Key Insights

The United States contract packaging market is poised for significant expansion, driven by increasing industry demand for efficient and cost-effective solutions. Key growth drivers include the burgeoning e-commerce sector, necessitating advanced protective packaging for direct-to-consumer shipments, and the stringent regulatory demands of the pharmaceutical and food & beverage industries. A growing emphasis on sustainability and the adoption of eco-friendly materials by consumers and businesses alike further bolster market trends. Consequently, the US contract packaging market is projected to reach approximately $98.77 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.23% from the 2025 base year.

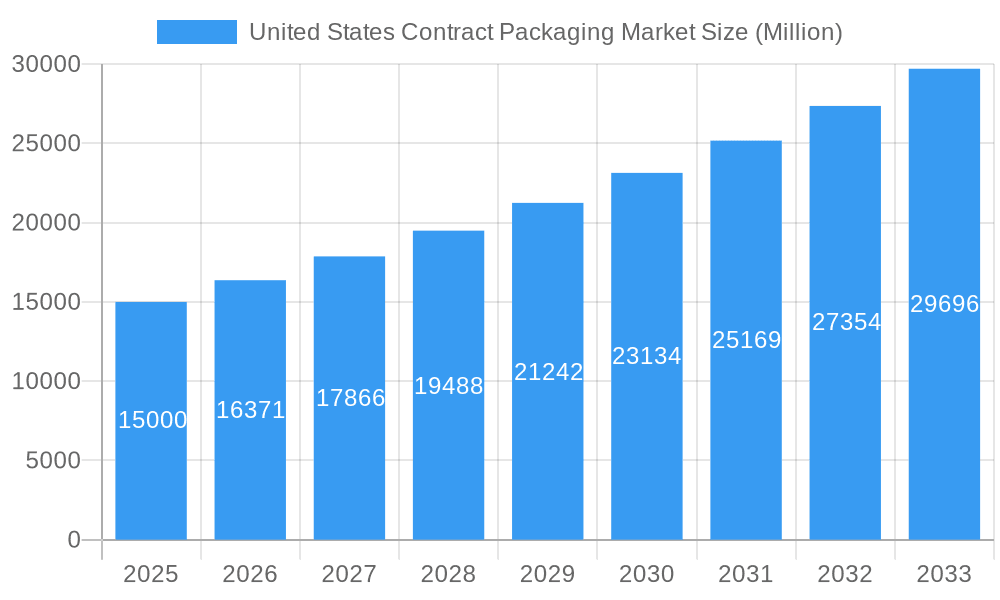

United States Contract Packaging Market Market Size (In Billion)

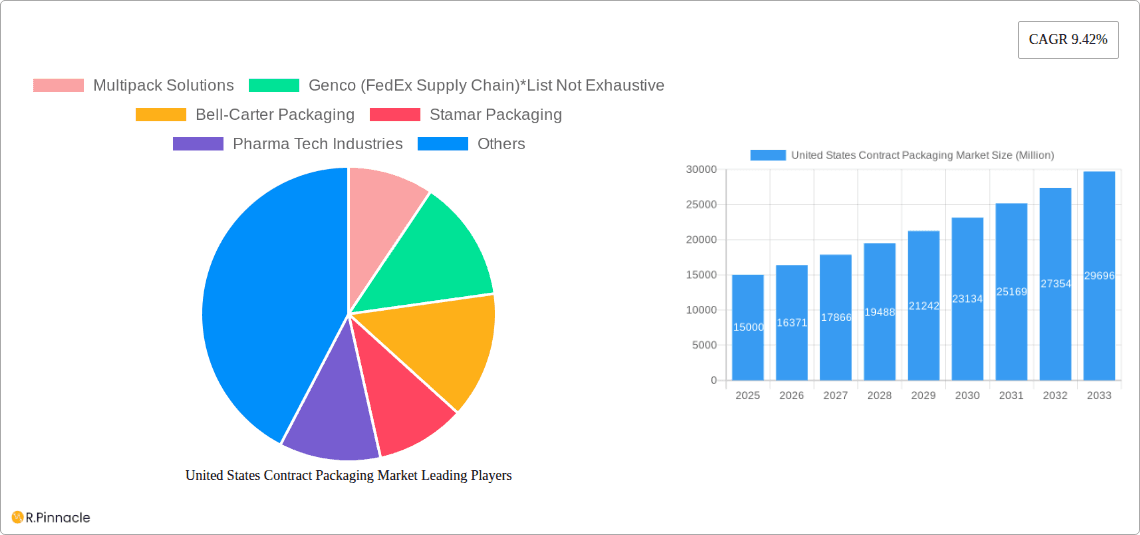

The market is segmented by packaging type (primary, secondary, tertiary) and end-user industry (food, beverage, pharmaceutical, home care & personal care, automotive, and others). Pharmaceutical and food & beverage sectors currently dominate market share due to high production volumes and stringent quality control. However, the expansion of e-commerce is driving increased demand for contract packaging across home care & personal care, and automotive sectors. The competitive landscape is fragmented, featuring key players such as Multipack Solutions, Genco (FedEx Supply Chain), and Bell-Carter Packaging. Future growth will be propelled by technological innovations in packaging materials and automation, alongside a sustained focus on sustainability and efficient supply chain management. Companies offering innovative, cost-effective, and sustainable contract packaging solutions are well-positioned for future market leadership.

United States Contract Packaging Market Company Market Share

United States Contract Packaging Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the United States contract packaging market, offering valuable insights for industry professionals, investors, and strategic planners. With a study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report delivers critical data on market size, segmentation, growth drivers, challenges, and future outlook. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

United States Contract Packaging Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of the US contract packaging market. The market exhibits a moderately concentrated structure, with key players holding significant market share. However, smaller, specialized companies also thrive, catering to niche segments. Multipack Solutions and Genco (FedEx Supply Chain) are prominent players, although market share data for individual companies remains xx.

Market Concentration: The Herfindahl-Hirschman Index (HHI) for the US contract packaging market is estimated at xx, indicating a moderately concentrated market.

Innovation Drivers:

- Automation and robotics in packaging processes.

- Sustainable and eco-friendly packaging solutions.

- Advancements in packaging materials and designs.

- Focus on enhancing supply chain efficiency and traceability.

Regulatory Frameworks: The FDA regulations heavily influence the pharmaceutical packaging segment, demanding stringent quality and safety standards. Other segments face less stringent regulatory oversight, but still must adhere to general product safety guidelines.

Mergers & Acquisitions (M&A): M&A activity in the US contract packaging market has been relatively robust, with deal values ranging from xx Million to xx Million in recent years. These activities reflect the industry's consolidation trend and expansion efforts.

United States Contract Packaging Market Dynamics & Trends

The US contract packaging market is experiencing robust growth, propelled by several key factors. The increasing demand for outsourced packaging services from diverse end-user industries, notably food & beverage and pharmaceuticals, is a major growth driver. Technological advancements, particularly in automation and sustainable packaging, are further boosting market expansion. Consumer preferences toward convenient, safe, and environmentally responsible packaging are also shaping market trends. Competitive dynamics are intensifying, with companies focusing on innovation, cost optimization, and service differentiation to gain a competitive edge. The market exhibits a strong correlation with the growth of the e-commerce sector, driving packaging demands for online retail channels. Market penetration of contract packaging services continues to rise, with significant growth witnessed in regions with strong manufacturing hubs and high consumer demand.

Dominant Regions & Segments in United States Contract Packaging Market

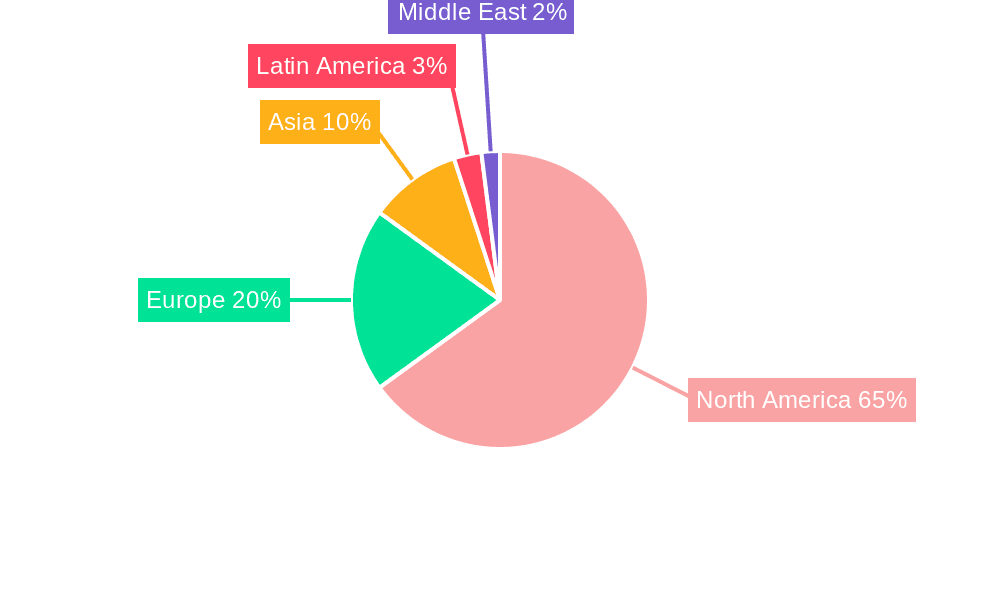

The market's dominance varies across segments and regions. While precise regional breakdowns are unavailable at this time, some generalizations can be made:

By Packaging Type: The secondary packaging segment is projected to hold the largest market share, driven by the rising demand for protective and informative packaging for various products.

By End-user Industry: The pharmaceutical segment is anticipated to dominate the market due to stringent quality and regulatory requirements necessitating specialized contract packaging services.

- Key Drivers for Pharmaceutical Segment:

- Stringent quality control standards.

- Demand for tamper-evident packaging.

- Growing pharmaceutical industry in the US.

- Key Drivers for Food & Beverage Segment:

- Increased demand for convenient and shelf-stable packaging.

- Rising e-commerce penetration.

- Emphasis on food safety and extended shelf-life.

United States Contract Packaging Market Product Innovations

Recent product innovations focus on sustainable and cost-effective solutions. This includes advancements in recyclable and biodegradable materials, along with improved automation techniques to enhance efficiency and reduce waste. These innovations are crucial for catering to evolving consumer preferences and environmental concerns. Companies are also emphasizing customization options to meet specific client needs, offering value-added services beyond basic packaging to improve their competitiveness and appeal.

Report Scope & Segmentation Analysis

This report segments the US contract packaging market based on packaging type (primary, secondary, tertiary) and end-user industry (food, beverage, pharmaceutical, home care and personal care, automotive, other). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. The pharmaceutical segment exhibits high growth owing to regulatory compliance demands. The food and beverage industry shows consistent growth, driven by consumer preferences for convenient packaging. The other segments show varied levels of growth, depending on specific market conditions.

Key Drivers of United States Contract Packaging Market Growth

Several factors propel the market's growth: rising demand for outsourced packaging services from various industries, technological advancements enhancing efficiency and sustainability, and increasing consumer focus on convenience and environmentally conscious packaging. Government regulations regarding product safety and labeling also impact growth.

Challenges in the United States Contract Packaging Market Sector

The market faces challenges such as fluctuating raw material costs, supply chain disruptions impacting packaging material availability and timely delivery, intense competition among numerous players, and rising labor costs increasing operating expenses. These factors influence profitability and require businesses to strategize effectively for sustained growth.

Emerging Opportunities in United States Contract Packaging Market

Emerging opportunities include the growing demand for sustainable packaging options, increasing adoption of automation and advanced technologies, and expansion into niche markets such as medical devices and personal care products. Companies are strategically targeting emerging sectors and investing in R&D to capitalize on these opportunities.

Leading Players in the United States Contract Packaging Market Market

- Multipack Solutions

- Genco (FedEx Supply Chain)

- Bell-Carter Packaging

- Stamar Packaging

- Pharma Tech Industries

- Aaron Thomas Company

- Reed-Lane Inc

- UNICEP Packaging

- Jones Packaging Inc

- Sharp Packaging Services

Key Developments in United States Contract Packaging Market Industry

- February 2022: GenNx360 Capital Partners invested in Nutra-Med Packaging Inc., expanding its presence in the pharmaceutical and health & wellness packaging sectors.

- April 2022: GreenSeed Contract Packaging expanded its facility, increasing warehousing capacity and strengthening its position in the CPG market.

Future Outlook for United States Contract Packaging Market Market

The US contract packaging market is poised for continued expansion, driven by technological innovations, growing demand from various industries, and increasing consumer awareness of sustainable practices. Companies that successfully adapt to these trends and invest in automation, innovative packaging solutions, and supply chain optimization will experience significant growth opportunities.

United States Contract Packaging Market Segmentation

-

1. Packaging Type

- 1.1. Primary

- 1.2. Secondary

- 1.3. Tertiary

-

2. End-user Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Pharmaceutical

- 2.4. Home Care and Personal Care

- 2.5. Automotive

- 2.6. Other End-user Industry

United States Contract Packaging Market Segmentation By Geography

- 1. United States

United States Contract Packaging Market Regional Market Share

Geographic Coverage of United States Contract Packaging Market

United States Contract Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Rapid Technological Advancements; Development in the Retail Chain

- 3.3. Market Restrains

- 3.3.1. In-house Packaging; Increasing Lead Time and Logistics Cost

- 3.4. Market Trends

- 3.4.1. Rapidly Growing Pharmaceutical Industry is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Primary

- 5.1.2. Secondary

- 5.1.3. Tertiary

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Home Care and Personal Care

- 5.2.5. Automotive

- 5.2.6. Other End-user Industry

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Multipack Solutions

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Genco (FedEx Supply Chain)*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bell-Carter Packaging

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stamar Packaging

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pharma Tech Industries

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aaron Thomas Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Reed-Lane Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 UNICEP Packaging

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jones Packaging Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sharp Packaging Services

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Multipack Solutions

List of Figures

- Figure 1: United States Contract Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Contract Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: United States Contract Packaging Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 2: United States Contract Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: United States Contract Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United States Contract Packaging Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 5: United States Contract Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: United States Contract Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Contract Packaging Market?

The projected CAGR is approximately 5.23%.

2. Which companies are prominent players in the United States Contract Packaging Market?

Key companies in the market include Multipack Solutions, Genco (FedEx Supply Chain)*List Not Exhaustive, Bell-Carter Packaging, Stamar Packaging, Pharma Tech Industries, Aaron Thomas Company, Reed-Lane Inc, UNICEP Packaging, Jones Packaging Inc, Sharp Packaging Services.

3. What are the main segments of the United States Contract Packaging Market?

The market segments include Packaging Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 98.77 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Rapid Technological Advancements; Development in the Retail Chain.

6. What are the notable trends driving market growth?

Rapidly Growing Pharmaceutical Industry is Driving the Market.

7. Are there any restraints impacting market growth?

In-house Packaging; Increasing Lead Time and Logistics Cost.

8. Can you provide examples of recent developments in the market?

February 2022 - GenNx360 Capital Partners, a New York-based private equity firm, announced its investment in Nutra-Med Packaging Inc., a New Jersey-based contract packaging organization focused on packaging for the pharmaceutical, health & wellness, and medical devices markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Contract Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Contract Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Contract Packaging Market?

To stay informed about further developments, trends, and reports in the United States Contract Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence