Key Insights

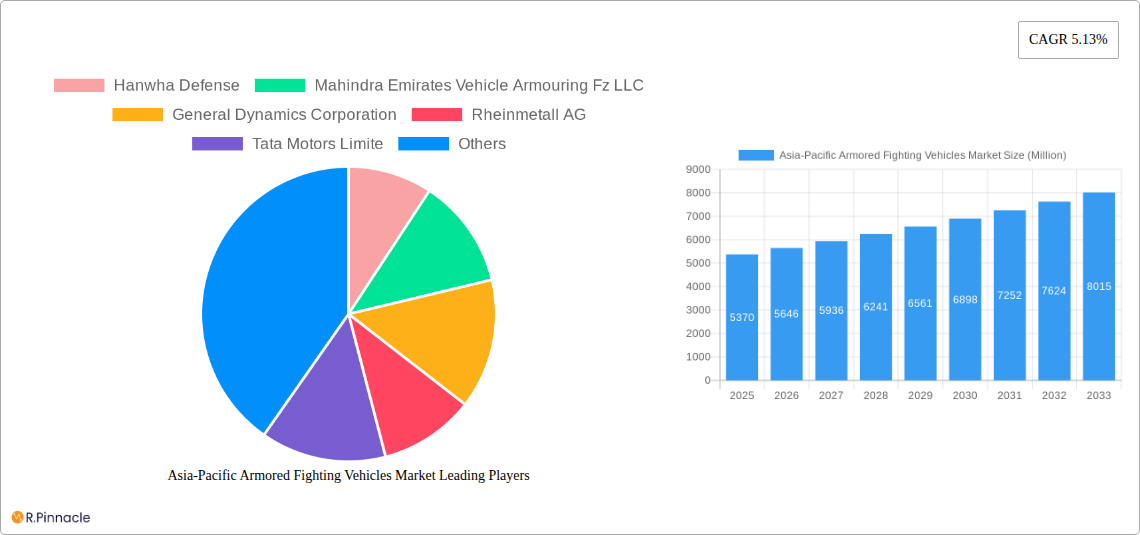

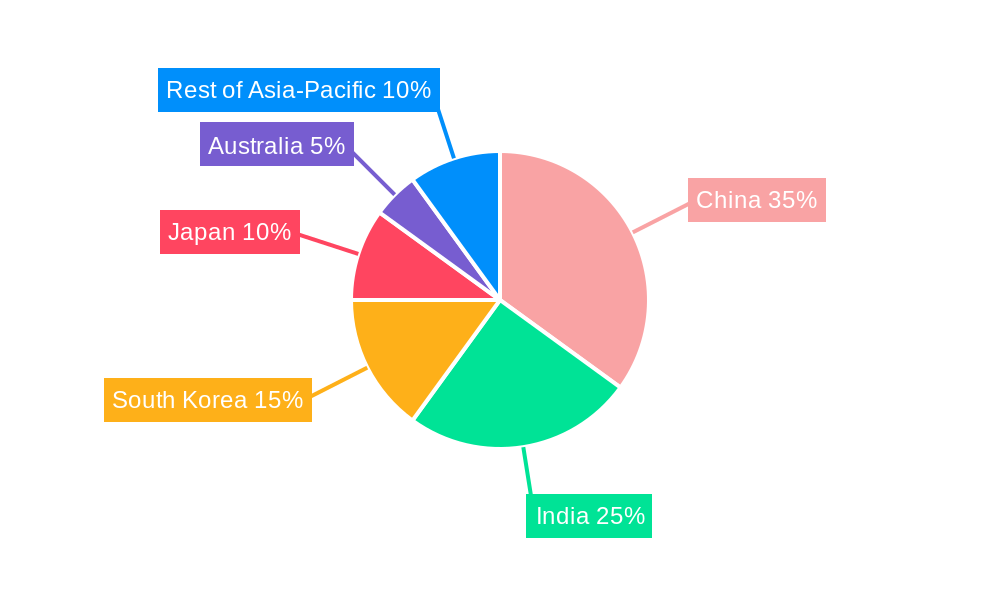

The Asia-Pacific Armored Fighting Vehicles (AFV) market, valued at $5.37 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions, modernization of armed forces across the region, and increasing cross-border conflicts. Key drivers include rising defense budgets in countries like India, China, and South Korea, coupled with a growing demand for advanced technological capabilities such as improved protection systems, enhanced mobility, and superior firepower in their AFVs. The market is segmented by vehicle type, with Armored Personnel Carriers (APCs), Infantry Fighting Vehicles (IFVs), and Main Battle Tanks (MBTs) representing significant portions of the market share. The substantial presence of major players like Hanwha Defense, General Dynamics, and BAE Systems, alongside regional manufacturers like Tata Motors and Mahindra, indicates a competitive landscape characterized by both global and local technological advancements. Continuous innovation in areas like hybrid propulsion systems, active protection systems, and unmanned combat capabilities are further shaping the market trajectory.

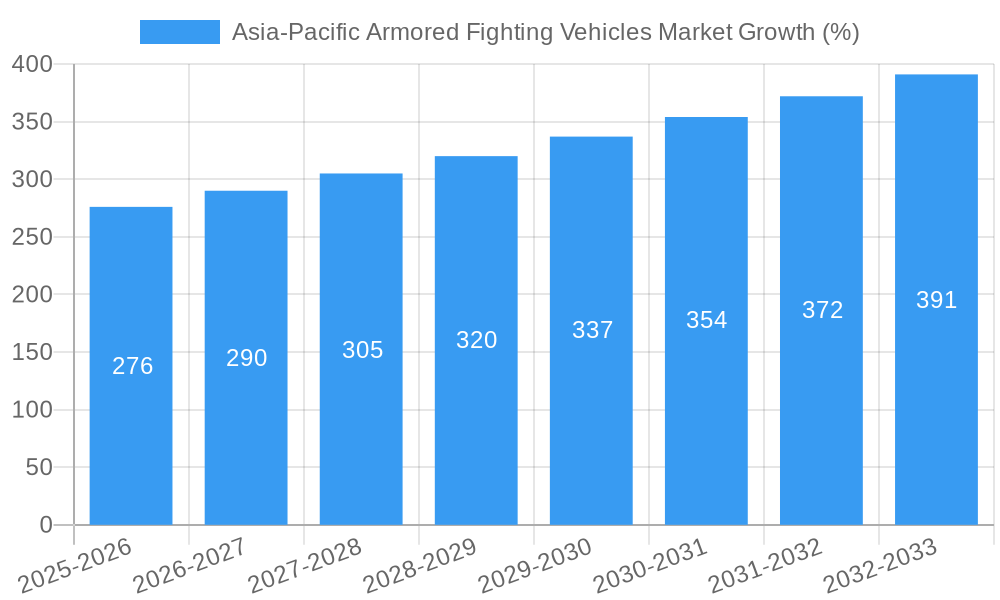

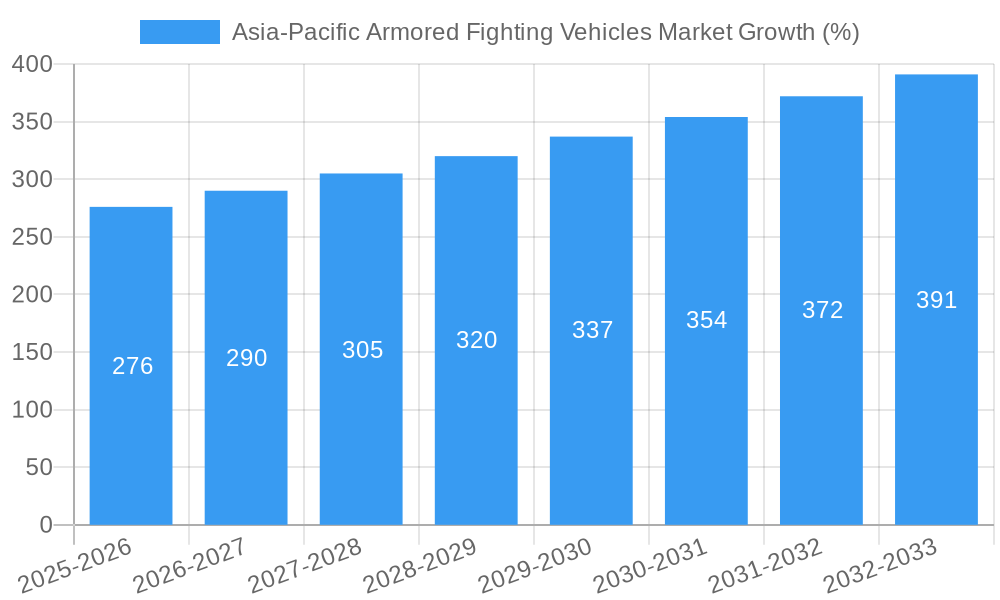

The forecast period (2025-2033) anticipates a Compound Annual Growth Rate (CAGR) of 5.13%, suggesting consistent expansion. This growth is expected to be fueled by the sustained modernization programs undertaken by numerous nations in the region. However, potential restraints include economic fluctuations influencing defense spending and the inherent complexities involved in technological integration and maintenance of advanced AFV systems. Despite these challenges, the long-term outlook for the Asia-Pacific AFV market remains positive, particularly given the strategic importance of regional security and the escalating demand for sophisticated military hardware. The increasing focus on asymmetric warfare and counter-insurgency operations is also likely to drive demand for versatile and adaptable AFV designs.

Asia-Pacific Armored Fighting Vehicles Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific Armored Fighting Vehicles (AFV) market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report utilizes data from the historical period (2019-2024) and incorporates key market developments to predict future trends. The market is segmented by type: Armored Personnel Carrier (APC), Infantry Fighting Vehicle (IFV), Main Battle Tank (MBT), and Other Types. Leading players include Hanwha Defense, Mahindra Emirates Vehicle Armouring Fz LLC, General Dynamics Corporation, Rheinmetall AG, Tata Motors Limited, FNSS Savunma Sistemleri AŞ, Kalyani Group, Patria Group, JSC Rosoboronexport (Rostec), BAE Systems plc, Krauss-Maffei Wegmann GmbH & Co KG, Defence Research and Development Organisation (DRDO), and Mitsubishi Heavy Industries Ltd. The report projects a market value of xx Million by 2033.

Asia-Pacific Armored Fighting Vehicles Market Structure & Innovation Trends

The Asia-Pacific AFV market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Market share data for 2024 indicates that [Insert estimated market share data for top 3-5 players]. Innovation is driven by the need for enhanced protection, mobility, and firepower, leading to the development of advanced technologies like active protection systems and advanced composite materials. Stringent regulatory frameworks, particularly concerning export controls and technology transfer, shape market dynamics. Product substitutes, such as unmanned ground vehicles (UGVs), are emerging, although they haven't significantly impacted the traditional AFV market yet. End-user demographics are primarily government defense forces and, to a lesser extent, paramilitary organizations. Mergers and acquisitions (M&A) activity has been moderate, with deal values totaling approximately xx Million in the past five years. Examples include [Insert examples of recent M&A activity with values if available, otherwise state "limited publicly available data"].

Asia-Pacific Armored Fighting Vehicles Market Market Dynamics & Trends

The Asia-Pacific AFV market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by increasing geopolitical tensions, modernization of defense forces, and rising defense budgets across the region. Technological disruptions, such as the integration of AI and autonomous systems, are expected to shape the future of AFVs, although full automation is still some years away. Consumer preferences, in this context, reflect a demand for lighter, more agile vehicles with enhanced survivability. Competitive dynamics are characterized by intense rivalry among both domestic and international players. Market penetration of advanced technologies like active protection systems is steadily increasing, yet faces challenges related to cost and technological maturity.

Dominant Regions & Segments in Asia-Pacific Armored Fighting Vehicles Market

Dominant Region: [Specify the leading region in APAC - e.g., Northeast Asia, South Asia]. This dominance is attributed to [Explain the reasons for dominance, e.g., high defense spending, strategic geopolitical location, robust domestic manufacturing].

Dominant Segments:

- Main Battle Tanks (MBTs): The MBT segment holds the largest market share, driven by the continuous demand for superior firepower and battlefield dominance. Several countries in the region, including [List countries], are actively upgrading their MBT fleets.

- Armored Personnel Carriers (APCs): APCs constitute a significant portion of the market due to their versatility in troop transport and support roles. The demand is driven by modernization programs and an increasing need for mechanized infantry capabilities. [List countries with notable APC modernization programs].

- Infantry Fighting Vehicles (IFVs): The IFV segment demonstrates notable growth potential, fueled by the need for enhanced protection and firepower for infantry units. Ongoing procurement initiatives by [List countries] contribute significantly to market expansion.

- Other Types: This segment includes specialized vehicles like reconnaissance vehicles and self-propelled artillery, which show moderate but steady growth.

Asia-Pacific Armored Fighting Vehicles Market Product Innovations

Recent product innovations in the Asia-Pacific AFV market focus on improved protection, mobility, and lethality. This includes the integration of advanced composite materials, active protection systems, and enhanced fire control systems. There's a growing emphasis on modularity and adaptability to cater to diverse operational needs. These innovations enhance the competitive advantages of manufacturers by offering superior performance and cost-effectiveness compared to older designs. Technological trends point towards increased autonomy and the integration of advanced sensors and communication systems.

Report Scope & Segmentation Analysis

Armored Personnel Carrier (APC): The APC segment is expected to witness significant growth, driven by increasing demand from militaries seeking to enhance troop mobility and protection. Market size in 2025 is estimated at xx Million. Competitive dynamics are shaped by both established and emerging players, vying to offer innovative features and cost-effective solutions.

Infantry Fighting Vehicle (IFV): The IFV market showcases robust growth potential, largely driven by modernization programs of several countries focusing on enhancing their mechanized infantry capabilities. The 2025 market size is estimated at xx Million. Key players focus on developing IFVs with advanced protection systems and firepower.

Main Battle Tank (MBT): The MBT segment dominates the market in terms of value, driven by continuous modernization efforts and the need for superior firepower. The 2025 market size is projected to be xx Million. Competition is fierce among major players, emphasizing advanced technologies and customized solutions.

Other Types: This segment, encompassing specialized vehicles, showcases steady growth driven by specific military requirements. The 2025 market size is estimated at xx Million. Niche players and specialized manufacturers are key competitors in this area.

Key Drivers of Asia-Pacific Armored Fighting Vehicles Market Growth

Several factors drive the Asia-Pacific AFV market's expansion. These include escalating geopolitical tensions leading to increased defense spending, modernization initiatives by regional militaries aiming to improve their combat capabilities, and the growing adoption of advanced technologies enhancing AFV performance. Technological advancements in areas such as active protection systems, composite armor, and enhanced fire control systems further boost market growth. Government regulations and policies promoting indigenous defense manufacturing contribute to the sector's expansion.

Challenges in the Asia-Pacific Armored Fighting Vehicles Market Sector

Challenges facing the Asia-Pacific AFV market include high acquisition costs, which can strain defense budgets. Supply chain disruptions, particularly regarding critical components and raw materials, can lead to production delays and increased costs. Intense competition among domestic and international manufacturers puts pressure on pricing and margins. Stringent export controls and regulations can hinder technology transfer and collaborations. The shift towards unmanned and autonomous systems presents both opportunities and challenges.

Emerging Opportunities in Asia-Pacific Armored Fighting Vehicles Market

Emerging opportunities include the increasing demand for lightweight and agile AFVs suitable for diverse terrains. The development of hybrid and electric propulsion systems offers potential for improved fuel efficiency and reduced emissions. There’s a growing interest in integrating advanced sensors, communication systems, and AI for enhanced situational awareness and battlefield management. New markets are opening up in countries modernizing their armed forces.

Leading Players in the Asia-Pacific Armored Fighting Vehicles Market Market

- Hanwha Defense

- Mahindra Emirates Vehicle Armouring Fz LLC

- General Dynamics Corporation

- Rheinmetall AG

- Tata Motors Limited

- FNSS Savunma Sistemleri AŞ

- Kalyani Group

- Patria Group

- JSC Rosoboronexport (Rostec)

- BAE Systems plc

- Krauss-Maffei Wegmann GmbH & Co KG

- Defence Research and Development Organisation (DRDO)

- Mitsubishi Heavy Industries Ltd

Key Developments in Asia-Pacific Armored Fighting Vehicles Market Industry

- June 2023: South Korea announced the mass production of additional K2 Black Panther main battle tanks for an estimated USD 1.46 Billion, boosting the MBT segment and solidifying South Korea's position as a major AFV producer.

- December 2022: Japan selected Patria-built armored modular vehicles (AMV) to replace its Type-96 8X8 wheeled armored personnel carriers, highlighting the growing adoption of modular designs and boosting Patria's market presence.

Future Outlook for Asia-Pacific Armored Fighting Vehicles Market Market

The Asia-Pacific AFV market is poised for continued growth, driven by persistent geopolitical uncertainties, ongoing military modernization efforts, and the integration of advanced technologies. Strategic opportunities lie in developing lighter, more agile vehicles with advanced protection and firepower, alongside integrating AI and autonomous features. The market's future success will depend on manufacturers' ability to adapt to evolving technological advancements and meet the specific needs of diverse regional militaries.

Asia-Pacific Armored Fighting Vehicles Market Segmentation

-

1. Type

- 1.1. Armored Personnel Carrier (APC)

- 1.2. Infantry Fighting Vehicle (IFV)

- 1.3. Main Battle Tank (MBT)

- 1.4. Other Types

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Australia

- 2.6. Singapore

- 2.7. Rest of Asia-Pacific

Asia-Pacific Armored Fighting Vehicles Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Australia

- 6. Singapore

- 7. Rest of Asia Pacific

Asia-Pacific Armored Fighting Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.13% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Main Battle Tank Segment is Expected to Lead the Market during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Armored Fighting Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Armored Personnel Carrier (APC)

- 5.1.2. Infantry Fighting Vehicle (IFV)

- 5.1.3. Main Battle Tank (MBT)

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Australia

- 5.2.6. Singapore

- 5.2.7. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Australia

- 5.3.6. Singapore

- 5.3.7. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Armored Fighting Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Armored Personnel Carrier (APC)

- 6.1.2. Infantry Fighting Vehicle (IFV)

- 6.1.3. Main Battle Tank (MBT)

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Australia

- 6.2.6. Singapore

- 6.2.7. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia-Pacific Armored Fighting Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Armored Personnel Carrier (APC)

- 7.1.2. Infantry Fighting Vehicle (IFV)

- 7.1.3. Main Battle Tank (MBT)

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Australia

- 7.2.6. Singapore

- 7.2.7. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Armored Fighting Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Armored Personnel Carrier (APC)

- 8.1.2. Infantry Fighting Vehicle (IFV)

- 8.1.3. Main Battle Tank (MBT)

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Australia

- 8.2.6. Singapore

- 8.2.7. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Korea Asia-Pacific Armored Fighting Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Armored Personnel Carrier (APC)

- 9.1.2. Infantry Fighting Vehicle (IFV)

- 9.1.3. Main Battle Tank (MBT)

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Australia

- 9.2.6. Singapore

- 9.2.7. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Australia Asia-Pacific Armored Fighting Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Armored Personnel Carrier (APC)

- 10.1.2. Infantry Fighting Vehicle (IFV)

- 10.1.3. Main Battle Tank (MBT)

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Australia

- 10.2.6. Singapore

- 10.2.7. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Singapore Asia-Pacific Armored Fighting Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Armored Personnel Carrier (APC)

- 11.1.2. Infantry Fighting Vehicle (IFV)

- 11.1.3. Main Battle Tank (MBT)

- 11.1.4. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. China

- 11.2.2. India

- 11.2.3. Japan

- 11.2.4. South Korea

- 11.2.5. Australia

- 11.2.6. Singapore

- 11.2.7. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Asia Pacific Asia-Pacific Armored Fighting Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Armored Personnel Carrier (APC)

- 12.1.2. Infantry Fighting Vehicle (IFV)

- 12.1.3. Main Battle Tank (MBT)

- 12.1.4. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. China

- 12.2.2. India

- 12.2.3. Japan

- 12.2.4. South Korea

- 12.2.5. Australia

- 12.2.6. Singapore

- 12.2.7. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. China Asia-Pacific Armored Fighting Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 14. Japan Asia-Pacific Armored Fighting Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 15. India Asia-Pacific Armored Fighting Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 16. South Korea Asia-Pacific Armored Fighting Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 17. Taiwan Asia-Pacific Armored Fighting Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 18. Australia Asia-Pacific Armored Fighting Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Asia-Pacific Asia-Pacific Armored Fighting Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Hanwha Defense

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Mahindra Emirates Vehicle Armouring Fz LLC

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 General Dynamics Corporation

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Rheinmetall AG

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Tata Motors Limite

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 FNSS Savunma Sistemleri AŞ

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Kalyani Group

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Patria Group

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 JSC Rosoboronexport (Rostec)

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 BAE Systems plc

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.11 Krauss-Maffei Wegmann GmbH & Co KG

- 20.2.11.1. Overview

- 20.2.11.2. Products

- 20.2.11.3. SWOT Analysis

- 20.2.11.4. Recent Developments

- 20.2.11.5. Financials (Based on Availability)

- 20.2.12 Defence Research and Development Organisation (DRDO)

- 20.2.12.1. Overview

- 20.2.12.2. Products

- 20.2.12.3. SWOT Analysis

- 20.2.12.4. Recent Developments

- 20.2.12.5. Financials (Based on Availability)

- 20.2.13 Mitsubishi Heavy Industries Ltd

- 20.2.13.1. Overview

- 20.2.13.2. Products

- 20.2.13.3. SWOT Analysis

- 20.2.13.4. Recent Developments

- 20.2.13.5. Financials (Based on Availability)

- 20.2.1 Hanwha Defense

List of Figures

- Figure 1: Asia-Pacific Armored Fighting Vehicles Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Armored Fighting Vehicles Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific Armored Fighting Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific Armored Fighting Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific Armored Fighting Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific Armored Fighting Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific Armored Fighting Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific Armored Fighting Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific Armored Fighting Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 27: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 29: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Asia-Pacific Armored Fighting Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Armored Fighting Vehicles Market?

The projected CAGR is approximately 5.13%.

2. Which companies are prominent players in the Asia-Pacific Armored Fighting Vehicles Market?

Key companies in the market include Hanwha Defense, Mahindra Emirates Vehicle Armouring Fz LLC, General Dynamics Corporation, Rheinmetall AG, Tata Motors Limite, FNSS Savunma Sistemleri AŞ, Kalyani Group, Patria Group, JSC Rosoboronexport (Rostec), BAE Systems plc, Krauss-Maffei Wegmann GmbH & Co KG, Defence Research and Development Organisation (DRDO), Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Asia-Pacific Armored Fighting Vehicles Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.37 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Main Battle Tank Segment is Expected to Lead the Market during the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2023: South Korea announced the mass production of additional K2 Black Panther main battle tanks for an estimated USD 1.46 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Armored Fighting Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Armored Fighting Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Armored Fighting Vehicles Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Armored Fighting Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence