Key Insights

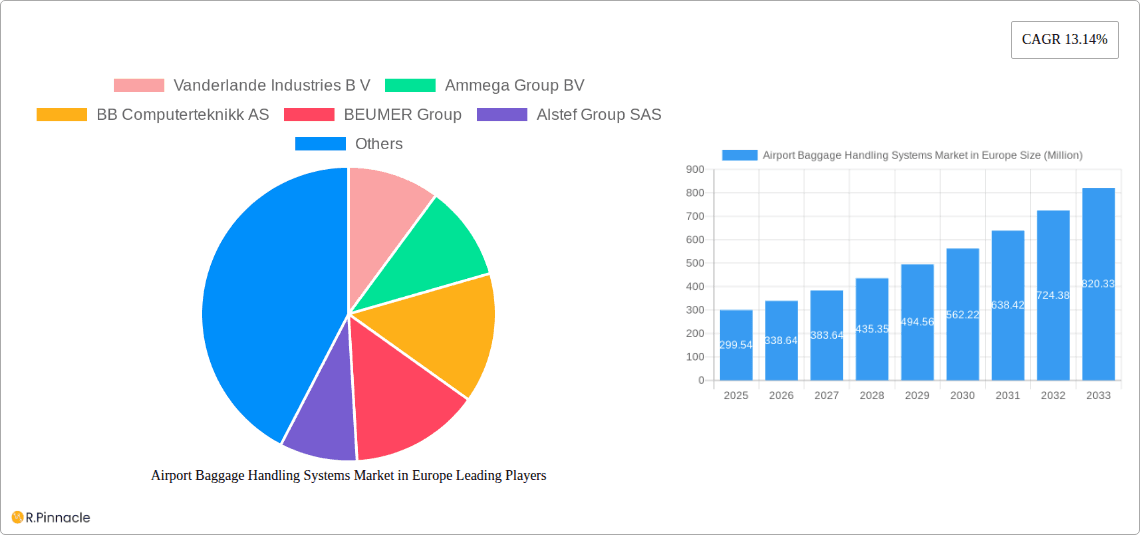

The European airport baggage handling systems market is experiencing robust growth, projected to reach €299.54 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 13.14% from 2025 to 2033. This expansion is fueled by several key drivers. Increased passenger traffic at major European airports necessitates the upgrade and expansion of existing baggage handling infrastructure to meet rising demand and maintain efficient operations. Furthermore, the growing adoption of advanced technologies such as automated baggage sorting systems, improved tracking technologies (RFID, AI-driven solutions), and self-service kiosks contributes significantly to market growth. Stringent security regulations and the need to enhance security protocols are further driving the adoption of sophisticated baggage handling systems. The market is segmented by airport capacity, reflecting the varying needs of smaller and larger hubs. Larger airports (above 40 million passengers annually) represent a significant segment, driving investment in high-capacity, technologically advanced systems. Leading players like Vanderlande Industries B.V., Ammega Group BV, and Siemens AG are shaping the market through continuous innovation and strategic partnerships. Competition is intense, emphasizing the need for continuous technological advancements and efficient customer service.

Airport Baggage Handling Systems Market in Europe Market Size (In Million)

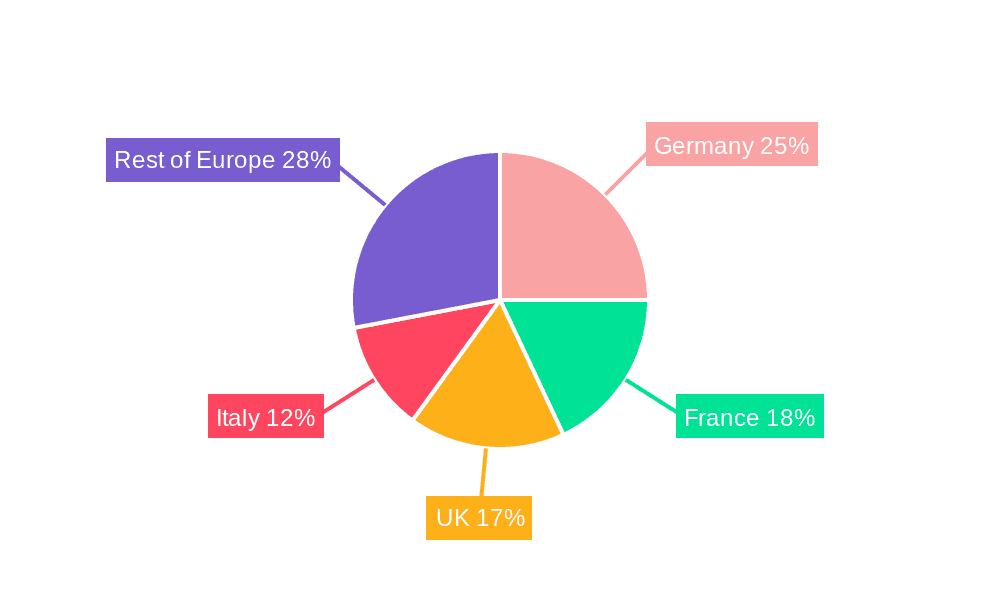

Growth is uneven across the European landscape. Germany, France, the UK, and Italy represent significant market shares, driven by high passenger volumes and ongoing investments in airport modernization. However, growth is expected in other European nations as well, driven by regional airport expansion and upgrading initiatives. While the market faces challenges such as high initial investment costs for advanced systems and potential integration complexities, the long-term benefits of improved efficiency, enhanced security, and enhanced passenger experience far outweigh these challenges, ensuring sustained growth over the forecast period. The market is expected to see continued consolidation as larger companies acquire smaller players to expand their market reach and technological capabilities. The integration of new technologies such as the Internet of Things (IoT) and cloud computing into baggage handling systems is expected to drive further efficiency and optimization in the coming years.

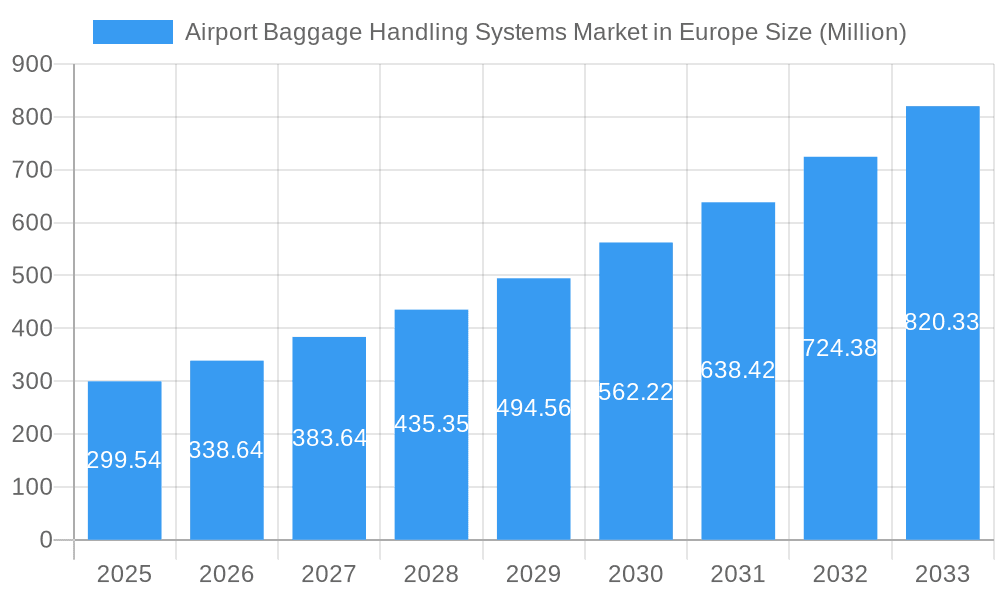

Airport Baggage Handling Systems Market in Europe Company Market Share

Airport Baggage Handling Systems Market in Europe: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Airport Baggage Handling Systems market in Europe, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market trends, competitive dynamics, and future growth potential. The study leverages rigorous data analysis and expert insights to provide actionable intelligence for navigating this dynamic sector.

Airport Baggage Handling Systems Market in Europe Market Structure & Innovation Trends

This section analyzes the European airport baggage handling systems market's structure, highlighting key innovation drivers, regulatory landscapes, and competitive dynamics. The market exhibits a moderately concentrated structure, with a few major players holding significant market share.

Market Leaders: Vanderlande Industries B V, BEUMER Group, and Daifuku Co Ltd are among the dominant players, commanding an estimated xx% of the overall market share in 2025. Smaller players like Alstef Group SAS and Ammega Group BV focus on niche segments and regional markets. Precise market share figures require access to confidential financial data from these companies.

Innovation Drivers: The drive towards automation, improved efficiency, and enhanced security is fueling innovation. The integration of AI, IoT, and advanced analytics is transforming baggage handling processes, improving throughput, and reducing operational costs.

Regulatory Framework: Stringent safety and security regulations imposed by the European Union Aviation Safety Agency (EASA) are shaping technology adoption and influencing market dynamics. Compliance with standards like EASA Standard 3.1 is a key factor for companies.

Mergers & Acquisitions (M&A): The market has witnessed several M&A activities in recent years, with deal values ranging from xx Million to xx Million. These activities are primarily aimed at expanding market reach, acquiring technological capabilities, and consolidating market share. However, specific details on the number and value of M&A deals are commercially sensitive and not publicly available.

Product Substitutes: Currently, there are limited direct substitutes for comprehensive baggage handling systems. However, airports may adopt piecemeal solutions or prioritize manual handling to address short-term needs. This significantly impacts the market competitiveness, depending on the nature of the contract and budget.

End-User Demographics: The primary end-users are airports of varying capacities, ranging from smaller regional airports to large international hubs. The segment of larger airports is the largest segment within this sector.

Airport Baggage Handling Systems Market in Europe Market Dynamics & Trends

The European airport baggage handling systems market is experiencing robust growth driven by factors like increasing passenger traffic, investments in airport infrastructure, and rising demand for efficient baggage handling solutions. The market is projected to grow at a CAGR of xx% during the forecast period (2025-2033). This growth is significantly driven by airport expansions and modernization projects across Europe.

Technological disruptions, such as the rise of autonomous systems and robotics, are transforming baggage handling. However, legacy systems and integration challenges can slow down the adoption of cutting-edge technologies. Consumer preferences towards a seamless travel experience are influencing the demand for faster and more reliable baggage handling. Intense competition among key players is driving innovation, price optimization, and improved services. The market penetration of automated baggage handling systems is steadily increasing, with a projected xx% penetration rate by 2033.

Dominant Regions & Segments in Airport Baggage Handling Systems Market in Europe

The report identifies Germany, the UK, and France as leading markets in Europe. The segment of airports with capacities above 40 Million passengers annually is the fastest growing segment.

Key Drivers for Dominant Regions:

- Germany: Strong economic growth, investments in airport infrastructure, and a high concentration of major airports.

- UK: Significant air passenger traffic, modernization initiatives, and focus on improving airport efficiency.

- France: Active airport development projects, government support for infrastructure upgrades, and strong domestic air travel.

Airport Capacity Segmentation:

- Up to 15 Million: This segment is characterized by a higher proportion of smaller, regional airports, focusing on cost-effective and scalable solutions.

- 15 - 25 Million: This segment represents a balance between smaller and larger airports, driving competition and product diversity.

- 25 - 40 Million: A growing segment with increasing demand for advanced automation and integration capabilities.

- Above 40 Million: This segment represents major international hubs, driving demand for high-capacity, sophisticated systems with advanced security features.

Airport Baggage Handling Systems Market in Europe Product Innovations

Recent product developments include the integration of AI-powered systems for predictive maintenance, improved baggage tracking technologies, and enhanced security screening capabilities. These innovations aim to optimize efficiency, enhance security, and improve the overall passenger experience. The focus is on systems that are scalable, modular, and adaptable to meet varying airport needs and future growth.

Report Scope & Segmentation Analysis

The report segments the market based on airport capacity: Up to 15 Million, 15-25 Million, 25-40 Million, and Above 40 Million passengers annually. Each segment's growth projections, market sizes, and competitive dynamics are analyzed. The data showcases differing demands and technological needs according to passenger volume, reflecting the complexity of the market. Detailed forecasts with specific values per segment are available within the full report.

Key Drivers of Airport Baggage Handling Systems Market in Europe Growth

The market's growth is driven by several factors: increasing passenger traffic, airport modernization initiatives, stringent security regulations, and technological advancements. The growing demand for enhanced passenger experiences and operational efficiency pushes airports to invest in advanced baggage handling systems.

Challenges in the Airport Baggage Handling Systems Market in Europe Sector

Challenges include high initial investment costs, integration complexities with existing systems, the need for skilled labor, and the evolving regulatory landscape. Supply chain disruptions can also affect project timelines and increase costs. These factors can restrict market growth in specific regions.

Emerging Opportunities in Airport Baggage Handling Systems Market in Europe

Emerging opportunities include the growing adoption of AI-powered solutions, integration with smart airport technologies, and the development of sustainable and energy-efficient systems. Focus on improved baggage tracking and real-time visibility is also driving new investments. The potential for expansion into smaller airports and developing markets within Europe also presents significant opportunities.

Leading Players in the Airport Baggage Handling Systems Market in Europe Market

- Vanderlande Industries B V

- Ammega Group BV

- BB Computerteknikk AS

- BEUMER Group

- Alstef Group SAS

- Siemens AG

- Lift All A

- Daifuku Co Ltd

- SITA

- PSI Logistics GmbH

Key Developments in Airport Baggage Handling Systems Market in Europe Industry

March 2023: Alstef Group secured an USD 11.06 Million contract to supply a new baggage handling system for Sofia Airport's Terminal 2, showcasing the ongoing demand for new system installations.

December 2022: Alstef Group won a contract to upgrade Strasbourg Airport's baggage handling system to meet EASA Standard 3.1 requirements, highlighting the importance of regulatory compliance and system upgrades in the market.

Future Outlook for Airport Baggage Handling Systems Market in Europe Market

The market is poised for continued growth, driven by increasing passenger numbers, airport expansion projects, and ongoing technological advancements. Strategic partnerships, technological innovation, and a focus on sustainability will be crucial for companies to succeed in this competitive market. The focus on improved passenger experience and operational efficiency will continue to drive investments in this sector throughout the forecast period.

Airport Baggage Handling Systems Market in Europe Segmentation

-

1. Airport Capacity

- 1.1. Up to 15 million

- 1.2. 15 - 25 million

- 1.3. 25 - 40 million

- 1.4. Above 40 Million

Airport Baggage Handling Systems Market in Europe Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Rest of Europe

Airport Baggage Handling Systems Market in Europe Regional Market Share

Geographic Coverage of Airport Baggage Handling Systems Market in Europe

Airport Baggage Handling Systems Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Above 40 Million Segment is Anticipated to Show Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Airport Baggage Handling Systems Market in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 5.1.1. Up to 15 million

- 5.1.2. 15 - 25 million

- 5.1.3. 25 - 40 million

- 5.1.4. Above 40 Million

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vanderlande Industries B V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ammega Group BV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BB Computerteknikk AS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BEUMER Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alstef Group SAS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lift All A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Daifuku Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SITA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PSI Logistics GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Vanderlande Industries B V

List of Figures

- Figure 1: Airport Baggage Handling Systems Market in Europe Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Airport Baggage Handling Systems Market in Europe Share (%) by Company 2025

List of Tables

- Table 1: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 2: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 4: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Germany Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of Europe Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airport Baggage Handling Systems Market in Europe?

The projected CAGR is approximately 13.14%.

2. Which companies are prominent players in the Airport Baggage Handling Systems Market in Europe?

Key companies in the market include Vanderlande Industries B V, Ammega Group BV, BB Computerteknikk AS, BEUMER Group, Alstef Group SAS, Siemens AG, Lift All A, Daifuku Co Ltd, SITA, PSI Logistics GmbH.

3. What are the main segments of the Airport Baggage Handling Systems Market in Europe?

The market segments include Airport Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 299.54 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Above 40 Million Segment is Anticipated to Show Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: Alstef Group, an automated airport solutions provider in France, signed a USD 11.06 million contract to supply a new baggage handling system for Sofia Airport's Terminal 2. Under the contract, the company will supply, install, and maintain the baggage handling solution with a capacity of up to 2,400 bags per hour.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airport Baggage Handling Systems Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airport Baggage Handling Systems Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airport Baggage Handling Systems Market in Europe?

To stay informed about further developments, trends, and reports in the Airport Baggage Handling Systems Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence