Key Insights

The Spanish snack bar market is poised for substantial growth, projected to reach an estimated market size of USD 167.70 million by 2025. This expansion is fueled by a robust Compound Annual Growth Rate (CAGR) of 6.16%, indicating a dynamic and evolving consumer landscape. The market's trajectory is shaped by several key drivers, including a growing consumer preference for convenient and on-the-go food options, increasing health consciousness, and the rising demand for functional snacks offering specific benefits like energy boosts or protein enrichment. The cereal bars segment, encompassing granola/muesli bars and other variations, is anticipated to lead the market due to its perceived health benefits and wide appeal. Energy bars are also expected to witness significant traction, catering to fitness enthusiasts and individuals seeking sustained energy release throughout the day. The "Other Snack Bars" category will likely encompass innovative products catering to niche dietary needs and evolving taste preferences.

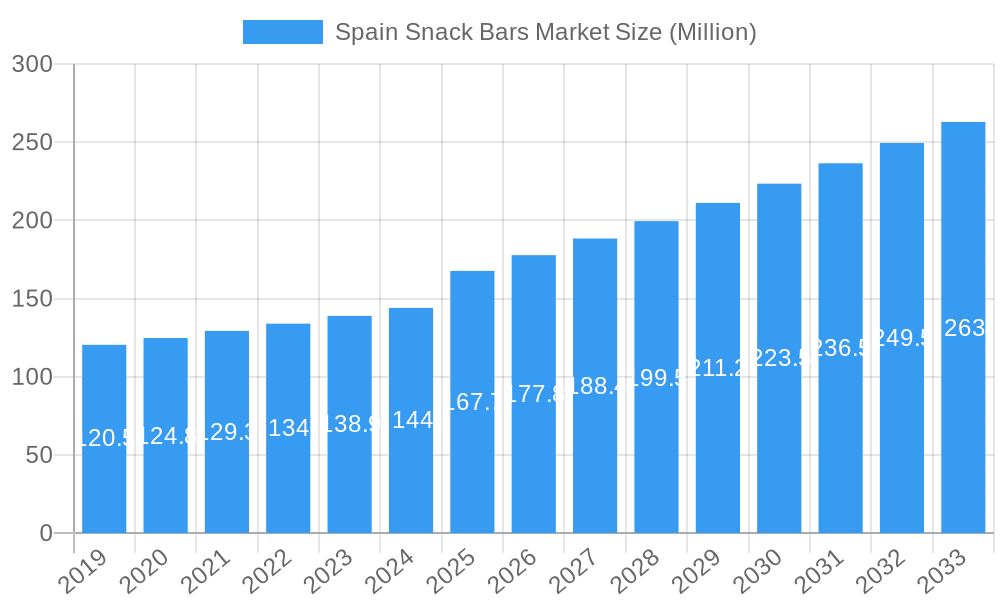

Spain Snack Bars Market Market Size (In Million)

Distribution channels play a crucial role in this market's accessibility and growth. Supermarkets and hypermarkets are expected to remain dominant, offering a wide selection and convenience for everyday shoppers. However, the significant rise of online stores is a critical trend, providing unparalleled convenience and access to a broader range of specialized products. Convenience stores will continue to capture impulse purchases, while specialty stores will cater to consumers seeking premium or health-focused options. Key players like Kellanova, General Mills Inc., Nestlé SA, and PepsiCo are actively shaping the market through product innovation, strategic partnerships, and targeted marketing campaigns. The market's growth in Spain is also influenced by evolving consumer lifestyles, a greater emphasis on balanced diets, and the increasing availability of diverse snack bar formulations designed to meet specific nutritional requirements and taste profiles, all contributing to a consistently expanding market value.

Spain Snack Bars Market Company Market Share

This in-depth report delivers a detailed examination of the Spain Snack Bars Market, providing critical insights for industry stakeholders. Covering the historical period of 2019-2024, the base and estimated year of 2025, and a robust forecast period of 2025-2033, this analysis leverages high-ranking keywords to enhance search visibility and engage professionals seeking actionable intelligence. Discover market dynamics, dominant segments, product innovations, growth drivers, challenges, emerging opportunities, and key players shaping the future of the Spanish snack bar industry. With a projected market size of XX Million in 2025, this report is an indispensable resource for strategic planning and investment decisions.

Spain Snack Bars Market Market Structure & Innovation Trends

The Spain Snack Bars Market exhibits a XX% market concentration, with key players like Kellanova, General Mills Inc., Nestlé SA, and PepsiCo holding significant market share. Innovation is primarily driven by evolving consumer demand for healthier, functional, and convenient snack options. Regulatory frameworks, particularly concerning food labeling and nutritional claims, play a crucial role in shaping product development. The threat of product substitutes, such as fresh fruit, yogurt, and other packaged snacks, remains a constant consideration for manufacturers. End-user demographics are increasingly skewed towards health-conscious millennials and Gen Z, seeking on-the-go solutions with transparent ingredient lists. Mergers and acquisitions (M&A) activities are anticipated to be moderate, with potential consolidation focused on acquiring niche brands offering innovative or specialized product lines. The estimated value of M&A deals within the past five years is XX Million.

- Market Concentration: XX%

- Innovation Drivers: Health & Wellness, Convenience, Functional Ingredients

- Regulatory Influence: Food Labeling, Nutritional Standards

- Product Substitutes: Fresh Produce, Dairy Products, Other Packaged Snacks

- End-User Demographics: Health-Conscious Millennials & Gen Z, Busy Professionals

- M&A Activity: Moderate, focused on niche and innovative brands

- Estimated M&A Deal Value (Past 5 Years): XX Million

Spain Snack Bars Market Market Dynamics & Trends

The Spain Snack Bars Market is poised for substantial growth, driven by an increasing demand for convenient and on-the-go food options, reflecting the fast-paced lifestyles prevalent in urban Spain. The escalating consumer awareness regarding health and wellness is a pivotal market growth driver, leading to a surge in demand for snack bars formulated with natural ingredients, lower sugar content, and added nutritional benefits like protein and fiber. Technological disruptions are manifesting in innovative product formulations, advanced manufacturing processes that enhance shelf-life and texture, and the development of novel packaging solutions that prioritize sustainability and consumer convenience. E-commerce platforms have emerged as significant distribution channels, facilitating wider market penetration and enabling brands to reach a broader consumer base. Competitive dynamics are characterized by intense product differentiation, with brands vying for consumer attention through unique flavor profiles, ingredient sourcing, and targeted marketing campaigns addressing specific dietary needs and lifestyle preferences. The projected Compound Annual Growth Rate (CAGR) for the Spain Snack Bars Market from 2025 to 2033 is estimated at XX%, with a market penetration rate of XX% by the end of the forecast period.

Dominant Regions & Segments in Spain Snack Bars Market

The Supermarkets/Hypermarkets distribution channel is currently the most dominant segment within the Spain Snack Bars Market, accounting for an estimated XX% of total sales in 2025. This dominance stems from their widespread accessibility, extensive product variety, and frequent promotional activities that attract a large customer base. Consumers often find a comprehensive selection of snack bars, from mainstream brands to specialized offerings, making these retail environments a one-stop shop for their needs.

- Leading Distribution Channel: Supermarkets/Hypermarkets

- Key Drivers of Dominance:

- Widespread Accessibility: Ubiquitous presence across urban and suburban areas.

- Product Variety: Offers a broad range of brands and product types catering to diverse consumer preferences.

- Promotional Activities: Frequent discounts and special offers attract price-sensitive consumers.

- Convenience: Allows for one-stop shopping for various grocery needs, including snacks.

- Detailed Dominance Analysis: Supermarkets and hypermarkets serve as the primary point of purchase for a significant portion of the Spanish population. Their large store formats enable retailers to stock a wide array of snack bars, from established global brands to emerging local producers. The consistent foot traffic, coupled with effective in-store merchandising and placement strategies, ensures high sales volumes. Furthermore, these channels often benefit from strong relationships with manufacturers, leading to preferred product placement and promotional support, reinforcing their market leadership.

- Key Drivers of Dominance:

In terms of Product Type, Cereal Bars (Granola/Muesli Bars) are projected to maintain their leading position, capturing an estimated XX% of the market share in 2025. The inherent appeal of granola and muesli bars lies in their association with a healthy and natural image, often perceived as a wholesome breakfast or mid-day snack option. The variety of ingredients, from fruits and nuts to seeds and whole grains, allows for extensive product differentiation and appeals to a wide spectrum of consumer tastes.

- Dominant Product Type: Cereal Bars (Granola/Muesli Bars)

- Key Drivers of Dominance:

- Perceived Healthiness: Strong consumer association with natural ingredients and wholesome nutrition.

- Versatility: Suitable for breakfast, snacks, and pre/post-workout consumption.

- Flavor and Ingredient Variety: Extensive customization options appeal to diverse palates.

- Established Consumer Habit: Long-standing preference for granola and muesli as a convenient and healthy option.

- Detailed Dominance Analysis: Granola and muesli bars have successfully carved out a significant niche in the Spanish snack bar market due to their established reputation for health and convenience. Manufacturers continually innovate within this sub-segment by introducing new flavor combinations, incorporating superfoods, and catering to specific dietary needs such as gluten-free or vegan options. The widespread availability in supermarkets and convenience stores further solidifies their market dominance, making them a go-to choice for consumers seeking a balanced and satisfying snack.

- Key Drivers of Dominance:

Spain Snack Bars Market Product Innovations

Product innovations in the Spain Snack Bars Market are primarily focused on enhancing nutritional profiles, incorporating functional ingredients, and addressing specific dietary needs. Brands are actively developing snack bars with higher protein content for fitness enthusiasts, incorporating prebiotics and probiotics for gut health, and offering low-sugar and naturally sweetened options for health-conscious consumers. Technological advancements in ingredient processing and formulation are enabling the creation of improved textures and extended shelf-life without compromising on naturalness. These innovations provide a competitive advantage by catering to the evolving demands of a discerning consumer base seeking both indulgence and well-being in their snacking choices.

Report Scope & Segmentation Analysis

This report meticulously segments the Spain Snack Bars Market by Product Type, encompassing Cereal Bars (Granola/Muesli Bars, Other Cereal Bars), Energy Bars, and Other Snack Bars. It also provides a comprehensive analysis based on Distribution Channel, including Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, and Other Distribution Channels. Each segment is analyzed for its projected market size, growth trajectory, and competitive landscape, offering granular insights into specific market dynamics and consumer preferences within each category.

- Product Type Segmentation: Granola/Muesli Bars, Other Cereal Bars, Energy Bars, Other Snack Bars.

- Distribution Channel Segmentation: Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Other Distribution Channels.

Key Drivers of Spain Snack Bars Market Growth

The Spain Snack Bars Market is propelled by several key drivers. The increasing consumer emphasis on health and wellness fuels demand for bars with natural ingredients, reduced sugar, and added functional benefits like protein and fiber. The pervasive need for convenient, on-the-go food solutions, driven by modern lifestyles, further bolsters market growth. Technological advancements in product development, including innovative ingredient sourcing and manufacturing techniques, allow for the creation of more appealing and health-conscious options. Furthermore, strategic marketing campaigns by leading players and the growing popularity of e-commerce platforms are expanding market reach and accessibility, contributing significantly to the market's upward trajectory.

Challenges in the Spain Snack Bars Market Sector

Despite robust growth, the Spain Snack Bars Market faces several challenges. Intense competition from a wide array of established and emerging brands leads to price pressures and necessitates continuous product innovation to stand out. Stringent regulatory frameworks concerning food labeling, nutritional claims, and ingredient sourcing can pose compliance hurdles for manufacturers. Fluctuations in raw material prices, such as oats, nuts, and fruits, can impact production costs and profit margins. Additionally, evolving consumer perceptions regarding the "healthiness" of processed snacks, coupled with the availability of healthier alternatives like fresh produce, present a constant challenge to market penetration.

Emerging Opportunities in Spain Snack Bars Market

The Spain Snack Bars Market is ripe with emerging opportunities. There is a growing demand for plant-based and vegan snack bars, catering to the expanding vegan and flexitarian population. The trend towards personalized nutrition presents an opportunity for brands to develop customized snack bars tailored to specific dietary requirements and health goals. Expansion into niche markets, such as sports nutrition and children's snacks, with targeted product formulations, offers significant growth potential. Moreover, the increasing adoption of sustainable packaging solutions aligns with consumer environmental consciousness, creating a competitive advantage for eco-friendly brands.

Leading Players in the Spain Snack Bars Market Market

- Kellanova

- General Mills Inc.

- Associated British Foods PLC

- Nestle SA

- PepsiCo

- Clif Bar & Company

- Mars Incorporated

- Abbott Nutrition Manufacturing Inc.

- Post Holdings Inc.

- KIND Snacks

Key Developments in Spain Snack Bars Market Industry

- October 2023: The Kellogg Company was split into two separate entities. The cereal business of North America will be operated under WK Kellogg Co., and global snacking brands, including snack bars, will be operated under Kellanova.

- May 2022: Kellogg collaborated with design firm Landor & Fitch to develop a new packaging system that complements the brand's current offerings. The new packaging was rolled out in regions like the United Kingdom and Ireland, Benelux, France, Italy, Portugal, Spain, the Middle East, and North Africa.

- April 2022: Mooski launched its granola bar, a refrigerated bar made with soaked oats, nut butter, and dried fruit, dipped in dairy-free dark chocolate in five flavors, namely peanut butter banana, chocolate peanut crunch, wild berry, an oatmeal raisin cookie, and apple cinnamon.

Future Outlook for Spain Snack Bars Market Market

The future outlook for the Spain Snack Bars Market is highly promising, driven by sustained consumer demand for convenient, healthy, and functional food options. Continued innovation in product formulation, focusing on natural ingredients, plant-based alternatives, and personalized nutrition, will be key growth accelerators. The expanding e-commerce landscape offers significant opportunities for enhanced market reach and direct-to-consumer engagement. Brands that prioritize sustainability in their packaging and sourcing practices will likely gain a competitive edge. Furthermore, strategic partnerships and potential acquisitions focusing on niche and innovative brands are expected to shape the market's competitive structure, ensuring continued dynamism and growth in the coming years.

Spain Snack Bars Market Segmentation

-

1. Product Type

-

1.1. Cereal Bars

- 1.1.1. Granola/Muesli Bars

- 1.1.2. Other Cereal Bars

- 1.2. Energy Bars

- 1.3. Other Snack Bars

-

1.1. Cereal Bars

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Stores

- 2.5. Other Distribution Channels

Spain Snack Bars Market Segmentation By Geography

- 1. Spain

Spain Snack Bars Market Regional Market Share

Geographic Coverage of Spain Snack Bars Market

Spain Snack Bars Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Convenient and Healthy On-The-Go Snacking; Surging Clean-Label And Free-From Demand?

- 3.3. Market Restrains

- 3.3.1. Demand for Convenient and Healthy On-The-Go Snacking; Surging Clean-Label And Free-From Demand?

- 3.4. Market Trends

- 3.4.1. Rise in Demand for Energy Bars due to an Increase in Active Lifestyles Boosting Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Snack Bars Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cereal Bars

- 5.1.1.1. Granola/Muesli Bars

- 5.1.1.2. Other Cereal Bars

- 5.1.2. Energy Bars

- 5.1.3. Other Snack Bars

- 5.1.1. Cereal Bars

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kellanova

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 General Mills Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Associated British Foods PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nestle SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PepsiCo

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Clif Bar & Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mars Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Clif Bar & Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Abbott Nutrition Manufacturing Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Post Holdings Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 KIND Snacks*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Kellanova

List of Figures

- Figure 1: Spain Snack Bars Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Spain Snack Bars Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Snack Bars Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Spain Snack Bars Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: Spain Snack Bars Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Spain Snack Bars Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 5: Spain Snack Bars Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Spain Snack Bars Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Spain Snack Bars Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Spain Snack Bars Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 9: Spain Snack Bars Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Spain Snack Bars Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 11: Spain Snack Bars Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Spain Snack Bars Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Snack Bars Market?

The projected CAGR is approximately 6.16%.

2. Which companies are prominent players in the Spain Snack Bars Market?

Key companies in the market include Kellanova, General Mills Inc, Associated British Foods PLC, Nestle SA, PepsiCo, Clif Bar & Company, Mars Incorporated, Clif Bar & Company, Abbott Nutrition Manufacturing Inc, Post Holdings Inc, KIND Snacks*List Not Exhaustive.

3. What are the main segments of the Spain Snack Bars Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 167.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Convenient and Healthy On-The-Go Snacking; Surging Clean-Label And Free-From Demand?.

6. What are the notable trends driving market growth?

Rise in Demand for Energy Bars due to an Increase in Active Lifestyles Boosting Market Growth.

7. Are there any restraints impacting market growth?

Demand for Convenient and Healthy On-The-Go Snacking; Surging Clean-Label And Free-From Demand?.

8. Can you provide examples of recent developments in the market?

October 2023: The Kellogg Company was split into two separate entities. The cereal business of North America will be operated under WK Kellogg Co., and global snacking brands, including snack bars, will be operated under Kellanova.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Snack Bars Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Snack Bars Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Snack Bars Market?

To stay informed about further developments, trends, and reports in the Spain Snack Bars Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence