Key Insights

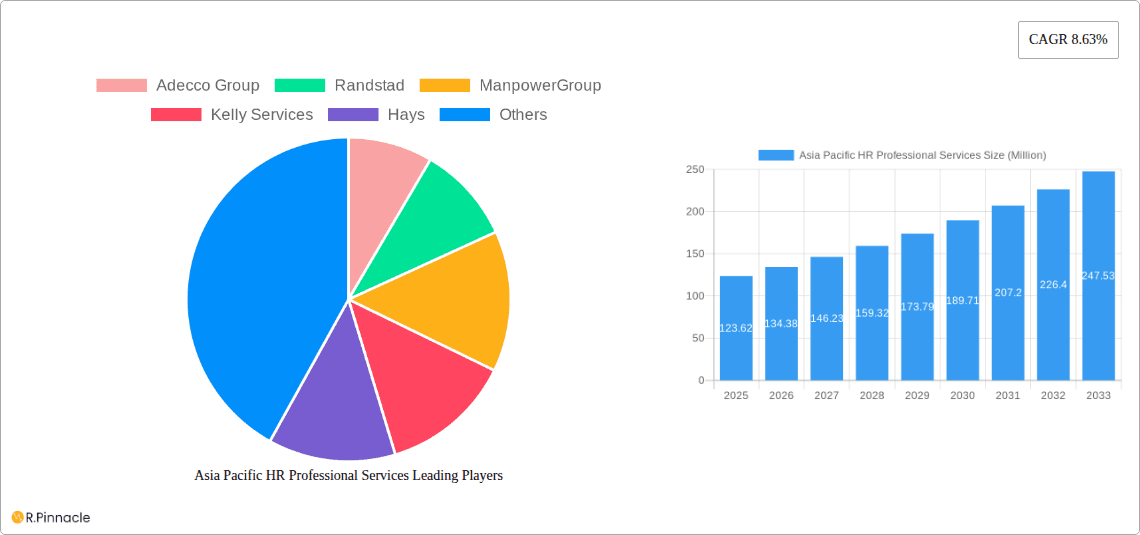

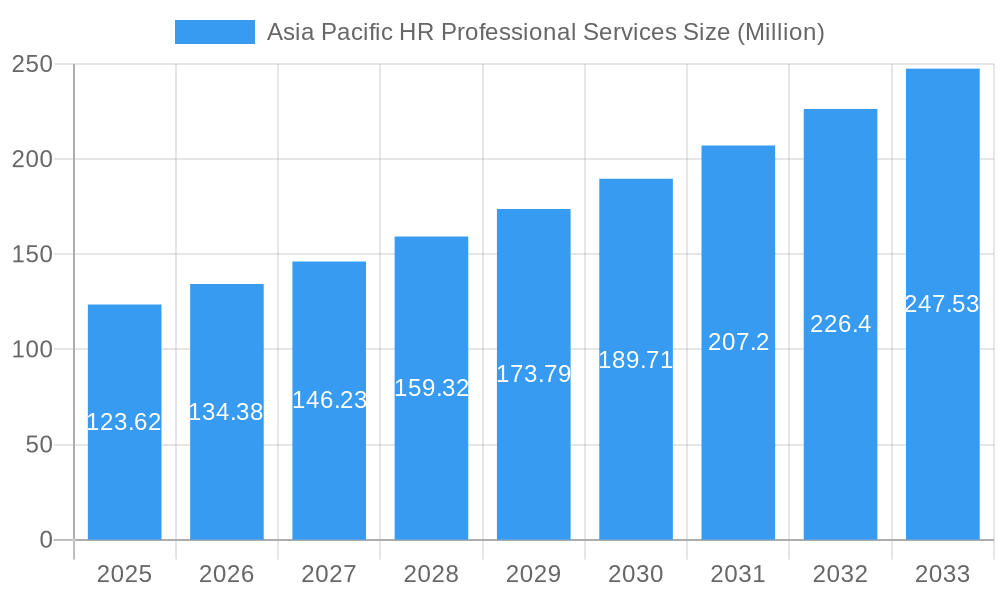

The Asia Pacific HR professional services market, valued at $123.62 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.63% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing adoption of advanced technologies like AI and automation within HR functions is streamlining processes and boosting efficiency, creating demand for specialized consulting services. Secondly, a growing emphasis on employee experience and engagement is leading organizations to invest more in talent acquisition, training, and development programs. Furthermore, the region's dynamic economic landscape, characterized by rapid urbanization and a burgeoning middle class, fuels the need for skilled workforce management, directly impacting the demand for HR professional services. Finally, the increasing prevalence of remote work and gig economy models requires sophisticated HR solutions for talent management and compliance, driving market growth further.

Asia Pacific HR Professional Services Market Size (In Million)

The competitive landscape is marked by the presence of both global giants like Adecco Group, Randstad, and ManpowerGroup, and regional players catering to specific market niches. These firms are constantly innovating to offer comprehensive solutions encompassing recruitment, payroll, benefits administration, and talent management consulting. However, market growth might face some headwinds, potentially from economic slowdowns, intense competition, and variations in regulatory environments across the diverse nations within the Asia-Pacific region. The segmentation of the market (which wasn't provided) is crucial to understand nuanced growth trends. For example, specializations like executive search or HR technology implementation might exhibit different growth rates than generalist HR services. A thorough analysis of these segments would provide a more granular perspective on future market opportunities.

Asia Pacific HR Professional Services Company Market Share

Asia Pacific HR Professional Services Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia Pacific HR professional services market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a robust understanding of the current market landscape and future growth trajectory. The report covers key players such as Adecco Group, Randstad, ManpowerGroup, Kelly Services, Hays, Robert Half, Allegis Group, Hudson, Michael Page, and Mercer, and analyzes market dynamics, innovation trends, and emerging opportunities across various segments. The total market value is projected to reach xx Million by 2033.

Asia Pacific HR Professional Services Market Structure & Innovation Trends

The Asia Pacific HR professional services market exhibits a moderately concentrated structure, with the top 10 players holding an estimated xx% market share in 2025. Market concentration is driven by factors such as economies of scale, brand recognition, and global networks. Key innovation drivers include advancements in HR technology (HR Tech), increasing demand for specialized talent solutions, and evolving regulatory landscapes.

- Market Concentration: Top 10 players hold approximately xx% market share (2025).

- Innovation Drivers: Advancements in AI-powered recruitment, data analytics for workforce planning, and digital learning platforms.

- Regulatory Frameworks: Compliance requirements related to data privacy, labor laws, and equal opportunities are shaping market practices.

- M&A Activities: The past five years have witnessed a significant number of M&A deals valued at approximately xx Million, reflecting strategic consolidation and expansion efforts within the sector. Notable deals include (examples of specific deals and values would be added here if available, otherwise replace with 'Further detailed M&A analysis available in the full report').

- Product Substitutes: The increasing use of in-house HR functions and freelance platforms presents a competitive threat.

- End-User Demographics: The market is driven by the increasing demand from diverse industries including technology, healthcare, finance and manufacturing.

Asia Pacific HR Professional Services Market Dynamics & Trends

The Asia Pacific HR professional services market is experiencing robust and dynamic growth, propelled by a confluence of strategic drivers. The Compound Annual Growth Rate (CAGR) is projected to reach an impressive xx% from 2025 to 2033, indicating significant expansion opportunities. This upward trajectory is primarily fueled by:

- An escalating demand for highly specialized skills across a diverse range of industries, a direct response to evolving business needs and technological advancements.

- The accelerating adoption of sophisticated HR technology solutions, enabling greater automation, efficiency, and data-driven decision-making.

- A heightened and critical focus on enhancing employee engagement, fostering a positive work environment, and implementing effective retention strategies to combat talent attrition.

- The imperative for increasingly agile and efficient talent acquisition methodologies to secure the right talent in a competitive global landscape.

Technological disruptions, particularly the pervasive influence of Artificial Intelligence (AI) and automation, are profoundly reshaping market dynamics, presenting both significant opportunities for innovation and strategic challenges to overcome. Concurrently, evolving consumer preferences are driving a shift towards more personalized, flexible, and outcome-oriented HR solutions. The competitive landscape is characterized by intense rivalry, with established global players and agile emerging startups continually vying for market share and strategic advantage. Market penetration rates are poised for substantial increase, especially within regions exhibiting rapid economic expansion. Further in-depth analysis of market segmentation by service type, industry, and geographical region is detailed in the subsequent sections.

Dominant Regions & Segments in Asia Pacific HR Professional Services

The report identifies [Country Name, e.g., Singapore] as the leading market within the Asia Pacific region. This dominance is attributed to a combination of factors:

- Economic Policies: Pro-business environment, supportive government initiatives, and strong foreign direct investment.

- Infrastructure: Well-developed infrastructure, including robust internet connectivity and digital ecosystems.

- Talent Pool: A large and skilled workforce, attracting both domestic and multinational companies.

- Regulatory Environment: A relatively stable and transparent regulatory framework.

Other key markets in the region (e.g., Australia, India, Japan) exhibit significant growth potential due to increasing investment in technology, expansion of the middle class, and rising demand for talent across various industries. The detailed analysis covers a breakdown by segment (e.g., recruitment, HR consulting, payroll outsourcing, etc.), highlighting the growth drivers and competitive dynamics within each segment. Market size projections for each country and segment are included in the full report.

Asia Pacific HR Professional Services Product Innovations

Pioneering product innovations within the Asia Pacific HR professional services market are heavily geared towards harnessing cutting-edge technology to elevate operational efficiency and strategic effectiveness. This includes the development and deployment of advanced AI-powered recruitment platforms designed to streamline candidate sourcing and selection, sophisticated data-driven workforce analytics solutions offering deep insights into talent management, and dynamic digital learning solutions that facilitate highly personalized and impactful employee development programs. These innovations are directly addressing the evolving and complex needs of modern businesses, empowering them to optimize their talent management processes and achieve superior business outcomes. The market is also witnessing a significant convergence of HR technology with other transformative emerging technologies such as cloud computing, blockchain, and big data analytics, further amplifying effectiveness, enhancing decision-making capabilities, and improving overall cost efficiency.

Report Scope & Segmentation Analysis

This comprehensive report provides a detailed analysis of the Asia Pacific HR professional services market, segmented across several critical dimensions to offer a holistic view:

- By Service Type: A granular breakdown including Recruitment (covering temporary staffing, permanent placement, and executive search), HR Consulting (encompassing HR strategy formulation, talent management optimization, and compensation & benefits design), Payroll & Benefits Administration, and RPO/MSP (Recruitment Process Outsourcing/Managed Service Provider). Each segment's projected growth rates, current market sizes, competitive dynamics, and key influential players are meticulously analyzed.

- By Industry: An in-depth examination of key industry verticals such as Technology, Finance, Healthcare, Manufacturing, and Retail. The unique characteristics, specific HR requirements, associated market sizes, and growth forecasts for each vertical are thoroughly described.

- By Region: Detailed market analysis is provided for pivotal countries across the Asia Pacific region, including comprehensive market size projections and tailored growth forecasts to capture regional nuances.

Key Drivers of Asia Pacific HR Professional Services Growth

Several key factors are driving the growth of the Asia Pacific HR professional services market:

- Technological Advancements: The adoption of AI, machine learning, and big data analytics is revolutionizing HR processes, enabling better decision-making and improved efficiency.

- Economic Growth: The strong economic performance in several Asia-Pacific countries fuels demand for skilled labor and talent management services.

- Regulatory Changes: New labor laws and data privacy regulations are increasing the need for specialized HR expertise.

- Globalization: The increasing globalization of businesses and cross-border talent movement creates opportunities for HR professional services providers.

Challenges in the Asia Pacific HR Professional Services Sector

The Asia Pacific HR professional services sector is navigating a landscape marked by several significant challenges, requiring strategic adaptation and proactive solutions:

- Talent Shortages: A persistent and escalating challenge is the difficulty in identifying, attracting, and retaining highly skilled and experienced HR professionals. This scarcity intensifies competition for talent, inevitably driving up operational costs and potentially impacting the caliber and consistency of services delivered.

- Regulatory Compliance: The intricate and often evolving web of labor laws, data privacy regulations (such as GDPR and its regional equivalents), and compliance mandates across diverse jurisdictions presents a considerable hurdle. Navigating these complexities can be both resource-intensive and time-consuming, demanding specialized expertise and continuous monitoring.

- Technological Disruption: The rapid pace of technological advancement, while offering opportunities, also necessitates continuous and substantial investment in acquiring new technologies, upskilling existing workforces, and integrating novel solutions. This constant evolution adds a layer of operational cost and strategic planning complexity.

- Competitive Pressure: The sector is characterized by a highly dynamic and competitive environment. A multitude of established global players, alongside agile and innovative new entrants, are actively vying for market share, driving down margins and emphasizing the need for differentiation and service excellence.

Emerging Opportunities in Asia Pacific HR Professional Services

Several emerging opportunities are shaping the future of the Asia Pacific HR professional services market:

- Rise of Gig Economy: The increasing prevalence of the gig economy necessitates innovative solutions for managing temporary and freelance workers.

- Focus on Employee Experience: Businesses are increasingly prioritizing employee experience, creating demand for services that enhance employee engagement and well-being.

- Expansion into Underserved Markets: There are significant opportunities for expansion into less developed markets within the Asia Pacific region.

- Adoption of New Technologies: The integration of blockchain technology for secure data management and AI-powered tools for talent acquisition present substantial opportunities for HR services providers.

Leading Players in the Asia Pacific HR Professional Services Market

The following are among the prominent organizations shaping the Asia Pacific HR Professional Services landscape:

Key Developments in Asia Pacific HR Professional Services Industry

- July 2023: Kelly Services announced strategic restructuring to enhance efficiency and effectiveness. This highlights the ongoing pressure on HR service providers to optimize operations and improve profitability.

- May 2024: ManpowerGroup's return as a Platinum Partner at VivaTech underscores the growing importance of technology and innovation in the HR services sector. This signifies the increasing focus on digital transformation and the adoption of cutting-edge technologies within the industry.

Future Outlook for Asia Pacific HR Professional Services Market

The Asia Pacific HR professional services market is poised for continued growth over the forecast period. Technological advancements, economic growth, and evolving workforce demographics will drive demand for innovative HR solutions. Strategic acquisitions and partnerships will shape the competitive landscape. Companies that effectively leverage technology and adapt to changing market trends will be best positioned for success. Opportunities exist for companies to expand into new markets and offer specialized services catering to the specific needs of different industries. The market is expected to witness increased consolidation and the emergence of new business models that will improve efficiencies for all stakeholders.

Asia Pacific HR Professional Services Segmentation

-

1. Provider Type

- 1.1. Consulting Companies

- 1.2. Software-as-a-Service Providers Companies

-

2. Function Type

- 2.1. Recruitment and Talent Acquisition

- 2.2. Benefits and Claims Management

- 2.3. Workforce Planning and Analytics

- 2.4. Payroll And Compensation Management

- 2.5. Other Functions

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. IT & Telecom

- 3.4. Manufacturing

- 3.5. Retail

- 3.6. Government

- 3.7. Other Industries

-

4. Geography

-

4.1. Asia-Pacific

- 4.1.1. China

- 4.1.2. India

- 4.1.3. Japan

- 4.1.4. Australia

- 4.1.5. Rest of Asia-Pacific

-

4.1. Asia-Pacific

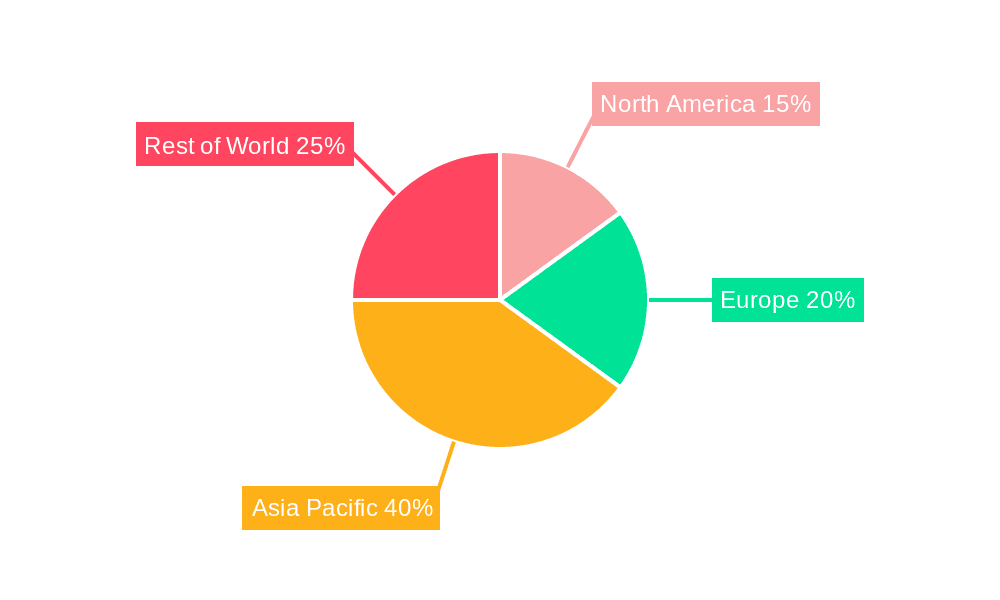

Asia Pacific HR Professional Services Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. Australia

- 1.5. Rest of Asia Pacific

Asia Pacific HR Professional Services Regional Market Share

Geographic Coverage of Asia Pacific HR Professional Services

Asia Pacific HR Professional Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services

- 3.3. Market Restrains

- 3.3.1. Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services

- 3.4. Market Trends

- 3.4.1. Recruitment and Talent Acquisition is the Largest Segment in the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia Pacific HR Professional Services Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Provider Type

- 5.1.1. Consulting Companies

- 5.1.2. Software-as-a-Service Providers Companies

- 5.2. Market Analysis, Insights and Forecast - by Function Type

- 5.2.1. Recruitment and Talent Acquisition

- 5.2.2. Benefits and Claims Management

- 5.2.3. Workforce Planning and Analytics

- 5.2.4. Payroll And Compensation Management

- 5.2.5. Other Functions

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. IT & Telecom

- 5.3.4. Manufacturing

- 5.3.5. Retail

- 5.3.6. Government

- 5.3.7. Other Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Asia-Pacific

- 5.4.1.1. China

- 5.4.1.2. India

- 5.4.1.3. Japan

- 5.4.1.4. Australia

- 5.4.1.5. Rest of Asia-Pacific

- 5.4.1. Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Provider Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Adecco Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Randstad

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ManpowerGroup

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kelly Services

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hays

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Robert Half

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Allegis Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hudson

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Michael Page

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mercer

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Adecco Group

List of Figures

- Figure 1: Global Asia Pacific HR Professional Services Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Asia Pacific HR Professional Services Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Provider Type 2025 & 2033

- Figure 4: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Provider Type 2025 & 2033

- Figure 5: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Provider Type 2025 & 2033

- Figure 6: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Provider Type 2025 & 2033

- Figure 7: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Function Type 2025 & 2033

- Figure 8: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Function Type 2025 & 2033

- Figure 9: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Function Type 2025 & 2033

- Figure 10: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Function Type 2025 & 2033

- Figure 11: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by End-user Industry 2025 & 2033

- Figure 13: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Geography 2025 & 2033

- Figure 16: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Geography 2025 & 2033

- Figure 17: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Geography 2025 & 2033

- Figure 19: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Country 2025 & 2033

- Figure 20: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 2: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 3: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Function Type 2020 & 2033

- Table 4: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Function Type 2020 & 2033

- Table 5: Global Asia Pacific HR Professional Services Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Asia Pacific HR Professional Services Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Geography 2020 & 2033

- Table 9: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 12: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 13: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Function Type 2020 & 2033

- Table 14: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Function Type 2020 & 2033

- Table 15: Global Asia Pacific HR Professional Services Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Asia Pacific HR Professional Services Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Geography 2020 & 2033

- Table 19: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Country 2020 & 2033

- Table 21: China Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: India Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Australia Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific HR Professional Services?

The projected CAGR is approximately 8.63%.

2. Which companies are prominent players in the Asia Pacific HR Professional Services?

Key companies in the market include Adecco Group, Randstad, ManpowerGroup, Kelly Services, Hays, Robert Half, Allegis Group, Hudson, Michael Page, Mercer.

3. What are the main segments of the Asia Pacific HR Professional Services?

The market segments include Provider Type, Function Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 123.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services.

6. What are the notable trends driving market growth?

Recruitment and Talent Acquisition is the Largest Segment in the Market Studied.

7. Are there any restraints impacting market growth?

Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services.

8. Can you provide examples of recent developments in the market?

May 2024: ManpowerGroup is set to reaffirm its status as a critical contributor to the 8th edition of Europe's largest startup and tech event, VivaTech, by returning as a Platinum Partner.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific HR Professional Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific HR Professional Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific HR Professional Services?

To stay informed about further developments, trends, and reports in the Asia Pacific HR Professional Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence