Key Insights

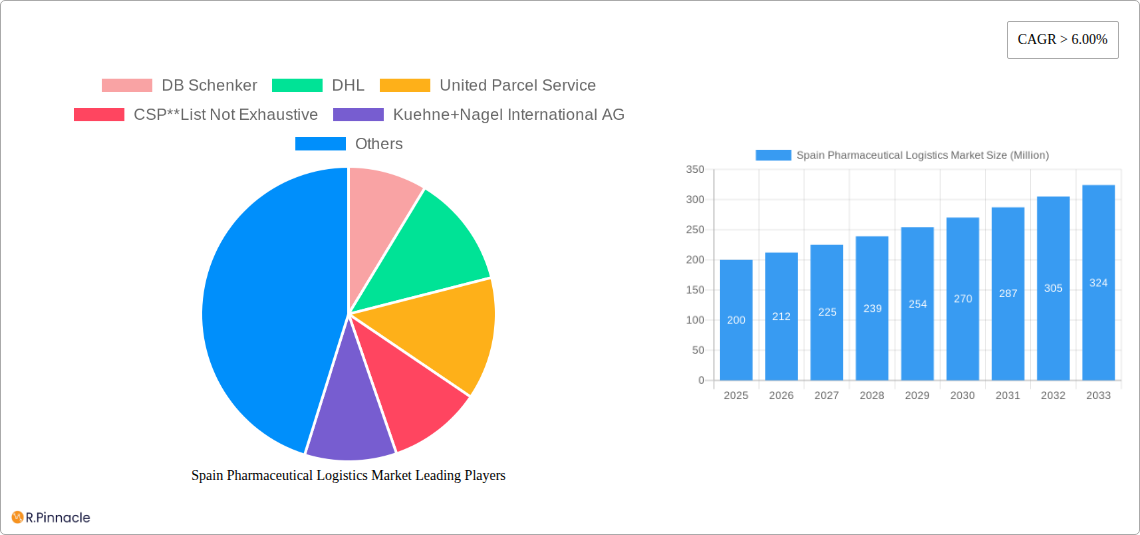

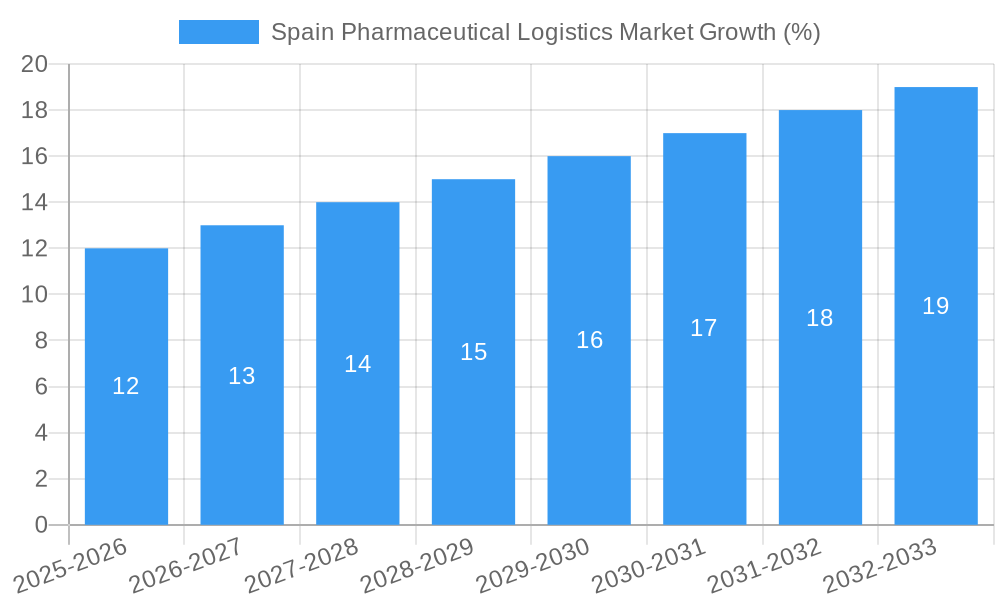

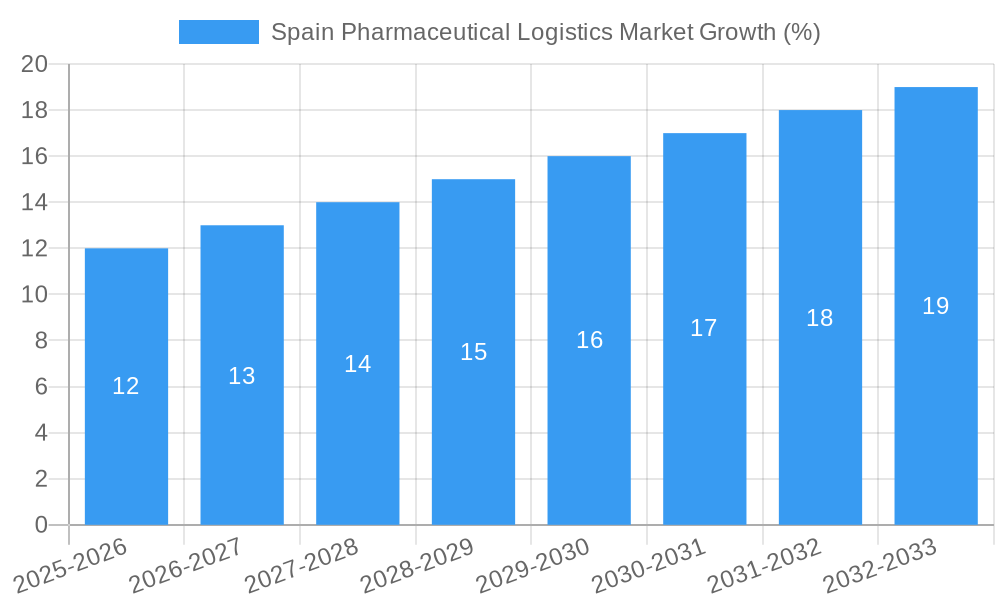

The Spain pharmaceutical logistics market, valued at approximately €[Estimate based on market size XX and value unit Million – let's assume €200 million in 2025], is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 6.00% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing prevalence of chronic diseases and the rising demand for pharmaceutical products fuel the need for efficient and reliable logistics solutions. Secondly, the stringent regulatory landscape surrounding pharmaceutical transportation and storage necessitates specialized cold chain logistics, contributing to market growth. Thirdly, the growing adoption of advanced technologies, such as real-time tracking and temperature monitoring systems, enhances supply chain visibility and efficiency, further boosting market expansion. The market is segmented by mode of transport (air, rail, road, sea), product type (generic and branded drugs), mode of operation (cold chain and non-cold chain logistics), and application (biopharma and chemical pharma). Major players like DB Schenker, DHL, UPS, and FedEx are actively shaping the market landscape through strategic partnerships and technological advancements. The growing focus on pharmaceutical security and traceability is expected to propel innovation within the sector.

The continued growth in the Spanish pharmaceutical sector, fueled by both domestic consumption and export opportunities, will provide substantial opportunities for logistics providers. The increasing emphasis on patient-centric care models, including home delivery of pharmaceuticals, will also drive demand for specialized logistics solutions. However, challenges such as fluctuating fuel prices and the increasing complexity of regulations may pose constraints to market growth. The successful players in this market will be those that effectively leverage technological advancements, maintain compliance with regulatory standards, and establish robust cold chain infrastructure to meet the evolving needs of the pharmaceutical industry in Spain.

Spain Pharmaceutical Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Spain pharmaceutical logistics market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report unveils market dynamics, segmentation trends, key players, and future growth prospects. The report leverages a robust data-driven methodology to provide accurate and reliable forecasts for the forecast period of 2025-2033.

Spain Pharmaceutical Logistics Market Structure & Innovation Trends

The Spanish pharmaceutical logistics market exhibits a moderately consolidated structure with key players such as DB Schenker, DHL, United Parcel Service, Kuehne+Nagel International AG, FedEx, CEVA Logistics, Agility Logistics, C.H. Robinson, Movianto, and Eurotranspharma holding significant market share. However, the market also accommodates several smaller, specialized players. Market share data for individual companies is not publicly available and varies by segment, requiring detailed competitive intelligence gathering. Innovation within the sector is driven by technological advancements in cold chain logistics, automation, and data analytics. Stringent regulatory frameworks, such as those mandated by the European Medicines Agency (EMA), impact market operations, ensuring pharmaceutical product safety and efficacy. The market also witnesses ongoing M&A activity, reflecting industry consolidation and expansion efforts. Recent examples include Lineage Logistics’ acquisition of Grupo Fuentes and Movianto's investment in a new facility. These transactions indicate a growing focus on enhanced cold chain infrastructure and capacity expansion, valued at xx Million.

- Market Concentration: Moderately consolidated, with a few major players controlling a significant share. Exact figures unavailable without primary research and detailed company filings.

- Innovation Drivers: Technological advancements (cold chain, automation, data analytics), regulatory compliance needs.

- Regulatory Framework: Stringent regulations from EMA and other agencies driving investment in compliance-focused solutions.

- Product Substitutes: Limited direct substitutes, but competition exists in terms of pricing and service efficiency.

- End-User Demographics: Primarily pharmaceutical manufacturers, distributors, hospitals, and pharmacies.

- M&A Activities: Significant M&A activity focuses on expanding cold chain capacity and market reach; Lineage Logistics’ acquisition of Grupo Fuentes and Movianto’s expansion exemplify this.

Spain Pharmaceutical Logistics Market Dynamics & Trends

The Spain pharmaceutical logistics market is witnessing robust growth, driven by several key factors. The increasing demand for pharmaceutical products fueled by an aging population and rising prevalence of chronic diseases is a major growth catalyst. This has resulted in a significant increase in the need for efficient and reliable logistics solutions. Technological advancements, such as the adoption of IoT and AI-powered solutions, are enhancing supply chain visibility, optimization, and security. Furthermore, the growing focus on cold chain logistics for temperature-sensitive pharmaceutical products is driving investment in specialized infrastructure and services. The market experiences intense competition among established players and new entrants. This competitive landscape is fostering innovation and driving down prices, benefiting consumers. The CAGR for the period 2025-2033 is projected at xx%, with market penetration increasing steadily, especially in specialized segments like cold chain logistics.

Dominant Regions & Segments in Spain Pharmaceutical Logistics Market

While precise market share data by region is currently unavailable for this report and requires detailed market research, the major urban centers and regions with significant pharmaceutical manufacturing and distribution infrastructure are expected to dominate the market. The cold chain logistics segment holds the largest market share due to the increasing demand for temperature-sensitive pharmaceutical products.

By Mode of Transport: Road shipping dominates due to its extensive network reach and cost-effectiveness.

By Product: Branded drugs hold a larger market share compared to generic drugs.

By Mode of Operation: Cold chain logistics is a dominant segment.

By Application: The biopharma segment is expected to grow significantly, driving demand for specialized logistics solutions.

Key Drivers (Examples):

- Developed road infrastructure supporting Road Shipping dominance.

- High concentration of pharmaceutical manufacturing and distribution centers in major cities.

- Stringent regulations supporting the growth of the cold chain logistics sector.

Spain Pharmaceutical Logistics Market Product Innovations

Technological advancements are significantly impacting the pharmaceutical logistics sector in Spain. The integration of IoT devices, AI-powered route optimization software, and advanced temperature monitoring systems are leading to improved efficiency, enhanced security, and greater visibility across the supply chain. These innovations are also enabling better inventory management, reducing waste, and minimizing the risk of product spoilage or degradation. The increasing adoption of these technologies is providing a competitive edge to logistics providers who can offer superior service levels and meet the evolving needs of pharmaceutical companies.

Report Scope & Segmentation Analysis

This report segments the Spain pharmaceutical logistics market across several key parameters:

- By Mode of Transport: Air, Rail, Road, and Sea shipping, with road shipping currently dominating due to network infrastructure. Market size projections for each mode require further in-depth market research.

- By Product: Generic and Branded drugs; branded drugs hold a larger market share currently, but generic drugs are projected to grow.

- By Mode of Operation: Cold Chain and Non-cold Chain logistics. Cold chain is the fastest-growing segment.

- By Application: Biopharma and Chemical pharma. Both segments are experiencing substantial growth, with projections indicating rapid expansion.

Each segment's growth projections and market sizes require extensive market research. Competitive dynamics are complex and vary across segments.

Key Drivers of Spain Pharmaceutical Logistics Market Growth

The growth of the Spanish pharmaceutical logistics market is propelled by several factors: the rising demand for pharmaceuticals driven by an aging population and increased prevalence of chronic illnesses; the growing adoption of advanced technologies such as IoT and AI for supply chain optimization; stringent regulatory requirements for pharmaceutical storage and transportation driving investments in cold chain infrastructure; and increased outsourcing of logistics functions by pharmaceutical companies to focus on core competencies.

Challenges in the Spain Pharmaceutical Logistics Market Sector

Several challenges hinder market growth: maintaining the integrity of temperature-sensitive products throughout the supply chain; ensuring regulatory compliance across evolving guidelines; effectively managing fluctuations in demand; high infrastructure costs, particularly for specialized cold chain facilities; and competition from both domestic and international logistics providers. Quantifiable impacts of these challenges on market growth require further research.

Emerging Opportunities in Spain Pharmaceutical Logistics Market

Significant opportunities exist: expansion of cold chain infrastructure to accommodate growing demand for temperature-sensitive products; adoption of advanced technologies like blockchain for enhanced traceability and security; growth in specialized logistics services for niche pharmaceutical products; and expansion into underserved regional markets. These opportunities present lucrative prospects for businesses focused on innovating and adapting to evolving market needs.

Leading Players in the Spain Pharmaceutical Logistics Market Market

- DB Schenker

- DHL

- United Parcel Service

- CSP (List Not Exhaustive)

- Kuehne+Nagel International AG

- FedEx

- CEVA Logistics

- Agility Logistics

- C.H. Robinson

- Movianto

- Eurotranspharma

Key Developments in Spain Pharmaceutical Logistics Market Industry

- August 2022: Lineage Logistics announced its intention to acquire Grupo Fuentes, expanding its cold storage capacity in Spain by 100,000 pallet positions. This significantly enhances cold chain infrastructure.

- January 2022: Movianto invested 41.88 Million USD in a new facility in Numancia de la Sagra, significantly increasing its cold storage capacity in Spain. This demonstrates increasing investment and capacity expansion within the industry.

Future Outlook for Spain Pharmaceutical Logistics Market Market

The Spanish pharmaceutical logistics market is poised for continued growth, driven by a combination of factors, including increasing demand for pharmaceuticals, technological advancements enhancing efficiency and security, and expanding cold chain infrastructure. The strategic focus on improving the overall supply chain resilience and optimizing logistics operations will further accelerate market expansion, presenting significant opportunities for industry stakeholders to capitalize on the growing market.

Spain Pharmaceutical Logistics Market Segmentation

-

1. Product

- 1.1. Generic Drugs

- 1.2. Branded Drugs

-

2. Mode of Operation

- 2.1. Cold Chain Logistics

- 2.2. Non-cold Chain Logistics

-

3. Application

- 3.1. Bio Pharma

- 3.2. Chemical Pharma

-

4. Mode Of Transport

- 4.1. Air Shipping

- 4.2. Rail Shipping

- 4.3. Road Shipping

- 4.4. Sea Shipping

Spain Pharmaceutical Logistics Market Segmentation By Geography

- 1. Spain

Spain Pharmaceutical Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Over the Counter Drugs Across the European Region; Growing Manufacture Activity from Pharmaceutical Companies

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Transportation Ordered

- 3.4. Market Trends

- 3.4.1. Increase in Pharmaceutical Sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Pharmaceutical Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Generic Drugs

- 5.1.2. Branded Drugs

- 5.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 5.2.1. Cold Chain Logistics

- 5.2.2. Non-cold Chain Logistics

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Bio Pharma

- 5.3.2. Chemical Pharma

- 5.4. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.4.1. Air Shipping

- 5.4.2. Rail Shipping

- 5.4.3. Road Shipping

- 5.4.4. Sea Shipping

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 United Parcel Service

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CSP**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kuehne+Nagel International AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEVA Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agility Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 C H Robinson

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Movianto

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Eurotranspharma

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Spain Pharmaceutical Logistics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain Pharmaceutical Logistics Market Share (%) by Company 2024

List of Tables

- Table 1: Spain Pharmaceutical Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain Pharmaceutical Logistics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Spain Pharmaceutical Logistics Market Revenue Million Forecast, by Mode of Operation 2019 & 2032

- Table 4: Spain Pharmaceutical Logistics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Spain Pharmaceutical Logistics Market Revenue Million Forecast, by Mode Of Transport 2019 & 2032

- Table 6: Spain Pharmaceutical Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Spain Pharmaceutical Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Spain Pharmaceutical Logistics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 9: Spain Pharmaceutical Logistics Market Revenue Million Forecast, by Mode of Operation 2019 & 2032

- Table 10: Spain Pharmaceutical Logistics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 11: Spain Pharmaceutical Logistics Market Revenue Million Forecast, by Mode Of Transport 2019 & 2032

- Table 12: Spain Pharmaceutical Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Pharmaceutical Logistics Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Spain Pharmaceutical Logistics Market?

Key companies in the market include DB Schenker, DHL, United Parcel Service, CSP**List Not Exhaustive, Kuehne+Nagel International AG, FedEx, CEVA Logistics, Agility Logistics, C H Robinson, Movianto, Eurotranspharma.

3. What are the main segments of the Spain Pharmaceutical Logistics Market?

The market segments include Product, Mode of Operation, Application, Mode Of Transport .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Over the Counter Drugs Across the European Region; Growing Manufacture Activity from Pharmaceutical Companies.

6. What are the notable trends driving market growth?

Increase in Pharmaceutical Sales.

7. Are there any restraints impacting market growth?

High Cost Associated with the Transportation Ordered.

8. Can you provide examples of recent developments in the market?

August 2022: Lineage Logistics, LLC ('Lineage' or the 'Company'), one of the world's leading temperature-controlled industrial REIT and logistics solutions providers, announced its intention to acquire Grupo Fuentes, a major operator of transport and cold storage facilities, headquartered in Murcia, Spain. Grupo Fuentes has a cold storage warehouse in Murcia with 60,000 pallet positions and plans to expand the site with an additional 40,000 pallet positions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Pharmaceutical Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Pharmaceutical Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Pharmaceutical Logistics Market?

To stay informed about further developments, trends, and reports in the Spain Pharmaceutical Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence