Key Insights

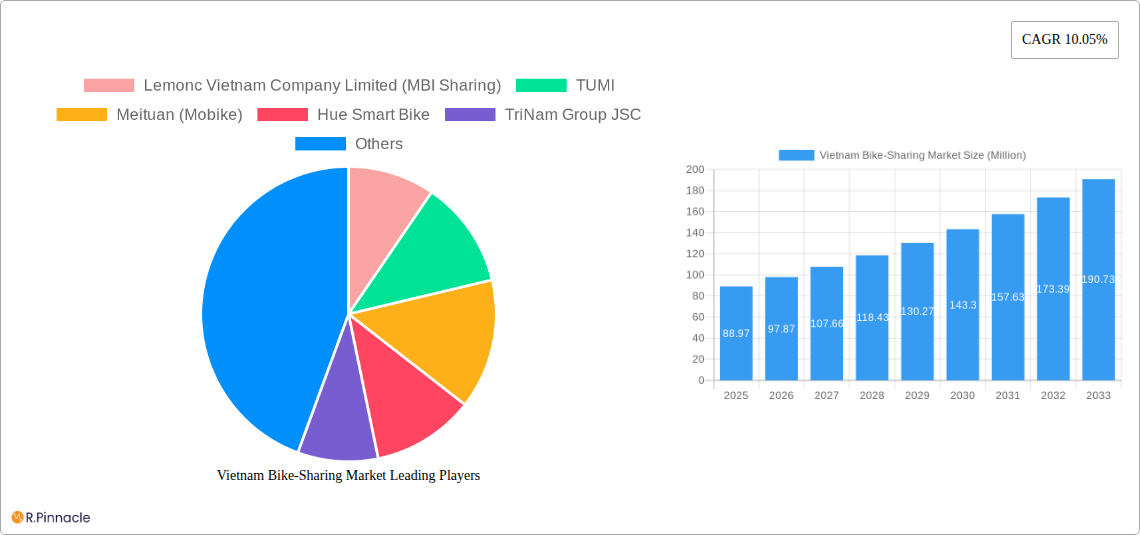

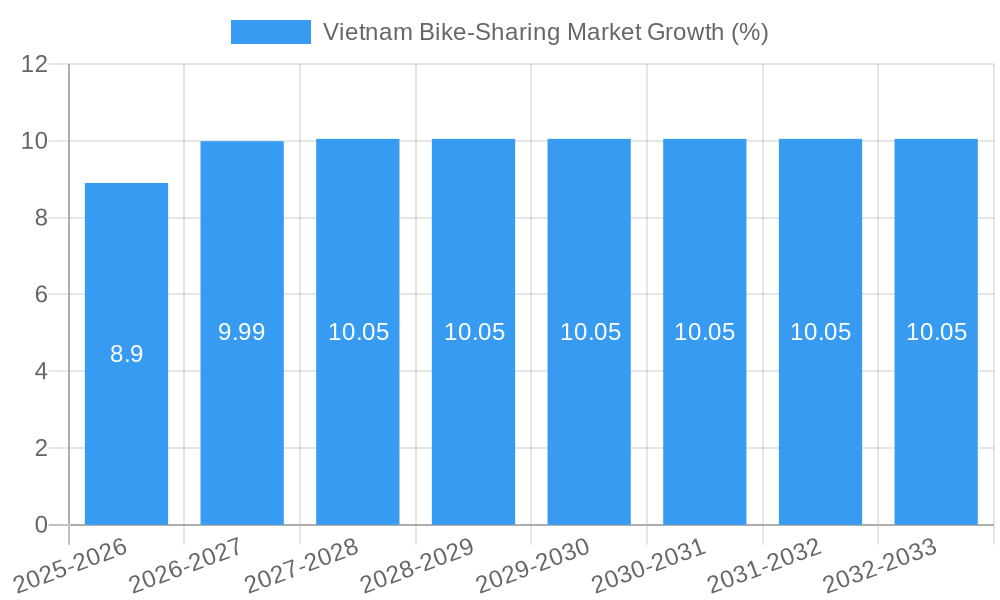

The Vietnam bike-sharing market, valued at $88.97 million in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.05% from 2025 to 2033. This expansion is driven by several key factors. Increasing urbanization and traffic congestion in major Vietnamese cities like Ho Chi Minh City and Hanoi are prompting a shift towards eco-friendly and efficient transportation solutions. Government initiatives promoting sustainable mobility and investments in cycling infrastructure further bolster market growth. The rising popularity of e-bikes, offering convenience and speed, is a major segment driver. Furthermore, the diverse sharing models—docked, dockless, and hybrid—cater to various user preferences and needs, contributing to market expansion. The market is segmented by bike type (traditional and e-bikes), sharing system (docked, dockless, hybrid), duration (short-term and long-term rentals), and application (commutes, recreation, and tourism). Competition is present among established players like Meituan (Mobike), and emerging local companies like Lemonc Vietnam Company Limited (MBI Sharing) and Hue Smart Bike, resulting in innovative service offerings and competitive pricing.

The market's future growth will likely be influenced by factors such as technological advancements (e.g., improved battery technology for e-bikes, smart locking systems), evolving consumer preferences, and government regulations. Addressing challenges like vandalism, bike theft, and ensuring equitable access across different socioeconomic groups will be crucial for sustained growth. Expansion into smaller cities and towns, leveraging strategic partnerships with local businesses and tourism operators, presents significant untapped potential. The long-term outlook remains positive, with the market expected to witness robust growth fueled by continued urbanization, increased environmental awareness, and a growing preference for shared mobility solutions in Vietnam.

Vietnam Bike-Sharing Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Vietnam bike-sharing market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, and future potential. Expect detailed segmentations, competitive landscapes, and growth projections, all supported by robust data and expert analysis. The report's findings will help you navigate the complexities of this dynamic market and capitalize on emerging opportunities.

Vietnam Bike-Sharing Market Structure & Innovation Trends

This section analyzes the Vietnam bike-sharing market's competitive landscape, encompassing market concentration, innovation drivers, regulatory frameworks, and M&A activities. The study period covers 2019-2024, with a forecast extending to 2033.

The market exhibits a moderately fragmented structure with several key players vying for market share. While precise market share figures for each company are unavailable at this time, we estimate that the top three players (Meituan (Mobike), Lemonc Vietnam Company Limited (MBI Sharing), and TriNam Group JSC) collectively hold approximately xx% of the market. Smaller operators, such as Hue Smart Bike and G-Bike (GCOO), cater to niche segments. The total market value in 2025 is estimated at xx Million.

Innovation Drivers: Government initiatives promoting sustainable transportation, coupled with increasing urbanization and traffic congestion, are key drivers of innovation. The introduction of e-bikes and advancements in dockless sharing systems are significant examples.

Regulatory Framework: The government's supportive stance towards cycling infrastructure development, evidenced by recent initiatives (detailed later in this report), significantly influences market growth.

Product Substitutes: Private vehicle ownership and public transportation remain primary substitutes. However, bike-sharing offers a more convenient and environmentally friendly alternative for short-to-medium distances.

End-User Demographics: The primary user base comprises young adults and professionals, utilizing bike-sharing for commuting and recreational purposes.

M&A Activity: While significant M&A activity in the Vietnamese bike-sharing market has not been observed recently, there is potential for future consolidation as the market matures. We predict a total M&A deal value of approximately xx Million in the forecast period (2025-2033).

Vietnam Bike-Sharing Market Dynamics & Trends

This section delves into the market's growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The compound annual growth rate (CAGR) for the Vietnam bike-sharing market during the forecast period (2025-2033) is projected at xx%. Market penetration is currently estimated at xx%, with significant growth potential in underserved urban areas.

Several factors fuel market growth: rising environmental awareness, increasing traffic congestion in major cities, the affordability of bike-sharing services, and government support for sustainable transportation initiatives. Technological disruptions, such as the introduction of smart bikes with GPS tracking and improved battery technology, enhance user experience and efficiency, leading to increased adoption.

Consumer preferences are shifting towards e-bikes due to their convenience and ability to tackle hilly terrains, thereby affecting the composition of the market segment. Intense competition among existing and emerging players is driving innovation and service improvements. This competitive pressure results in price wars and promotions, benefiting consumers.

Dominant Regions & Segments in Vietnam Bike-Sharing Market

This section identifies the leading regions and market segments within the Vietnam bike-sharing market.

Leading Region: Major metropolitan areas like Hanoi and Ho Chi Minh City dominate the market, driven by high population density, better cycling infrastructure, and higher consumer disposable incomes.

Dominant Segments:

By Bike Type: E-bikes are rapidly gaining popularity, surpassing traditional bikes due to their convenience and extended range.

By Sharing System: Dockless systems are becoming increasingly prevalent due to their flexibility and cost-effectiveness.

By Sharing Duration: Short-term rentals constitute the largest segment, aligned with the majority of users' preferences for occasional rides.

By Application: Regular commutes and recreation currently account for the largest share, but tourism represents a growing segment with increasing tourist arrivals.

Key Drivers:

Economic Policies: Government incentives and subsidies for sustainable transportation promote the adoption of bike-sharing services.

Infrastructure Development: The expansion of dedicated cycling lanes and infrastructure upgrades significantly impact market growth.

Vietnam Bike-Sharing Market Product Innovations

Recent innovations focus on enhanced safety features, improved battery technology for e-bikes, and integration with mobile payment systems. Smart locks, GPS tracking, and mobile app-based booking systems have improved user experience and convenience, driving market expansion. These technological advancements enhance the competitiveness of the services, attract new customers, and drive growth. The integration of e-bike functionalities and IoT connectivity in existing offerings is a significant trend.

Report Scope & Segmentation Analysis

This report segments the Vietnam bike-sharing market by bike type (traditional/conventional bikes and e-bikes), sharing system (docked/station-based, dockless, and hybrid), sharing duration (short-term and long-term), and application (regular commutes and recreation, and tourism). Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed. The market is projected to experience considerable growth across all segments, particularly e-bikes and dockless systems.

Key Drivers of Vietnam Bike-Sharing Market Growth

The Vietnam bike-sharing market is driven by a combination of factors: government initiatives promoting sustainable transportation, including dedicated bicycle lanes and infrastructure development; increasing urbanization and traffic congestion in major cities, creating a demand for alternative transportation modes; rising environmental awareness among consumers; and the affordability and convenience of bike-sharing compared to private vehicle ownership.

Challenges in the Vietnam Bike-Sharing Market Sector

Challenges include the need for further infrastructure development (bicycle lanes and secure parking areas), maintaining bike availability and preventing theft, managing operational costs, and navigating regulatory hurdles relating to licensing and safety standards. The competitive landscape also poses a challenge, leading to pricing pressure and the need for constant innovation. We project a loss of xx Million annually due to theft and vandalism.

Emerging Opportunities in Vietnam Bike-Sharing Market

Opportunities exist in expanding into smaller cities and towns, developing innovative bike-sharing models targeting specific niches (e.g., tourism), integrating bike-sharing with other modes of transportation, and leveraging technological advancements to enhance the user experience. The growth of e-commerce and last-mile delivery presents a significant opportunity for bike-sharing companies to expand into the logistics sector.

Leading Players in the Vietnam Bike-Sharing Market Market

- Lemonc Vietnam Company Limited (MBI Sharing)

- TUMI

- Meituan (Mobike)

- Hue Smart Bike

- TriNam Group JSC

- Hyosung Group

- G-Bike (GCOO)

Key Developments in Vietnam Bike-Sharing Market Industry

- February 2024: The Hanoi Transport Department launched a dedicated 3m bicycle lane along the To Lich River, boosting demand for bike-sharing.

- June 2023: The UNDP and Vietnamese Ministry of Transport organized a workshop promoting electric bike-sharing models, fostering industry knowledge and development.

- May 2023: The launch of technical guidelines for urban bicycling infrastructure design, in collaboration with international organizations, facilitates the creation of cycling paths nationwide, creating opportunities for bike-sharing providers.

Future Outlook for Vietnam Bike-Sharing Market Market

The Vietnam bike-sharing market is poised for substantial growth, driven by sustained government support, infrastructure development, and increasing consumer preference for sustainable transportation options. Strategic partnerships, technological advancements, and expansion into new markets will shape the future of this dynamic sector. The market is projected to reach xx Million by 2033.

Vietnam Bike-Sharing Market Segmentation

-

1. Bike Type

- 1.1. Traditional/Conventional Bikes

- 1.2. E-bikes

-

2. Sharing System

- 2.1. Docked/Station-based

- 2.2. Dock Less

- 2.3. Hybrid

-

3. Sharing Duration

- 3.1. Short Term

- 3.2. Long Term

-

4. Application

- 4.1. Regular Commutes and Recreation

- 4.2. Tourism

Vietnam Bike-Sharing Market Segmentation By Geography

- 1. Vietnam

Vietnam Bike-Sharing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.05% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shifting Consumer Preference toward Eco-friendly Medium of Transportation

- 3.3. Market Restrains

- 3.3.1. Growing Incidents of Bike Damage and Theft

- 3.4. Market Trends

- 3.4.1. E-bikes Segment to Gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Bike-Sharing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Bike Type

- 5.1.1. Traditional/Conventional Bikes

- 5.1.2. E-bikes

- 5.2. Market Analysis, Insights and Forecast - by Sharing System

- 5.2.1. Docked/Station-based

- 5.2.2. Dock Less

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Sharing Duration

- 5.3.1. Short Term

- 5.3.2. Long Term

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Regular Commutes and Recreation

- 5.4.2. Tourism

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Bike Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Lemonc Vietnam Company Limited (MBI Sharing)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TUMI

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Meituan (Mobike)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hue Smart Bike

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TriNam Group JSC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hyosung Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 G-Bike (GCOO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Lemonc Vietnam Company Limited (MBI Sharing)

List of Figures

- Figure 1: Vietnam Bike-Sharing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Bike-Sharing Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Bike-Sharing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Bike-Sharing Market Revenue Million Forecast, by Bike Type 2019 & 2032

- Table 3: Vietnam Bike-Sharing Market Revenue Million Forecast, by Sharing System 2019 & 2032

- Table 4: Vietnam Bike-Sharing Market Revenue Million Forecast, by Sharing Duration 2019 & 2032

- Table 5: Vietnam Bike-Sharing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Vietnam Bike-Sharing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Vietnam Bike-Sharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Vietnam Bike-Sharing Market Revenue Million Forecast, by Bike Type 2019 & 2032

- Table 9: Vietnam Bike-Sharing Market Revenue Million Forecast, by Sharing System 2019 & 2032

- Table 10: Vietnam Bike-Sharing Market Revenue Million Forecast, by Sharing Duration 2019 & 2032

- Table 11: Vietnam Bike-Sharing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Vietnam Bike-Sharing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Bike-Sharing Market?

The projected CAGR is approximately 10.05%.

2. Which companies are prominent players in the Vietnam Bike-Sharing Market?

Key companies in the market include Lemonc Vietnam Company Limited (MBI Sharing), TUMI, Meituan (Mobike), Hue Smart Bike, TriNam Group JSC, Hyosung Group, G-Bike (GCOO.

3. What are the main segments of the Vietnam Bike-Sharing Market?

The market segments include Bike Type, Sharing System, Sharing Duration, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 88.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Shifting Consumer Preference toward Eco-friendly Medium of Transportation.

6. What are the notable trends driving market growth?

E-bikes Segment to Gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

Growing Incidents of Bike Damage and Theft.

8. Can you provide examples of recent developments in the market?

February 2024: The Hanoi Transport Department unveiled its plan to operate an exclusive bicycle lane along the To Lich River. The goal is to encourage consumers to use bicycles for short-distance travel, which can help reduce traffic congestion in the city. The 3 m bicycle path was explicitly developed for riders only, allowing non-electric bicycles to operate in the space. The transport department plans to expand its route to adjacent bicycle lanes along the To Lich River. Formulating dedicated bicycle lanes helps increase the demand for bicycle-sharing services nationwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Bike-Sharing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Bike-Sharing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Bike-Sharing Market?

To stay informed about further developments, trends, and reports in the Vietnam Bike-Sharing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence