Key Insights

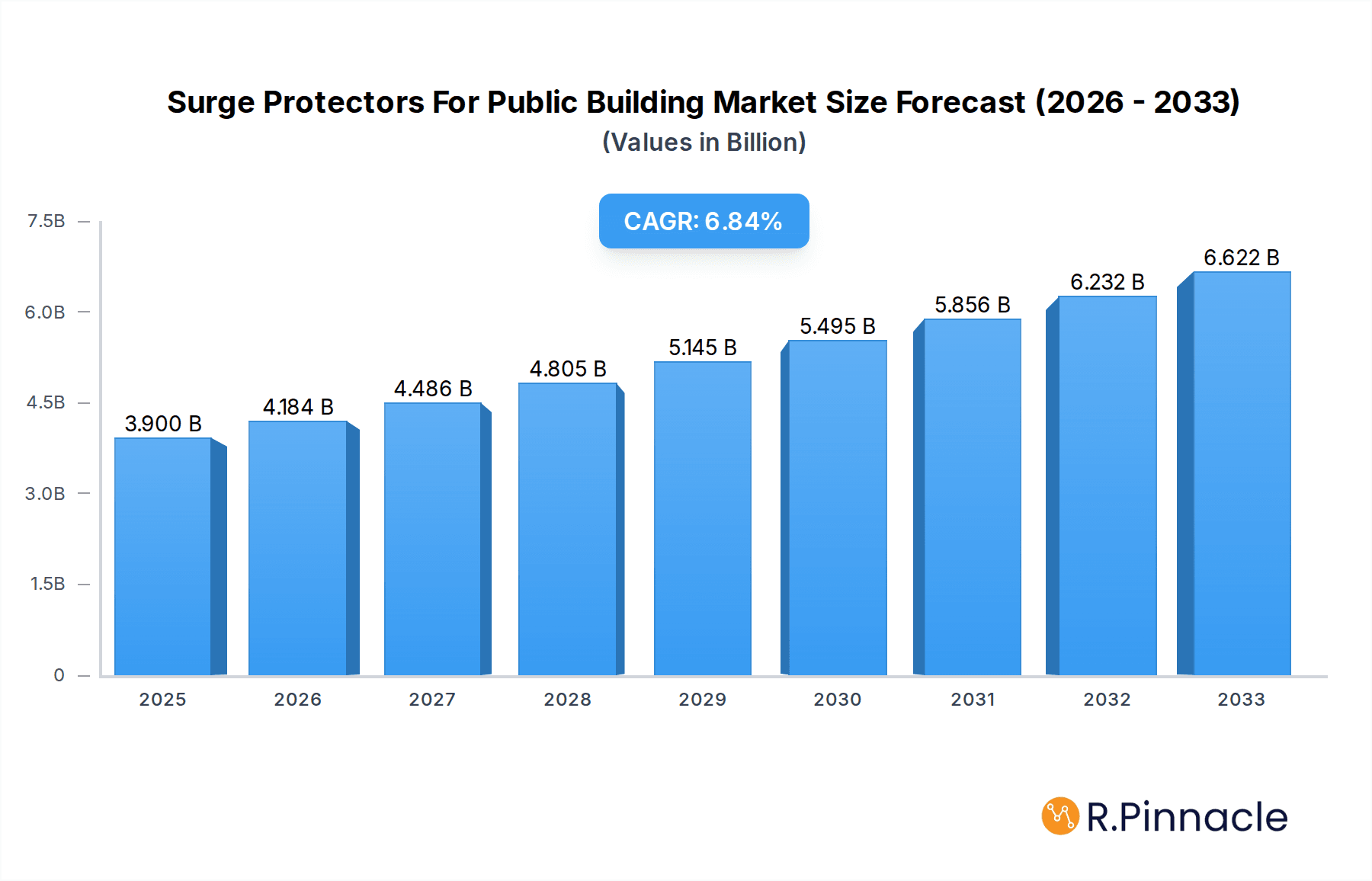

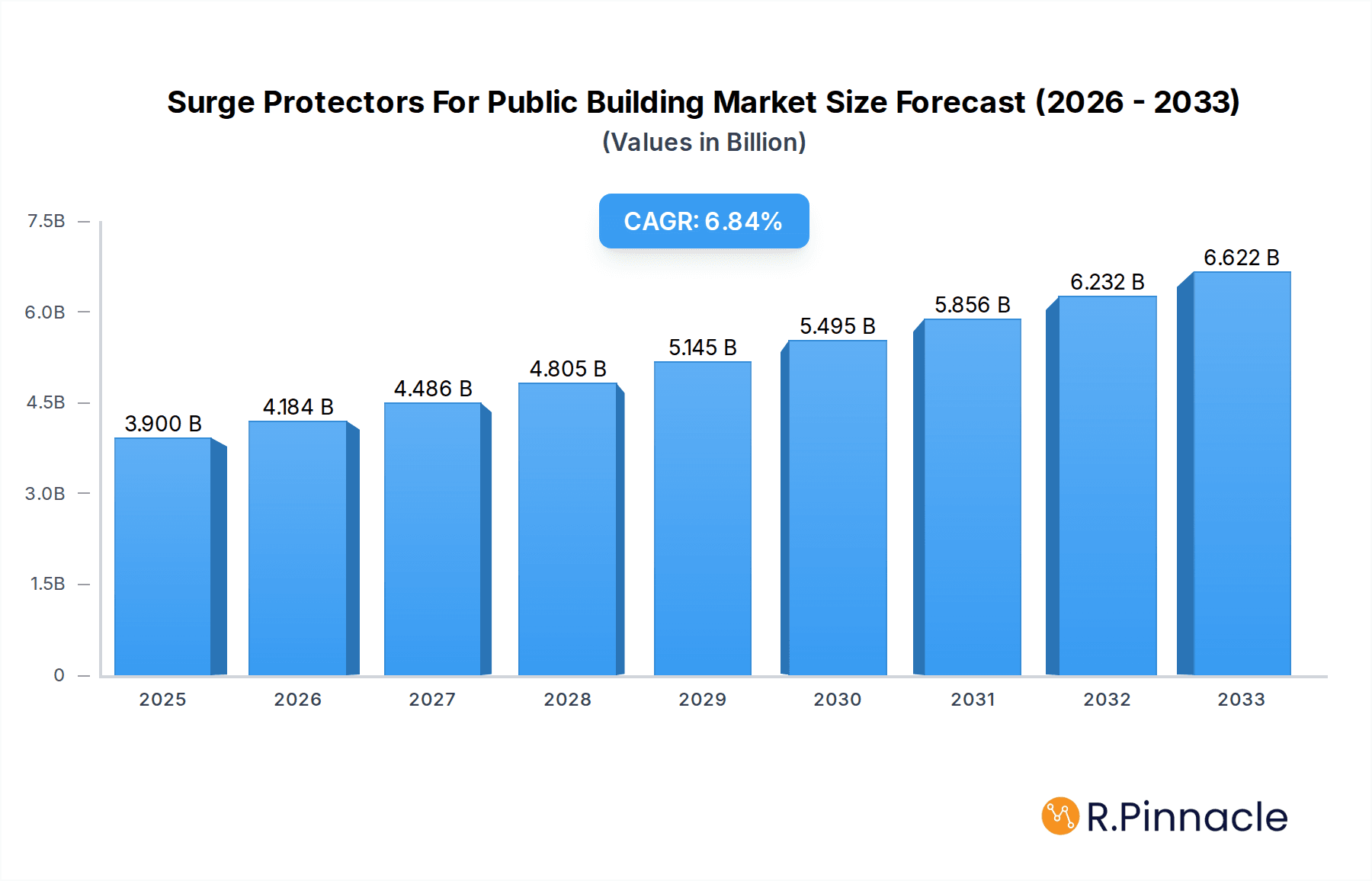

The global market for surge protectors in public buildings is poised for significant expansion, projected to reach $3.9 billion in 2025. This robust growth is underpinned by a healthy 7.1% CAGR, indicating a dynamic and evolving market landscape. The primary drivers for this surge in demand include the increasing adoption of sophisticated electronic systems in public infrastructure, such as smart city technologies, advanced communication networks, and integrated building management systems, all of which are highly susceptible to voltage fluctuations and power surges. Furthermore, heightened awareness regarding the financial and operational implications of equipment damage caused by power disturbances, coupled with stringent government regulations mandating the installation of protective devices in public facilities like hospitals, educational institutions, and transportation hubs, are further propelling market growth. The trend towards enhanced grid stability and resilience also plays a crucial role, with surge protectors being a foundational element in safeguarding critical public services from transient overvoltages.

Surge Protectors For Public Building Market Size (In Billion)

The market is characterized by a diverse range of applications, from protecting essential building infrastructure to safeguarding sensitive electronic equipment. Key segments include industrial applications, commercial buildings, and institutional facilities, each presenting unique protection requirements. The type segment encompasses various surge protective devices (SPDs), including plug-in protectors, hardwired units, and whole-building systems, catering to a spectrum of protection needs and budget considerations. Despite the positive growth trajectory, the market faces certain restraints, such as the initial cost of installation for comprehensive surge protection systems and a lack of universal standardization in some regions, which can lead to fragmented adoption. However, the long-term benefits of reduced downtime, extended equipment lifespan, and enhanced operational reliability are increasingly outweighing these initial concerns. Leading players like MERSEN, Schneider Electric, ABB, Eaton, and Rockwell Automation are actively innovating and expanding their product portfolios to meet the evolving demands of this critical market.

Surge Protectors For Public Building Company Market Share

Here's an SEO-optimized, reader-centric report description for "Surge Protectors For Public Building," designed for industry professionals and maximizing search visibility.

This comprehensive report delivers in-depth insights into the global Surge Protectors for Public Building market, providing critical analysis for industry stakeholders from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study examines market structure, dynamics, innovation trends, and regional dominance, offering actionable intelligence for strategic decision-making. The report covers historical performance from 2019 to 2024, presenting a robust understanding of past market behavior and future potential.

Surge Protectors For Public Building Market Structure & Innovation Trends

The Surge Protectors for Public Building market exhibits a XX% market concentration, with leading players such as MERSEN, Schneider Electric, and ABB holding substantial market share. Innovation is driven by the increasing demand for advanced protection against transient voltage surges and electromagnetic interference, particularly in critical infrastructure like hospitals, airports, and educational institutions. Regulatory frameworks, such as those mandating compliance with IEC and UL standards, are shaping product development and market entry strategies. The proliferation of smart buildings and the Internet of Things (IoT) necessitates enhanced surge protection for connected devices, driving the adoption of sophisticated solutions. Product substitutes, while present in lower-tier applications, are largely outpaced by the performance and reliability requirements in public building environments. End-user demographics are evolving, with government agencies, educational institutions, and healthcare providers being key consumers. M&A activities are notable, with recent deals valued at over $10 billion indicating consolidation and strategic expansion by major corporations seeking to broaden their product portfolios and geographical reach within this vital sector.

Surge Protectors For Public Building Market Dynamics & Trends

The Surge Protectors for Public Building market is experiencing robust growth, propelled by a projected Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This expansion is fueled by an escalating awareness of the economic and operational consequences of electrical disturbances. Increasing investments in public infrastructure across developing nations, coupled with the modernization of existing facilities, are significant market growth drivers. Technological disruptions, including the integration of smart functionalities, remote monitoring capabilities, and advanced diagnostic features into surge protective devices (SPDs), are transforming the competitive landscape. Consumer preferences are shifting towards higher reliability, longer lifespans, and compliance with stringent safety and performance standards. The growing adoption of renewable energy sources in public buildings also presents a unique set of surge protection challenges, demanding innovative solutions. Competitive dynamics are characterized by intense research and development, strategic partnerships, and a focus on customized solutions for diverse public sector applications. Market penetration is steadily increasing as the understanding of the value proposition of robust surge protection becomes more widespread among facility managers and public procurement officers. The continuous evolution of electronic equipment and the increasing density of sensitive devices within public facilities necessitate constant upgrades and installations of advanced surge protection, further solidifying market trends.

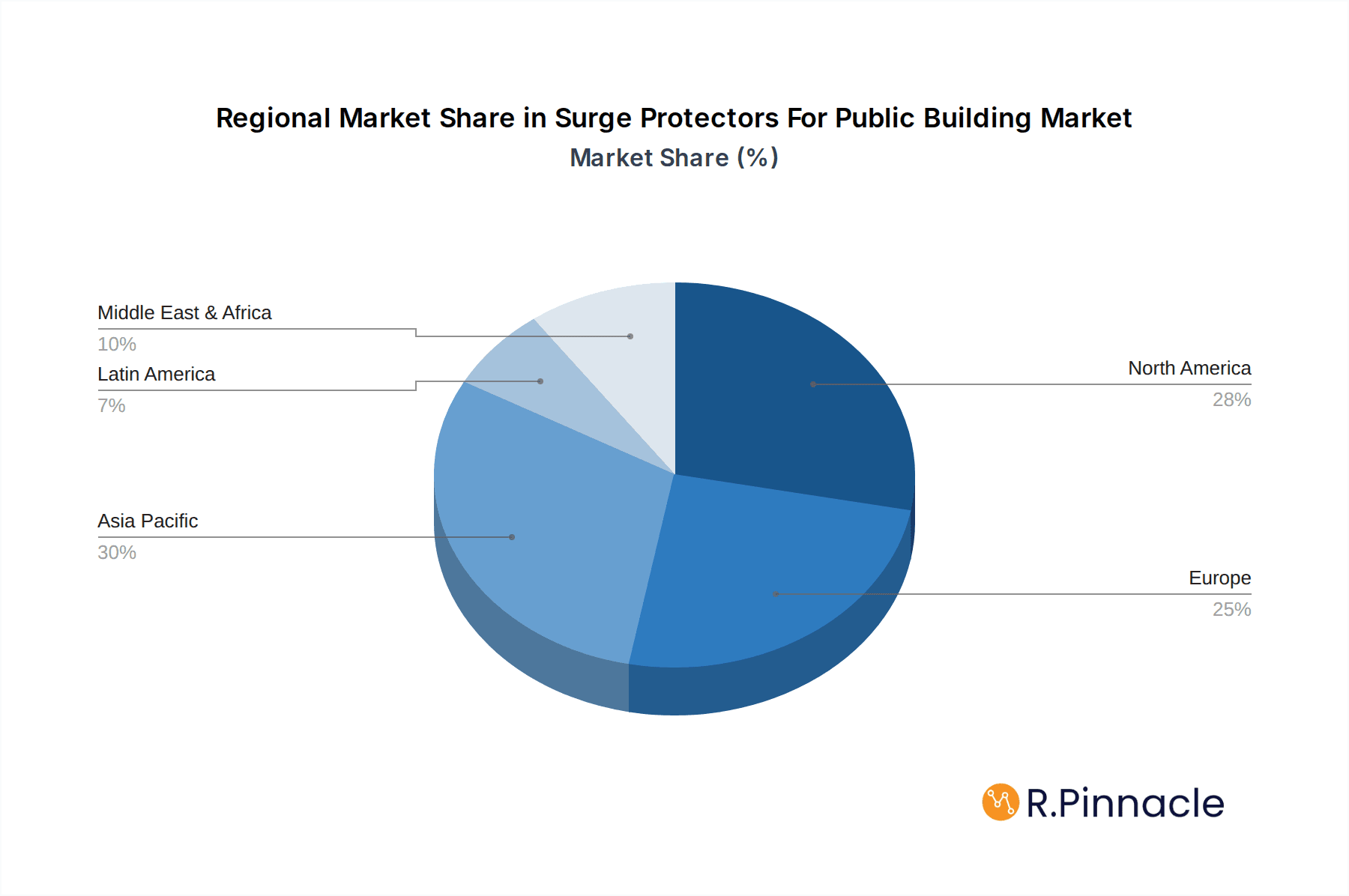

Dominant Regions & Segments in Surge Protectors For Public Building

North America currently leads the Surge Protectors for Public Building market, driven by stringent safety regulations, significant investments in smart city initiatives, and a high density of critical public infrastructure. The United States, in particular, stands out due to its advanced technological adoption and the presence of major market players.

Application Dominance:

- Healthcare: Hospitals and medical facilities represent a dominant application segment due to the critical nature of life-support systems and sensitive diagnostic equipment, where even minor power fluctuations can have catastrophic consequences. High demand for reliable surge protection for MRI machines, CT scanners, and patient monitoring systems fuels this segment.

- Education: Educational institutions, from K-12 schools to universities, are increasingly investing in smart classrooms, computer labs, and research facilities, necessitating robust surge protection to safeguard valuable electronic assets and ensure uninterrupted learning.

- Government & Public Administration: Government buildings, data centers, and public transportation hubs are critical infrastructure requiring uninterrupted power supply and protection against surges to maintain operational continuity and data integrity.

Type Dominance:

- Type 2 Surge Protective Devices (SPDs): These SPDs are widely adopted as the primary form of protection for main distribution panels in public buildings, offering a balanced combination of protection and cost-effectiveness for a broad range of applications.

- Type 1 Surge Protective Devices (SPDs): Increasingly deployed in areas with high lightning activity or weak power grids, Type 1 SPDs provide essential protection at the service entrance of public buildings, safeguarding downstream equipment from severe surge events.

- Type 3 Surge Protective Devices (SPDs): Utilized at the point of use for highly sensitive equipment, such as in laboratories or IT rooms within public facilities, Type 3 SPDs offer localized, fine-tuned protection.

Surge Protectors For Public Building Product Innovations

Recent product innovations in surge protectors for public buildings focus on enhanced diagnostic capabilities, remote monitoring, and improved modular designs for easier maintenance. Companies are developing SPDs with integrated communication modules that allow for real-time performance monitoring and predictive maintenance, significantly reducing downtime. The integration of advanced materials and patented technologies ensures superior surge suppression and extended product lifespan. These innovations are tailored to meet the unique demands of critical infrastructure, offering reliable protection against increasingly complex power disturbances and ensuring operational resilience in public facilities.

Report Scope & Segmentation Analysis

This report segments the Surge Protectors for Public Building market by Application and Type. Key application segments include Healthcare, Education, Government & Public Administration, Transportation, and others. For Type, the segmentation covers Type 1, Type 2, and Type 3 Surge Protective Devices. Market growth projections for each segment indicate strong expansion, with Healthcare and Transportation applications expected to witness significant CAGR of XX% and XX% respectively through 2033. The market size for Type 2 SPDs is estimated to reach $XX billion by 2033, driven by their widespread use in commercial and institutional settings. Competitive dynamics vary across segments, with specialized providers often leading in niche applications.

Key Drivers of Surge Protectors For Public Building Growth

The surge protectors for public building market is propelled by several key drivers:

- Increasing Government Investments: Enhanced funding for critical infrastructure upgrades, smart city projects, and public facility modernization worldwide.

- Growing Demand for Reliability: The critical nature of public services necessitates uninterrupted operations, driving demand for robust surge protection against power disruptions.

- Technological Advancements: The proliferation of sensitive electronic equipment and IoT devices in public spaces requires advanced protection against voltage surges and transients.

- Stringent Safety Regulations: Mandates and standards for electrical safety in public buildings are increasing, compelling the adoption of high-performance surge protection solutions.

- Rising Awareness of Economic Impact: A greater understanding of the cost savings associated with preventing equipment damage and operational downtime due to surges.

Challenges in the Surge Protectors For Public Building Sector

Challenges in the Surge Protectors for Public Building sector include:

- Cost Constraints: Budget limitations in public sector procurement can sometimes lead to the selection of less advanced or lower-quality surge protection solutions.

- Complex Procurement Processes: Navigating intricate tendering and approval procedures for public projects can be time-consuming and resource-intensive.

- Lack of Standardization in Some Regions: Inconsistent or less stringent regional standards can create a fragmented market and hinder the adoption of best practices.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability and cost of critical components, affecting lead times and project timelines.

- Rapid Technological Obsolescence: The fast pace of technological evolution necessitates continuous updates and replacements, posing an ongoing challenge for long-term planning.

Emerging Opportunities in Surge Protectors For Public Building

Emerging opportunities in the Surge Protectors for Public Building sector include:

- Smart Building Integration: The growing adoption of IoT and smart building technologies creates demand for integrated surge protection solutions with advanced monitoring and control capabilities.

- Renewable Energy Infrastructure: The increasing integration of solar and wind power in public facilities presents new surge protection challenges and opportunities for specialized SPD solutions.

- Retrofitting and Upgrades: Opportunities exist in upgrading outdated surge protection systems in existing public buildings to meet current safety and performance standards.

- Emerging Markets: Rapid infrastructure development in developing economies offers significant untapped potential for surge protector installations in new public facilities.

- Data Center Protection: The expansion of public sector data centers highlights the critical need for highly reliable and sophisticated surge protection to safeguard sensitive IT infrastructure.

Leading Players in the Surge Protectors For Public Building Market

- MERSEN

- Schneider Electric

- ABB

- Eaton

- Rockwell Automation

- Raycap

- DEHN

- Pepperl+Fuchs

- Siemens

- Phoenix Contact

- CITEL

- Leviton

- BENY New Energy

- Intermatic Incorporated

- Hager Group

- Prosurge

- SUPCON Group

- nVent Electric

- Weidmüller Interface

- Legrand

- Shanghai IZE Industries

- CHINT Group

- Zhejiang Zhongdian Power Equipment

- Shenzhen Haipengxin Electronics

- Shanghai Liangxin Electrical

Key Developments in Surge Protectors For Public Building Industry

- 2024: MERSEN launches its new line of advanced Type 2 SPDs for critical infrastructure, featuring enhanced diagnostic capabilities and remote monitoring.

- 2023: Schneider Electric acquires a leading provider of industrial surge protection solutions to bolster its portfolio for critical facilities.

- 2023: ABB introduces a modular SPD system designed for easy installation and maintenance in large-scale public building projects.

- 2022: Eaton expands its offering of smart surge protection devices, integrating them into broader building management systems.

- 2022: Raycap unveils innovative SPD solutions tailored for renewable energy integration in public sector applications.

- 2021: Siemens announces strategic partnerships to enhance its SPD offerings for smart city infrastructure projects.

- 2021: DEHN expands its global manufacturing capacity to meet the growing demand for surge protection in emerging markets.

Future Outlook for Surge Protectors For Public Building Market

The future outlook for the Surge Protectors for Public Building market is exceptionally positive, projected for sustained growth driven by ongoing infrastructure development and the increasing digitalization of public services. The continuous evolution of technology, coupled with stringent regulatory mandates, will necessitate the adoption of more sophisticated and intelligent surge protection solutions. Key growth accelerators include the expansion of smart city initiatives, the increasing demand for reliable power in healthcare and educational sectors, and the integration of renewable energy sources. Companies that focus on innovation, particularly in areas like predictive maintenance, remote diagnostics, and enhanced interoperability with building management systems, will be well-positioned to capitalize on emerging opportunities and secure a significant market share in this vital and expanding sector.

Surge Protectors For Public Building Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Surge Protectors For Public Building Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Surge Protectors For Public Building Regional Market Share

Geographic Coverage of Surge Protectors For Public Building

Surge Protectors For Public Building REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Surge Protectors For Public Building Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Surge Protectors For Public Building Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Surge Protectors For Public Building Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Surge Protectors For Public Building Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Surge Protectors For Public Building Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Surge Protectors For Public Building Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 MERSEN

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Schneider Electric

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ABB

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Eaton

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rockwell Automation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Raycap

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DEHN

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pepperl+Fuchs

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Siemens

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Phoenix Contact

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CITEL

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Leviton

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BENY New Energy

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Intermatic Incorporated

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Hager Group

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Prosurge

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 SUPCON Group

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 nVent Electric

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Weidmüller Interface

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Legrand

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Shanghai IZE Industries

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 CHINT Group

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Zhejiang Zhongdian Power Equipment

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Shenzhen Haipengxin Electronics

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Shanghai Liangxin Electrical

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 MERSEN

List of Figures

- Figure 1: Global Surge Protectors For Public Building Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: undefined Surge Protectors For Public Building Revenue (undefined), by Application 2025 & 2033

- Figure 3: undefined Surge Protectors For Public Building Revenue Share (%), by Application 2025 & 2033

- Figure 4: undefined Surge Protectors For Public Building Revenue (undefined), by Type 2025 & 2033

- Figure 5: undefined Surge Protectors For Public Building Revenue Share (%), by Type 2025 & 2033

- Figure 6: undefined Surge Protectors For Public Building Revenue (undefined), by Country 2025 & 2033

- Figure 7: undefined Surge Protectors For Public Building Revenue Share (%), by Country 2025 & 2033

- Figure 8: undefined Surge Protectors For Public Building Revenue (undefined), by Application 2025 & 2033

- Figure 9: undefined Surge Protectors For Public Building Revenue Share (%), by Application 2025 & 2033

- Figure 10: undefined Surge Protectors For Public Building Revenue (undefined), by Type 2025 & 2033

- Figure 11: undefined Surge Protectors For Public Building Revenue Share (%), by Type 2025 & 2033

- Figure 12: undefined Surge Protectors For Public Building Revenue (undefined), by Country 2025 & 2033

- Figure 13: undefined Surge Protectors For Public Building Revenue Share (%), by Country 2025 & 2033

- Figure 14: undefined Surge Protectors For Public Building Revenue (undefined), by Application 2025 & 2033

- Figure 15: undefined Surge Protectors For Public Building Revenue Share (%), by Application 2025 & 2033

- Figure 16: undefined Surge Protectors For Public Building Revenue (undefined), by Type 2025 & 2033

- Figure 17: undefined Surge Protectors For Public Building Revenue Share (%), by Type 2025 & 2033

- Figure 18: undefined Surge Protectors For Public Building Revenue (undefined), by Country 2025 & 2033

- Figure 19: undefined Surge Protectors For Public Building Revenue Share (%), by Country 2025 & 2033

- Figure 20: undefined Surge Protectors For Public Building Revenue (undefined), by Application 2025 & 2033

- Figure 21: undefined Surge Protectors For Public Building Revenue Share (%), by Application 2025 & 2033

- Figure 22: undefined Surge Protectors For Public Building Revenue (undefined), by Type 2025 & 2033

- Figure 23: undefined Surge Protectors For Public Building Revenue Share (%), by Type 2025 & 2033

- Figure 24: undefined Surge Protectors For Public Building Revenue (undefined), by Country 2025 & 2033

- Figure 25: undefined Surge Protectors For Public Building Revenue Share (%), by Country 2025 & 2033

- Figure 26: undefined Surge Protectors For Public Building Revenue (undefined), by Application 2025 & 2033

- Figure 27: undefined Surge Protectors For Public Building Revenue Share (%), by Application 2025 & 2033

- Figure 28: undefined Surge Protectors For Public Building Revenue (undefined), by Type 2025 & 2033

- Figure 29: undefined Surge Protectors For Public Building Revenue Share (%), by Type 2025 & 2033

- Figure 30: undefined Surge Protectors For Public Building Revenue (undefined), by Country 2025 & 2033

- Figure 31: undefined Surge Protectors For Public Building Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Surge Protectors For Public Building Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Surge Protectors For Public Building Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Surge Protectors For Public Building Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Surge Protectors For Public Building Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Surge Protectors For Public Building Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Surge Protectors For Public Building Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Surge Protectors For Public Building Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Surge Protectors For Public Building Revenue undefined Forecast, by Type 2020 & 2033

- Table 9: Global Surge Protectors For Public Building Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Surge Protectors For Public Building Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Surge Protectors For Public Building Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Surge Protectors For Public Building Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Surge Protectors For Public Building Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global Surge Protectors For Public Building Revenue undefined Forecast, by Type 2020 & 2033

- Table 15: Global Surge Protectors For Public Building Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Surge Protectors For Public Building Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Surge Protectors For Public Building Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Surge Protectors For Public Building Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Surge Protectors For Public Building?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the Surge Protectors For Public Building?

Key companies in the market include MERSEN, Schneider Electric, ABB, Eaton, Rockwell Automation, Raycap, DEHN, Pepperl+Fuchs, Siemens, Phoenix Contact, CITEL, Leviton, BENY New Energy, Intermatic Incorporated, Hager Group, Prosurge, SUPCON Group, nVent Electric, Weidmüller Interface, Legrand, Shanghai IZE Industries, CHINT Group, Zhejiang Zhongdian Power Equipment, Shenzhen Haipengxin Electronics, Shanghai Liangxin Electrical.

3. What are the main segments of the Surge Protectors For Public Building?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Surge Protectors For Public Building," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Surge Protectors For Public Building report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Surge Protectors For Public Building?

To stay informed about further developments, trends, and reports in the Surge Protectors For Public Building, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence