Key Insights

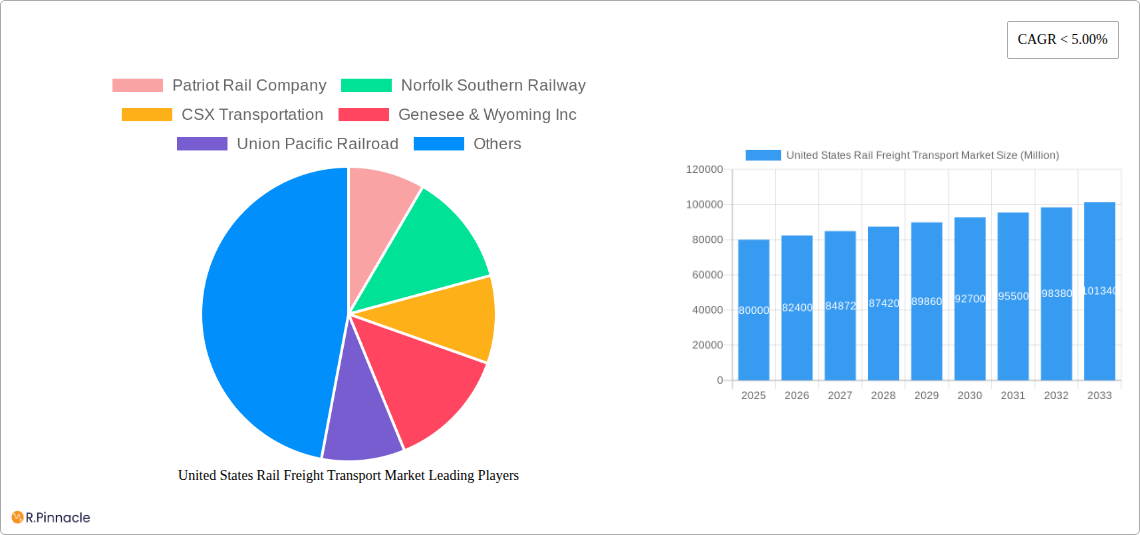

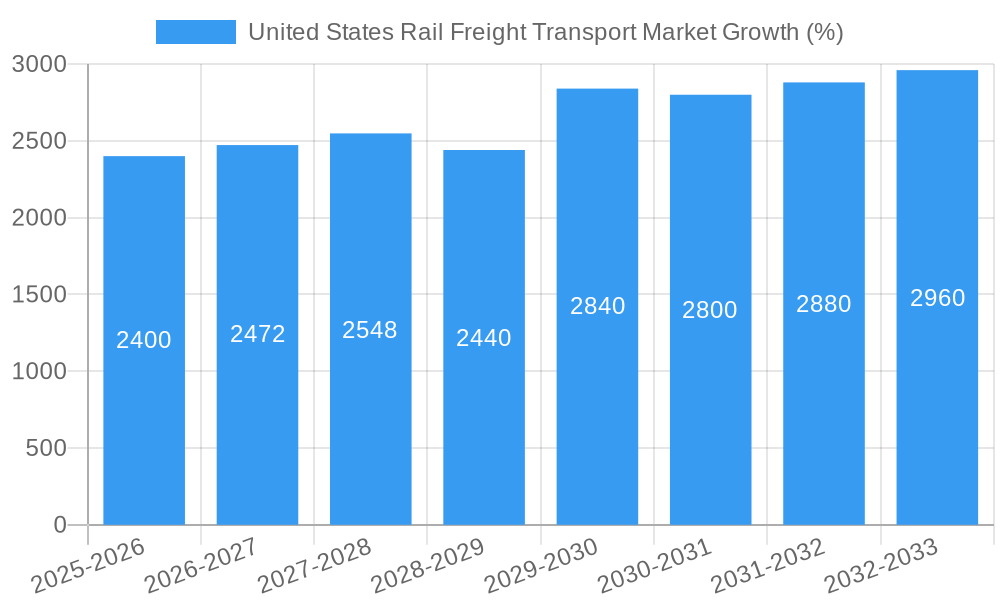

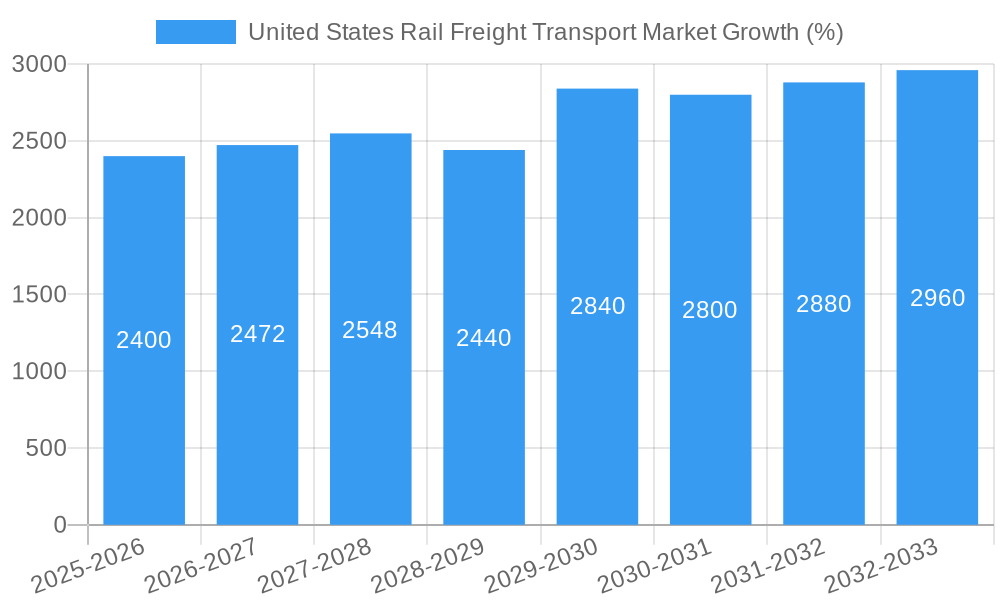

The United States rail freight transport market is a substantial and dynamic sector, experiencing consistent growth driven by several key factors. The historical period (2019-2024) likely saw a moderate CAGR, influenced by economic fluctuations and infrastructure investments. Considering the overall growth trajectory of the US economy and the increasing reliance on efficient long-haul transportation, a conservative estimate for the market size in 2025 would be around $80 billion. This figure accounts for the considerable investment in infrastructure modernization and the ongoing shift towards intermodal transportation, which leverages rail's cost-effectiveness for long distances. Looking ahead to 2033, continued growth is anticipated, fueled by factors such as increasing e-commerce logistics requiring efficient freight solutions, growing industrial production needing bulk material transportation, and government initiatives to enhance rail infrastructure. The projected CAGR for the forecast period (2025-2033) could range between 3% and 5%, resulting in a market size exceeding $110 billion by 2033. This moderate growth reflects realistic expectations, considering potential economic shifts and competition from other modes of transportation.

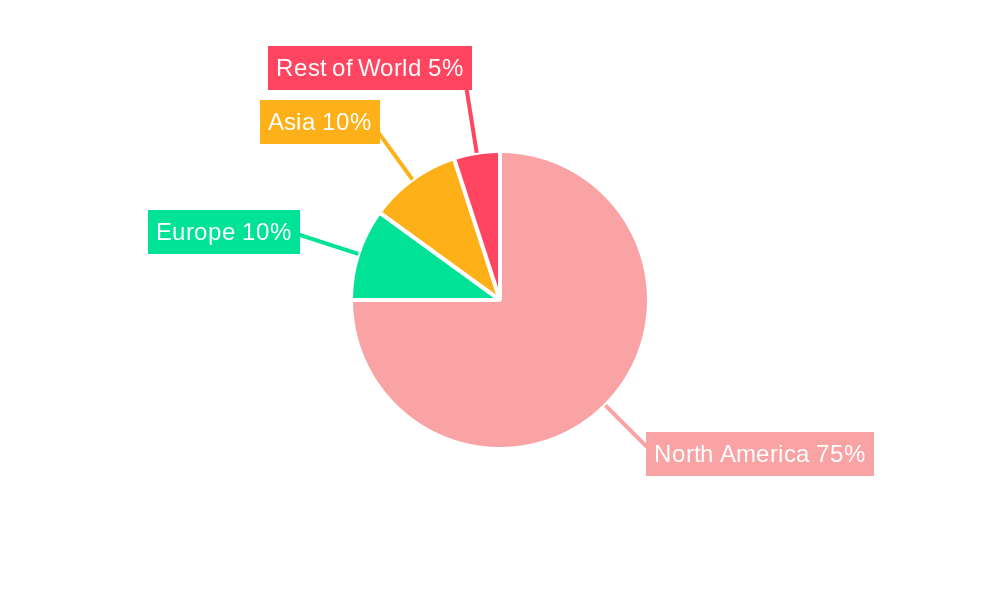

The market's growth will likely be geographically diverse, with strong performance in regions with significant industrial activity and well-developed rail networks. Key challenges include maintaining and upgrading aging infrastructure, ensuring sufficient skilled labor, and navigating regulatory hurdles. However, ongoing investments in technology, such as precision railcar tracking and advanced signaling systems, are streamlining operations and boosting efficiency. Furthermore, environmental concerns are pushing for a greater adoption of rail freight, given its lower carbon footprint compared to trucking. This contributes to the overall positive outlook for the US rail freight transport market over the long term. Innovative approaches, such as the integration of autonomous systems and the development of high-speed rail freight corridors, will further shape the market's evolution.

United States Rail Freight Transport Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Rail Freight Transport Market, covering the period 2019-2033. It delves into market dynamics, competitive landscapes, technological advancements, and future growth projections, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report leverages extensive data analysis and expert insights to provide actionable intelligence, enabling informed strategic planning and investment decisions. The market is segmented by type of cargo, destination, and service type, offering a granular understanding of the various market segments and their growth trajectories.

United States Rail Freight Transport Market Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, encompassing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user demographics, and merger & acquisition (M&A) activities. The analysis includes detailed examination of market share for key players such as Patriot Rail Company, Norfolk Southern Railway, CSX Transportation, Genesee & Wyoming Inc, Union Pacific Railroad, BNSF Railway Company, Canadian National Railway, and Kansas City Southern (list not exhaustive).

- Market Concentration: The US rail freight market demonstrates a moderately concentrated structure, with a few major players holding significant market share. Further analysis will detail the precise market share distribution and the Herfindahl-Hirschman Index (HHI).

- Innovation Drivers: Technological advancements like the adoption of battery-electric locomotives (as exemplified by Wabtec's FLXdrive) are key drivers, alongside efforts to improve efficiency and capacity through infrastructure investments.

- Regulatory Framework: The regulatory environment, including safety regulations and environmental policies, significantly influences market dynamics and investment decisions. The report will detail the impact of key regulations on the market.

- Product Substitutes: The report will explore substitute transportation modes such as trucking and their impact on market share.

- End-User Demographics: The diverse end-user segments (consumer goods, agricultural products, industrial materials, etc.) and their transportation needs are analyzed to identify key demand drivers.

- M&A Activity: The report will analyze past M&A activity in the sector, including deal values and their impact on market consolidation, providing insight into potential future trends. The value of M&A deals in the period 2019-2024 is estimated at xx Million.

United States Rail Freight Transport Market Market Dynamics & Trends

This section explores the market's growth trajectory, encompassing market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The analysis covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). Key metrics, such as the Compound Annual Growth Rate (CAGR) and market penetration rates for various segments, will be presented and analyzed.

(This section will contain 600 words detailing the factors influencing market growth, technological advancements impacting the sector, evolving consumer preferences influencing demand, and the competitive landscape, including strategies employed by leading players. Specific CAGR and market penetration figures will be provided for the forecast period.)

Dominant Regions & Segments in United States Rail Freight Transport Market

This section identifies the leading regions, countries, and segments within the US rail freight market. The analysis covers segmentation by:

- By Type of Cargo: Containerized (Includes Intermodal), Non-containerized, Liquid Bulk

- By Destination: Domestic, International

- By Service Type: Transportation, Services Allied to Transportation (Maintenance of Railcars and Rail Tracks, Switching of Cargo, and Storage)

(This section will contain 600 words using bullet points for key drivers and paragraphs for detailed dominance analysis. It will include factors driving the growth of each segment, such as economic policies, infrastructure development, and regulatory changes.)

United States Rail Freight Transport Market Product Innovations

This section summarizes recent product developments, applications, and their competitive advantages. It focuses on technological trends and their impact on market fit, emphasizing the adoption of eco-friendly technologies like battery-electric locomotives and the ongoing efforts to improve efficiency and capacity.

Report Scope & Segmentation Analysis

This section details the market segmentation by type of cargo, destination, and service type. Each segment's growth projections, market sizes, and competitive dynamics will be discussed.

(This section will contain 100-150 words, with a paragraph for each segment detailing the factors influencing growth and market dynamics, including specific data for market size and projections.)

Key Drivers of United States Rail Freight Transport Market Growth

Key growth drivers for the US rail freight transport market include increasing demand for efficient and cost-effective freight solutions, technological advancements enhancing operational efficiency, and government initiatives promoting sustainable transportation. The expanding e-commerce sector and the need for improved supply chain resilience also contribute to market growth.

Challenges in the United States Rail Freight Transport Market Sector

The US rail freight market faces challenges such as aging infrastructure requiring significant investment, stringent safety regulations, and competition from other transportation modes. Fuel price volatility and labor shortages also pose significant operational challenges. The impact of these challenges on market growth will be quantified.

Emerging Opportunities in United States Rail Freight Transport Market

Emerging opportunities include the growing adoption of sustainable technologies (e.g., battery-electric locomotives), increased focus on intermodal transportation, and the expansion of rail infrastructure to support growing freight volumes. The potential for growth in underserved regions and the increasing demand for specialized rail services also present opportunities for market expansion.

Leading Players in the United States Rail Freight Transport Market Market

- Patriot Rail Company

- Norfolk Southern Railway (Norfolk Southern Railway)

- CSX Transportation (CSX Transportation)

- Genesee & Wyoming Inc (Genesee & Wyoming Inc)

- Union Pacific Railroad (Union Pacific Railroad)

- BNSF Railway Company (BNSF Railway Company)

- Canadian National Railway (Canadian National Railway)

- Kansas City Southern (Kansas City Southern) (List Not Exhaustive)

Key Developments in United States Rail Freight Transport Market Industry

- January 2022: Wabtec Corporation receives an order for 10 FLXdrive battery-electric locomotives from Union Pacific Railroad, promoting GHG emission reduction and infrastructure upgrades. This signals a significant shift towards sustainable transportation solutions within the industry.

- February 2022: BNSF Railway announces a USD 580 Million capital plan for efficiency and expansion initiatives, including double- and triple-track additions, bridge projects, and intermodal facility expansions. This demonstrates significant investment in infrastructure development to meet growing demand.

Future Outlook for United States Rail Freight Transport Market Market

The US rail freight transport market is poised for continued growth, driven by technological advancements, infrastructure investments, and a focus on sustainability. Strategic partnerships, mergers and acquisitions, and the continued expansion of intermodal transportation will shape the future market landscape. The market is expected to experience substantial growth throughout the forecast period, driven by both organic growth and strategic acquisitions.

United States Rail Freight Transport Market Segmentation

-

1. Type of Cargo

- 1.1. Containerized (Includes Intermodal)

- 1.2. Non-containerized

- 1.3. Liquid Bulk

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Service Type

- 3.1. Transportation

- 3.2. Services

United States Rail Freight Transport Market Segmentation By Geography

- 1. United States

United States Rail Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need for Reliable Connections between Carriers and Shippers; Demand for Real-time Visibility of Shipments

- 3.3. Market Restrains

- 3.3.1. High Fragmentation of the Logistics Industry; Data Security Concerns

- 3.4. Market Trends

- 3.4.1. Demand on The US Freight Rail Network Increase

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 5.1.1. Containerized (Includes Intermodal)

- 5.1.2. Non-containerized

- 5.1.3. Liquid Bulk

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Service Type

- 5.3.1. Transportation

- 5.3.2. Services

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 6. North America United States Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 7. Europe United States Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Germany

- 7.1.2 United Kingdom

- 7.1.3 France

- 7.1.4 Russia

- 7.1.5 Spain

- 7.1.6 Rest of Europe

- 8. Asia Pacific United States Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 India

- 8.1.2 China

- 8.1.3 Japan

- 8.1.4 Rest of Asia Pacific

- 9. Latin America United States Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 Brazil

- 9.1.2 Argentina

- 9.1.3 Rest of Latin America

- 10. Middle East and Africa United States Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United Arab Emirates

- 10.1.2 Saudi Arabia

- 10.1.3 Qatar

- 10.1.4 Rest of Middle East and Africa

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Patriot Rail Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Norfolk Southern Railway

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CSX Transportation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Genesee & Wyoming Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Union Pacific Railroad

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BNSF Railway Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Canadian National Railway

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kansas City Southern**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Patriot Rail Company

List of Figures

- Figure 1: United States Rail Freight Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Rail Freight Transport Market Share (%) by Company 2024

List of Tables

- Table 1: United States Rail Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Rail Freight Transport Market Revenue Million Forecast, by Type of Cargo 2019 & 2032

- Table 3: United States Rail Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: United States Rail Freight Transport Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 5: United States Rail Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Russia United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United States Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: India United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: China United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United States Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Latin America United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: United Arab Emirates United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Saudi Arabia United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Qatar United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Middle East and Africa United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: United States Rail Freight Transport Market Revenue Million Forecast, by Type of Cargo 2019 & 2032

- Table 32: United States Rail Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 33: United States Rail Freight Transport Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 34: United States Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Rail Freight Transport Market?

The projected CAGR is approximately < 5.00%.

2. Which companies are prominent players in the United States Rail Freight Transport Market?

Key companies in the market include Patriot Rail Company, Norfolk Southern Railway, CSX Transportation, Genesee & Wyoming Inc, Union Pacific Railroad, BNSF Railway Company, Canadian National Railway, Kansas City Southern**List Not Exhaustive.

3. What are the main segments of the United States Rail Freight Transport Market?

The market segments include Type of Cargo, Destination, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Need for Reliable Connections between Carriers and Shippers; Demand for Real-time Visibility of Shipments.

6. What are the notable trends driving market growth?

Demand on The US Freight Rail Network Increase.

7. Are there any restraints impacting market growth?

High Fragmentation of the Logistics Industry; Data Security Concerns.

8. Can you provide examples of recent developments in the market?

January 2022 - Wabtec Corporation has received an order for 10 FLXdrive battery-electric locomotives from Union Pacific Railroad, a freight-hauling railroad in the US. The action will promote Union Pacific's efforts to lower greenhouse gas (GHG) emissions from operations while also upgrading the infrastructure of its train yards. Seven thousand battery cells will be used in each FLXdrive battery-electric locomotive. The US will be the exclusive producer of all the vehicles. The 10 battery-powered locomotives will be able to offset 4,000t of carbon emissions from Union Pacific's train yards each year when used together. Union Pacific is expected to receive the first units from Wabtec in late 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Rail Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Rail Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Rail Freight Transport Market?

To stay informed about further developments, trends, and reports in the United States Rail Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence