Key Insights

The South American gluten-free foods and beverages market is projected for substantial growth, driven by increasing health consciousness and the rising diagnosis of celiac disease and gluten sensitivity. Key market drivers include growing consumer demand for gluten-free alternatives across diverse product categories like beverages, baked goods, and meat substitutes, supported by increasing disposable incomes in major economies such as Brazil and Argentina. Expanded distribution networks, particularly the surge in online retail catering to this niche, are further propelling market expansion. Despite challenges posed by higher product pricing and ingredient availability in certain regions, the market benefits from a broadening product assortment that caters to evolving dietary preferences. Key industry participants, including Kelkin Ltd, Dr Schar AG, and General Mills Inc., are actively innovating and shaping the market landscape.

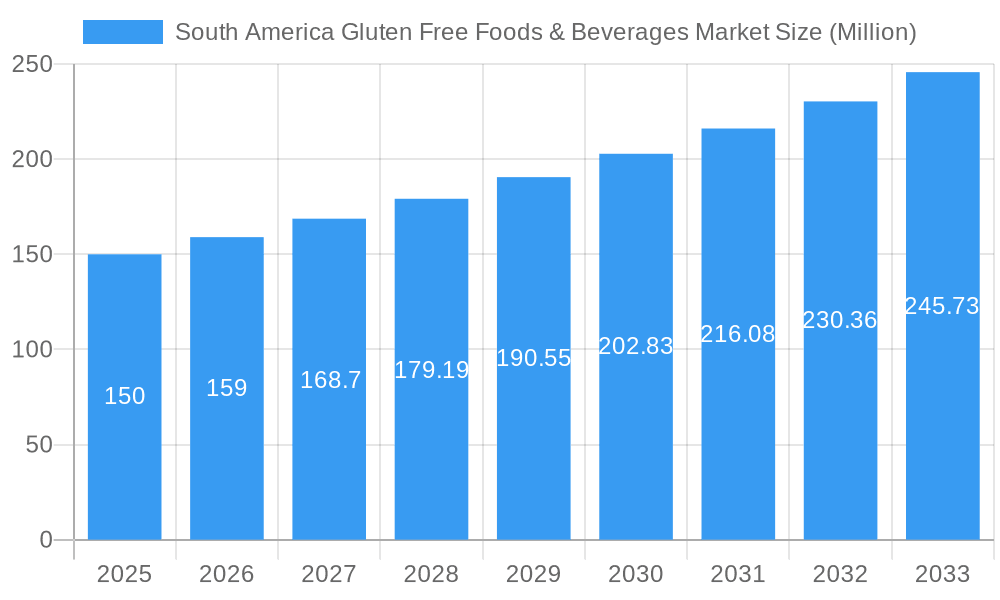

South America Gluten Free Foods & Beverages Market Market Size (In Million)

The market is segmented by product type, with bakery items and beverages currently leading due to strong consumer preference for convenient and appealing gluten-free options. Supermarkets and hypermarkets remain primary distribution channels, with online retailers demonstrating significant growth potential for enhanced market reach and consumer convenience. Future market expansion will be influenced by advancements in gluten-free food technology, strategic collaborations, educational marketing initiatives, and consistent access to high-quality ingredients. Successfully addressing these elements will solidify the growth trajectory of the South American gluten-free foods and beverages market over the forecast period. The market is estimated to reach $531.5 million in 2024, with a projected Compound Annual Growth Rate (CAGR) of 10.3% through 2033.

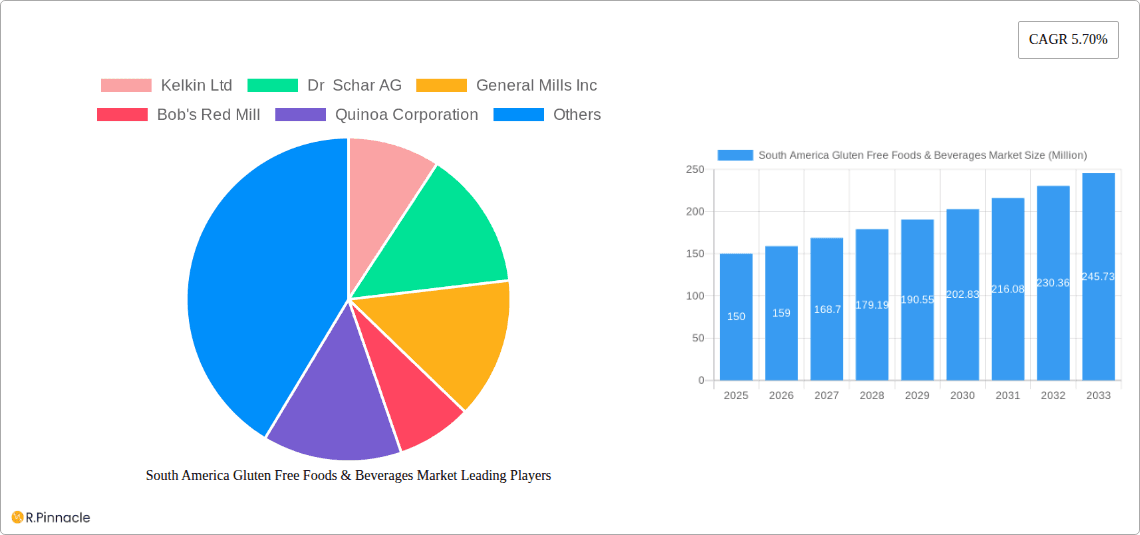

South America Gluten Free Foods & Beverages Market Company Market Share

South America Gluten-Free Foods & Beverages Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the South America gluten-free foods and beverages market, offering valuable insights for industry professionals, investors, and stakeholders. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. It analyzes market size, growth drivers, challenges, opportunities, and competitive landscape, providing actionable strategies for success in this rapidly expanding market.

South America Gluten-Free Foods & Beverages Market Structure & Innovation Trends

The South American gluten-free market is experiencing significant growth, driven by increasing awareness of gluten-related disorders and a rising demand for healthier food options. Market concentration is moderate, with several key players dominating specific segments.

- Market Share: The top five companies (Kelkin Ltd, Dr Schar AG, General Mills Inc, Bob's Red Mill, Quinoa Corporation) collectively hold an estimated 45% market share in 2025. Smaller regional players account for the remaining share.

- Innovation Drivers: Increasing consumer demand for convenient, palatable, and diverse gluten-free products is a key driver of innovation. Technological advancements in gluten-free ingredient processing are also playing a significant role.

- Regulatory Framework: Varying regulations across South American countries regarding gluten-free labeling and ingredient standards influence market dynamics. Harmonization of these regulations could further accelerate market growth.

- Product Substitutes: Traditional food products continue to be a primary substitute, but ongoing innovation in gluten-free alternatives is reducing this competition.

- End-User Demographics: The target demographic is expanding beyond individuals with diagnosed celiac disease or gluten sensitivity to include health-conscious consumers seeking dietary diversification.

- M&A Activities: The market has witnessed xx M&A deals in the last five years, with an average deal value of approximately $xx Million, primarily driven by expansion strategies and consolidation efforts.

South America Gluten-Free Foods & Beverages Market Dynamics & Trends

The South American gluten-free foods and beverages market is poised for robust growth, exhibiting a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors:

- Rising Prevalence of Gluten-Related Disorders: Increased awareness and diagnosis of celiac disease and non-celiac gluten sensitivity are major drivers.

- Growing Health & Wellness Consciousness: Consumers are increasingly seeking healthier and more specialized dietary options.

- Technological Advancements: Improvements in gluten-free ingredient processing and product formulation are enhancing taste and texture, leading to increased consumer acceptance.

- Expanding Distribution Channels: Growth in online retail and expansion into new retail formats is increasing product accessibility.

- Changing Consumer Preferences: Consumers are demanding more diverse and convenient gluten-free products, including ready-to-eat meals and snacks.

- Competitive Landscape: The market is dynamic, with existing players expanding product portfolios and new entrants entering the market, leading to increased competition. Market penetration of gluten-free products is projected to reach xx% by 2033.

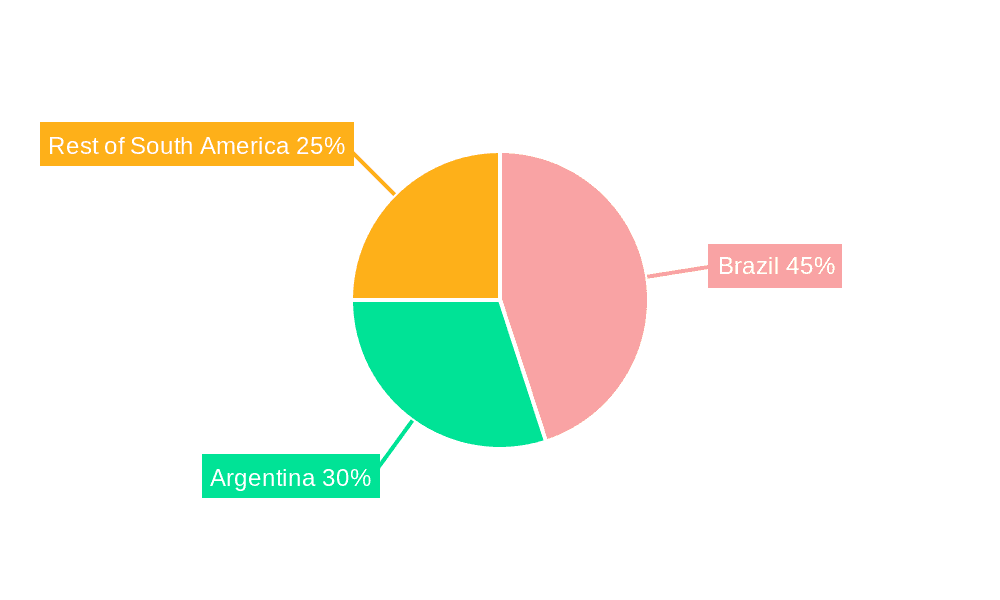

Dominant Regions & Segments in South America Gluten-Free Foods & Beverages Market

The Brazilian market is currently the dominant region in South America for gluten-free foods and beverages, followed by Argentina and Chile. High disposable incomes in these countries and growing health consciousness are contributing factors.

By Product Type:

- Bakery Products: This segment holds the largest market share, driven by consumer demand for gluten-free bread, cakes, and pastries.

- Dairy/Dairy Substitutes: This is a rapidly growing segment due to the increasing availability of plant-based alternatives.

By Distribution Channel:

- Supermarket/Hypermarket: This remains the primary distribution channel, although online retail is rapidly gaining traction.

Key Drivers for Dominant Regions:

- Brazil: High population density, increasing disposable incomes, and a growing awareness of health and wellness contribute to strong market growth.

- Argentina: A sizeable middle class and a focus on imported and local gluten-free products contribute to market expansion.

South America Gluten-Free Foods & Beverages Market Product Innovations

Recent innovations focus on improving the taste, texture, and nutritional profile of gluten-free products. Companies are developing new recipes, incorporating novel ingredients, and leveraging advanced processing techniques to create products that closely resemble their gluten-containing counterparts. The emphasis is on convenient and ready-to-eat options. The use of alternative flours, such as quinoa and cassava, is becoming increasingly popular.

Report Scope & Segmentation Analysis

This report segments the South American gluten-free foods and beverages market by product type (Beverages, Bakery Products, Condiments, Seasonings and Spreads, Dairy/Dairy Substitutes, Meat/Meat Substitutes, Other Gluten Products) and distribution channel (Supermarket/Hypermarket, Convenience Stores, Online Retailers, Others). Each segment is analyzed individually, providing insights into market size, growth projections, and competitive dynamics. For example, the bakery segment is expected to maintain its leading position, driven by a steady increase in consumer demand. Online retail, meanwhile, is projected to demonstrate the fastest growth among distribution channels.

Key Drivers of South America Gluten-Free Foods & Beverages Market Growth

The South American gluten-free market growth is driven by increasing awareness of gluten-related disorders, rising disposable incomes, and a shift towards healthier eating habits. Government initiatives promoting healthy diets and the introduction of supportive policies further fuel market expansion. Technological advancements are improving product quality, leading to wider consumer acceptance.

Challenges in the South America Gluten-Free Foods & Beverages Market Sector

The market faces challenges such as the relatively high cost of gluten-free products compared to conventional alternatives. Furthermore, inconsistent regulations across different countries and a lack of awareness in certain regions pose constraints. Supply chain issues for sourcing specialty ingredients can also affect production and distribution. These factors together may limit market penetration in some segments.

Emerging Opportunities in South America Gluten-Free Foods & Beverages Market

Significant opportunities exist in expanding product diversification, catering to specific dietary needs (e.g., vegan, organic). Investing in research and development for improved gluten-free ingredients and product formulations holds significant potential. Reaching underserved populations through targeted marketing and affordable product offerings can unlock substantial market growth.

Leading Players in the South America Gluten-Free Foods & Beverages Market

- Kelkin Ltd

- Dr Schar AG

- General Mills Inc

- Bob's Red Mill

- Quinoa Corporation

- Cerealko SA

- Molinos Rio de la Plata

- CeliGourmet

*List Not Exhaustive

Key Developments in South America Gluten-Free Foods & Beverages Market Industry

- 2022 October: General Mills launched a new line of gluten-free snacks in Brazil.

- 2023 March: Dr. Schar invested in a new production facility in Argentina to expand its capacity.

- 2024 June: A significant merger occurred between two regional gluten-free food producers in Chile. (Further details not available)

Future Outlook for South America Gluten-Free Foods & Beverages Market

The future of the South American gluten-free foods and beverages market remains bright, driven by sustained growth in health consciousness, the increasing prevalence of gluten-related disorders, and continuous product innovation. Strategic collaborations, market expansion into new regions, and the development of innovative products that cater to evolving consumer preferences will drive market growth in the coming years. The market is expected to witness further consolidation and the emergence of new players.

South America Gluten Free Foods & Beverages Market Segmentation

-

1. Product Type

- 1.1. Beverages

- 1.2. Bakery Products

- 1.3. Condiments, Seasonings and Spreads

- 1.4. Dairy/Dairy Substitutes

- 1.5. Meat/Meat Substitutes

- 1.6. Other Gluten Products

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Convenience Stores

- 2.3. Online retailers

- 2.4. Others

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Gluten Free Foods & Beverages Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Gluten Free Foods & Beverages Market Regional Market Share

Geographic Coverage of South America Gluten Free Foods & Beverages Market

South America Gluten Free Foods & Beverages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages

- 3.3. Market Restrains

- 3.3.1. Competition from Substitute Products

- 3.4. Market Trends

- 3.4.1. Rising Demand for Organic Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Gluten Free Foods & Beverages Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beverages

- 5.1.2. Bakery Products

- 5.1.3. Condiments, Seasonings and Spreads

- 5.1.4. Dairy/Dairy Substitutes

- 5.1.5. Meat/Meat Substitutes

- 5.1.6. Other Gluten Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Convenience Stores

- 5.2.3. Online retailers

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Gluten Free Foods & Beverages Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Beverages

- 6.1.2. Bakery Products

- 6.1.3. Condiments, Seasonings and Spreads

- 6.1.4. Dairy/Dairy Substitutes

- 6.1.5. Meat/Meat Substitutes

- 6.1.6. Other Gluten Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarket/Hypermarket

- 6.2.2. Convenience Stores

- 6.2.3. Online retailers

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Gluten Free Foods & Beverages Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Beverages

- 7.1.2. Bakery Products

- 7.1.3. Condiments, Seasonings and Spreads

- 7.1.4. Dairy/Dairy Substitutes

- 7.1.5. Meat/Meat Substitutes

- 7.1.6. Other Gluten Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarket/Hypermarket

- 7.2.2. Convenience Stores

- 7.2.3. Online retailers

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Gluten Free Foods & Beverages Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Beverages

- 8.1.2. Bakery Products

- 8.1.3. Condiments, Seasonings and Spreads

- 8.1.4. Dairy/Dairy Substitutes

- 8.1.5. Meat/Meat Substitutes

- 8.1.6. Other Gluten Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarket/Hypermarket

- 8.2.2. Convenience Stores

- 8.2.3. Online retailers

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Kelkin Ltd

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Dr Schar AG

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 General Mills Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Bob's Red Mill

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Quinoa Corporation

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Cerealko SA

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Molinos Rio de la Plata

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 CeliGourmet*List Not Exhaustive

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Kelkin Ltd

List of Figures

- Figure 1: South America Gluten Free Foods & Beverages Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South America Gluten Free Foods & Beverages Market Share (%) by Company 2025

List of Tables

- Table 1: South America Gluten Free Foods & Beverages Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: South America Gluten Free Foods & Beverages Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: South America Gluten Free Foods & Beverages Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: South America Gluten Free Foods & Beverages Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: South America Gluten Free Foods & Beverages Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: South America Gluten Free Foods & Beverages Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Gluten Free Foods & Beverages Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: South America Gluten Free Foods & Beverages Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: South America Gluten Free Foods & Beverages Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: South America Gluten Free Foods & Beverages Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 11: South America Gluten Free Foods & Beverages Market Revenue million Forecast, by Geography 2020 & 2033

- Table 12: South America Gluten Free Foods & Beverages Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: South America Gluten Free Foods & Beverages Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 14: South America Gluten Free Foods & Beverages Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 15: South America Gluten Free Foods & Beverages Market Revenue million Forecast, by Geography 2020 & 2033

- Table 16: South America Gluten Free Foods & Beverages Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Gluten Free Foods & Beverages Market?

The projected CAGR is approximately 10.3%.

2. Which companies are prominent players in the South America Gluten Free Foods & Beverages Market?

Key companies in the market include Kelkin Ltd, Dr Schar AG, General Mills Inc, Bob's Red Mill, Quinoa Corporation, Cerealko SA, Molinos Rio de la Plata, CeliGourmet*List Not Exhaustive.

3. What are the main segments of the South America Gluten Free Foods & Beverages Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 531.5 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages.

6. What are the notable trends driving market growth?

Rising Demand for Organic Beverages.

7. Are there any restraints impacting market growth?

Competition from Substitute Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Gluten Free Foods & Beverages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Gluten Free Foods & Beverages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Gluten Free Foods & Beverages Market?

To stay informed about further developments, trends, and reports in the South America Gluten Free Foods & Beverages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence