Key Insights

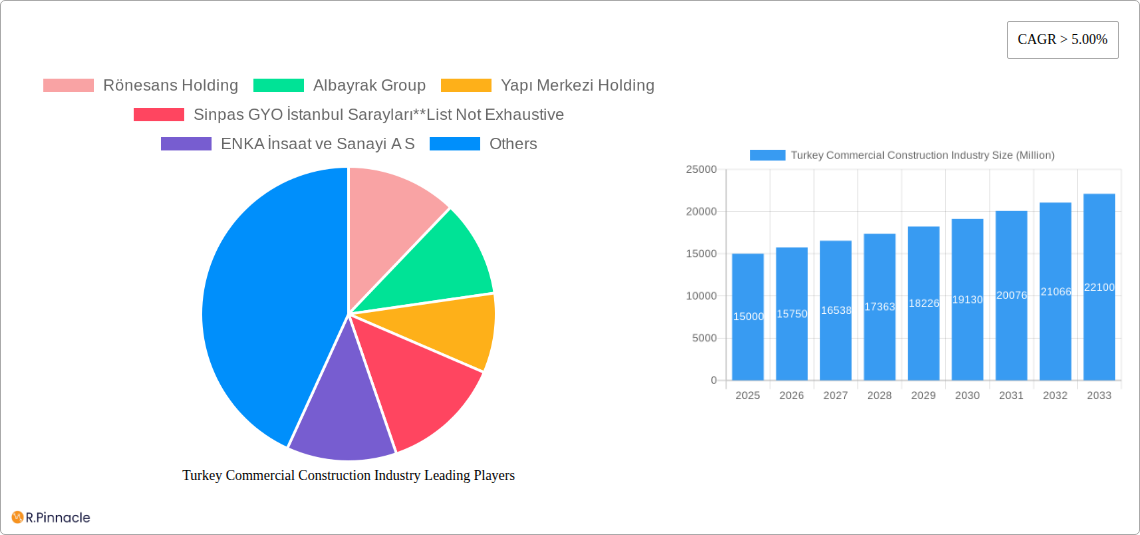

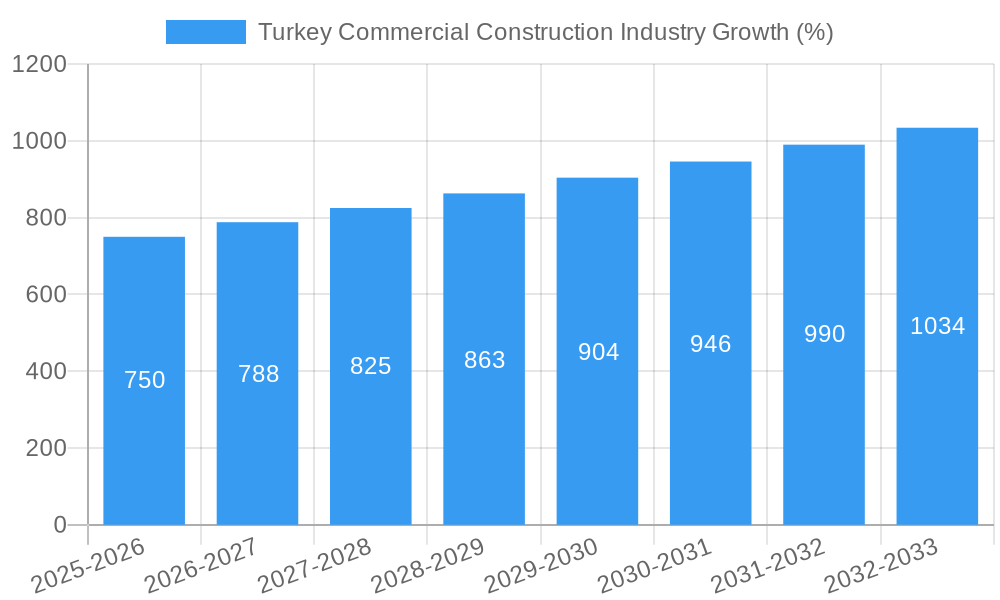

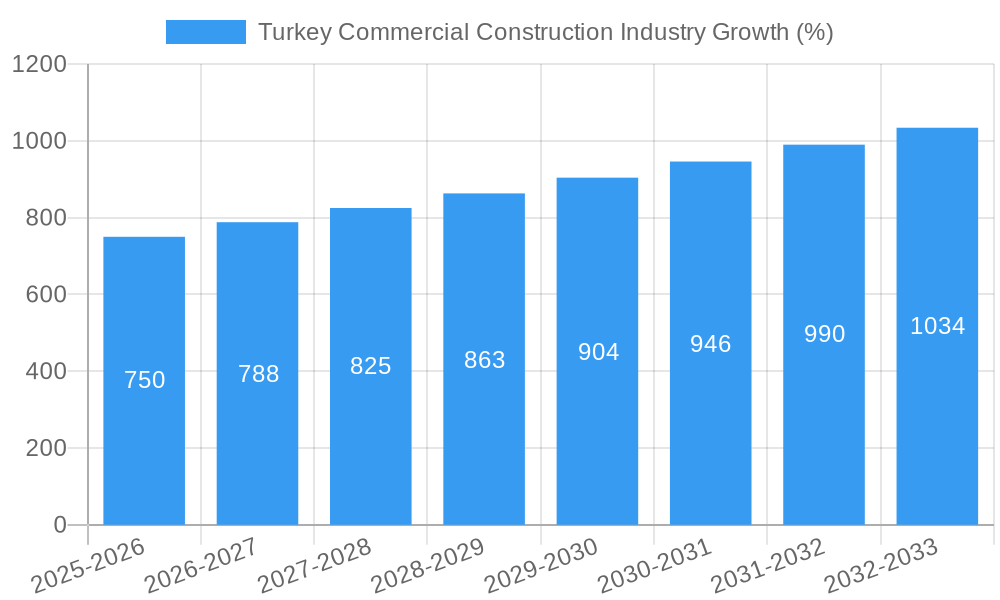

The Turkish commercial construction industry, exhibiting a CAGR exceeding 5% since 2019, presents a robust and expanding market. Driven by factors such as increasing urbanization, tourism infrastructure development, and government initiatives promoting real estate investment, the sector is projected to maintain significant growth throughout the forecast period (2025-2033). Key segments, including office building, retail, hospitality, and institutional construction, contribute to this growth, with a notable focus on modernizing existing infrastructure and developing new projects catering to a growing population and expanding economy. Leading players like Rönesans Holding, Albayrak Group, and ENKA İnsaat are actively shaping the market landscape through large-scale projects and strategic partnerships. While challenges such as fluctuations in material costs and economic uncertainties exist, the long-term outlook remains positive, fueled by sustained demand and ongoing investments in infrastructure development across major cities.

The industry's growth is further supported by a strong tourism sector, contributing to increased demand for hospitality projects, and the ongoing expansion of Turkey's business and commercial hubs. The government's focus on sustainable development is also influencing construction practices, with a move towards eco-friendly building materials and energy-efficient designs. Competition within the industry is fierce, driving innovation and efficiency gains. However, potential challenges include securing skilled labor and navigating fluctuating regulatory environments. Projections indicate sustained growth for the coming years, making the Turkish commercial construction market an attractive area for investment and expansion for both domestic and international players. The segment breakdown suggests a balanced contribution from diverse sectors, highlighting the overall health and resilience of this expanding market.

Turkey Commercial Construction Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Turkish commercial construction industry, offering invaluable insights for investors, industry professionals, and strategic planners. With a focus on market dynamics, key players, and future trends, this report covers the period from 2019 to 2033, utilizing 2025 as the base year.

Turkey Commercial Construction Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of the Turkish commercial construction market. The market is characterized by a mix of large, established players and smaller, specialized firms. Market concentration is moderate, with a few dominant players holding significant market share. However, the market is also highly fragmented, with numerous smaller firms competing in niche segments.

- Market Share: Rönesans Holding, ENKA İnsaat ve Sanayi A S, and Yapı Merkezi Holding hold a significant portion of the overall market share, estimated at xx% collectively in 2025. Precise figures are unavailable for other players due to the fragmented nature of the market.

- M&A Activity: The historical period (2019-2024) saw moderate M&A activity, with deal values totaling approximately xx Billion USD. The forecast period (2025-2033) is projected to see increased activity driven by consolidation and expansion efforts.

- Innovation Drivers: Government initiatives promoting sustainable construction practices and technological advancements in building materials and construction techniques are key drivers of innovation. Stringent building codes and environmental regulations also necessitate continuous innovation.

- Regulatory Framework: The Turkish government's focus on infrastructure development significantly influences the market. Regulatory changes and approvals impact project timelines and costs.

- Product Substitutes: The construction industry witnesses minimal product substitution; however, innovations in materials like sustainable alternatives to concrete may gradually alter market dynamics.

- End-User Demographics: The increasing urbanization and a growing middle class are key drivers for the demand for commercial construction projects in Turkey.

Turkey Commercial Construction Industry Market Dynamics & Trends

The Turkish commercial construction industry demonstrates robust growth, driven by several factors including government investments in infrastructure projects, a growing population, and increasing urbanization. The market is experiencing a shift towards sustainable and technologically advanced construction practices.

The market is anticipated to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by increased government spending on infrastructure and steady economic growth. While experiencing periodic fluctuations related to global economic conditions and domestic policies, the market exhibits a generally positive trajectory. Market penetration of new technologies, such as Building Information Modeling (BIM) and prefabrication techniques, is gradually increasing, though adoption rates vary across the segments and players. Consumer preferences are shifting toward sustainable and energy-efficient buildings, influencing design choices and material selection. Competitive dynamics are characterized by a mix of fierce competition and strategic partnerships.

Dominant Regions & Segments in Turkey Commercial Construction Industry

While data for precise regional dominance is unavailable, Istanbul and Ankara are expected to continue dominating the market due to their status as major urban centers and commercial hubs. High population density and central locations significantly affect the demand for commercial construction within these cities.

- Key Drivers for dominance in Istanbul and Ankara:

- Extensive infrastructure development.

- Strong economic activity and a thriving business environment.

- High population density and urbanization.

- Significant government investment in infrastructure projects.

Segment Analysis:

The office building construction segment is anticipated to show robust growth due to the expanding business sector and increased demand for modern office spaces. Retail construction will likely experience steady growth mirroring the growth of the consumer market and e-commerce integration. Hospitality construction shows a steady increase, linked to Turkey's growing tourism industry. Institutional construction (hospitals, schools, etc.) is driven by government initiatives, resulting in reliable growth. The "Others" segment encompasses various construction projects, and its growth will be contingent upon diverse market factors.

Turkey Commercial Construction Industry Product Innovations

The Turkish commercial construction sector is witnessing increased adoption of advanced technologies, such as BIM for efficient project management and prefabrication for faster construction times and reduced waste. The emphasis on sustainable building practices is driving the development and use of eco-friendly materials and energy-efficient designs. These innovations enhance project efficiency, minimize environmental impact, and improve building performance, creating competitive advantages for companies adopting them.

Report Scope & Segmentation Analysis

This report segments the Turkish commercial construction market by building type: Office Building Construction, Retail Construction, Hospitality Construction, Institutional Construction, and Others. Each segment's growth projections, market size, and competitive dynamics are analyzed individually. Data unavailable for precise market size estimates for 2025 for all segments, but growth projections suggest substantial opportunity across the board. Competitive dynamics vary among segments, influenced by project size, technical expertise, and specialization.

Key Drivers of Turkey Commercial Construction Industry Growth

Several factors fuel the growth of the Turkish commercial construction industry. Significant government investment in infrastructure projects creates a large demand for construction services. The expanding tourism industry boosts the demand for hospitality projects. Turkey's growing population and urbanization contribute to the need for housing and commercial spaces. Finally, the government's continuous efforts to improve the business environment encourage investment in commercial construction.

Challenges in the Turkey Commercial Construction Industry Sector

Challenges include fluctuating currency exchange rates impacting material costs, supply chain disruptions affecting project timelines, and intense competition for contracts. The impacts are quantifiable through project cost overruns and delays, leading to reduced profitability for some companies. Furthermore, stringent regulatory requirements and bureaucratic processes can add complexity and delays to projects.

Emerging Opportunities in Turkey Commercial Construction Industry

Emerging opportunities include increased demand for sustainable and green buildings, the rise of prefabricated construction methods, and the potential for technological advancements like 3D printing. Moreover, expanding tourism and the increasing popularity of mixed-use developments presents growth potentials. Focus on infrastructure development presents significant opportunities, especially in developing regions of Turkey.

Leading Players in the Turkey Commercial Construction Industry Market

- Rönesans Holding

- Albayrak Group

- Yapı Merkezi Holding

- Sinpas GYO İstanbul Sarayları

- ENKA İnsaat ve Sanayi A S

- YDA Group

- Umut Construction Tourism Industry ve Tic Inc

- Yenigün Construction

- GAP İnşaat

- Zorlu Group

Key Developments in Turkey Commercial Construction Industry

- December 2022: The EBRD provided a USD 79.5 Million loan to Rönesans Holding's subsidiary for hospital infrastructure investment, showcasing significant investment in the healthcare sector and boosting Rönesans's position in the Institutional Construction segment. This significantly impacts the hospital construction segment.

- August 2022: The commencement of a new stadium construction in Ankara (USD 0.24 Billion contract) highlights ongoing public investment in sporting infrastructure, a boost for the "Others" segment. This signals a potential uptick in similar projects.

Future Outlook for Turkey Commercial Construction Industry Market

The Turkish commercial construction industry is projected to experience sustained growth over the forecast period (2025-2033), driven by ongoing government investments, a growing economy, and a focus on infrastructure development. The increasing adoption of sustainable and technologically advanced construction methods will shape the industry's trajectory. Strategic partnerships and technological innovation will be crucial for companies to maintain competitiveness and capitalize on emerging opportunities.

Turkey Commercial Construction Industry Segmentation

-

1. Type

- 1.1. Office Building Construction

- 1.2. Retail Construction

- 1.3. Hospitality Construction

- 1.4. Institutional Construction

- 1.5. Others

Turkey Commercial Construction Industry Segmentation By Geography

- 1. Turkey

Turkey Commercial Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Office Space Demand Fuelling the Market Growth of Commercial Construction; Growing Retail Sector to Support the Market Development in the Turkey

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labour in the Construction Industry; Complex architectural designs or unique project requirements can pose restraints.

- 3.4. Market Trends

- 3.4.1. Office Space Demand Fuelling the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office Building Construction

- 5.1.2. Retail Construction

- 5.1.3. Hospitality Construction

- 5.1.4. Institutional Construction

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Rönesans Holding

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Albayrak Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yapı Merkezi Holding

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sinpas GYO İstanbul Sarayları**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ENKA İnsaat ve Sanayi A S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 YDA Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Umut Construction Tourism Industry ve Tic Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yenigün Construction

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GAP Insaat

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zorlu Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rönesans Holding

List of Figures

- Figure 1: Turkey Commercial Construction Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Turkey Commercial Construction Industry Share (%) by Company 2024

List of Tables

- Table 1: Turkey Commercial Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Turkey Commercial Construction Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Turkey Commercial Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Turkey Commercial Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Turkey Commercial Construction Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Turkey Commercial Construction Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey Commercial Construction Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Turkey Commercial Construction Industry?

Key companies in the market include Rönesans Holding, Albayrak Group, Yapı Merkezi Holding, Sinpas GYO İstanbul Sarayları**List Not Exhaustive, ENKA İnsaat ve Sanayi A S, YDA Group, Umut Construction Tourism Industry ve Tic Inc, Yenigün Construction, GAP Insaat, Zorlu Group.

3. What are the main segments of the Turkey Commercial Construction Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Office Space Demand Fuelling the Market Growth of Commercial Construction; Growing Retail Sector to Support the Market Development in the Turkey.

6. What are the notable trends driving market growth?

Office Space Demand Fuelling the Market Growth.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labour in the Construction Industry; Complex architectural designs or unique project requirements can pose restraints..

8. Can you provide examples of recent developments in the market?

December 2022: The European Bank for Reconstruction and Development (EBRD) will provide a long-term convertible loan of EUR 75 million (USD 79.5 million) to a subsidiary of Turkey's Ronesans Holding for hospital infrastructure investment. Ronesans Saglik Yatirim, the unit of the conglomerate that runs hospitals, will undertake to complete the newly acquired hospital project in their portfolio. Rönesans currently has five operational hospital projects in progress, with a combined construction area of 3.2 million m2 and a total capacity of 7,100 beds. Once all of these projects have been completed, Rönesans will reach a total capacity of 9,000 beds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey Commercial Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey Commercial Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey Commercial Construction Industry?

To stay informed about further developments, trends, and reports in the Turkey Commercial Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence