Key Insights

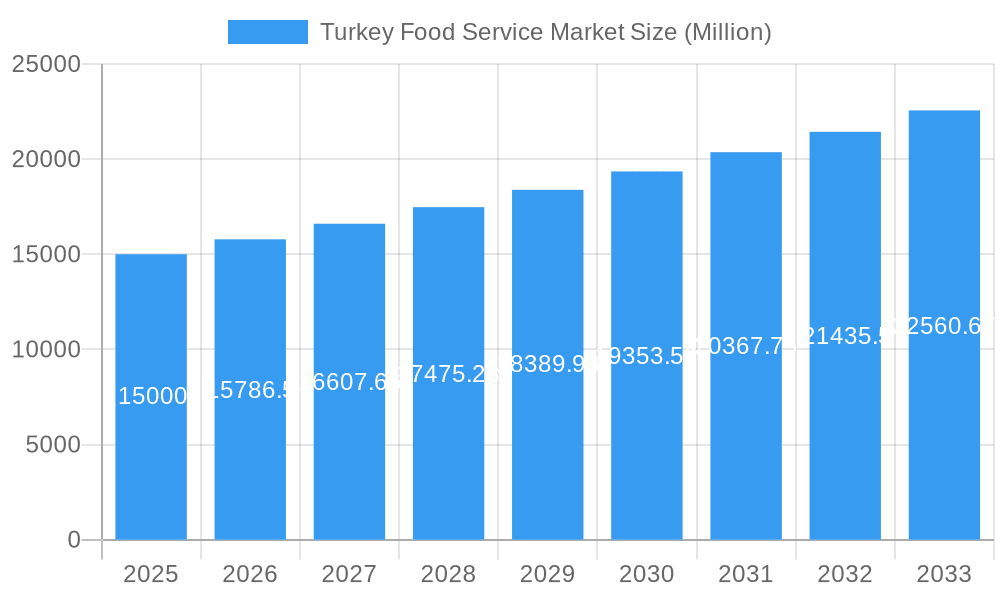

The Turkish food service market, valued at approximately $12.67 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.96% from 2025 to 2033. Key drivers include a flourishing tourism sector, rising disposable incomes, and evolving consumer preferences for convenience and dining out. The diversification of culinary offerings, from traditional Turkish dishes to international cuisines, also fuels expansion. The Quick Service Restaurant (QSR) segment, particularly popular for kebabs and doner, shows significant growth. Challenges include economic volatility and intense competition from international chains. The market comprises both chained and independent establishments across various locations. Cafes, bars, and other QSR segments are rapidly growing, reflecting a demand for diverse and convenient food options.

Turkey Food Service Market Market Size (In Billion)

The Turkish food service market forecast remains positive, driven by demographic trends, tourism, and economic recovery. Investments in technology, such as online ordering and delivery platforms, are expected to be transformative. Companies like Simit Sarayi, Anadolu Restoran İşletmeleri, and Yum! Brands are strategically positioned. Sustained success requires continuous innovation, adaptation to regional preferences, and navigation of economic conditions. Opportunities for growth lie in expanding to less saturated regions and exploring new culinary concepts, such as fusion cuisine.

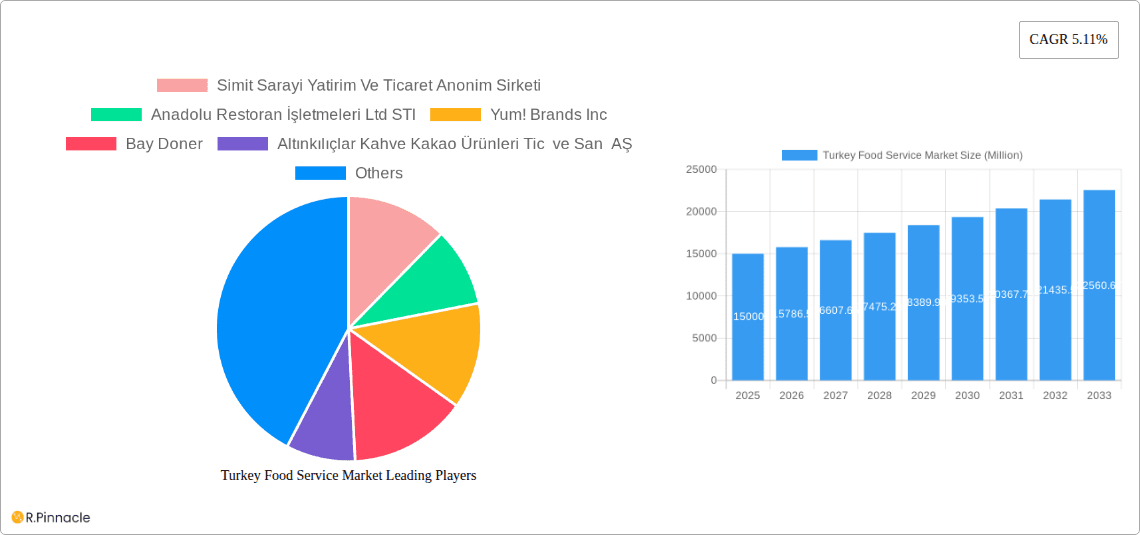

Turkey Food Service Market Company Market Share

Turkey Food Service Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Turkey food service market, offering valuable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a base year of 2025, this report unveils the market's structure, dynamics, and future potential. We delve into key segments, leading players, and emerging trends, equipping you with actionable intelligence to navigate this dynamic market. The report projects a xx Million market value by 2033, reflecting a significant CAGR of xx% during the forecast period (2025-2033).

Turkey Food Service Market Structure & Innovation Trends

The Turkish food service market exhibits a diverse structure, characterized by both large multinational chains and numerous independent outlets. Market concentration is moderate, with a few dominant players holding significant market share, while smaller players compete fiercely for market niches. Simit Sarayı, for instance, holds a substantial share in the bakery segment, while Anadolu Restoran İşletmeleri (McDonald's franchisee) dominates the fast-food sector. Innovation is driven by evolving consumer preferences, technological advancements (e.g., online ordering, delivery platforms), and increasing competition.

- Market Concentration: Moderate, with a few dominant players and numerous smaller entities.

- Innovation Drivers: Consumer preferences, technological advancements (e.g., online ordering & delivery), and competitive pressures.

- Regulatory Framework: The report includes an analysis of relevant regulations impacting the food service sector in Turkey.

- Product Substitutes: The analysis considers alternative options available to consumers, influencing market dynamics.

- End-User Demographics: The report analyzes the key demographic trends shaping the market (e.g., age, income, location).

- M&A Activities: Recent mergers and acquisitions (M&As) are analyzed, including deal values and implications for market structure (e.g., Anadolu Restaurant’s acquisition). The total value of M&A deals in the studied period is estimated at xx Million.

Turkey Food Service Market Dynamics & Trends

The Turkish food service market is experiencing robust growth fueled by several key factors. Rising disposable incomes, urbanization, changing lifestyles, and a growing preference for convenience are driving demand. Technological advancements, such as online food ordering and delivery platforms, are revolutionizing the sector, expanding reach and enhancing customer experience. Intense competition forces continuous innovation in menu offerings, service delivery, and operational efficiency. The market penetration of online ordering platforms is projected to reach xx% by 2033. The CAGR for the market is estimated to be xx% during the forecast period. Consumer preferences are shifting towards healthier options, influencing menu development and product offerings among businesses. The competitive landscape is highly dynamic with both established chains and new entrants vying for market share.

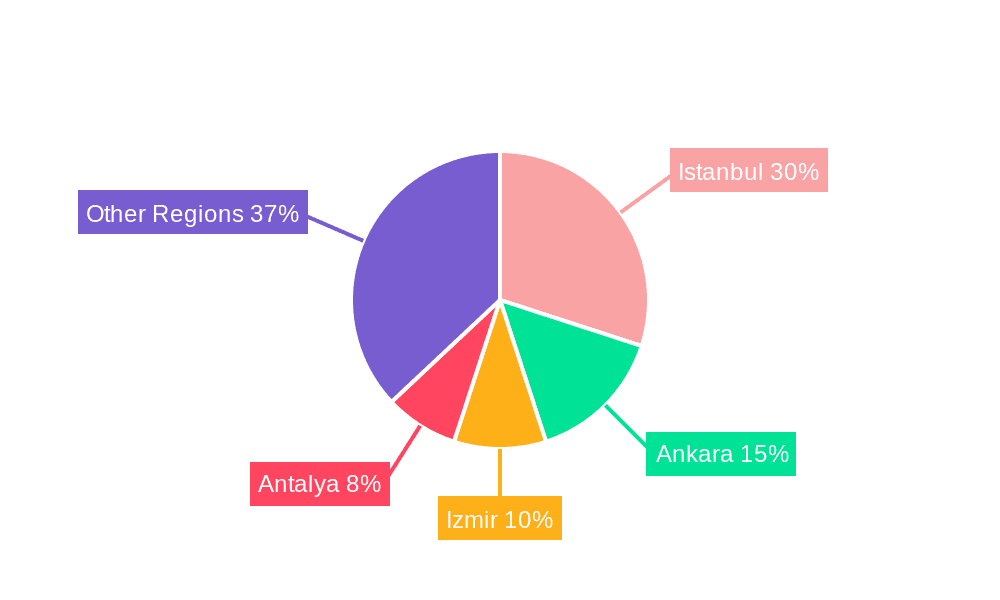

Dominant Regions & Segments in Turkey Food Service Market

The Istanbul region dominates the Turkey food service market, fueled by its high population density, strong tourism sector, and robust economic activity. Significant growth is also observed in other major cities like Ankara and Izmir. Within segments, Chained Outlets are showing faster growth compared to Independent Outlets, due to better brand recognition, efficient supply chains, and marketing capabilities. The Leisure segment (e.g., restaurants in tourist areas) is experiencing rapid growth driven by tourism.

Key Drivers for Istanbul's Dominance:

- High population density

- Thriving tourism sector

- Robust economic activity

- Developed infrastructure

Key Drivers for Chained Outlets' Growth:

- Brand recognition

- Efficient supply chain

- Effective marketing and promotions

Key Drivers for Leisure Segment Growth:

- Increasing tourism

- Higher disposable incomes

- Growing preference for dining out

Turkey Food Service Market Product Innovations

The Turkish food service market is witnessing significant product innovations, including customized menus, healthier options, and the introduction of innovative culinary concepts. Technological integrations, such as online ordering systems and mobile payment options, are enhancing customer experience and operational efficiency. The increasing demand for convenience and personalized experiences is driving further innovation.

Report Scope & Segmentation Analysis

This report segments the Turkey food service market across various dimensions:

Outlet: Chained Outlets (projected growth of xx Million by 2033) and Independent Outlets (xx Million by 2033). Chained outlets benefit from economies of scale, while independent outlets offer personalized experiences.

Location: Leisure (xx Million by 2033), Lodging (xx Million by 2033), Retail (xx Million by 2033), Standalone (xx Million by 2033), and Travel (xx Million by 2033) locations reflect varying customer demands and competition levels.

Foodservice Type: Cafes & Bars (xx Million by 2033) and Other QSR Cuisines (xx Million by 2033) represent distinct culinary preferences and market dynamics.

Key Drivers of Turkey Food Service Market Growth

Several factors drive the growth of the Turkish food service market. A rising middle class with increased disposable income leads to greater spending on dining out. Urbanization and changing lifestyles contribute to higher demand for convenience and ready-to-eat meals. Furthermore, government initiatives promoting tourism and hospitality contribute positively to market expansion. The influx of international food chains also boosts the sector's diversity and consumer choice.

Challenges in the Turkey Food Service Market Sector

Challenges faced by the sector include rising food costs and inflation, impacting profitability. Supply chain disruptions and fluctuating currency exchange rates also pose risks. Stringent food safety regulations demand adherence to standards, increasing operational costs. Lastly, intense competition for customers and securing skilled labor remain ongoing issues.

Emerging Opportunities in Turkey Food Service Market

Emerging opportunities lie in catering to health-conscious consumers by offering nutritious and organic options. The growing demand for unique culinary experiences creates scope for new food concepts and innovative menu offerings. Furthermore, leveraging technology for enhanced customer experience through mobile ordering and delivery is crucial for growth. Expansion into underserved regions with high growth potential also offers substantial opportunities.

Leading Players in the Turkey Food Service Market Market

- Simit Sarayi Yatirim Ve Ticaret Anonim Sirketi

- Anadolu Restoran İşletmeleri Ltd STI

- Yum! Brands Inc

- Bay Doner

- Altınkılıçlar Kahve Kakao Ürünleri Tic ve San AŞ

- DP Eurasia NV

- TAB Gida

- Kofteci Ramiz

- Çelebi Holdin

- Yörpaş Regional Foods SA

- Tavuk Dunyasi

- Bereket Döner

- Migros Ticaret AŞ

- Otantik Kumpir

Key Developments in Turkey Food Service Market Industry

August 2022: Subway's plan to expand its presence in Turkey by 400 new restaurants over seven years showcases the growth potential and strategic investment in the market. This expansion highlights the increasing preference for international food chains and convenience-focused options.

May 2022: The sale of Anadolu Restaurant (McDonald's franchisee) to Boheme Investment signifies significant consolidation and investment activity within the Turkish food service sector. This underscores the attractiveness of the market for foreign investors. The transaction value is estimated at xx Million.

Future Outlook for Turkey Food Service Market Market

The Turkish food service market is poised for continued growth, driven by increasing disposable incomes, urbanization, and evolving consumer preferences. Strategic investments in technology, innovative food concepts, and expansion into new geographical areas will be crucial for success. The focus on healthy and sustainable food options will further shape the future of the market. The market is expected to maintain a robust growth trajectory throughout the forecast period, attracting both domestic and international players.

Turkey Food Service Market Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Turkey Food Service Market Segmentation By Geography

- 1. Turkey

Turkey Food Service Market Regional Market Share

Geographic Coverage of Turkey Food Service Market

Turkey Food Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products

- 3.3. Market Restrains

- 3.3.1. Presence of Preservatives in Ready Meals may Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing affinity toward meat-based fast food and the expansion of franchise outlets are propelling the growth of QSRs.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey Food Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Simit Sarayi Yatirim Ve Ticaret Anonim Sirketi

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Anadolu Restoran İşletmeleri Ltd STI

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yum! Brands Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bay Doner

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Altınkılıçlar Kahve Kakao Ürünleri Tic ve San AŞ

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DP Eurasia NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TAB Gida

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kofteci Ramiz

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Çelebi Holdin

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Yörpaş Regional Foods SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tavuk Dunyasi

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Bereket Döner

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Migros Ticaret AŞ

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Otantik Kumpir

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Simit Sarayi Yatirim Ve Ticaret Anonim Sirketi

List of Figures

- Figure 1: Turkey Food Service Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Turkey Food Service Market Share (%) by Company 2025

List of Tables

- Table 1: Turkey Food Service Market Revenue billion Forecast, by Foodservice Type 2020 & 2033

- Table 2: Turkey Food Service Market Revenue billion Forecast, by Outlet 2020 & 2033

- Table 3: Turkey Food Service Market Revenue billion Forecast, by Location 2020 & 2033

- Table 4: Turkey Food Service Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Turkey Food Service Market Revenue billion Forecast, by Foodservice Type 2020 & 2033

- Table 6: Turkey Food Service Market Revenue billion Forecast, by Outlet 2020 & 2033

- Table 7: Turkey Food Service Market Revenue billion Forecast, by Location 2020 & 2033

- Table 8: Turkey Food Service Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey Food Service Market?

The projected CAGR is approximately 5.96%.

2. Which companies are prominent players in the Turkey Food Service Market?

Key companies in the market include Simit Sarayi Yatirim Ve Ticaret Anonim Sirketi, Anadolu Restoran İşletmeleri Ltd STI, Yum! Brands Inc, Bay Doner, Altınkılıçlar Kahve Kakao Ürünleri Tic ve San AŞ, DP Eurasia NV, TAB Gida, Kofteci Ramiz, Çelebi Holdin, Yörpaş Regional Foods SA, Tavuk Dunyasi, Bereket Döner, Migros Ticaret AŞ, Otantik Kumpir.

3. What are the main segments of the Turkey Food Service Market?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.67 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products.

6. What are the notable trends driving market growth?

Increasing affinity toward meat-based fast food and the expansion of franchise outlets are propelling the growth of QSRs..

7. Are there any restraints impacting market growth?

Presence of Preservatives in Ready Meals may Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

August 2022: Subway announced that it had signed a deal to increase its footprint of approximately 80 restaurants in Turkey by five times, adding 400 new restaurants over the next seven years. The new restaurants will feature the brand’s modernized “Fresh Forward” design and offer enhanced delivery and online ordering options.May 2022: Turkish firm AG Anadolu Group Holding agreed to divest 100% of the shares of its subsidiary, Anadolu Restaurant, which operates McDonald's restaurants in Turkey, to Boheme Investment.May 2022: G Anadolu Group Holding signed a binding share transfer agreement with Qatari Boheme Investment GmbH to sell shares representing 100% of the capital of its subsidiary, Anadolu Restaurant, which operates McDonald's franchises in Turkey.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey Food Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey Food Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey Food Service Market?

To stay informed about further developments, trends, and reports in the Turkey Food Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence