Key Insights

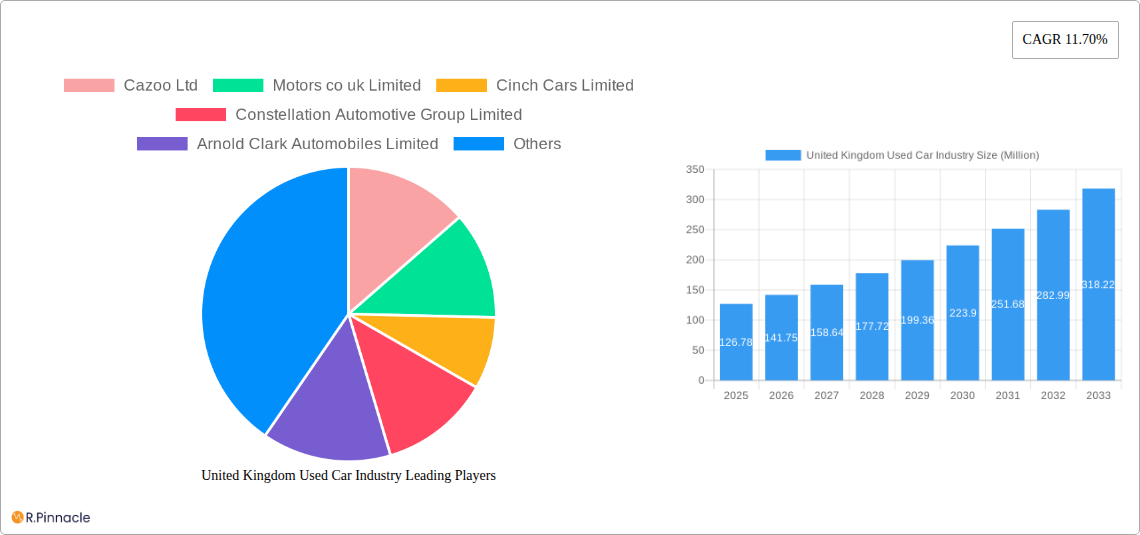

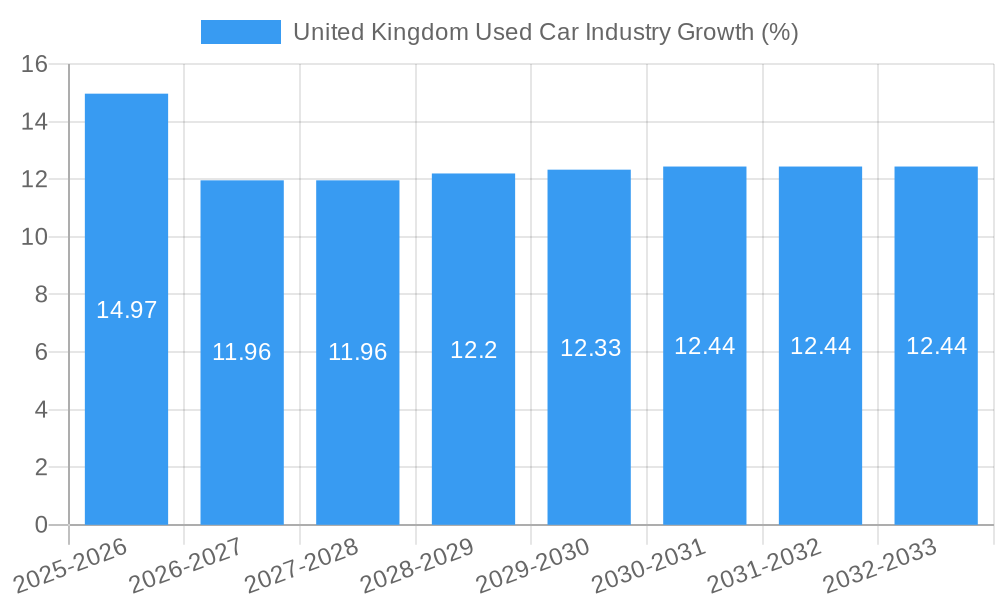

The United Kingdom used car market, valued at £126.78 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.70% from 2025 to 2033. This significant expansion is driven by several key factors. Increasing consumer preference for pre-owned vehicles due to affordability concerns and the rising cost of new cars is a primary driver. The shift towards online car sales platforms, offering convenience and transparency, is also fueling market growth. Furthermore, the evolving landscape of fuel types, with growing adoption of electric and hybrid vehicles entering the used car market, adds another layer of dynamism. The market segmentation reveals strong performance across various categories, including hatchbacks, sedans, SUVs, and MPVs, reflecting diverse consumer preferences. Both online and offline sales channels contribute significantly, highlighting the market's adaptability. The organized sector is likely to maintain its dominance, although the unorganized sector continues to be a notable player, particularly in regional markets.

However, market growth isn't without challenges. Rising interest rates and potential economic downturns could dampen consumer spending on used cars. Fluctuations in the used car supply chain, influenced by factors like semiconductor shortages and global economic conditions, can impact pricing and availability. Competition among established players like Cazoo, Motors.co.uk, Cinch Cars, and others remains intense, requiring continuous innovation and adaptation to retain market share. Government regulations regarding emissions and vehicle standards also play a role, influencing consumer choices and shaping the future of the used car market. Understanding these dynamics is critical for players aiming to succeed in this ever-evolving landscape. The Asia-Pacific region, particularly China and India, present potential avenues for expansion given their large populations and growing automotive markets, though this requires significant market entry strategy development.

United Kingdom Used Car Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UK used car market, offering invaluable insights for industry professionals, investors, and strategists. With a focus on market structure, dynamics, and future trends, this report covers the period from 2019 to 2033, including a detailed analysis of the base year 2025 and forecasts until 2033. The report leverages extensive data analysis to provide actionable intelligence on market size, growth rates, key players, and emerging opportunities.

United Kingdom Used Car Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the UK used car market, examining market concentration, innovation drivers, regulatory frameworks, and key industry activities. We delve into the impact of mergers and acquisitions (M&A) and assess the influence of various factors shaping the market structure.

- Market Concentration: The UK used car market exhibits a mix of large organized players and numerous smaller, unorganized vendors. Organized players like Constellation Automotive Group and Auto Trader command significant market share (estimated at xx%), while smaller vendors contribute to the remaining xx%.

- Innovation Drivers: Technological advancements, particularly in online sales platforms and data analytics, are major innovation drivers. The rise of online marketplaces like Cazoo reflects this trend.

- Regulatory Framework: Government regulations concerning emissions, safety standards, and consumer protection significantly impact market dynamics. Changes in these regulations can affect market growth and player strategies.

- Product Substitutes: The emergence of ride-sharing services and subscription models presents some level of substitution for traditional used car ownership, although the extent of this impact requires further study.

- End-User Demographics: The demographic profile of used car buyers influences demand trends. Understanding age, income, and geographic distribution is crucial for effective market segmentation.

- M&A Activities: Significant M&A activity has shaped the market landscape, with deal values totaling an estimated £xx Million in the past five years. Consolidation among larger players continues to be a prominent trend.

United Kingdom Used Car Industry Market Dynamics & Trends

This section provides a detailed analysis of market dynamics, focusing on growth drivers, technological disruptions, consumer preferences, and competitive dynamics.

The UK used car market has experienced a [CAGR] over the historical period (2019-2024), driven by factors such as rising disposable incomes, increased vehicle affordability, and diverse consumer preferences. Technological disruptions, especially the rise of online marketplaces, have significantly altered the buying experience, leading to a [Market penetration percentage]% online market penetration by 2025. This is further impacted by evolving consumer preferences toward specific body types, fuel types, and sales channels. Competitive dynamics are characterized by ongoing consolidation, intensified marketing efforts, and a focus on enhancing customer experience.

Dominant Regions & Segments in United Kingdom Used Car Industry

This section identifies the dominant regions and segments within the UK used car market, analyzing key drivers behind their dominance.

- Leading Regions: London and the surrounding areas consistently demonstrate high demand due to higher population density and income levels. Other major metropolitan areas also show strong performance.

- Dominant Body Types: SUVs and hatchbacks currently represent the largest segments of the UK used car market, driven by diverse consumer needs and preferences.

- Sales Channel Dominance: While offline sales still constitute a larger share, online sales are rapidly gaining traction and represent a significant growth area with expectations of [Market share percentage]% by 2033.

- Vendor Type: Organized vendors hold a larger market share due to economies of scale, established brands, and enhanced customer services. However, unorganized vendors continue to operate significantly in specific niches, particularly in local markets.

- Fuel Type: Petrol and diesel cars remain the dominant fuel types in the used car market; however, the increasing adoption of electric vehicles is expected to transform this segment considerably over the forecast period.

Key Drivers of Regional and Segmental Dominance:

- Economic factors: Regional economic strength, employment levels, and disposable income levels strongly influence demand.

- Infrastructure: Accessibility to dealerships, online platforms, and efficient transportation networks influences sales channels and consumer preference.

United Kingdom Used Car Industry Product Innovations

Recent innovations focus on enhancing the online buying experience, such as virtual reality vehicle inspections, improved online financing tools, and enhanced warranty programs. These innovations aim to streamline the purchase process, build consumer trust, and enhance customer satisfaction. The market is also seeing the integration of data analytics and AI in inventory management and pricing strategies.

Report Scope & Segmentation Analysis

This report segments the UK used car market by body type (Hatchback, Sedan, SUVs, MPVs), sales channel (online, offline), vendor type (organized, unorganized), and fuel type (Petrol, Diesel, Electric, Other). Growth projections, market sizes, and competitive dynamics are analyzed for each segment, providing a granular view of market opportunities and challenges. Each segment exhibits varied growth rates and competitive dynamics, influenced by consumer preferences, technological advancements, and regulatory changes. For example, the electric vehicle segment is projected to experience significant growth in the coming years.

Key Drivers of United Kingdom Used Car Industry Growth

Several factors are driving the growth of the UK used car market. These include:

- Increasing affordability: Used cars offer a more accessible alternative to new vehicles for many consumers.

- Technological advancements: Online marketplaces and data-driven pricing strategies are enhancing the buying experience.

- Favorable economic conditions: Periods of economic growth often lead to increased consumer spending on vehicles.

Challenges in the United Kingdom Used Car Industry Sector

The UK used car market faces several challenges, including:

- Supply chain disruptions: Global supply chain issues can impact the availability of used vehicles.

- Regulatory changes: Emission regulations and other environmental policies can affect the demand for certain types of vehicles.

- Intense competition: The presence of large organized players, including both online and offline players creates intense competition in terms of pricing and customer experience.

Emerging Opportunities in United Kingdom Used Car Industry

Emerging opportunities include:

- Growth of the electric vehicle market: The increasing demand for electric vehicles will create significant opportunities in the used car market as well.

- Expansion of online sales channels: Further penetration of online sales is expected, offering substantial growth opportunities.

- Data analytics and AI: Leveraging data to enhance pricing, inventory management and customer experience.

Leading Players in the United Kingdom Used Car Industry Market

- Cazoo Ltd

- Motors co uk Limited

- Cinch Cars Limited

- Constellation Automotive Group Limited

- Arnold Clark Automobiles Limited

- Aramis Group

- Auto Trader Limited

- McCarthy Cars (UK) Limite

- Carcraft co uk

- Car Giant Limited

Key Developments in United Kingdom Used Car Industry Industry

- August 2023: Cazoo Ltd reported positive financial results for Q2 and H1 2023, following its exit from European markets, demonstrating a successful refocusing on the UK market.

Future Outlook for United Kingdom Used Car Industry Market

The UK used car market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and the increasing adoption of electric vehicles. Strategic opportunities exist for players who can effectively leverage data analytics, enhance online platforms, and adapt to shifting market demands. The market is expected to reach a value of £xx Million by 2033, indicating a strong growth trajectory.

United Kingdom Used Car Industry Segmentation

-

1. Vendor Type

- 1.1. Organized

- 1.2. Unorganized

-

2. Fuel Type

- 2.1. Petrol

- 2.2. Diesel

- 2.3. Electric

- 2.4. Other Fuel Types

-

3. Body Type

- 3.1. Hatchback

- 3.2. Sedan

- 3.3. SUVs and MPVs

-

4. Sales Channel

- 4.1. Online

- 4.2. Offline

United Kingdom Used Car Industry Segmentation By Geography

- 1. United Kingdom

United Kingdom Used Car Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Fuel Market Demand

- 3.3. Market Restrains

- 3.3.1. High Maintenance cost of RV Rental Fleets

- 3.4. Market Trends

- 3.4.1. The Offline Segment is Expected to Hold Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Used Car Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vendor Type

- 5.1.1. Organized

- 5.1.2. Unorganized

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Petrol

- 5.2.2. Diesel

- 5.2.3. Electric

- 5.2.4. Other Fuel Types

- 5.3. Market Analysis, Insights and Forecast - by Body Type

- 5.3.1. Hatchback

- 5.3.2. Sedan

- 5.3.3. SUVs and MPVs

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Vendor Type

- 6. China United Kingdom Used Car Industry Analysis, Insights and Forecast, 2019-2031

- 7. India United Kingdom Used Car Industry Analysis, Insights and Forecast, 2019-2031

- 8. Japan United Kingdom Used Car Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea United Kingdom Used Car Industry Analysis, Insights and Forecast, 2019-2031

- 10. Rest of Asia Pacific United Kingdom Used Car Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Cazoo Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Motors co uk Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cinch Cars Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Constellation Automotive Group Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Arnold Clark Automobiles Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aramis Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Auto Trader Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 McCarthy Cars (UK) Limite

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Carcraft co uk

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Car Giant Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Cazoo Ltd

List of Figures

- Figure 1: United Kingdom Used Car Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Used Car Industry Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Used Car Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Used Car Industry Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 3: United Kingdom Used Car Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: United Kingdom Used Car Industry Revenue Million Forecast, by Body Type 2019 & 2032

- Table 5: United Kingdom Used Car Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 6: United Kingdom Used Car Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: United Kingdom Used Car Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China United Kingdom Used Car Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India United Kingdom Used Car Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan United Kingdom Used Car Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea United Kingdom Used Car Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia Pacific United Kingdom Used Car Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Used Car Industry Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 14: United Kingdom Used Car Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 15: United Kingdom Used Car Industry Revenue Million Forecast, by Body Type 2019 & 2032

- Table 16: United Kingdom Used Car Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 17: United Kingdom Used Car Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Used Car Industry?

The projected CAGR is approximately 11.70%.

2. Which companies are prominent players in the United Kingdom Used Car Industry?

Key companies in the market include Cazoo Ltd, Motors co uk Limited, Cinch Cars Limited, Constellation Automotive Group Limited, Arnold Clark Automobiles Limited, Aramis Group, Auto Trader Limited, McCarthy Cars (UK) Limite, Carcraft co uk, Car Giant Limited.

3. What are the main segments of the United Kingdom Used Car Industry?

The market segments include Vendor Type, Fuel Type, Body Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 126.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Fuel Market Demand.

6. What are the notable trends driving market growth?

The Offline Segment is Expected to Hold Major Share in the Market.

7. Are there any restraints impacting market growth?

High Maintenance cost of RV Rental Fleets.

8. Can you provide examples of recent developments in the market?

August 2023: Cazoo, the British online auto marketplace, released positive financial results for the second quarter and first half of 2023. This comes after the strategic decision to exit European businesses, focusing exclusively on its home turf in the United Kingdom. The move appears to have yielded favorable outcomes, contributing to the upbeat financial performance reported by Cazoo during this period.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Used Car Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Used Car Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Used Car Industry?

To stay informed about further developments, trends, and reports in the United Kingdom Used Car Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence