Key Insights

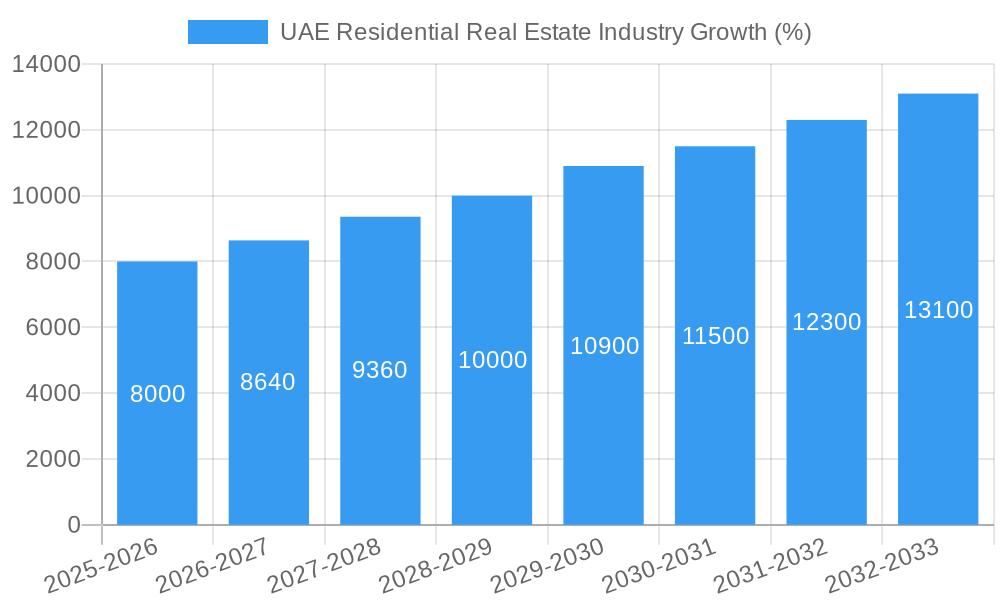

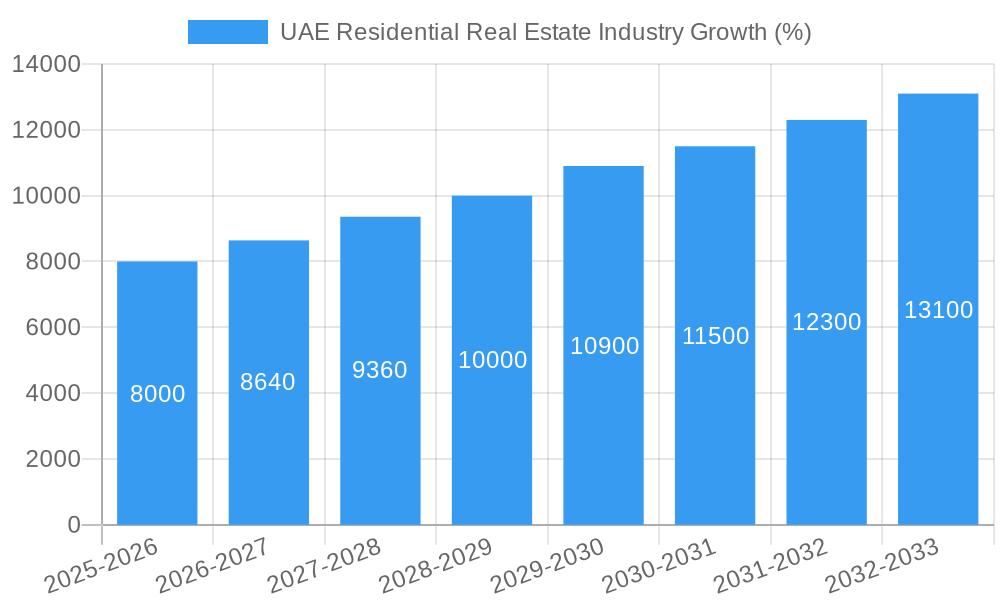

The UAE residential real estate market, encompassing villas/landed houses, condominiums/apartments across key cities like Dubai, Abu Dhabi, and Sharjah, exhibits robust growth potential. Driven by factors such as a burgeoning population, increasing tourism, government initiatives promoting real estate development, and a diversification of the economy beyond oil, the sector is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 8% from 2025 to 2033. Significant investments in infrastructure, improved connectivity, and the appeal of a high quality of life continue to attract both domestic and international buyers and investors. Key players like Emaar, Damac Properties, Aldar Properties, and Nakheel PJSC are shaping the market landscape through innovative projects and strategic partnerships. While potential challenges such as fluctuating global economic conditions and regulatory changes exist, the long-term outlook remains positive, fueled by sustained demand and ongoing development activities. The market segmentation, with villas and apartments catering to different segments of the population, ensures a broader appeal and resilience against market fluctuations.

The sector's expansion is not uniform across all segments. While the luxury villa market in prime locations like Dubai Marina and Palm Jumeirah shows strong performance, the condominium/apartment sector offers a more diverse range of price points, catering to a wider spectrum of buyers. Sharjah, with its more affordable housing options, offers attractive opportunities for investors focusing on mid-market segments. The success of the overall market will depend on factors such as the availability of financing options, the strength of the local economy, and continued government support for infrastructure development. The ongoing evolution of the market will require developers to adapt to changing preferences and prioritize sustainable and technologically advanced developments to maintain competitiveness and appeal to a growing environmentally conscious population.

UAE Residential Real Estate Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the UAE residential real estate market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report analyzes market dynamics, key players, and future trends. The report leverages extensive data and expert analysis to provide actionable strategies for navigating this dynamic market. The total market value is estimated to reach XX Million by 2033.

UAE Residential Real Estate Industry Market Structure & Innovation Trends

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities within the UAE residential real estate sector. The report examines market share held by key players such as Emaar, Aldar Properties, Damac Properties, and others.

- Market Concentration: The UAE residential real estate market exhibits a moderately concentrated structure, with a few large players holding significant market share. Emaar, for example, commands a substantial portion, while other developers such as Aldar Properties and Damac Properties also hold significant positions. Smaller players are also present, catering to niche segments.

- Innovation Drivers: Technological advancements in construction techniques, sustainable building materials, and smart home technology are key innovation drivers. The rising demand for luxury properties and high-end amenities also fuels innovation in design and development.

- Regulatory Frameworks: The regulatory environment plays a critical role in shaping market dynamics, influencing development approvals, land use regulations, and construction standards. Recent policy changes and their impact on the market are assessed.

- Product Substitutes: While limited, potential substitutes include renting versus owning, opting for alternative accommodations like serviced apartments, and investment in other asset classes. The report analyzes the competitive pressures from these alternatives.

- End-User Demographics: The report analyzes the changing demographics of the end-user population and their preferences (e.g., expatriates, young professionals, families). The influence of demographic shifts on demand for different property types is thoroughly examined.

- M&A Activities: The report documents recent mergers and acquisitions (M&A) activities, including the Alpha Dhabi Holding's acquisition of a significant stake in Aldar Properties (January 2022), analyzing their impact on market consolidation and competition. The total value of M&A deals over the study period is estimated at XX Million.

UAE Residential Real Estate Industry Market Dynamics & Trends

This section explores the key market drivers, technological disruptions, consumer preferences, and competitive dynamics shaping the UAE residential real estate market. The report utilizes a detailed analysis of historical data and future projections to determine the Compound Annual Growth Rate (CAGR) and market penetration rates for different segments.

The UAE's robust economy, a growing population, and government initiatives promoting real estate development are crucial growth drivers. Technological advancements, such as the implementation of Building Information Modeling (BIM) and the use of smart technologies in construction, are transforming the industry. Consumer preferences are shifting towards sustainable and technologically advanced homes, impacting the demand for various property types. The competitive landscape is analyzed, assessing strategies adopted by leading developers to maintain a competitive edge. Market penetration rates for luxury properties and off-plan sales are evaluated. The CAGR for the UAE residential real estate market is projected to be XX% during the forecast period.

Dominant Regions & Segments in UAE Residential Real Estate Industry

This section identifies the leading regions and segments within the UAE residential real estate market, including Dubai, Abu Dhabi, and Sharjah, examining villas/landed houses and condominiums/apartments.

- Dubai: Remains the dominant region due to its robust economy, diverse population, and extensive infrastructure development. Key drivers include strong investor interest, a thriving tourism sector, and the availability of various property options.

- Abu Dhabi: Exhibits steady growth, driven by government investments in infrastructure and initiatives promoting sustainable development. The influence of large-scale projects and government policies on the market is analyzed.

- Sharjah: Provides more affordable housing options compared to Dubai and Abu Dhabi, attracting budget-conscious buyers. Growth is influenced by its strategic location and improving infrastructure.

- Villas/Landed Houses: This segment caters to a specific segment of the market, characterized by high-value properties and strong demand from affluent buyers.

- Condominiums/Apartments: This segment dominates the market owing to a wider range of price points and preferences among a broader spectrum of buyers. The report analyzes the factors influencing the higher market share compared to villas.

UAE Residential Real Estate Industry Product Innovations

The UAE residential real estate market is witnessing significant product innovation, driven by technological advancements and evolving consumer preferences. Smart home technology integration, sustainable building materials, and innovative architectural designs are key trends. These innovations enhance property value and appeal to discerning buyers, creating a competitive advantage for developers who adopt these technologies.

Report Scope & Segmentation Analysis

This report segments the UAE residential real estate market by property type (villas/landed houses and condominiums/apartments) and key cities (Dubai, Abu Dhabi, and Sharjah). Growth projections, market sizes, and competitive dynamics are analyzed for each segment. For instance, the condominium/apartment segment is projected to experience faster growth due to higher affordability and demand in urban areas. Each city's unique market characteristics and drivers are outlined.

Key Drivers of UAE Residential Real Estate Industry Growth

Several factors drive growth in the UAE residential real estate market, including a stable economy, favorable government policies supporting infrastructure development, and substantial investment in major projects like Emaar Beachfront. Technological advancements and evolving consumer preferences further contribute to market expansion. The influx of both domestic and international investors plays a pivotal role in fueling the demand for residential properties.

Challenges in the UAE Residential Real Estate Industry Sector

The UAE residential real estate market also faces challenges. These include the fluctuating global economy, the impact of international events on investor sentiment, and potential supply chain disruptions impacting construction costs. Regulatory changes and the increasing competition among developers also pose challenges. The report quantifies these impacts and suggests mitigating strategies.

Emerging Opportunities in UAE Residential Real Estate Industry

Emerging opportunities exist in sustainable development, smart home technology integration, and catering to the growing demand for affordable housing. The development of new communities and strategic partnerships with technology companies present significant growth potential. The increasing adoption of proptech solutions creates exciting new avenues.

Leading Players in the UAE Residential Real Estate Industry Market

- Emaar

- Aldar Properties

- Damac Properties

- Azizi Developments

- Bloom Properties

- Union Properties

- Manazel

- Dubai Properties

- Deyaar Properties

- Nakheel PJSC

- Arada

Key Developments in UAE Residential Real Estate Industry

- January 2022: Alpha Dhabi Holding acquired an additional 17% stake in Aldar Properties, increasing its ownership to 29.8%.

- November 2021: Emaar launched its Emaar Beachfront development, a 10 Million sq ft luxury residential project.

Future Outlook for UAE Residential Real Estate Industry Market

The future of the UAE residential real estate market remains positive, driven by continuous economic growth, government initiatives promoting sustainable development, and ongoing investment in large-scale infrastructure projects. The demand for high-quality, sustainable, and technologically advanced homes will shape the future of the market. Strategic partnerships and technological innovations will play a key role in unlocking the market's full potential.

UAE Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Villas/Landed Houses

- 1.2. Condominiums/Apartments

-

2. Key Cities

- 2.1. Dubai

- 2.2. Abu Dhabi

- 2.3. Sharjah

UAE Residential Real Estate Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Disposable Incomes4.; Government Initiatives4.; Growing Expatriate Population

- 3.3. Market Restrains

- 3.3.1. 4.; Regulatory Framework4.; The Risk of Oversupply

- 3.4. Market Trends

- 3.4.1. New Project Launches in Dubai are Expected to Boost the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas/Landed Houses

- 5.1.2. Condominiums/Apartments

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Dubai

- 5.2.2. Abu Dhabi

- 5.2.3. Sharjah

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UAE Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Villas/Landed Houses

- 6.1.2. Condominiums/Apartments

- 6.2. Market Analysis, Insights and Forecast - by Key Cities

- 6.2.1. Dubai

- 6.2.2. Abu Dhabi

- 6.2.3. Sharjah

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UAE Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Villas/Landed Houses

- 7.1.2. Condominiums/Apartments

- 7.2. Market Analysis, Insights and Forecast - by Key Cities

- 7.2.1. Dubai

- 7.2.2. Abu Dhabi

- 7.2.3. Sharjah

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UAE Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Villas/Landed Houses

- 8.1.2. Condominiums/Apartments

- 8.2. Market Analysis, Insights and Forecast - by Key Cities

- 8.2.1. Dubai

- 8.2.2. Abu Dhabi

- 8.2.3. Sharjah

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UAE Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Villas/Landed Houses

- 9.1.2. Condominiums/Apartments

- 9.2. Market Analysis, Insights and Forecast - by Key Cities

- 9.2.1. Dubai

- 9.2.2. Abu Dhabi

- 9.2.3. Sharjah

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UAE Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Villas/Landed Houses

- 10.1.2. Condominiums/Apartments

- 10.2. Market Analysis, Insights and Forecast - by Key Cities

- 10.2.1. Dubai

- 10.2.2. Abu Dhabi

- 10.2.3. Sharjah

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Damac Properties

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Azizi Developments

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Emaar

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bloom Properties

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Union Properties

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Manazel

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dubai Properties**List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Deyaar Properties

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aldar Properties

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nakheel PJSC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Arada

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Damac Properties

List of Figures

- Figure 1: Global UAE Residential Real Estate Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: UAE UAE Residential Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: UAE UAE Residential Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UAE Residential Real Estate Industry Revenue (Million), by Type 2024 & 2032

- Figure 5: North America UAE Residential Real Estate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America UAE Residential Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 7: North America UAE Residential Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 8: North America UAE Residential Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: North America UAE Residential Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America UAE Residential Real Estate Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: South America UAE Residential Real Estate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America UAE Residential Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 13: South America UAE Residential Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 14: South America UAE Residential Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: South America UAE Residential Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe UAE Residential Real Estate Industry Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe UAE Residential Real Estate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe UAE Residential Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 19: Europe UAE Residential Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 20: Europe UAE Residential Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe UAE Residential Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa UAE Residential Real Estate Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Middle East & Africa UAE Residential Real Estate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa UAE Residential Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 25: Middle East & Africa UAE Residential Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 26: Middle East & Africa UAE Residential Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa UAE Residential Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific UAE Residential Real Estate Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific UAE Residential Real Estate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific UAE Residential Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 31: Asia Pacific UAE Residential Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 32: Asia Pacific UAE Residential Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific UAE Residential Real Estate Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 14: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 20: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 32: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 41: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Residential Real Estate Industry?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the UAE Residential Real Estate Industry?

Key companies in the market include Damac Properties, Azizi Developments, Emaar, Bloom Properties, Union Properties, Manazel, Dubai Properties**List Not Exhaustive, Deyaar Properties, Aldar Properties, Nakheel PJSC, Arada.

3. What are the main segments of the UAE Residential Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Disposable Incomes4.; Government Initiatives4.; Growing Expatriate Population.

6. What are the notable trends driving market growth?

New Project Launches in Dubai are Expected to Boost the Market.

7. Are there any restraints impacting market growth?

4.; Regulatory Framework4.; The Risk of Oversupply.

8. Can you provide examples of recent developments in the market?

In January 2022, the UAE-based conglomerate Alpha Dhabi Holding (ADH) acquired an additional 17% stake in Abu Dhabi's largest property developer Aldar Properties, taking its stake to 29.8%. In this latest investment, Alpha Dhabi Holding completed the acquisition of Sublime 2, Sogno 2, and Sogno 3, which together own 17% of Aldar Properties.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the UAE Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence