Key Insights

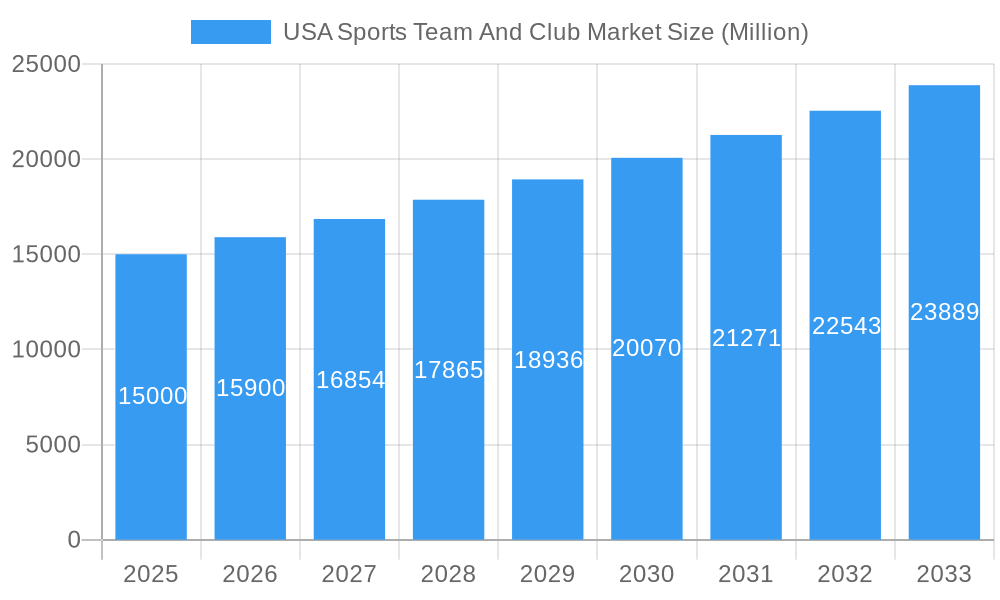

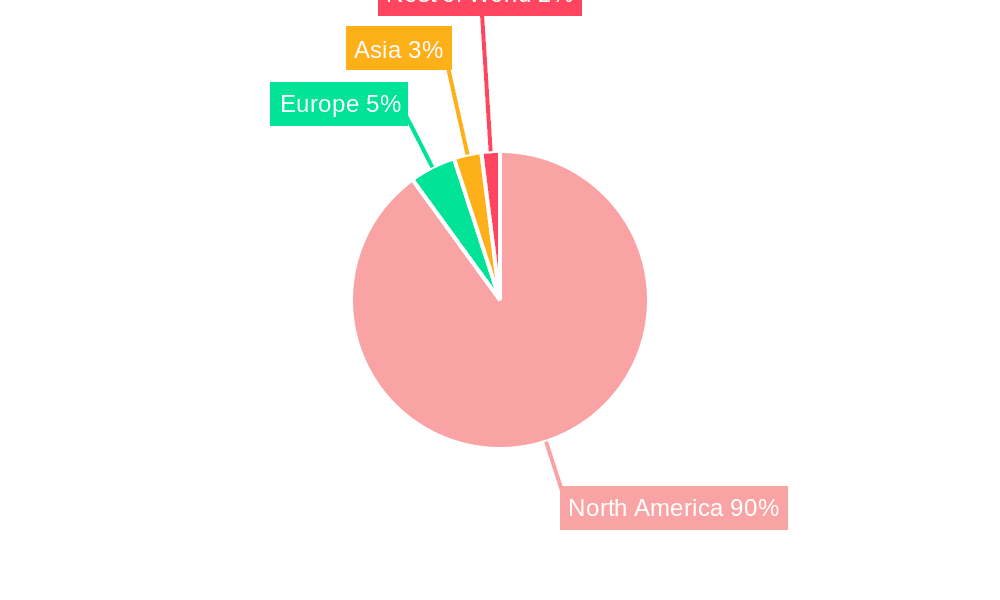

The USA Sports Team and Club Market is poised for significant expansion, projected at a Compound Annual Growth Rate (CAGR) of 8.6% through 2033. In the base year of 2025, the market is valued at $48.9 billion. Key growth drivers include escalating media rights revenues from widespread sports league and team popularity across broadcast, streaming, and digital platforms. Merchandising and brand sponsorships are also substantial contributors. Enhanced fan engagement via digital platforms and interactive experiences fuels increased participation and spending. Strategic investments in stadium modernization, technological advancements, and player development further bolster revenue streams and fan loyalty. Football and basketball lead market revenue, followed by baseball and hockey. Niche sports with dedicated fan bases and growing participation also contribute to overall market dynamism. The United States is the primary revenue-generating region, driven by major league teams and associated commercial ventures.

USA Sports Team And Club Market Market Size (In Billion)

Despite a robust growth outlook, the market faces intense competition for fan attention and sponsorships. High operational expenses, including athlete salaries and facility maintenance, may impact profitability. The inherent unpredictability of sporting events, such as injuries and performance fluctuations, can also affect revenue. Nevertheless, the market's positive trajectory is sustained by ongoing innovation in fan engagement, technology adoption, and enduring sports popularity across demographics. Strategic alliances between teams, media entities like ESPN, Fox Sports, and CBS, brands such as Nike and PepsiCo, and sponsors are crucial for maintaining this growth.

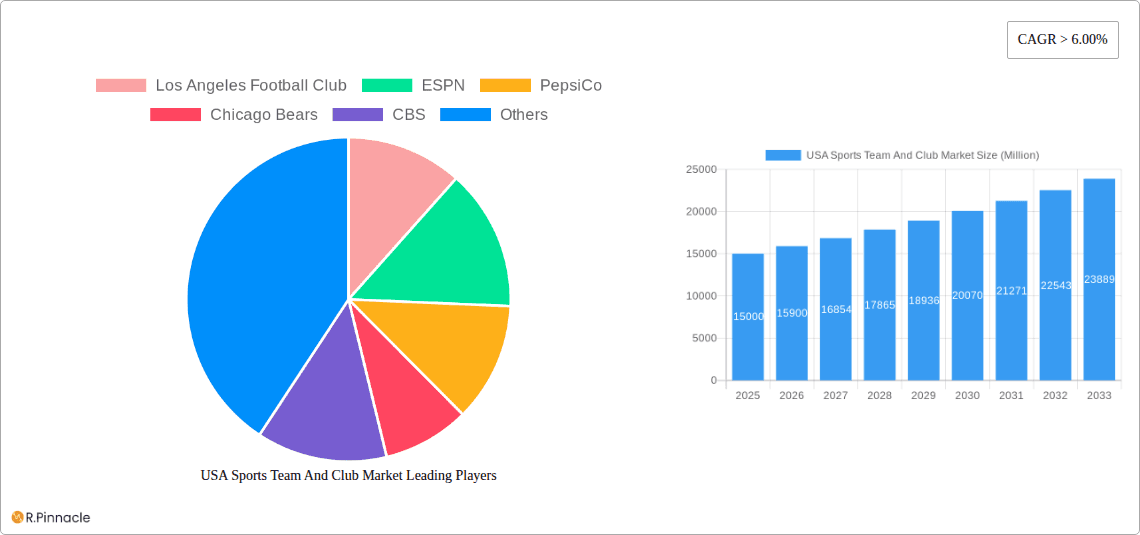

USA Sports Team And Club Market Company Market Share

USA Sports Team & Club Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the USA Sports Team & Club Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, and future growth prospects. The market is projected to reach xx Million by 2033.

USA Sports Team And Club Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, highlighting market concentration, innovation drivers, regulatory influences, and market dynamics. The USA sports team and club market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. For example, the NFL (represented by teams like the Chicago Bears and Dallas Cowboys) and MLB (represented by teams like the Detroit Tigers) hold substantial market power in their respective segments. However, the market also displays a significant number of smaller, regional teams and clubs contributing to the overall market size.

Market Concentration:

- Top 5 players account for approximately xx% of the market share in 2025.

- High barriers to entry, including significant capital investment and established brand recognition, contribute to market concentration.

Innovation Drivers:

- Technological advancements in broadcasting, data analytics, and fan engagement are driving innovation. The use of augmented reality (AR) and virtual reality (VR) is transforming the fan experience.

- Strategic partnerships, such as those between teams and major brands like Nike and PepsiCo, lead to innovative merchandising and sponsorship strategies.

- Mergers & Acquisitions (M&A) activity is reshaping the market, with deal values reaching hundreds of millions of dollars. Recent notable M&A activities include Liberty Media's acquisition of QuintEvents (USD 313 Million).

Regulatory Framework: The market is subject to various regulations, including those governing broadcasting rights, player contracts, and antitrust laws. These regulations significantly impact market dynamics.

Product Substitutes: While core sports remain central, the rise of esports and alternative entertainment forms presents a degree of substitution.

End-User Demographics: The market is largely driven by a broad demographic base, with variations based on specific sports and teams.

USA Sports Team And Club Market Market Dynamics & Trends

The USA Sports Team & Club Market is experiencing a period of significant dynamism and robust expansion, fueled by a confluence of factors. Projections indicate a compelling Compound Annual Growth Rate (CAGR) of [Insert specific CAGR here]% over the forecast period spanning 2025-2033. This upward trajectory is underpinned by several key drivers: a substantial increase in media consumption across various platforms, consistently rising disposable incomes enabling greater discretionary spending on entertainment, and the enduring, and in many cases, growing popularity of professional and collegiate sports leagues. Technological advancements are revolutionizing fan engagement; the proliferation of sophisticated streaming services, interactive mobile applications, and innovative digital content are not only enhancing the fan experience but also driving deeper market penetration and fostering heightened loyalty. The competitive landscape is characterized by its intensity, compelling sports organizations to continually innovate. This innovation is focused on developing novel strategies to attract and retain fan bases, optimize diverse revenue streams beyond traditional ticketing, and strategically elevate their brand value in an increasingly crowded entertainment ecosystem. Emerging trends also include a greater emphasis on data analytics for fan understanding and personalized marketing efforts.

Dominant Regions & Segments in USA Sports Team And Club Market

The USA Sports Team & Club Market displays regional variations in terms of popularity and revenue generation. However, major metropolitan areas generally exhibit higher market concentration and revenue, with California and Texas representing key regions.

By Type:

- Football: Commands the largest segment of the market due to the immense popularity of the NFL and collegiate football.

- Basketball: The NBA and NCAA basketball maintain a substantial market share, driven by strong media rights deals and a wide fan base.

- Baseball: MLB continues to be a significant contributor to the overall market.

- Hockey: The NHL holds a smaller market share compared to football and basketball but demonstrates steady growth.

- Other Types: This segment encompasses various sports such as soccer (increasingly popular), motorsports, and cycling (represented by USA Cycling), contributing to overall market diversity.

By Revenue Source:

- Media Rights: This constitutes a major revenue stream, with significant deals struck between leagues, teams, and broadcasters like ESPN, CBS, and Fox Sports.

- Merchandising: Sales of team apparel, memorabilia, and other licensed products from companies like Nike contribute significantly to revenue.

- Tickets: Ticket sales represent a major income source for most teams and leagues.

- Sponsorship: Major brands such as PepsiCo invest heavily in team sponsorships, providing another significant revenue channel.

Key Drivers: Strong media rights deals, consistent fan engagement, and substantial infrastructure investments fuel the market's growth.

USA Sports Team And Club Market Product Innovations

Technological advancements have significantly impacted the product offerings within the USA Sports Team & Club Market. Improved broadcasting technologies, enhanced fan engagement platforms, and data-driven analytics are refining both the fan experience and team management strategies. This evolution enhances fan loyalty, revenue streams, and competitive advantages for teams and leagues. New revenue channels are being developed through interactive content and personalized fan experiences.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the USA Sports Team & Club Market to provide granular insights. The market is analyzed by sport type, encompassing major categories such as Football (NFL, College Football), Basketball (NBA, WNBA, College Basketball), Baseball (MLB, Minor League Baseball), Hockey (NHL, Minor League Hockey), and a range of 'Other Types' including Soccer (MLS, NWSL), Motorsports, Tennis, Golf, and more. Furthermore, revenue streams are dissected into key components: Media Rights (broadcast, digital, international), Merchandising (apparel, collectibles, licensing), Tickets (season tickets, single-game, premium seating), and Sponsorship (corporate partnerships, naming rights, advertising). For each segment, the report details projected growth rates, current and projected market size, and an in-depth analysis of competitive dynamics. This granular approach offers a profound understanding of the market's intricate composition and untapped potential. It's important to note that growth rates can exhibit significant variance across segments, heavily influenced by factors such as team performance, the negotiation of lucrative media deals, and the evolving preferences of fan demographics. The competitive landscape within each segment also differs considerably, marked by the presence of established, dominant players and the emergence of dynamic new competitors challenging the status quo.

Key Drivers of USA Sports Team And Club Market Growth

Several factors contribute to the growth of the USA Sports Team & Club Market. The increasing popularity of sports, rising disposable incomes allowing for higher spending on entertainment, and technological advancements enhancing fan experience and engagement are key drivers. Favorable media rights deals and lucrative sponsorship contracts also significantly influence growth. Furthermore, the robust infrastructure supporting these sports, including stadiums and broadcasting networks, underpins this continued expansion.

Challenges in the USA Sports Team And Club Market Sector

The USA Sports Team & Club Market, while experiencing growth, is not without its considerable challenges. Intense competition for consumer attention and entertainment dollars from a wide array of leisure activities, including other sports, entertainment options, and digital content, presents a persistent hurdle. Furthermore, economic downturns and inflationary pressures can significantly impact consumer discretionary spending, directly affecting ticket sales, merchandise purchases, and fan engagement budgets. The ever-evolving media landscape necessitates continuous adaptation; the shift towards digital platforms, the fragmentation of viewership, and the high cost of securing media rights demand agile strategies. Regulatory hurdles and evolving compliance requirements, alongside substantial player salaries and operational costs, represent significant financial constraints that can impact profitability and strategic decision-making. Perhaps one of the most critical ongoing challenges is the imperative to maintain and enhance fan engagement and loyalty in a constantly evolving entertainment environment, where audience expectations are high and attention spans can be fleeting. The need to cater to diverse fan demographics and evolving preferences adds another layer of complexity.

Emerging Opportunities in USA Sports Team And Club Market

The USA Sports Team & Club Market is ripe with emerging opportunities poised to drive future growth and innovation. The meteoric rise and increasing mainstream acceptance of esports present a significant avenue for expansion, attracting a new generation of fans and creating lucrative partnership and media rights opportunities. The development of immersive fan experiences through virtual reality (VR) and augmented reality (AR) technologies offers groundbreaking ways to engage fans, whether at home or in the stadium, enhancing content consumption and interactive elements. Expansion into new and underserved domestic and international markets holds considerable potential for broadcasting rights, team operations, and sponsorship. Furthermore, the strategic implementation of personalized marketing and data-driven strategies is becoming crucial for understanding fan behavior, tailoring offers, and optimizing revenue streams. The market's expanding global reach also presents substantial opportunities for negotiating higher-value international media rights deals and forging robust sponsorship partnerships with global brands seeking to connect with passionate sports audiences.

Leading Players in the USA Sports Team And Club Market Market

- Los Angeles Football Club

- ESPN

- PepsiCo

- Chicago Bears

- CBS

- Detroit Tigers

- Fox Sports

- Dallas Cowboys

- Nike

- USA Cycling

- [Add other prominent teams/organizations, e.g., New York Yankees, Golden State Warriors, Manchester United (for global reach context), NFL, NBA, MLB, NHL leagues themselves]

- [Add major media partners, e.g., Amazon Prime Video, Warner Bros. Discovery Sports]

- [Add significant sponsorship entities, e.g., Coca-Cola, McDonald's]

Key Developments in USA Sports Team And Club Market Industry

- July 2023: U.S. Soccer and Coca-Cola North America formed a long-term partnership, significantly boosting the visibility of both brands. This partnership exemplifies the growing importance of strategic alliances in the market.

- September 2023: Liberty Media's acquisition of QuintEvents for USD 313 Million signifies a major consolidation within the ticketing and hospitality sector, influencing how fans experience sporting events.

Future Outlook for USA Sports Team And Club Market Market

The USA Sports Team & Club Market is poised for continued growth, driven by technological innovation, increased fan engagement through diverse platforms, and expanding global reach. Strategic partnerships and the development of innovative revenue streams will further fuel market expansion. The integration of data analytics and personalized marketing strategies will optimize fan engagement and revenue generation, securing the market's future trajectory.

USA Sports Team And Club Market Segmentation

-

1. Type

- 1.1. Football

- 1.2. Basketball

- 1.3. Baseball

- 1.4. Hockey

- 1.5. Other Types

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Tickets

- 2.4. Sponsorship

USA Sports Team And Club Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Sports Team And Club Market Regional Market Share

Geographic Coverage of USA Sports Team And Club Market

USA Sports Team And Club Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-sports and Digital Innovation Driving the market; Rising Sports Event In United States Driving The Market

- 3.3. Market Restrains

- 3.3.1. Large share of Sponsoring and Media limited to few sports; Concentration of leading players in few clubs negatively affecting small clubs

- 3.4. Market Trends

- 3.4.1. Increasing Sports Sponsorship Driving Sports Team And Club

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Sports Team And Club Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Football

- 5.1.2. Basketball

- 5.1.3. Baseball

- 5.1.4. Hockey

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Tickets

- 5.2.4. Sponsorship

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America USA Sports Team And Club Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Football

- 6.1.2. Basketball

- 6.1.3. Baseball

- 6.1.4. Hockey

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Revenue Source

- 6.2.1. Media Rights

- 6.2.2. Merchandising

- 6.2.3. Tickets

- 6.2.4. Sponsorship

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America USA Sports Team And Club Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Football

- 7.1.2. Basketball

- 7.1.3. Baseball

- 7.1.4. Hockey

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Revenue Source

- 7.2.1. Media Rights

- 7.2.2. Merchandising

- 7.2.3. Tickets

- 7.2.4. Sponsorship

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe USA Sports Team And Club Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Football

- 8.1.2. Basketball

- 8.1.3. Baseball

- 8.1.4. Hockey

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Revenue Source

- 8.2.1. Media Rights

- 8.2.2. Merchandising

- 8.2.3. Tickets

- 8.2.4. Sponsorship

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa USA Sports Team And Club Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Football

- 9.1.2. Basketball

- 9.1.3. Baseball

- 9.1.4. Hockey

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Revenue Source

- 9.2.1. Media Rights

- 9.2.2. Merchandising

- 9.2.3. Tickets

- 9.2.4. Sponsorship

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific USA Sports Team And Club Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Football

- 10.1.2. Basketball

- 10.1.3. Baseball

- 10.1.4. Hockey

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Revenue Source

- 10.2.1. Media Rights

- 10.2.2. Merchandising

- 10.2.3. Tickets

- 10.2.4. Sponsorship

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Los Angeles Football Club

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ESPN

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PepsiCo

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Chicago Bears

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CBS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Detroit Tigers

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fox Sports

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dallas Cowboy

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nike

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 USA Cycling

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Los Angeles Football Club

List of Figures

- Figure 1: Global USA Sports Team And Club Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America USA Sports Team And Club Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America USA Sports Team And Club Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America USA Sports Team And Club Market Revenue (billion), by Revenue Source 2025 & 2033

- Figure 5: North America USA Sports Team And Club Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 6: North America USA Sports Team And Club Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America USA Sports Team And Club Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America USA Sports Team And Club Market Revenue (billion), by Type 2025 & 2033

- Figure 9: South America USA Sports Team And Club Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America USA Sports Team And Club Market Revenue (billion), by Revenue Source 2025 & 2033

- Figure 11: South America USA Sports Team And Club Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 12: South America USA Sports Team And Club Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America USA Sports Team And Club Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe USA Sports Team And Club Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe USA Sports Team And Club Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe USA Sports Team And Club Market Revenue (billion), by Revenue Source 2025 & 2033

- Figure 17: Europe USA Sports Team And Club Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 18: Europe USA Sports Team And Club Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe USA Sports Team And Club Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa USA Sports Team And Club Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Middle East & Africa USA Sports Team And Club Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa USA Sports Team And Club Market Revenue (billion), by Revenue Source 2025 & 2033

- Figure 23: Middle East & Africa USA Sports Team And Club Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 24: Middle East & Africa USA Sports Team And Club Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa USA Sports Team And Club Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific USA Sports Team And Club Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Asia Pacific USA Sports Team And Club Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific USA Sports Team And Club Market Revenue (billion), by Revenue Source 2025 & 2033

- Figure 29: Asia Pacific USA Sports Team And Club Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 30: Asia Pacific USA Sports Team And Club Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific USA Sports Team And Club Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Sports Team And Club Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global USA Sports Team And Club Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 3: Global USA Sports Team And Club Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global USA Sports Team And Club Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global USA Sports Team And Club Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 6: Global USA Sports Team And Club Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global USA Sports Team And Club Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global USA Sports Team And Club Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 12: Global USA Sports Team And Club Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global USA Sports Team And Club Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global USA Sports Team And Club Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 18: Global USA Sports Team And Club Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global USA Sports Team And Club Market Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Global USA Sports Team And Club Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 30: Global USA Sports Team And Club Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global USA Sports Team And Club Market Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global USA Sports Team And Club Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 39: Global USA Sports Team And Club Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific USA Sports Team And Club Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Sports Team And Club Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the USA Sports Team And Club Market?

Key companies in the market include Los Angeles Football Club, ESPN, PepsiCo, Chicago Bears, CBS, Detroit Tigers, Fox Sports, Dallas Cowboy, Nike, USA Cycling.

3. What are the main segments of the USA Sports Team And Club Market?

The market segments include Type, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.9 billion as of 2022.

5. What are some drivers contributing to market growth?

E-sports and Digital Innovation Driving the market; Rising Sports Event In United States Driving The Market.

6. What are the notable trends driving market growth?

Increasing Sports Sponsorship Driving Sports Team And Club.

7. Are there any restraints impacting market growth?

Large share of Sponsoring and Media limited to few sports; Concentration of leading players in few clubs negatively affecting small clubs.

8. Can you provide examples of recent developments in the market?

July 2023: U.S. Soccer and Coca-Cola North America entered into a long-term partnership, supporting the U.S. soccer ecosystem and providing Coca-Cola with a global reach to connect with fans around the world. Coca-Cola exists as a total beverage company with products sold in more than 200 countries, and the U.S. Soccer Federation has existed as the official governing body of the sport in the United States for more than 100 years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Sports Team And Club Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Sports Team And Club Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Sports Team And Club Market?

To stay informed about further developments, trends, and reports in the USA Sports Team And Club Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence