Key Insights

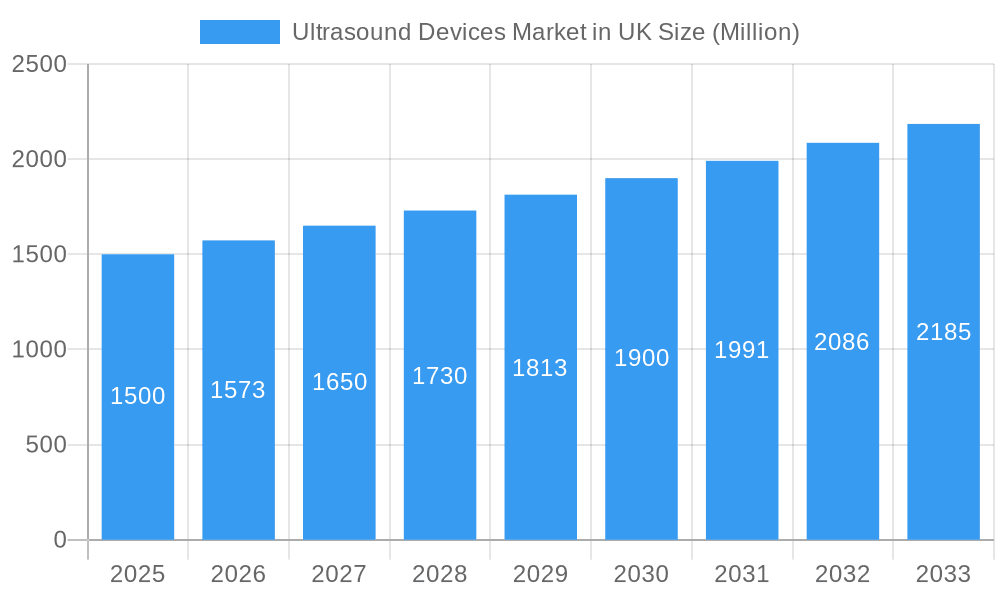

The United Kingdom's Ultrasound Devices Market is projected for substantial growth, propelled by escalating demand for sophisticated diagnostic imaging across diverse medical fields. With a projected market size of 434.41 million in the base year 2025, the sector is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 3.84% through 2033. This expansion is driven by the increasing incidence of chronic diseases necessitating continuous monitoring, an aging demographic, and a heightened focus on proactive healthcare. Leading applications in cardiology and obstetrics/gynecology are at the forefront of this growth, capitalizing on ultrasound's non-invasive, real-time imaging for accurate diagnosis, treatment oversight, and early detection. Substantial investments in healthcare infrastructure and technological innovations, including AI-enhanced ultrasound systems and compact portable devices, are creating new avenues for market participants. The growing adoption of 3D and 4D ultrasound for superior visualization and diagnostic precision is also a key growth catalyst, enhancing patient care and clinical confidence.

Ultrasound Devices Market in UK Market Size (In Million)

While the market outlook is positive, certain factors may influence its trajectory. The significant investment required for advanced ultrasound equipment and the necessity for proficient sonographers to operate these complex systems pose initial adoption hurdles, particularly for smaller healthcare providers. Rigorous regulatory approvals for novel technologies also extend product launch cycles. Nevertheless, the market is actively addressing these challenges by developing more accessible portable ultrasound solutions and implementing comprehensive training initiatives. The ongoing transition to value-based healthcare supports the utilization of cost-effective diagnostic tools such as ultrasound. Emerging trends, including the integration of ultrasound in primary care and the proliferation of point-of-care ultrasound (POCUS), are expected to broaden access to this critical technology, solidifying its importance in the UK's healthcare ecosystem and fostering sustained market expansion.

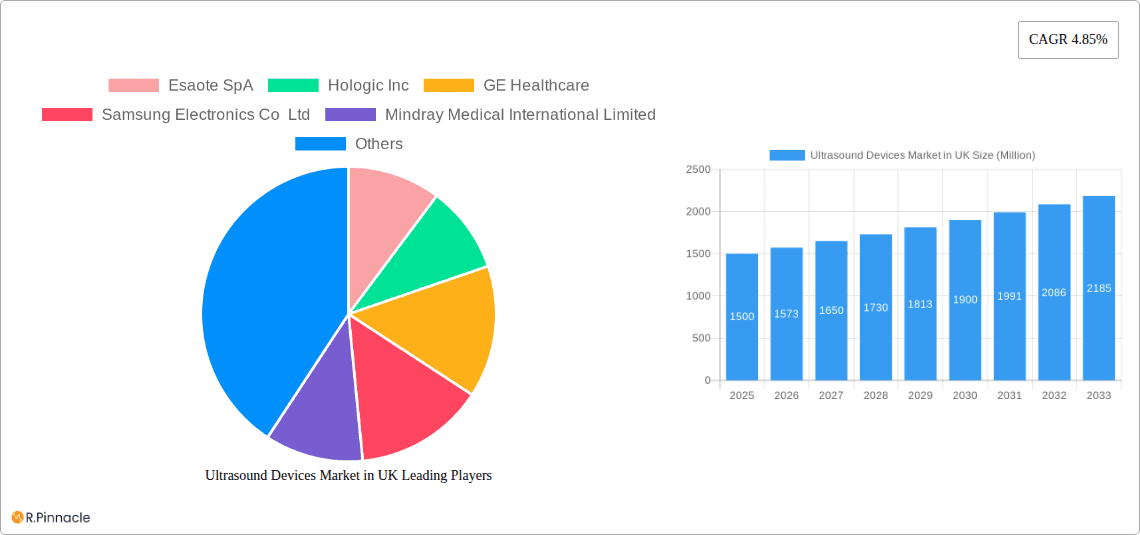

Ultrasound Devices Market in UK Company Market Share

UK Ultrasound Devices Market: Comprehensive Growth Analysis 2019-2033

This in-depth report offers a granular analysis of the UK ultrasound devices market, projecting significant growth and evolving trends throughout the forecast period of 2025–2033. Dive into the intricate dynamics of this vital healthcare sector, uncovering key drivers, emerging opportunities, and the competitive landscape that shapes the future of medical imaging in the United Kingdom. This comprehensive study is essential for industry professionals seeking actionable insights into market structure, technological advancements, and strategic growth opportunities within the UK medical imaging market.

Ultrasound Devices Market in UK Market Structure & Innovation Trends

The UK ultrasound devices market exhibits a moderately concentrated structure, with a few dominant players holding significant market share, alongside a growing number of specialized innovators. Key companies such as GE Healthcare, Siemens Healthineers AG, and Koninklijke Philips NV lead the market, leveraging extensive product portfolios and strong distribution networks. Innovation is a critical driver, fueled by advancements in imaging resolution, portability, and AI-driven diagnostic assistance. Regulatory frameworks, overseen by bodies like the Medicines and Healthcare products Regulatory Agency (MHRA), ensure product safety and efficacy, impacting market entry and product development timelines. The threat of product substitutes, while present from other imaging modalities, is mitigated by ultrasound's non-invasive nature, real-time visualization capabilities, and cost-effectiveness. End-user demographics are shifting, with an increasing demand for point-of-care ultrasound (POCUS) solutions across various medical disciplines and an aging population requiring more sophisticated diagnostic tools. Merger and acquisition (M&A) activities are strategic, aimed at expanding product offerings, geographical reach, or acquiring cutting-edge technologies. For instance, recent M&A deals in the broader European market indicate a trend towards consolidation and strategic partnerships, with an estimated aggregate deal value in the range of hundreds of millions of pounds. Market concentration is estimated to be around 65% held by the top five players. Innovation adoption rates are high, particularly for portable and AI-enhanced systems, with a projected increase in market penetration by 15% over the next five years.

Ultrasound Devices Market in UK Market Dynamics & Trends

The UK ultrasound devices market is poised for robust expansion, driven by a confluence of technological advancements, evolving healthcare demands, and supportive economic policies. A primary growth driver is the increasing prevalence of chronic diseases, such as cardiovascular conditions and cancer, which necessitates advanced diagnostic imaging. The UK cardiology ultrasound market and UK radiology ultrasound market are particularly dynamic segments, benefiting from early disease detection and personalized treatment planning. Technological disruptions are rapidly transforming the market, with the advent of portable and wireless ultrasound devices enabling point-of-care diagnostics in diverse settings, from emergency rooms to remote clinics. This trend is significantly impacting the UK portable ultrasound market, making high-performance imaging more accessible. Furthermore, the integration of artificial intelligence (AI) into ultrasound systems is enhancing diagnostic accuracy and efficiency, offering valuable insights to clinicians. Consumer preferences are leaning towards user-friendly, integrated, and cost-effective solutions. Healthcare providers are increasingly seeking ultrasound devices that offer superior image quality, ergonomic design, and seamless integration with existing hospital IT infrastructure. The competitive dynamics within the UK medical equipment market are intense, characterized by strategic product launches, aggressive pricing strategies, and a focus on after-sales service and support. The overall UK healthcare technology market is experiencing a compound annual growth rate (CAGR) of approximately 7.5%, with the ultrasound segment mirroring this upward trajectory. Market penetration for advanced ultrasound technologies, such as 3D/4D imaging and Doppler capabilities, is steadily increasing, driven by growing awareness and clinical validation. The demand for specialized applications, like UK anesthesiology ultrasound and UK gynecology ultrasound, continues to grow, reflecting the expanding utility of ultrasound across medical disciplines. The adoption of high-intensity focused ultrasound (HIFU) for therapeutic applications is also an emerging trend, presenting new avenues for market growth.

Dominant Regions & Segments in Ultrasound Devices Market in UK

The United Kingdom ultrasound devices market is characterized by strong dominance in specific segments and applications, driven by healthcare infrastructure, clinical expertise, and patient demographics.

Application Dominance

- Radiology: This segment remains the largest and most dominant application for ultrasound devices in the UK. The growing incidence of cancer, the need for non-invasive diagnostic procedures, and the established role of ultrasound in abdominal, breast, and musculoskeletal imaging solidify its leadership. The UK radiology ultrasound market benefits from advanced imaging capabilities that provide detailed anatomical insights.

- Key Drivers:

- High demand for diagnostic imaging in cancer screening and management.

- Versatility in imaging various organ systems.

- Integration of AI for enhanced image interpretation.

- Increasing adoption of advanced technologies like 3D/4D and Doppler imaging.

- Key Drivers:

- Cardiology: The burgeoning burden of cardiovascular diseases makes cardiology a high-growth application area. Ultrasound, particularly echocardiography, is indispensable for diagnosing heart conditions, assessing cardiac function, and guiding interventions. The UK cardiology ultrasound market is witnessing significant investment in advanced systems capable of detailed cardiac imaging.

- Key Drivers:

- Rising rates of heart disease and stroke.

- Need for real-time assessment of cardiac structure and function.

- Development of specialized cardiac ultrasound probes.

- Key Drivers:

- Gynecology/Obstetrics: This segment is a consistent performer, driven by routine prenatal care, fertility treatments, and gynecological health monitoring. The ability of ultrasound to provide real-time visualization of fetal development and reproductive organs makes it a cornerstone in this field. The UK gynecology ultrasound market is influenced by demographic trends and the emphasis on maternal and child health.

- Key Drivers:

- Demand for prenatal screening and monitoring.

- Advancements in 3D/4D imaging for fetal visualization.

- Routine use in women's health check-ups.

- Key Drivers:

- Anesthesiology: The increasing adoption of ultrasound for regional anesthesia and procedural guidance has propelled this segment. Its ability to visualize nerves and blood vessels leads to improved patient safety and procedural success rates. The UK anesthesiology ultrasound market is experiencing growth due to the emphasis on minimally invasive techniques.

- Key Drivers:

- Enhanced patient safety in anesthesia.

- Improved accuracy in nerve blocks and vascular access.

- Development of compact and portable systems for perioperative use.

- Key Drivers:

Technology Dominance

- 2D Ultrasound Imaging: This foundational technology continues to be the most widely used due to its reliability, affordability, and broad applicability across all medical specialties. The UK 2D ultrasound market is mature but benefits from continuous improvements in image quality and processing.

- Key Drivers:

- Cost-effectiveness and widespread availability.

- Established clinical protocols and user familiarity.

- Key Drivers:

- Doppler Imaging: Essential for assessing blood flow, Doppler imaging is crucial in cardiology, vascular studies, and obstetrics. Its ability to detect and quantify blood velocity and direction makes it indispensable for diagnosis.

- Key Drivers:

- Critical for diagnosis of vascular diseases.

- Enhances diagnostic capabilities in cardiology and obstetrics.

- Key Drivers:

Type Dominance

- Stationary Ultrasound: These high-end systems, typically found in hospitals and specialized imaging centers, offer advanced features and superior image quality, catering to complex diagnostic needs. The UK stationary ultrasound market is driven by the demand for sophisticated imaging solutions in acute care and specialized departments.

- Key Drivers:

- Requirement for high-resolution imaging in complex cases.

- Integration with hospital PACS (Picture Archiving and Communication System).

- Key Drivers:

- Portable Ultrasound: The growth of portable ultrasound devices is a significant trend, driven by the need for rapid, on-the-spot diagnostics at the point of care. This segment is expanding rapidly due to its versatility and increasing affordability. The UK portable ultrasound market is a key area of innovation and growth.

- Key Drivers:

- Increasing adoption of Point-of-Care Ultrasound (POCUS).

- Demand for mobile diagnostic solutions in various clinical settings.

- Technological advancements in miniaturization and battery life.

- Key Drivers:

Ultrasound Devices Market in UK Product Innovations

Product innovation in the UK ultrasound devices market centers on enhancing diagnostic precision, user experience, and accessibility. Key developments include the introduction of AI-powered image analysis, which assists clinicians in identifying subtle abnormalities and streamlining workflows. The miniaturization of devices continues, leading to more portable and wireless ultrasound scanners that are ideal for point-of-care applications. These innovations offer significant competitive advantages by enabling faster, more accurate diagnoses in diverse settings. Companies are focusing on improving transducer technology for enhanced image quality and patient comfort, alongside intuitive user interfaces that reduce the learning curve for new operators. The integration of cloud-based solutions for data management and remote collaboration is also a notable trend, further improving the efficiency and reach of ultrasound diagnostics.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the UK ultrasound devices market, segmenting it by Application, Technology, and Type.

- Application: Segments include Anesthesiology, Cardiology, Gynecology/Obstetrics, Musculoskeletal, Radiology, Critical Care, and Other Applications. The Radiology and Cardiology segments are projected to lead in market size, driven by increasing diagnostic needs and advancements in imaging capabilities. Growth projections for Critical Care and Anesthesiology are robust due to the rise of point-of-care ultrasound.

- Technology: The market is segmented into 2D Ultrasound Imaging, 3D and 4D Ultrasound Imaging, Doppler Imaging, and High-intensity Focused Ultrasound. 2D Ultrasound Imaging currently dominates due to its widespread use, while Doppler Imaging remains critical for vascular assessments. 3D and 4D Ultrasound Imaging are gaining traction in obstetrics and cardiology, with significant growth potential. High-intensity Focused Ultrasound, though a nascent market, presents emerging therapeutic opportunities.

- Type: Key segments are Stationary Ultrasound and Portable Ultrasound. While Stationary Ultrasound systems continue to be essential for hospital-based diagnostics, the Portable Ultrasound segment is experiencing exponential growth, fueled by the demand for point-of-care solutions across various clinical settings. Projections indicate a significant shift towards portable devices.

Key Drivers of Ultrasound Devices Market in UK Growth

The UK ultrasound devices market is propelled by several key drivers:

- Technological Advancements: Continuous innovation in ultrasound technology, including enhanced image resolution, miniaturization of devices, and the integration of AI, significantly boosts market growth. The development of portable and wireless ultrasound systems is revolutionizing point-of-care diagnostics.

- Increasing Healthcare Expenditure: Rising healthcare spending in the UK, coupled with government initiatives to improve diagnostic capabilities, directly fuels demand for advanced medical equipment like ultrasound devices.

- Growing Prevalence of Chronic Diseases: The increasing incidence of conditions such as cardiovascular diseases, cancer, and gynecological disorders necessitates sophisticated diagnostic tools, driving the adoption of ultrasound across various specialties.

- Demand for Non-Invasive Imaging: Ultrasound offers a safe, non-ionizing, and cost-effective imaging modality, making it a preferred choice for routine diagnostics and follow-up examinations compared to X-rays or CT scans.

- Focus on Point-of-Care Ultrasound (POCUS): The growing trend of POCUS, enabling rapid bedside diagnostics, is significantly expanding the market for portable and handheld ultrasound devices, particularly in emergency medicine, critical care, and primary care settings.

Challenges in the Ultrasound Devices Market in UK Sector

Despite robust growth prospects, the UK ultrasound devices market faces several challenges:

- Reimbursement Policies: Evolving reimbursement policies and the pressure to control healthcare costs can impact the adoption rates of advanced and high-priced ultrasound systems.

- Skilled Workforce Shortage: A persistent shortage of trained sonographers and healthcare professionals proficient in operating advanced ultrasound equipment can limit market expansion and the effective utilization of technology.

- High Initial Investment Costs: While portable devices are becoming more accessible, sophisticated stationary ultrasound systems represent a substantial capital investment for healthcare providers, potentially slowing down upgrades.

- Data Security and Privacy Concerns: The increasing digitalization of healthcare and the use of cloud-based solutions raise concerns regarding data security and patient privacy, requiring stringent adherence to regulations like GDPR.

- Interoperability Issues: Ensuring seamless integration of new ultrasound devices with existing hospital IT infrastructure and electronic health records can be complex, posing a barrier to widespread adoption.

Emerging Opportunities in Ultrasound Devices Market in UK

The UK ultrasound devices market is ripe with emerging opportunities:

- Expansion of Point-of-Care Ultrasound (POCUS): The increasing integration of POCUS into primary care, emergency medicine, and remote healthcare settings presents a significant growth avenue for portable and handheld ultrasound devices.

- AI and Machine Learning Integration: The development and deployment of AI algorithms for automated image analysis, disease detection, and workflow optimization offer substantial opportunities to enhance diagnostic accuracy and efficiency.

- Therapeutic Ultrasound Applications: Beyond diagnostics, the growing interest and research in high-intensity focused ultrasound (HIFU) for therapeutic purposes, such as tumor ablation and drug delivery, open new market frontiers.

- Home Healthcare and Remote Monitoring: The advancement of wearable and connected ultrasound devices could enable remote patient monitoring and home-based diagnostics, catering to the growing demand for telehealth services.

- Emerging Market Segments: Increased focus on specialized applications, such as musculoskeletal ultrasound for sports injuries and point-of-care ultrasound in veterinary medicine, represents untapped market potential.

Leading Players in the Ultrasound Devices Market in UK Market

- Esaote SpA

- Hologic Inc

- GE Healthcare

- Samsung Electronics Co Ltd

- Mindray Medical International Limited

- Siemens Healthineers AG

- Carestream Health

- Koninklijke Philips NV

- Becton Dickinson and Company

- Canon Medical Systems Corporation

- SonoScape Medical Corp

- Fujifilm Holdings Corporation

Key Developments in Ultrasound Devices Market in UK Industry

- September 2022: FUJIFILM Sonosite, Inc. launched its new, premium Sonosite LX system in European countries, including the United Kingdom. The Sonosite LX system is a point-of-care ultrasound system designed for advanced imaging capabilities at the bedside.

- May 2022: Clarius Mobile Health introduced its third-generation product line of high-performance wireless ultrasound scanners in the European Union and the United Kingdom, offering enhanced image quality and portability for medical professionals.

Future Outlook for Ultrasound Devices Market in UK Market

The future outlook for the UK ultrasound devices market is exceptionally positive, driven by sustained technological innovation and an expanding application scope. The continued development of artificial intelligence integrated into ultrasound systems will further enhance diagnostic accuracy and clinical decision-making. The trend towards miniaturization and increased portability will solidify the dominance of point-of-care ultrasound, enabling faster and more efficient diagnostics across all healthcare settings, from urban hospitals to rural clinics. Furthermore, the growing recognition of therapeutic applications of ultrasound, particularly high-intensity focused ultrasound (HIFU), suggests potential for significant market diversification and growth. As the UK healthcare system continues to prioritize early disease detection and personalized medicine, the demand for advanced, versatile, and user-friendly ultrasound solutions is set to surge, creating substantial opportunities for market expansion and strategic advancements.

Ultrasound Devices Market in UK Segmentation

-

1. Application

- 1.1. Anesthesiology

- 1.2. Cardiology

- 1.3. Gynecology/Obstetrics

- 1.4. Musculoskeletal

- 1.5. Radiology

- 1.6. Critical Care

- 1.7. Other Applications

-

2. Technology

- 2.1. 2D Ultrasound Imaging

- 2.2. 3D and 4D Ultrasound Imaging

- 2.3. Doppler Imaging

- 2.4. High-intensity Focused Ultrasound

-

3. Type

- 3.1. Stationary Ultrasound

- 3.2. Portable Ultrasound

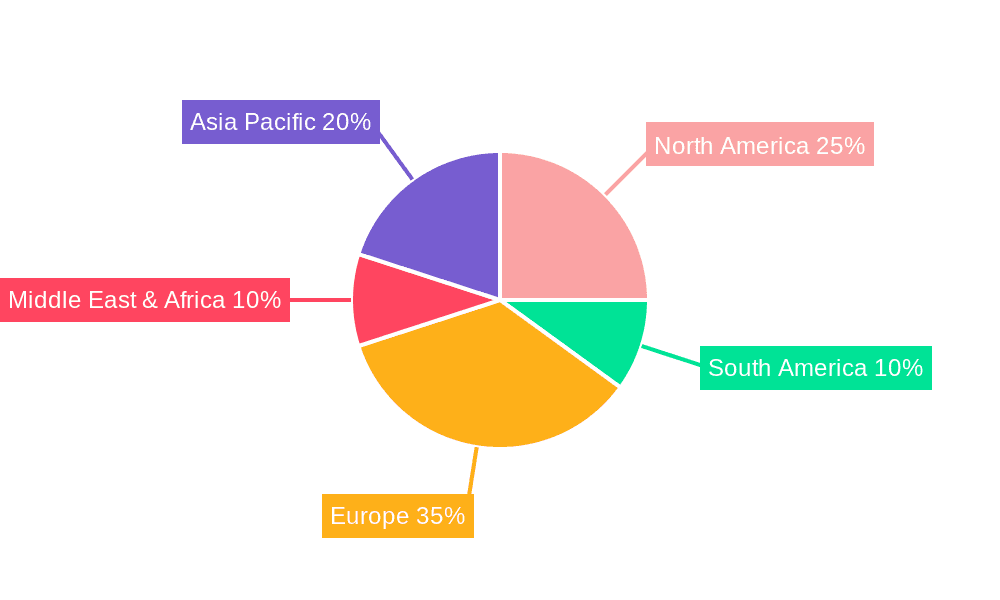

Ultrasound Devices Market in UK Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ultrasound Devices Market in UK Regional Market Share

Geographic Coverage of Ultrasound Devices Market in UK

Ultrasound Devices Market in UK REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Chronic Diseases; Technological Advancements in Ultrasound Devices and Rising Usage of Ultrasound Devices in Disease Diagnosis

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations

- 3.4. Market Trends

- 3.4.1. 2D Ultrasound Imaging Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ultrasound Devices Market in UK Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Anesthesiology

- 5.1.2. Cardiology

- 5.1.3. Gynecology/Obstetrics

- 5.1.4. Musculoskeletal

- 5.1.5. Radiology

- 5.1.6. Critical Care

- 5.1.7. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. 2D Ultrasound Imaging

- 5.2.2. 3D and 4D Ultrasound Imaging

- 5.2.3. Doppler Imaging

- 5.2.4. High-intensity Focused Ultrasound

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Stationary Ultrasound

- 5.3.2. Portable Ultrasound

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ultrasound Devices Market in UK Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Anesthesiology

- 6.1.2. Cardiology

- 6.1.3. Gynecology/Obstetrics

- 6.1.4. Musculoskeletal

- 6.1.5. Radiology

- 6.1.6. Critical Care

- 6.1.7. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. 2D Ultrasound Imaging

- 6.2.2. 3D and 4D Ultrasound Imaging

- 6.2.3. Doppler Imaging

- 6.2.4. High-intensity Focused Ultrasound

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Stationary Ultrasound

- 6.3.2. Portable Ultrasound

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ultrasound Devices Market in UK Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Anesthesiology

- 7.1.2. Cardiology

- 7.1.3. Gynecology/Obstetrics

- 7.1.4. Musculoskeletal

- 7.1.5. Radiology

- 7.1.6. Critical Care

- 7.1.7. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. 2D Ultrasound Imaging

- 7.2.2. 3D and 4D Ultrasound Imaging

- 7.2.3. Doppler Imaging

- 7.2.4. High-intensity Focused Ultrasound

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Stationary Ultrasound

- 7.3.2. Portable Ultrasound

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ultrasound Devices Market in UK Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Anesthesiology

- 8.1.2. Cardiology

- 8.1.3. Gynecology/Obstetrics

- 8.1.4. Musculoskeletal

- 8.1.5. Radiology

- 8.1.6. Critical Care

- 8.1.7. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. 2D Ultrasound Imaging

- 8.2.2. 3D and 4D Ultrasound Imaging

- 8.2.3. Doppler Imaging

- 8.2.4. High-intensity Focused Ultrasound

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Stationary Ultrasound

- 8.3.2. Portable Ultrasound

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ultrasound Devices Market in UK Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Anesthesiology

- 9.1.2. Cardiology

- 9.1.3. Gynecology/Obstetrics

- 9.1.4. Musculoskeletal

- 9.1.5. Radiology

- 9.1.6. Critical Care

- 9.1.7. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. 2D Ultrasound Imaging

- 9.2.2. 3D and 4D Ultrasound Imaging

- 9.2.3. Doppler Imaging

- 9.2.4. High-intensity Focused Ultrasound

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Stationary Ultrasound

- 9.3.2. Portable Ultrasound

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ultrasound Devices Market in UK Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Anesthesiology

- 10.1.2. Cardiology

- 10.1.3. Gynecology/Obstetrics

- 10.1.4. Musculoskeletal

- 10.1.5. Radiology

- 10.1.6. Critical Care

- 10.1.7. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. 2D Ultrasound Imaging

- 10.2.2. 3D and 4D Ultrasound Imaging

- 10.2.3. Doppler Imaging

- 10.2.4. High-intensity Focused Ultrasound

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Stationary Ultrasound

- 10.3.2. Portable Ultrasound

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Esaote SpA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hologic Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GE Healthcare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Samsung Electronics Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mindray Medical International Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens Healthineers AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Carestream Health

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Koninklijke Philips NV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Becton Dickinson and Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Canon Medical Systems Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SonoScape Medical Corp

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Fujifilm Holdings Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Esaote SpA

List of Figures

- Figure 1: Global Ultrasound Devices Market in UK Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Ultrasound Devices Market in UK Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Ultrasound Devices Market in UK Revenue (million), by Application 2025 & 2033

- Figure 4: North America Ultrasound Devices Market in UK Volume (K Unit), by Application 2025 & 2033

- Figure 5: North America Ultrasound Devices Market in UK Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Ultrasound Devices Market in UK Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Ultrasound Devices Market in UK Revenue (million), by Technology 2025 & 2033

- Figure 8: North America Ultrasound Devices Market in UK Volume (K Unit), by Technology 2025 & 2033

- Figure 9: North America Ultrasound Devices Market in UK Revenue Share (%), by Technology 2025 & 2033

- Figure 10: North America Ultrasound Devices Market in UK Volume Share (%), by Technology 2025 & 2033

- Figure 11: North America Ultrasound Devices Market in UK Revenue (million), by Type 2025 & 2033

- Figure 12: North America Ultrasound Devices Market in UK Volume (K Unit), by Type 2025 & 2033

- Figure 13: North America Ultrasound Devices Market in UK Revenue Share (%), by Type 2025 & 2033

- Figure 14: North America Ultrasound Devices Market in UK Volume Share (%), by Type 2025 & 2033

- Figure 15: North America Ultrasound Devices Market in UK Revenue (million), by Country 2025 & 2033

- Figure 16: North America Ultrasound Devices Market in UK Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Ultrasound Devices Market in UK Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Ultrasound Devices Market in UK Volume Share (%), by Country 2025 & 2033

- Figure 19: South America Ultrasound Devices Market in UK Revenue (million), by Application 2025 & 2033

- Figure 20: South America Ultrasound Devices Market in UK Volume (K Unit), by Application 2025 & 2033

- Figure 21: South America Ultrasound Devices Market in UK Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Ultrasound Devices Market in UK Volume Share (%), by Application 2025 & 2033

- Figure 23: South America Ultrasound Devices Market in UK Revenue (million), by Technology 2025 & 2033

- Figure 24: South America Ultrasound Devices Market in UK Volume (K Unit), by Technology 2025 & 2033

- Figure 25: South America Ultrasound Devices Market in UK Revenue Share (%), by Technology 2025 & 2033

- Figure 26: South America Ultrasound Devices Market in UK Volume Share (%), by Technology 2025 & 2033

- Figure 27: South America Ultrasound Devices Market in UK Revenue (million), by Type 2025 & 2033

- Figure 28: South America Ultrasound Devices Market in UK Volume (K Unit), by Type 2025 & 2033

- Figure 29: South America Ultrasound Devices Market in UK Revenue Share (%), by Type 2025 & 2033

- Figure 30: South America Ultrasound Devices Market in UK Volume Share (%), by Type 2025 & 2033

- Figure 31: South America Ultrasound Devices Market in UK Revenue (million), by Country 2025 & 2033

- Figure 32: South America Ultrasound Devices Market in UK Volume (K Unit), by Country 2025 & 2033

- Figure 33: South America Ultrasound Devices Market in UK Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Ultrasound Devices Market in UK Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Ultrasound Devices Market in UK Revenue (million), by Application 2025 & 2033

- Figure 36: Europe Ultrasound Devices Market in UK Volume (K Unit), by Application 2025 & 2033

- Figure 37: Europe Ultrasound Devices Market in UK Revenue Share (%), by Application 2025 & 2033

- Figure 38: Europe Ultrasound Devices Market in UK Volume Share (%), by Application 2025 & 2033

- Figure 39: Europe Ultrasound Devices Market in UK Revenue (million), by Technology 2025 & 2033

- Figure 40: Europe Ultrasound Devices Market in UK Volume (K Unit), by Technology 2025 & 2033

- Figure 41: Europe Ultrasound Devices Market in UK Revenue Share (%), by Technology 2025 & 2033

- Figure 42: Europe Ultrasound Devices Market in UK Volume Share (%), by Technology 2025 & 2033

- Figure 43: Europe Ultrasound Devices Market in UK Revenue (million), by Type 2025 & 2033

- Figure 44: Europe Ultrasound Devices Market in UK Volume (K Unit), by Type 2025 & 2033

- Figure 45: Europe Ultrasound Devices Market in UK Revenue Share (%), by Type 2025 & 2033

- Figure 46: Europe Ultrasound Devices Market in UK Volume Share (%), by Type 2025 & 2033

- Figure 47: Europe Ultrasound Devices Market in UK Revenue (million), by Country 2025 & 2033

- Figure 48: Europe Ultrasound Devices Market in UK Volume (K Unit), by Country 2025 & 2033

- Figure 49: Europe Ultrasound Devices Market in UK Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Ultrasound Devices Market in UK Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa Ultrasound Devices Market in UK Revenue (million), by Application 2025 & 2033

- Figure 52: Middle East & Africa Ultrasound Devices Market in UK Volume (K Unit), by Application 2025 & 2033

- Figure 53: Middle East & Africa Ultrasound Devices Market in UK Revenue Share (%), by Application 2025 & 2033

- Figure 54: Middle East & Africa Ultrasound Devices Market in UK Volume Share (%), by Application 2025 & 2033

- Figure 55: Middle East & Africa Ultrasound Devices Market in UK Revenue (million), by Technology 2025 & 2033

- Figure 56: Middle East & Africa Ultrasound Devices Market in UK Volume (K Unit), by Technology 2025 & 2033

- Figure 57: Middle East & Africa Ultrasound Devices Market in UK Revenue Share (%), by Technology 2025 & 2033

- Figure 58: Middle East & Africa Ultrasound Devices Market in UK Volume Share (%), by Technology 2025 & 2033

- Figure 59: Middle East & Africa Ultrasound Devices Market in UK Revenue (million), by Type 2025 & 2033

- Figure 60: Middle East & Africa Ultrasound Devices Market in UK Volume (K Unit), by Type 2025 & 2033

- Figure 61: Middle East & Africa Ultrasound Devices Market in UK Revenue Share (%), by Type 2025 & 2033

- Figure 62: Middle East & Africa Ultrasound Devices Market in UK Volume Share (%), by Type 2025 & 2033

- Figure 63: Middle East & Africa Ultrasound Devices Market in UK Revenue (million), by Country 2025 & 2033

- Figure 64: Middle East & Africa Ultrasound Devices Market in UK Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East & Africa Ultrasound Devices Market in UK Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa Ultrasound Devices Market in UK Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific Ultrasound Devices Market in UK Revenue (million), by Application 2025 & 2033

- Figure 68: Asia Pacific Ultrasound Devices Market in UK Volume (K Unit), by Application 2025 & 2033

- Figure 69: Asia Pacific Ultrasound Devices Market in UK Revenue Share (%), by Application 2025 & 2033

- Figure 70: Asia Pacific Ultrasound Devices Market in UK Volume Share (%), by Application 2025 & 2033

- Figure 71: Asia Pacific Ultrasound Devices Market in UK Revenue (million), by Technology 2025 & 2033

- Figure 72: Asia Pacific Ultrasound Devices Market in UK Volume (K Unit), by Technology 2025 & 2033

- Figure 73: Asia Pacific Ultrasound Devices Market in UK Revenue Share (%), by Technology 2025 & 2033

- Figure 74: Asia Pacific Ultrasound Devices Market in UK Volume Share (%), by Technology 2025 & 2033

- Figure 75: Asia Pacific Ultrasound Devices Market in UK Revenue (million), by Type 2025 & 2033

- Figure 76: Asia Pacific Ultrasound Devices Market in UK Volume (K Unit), by Type 2025 & 2033

- Figure 77: Asia Pacific Ultrasound Devices Market in UK Revenue Share (%), by Type 2025 & 2033

- Figure 78: Asia Pacific Ultrasound Devices Market in UK Volume Share (%), by Type 2025 & 2033

- Figure 79: Asia Pacific Ultrasound Devices Market in UK Revenue (million), by Country 2025 & 2033

- Figure 80: Asia Pacific Ultrasound Devices Market in UK Volume (K Unit), by Country 2025 & 2033

- Figure 81: Asia Pacific Ultrasound Devices Market in UK Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific Ultrasound Devices Market in UK Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ultrasound Devices Market in UK Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: Global Ultrasound Devices Market in UK Revenue million Forecast, by Technology 2020 & 2033

- Table 4: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Technology 2020 & 2033

- Table 5: Global Ultrasound Devices Market in UK Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: Global Ultrasound Devices Market in UK Revenue million Forecast, by Region 2020 & 2033

- Table 8: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Ultrasound Devices Market in UK Revenue million Forecast, by Application 2020 & 2033

- Table 10: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Ultrasound Devices Market in UK Revenue million Forecast, by Technology 2020 & 2033

- Table 12: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Technology 2020 & 2033

- Table 13: Global Ultrasound Devices Market in UK Revenue million Forecast, by Type 2020 & 2033

- Table 14: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Global Ultrasound Devices Market in UK Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: United States Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Canada Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Ultrasound Devices Market in UK Revenue million Forecast, by Application 2020 & 2033

- Table 24: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Application 2020 & 2033

- Table 25: Global Ultrasound Devices Market in UK Revenue million Forecast, by Technology 2020 & 2033

- Table 26: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Technology 2020 & 2033

- Table 27: Global Ultrasound Devices Market in UK Revenue million Forecast, by Type 2020 & 2033

- Table 28: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Type 2020 & 2033

- Table 29: Global Ultrasound Devices Market in UK Revenue million Forecast, by Country 2020 & 2033

- Table 30: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Brazil Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Brazil Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Argentina Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Argentina Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Ultrasound Devices Market in UK Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Application 2020 & 2033

- Table 39: Global Ultrasound Devices Market in UK Revenue million Forecast, by Technology 2020 & 2033

- Table 40: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Technology 2020 & 2033

- Table 41: Global Ultrasound Devices Market in UK Revenue million Forecast, by Type 2020 & 2033

- Table 42: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Type 2020 & 2033

- Table 43: Global Ultrasound Devices Market in UK Revenue million Forecast, by Country 2020 & 2033

- Table 44: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: United Kingdom Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Germany Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Germany Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: France Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: France Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Italy Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Italy Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Spain Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 54: Spain Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Russia Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 56: Russia Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Benelux Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 58: Benelux Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: Nordics Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 60: Nordics Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Ultrasound Devices Market in UK Revenue million Forecast, by Application 2020 & 2033

- Table 64: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Application 2020 & 2033

- Table 65: Global Ultrasound Devices Market in UK Revenue million Forecast, by Technology 2020 & 2033

- Table 66: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Technology 2020 & 2033

- Table 67: Global Ultrasound Devices Market in UK Revenue million Forecast, by Type 2020 & 2033

- Table 68: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Type 2020 & 2033

- Table 69: Global Ultrasound Devices Market in UK Revenue million Forecast, by Country 2020 & 2033

- Table 70: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: Turkey Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 72: Turkey Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: Israel Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 74: Israel Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: GCC Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 76: GCC Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: North Africa Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 78: North Africa Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: South Africa Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 80: South Africa Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: Global Ultrasound Devices Market in UK Revenue million Forecast, by Application 2020 & 2033

- Table 84: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Application 2020 & 2033

- Table 85: Global Ultrasound Devices Market in UK Revenue million Forecast, by Technology 2020 & 2033

- Table 86: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Technology 2020 & 2033

- Table 87: Global Ultrasound Devices Market in UK Revenue million Forecast, by Type 2020 & 2033

- Table 88: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Type 2020 & 2033

- Table 89: Global Ultrasound Devices Market in UK Revenue million Forecast, by Country 2020 & 2033

- Table 90: Global Ultrasound Devices Market in UK Volume K Unit Forecast, by Country 2020 & 2033

- Table 91: China Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 92: China Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 93: India Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 94: India Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 95: Japan Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 96: Japan Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 97: South Korea Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 98: South Korea Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 99: ASEAN Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 100: ASEAN Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 101: Oceania Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 102: Oceania Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific Ultrasound Devices Market in UK Revenue (million) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific Ultrasound Devices Market in UK Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ultrasound Devices Market in UK?

The projected CAGR is approximately 3.84%.

2. Which companies are prominent players in the Ultrasound Devices Market in UK?

Key companies in the market include Esaote SpA, Hologic Inc, GE Healthcare, Samsung Electronics Co Ltd, Mindray Medical International Limited, Siemens Healthineers AG, Carestream Health, Koninklijke Philips NV, Becton Dickinson and Company, Canon Medical Systems Corporation, SonoScape Medical Corp, Fujifilm Holdings Corporation.

3. What are the main segments of the Ultrasound Devices Market in UK?

The market segments include Application, Technology, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 434.41 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Chronic Diseases; Technological Advancements in Ultrasound Devices and Rising Usage of Ultrasound Devices in Disease Diagnosis.

6. What are the notable trends driving market growth?

2D Ultrasound Imaging Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulations.

8. Can you provide examples of recent developments in the market?

In September 2022, FUJIFILM Sonosite, Inc launched its new, premium Sonosite LX system in European countries, including the United Kingdom. The Sonosite LX system is a point-of-care ultrasound system.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ultrasound Devices Market in UK," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ultrasound Devices Market in UK report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ultrasound Devices Market in UK?

To stay informed about further developments, trends, and reports in the Ultrasound Devices Market in UK, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence