Key Insights

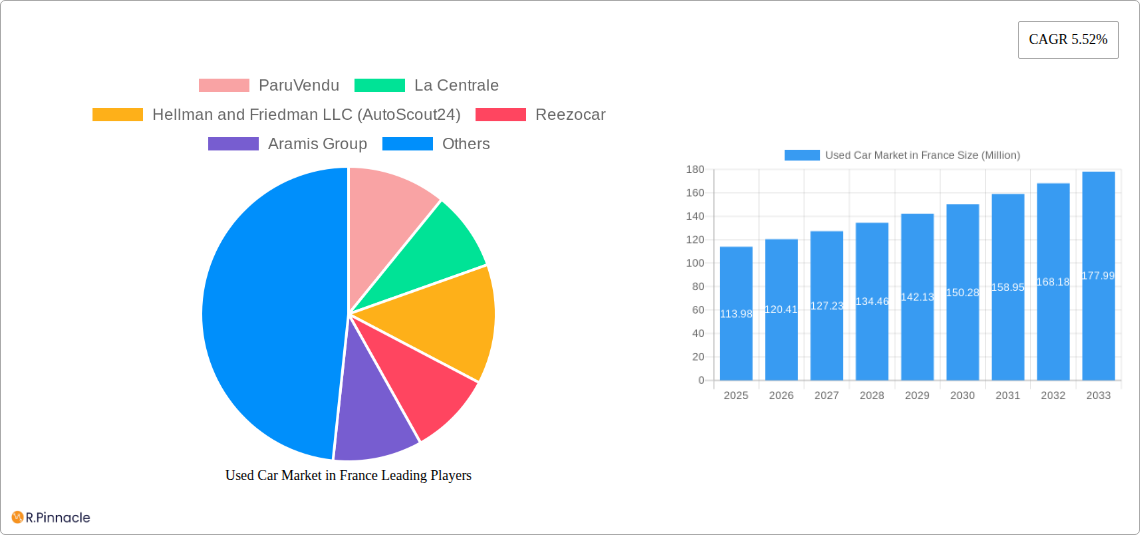

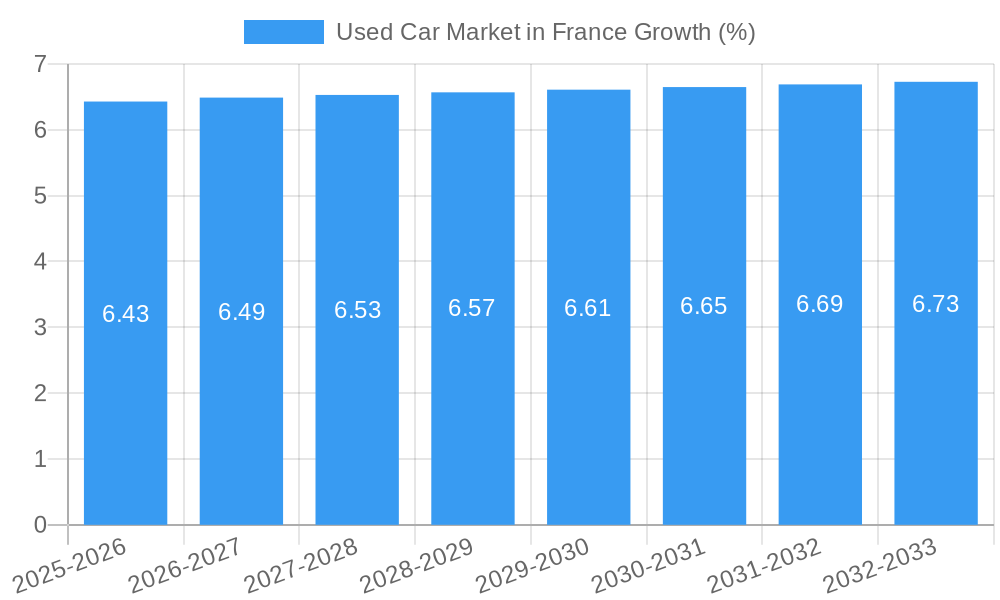

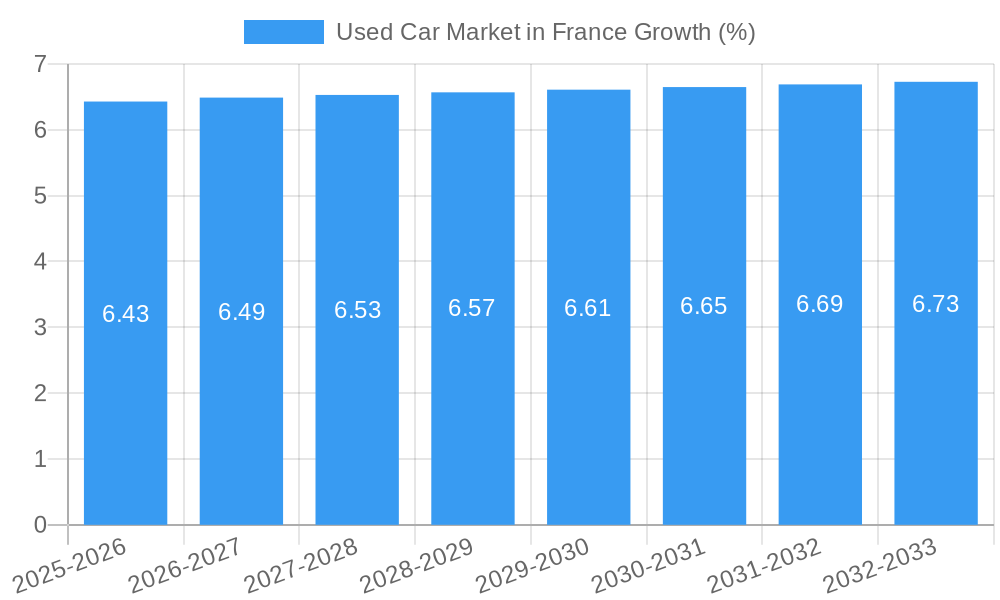

The French used car market, valued at €113.98 million in 2025, is projected to experience robust growth, driven by several key factors. The increasing preference for pre-owned vehicles due to affordability compared to new cars, coupled with stringent emission regulations impacting the price of newer models, fuels market expansion. Furthermore, the rise of online platforms like ParuVendu, La Centrale, and AutoScout24 is transforming the sales landscape, offering greater transparency and convenience to buyers. The market is segmented by vehicle type (hatchbacks, sedans, SUVs, MPVs), vendor type (organized vs. unorganized), fuel type (petrol, diesel, electric, others), and sales channel (online vs. offline). The dominance of specific segments, such as SUVs, driven by consumer preference for larger vehicles, and the growth of organized vendors reflecting increasing professionalism in the sector, shape the overall market dynamics. A notable trend is the burgeoning electric used car segment, though still relatively small, reflecting broader consumer adoption of electric vehicles. Challenges include fluctuating used car prices due to economic conditions and the ongoing need to address concerns around vehicle history and reliability. With a projected CAGR of 5.52% from 2025 to 2033, the French used car market presents significant opportunities for both established players and new entrants. Competition among online marketplaces is intensifying, and companies are investing in technological enhancements to improve customer experience and inventory management.

The continued growth of the market will depend on various factors, including economic stability, consumer confidence, and the evolution of electric vehicle adoption. Government policies related to vehicle emissions and incentives for purchasing used vehicles will also play a crucial role. Expansion in the organized sector, characterized by improved transparency, warranties, and financing options, is likely to further consolidate the market. Regional variations within France, including differences in consumer preferences and economic conditions, will influence market performance. Understanding these regional nuances is vital for targeted market strategies. A deeper analysis of consumer behavior, including factors influencing purchasing decisions and brand loyalty, is essential for companies seeking to gain a competitive edge.

Used Car Market in France: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the used car market in France, covering market dynamics, key players, segment performance, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic market.

Used Car Market in France: Market Structure & Innovation Trends

The French used car market, valued at approximately €XX Million in 2024, is characterized by a moderately concentrated landscape. Key players like La Centrale, ParuVendu, and AutoScout24 (Hellman and Friedman LLC) hold significant market share, though numerous smaller players and independent dealers also contribute significantly. The market share of the top 5 players is estimated at XX%. Innovation is driven by the increasing adoption of online sales channels, the development of data-driven pricing models, and advancements in vehicle inspection and certification technologies. Regulatory frameworks, including emissions standards and consumer protection laws, significantly influence market operations. The market experiences competition from public transport and ride-sharing services. The end-user demographic is broad, ranging from young drivers to older individuals seeking affordable transportation options. Mergers and acquisitions (M&A) activity has been notable in recent years, with significant deals involving players like Aramis Group (€XX Million in acquisitions).

- Market Concentration: Moderately concentrated, with a few dominant players and many smaller operators.

- Innovation Drivers: Online sales, data-driven pricing, vehicle inspection tech.

- Regulatory Framework: Emissions standards, consumer protection laws.

- Product Substitutes: Public transport, ride-sharing services.

- End-User Demographics: Diverse, spanning various age groups and income levels.

- M&A Activity: Significant activity observed, with deal values totaling €XX Million in the last 5 years (estimated).

Used Car Market in France: Market Dynamics & Trends

The French used car market is experiencing robust growth, driven by factors such as increasing vehicle affordability compared to new cars, a growing preference for pre-owned vehicles among budget-conscious consumers, and evolving consumer preferences towards SUVs and electric vehicles. The market's CAGR from 2019 to 2024 is estimated at XX%. Technological disruptions, like the rise of online marketplaces and the implementation of digital inspection and financing solutions, are reshaping the industry landscape. Consumer preferences are shifting towards fuel-efficient vehicles and vehicles with advanced safety features. The competitive landscape is characterized by both intense rivalry among established players and entry of new, digitally-native businesses. Market penetration of online sales channels is steadily increasing, currently estimated at approximately XX%.

Dominant Regions & Segments in Used Car Market in France

The Île-de-France region represents the largest segment of the used car market in France due to its high population density and economic activity.

- By Vehicle Type: SUVs have witnessed the strongest growth due to consumer preference for larger vehicles.

- By Vendor Type: The organized sector dominates, driven by the larger players' market share.

- By Fuel Type: Petrol and Diesel continue to dominate, but Electric vehicles are experiencing rapid growth.

- By Sales Channel: Online sales are witnessing increased adoption and market penetration, but Offline channels still retain a significant share.

Key drivers for dominance vary across segments; for example, Île-de-France benefits from higher disposable incomes and demand while SUVs' popularity stems from consumer lifestyle shifts.

Used Car Market in France: Product Innovations

Product innovations focus on enhancing the online car-buying experience, improving vehicle condition assessments, and expanding financing options. Technological trends include the use of AI for pricing, virtual inspections, and automated customer service. Market fit is achieved by addressing consumer demands for transparency, convenience, and trust in the pre-owned vehicle purchasing process. Features like detailed vehicle history reports and extended warranties are increasing in popularity.

Report Scope & Segmentation Analysis

This report analyzes the French used car market across several key segments:

- By Vehicle Type: Hatchbacks, Sedans, SUVs, MPVs (Growth projections and market size vary widely by type, with SUVs exhibiting fastest growth).

- By Vendor Type: Organized (dealerships, large online platforms) and Unorganized (private sellers). The organized sector exhibits higher growth due to improved consumer trust and services.

- By Fuel Type: Petrol, Diesel, Electric, Others (LPG, CNG). Electric vehicle sales are experiencing rapid growth, while Petrol and Diesel remain significant.

- By Sales Channel: Online and Offline. Online sales are rapidly expanding, presenting challenges and opportunities for both established and new players.

Key Drivers of Used Car Market in France Growth

The market's growth is fueled by several factors: increasing affordability of used cars compared to new vehicles, rising consumer demand for SUVs and EVs, expansion of online sales channels, and the improving quality and reliability of used cars due to advanced vehicle inspection technologies. Government incentives for electric vehicles also contribute significantly to the overall growth.

Challenges in the Used Car Market in France Sector

Challenges include the fluctuating prices of used cars due to economic conditions, the increasing complexity of vehicle technology and maintenance, and intense competition amongst players. Regulatory changes regarding emissions and vehicle safety standards also present hurdles for operators. The supply chain disruption caused by the semiconductor shortage also impacted market dynamics in the past couple of years.

Emerging Opportunities in Used Car Market in France

Opportunities lie in the growing demand for electric and hybrid vehicles, the expansion of subscription-based car ownership models, and the application of innovative technologies such as blockchain for increased transparency and trust. Further growth is expected in the online and digital services segments.

Leading Players in the Used Car Market in France Market

- ParuVendu

- La Centrale

- Hellman and Friedman LLC (AutoScout24)

- Reezocar

- Aramis Group

- OOYOO

- BYmyCAR Group

- Autospher

- Auto Beeb

- HeyCar

- Leboncoin

- BNP Paribas Fortis (Arval AutoSelect)

Key Developments in Used Car Market in France Industry

- November 2022: Aramis Group's acquisition of Cazoo's Italian business (Brumbrum) for approximately €30 Million.

- October 2023: AutoScout24's report highlighting the dominance of 2-5 year old vehicles (27.07% market share) and declining registrations of diesel and gasoline cars.

- January 2023: Heycar's restructuring, involving a 16% staff reduction to improve profitability.

Future Outlook for Used Car Market in France Market

The French used car market is poised for continued growth, driven by evolving consumer preferences, technological advancements, and the increasing adoption of online sales channels. Strategic opportunities exist for players who can effectively leverage data analytics, enhance the customer experience, and adapt to the changing regulatory landscape. The market is expected to experience continued growth through 2033.

Used Car Market in France Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports Utility Vehicles (SUVs)

- 1.4. Multi-purpose Vehicles (MPVs)

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Petrol

- 3.2. Diesel

- 3.3. Electric

- 3.4. Others (LPG, CNG, etc.)

-

4. Sales Channel

- 4.1. Online

- 4.2. Offline

Used Car Market in France Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Used Car Market in France REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.52% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing New Car Prices to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Presence of Various Used Car Dealerships Hampers the Market Growth

- 3.4. Market Trends

- 3.4.1. The Online Segment of the Market to Gain Traction During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Car Market in France Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports Utility Vehicles (SUVs)

- 5.1.4. Multi-purpose Vehicles (MPVs)

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Petrol

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Others (LPG, CNG, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Used Car Market in France Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Hatchbacks

- 6.1.2. Sedans

- 6.1.3. Sports Utility Vehicles (SUVs)

- 6.1.4. Multi-purpose Vehicles (MPVs)

- 6.2. Market Analysis, Insights and Forecast - by Vendor Type

- 6.2.1. Organized

- 6.2.2. Unorganized

- 6.3. Market Analysis, Insights and Forecast - by Fuel Type

- 6.3.1. Petrol

- 6.3.2. Diesel

- 6.3.3. Electric

- 6.3.4. Others (LPG, CNG, etc.)

- 6.4. Market Analysis, Insights and Forecast - by Sales Channel

- 6.4.1. Online

- 6.4.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America Used Car Market in France Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Hatchbacks

- 7.1.2. Sedans

- 7.1.3. Sports Utility Vehicles (SUVs)

- 7.1.4. Multi-purpose Vehicles (MPVs)

- 7.2. Market Analysis, Insights and Forecast - by Vendor Type

- 7.2.1. Organized

- 7.2.2. Unorganized

- 7.3. Market Analysis, Insights and Forecast - by Fuel Type

- 7.3.1. Petrol

- 7.3.2. Diesel

- 7.3.3. Electric

- 7.3.4. Others (LPG, CNG, etc.)

- 7.4. Market Analysis, Insights and Forecast - by Sales Channel

- 7.4.1. Online

- 7.4.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe Used Car Market in France Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Hatchbacks

- 8.1.2. Sedans

- 8.1.3. Sports Utility Vehicles (SUVs)

- 8.1.4. Multi-purpose Vehicles (MPVs)

- 8.2. Market Analysis, Insights and Forecast - by Vendor Type

- 8.2.1. Organized

- 8.2.2. Unorganized

- 8.3. Market Analysis, Insights and Forecast - by Fuel Type

- 8.3.1. Petrol

- 8.3.2. Diesel

- 8.3.3. Electric

- 8.3.4. Others (LPG, CNG, etc.)

- 8.4. Market Analysis, Insights and Forecast - by Sales Channel

- 8.4.1. Online

- 8.4.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa Used Car Market in France Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Hatchbacks

- 9.1.2. Sedans

- 9.1.3. Sports Utility Vehicles (SUVs)

- 9.1.4. Multi-purpose Vehicles (MPVs)

- 9.2. Market Analysis, Insights and Forecast - by Vendor Type

- 9.2.1. Organized

- 9.2.2. Unorganized

- 9.3. Market Analysis, Insights and Forecast - by Fuel Type

- 9.3.1. Petrol

- 9.3.2. Diesel

- 9.3.3. Electric

- 9.3.4. Others (LPG, CNG, etc.)

- 9.4. Market Analysis, Insights and Forecast - by Sales Channel

- 9.4.1. Online

- 9.4.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific Used Car Market in France Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Hatchbacks

- 10.1.2. Sedans

- 10.1.3. Sports Utility Vehicles (SUVs)

- 10.1.4. Multi-purpose Vehicles (MPVs)

- 10.2. Market Analysis, Insights and Forecast - by Vendor Type

- 10.2.1. Organized

- 10.2.2. Unorganized

- 10.3. Market Analysis, Insights and Forecast - by Fuel Type

- 10.3.1. Petrol

- 10.3.2. Diesel

- 10.3.3. Electric

- 10.3.4. Others (LPG, CNG, etc.)

- 10.4. Market Analysis, Insights and Forecast - by Sales Channel

- 10.4.1. Online

- 10.4.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ParuVendu

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 La Centrale

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hellman and Friedman LLC (AutoScout24)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Reezocar

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aramis Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 OOYOO

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BYmyCAR Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Autospher

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Auto Beeb

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HeyCar

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Leboncoin

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BNP Paribas Fortis (Arval AutoSelect)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 ParuVendu

List of Figures

- Figure 1: Global Used Car Market in France Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: France Used Car Market in France Revenue (Million), by Country 2024 & 2032

- Figure 3: France Used Car Market in France Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Used Car Market in France Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 5: North America Used Car Market in France Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 6: North America Used Car Market in France Revenue (Million), by Vendor Type 2024 & 2032

- Figure 7: North America Used Car Market in France Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 8: North America Used Car Market in France Revenue (Million), by Fuel Type 2024 & 2032

- Figure 9: North America Used Car Market in France Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 10: North America Used Car Market in France Revenue (Million), by Sales Channel 2024 & 2032

- Figure 11: North America Used Car Market in France Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 12: North America Used Car Market in France Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Used Car Market in France Revenue Share (%), by Country 2024 & 2032

- Figure 14: South America Used Car Market in France Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 15: South America Used Car Market in France Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 16: South America Used Car Market in France Revenue (Million), by Vendor Type 2024 & 2032

- Figure 17: South America Used Car Market in France Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 18: South America Used Car Market in France Revenue (Million), by Fuel Type 2024 & 2032

- Figure 19: South America Used Car Market in France Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 20: South America Used Car Market in France Revenue (Million), by Sales Channel 2024 & 2032

- Figure 21: South America Used Car Market in France Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 22: South America Used Car Market in France Revenue (Million), by Country 2024 & 2032

- Figure 23: South America Used Car Market in France Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Used Car Market in France Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 25: Europe Used Car Market in France Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 26: Europe Used Car Market in France Revenue (Million), by Vendor Type 2024 & 2032

- Figure 27: Europe Used Car Market in France Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 28: Europe Used Car Market in France Revenue (Million), by Fuel Type 2024 & 2032

- Figure 29: Europe Used Car Market in France Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 30: Europe Used Car Market in France Revenue (Million), by Sales Channel 2024 & 2032

- Figure 31: Europe Used Car Market in France Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 32: Europe Used Car Market in France Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe Used Car Market in France Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East & Africa Used Car Market in France Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 35: Middle East & Africa Used Car Market in France Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 36: Middle East & Africa Used Car Market in France Revenue (Million), by Vendor Type 2024 & 2032

- Figure 37: Middle East & Africa Used Car Market in France Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 38: Middle East & Africa Used Car Market in France Revenue (Million), by Fuel Type 2024 & 2032

- Figure 39: Middle East & Africa Used Car Market in France Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 40: Middle East & Africa Used Car Market in France Revenue (Million), by Sales Channel 2024 & 2032

- Figure 41: Middle East & Africa Used Car Market in France Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 42: Middle East & Africa Used Car Market in France Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Used Car Market in France Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Used Car Market in France Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 45: Asia Pacific Used Car Market in France Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 46: Asia Pacific Used Car Market in France Revenue (Million), by Vendor Type 2024 & 2032

- Figure 47: Asia Pacific Used Car Market in France Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 48: Asia Pacific Used Car Market in France Revenue (Million), by Fuel Type 2024 & 2032

- Figure 49: Asia Pacific Used Car Market in France Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 50: Asia Pacific Used Car Market in France Revenue (Million), by Sales Channel 2024 & 2032

- Figure 51: Asia Pacific Used Car Market in France Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 52: Asia Pacific Used Car Market in France Revenue (Million), by Country 2024 & 2032

- Figure 53: Asia Pacific Used Car Market in France Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Used Car Market in France Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Used Car Market in France Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Global Used Car Market in France Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 4: Global Used Car Market in France Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: Global Used Car Market in France Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 6: Global Used Car Market in France Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Used Car Market in France Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Used Car Market in France Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 9: Global Used Car Market in France Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 10: Global Used Car Market in France Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 11: Global Used Car Market in France Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 12: Global Used Car Market in France Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Used Car Market in France Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 17: Global Used Car Market in France Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 18: Global Used Car Market in France Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 19: Global Used Car Market in France Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 20: Global Used Car Market in France Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Used Car Market in France Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 25: Global Used Car Market in France Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 26: Global Used Car Market in France Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 27: Global Used Car Market in France Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 28: Global Used Car Market in France Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Kingdom Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Germany Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: France Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Spain Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Russia Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Benelux Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Nordics Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Used Car Market in France Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 39: Global Used Car Market in France Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 40: Global Used Car Market in France Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 41: Global Used Car Market in France Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 42: Global Used Car Market in France Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Turkey Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: GCC Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: North Africa Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East & Africa Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Used Car Market in France Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 50: Global Used Car Market in France Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 51: Global Used Car Market in France Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 52: Global Used Car Market in France Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 53: Global Used Car Market in France Revenue Million Forecast, by Country 2019 & 2032

- Table 54: China Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Japan Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: ASEAN Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Oceania Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Asia Pacific Used Car Market in France Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Car Market in France?

The projected CAGR is approximately 5.52%.

2. Which companies are prominent players in the Used Car Market in France?

Key companies in the market include ParuVendu, La Centrale, Hellman and Friedman LLC (AutoScout24), Reezocar, Aramis Group, OOYOO, BYmyCAR Group, Autospher, Auto Beeb, HeyCar, Leboncoin, BNP Paribas Fortis (Arval AutoSelect).

3. What are the main segments of the Used Car Market in France?

The market segments include Vehicle Type, Vendor Type, Fuel Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 113.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing New Car Prices to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

The Online Segment of the Market to Gain Traction During the Forecast Period.

7. Are there any restraints impacting market growth?

Presence of Various Used Car Dealerships Hampers the Market Growth.

8. Can you provide examples of recent developments in the market?

January 2023: Heycar, an online used car marketplace with operations in France, announced its restructuring strategy for its global business by reducing 16% of its 450 staff. The company stated that the restructuring aims to reduce expenditure to widen its profit margins, which have declined in recent years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Car Market in France," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Car Market in France report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Car Market in France?

To stay informed about further developments, trends, and reports in the Used Car Market in France, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence