like Chile and Colombia showing increasing market potential.

Within product types, Pineapple and Peaches are consistently leading segments, owing to their widespread cultivation and high consumer demand in the region. Mandarin oranges and Pears also command a considerable market share.

In terms of form, Cut fruits generally hold a larger market share than Whole fruits, reflecting a consumer preference for convenience and ease of use in recipes and direct consumption.

The Supermarkets/Hypermarkets distribution channel remains the most dominant, owing to their wide reach, accessibility, and ability to cater to bulk purchases. However, Online Stores are rapidly gaining traction, driven by the digital transformation and changing shopping habits of consumers, especially in urban centers.

Key Drivers of Dominance:

Brazil:

- Economic Policies: Government support for agricultural processing and export incentives.

- Infrastructure: Well-established logistics and cold chain infrastructure.

- Consumer Base: Large and growing population with increasing disposable income.

- Agricultural Output: Significant production of key fruit varieties.

Argentina:

- Agricultural Prowess: High-quality fruit production, particularly for export.

- Export Market Focus: Strong presence in international markets influences domestic supply and demand.

- Processing Capabilities: Advanced canning and packaging facilities.

Product Type (Pineapple & Peaches):

- Consumer Preference: High demand for their versatility in culinary applications and inherent sweetness.

- Availability: Consistent and large-scale cultivation ensures year-round supply.

- Cost-Effectiveness: Relatively competitive pricing compared to exotic fruits.

Form (Cut Fruits):

- Convenience: Saves consumers preparation time, appealing to busy lifestyles.

- Versatility: Easy to incorporate into salads, desserts, and beverages.

- Portion Control: Ideal for single-serving consumption.

Distribution Channel (Supermarkets/Hypermarkets):

- Reach: Extensive store networks across urban and semi-urban areas.

- Variety: Offer a wide range of brands and product options.

- Promotional Activities: Frequent discounts and bulk offers attract price-sensitive consumers.

South America Canned Fruits Market Product Innovations

Product innovation in the South America canned fruits market is centered on enhancing health benefits and convenience. Companies are actively developing canned fruit variants infused with antioxidants, vitamins, and probiotics to cater to a growing health-conscious consumer base. Examples include canned fruit chunks with added antioxidants and functional fruit cups with no added sugars and enriched with vitamins. These innovations aim to differentiate products from traditional offerings, attract new consumer segments, and command premium pricing. The competitive advantage lies in aligning product development with evolving consumer trends, ensuring market fit through appealing packaging and clear labeling of health benefits.

Report Scope & Segmentation Analysis

This report meticulously segments the South America Canned Fruits Market across several key dimensions. The Product Type segmentation includes Peaches, Pineapple, Mandarin oranges, Pears, and Other Fruit Types, providing insights into the demand for specific fruits. The Form segmentation distinguishes between Whole fruits and Cut fruits, highlighting consumer preferences for convenience. The Distribution Channel analysis covers Supermarkets/Hypermarkets, Convenience Stores, Online Stores, and Other Distribution Channels, mapping out market access and reach. Geographically, the market is divided into Brazil, Argentina, and the Rest of South America, offering regional insights into market dynamics. Growth projections and market sizes are provided for each segment, with an emphasis on competitive dynamics within these specific categories.

Key Drivers of South America Canned Fruits Market Growth

The South America canned fruits market is propelled by a confluence of factors. A growing middle class with increasing disposable incomes fuels demand for convenient and shelf-stable food products. The expanding food processing sector, supported by favorable government initiatives and investments in agricultural value chains, enhances production capabilities and export potential. Consumer preference for healthier options is driving innovation in low-sugar and fortified canned fruits. Furthermore, robust agricultural output and established supply chains in key countries ensure consistent availability and competitive pricing.

Challenges in the South America Canned Fruits Market Sector

Despite its growth potential, the South America canned fruits market faces several challenges. Fluctuations in raw material prices due to climatic conditions and global demand can impact profitability. Stringent food safety regulations and varying import/export policies across different South American countries can create trade barriers. Competition from fresh and frozen fruit segments, as well as the rise of private label brands, puts pressure on pricing and market share. Supply chain disruptions, particularly in remote regions, and logistical complexities can affect product availability and shelf life.

Emerging Opportunities in South America Canned Fruits Market

Emerging opportunities in the South America canned fruits market lie in the growing demand for organic and sustainably sourced products. The increasing adoption of e-commerce and online grocery platforms presents a significant avenue for market expansion and direct consumer engagement. There is also a rising interest in exotic and tropical fruit varieties beyond traditional offerings, creating niches for specialized canned products. Furthermore, the development of value-added products with added health benefits, such as prebiotics, probiotics, and functional ingredients, caters to the wellness trend and can command premium prices.

Leading Players in the South America Canned Fruits Market Market

- Bonduelle

- Dole plc

- Walmart

- Native Forest Organic

- McCallum Industries

- Aconcagua Foods SA

- Colombina

- The Kraft Heinz Company

- Century Pacific Foods

- Del Monte Foods Inc

Key Developments in South America Canned Fruits Market Industry

- August 2021: Del Monte Foods declared the launch of the Gut Food product range which is canned fruit chunks infused with antioxidants in the market.

- July 2021: Dole Packaged Foods, LLC announced the launch of latest functional fruit-based product range, Dole Essentials fruit cups. The cups are available in three varieties such as gluten-free, non-GMO, contain no added sugars, and contain 50% of the daily recommended amount of vitamin C.

Future Outlook for South America Canned Fruits Market Market

The future outlook for the South America canned fruits market is exceptionally positive, driven by sustained economic development and evolving consumer lifestyles. The increasing urbanization and the subsequent demand for convenient food options will continue to be a significant growth accelerator. Innovations in product formulation, focusing on health and wellness attributes such as natural ingredients, reduced sugar content, and added vitamins, will further bolster market penetration. The expansion of online retail channels will enhance accessibility and cater to a broader customer base, particularly younger demographics. Strategic collaborations and investments in sustainable sourcing and production practices are expected to shape the competitive landscape, positioning the market for continued expansion and increased value creation over the forecast period.

South America Canned Fruits Market Segmentation

-

1. Product Type

- 1.1. Peaches

- 1.2. Pineapple

- 1.3. Mandarin oranges

- 1.4. Pears

- 1.5. Other Fruit Types

-

2. Form

- 2.1. Whole fruits

- 2.2. Cut fruits

-

3. Distibution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience Stores

- 3.3. Online Stores

- 3.4. Other Distribution Channels

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

South America Canned Fruits Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Canned Fruits Market Regional Market Share

Geographic Coverage of South America Canned Fruits Market

South America Canned Fruits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Inclination Towards Health

- 3.2.2 Personal Care and Anti-Aging Supplements; Increasing Consumption of Functional Beverages

- 3.3. Market Restrains

- 3.3.1. High Price of the Final Product

- 3.4. Market Trends

- 3.4.1. Rising Inclination Towards Convenience Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Canned Fruits Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Peaches

- 5.1.2. Pineapple

- 5.1.3. Mandarin oranges

- 5.1.4. Pears

- 5.1.5. Other Fruit Types

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Whole fruits

- 5.2.2. Cut fruits

- 5.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Online Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Canned Fruits Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Peaches

- 6.1.2. Pineapple

- 6.1.3. Mandarin oranges

- 6.1.4. Pears

- 6.1.5. Other Fruit Types

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Whole fruits

- 6.2.2. Cut fruits

- 6.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Convenience Stores

- 6.3.3. Online Stores

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Canned Fruits Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Peaches

- 7.1.2. Pineapple

- 7.1.3. Mandarin oranges

- 7.1.4. Pears

- 7.1.5. Other Fruit Types

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Whole fruits

- 7.2.2. Cut fruits

- 7.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Convenience Stores

- 7.3.3. Online Stores

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Canned Fruits Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Peaches

- 8.1.2. Pineapple

- 8.1.3. Mandarin oranges

- 8.1.4. Pears

- 8.1.5. Other Fruit Types

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Whole fruits

- 8.2.2. Cut fruits

- 8.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Convenience Stores

- 8.3.3. Online Stores

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Bonduelle

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Dole plc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Walmart

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Native Forest Organic

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 McCallum Industries

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Aconcagua Foods SA

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Colombina

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 The Kraft Heinz Company

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Century Pacific Foods*List Not Exhaustive

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Del Monte Foods Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Bonduelle

List of Figures

- Figure 1: South America Canned Fruits Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South America Canned Fruits Market Share (%) by Company 2025

List of Tables

- Table 1: South America Canned Fruits Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: South America Canned Fruits Market Revenue million Forecast, by Form 2020 & 2033

- Table 3: South America Canned Fruits Market Revenue million Forecast, by Distibution Channel 2020 & 2033

- Table 4: South America Canned Fruits Market Revenue million Forecast, by Geography 2020 & 2033

- Table 5: South America Canned Fruits Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: South America Canned Fruits Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: South America Canned Fruits Market Revenue million Forecast, by Form 2020 & 2033

- Table 8: South America Canned Fruits Market Revenue million Forecast, by Distibution Channel 2020 & 2033

- Table 9: South America Canned Fruits Market Revenue million Forecast, by Geography 2020 & 2033

- Table 10: South America Canned Fruits Market Revenue million Forecast, by Country 2020 & 2033

- Table 11: South America Canned Fruits Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 12: South America Canned Fruits Market Revenue million Forecast, by Form 2020 & 2033

- Table 13: South America Canned Fruits Market Revenue million Forecast, by Distibution Channel 2020 & 2033

- Table 14: South America Canned Fruits Market Revenue million Forecast, by Geography 2020 & 2033

- Table 15: South America Canned Fruits Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: South America Canned Fruits Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 17: South America Canned Fruits Market Revenue million Forecast, by Form 2020 & 2033

- Table 18: South America Canned Fruits Market Revenue million Forecast, by Distibution Channel 2020 & 2033

- Table 19: South America Canned Fruits Market Revenue million Forecast, by Geography 2020 & 2033

- Table 20: South America Canned Fruits Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Canned Fruits Market?

The projected CAGR is approximately 5.36%.

2. Which companies are prominent players in the South America Canned Fruits Market?

Key companies in the market include Bonduelle, Dole plc, Walmart, Native Forest Organic, McCallum Industries, Aconcagua Foods SA, Colombina, The Kraft Heinz Company, Century Pacific Foods*List Not Exhaustive, Del Monte Foods Inc.

3. What are the main segments of the South America Canned Fruits Market?

The market segments include Product Type, Form, Distibution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 661.49 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Inclination Towards Health. Personal Care and Anti-Aging Supplements; Increasing Consumption of Functional Beverages.

6. What are the notable trends driving market growth?

Rising Inclination Towards Convenience Food.

7. Are there any restraints impacting market growth?

High Price of the Final Product.

8. Can you provide examples of recent developments in the market?

In August 2021, Del Monte Foods declared the launch of the Gut Food product range which is canned fruit chunks infused with antioxidants in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Canned Fruits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Canned Fruits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Canned Fruits Market?

To stay informed about further developments, trends, and reports in the South America Canned Fruits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence