Key Insights

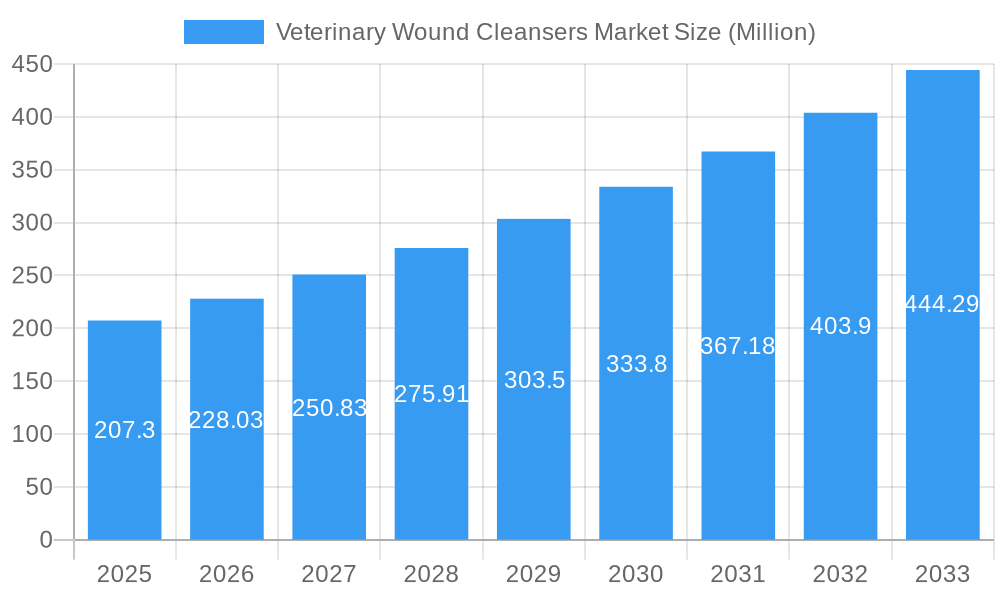

The global Veterinary Wound Cleansers Market is poised for significant expansion, projected to reach an impressive market size of $207.30 million in 2025 and demonstrate a robust Compound Annual Growth Rate (CAGR) of 10.40% through 2033. This upward trajectory is fueled by a confluence of factors, primarily the increasing pet ownership worldwide and the growing emphasis on animal welfare and advanced veterinary care. As companion animals become integral members of families, owners are investing more in their health and well-being, driving demand for effective wound management solutions. Furthermore, the livestock industry's continuous efforts to optimize animal health for productivity and disease prevention also contribute substantially to this market's growth. The market is experiencing a clear shift towards advanced and natural cleansing formulations, reflecting a broader trend in both human and veterinary healthcare towards safer, more effective, and environmentally conscious products. Key players are investing in research and development to introduce innovative solutions that offer faster healing times, reduced infection risks, and improved patient comfort, further stimulating market dynamism.

Veterinary Wound Cleansers Market Market Size (In Million)

The market's expansion is further supported by the growing sophistication of veterinary infrastructure, with veterinary hospitals and clinics increasingly adopting cutting-edge treatments. While the overall outlook is overwhelmingly positive, certain factors may present challenges. The cost of advanced wound care products and the availability of skilled veterinary professionals in certain regions could act as restraints. However, the proactive strategies by leading companies, including Zoetis Services LLC, Dechra Pharmaceuticals, and Virbac, to expand their product portfolios and geographical reach, coupled with increasing awareness campaigns about proper wound care for animals, are expected to overcome these hurdles. The market is segmented by product type, encompassing traditional, advanced, and natural cleansers, catering to diverse needs. By animal type, companion and livestock animals represent the primary beneficiaries, while end-user segments like veterinary hospitals and homecare are driving adoption. Geographically, North America and Europe are expected to lead in market share, with Asia Pacific demonstrating substantial growth potential due to its burgeoning pet population and improving veterinary services.

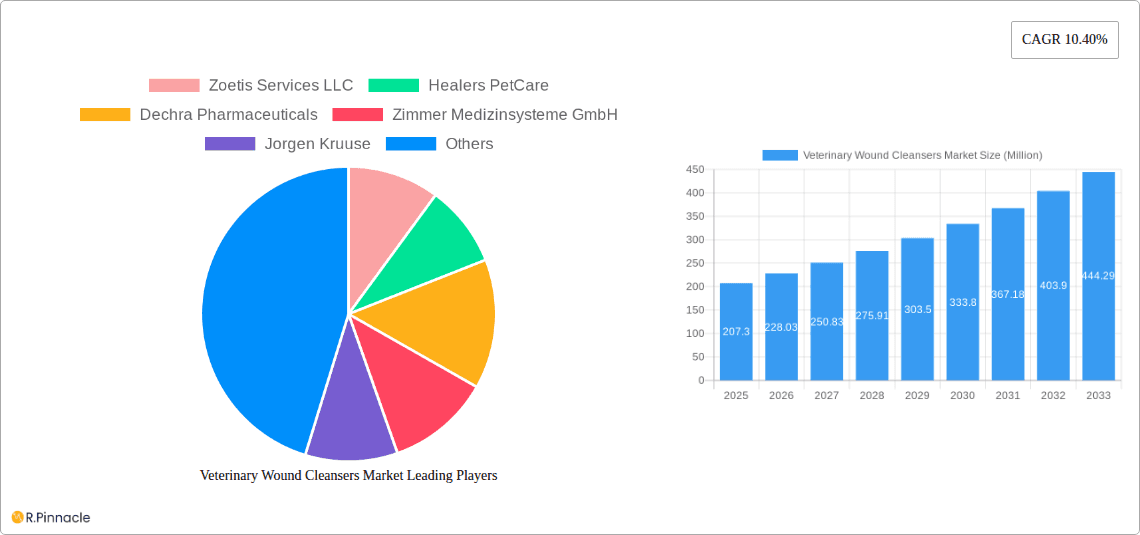

Veterinary Wound Cleansers Market Company Market Share

Here is an SEO-optimized, reader-centric report description for the Veterinary Wound Cleansers Market, designed for immediate use without modification:

Veterinary Wound Cleansers Market: Comprehensive Analysis & Growth Projections (2019–2033)

Gain unparalleled insights into the global Veterinary Wound Cleansers Market, a critical segment within the animal health industry. This definitive report delivers an in-depth analysis of market dynamics, innovation trends, and future growth trajectories from 2019 to 2033. Leveraging advanced analytics and expert insights, this study provides actionable intelligence for stakeholders seeking to capitalize on the expanding opportunities in veterinary wound care. We meticulously examine market segmentation by product type, animal type, and end-user, while profiling key industry players and their strategic initiatives. The report covers the base year 2025, with estimated figures for the same year and comprehensive forecast period analysis for 2025–2033, building upon historical data from 2019–2024.

Veterinary Wound Cleansers Market Market Structure & Innovation Trends

The Veterinary Wound Cleansers Market exhibits a moderate to highly concentrated structure, with a significant share held by established global players. Innovation in this market is primarily driven by advancements in antimicrobial efficacy, biocompatibility, and ease of application. Regulatory frameworks, though varying by region, increasingly emphasize safety and proven effectiveness, influencing product development and market entry strategies. Product substitutes include traditional wound care methods and alternative therapies, but the demand for specialized veterinary wound cleansers remains robust due to their targeted benefits. End-user demographics are shifting, with a growing emphasis on companion animal health and the increasing sophistication of veterinary diagnostics and treatments. Mergers and acquisitions (M&A) activities are prevalent, with recent deal values ranging from tens to hundreds of millions of dollars, indicating strategic consolidation and expansion by major companies seeking to enhance their product portfolios and market reach. For instance, a recent M&A involving a prominent animal health company could significantly alter market share distribution, potentially shifting it by several percentage points.

Veterinary Wound Cleansers Market Market Dynamics & Trends

The Veterinary Wound Cleansers Market is poised for substantial growth, driven by a confluence of factors that are reshaping animal healthcare. A primary growth driver is the escalating pet ownership globally, particularly in developed and emerging economies. This surge in companion animal populations directly translates to increased demand for veterinary services, including wound management. Furthermore, the growing humanization of pets means owners are increasingly willing to invest in premium healthcare solutions, including advanced wound cleansers, to ensure their animals' well-being and speedy recovery. Technological disruptions are playing a pivotal role, with the development of novel formulations featuring enhanced antimicrobial properties, faster healing capabilities, and reduced irritation. Advanced cleansers incorporating nanotechnology or bio-active ingredients are gaining traction, offering superior performance over traditional solutions. Consumer preferences are also evolving; veterinarians and pet owners are seeking user-friendly, effective, and safe wound care products. This includes a rising interest in natural or organic-based cleansers, reflecting a broader trend towards holistic pet care. The competitive dynamics within the market are intense, characterized by strategic product launches, partnerships, and aggressive marketing campaigns by leading players. Market penetration is steadily increasing as awareness of effective wound management techniques and products grows. The projected Compound Annual Growth Rate (CAGR) for the Veterinary Wound Cleansers Market is estimated to be in the range of 6-8% over the forecast period. This growth is underpinned by ongoing research and development efforts aimed at addressing unmet needs in wound healing, such as combating antibiotic resistance and improving patient compliance. The increasing prevalence of chronic wounds and post-surgical infections in animals also contributes significantly to market expansion. The expanding veterinary infrastructure, coupled with the growing number of veterinary practitioners, further supports market growth by ensuring greater accessibility to these specialized products. The trend towards at-home veterinary care and the availability of over-the-counter wound cleansers are also contributing to market penetration, empowering pet owners to manage minor wounds effectively.

Dominant Regions & Segments in Veterinary Wound Cleansers Market

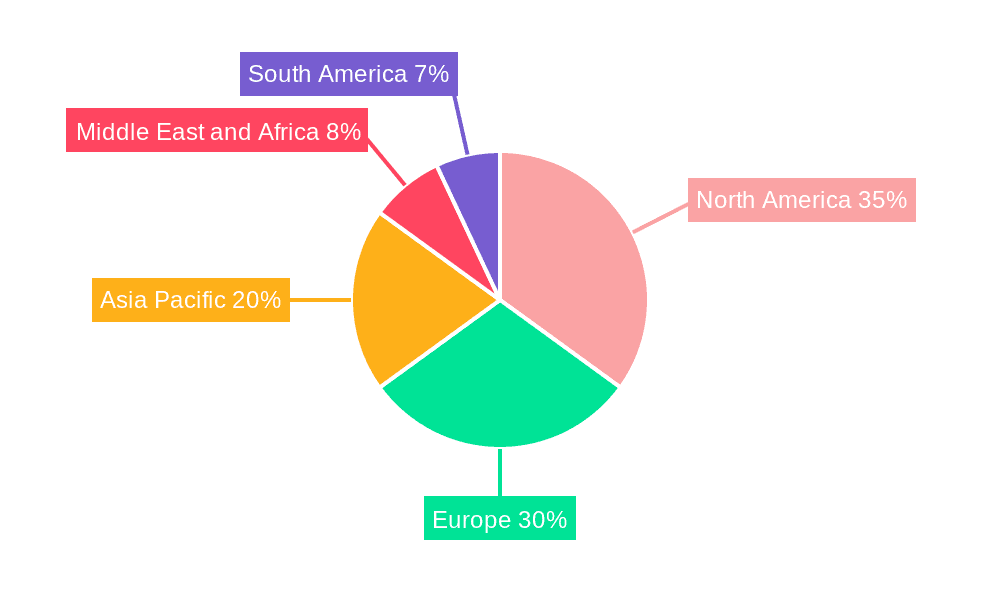

North America currently dominates the Veterinary Wound Cleansers Market, driven by a highly developed animal healthcare infrastructure, substantial disposable income allocated to pet care, and a strong presence of leading veterinary pharmaceutical companies. Within North America, the United States is the leading country, accounting for a significant portion of the market share, estimated to be over 35%. This dominance is fueled by a high pet ownership rate and a robust veterinary research and development ecosystem.

Key Drivers of Regional Dominance:

- Economic Policies: Favorable government policies supporting animal health research and industry growth.

- Infrastructure: Extensive network of veterinary hospitals, specialty clinics, and advanced diagnostic facilities.

- Consumer Spending: High per capita spending on pet healthcare and well-being.

- Technological Advancement: Early adoption of innovative wound care technologies and formulations.

Dominance Analysis by Segment:

- Product Type: Advanced Cleansers are witnessing the fastest growth and are increasingly dominating the market share, surpassing Traditional Cleansers. This is due to their superior efficacy, faster healing properties, and reduced adverse effects, catering to the demand for premium solutions. Natural Cleansers are an emerging segment with growing consumer interest, especially among environmentally conscious pet owners.

- Animal Type: Companion Animals represent the largest and most influential segment. The growing humanization of pets and increased spending on their healthcare ensure a consistent demand for specialized wound care products. Livestock Animal segment also contributes significantly, particularly in regions with large agricultural sectors, due to the need for effective wound management in farm animals to prevent disease outbreaks and maintain productivity.

- End User: Veterinary Hospitals and Clinics are the primary end-users, accounting for the largest market share due to their direct role in diagnosis, treatment, and prescription of wound care products. Homecare is a rapidly expanding segment, driven by the availability of over-the-counter products and increasing owner engagement in managing minor wounds at home. Research Institutes represent a smaller but crucial segment, contributing to the development and validation of new wound cleansing technologies.

The market penetration in Europe is also substantial, with countries like Germany, the UK, and France exhibiting strong growth due to similar factors of high pet ownership and advanced veterinary care. Asia-Pacific is emerging as a key growth region, fueled by increasing pet adoption rates, rising disposable incomes, and a growing awareness of animal welfare, leading to a projected CAGR of over 8% in this region.

Veterinary Wound Cleansers Market Product Innovations

Product innovations in the Veterinary Wound Cleansers Market are centered on developing formulations that offer enhanced antimicrobial efficacy, accelerate wound healing, and minimize patient discomfort. Advanced cleansers incorporating ingredients like polyhexanide (PHMB), hypochlorous acid (HOCl), and advanced polymers are gaining prominence for their broad-spectrum antimicrobial activity and biocompatibility. These innovations provide competitive advantages by offering faster recovery times, reduced inflammation, and improved scar formation. The trend towards natural and bio-derived ingredients is also driving innovation, catering to the demand for gentler, eco-friendly wound care solutions.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the Veterinary Wound Cleansers Market, segmented across crucial categories.

- Product Type: The market is bifurcated into Traditional Cleansers (e.g., iodine-based, chlorhexidine), Advanced Cleansers (e.g., PHMB, HOCl, enzyme-based), and Natural Cleansers (e.g., plant-derived extracts, essential oils). Advanced Cleansers are projected to exhibit the highest growth rate, driven by their enhanced efficacy and specialized applications.

- Animal Type: Analysis covers Companion Animal (dogs, cats, horses) and Livestock Animal (cattle, sheep, poultry). The companion animal segment dominates due to the increasing humanization of pets and higher spending on their healthcare.

- End User: The report examines Veterinary Hospitals and Clinics, Homecare (direct-to-consumer sales, over-the-counter products), and Research Institutes. Veterinary hospitals and clinics are the largest end-user segment, while homecare presents significant growth potential.

Key Drivers of Veterinary Wound Cleansers Market Growth

The Veterinary Wound Cleansers Market is propelled by several key drivers. The escalating prevalence of animal obesity and chronic diseases, leading to an increased incidence of wounds, is a significant factor. Furthermore, the rising global pet population and the growing trend of pet humanization are driving higher spending on veterinary care, including advanced wound management solutions. Technological advancements in wound care formulations, such as the development of broad-spectrum antimicrobial agents and biofilm-disrupting technologies, are enhancing product efficacy and demand. Government initiatives promoting animal health and welfare, alongside increasing awareness among pet owners regarding effective wound care practices, also contribute to market expansion.

Challenges in the Veterinary Wound Cleansers Market Sector

Despite robust growth, the Veterinary Wound Cleansers Market faces several challenges. Stringent regulatory approval processes for new veterinary drugs and medical devices can lead to prolonged market entry timelines and increased development costs. The high cost of advanced wound care products can limit accessibility for some pet owners, particularly in price-sensitive markets. Moreover, the presence of counterfeit or substandard products poses a threat to market integrity and consumer trust. Supply chain disruptions, as witnessed during global health crises, can impact the availability and affordability of raw materials and finished goods. Intense competition among established players and emerging entrants also exerts pressure on pricing and profit margins.

Emerging Opportunities in Veterinary Wound Cleansers Market

Emerging opportunities in the Veterinary Wound Cleansers Market lie in the development of novel, targeted therapies for chronic and complex wounds, including diabetic ulcers and pressure sores. The growing demand for sustainable and eco-friendly wound care solutions presents an opportunity for natural and bio-based cleansers. Expansion into underserved emerging markets with increasing pet ownership and veterinary infrastructure offers significant growth potential. Furthermore, the integration of digital technologies, such as telemedicine platforms for remote wound assessment and guidance, can enhance the delivery of wound care services and product adoption. Personalized wound management approaches tailored to specific animal breeds and wound types are also likely to gain traction.

Leading Players in the Veterinary Wound Cleansers Market Market

- Zoetis Services LLC

- Healers PetCare

- Dechra Pharmaceuticals

- Zimmer Medizinsysteme GmbH

- Jorgen Kruuse

- Vetoquinol

- Sonoma Pharmaceuticals Inc

- Axio Biosolutions Pvt Ltd

- Innovacyn Inc

- Virbac

- AMERX Health Care

Key Developments in Veterinary Wound Cleansers Market Industry

- March 2024: Modern Animal expanded its clinic in Los Angeles, located on La Brea Avenue, to advance veterinary experience for both pets and their owners. The clinic offers primary and urgent care to dogs and cats.

- March 2023: The Tamil Nadu government launched 245 mobile veterinary clinics under a public-private partnership model for offering treatment to disease-bearing domestic animals and poultry birds.

Future Outlook for Veterinary Wound Cleansers Market Market

The future outlook for the Veterinary Wound Cleansers Market is highly promising, with sustained growth anticipated over the forecast period. The increasing focus on preventive healthcare and early intervention in animal health will continue to drive demand for effective wound management solutions. Innovations in nanotechnology, regenerative medicine, and smart wound dressings are expected to revolutionize the market, offering advanced therapeutic options. The expanding veterinary pharmaceutical landscape, coupled with strategic collaborations and M&A activities, will further consolidate the market and foster innovation. The growing awareness among pet owners and the increasing accessibility of veterinary services, especially in emerging economies, will also act as significant growth accelerators, ensuring a robust and expanding market for veterinary wound cleansers.

Veterinary Wound Cleansers Market Segmentation

-

1. Product Type

- 1.1. Traditional Cleansers

- 1.2. Advanced Cleansers

- 1.3. Natural Cleansers

-

2. Animal Type

- 2.1. Companion Animal

- 2.2. Livestock Animal

-

3. End User

- 3.1. Veterinary Hospitals and Clinics

- 3.2. Homecare

- 3.3. Research Institute

Veterinary Wound Cleansers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Veterinary Wound Cleansers Market Regional Market Share

Geographic Coverage of Veterinary Wound Cleansers Market

Veterinary Wound Cleansers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Animal Diseases and Injuries; Increasing Awareness About Pet Insurance Among Pet Owners; Surge in Pet Ownership

- 3.3. Market Restrains

- 3.3.1. Limited Availability of Wound Cleansers in Underdeveloping Countries

- 3.4. Market Trends

- 3.4.1. The Companion Animal Segment is Expected to Witness Significant Growth Between 2024 and 2029

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Veterinary Wound Cleansers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Traditional Cleansers

- 5.1.2. Advanced Cleansers

- 5.1.3. Natural Cleansers

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Companion Animal

- 5.2.2. Livestock Animal

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Veterinary Hospitals and Clinics

- 5.3.2. Homecare

- 5.3.3. Research Institute

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Veterinary Wound Cleansers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Traditional Cleansers

- 6.1.2. Advanced Cleansers

- 6.1.3. Natural Cleansers

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Companion Animal

- 6.2.2. Livestock Animal

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Veterinary Hospitals and Clinics

- 6.3.2. Homecare

- 6.3.3. Research Institute

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Veterinary Wound Cleansers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Traditional Cleansers

- 7.1.2. Advanced Cleansers

- 7.1.3. Natural Cleansers

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Companion Animal

- 7.2.2. Livestock Animal

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Veterinary Hospitals and Clinics

- 7.3.2. Homecare

- 7.3.3. Research Institute

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Veterinary Wound Cleansers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Traditional Cleansers

- 8.1.2. Advanced Cleansers

- 8.1.3. Natural Cleansers

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Companion Animal

- 8.2.2. Livestock Animal

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Veterinary Hospitals and Clinics

- 8.3.2. Homecare

- 8.3.3. Research Institute

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Veterinary Wound Cleansers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Traditional Cleansers

- 9.1.2. Advanced Cleansers

- 9.1.3. Natural Cleansers

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Companion Animal

- 9.2.2. Livestock Animal

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Veterinary Hospitals and Clinics

- 9.3.2. Homecare

- 9.3.3. Research Institute

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Veterinary Wound Cleansers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Traditional Cleansers

- 10.1.2. Advanced Cleansers

- 10.1.3. Natural Cleansers

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Companion Animal

- 10.2.2. Livestock Animal

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Veterinary Hospitals and Clinics

- 10.3.2. Homecare

- 10.3.3. Research Institute

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Zoetis Services LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Healers PetCare

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dechra Pharmaceuticals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Zimmer Medizinsysteme GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jorgen Kruuse

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Vetoquinol

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sonoma Pharmaceuticals Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Axio Biosolutions Pvt Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Innovacyn Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Virbac

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AMERX Health Care

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Zoetis Services LLC

List of Figures

- Figure 1: Global Veterinary Wound Cleansers Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Veterinary Wound Cleansers Market Volume Breakdown (K unit, %) by Region 2025 & 2033

- Figure 3: North America Veterinary Wound Cleansers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 4: North America Veterinary Wound Cleansers Market Volume (K unit), by Product Type 2025 & 2033

- Figure 5: North America Veterinary Wound Cleansers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Veterinary Wound Cleansers Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Veterinary Wound Cleansers Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 8: North America Veterinary Wound Cleansers Market Volume (K unit), by Animal Type 2025 & 2033

- Figure 9: North America Veterinary Wound Cleansers Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 10: North America Veterinary Wound Cleansers Market Volume Share (%), by Animal Type 2025 & 2033

- Figure 11: North America Veterinary Wound Cleansers Market Revenue (Million), by End User 2025 & 2033

- Figure 12: North America Veterinary Wound Cleansers Market Volume (K unit), by End User 2025 & 2033

- Figure 13: North America Veterinary Wound Cleansers Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Veterinary Wound Cleansers Market Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Veterinary Wound Cleansers Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Veterinary Wound Cleansers Market Volume (K unit), by Country 2025 & 2033

- Figure 17: North America Veterinary Wound Cleansers Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Veterinary Wound Cleansers Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Veterinary Wound Cleansers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 20: Europe Veterinary Wound Cleansers Market Volume (K unit), by Product Type 2025 & 2033

- Figure 21: Europe Veterinary Wound Cleansers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe Veterinary Wound Cleansers Market Volume Share (%), by Product Type 2025 & 2033

- Figure 23: Europe Veterinary Wound Cleansers Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 24: Europe Veterinary Wound Cleansers Market Volume (K unit), by Animal Type 2025 & 2033

- Figure 25: Europe Veterinary Wound Cleansers Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 26: Europe Veterinary Wound Cleansers Market Volume Share (%), by Animal Type 2025 & 2033

- Figure 27: Europe Veterinary Wound Cleansers Market Revenue (Million), by End User 2025 & 2033

- Figure 28: Europe Veterinary Wound Cleansers Market Volume (K unit), by End User 2025 & 2033

- Figure 29: Europe Veterinary Wound Cleansers Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Veterinary Wound Cleansers Market Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Veterinary Wound Cleansers Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Veterinary Wound Cleansers Market Volume (K unit), by Country 2025 & 2033

- Figure 33: Europe Veterinary Wound Cleansers Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Veterinary Wound Cleansers Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Veterinary Wound Cleansers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Veterinary Wound Cleansers Market Volume (K unit), by Product Type 2025 & 2033

- Figure 37: Asia Pacific Veterinary Wound Cleansers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific Veterinary Wound Cleansers Market Volume Share (%), by Product Type 2025 & 2033

- Figure 39: Asia Pacific Veterinary Wound Cleansers Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 40: Asia Pacific Veterinary Wound Cleansers Market Volume (K unit), by Animal Type 2025 & 2033

- Figure 41: Asia Pacific Veterinary Wound Cleansers Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 42: Asia Pacific Veterinary Wound Cleansers Market Volume Share (%), by Animal Type 2025 & 2033

- Figure 43: Asia Pacific Veterinary Wound Cleansers Market Revenue (Million), by End User 2025 & 2033

- Figure 44: Asia Pacific Veterinary Wound Cleansers Market Volume (K unit), by End User 2025 & 2033

- Figure 45: Asia Pacific Veterinary Wound Cleansers Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Veterinary Wound Cleansers Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Veterinary Wound Cleansers Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Veterinary Wound Cleansers Market Volume (K unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Veterinary Wound Cleansers Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Veterinary Wound Cleansers Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Veterinary Wound Cleansers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 52: Middle East and Africa Veterinary Wound Cleansers Market Volume (K unit), by Product Type 2025 & 2033

- Figure 53: Middle East and Africa Veterinary Wound Cleansers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Middle East and Africa Veterinary Wound Cleansers Market Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Middle East and Africa Veterinary Wound Cleansers Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 56: Middle East and Africa Veterinary Wound Cleansers Market Volume (K unit), by Animal Type 2025 & 2033

- Figure 57: Middle East and Africa Veterinary Wound Cleansers Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 58: Middle East and Africa Veterinary Wound Cleansers Market Volume Share (%), by Animal Type 2025 & 2033

- Figure 59: Middle East and Africa Veterinary Wound Cleansers Market Revenue (Million), by End User 2025 & 2033

- Figure 60: Middle East and Africa Veterinary Wound Cleansers Market Volume (K unit), by End User 2025 & 2033

- Figure 61: Middle East and Africa Veterinary Wound Cleansers Market Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East and Africa Veterinary Wound Cleansers Market Volume Share (%), by End User 2025 & 2033

- Figure 63: Middle East and Africa Veterinary Wound Cleansers Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East and Africa Veterinary Wound Cleansers Market Volume (K unit), by Country 2025 & 2033

- Figure 65: Middle East and Africa Veterinary Wound Cleansers Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Veterinary Wound Cleansers Market Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Veterinary Wound Cleansers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 68: South America Veterinary Wound Cleansers Market Volume (K unit), by Product Type 2025 & 2033

- Figure 69: South America Veterinary Wound Cleansers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 70: South America Veterinary Wound Cleansers Market Volume Share (%), by Product Type 2025 & 2033

- Figure 71: South America Veterinary Wound Cleansers Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 72: South America Veterinary Wound Cleansers Market Volume (K unit), by Animal Type 2025 & 2033

- Figure 73: South America Veterinary Wound Cleansers Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 74: South America Veterinary Wound Cleansers Market Volume Share (%), by Animal Type 2025 & 2033

- Figure 75: South America Veterinary Wound Cleansers Market Revenue (Million), by End User 2025 & 2033

- Figure 76: South America Veterinary Wound Cleansers Market Volume (K unit), by End User 2025 & 2033

- Figure 77: South America Veterinary Wound Cleansers Market Revenue Share (%), by End User 2025 & 2033

- Figure 78: South America Veterinary Wound Cleansers Market Volume Share (%), by End User 2025 & 2033

- Figure 79: South America Veterinary Wound Cleansers Market Revenue (Million), by Country 2025 & 2033

- Figure 80: South America Veterinary Wound Cleansers Market Volume (K unit), by Country 2025 & 2033

- Figure 81: South America Veterinary Wound Cleansers Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Veterinary Wound Cleansers Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 4: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by Animal Type 2020 & 2033

- Table 5: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by End User 2020 & 2033

- Table 7: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by Region 2020 & 2033

- Table 9: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by Product Type 2020 & 2033

- Table 11: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 12: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by Animal Type 2020 & 2033

- Table 13: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by End User 2020 & 2033

- Table 15: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by Country 2020 & 2033

- Table 17: United States Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 23: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by Product Type 2020 & 2033

- Table 25: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 26: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by Animal Type 2020 & 2033

- Table 27: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by End User 2020 & 2033

- Table 29: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by Country 2020 & 2033

- Table 31: Germany Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 35: France Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: France Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Spain Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 43: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 44: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by Product Type 2020 & 2033

- Table 45: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 46: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by Animal Type 2020 & 2033

- Table 47: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by End User 2020 & 2033

- Table 48: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by End User 2020 & 2033

- Table 49: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by Country 2020 & 2033

- Table 51: China Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: China Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 53: Japan Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 55: India Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: India Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 57: Australia Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Australia Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 59: South Korea Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Korea Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 63: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 64: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by Product Type 2020 & 2033

- Table 65: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 66: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by Animal Type 2020 & 2033

- Table 67: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by End User 2020 & 2033

- Table 68: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by End User 2020 & 2033

- Table 69: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by Country 2020 & 2033

- Table 71: GCC Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: GCC Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 73: South Africa Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 77: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 78: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by Product Type 2020 & 2033

- Table 79: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 80: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by Animal Type 2020 & 2033

- Table 81: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by End User 2020 & 2033

- Table 82: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by End User 2020 & 2033

- Table 83: Global Veterinary Wound Cleansers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 84: Global Veterinary Wound Cleansers Market Volume K unit Forecast, by Country 2020 & 2033

- Table 85: Brazil Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Brazil Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 87: Argentina Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Argentina Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Veterinary Wound Cleansers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Veterinary Wound Cleansers Market Volume (K unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary Wound Cleansers Market?

The projected CAGR is approximately 10.40%.

2. Which companies are prominent players in the Veterinary Wound Cleansers Market?

Key companies in the market include Zoetis Services LLC, Healers PetCare, Dechra Pharmaceuticals, Zimmer Medizinsysteme GmbH, Jorgen Kruuse, Vetoquinol, Sonoma Pharmaceuticals Inc, Axio Biosolutions Pvt Ltd, Innovacyn Inc, Virbac, AMERX Health Care.

3. What are the main segments of the Veterinary Wound Cleansers Market?

The market segments include Product Type, Animal Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 207.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Animal Diseases and Injuries; Increasing Awareness About Pet Insurance Among Pet Owners; Surge in Pet Ownership.

6. What are the notable trends driving market growth?

The Companion Animal Segment is Expected to Witness Significant Growth Between 2024 and 2029.

7. Are there any restraints impacting market growth?

Limited Availability of Wound Cleansers in Underdeveloping Countries.

8. Can you provide examples of recent developments in the market?

March 2024: Modern Animal expanded its clinic in Los Angeles, located on La Brea Avenue, to advance veterinary experience for both pets and their owners. The clinic offers primary and urgent care to dogs and cats.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Veterinary Wound Cleansers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Veterinary Wound Cleansers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Veterinary Wound Cleansers Market?

To stay informed about further developments, trends, and reports in the Veterinary Wound Cleansers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence