Key Insights

The South America energy drinks market is projected to experience substantial growth, reaching an estimated market size of $3075.61 million by 2024, with a Compound Annual Growth Rate (CAGR) of 8.2%. This expansion is driven by escalating consumer demand for functional beverages that provide enhanced energy and focus, particularly among young adults engaged in sports, demanding careers, and academic pursuits. Increased consumer awareness of key ingredients such as caffeine and taurine, coupled with the introduction of innovative formulations and flavors, is further stimulating market growth. The proliferation of diverse distribution channels, including on-trade venues like cafes and clubs, and off-trade options such as supermarkets, convenience stores, and expanding online retail platforms, ensures widespread product accessibility and consumer convenience across the region.

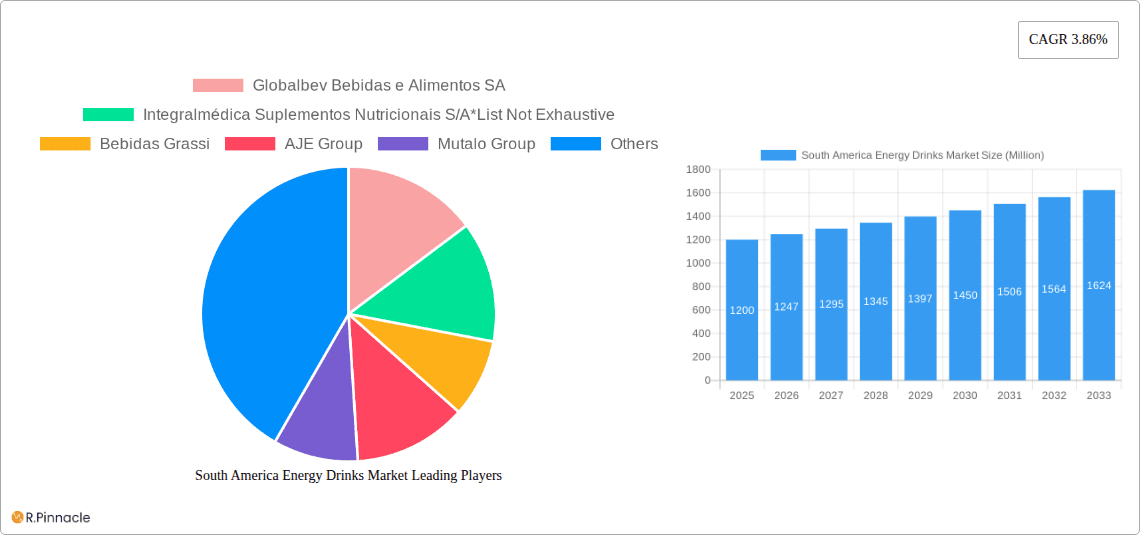

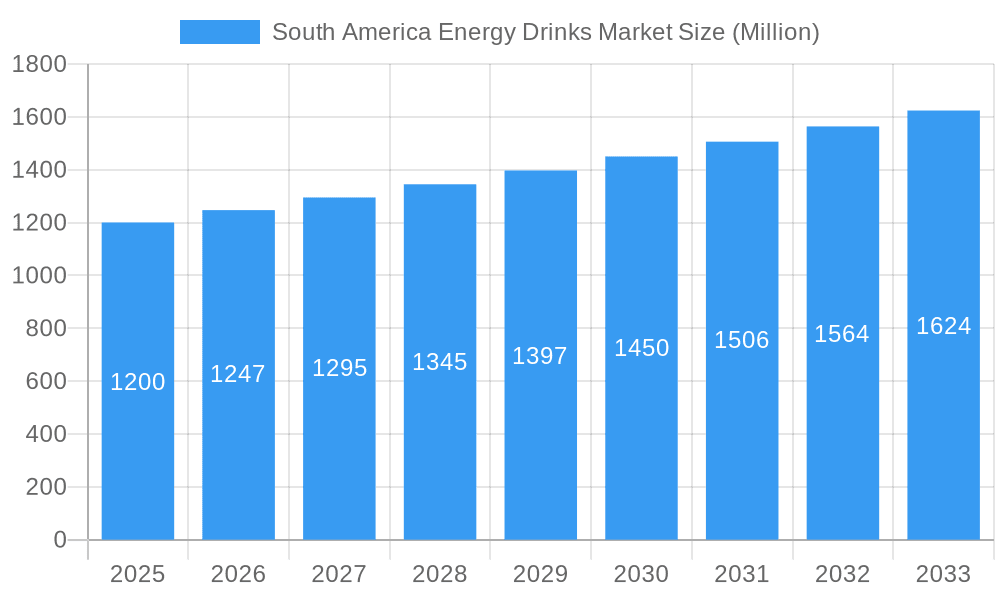

South America Energy Drinks Market Market Size (In Billion)

Several key trends are influencing the competitive landscape. The premiumization of energy drinks is a significant development, with brands offering specialized variants for targeted needs like cognitive enhancement or pre-workout performance. The growing consumer preference for plant-based and natural ingredient formulations reflects a rising health consciousness. Innovations in packaging, such as the widespread use of convenient and recyclable PET bottles and cans, are also noteworthy. Potential market challenges include increased regulatory oversight regarding ingredient usage and marketing claims, as well as rising raw material costs impacting pricing. The market is highly competitive, featuring established global brands and agile local players actively competing through strategic product introductions, robust marketing initiatives, and expanded distribution networks.

South America Energy Drinks Market Company Market Share

South America Energy Drinks Market: Comprehensive Market Analysis & Growth Forecast (2019-2033)

Unlock the immense potential of the South American energy drinks market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis provides critical insights into market dynamics, consumer trends, competitive landscapes, and future opportunities. Essential for industry professionals, manufacturers, distributors, and investors seeking to capitalize on this rapidly evolving sector. Discover key segments, dominant regions, product innovations, and strategic drivers shaping the future of energy consumption in South America. This report is meticulously structured for immediate use, requiring no further modifications.

South America Energy Drinks Market Market Structure & Innovation Trends

The South America energy drinks market exhibits a moderately concentrated structure, with a few dominant players holding significant market share, alongside a growing number of regional and niche brands. Innovation is a key driver, fueled by evolving consumer preferences for healthier, natural ingredients, and functional benefits beyond mere energy boost. Regulatory frameworks vary across countries, impacting product formulation, labeling, and marketing claims. Product substitutes include coffee, tea, and other functional beverages, posing a constant competitive challenge. End-user demographics are broad, encompassing young adults, students, professionals, athletes, and increasingly, gamers, each with distinct consumption patterns and needs. Mergers and acquisitions (M&A) activities, while not as prevalent as in more mature markets, are expected to increase as larger players seek to expand their portfolios and market reach. The total M&A deal value for the region is projected to reach approximately USD 500 Million by 2033. Key innovation trends focus on sugar-free options, natural caffeine sources, added vitamins and minerals, and unique flavor profiles.

South America Energy Drinks Market Market Dynamics & Trends

The South America energy drinks market is poised for robust expansion, driven by a confluence of factors that are reshaping consumer habits and industry strategies. A primary growth driver is the increasing disposable income across several South American nations, leading to higher consumer spending on convenience and functional beverages. The fast-paced lifestyles, coupled with longer working hours and a growing demand for enhanced physical and mental performance, are significantly boosting consumption. Technological disruptions are also playing a crucial role, with advancements in beverage manufacturing processes allowing for more diverse product formulations and packaging innovations. Online retail channels have witnessed exponential growth, making energy drinks more accessible to a wider consumer base, particularly in urban centers. Consumer preferences are evolving towards healthier alternatives, with a notable shift away from high-sugar options towards sugar-free, low-calorie, and naturally-sourced ingredient variants. The demand for functional ingredients like vitamins, minerals, and adaptogens is also on the rise, as consumers seek added health benefits. The competitive dynamics within the market are intensifying, with both global giants and agile local players vying for market share. This competition spurs further innovation in product development, marketing strategies, and distribution networks. The overall market penetration is estimated to reach 55% by 2033. The Compound Annual Growth Rate (CAGR) for the South America energy drinks market is projected to be approximately 8.5% during the forecast period of 2025-2033. This sustained growth is underpinned by a youthful population demographic and a cultural appreciation for energizing beverages.

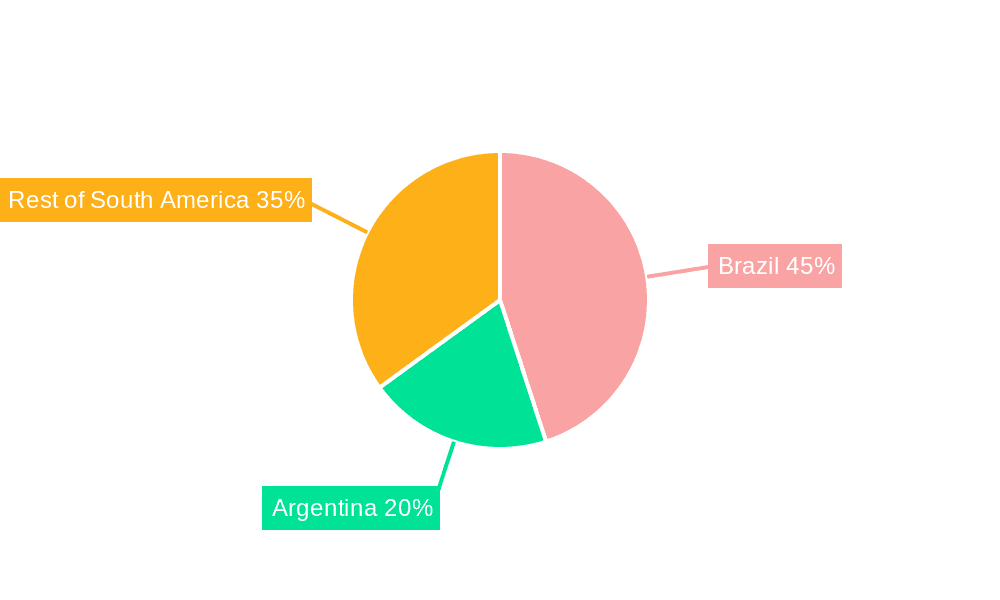

Dominant Regions & Segments in South America Energy Drinks Market

Brazil stands out as the dominant region in the South America energy drinks market, consistently leading in consumption and market value, estimated to contribute over 45% of the total market revenue in 2025. This dominance is attributed to its large population, robust economy, and a well-established beverage culture that readily embraces energy-boosting products.

Product Type Dominance:

- Drinks: The "Drinks" segment, encompassing traditional energy drinks, remains the largest and most influential. Its widespread availability and diverse product offerings cater to a broad consumer base seeking immediate energy boosts for various activities. Key drivers for this segment's dominance include extensive marketing campaigns by major brands and continuous product line extensions. The market size for drinks is projected to reach USD 7,800 Million by 2025.

- Shots: While smaller, the "Shots" segment is experiencing rapid growth, particularly among younger demographics and those seeking a quick, potent energy fix. Factors such as convenience and portability are major contributors to its expansion.

- Mixers: The "Mixers" segment, often blended with alcoholic beverages, caters to the nightlife and social consumption occasions, showing steady growth with increasing urbanization and entertainment options.

Packaging Type Dominance:

- Cans: Energy drink cans are the most popular packaging format due to their portability, recyclability, and ability to maintain product freshness. Their widespread availability across all distribution channels, from convenience stores to supermarkets, further solidifies their dominance. The market size for cans is estimated at USD 6,500 Million in 2025.

- Bottle (PET/Glass): Bottles, particularly PET, offer larger serving sizes and are favored for at-home consumption or longer-duration activities. Glass bottles are perceived as premium packaging by some consumer segments.

Distribution Channel Dominance:

- Off-trade: The "Off-trade" channel, with Supermarkets/Hypermarkets leading the charge, accounts for the largest share of sales. These large retail formats offer wider product selection, competitive pricing, and greater accessibility to a broad consumer base. Supermarkets/Hypermarkets are expected to capture approximately 55% of the off-trade sales.

- Convenience Stores: Convenience stores play a vital role, especially in urban areas, by providing immediate access to energy drinks for impulse purchases and consumers on-the-go.

- Online Retail Stores: The "Online Retail Stores" segment is experiencing the fastest growth, driven by the convenience of home delivery and the increasing adoption of e-commerce in South America. This channel is expected to see a CAGR of 15% during the forecast period.

Geographic Dominance:

- Brazil: As mentioned, Brazil is the undisputed leader. Its vast population and developed retail infrastructure make it a primary market for energy drink manufacturers.

- Argentina: Argentina represents the second-largest market, driven by a sizable urban population and a growing demand for functional beverages, with an estimated market size of USD 1,500 Million by 2025.

- Rest of South America: This segment, encompassing countries like Colombia, Chile, Peru, and Venezuela, presents significant untapped potential and is expected to witness substantial growth due to increasing urbanization and rising disposable incomes.

South America Energy Drinks Market Product Innovations

Product innovations in the South America energy drinks market are increasingly focused on enhancing nutritional profiles and catering to niche consumer demands. Manufacturers are introducing sugar-free and low-calorie variants to address health concerns, alongside those featuring natural caffeine sources like green tea extract and guarana. The integration of vitamins (e.g., B-vitamins), minerals, and functional ingredients such as L-theanine and taurine is becoming standard practice to offer enhanced cognitive function and stress reduction benefits. A significant trend is the development of flavor extensions beyond traditional fruit and tropical profiles, incorporating unique blends and even savory notes. For gamers, specialized products like Acer's PredatorShot are emerging, formulated to boost concentration and stamina during extended play sessions. The competitive advantage lies in offering superior taste, demonstrable functional benefits, and appealing branding that resonates with specific target demographics.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the South America energy drinks market, segmented across key parameters for granular insights. The Product Type segmentation includes Drinks, Shots, and Mixers, offering a detailed breakdown of their respective market sizes, growth trajectories, and competitive landscapes. The Packaging Type segmentation covers Bottle (PET/Glass) and Cans, highlighting their market penetration and consumer preferences. The Distribution Channel segmentation delves into On-trade and Off-trade channels, with a specific focus on Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, and Other Off-trade Channels, examining their contribution to market growth and accessibility. Geographically, the market is analyzed across Brazil, Argentina, and the Rest of South America, detailing the unique market dynamics, consumer behaviors, and growth opportunities within each region. Projections indicate a consistent growth across all segments, with online retail and convenience stores expected to experience the most dynamic expansion.

Key Drivers of South America Energy Drinks Market Growth

The South America energy drinks market is propelled by several significant growth drivers. Firstly, the rising demand for convenience and functional beverages, driven by increasingly busy lifestyles and a desire for enhanced performance, is a primary catalyst. Secondly, the growing youth population and their adoption of energy drinks for academic, social, and recreational activities are contributing significantly to market expansion. Technological advancements in product formulation, leading to healthier and more diverse options such as sugar-free and natural ingredient-based drinks, are attracting a broader consumer base. Furthermore, economic growth and increasing disposable incomes in key South American countries allow for greater consumer spending on premium and functional beverages. The expansion of online retail platforms and e-commerce penetration is making energy drinks more accessible than ever before, further fueling growth.

Challenges in the South America Energy Drinks Market Sector

Despite robust growth, the South America energy drinks market faces several challenges. Stringent regulations in some countries regarding caffeine content, labeling requirements, and marketing to minors can pose hurdles for manufacturers and impact product development strategies. Concerns over the health implications of excessive sugar and caffeine consumption, leading to negative consumer perceptions and a demand for healthier alternatives, present a significant restraint. Supply chain complexities and logistical challenges in certain regions of South America can lead to increased operational costs and impact product availability. Intense competition from both global brands and local players, often leading to price wars, can compress profit margins. Moreover, the availability of substitute beverages like coffee and tea offers consumers alternative options for energy enhancement, requiring energy drink brands to continuously innovate and differentiate their offerings.

Emerging Opportunities in South America Energy Drinks Market

The South America energy drinks market is ripe with emerging opportunities. The growing health and wellness trend presents a significant opportunity for manufacturers to expand their portfolio of sugar-free, low-calorie, and natural ingredient-based energy drinks. The increasing popularity of e-sports and gaming creates a niche market for gamer-specific energy drinks, offering enhanced focus and stamina. Expansion into untapped rural markets and developing regions within South America offers considerable growth potential as disposable incomes rise. Furthermore, exploring new product formats, such as energy drink powders, gels, or functional shots with added benefits like immune support or hydration, can cater to evolving consumer needs. Strategic partnerships with local distributors and retailers can enhance market penetration and brand visibility across diverse geographies. The increasing demand for sustainable packaging solutions also presents an opportunity for brands to differentiate themselves.

Leading Players in the South America Energy Drinks Market Market

- Globalbev Bebidas e Alimentos SA

- Integralmédica Suplementos Nutricionais S/A

- Bebidas Grassi

- AJE Group

- Mutalo Group

- PepsiCo Inc

- Red Bull GmbH

- The Coca-Cola Company

- Anheuser-Busch InBev SA/NV (Ambev SA)

- Grupo Petrópolis

Key Developments in South America Energy Drinks Market Industry

- November 2022: Grupo Petrópolis launched a range of fruit-based energy drinks under the brand name TNT Energy Drink. The first flavor of the extended product line is Mango Summer, which consists of a mix of fruits with a high presence of mango flavor. It is available in 473ml and 269ml cans in the South American market.

- May 2022: Coca-Cola's energy drink company Monster Beverage Corporation launched multiple new products across South America. The company launched VR46 The Doctor in Argentina and expanded its product offering in Chile by introducing Melon Mania Lemon Heads and Organce Dreamsicle. Additionally, the company launched Monster Mango Loco in Colombia and Monster Ultra Gold in Puerto Rico.

- February 2022: Acer Inc., a Taiwan-based hardware and electronic gadgets manufacturer launched the PredatorShot energy drink for gamers in Brazil. The company claims that it contains taurine and caffeine which stimulate concentration and deliver more energy to the players during online matches. The product has been introduced in the country with a price of USD 7.42 (pack of 6 cans of 269 ml) which can be purchased through the online Acer online store.

Future Outlook for South America Energy Drinks Market Market

The future outlook for the South America energy drinks market is exceptionally promising, characterized by sustained growth and evolving consumer preferences. The market is expected to be driven by continued innovation in product development, with a strong emphasis on healthier formulations, natural ingredients, and functional benefits that extend beyond simple energy enhancement. The expansion of online retail channels and the increasing adoption of e-commerce will further democratize access to energy drinks, particularly in remote areas. Emerging economies within South America are poised for significant growth as disposable incomes rise, creating new consumer segments and market opportunities. Strategic collaborations, mergers, and acquisitions are likely to shape the competitive landscape, leading to market consolidation and the emergence of stronger regional players. The focus on sustainability in packaging and ethical sourcing will also become increasingly important, influencing brand loyalty and market positioning. Overall, the South America energy drinks market is projected to continue its upward trajectory, presenting lucrative opportunities for stakeholders.

South America Energy Drinks Market Segmentation

-

1. Product Type

- 1.1. Drinks

- 1.2. Shots

- 1.3. Mixers

-

2. Packaging Type

- 2.1. Bottle (Pet/Glass)

- 2.2. Cans

- 2.3. Other Packaging Types

-

3. Distribution Channel

- 3.1. On-trade

-

3.2. Off-trade

- 3.2.1. Supermarkets/Hypermarkets

- 3.2.2. Convenience Stores

- 3.2.3. Online Retail Stores

- 3.2.4. Other Off-trade Channels

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

South America Energy Drinks Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Energy Drinks Market Regional Market Share

Geographic Coverage of South America Energy Drinks Market

South America Energy Drinks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Low-Sugar/Sugar-free Beverages

- 3.3. Market Restrains

- 3.3.1. Concerns Over Health Issues Associated with Functional Beverages

- 3.4. Market Trends

- 3.4.1. Foodservice and E-commerce Channels Significantly Creating Shelf Space to Energy Drinks

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Energy Drinks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Drinks

- 5.1.2. Shots

- 5.1.3. Mixers

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Bottle (Pet/Glass)

- 5.2.2. Cans

- 5.2.3. Other Packaging Types

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. On-trade

- 5.3.2. Off-trade

- 5.3.2.1. Supermarkets/Hypermarkets

- 5.3.2.2. Convenience Stores

- 5.3.2.3. Online Retail Stores

- 5.3.2.4. Other Off-trade Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Energy Drinks Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Drinks

- 6.1.2. Shots

- 6.1.3. Mixers

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Bottle (Pet/Glass)

- 6.2.2. Cans

- 6.2.3. Other Packaging Types

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. On-trade

- 6.3.2. Off-trade

- 6.3.2.1. Supermarkets/Hypermarkets

- 6.3.2.2. Convenience Stores

- 6.3.2.3. Online Retail Stores

- 6.3.2.4. Other Off-trade Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Energy Drinks Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Drinks

- 7.1.2. Shots

- 7.1.3. Mixers

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Bottle (Pet/Glass)

- 7.2.2. Cans

- 7.2.3. Other Packaging Types

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. On-trade

- 7.3.2. Off-trade

- 7.3.2.1. Supermarkets/Hypermarkets

- 7.3.2.2. Convenience Stores

- 7.3.2.3. Online Retail Stores

- 7.3.2.4. Other Off-trade Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Energy Drinks Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Drinks

- 8.1.2. Shots

- 8.1.3. Mixers

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Bottle (Pet/Glass)

- 8.2.2. Cans

- 8.2.3. Other Packaging Types

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. On-trade

- 8.3.2. Off-trade

- 8.3.2.1. Supermarkets/Hypermarkets

- 8.3.2.2. Convenience Stores

- 8.3.2.3. Online Retail Stores

- 8.3.2.4. Other Off-trade Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Globalbev Bebidas e Alimentos SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Integralmédica Suplementos Nutricionais S/A*List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Bebidas Grassi

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 AJE Group

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Mutalo Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 PepsiCo Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Red Bull GmbH

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 The Coca-Cola Company

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Anheuser-Busch InBev SA/NV (Ambev SA)

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Grupo Petrópolis

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Globalbev Bebidas e Alimentos SA

List of Figures

- Figure 1: South America Energy Drinks Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South America Energy Drinks Market Share (%) by Company 2025

List of Tables

- Table 1: South America Energy Drinks Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: South America Energy Drinks Market Revenue million Forecast, by Packaging Type 2020 & 2033

- Table 3: South America Energy Drinks Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: South America Energy Drinks Market Revenue million Forecast, by Geography 2020 & 2033

- Table 5: South America Energy Drinks Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: South America Energy Drinks Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: South America Energy Drinks Market Revenue million Forecast, by Packaging Type 2020 & 2033

- Table 8: South America Energy Drinks Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 9: South America Energy Drinks Market Revenue million Forecast, by Geography 2020 & 2033

- Table 10: South America Energy Drinks Market Revenue million Forecast, by Country 2020 & 2033

- Table 11: South America Energy Drinks Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 12: South America Energy Drinks Market Revenue million Forecast, by Packaging Type 2020 & 2033

- Table 13: South America Energy Drinks Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: South America Energy Drinks Market Revenue million Forecast, by Geography 2020 & 2033

- Table 15: South America Energy Drinks Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: South America Energy Drinks Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 17: South America Energy Drinks Market Revenue million Forecast, by Packaging Type 2020 & 2033

- Table 18: South America Energy Drinks Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 19: South America Energy Drinks Market Revenue million Forecast, by Geography 2020 & 2033

- Table 20: South America Energy Drinks Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Energy Drinks Market?

The projected CAGR is approximately 8.2%.

2. Which companies are prominent players in the South America Energy Drinks Market?

Key companies in the market include Globalbev Bebidas e Alimentos SA, Integralmédica Suplementos Nutricionais S/A*List Not Exhaustive, Bebidas Grassi, AJE Group, Mutalo Group, PepsiCo Inc, Red Bull GmbH, The Coca-Cola Company, Anheuser-Busch InBev SA/NV (Ambev SA), Grupo Petrópolis.

3. What are the main segments of the South America Energy Drinks Market?

The market segments include Product Type, Packaging Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3075.61 million as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Low-Sugar/Sugar-free Beverages.

6. What are the notable trends driving market growth?

Foodservice and E-commerce Channels Significantly Creating Shelf Space to Energy Drinks.

7. Are there any restraints impacting market growth?

Concerns Over Health Issues Associated with Functional Beverages.

8. Can you provide examples of recent developments in the market?

In November 2022, Grupo Petrópolis launched a range of fruit-based energy drinks under the brand name TNT Energy Drink. The first flavor of the extended product line is Mango Summer, which consists of a mix of fruits with a high presence of mango flavor. It is available in 473ml and 269ml cans in the South American market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Energy Drinks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Energy Drinks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Energy Drinks Market?

To stay informed about further developments, trends, and reports in the South America Energy Drinks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence