Key Insights

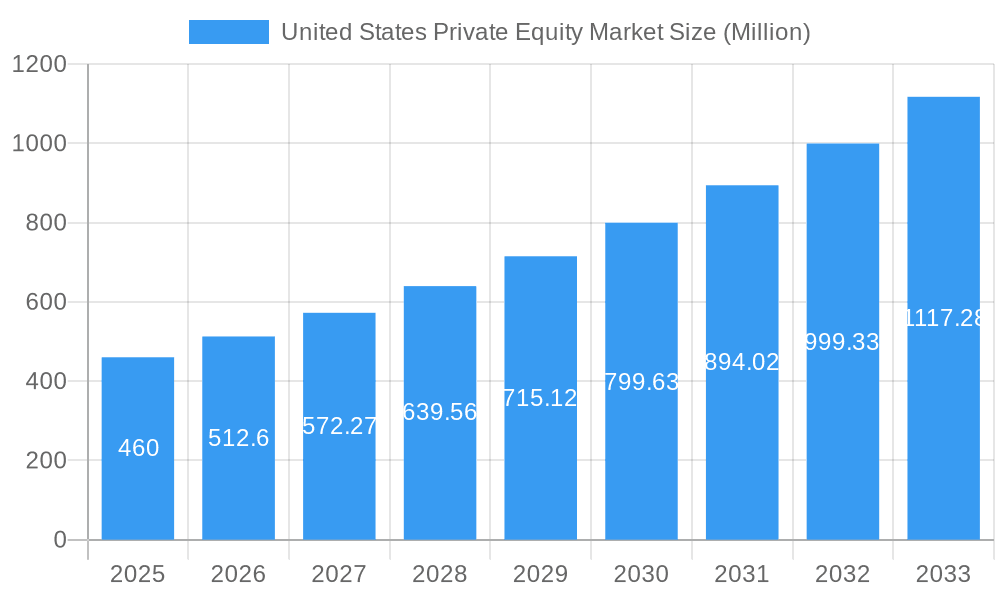

The United States private equity market is experiencing robust growth, projected to reach a significant size over the next decade. With a 2025 market size of $460 million and a Compound Annual Growth Rate (CAGR) exceeding 11%, the market demonstrates strong investor confidence and significant deal-making activity. This expansion is fueled by several factors, including increasing availability of capital, a favorable regulatory environment (relative to other investment classes), and a large number of attractive acquisition targets across diverse sectors. The market's attractiveness is further enhanced by a growing number of institutional investors actively seeking high-return private equity investments, driving the demand for private equity funds and fueling competition among established players. This competitive landscape involves prominent firms like Blackstone Group, Carlyle Group, KKR, and TPG Capital, constantly vying for high-quality investments. The market's dynamism is driven by strategic mergers and acquisitions, alongside a focus on technology, healthcare, and other high-growth sectors.

United States Private Equity Market Market Size (In Million)

Despite this positive outlook, potential market restraints include economic downturns, increased regulatory scrutiny, and a general cyclical nature of the private equity industry. However, the sustained growth projections suggest that these factors are likely to be mitigated by the resilience of large private equity players, their long-term investment horizons, and ongoing evolution of investment strategies toward more resilient business models and sectors. While precise segmentation data is unavailable, a reasonable inference based on market trends would suggest significant sector allocation to technology, healthcare, and consumer staples due to their comparatively high growth prospects and resilience to economic fluctuations. This diversified investment approach will contribute to consistent market expansion throughout the forecast period (2025-2033).

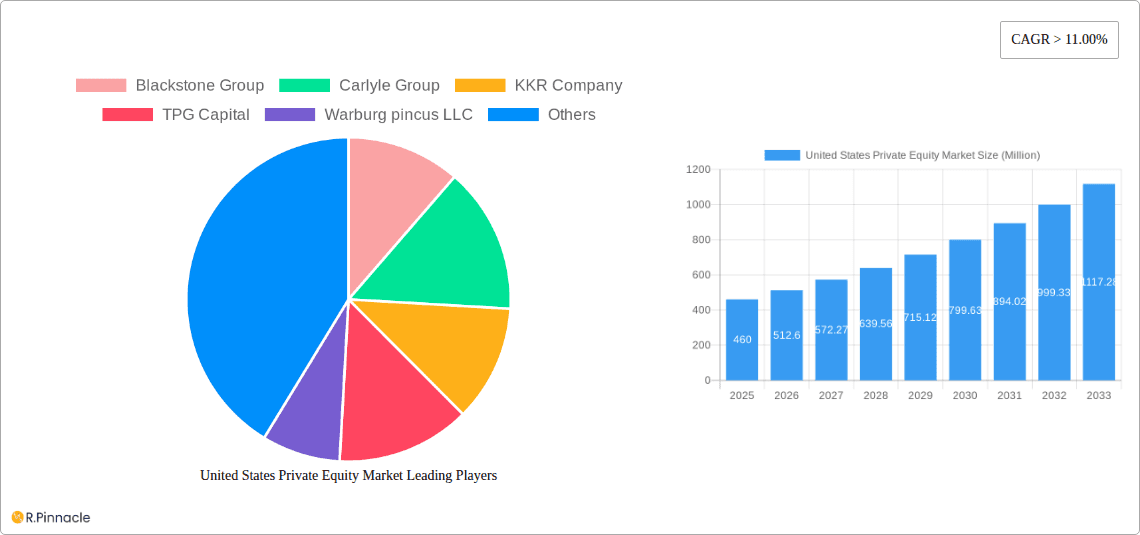

United States Private Equity Market Company Market Share

United States Private Equity Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Private Equity Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils market dynamics, growth drivers, challenges, and emerging opportunities within this dynamic sector. The report leverages extensive data analysis and expert insights to provide actionable strategies for navigating the complexities of the US private equity landscape.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

United States Private Equity Market Structure & Innovation Trends

This section analyzes the market structure, highlighting key aspects driving innovation and shaping the competitive landscape. We delve into market concentration, assessing the influence of major players and exploring the dynamics of mergers and acquisitions (M&A). The regulatory landscape, technological advancements, and evolving consumer preferences are also examined.

Market Concentration: The US private equity market exhibits a high degree of concentration, with a few dominant players controlling a significant market share. Blackstone Group, Carlyle Group, and KKR & Co. consistently rank among the top firms, collectively managing assets exceeding xx Million. The market share of these leading players is estimated at approximately xx%. Smaller firms often specialize in niche sectors or investment strategies.

Innovation Drivers: Technological advancements, particularly in data analytics and artificial intelligence, are driving innovation in deal sourcing, due diligence, and portfolio management. The increasing sophistication of financial modeling and valuation techniques also play a significant role. Regulatory changes, particularly those impacting the private equity industry, can also act as innovation drivers.

M&A Activity: The US private equity market is characterized by robust M&A activity, with deal values fluctuating based on economic conditions. In recent years, we've witnessed significant transactions exceeding USD 4.6 Billion (e.g., Blackstone’s acquisition of Cvent), reflecting the continued appetite for investment and consolidation within the sector.

United States Private Equity Market Market Dynamics & Trends

This section examines the key dynamics influencing the growth trajectory of the US private equity market. We analyze market growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. The report also offers detailed projections based on comprehensive data analysis.

The US private equity market is experiencing robust growth, driven by several factors including increased institutional investor participation, a favorable regulatory environment (with some regional variations), and opportunities in various sectors of the economy. Technological advancements are transforming deal-making processes and improving portfolio management strategies. Shifts in consumer preferences are also influencing investment decisions, driving demand for companies operating within sectors with growth potential. Competition among private equity firms remains intense, with firms constantly vying for the best investment opportunities. The Compound Annual Growth Rate (CAGR) for the market during the forecast period (2025-2033) is projected at xx%. Market penetration is expected to increase to xx% by 2033.

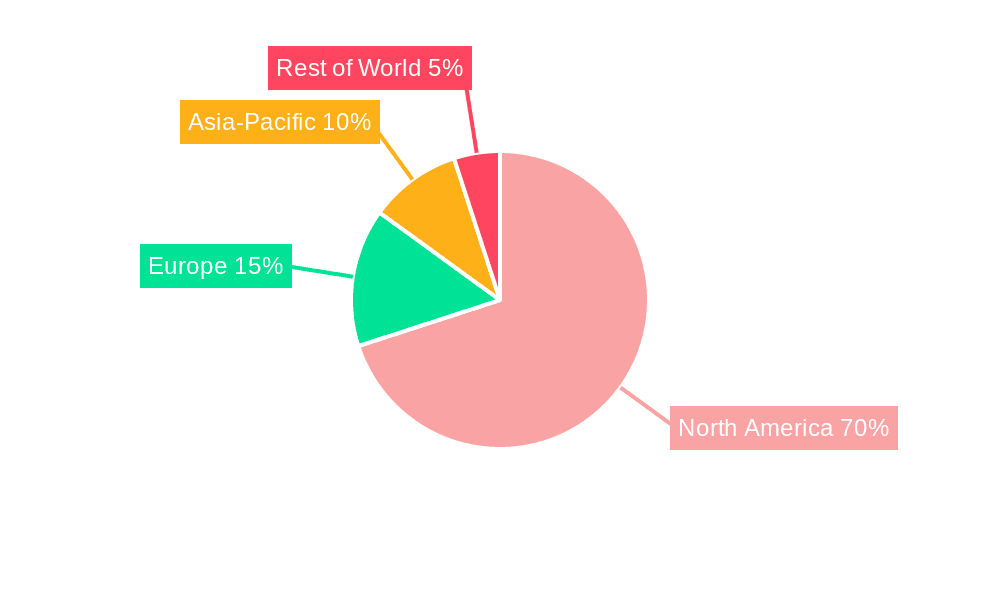

Dominant Regions & Segments in United States Private Equity Market

This section identifies the leading regions and segments within the US private equity market. We analyze the factors contributing to their dominance, considering economic policies, infrastructure development, and sector-specific growth drivers.

Key Drivers of Regional Dominance: The Northeast and West Coast regions continue to be dominant centers for private equity activity due to factors such as the high concentration of established firms, access to capital, and a robust ecosystem of supporting service providers. The presence of major financial hubs, technological innovation, and a large pool of skilled professionals all contribute to the success of these regions.

Dominant Segments: The technology, healthcare, and consumer goods sectors are currently among the most attractive segments for private equity investment. This is influenced by robust growth potential, opportunities for consolidation, and the presence of high-value targets.

United States Private Equity Market Product Innovations

The US private equity market is witnessing significant product innovations focused on enhancing investment strategies and portfolio management. These innovations include sophisticated financial modeling techniques, advanced data analytics, and improved technology-driven deal sourcing methods. These advancements are increasing efficiency and optimizing returns while providing competitive advantages.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the US private equity market based on several key criteria, including investment strategy (e.g., leveraged buyout, growth equity), target industry (e.g., technology, healthcare, real estate), and deal size. Each segment displays unique growth projections and competitive dynamics. (Further details on specific segment market sizes and growth projections will be included in the full report).

Key Drivers of United States Private Equity Market Growth

Several factors are driving the growth of the US private equity market. Increased institutional investor participation, attractive valuations, low interest rates, and technological advancements create a favorable environment for investment. Furthermore, the availability of capital and the strong performance of previous investments continue to attract new investment.

Challenges in the United States Private Equity Market Sector

The US private equity market faces several challenges, including increased regulatory scrutiny, evolving investor preferences, and intense competition. Geopolitical uncertainty, economic fluctuations, and potential supply chain disruptions also pose significant risks to investors. These factors can impact deal flow and negatively affect returns.

Emerging Opportunities in United States Private Equity Market

The US private equity market presents exciting opportunities in various emerging sectors such as renewable energy, artificial intelligence, and biotechnology. These sectors offer substantial growth potential and attract significant investment. Further, strategic partnerships and international expansion can lead to new revenue streams and diversified portfolio diversification.

Leading Players in the United States Private Equity Market Market

- Blackstone Group

- Carlyle Group

- KKR & Co.

- TPG Capital

- Warburg Pincus LLC

- Neuberger Berman Group LLC

- Vista Equity Partners

- Chicago Capital Holdings

- CVC Capital Partners

- Apollo Global Management

- Kohlberg Kravis Roberts & Co

- Bain Capital LP

- Thoma Bravo LP

- Silver Lake

- Gottenberg Associates LLC (List Not Exhaustive)

Key Developments in United States Private Equity Market Industry

- September 2023: Everton Football Club sold to 777 Partners for over USD 685 Million. This significant transaction highlights the increasing involvement of US private equity firms in global sports.

- March 2023: Blackstone acquires Cvent Holding Corp. for approximately USD 4.6 Billion. This deal signifies the continued strong interest in the technology sector from private equity investors.

Future Outlook for United States Private Equity Market Market

The future of the US private equity market appears bright, driven by several factors, including sustained economic growth, technological innovation, and the availability of capital. Strategic partnerships, global expansion, and a focus on sustainable investments will create numerous opportunities for growth. The market is poised for continued expansion, with significant potential for further consolidation and diversification.

United States Private Equity Market Segmentation

-

1. Investment Type

- 1.1. Large Cap

- 1.2. Mid Cap

- 1.3. Small Cap

-

2. Application

- 2.1. Early Stage Venture Capitals

- 2.2. Private Equity

- 2.3. Leveraged Buyouts

United States Private Equity Market Segmentation By Geography

- 1. United States

United States Private Equity Market Regional Market Share

Geographic Coverage of United States Private Equity Market

United States Private Equity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 11.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low Interest Rates in United States and Abundant Capital is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Low Interest Rates in United States and Abundant Capital is Driving the Market

- 3.4. Market Trends

- 3.4.1. Lower Interest Rates and Tax Benefits Raising the Private Equity Adaption In United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Private Equity Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investment Type

- 5.1.1. Large Cap

- 5.1.2. Mid Cap

- 5.1.3. Small Cap

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Early Stage Venture Capitals

- 5.2.2. Private Equity

- 5.2.3. Leveraged Buyouts

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Investment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Blackstone Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Carlyle Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KKR Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TPG Capital

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Warburg pincus LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Neuberger Berman group LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vista Equity Partners

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Chicago Capital Holdings

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CVC Capital Partners

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Apollo Global Management

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kohlberg Kravis Roberts & Co

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Bain Capital LP

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Thoma Bravo LP

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Silver Lake

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Gottenberg associates LLC**List Not Exhaustive

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Blackstone Group

List of Figures

- Figure 1: United States Private Equity Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Private Equity Market Share (%) by Company 2025

List of Tables

- Table 1: United States Private Equity Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 2: United States Private Equity Market Volume Billion Forecast, by Investment Type 2020 & 2033

- Table 3: United States Private Equity Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: United States Private Equity Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: United States Private Equity Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States Private Equity Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: United States Private Equity Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 8: United States Private Equity Market Volume Billion Forecast, by Investment Type 2020 & 2033

- Table 9: United States Private Equity Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: United States Private Equity Market Volume Billion Forecast, by Application 2020 & 2033

- Table 11: United States Private Equity Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Private Equity Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Private Equity Market?

The projected CAGR is approximately > 11.00%.

2. Which companies are prominent players in the United States Private Equity Market?

Key companies in the market include Blackstone Group, Carlyle Group, KKR Company, TPG Capital, Warburg pincus LLC, Neuberger Berman group LLC, Vista Equity Partners, Chicago Capital Holdings, CVC Capital Partners, Apollo Global Management, Kohlberg Kravis Roberts & Co, Bain Capital LP, Thoma Bravo LP, Silver Lake, Gottenberg associates LLC**List Not Exhaustive.

3. What are the main segments of the United States Private Equity Market?

The market segments include Investment Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 460 Million as of 2022.

5. What are some drivers contributing to market growth?

Low Interest Rates in United States and Abundant Capital is Driving the Market.

6. What are the notable trends driving market growth?

Lower Interest Rates and Tax Benefits Raising the Private Equity Adaption In United States.

7. Are there any restraints impacting market growth?

Low Interest Rates in United States and Abundant Capital is Driving the Market.

8. Can you provide examples of recent developments in the market?

September 2023: Everton has been sold to 777 Partners, with the US private equity firm taking over from Farhad Moshiri in a deal reportedly worth more than USD 685 Million. The Miami-based investment fund had signed an agreement with British-Iranian billionaire Moshiri to acquire his 94.1 percent stake.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Private Equity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Private Equity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Private Equity Market?

To stay informed about further developments, trends, and reports in the United States Private Equity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence