Key Insights

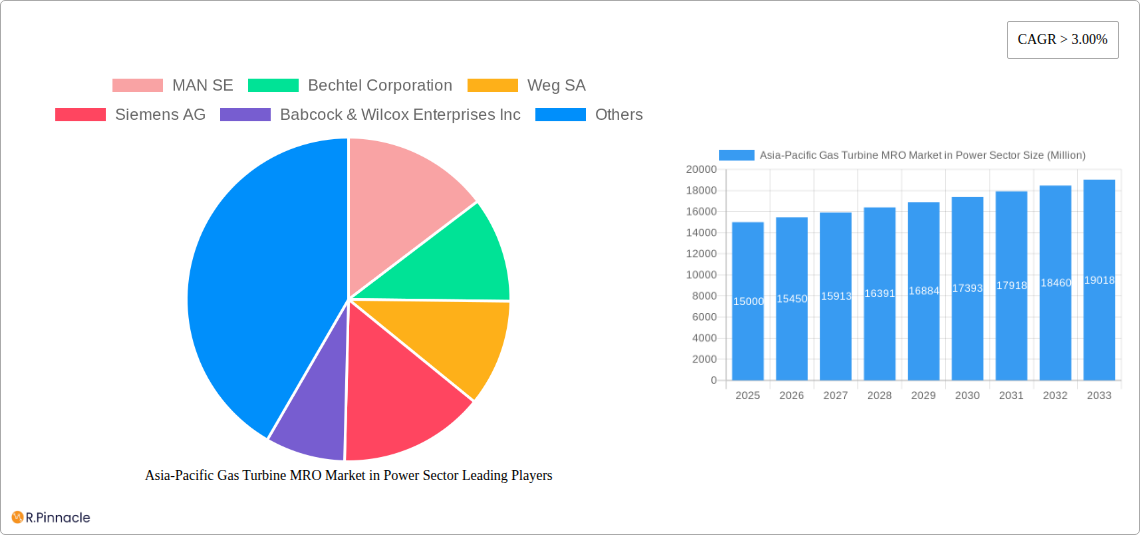

The Asia-Pacific gas turbine MRO (Maintenance, Repair, and Overhaul) market within the power sector is experiencing robust growth, driven by the increasing age of existing gas turbine fleets and the rising demand for reliable power generation across the region. A significant portion of this growth is attributed to the expanding power generation capacity in rapidly developing economies like China, India, and South Korea, necessitating extensive maintenance and repair services for their aging infrastructure. Furthermore, stringent environmental regulations promoting cleaner energy sources are indirectly boosting the market as older, less efficient turbines require more frequent MRO to meet compliance standards. The market is segmented by service type, primarily encompassing maintenance, repair, and overhaul services. Key players, including MAN SE, Bechtel Corporation, Siemens AG, and others, are strategically investing in advanced technologies and expanding their service capabilities to capitalize on this growing opportunity. The market's trajectory is influenced by factors like technological advancements in MRO services, the increasing adoption of digital technologies for predictive maintenance, and government initiatives supporting the modernization of power infrastructure. However, challenges such as the high cost of MRO services and the potential for disruptions due to geopolitical instability and supply chain complexities pose restraints on market growth.

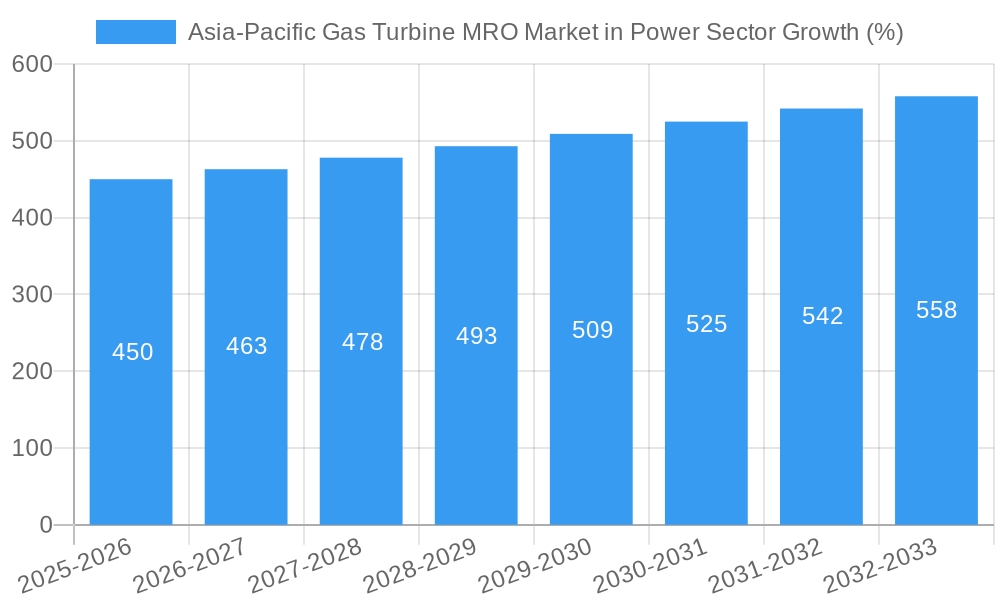

Based on a CAGR exceeding 3% from 2019 to 2024 and projecting a similar rate for the forecast period, the Asia-Pacific gas turbine MRO market in the power sector is poised for continued expansion. The market size in 2025 is estimated to be significant, considering the already established presence of major players and the continuous growth drivers within the region. This growth will be fueled by several key factors, including the aging gas turbine fleet, the increasing adoption of digital technologies for predictive maintenance, and continued investments in renewable energy infrastructure. The dominance of China, India, Japan, and South Korea in the region's energy consumption will continue to drive demand. However, economic fluctuations and technological advancements will be crucial factors influencing the pace of expansion.

Asia-Pacific Gas Turbine MRO Market in Power Sector: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific Gas Turbine Maintenance, Repair, and Overhaul (MRO) market within the power sector, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities. The study encompasses detailed segmentation analysis, competitive landscape evaluation, and regional breakdowns, providing a 360-degree view of this dynamic market.

Asia-Pacific Gas Turbine MRO Market in Power Sector Market Structure & Innovation Trends

This section analyzes the market structure of the Asia-Pacific Gas Turbine MRO market in the power sector, focusing on market concentration, innovation, and regulatory influences. We examine the competitive landscape, identifying key players and their market share, as well as assessing the impact of mergers and acquisitions (M&A) activities. The report delves into the role of innovation in driving market growth, highlighting technological advancements and their implications for market participants. Furthermore, the influence of regulatory frameworks and the presence of substitute products are thoroughly explored. Finally, an analysis of end-user demographics helps paint a complete picture of this complex market.

- Market Concentration: The market exhibits a moderately concentrated structure with a few dominant players holding significant market share (e.g., General Electric holds approximately xx% of the market share in 2025). Smaller players and niche service providers constitute the remaining portion of the market.

- Innovation Drivers: Technological advancements such as digitalization, predictive maintenance, and advanced materials are primary innovation drivers, significantly impacting operational efficiency and reducing downtime.

- Regulatory Framework: Stringent environmental regulations, coupled with the increasing demand for efficient and reliable power generation, are shaping the market's trajectory.

- Product Substitutes: The emergence of renewable energy sources presents a competitive challenge to traditional gas turbine technologies. However, gas turbines still play a crucial role in meeting peak demand and providing grid stability.

- End-User Demographics: The key end-users are power generation companies, independent power producers (IPPs), and government-owned utilities. The market is largely driven by the increasing demand for electricity in rapidly developing economies.

- M&A Activity: The last five years have witnessed xx M&A deals valued at approximately $xx Million, primarily driven by strategic expansion and consolidation efforts.

Asia-Pacific Gas Turbine MRO Market in Power Sector Market Dynamics & Trends

This section explores the market dynamics influencing the Asia-Pacific Gas Turbine MRO market in the power sector. We examine factors driving market growth, the impact of technological disruptions, evolving consumer preferences, and the competitive landscape. Key metrics, such as the Compound Annual Growth Rate (CAGR) and market penetration, are analyzed to provide a clear understanding of the market's trajectory. The study covers a range of topics from advancements in maintenance technologies to the increasing need for power reliability in fast-growing Asian economies. Changes in government policies and environmental regulations, and their influence on market behavior are analyzed in detail.

- The market is projected to witness a CAGR of xx% during the forecast period (2025-2033).

- Market penetration of advanced maintenance technologies is expected to reach xx% by 2033.

- Key growth drivers include rising electricity demand, aging gas turbine fleets requiring extensive MRO services, and government initiatives promoting energy efficiency.

- Competitive dynamics are shaped by factors such as pricing strategies, technological innovations, and service offerings of leading market players.

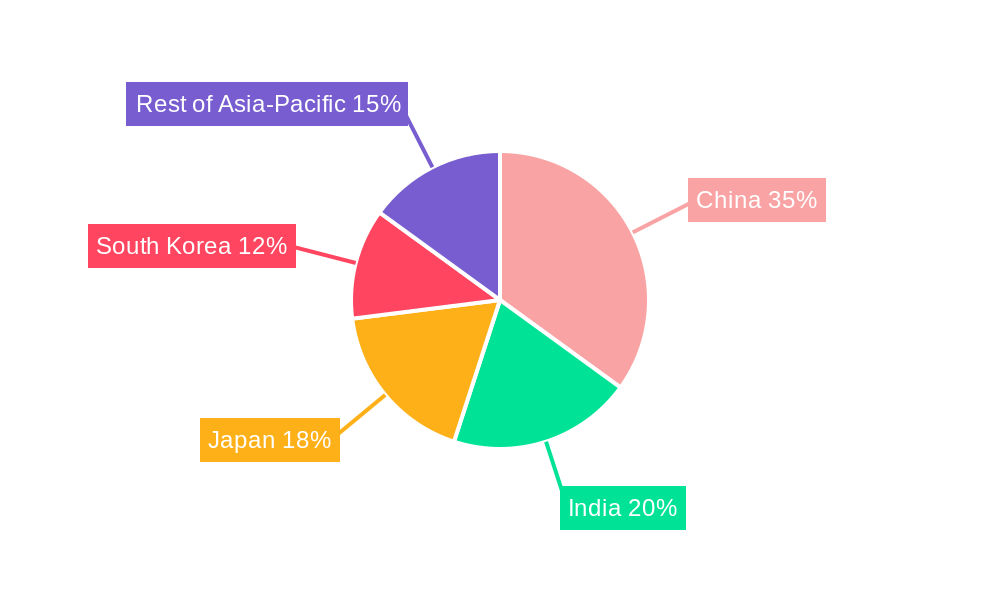

Dominant Regions & Segments in Asia-Pacific Gas Turbine MRO Market in Power Sector

This section identifies the dominant regions, countries, and segments within the Asia-Pacific Gas Turbine MRO market in the power sector, specifically focusing on Service Type: Maintenance, Repair, and Overhaul. We provide in-depth analysis of the key factors driving dominance in these regions and segments, highlighting economic policies, infrastructure development, and other relevant factors.

- Leading Region: China is currently the dominant region, driven by substantial investments in power generation infrastructure and a large installed base of gas turbines.

- Leading Country: Within China, key provinces such as Guangdong and Jiangsu exhibit significant growth potential owing to robust industrialization and urbanization.

- Leading Service Type: The Maintenance segment currently holds the largest market share, followed by Repair and Overhaul. This is attributed to the emphasis on preventative maintenance to reduce unexpected downtime and ensure optimal operational efficiency.

Key Drivers for Dominance in China:

- Significant investments in power generation infrastructure to meet the growing electricity demand.

- A large installed base of gas turbines requiring regular maintenance, repair, and overhaul services.

- Favorable government policies promoting energy efficiency and sustainable power generation.

- Rapid industrialization and urbanization leading to increased electricity consumption.

Asia-Pacific Gas Turbine MRO Market in Power Sector Product Innovations

Recent product innovations in the Asia-Pacific gas turbine MRO market have focused on enhancing efficiency, reliability, and reducing environmental impact. This includes the development of advanced diagnostic tools for predictive maintenance, the adoption of digital technologies for remote monitoring, and the introduction of innovative repair techniques to minimize downtime. These innovations are aligned with the industry's move towards more sustainable and efficient operations.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific Gas Turbine MRO market in the power sector by service type: Maintenance, Repair, and Overhaul. Each segment’s market size, growth projections, and competitive landscape are analyzed.

Maintenance: This segment is characterized by high volume, recurring revenue streams, and focuses on preventative measures to optimize equipment lifespan. Market size in 2025 is estimated at $xx Million, with an anticipated growth to $xx Million by 2033.

Repair: This segment focuses on addressing equipment malfunctions and restoring functionality. Market size in 2025 is estimated at $xx Million, with projected growth to $xx Million by 2033. Competitive intensity in this segment is high due to the specialized skills and expertise required.

Overhaul: This segment involves extensive refurbishment of gas turbines, often extending their operational lifespan. Market size in 2025 is estimated at $xx Million, with a projected growth to $xx Million by 2033. This segment is typically characterized by larger contracts and longer lead times.

Key Drivers of Asia-Pacific Gas Turbine MRO Market in Power Sector Growth

Several factors are driving the growth of the Asia-Pacific gas turbine MRO market. These include:

- The increasing demand for electricity in rapidly developing economies.

- The aging gas turbine fleet necessitates regular maintenance and repairs.

- Government initiatives and policies supporting energy efficiency and renewable integration.

- Technological advancements enabling enhanced efficiency, reliability, and reduced emissions.

Challenges in the Asia-Pacific Gas Turbine MRO Market in Power Sector Sector

The Asia-Pacific gas turbine MRO market faces several challenges including:

- The competitive landscape with many players vying for market share.

- Supply chain disruptions impacting the availability of spare parts and components.

- Stringent environmental regulations demanding compliance and potentially impacting operational costs.

- The increasing adoption of renewable energy sources, potentially reducing the overall demand for gas turbines.

Emerging Opportunities in Asia-Pacific Gas Turbine MRO Market in Power Sector

Despite challenges, several promising opportunities exist for growth:

- The increasing adoption of digital technologies, including predictive maintenance and remote monitoring, offers potential for cost savings and enhanced efficiency.

- The growth of the renewable energy sector creates opportunities for MRO services in hybrid power systems that integrate gas turbines and renewables.

- The need for experienced professionals to support the operation and maintenance of complex gas turbine systems generates demand for skilled labor.

Leading Players in the Asia-Pacific Gas Turbine MRO Market in Power Sector Market

- MAN SE

- Bechtel Corporation

- Weg SA

- Siemens AG

- Babcock & Wilcox Enterprises Inc

- John Wood Group PLC

- Sulzer AG

- General Electric Company

- Flour Corporation

- Mitsubishi Heavy Industries Ltd

- Rolls-Royce Holding PLC

Key Developments in Asia-Pacific Gas Turbine MRO Market in Power Sector Industry

- Q1 2023: Siemens AG launched a new digital platform for predictive maintenance of gas turbines.

- Q3 2022: General Electric and Mitsubishi Heavy Industries Ltd announced a strategic partnership for gas turbine MRO services in Southeast Asia.

- Q4 2021: Several significant M&A activities occurred within the industry, leading to consolidation among market players. (Specific details and companies to be added based on data)

Future Outlook for Asia-Pacific Gas Turbine MRO Market in Power Sector Market

The future outlook for the Asia-Pacific gas turbine MRO market is positive, driven by sustained growth in electricity demand, the continued need for reliable power generation, and technological advancements enabling improved efficiency and sustainability. While renewable energy sources will play an increasingly important role, gas turbines will remain a critical component of the power generation mix, ensuring stability and meeting peak demands. This implies continued robust demand for MRO services in the coming years, creating significant opportunities for market players to capitalize on innovation, technological improvements, and strategic partnerships.

Asia-Pacific Gas Turbine MRO Market in Power Sector Segmentation

-

1. Service Type

- 1.1. Maintenance

- 1.2. Repair

- 1.3. Overhaul

-

2. Geography

- 2.1. China

- 2.2. Japan

- 2.3. India

- 2.4. Rest of Asia-Pacific

Asia-Pacific Gas Turbine MRO Market in Power Sector Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Rest of Asia Pacific

Asia-Pacific Gas Turbine MRO Market in Power Sector REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies and Incentives4.; Environmental Concerns

- 3.3. Market Restrains

- 3.3.1. 4.; Fossil Fuel Subsidies

- 3.4. Market Trends

- 3.4.1. Maintenance Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Gas Turbine MRO Market in Power Sector Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Maintenance

- 5.1.2. Repair

- 5.1.3. Overhaul

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. Japan

- 5.2.3. India

- 5.2.4. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. China Asia-Pacific Gas Turbine MRO Market in Power Sector Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Maintenance

- 6.1.2. Repair

- 6.1.3. Overhaul

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. Japan

- 6.2.3. India

- 6.2.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Japan Asia-Pacific Gas Turbine MRO Market in Power Sector Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Maintenance

- 7.1.2. Repair

- 7.1.3. Overhaul

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. Japan

- 7.2.3. India

- 7.2.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. India Asia-Pacific Gas Turbine MRO Market in Power Sector Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Maintenance

- 8.1.2. Repair

- 8.1.3. Overhaul

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. Japan

- 8.2.3. India

- 8.2.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of Asia Pacific Asia-Pacific Gas Turbine MRO Market in Power Sector Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Maintenance

- 9.1.2. Repair

- 9.1.3. Overhaul

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. Japan

- 9.2.3. India

- 9.2.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. China Asia-Pacific Gas Turbine MRO Market in Power Sector Analysis, Insights and Forecast, 2019-2031

- 11. Japan Asia-Pacific Gas Turbine MRO Market in Power Sector Analysis, Insights and Forecast, 2019-2031

- 12. India Asia-Pacific Gas Turbine MRO Market in Power Sector Analysis, Insights and Forecast, 2019-2031

- 13. South Korea Asia-Pacific Gas Turbine MRO Market in Power Sector Analysis, Insights and Forecast, 2019-2031

- 14. Taiwan Asia-Pacific Gas Turbine MRO Market in Power Sector Analysis, Insights and Forecast, 2019-2031

- 15. Australia Asia-Pacific Gas Turbine MRO Market in Power Sector Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia-Pacific Asia-Pacific Gas Turbine MRO Market in Power Sector Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 MAN SE

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Bechtel Corporation

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Weg SA

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Siemens AG

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Babcock & Wilcox Enterprises Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 John Wood Group PLC

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Sulzer AG

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 General Electric Company

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Flour Corporation

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Mitsubishi Heavy Industries Ltd

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Rolls-Royce Holding PLC

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.1 MAN SE

List of Figures

- Figure 1: Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Gas Turbine MRO Market in Power Sector Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue Million Forecast, by Service Type 2019 & 2032

- Table 14: Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue Million Forecast, by Service Type 2019 & 2032

- Table 17: Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue Million Forecast, by Service Type 2019 & 2032

- Table 20: Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue Million Forecast, by Service Type 2019 & 2032

- Table 23: Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Asia-Pacific Gas Turbine MRO Market in Power Sector Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Gas Turbine MRO Market in Power Sector?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Asia-Pacific Gas Turbine MRO Market in Power Sector?

Key companies in the market include MAN SE, Bechtel Corporation, Weg SA, Siemens AG, Babcock & Wilcox Enterprises Inc, John Wood Group PLC, Sulzer AG, General Electric Company, Flour Corporation, Mitsubishi Heavy Industries Ltd, Rolls-Royce Holding PLC.

3. What are the main segments of the Asia-Pacific Gas Turbine MRO Market in Power Sector?

The market segments include Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies and Incentives4.; Environmental Concerns.

6. What are the notable trends driving market growth?

Maintenance Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Fossil Fuel Subsidies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Gas Turbine MRO Market in Power Sector," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Gas Turbine MRO Market in Power Sector report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Gas Turbine MRO Market in Power Sector?

To stay informed about further developments, trends, and reports in the Asia-Pacific Gas Turbine MRO Market in Power Sector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence