Key Insights

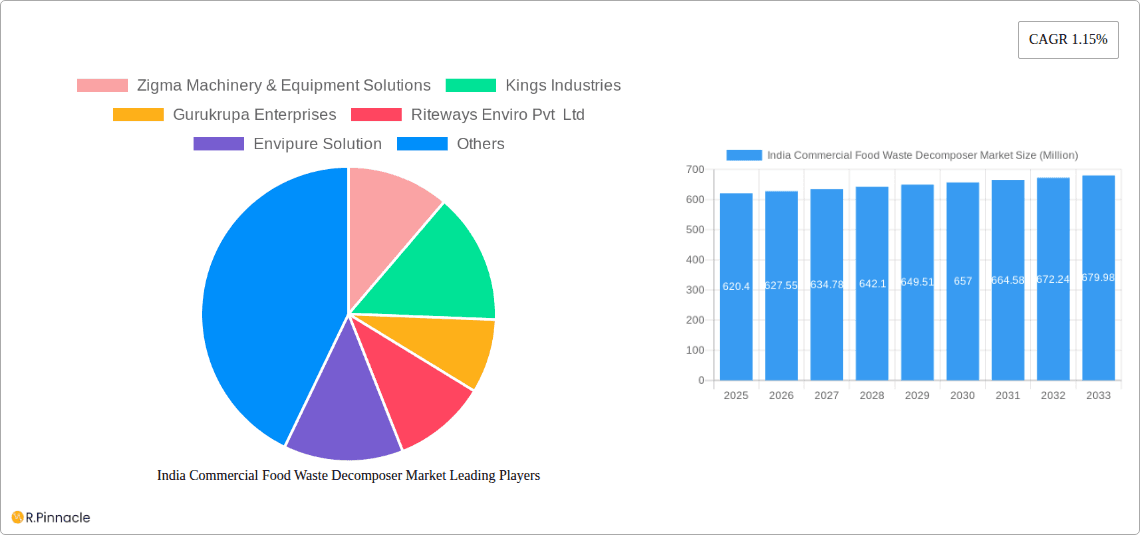

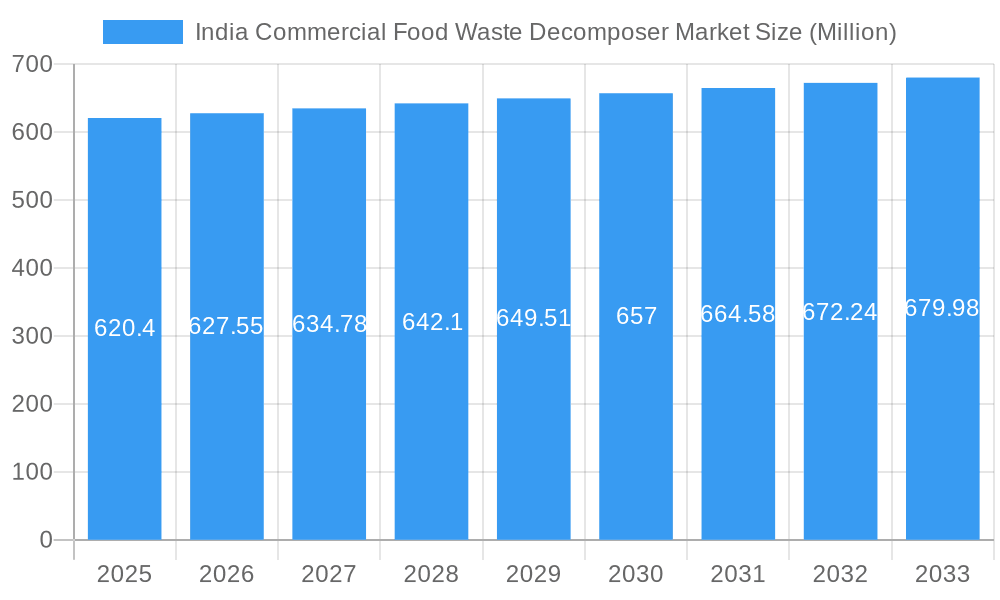

The India Commercial Food Waste Decomposer Market is poised for steady growth, driven by an increasing awareness of sustainable waste management practices and stringent government regulations. The market size is estimated to be $620.40 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 1.15% over the forecast period of 2025-2033. This moderate growth, while seemingly low, indicates a mature and established market where adoption is becoming more widespread and efficiency gains are paramount. Key drivers for this expansion include the escalating volume of food waste generated by commercial establishments such as restaurants, hotels, and food processing industries, coupled with a growing emphasis on circular economy principles and the desire to convert waste into valuable compost for agricultural applications. The rising operational costs associated with traditional waste disposal methods further incentivize businesses to invest in composting solutions.

India Commercial Food Waste Decomposer Market Market Size (In Million)

The market is segmented by machine type, with Continuous Composters and Batch Composters catering to diverse operational needs and capacities. Application-wise, the Agricultural sector remains a dominant force, benefiting from readily available organic fertilizer. However, the Restaurants & Hotels and Food Processing Industries segments are expected to witness significant adoption due to mandatory waste segregation rules and the economic benefits of on-site decomposition. Sales channels, including Direct Sales and Distributor networks, are crucial for reaching a broad customer base. The capacity segmentation (Small-Scale, Medium-Scale, Large-Scale) reflects the varied requirements of different commercial entities. Companies such as Zigma Machinery & Equipment Solutions, Kings Industries, and Gurukrupa Enterprises are key players actively shaping this market. The robust performance of the Indian market is expected to remain consistent throughout the study period, reflecting a sustained commitment to sustainable waste management.

India Commercial Food Waste Decomposer Market Company Market Share

Unlocking Profitability: India Commercial Food Waste Decomposer Market Analysis & Forecast (2019–2033)

Gain critical insights into the burgeoning India Commercial Food Waste Decomposer Market with our comprehensive report. This detailed analysis, spanning 2019–2033 with a Base Year of 2025, provides an in-depth understanding of market dynamics, innovation trends, and future growth trajectories. Discover how to capitalize on the escalating demand for sustainable waste management solutions in India's commercial sector. This report is your essential guide to navigating the complexities and opportunities within this rapidly expanding market.

India Commercial Food Waste Decomposer Market Market Structure & Innovation Trends

The India Commercial Food Waste Decomposer Market exhibits a dynamic structure characterized by moderate market concentration and a strong emphasis on technological innovation. Key players are actively investing in research and development to enhance the efficiency and environmental benefits of their composting solutions. Regulatory frameworks, driven by increasing environmental awareness and government initiatives for waste reduction, are playing a pivotal role in shaping market growth. Product substitutes, such as traditional landfilling and incineration, are facing increasing scrutiny and are gradually being displaced by more sustainable decomposition methods. End-user demographics are diverse, ranging from small-scale agricultural enterprises to large-scale food processing industries and hospitality businesses, each with unique waste management needs. Mergers and acquisitions (M&A) activities are expected to become more prominent as established companies seek to expand their market reach and technological capabilities. Projected M&A deal values are anticipated to grow, reflecting the strategic importance of acquiring innovative decomposer technologies and market share.

- Market Concentration: Moderate, with a growing number of specialized players.

- Innovation Drivers: Efficiency, odor control, pathogen reduction, energy recovery, and compliance with environmental regulations.

- Regulatory Frameworks: Stringent waste management policies and incentives for adopting green technologies.

- Product Substitutes: Landfilling, incineration, anaerobic digestion (less common for direct decomposition).

- End-User Demographics: Hospitality, food processing, agriculture, institutional kitchens, and municipal corporations.

- M&A Activities: Expected to increase as the market matures.

India Commercial Food Waste Decomposer Market Market Dynamics & Trends

The India Commercial Food Waste Decomposer Market is poised for substantial growth, driven by a confluence of powerful market dynamics and evolving trends. A primary growth driver is the escalating volume of commercial food waste generated across the nation, coupled with a heightened awareness of its detrimental environmental impact. Stringent government regulations and policies aimed at promoting sustainable waste management practices are compelling businesses to adopt effective decomposition solutions. Technological advancements are revolutionizing the sector, with the introduction of more efficient, automated, and energy-neutral decomposer systems. Consumer preferences are also shifting towards eco-conscious practices, influencing businesses to invest in environmentally friendly waste disposal methods. The competitive landscape is intensifying, fostering innovation and price competition. Key market penetration is steadily increasing, particularly in urban and semi-urban areas where waste management infrastructure is more developed.

The market penetration for commercial food waste decomposers is projected to witness a significant surge, moving from an estimated XX% in 2024 to a projected XX% by 2033. This growth is underpinned by the annual Compound Annual Growth Rate (CAGR) of approximately XX% forecasted for the period 2025–2033. This robust expansion is further fueled by the rising operational costs associated with traditional waste disposal methods, making the long-term economic benefits of decomposition more attractive. The increasing adoption of smart technologies, such as IoT-enabled monitoring and automated operation, is enhancing the appeal and efficiency of these decomposers, making them a more viable and attractive investment for businesses. Furthermore, the potential for generating valuable by-products like compost and biogas from the decomposition process adds an economic incentive, encouraging a circular economy approach to waste management. The availability of various financing schemes and government subsidies also plays a crucial role in reducing the initial capital expenditure barrier for many businesses, thereby accelerating market adoption. The growing trend of corporate social responsibility (CSR) initiatives is also pushing companies to invest in sustainable waste management solutions, including commercial food waste decomposers, to enhance their brand image and contribute to environmental conservation.

Dominant Regions & Segments in India Commercial Food Waste Decomposer Market

The India Commercial Food Waste Decomposer Market is witnessing significant traction across various regions and segments, with certain areas and applications emerging as dominant forces.

Leading Region: The Western Region of India is currently the dominant force in the commercial food waste decomposer market. This dominance is attributed to several key drivers:

- Economic Policies: Proactive state governments in Maharashtra, Gujarat, and Goa have implemented favorable policies and incentives for waste management and environmental sustainability.

- Infrastructure: Well-developed urban infrastructure and a high concentration of commercial establishments, including a robust hospitality and food processing industry, create a substantial demand.

- Awareness: Higher levels of environmental consciousness and stricter enforcement of waste management regulations in these states.

Dominant Segments:

Machine Type: Continuous Composters

- Key Drivers: High volume waste processing capabilities, suitability for large-scale operations, and automation for reduced labor.

- Dominance Analysis: Continuous composters are preferred by large food processing industries and large hotels due to their ability to handle consistent, high volumes of food waste efficiently. Their design allows for a steady flow of material, ensuring uninterrupted decomposition cycles and higher throughput, which is crucial for operations generating substantial daily waste. The initial investment is higher, but the operational efficiency and scalability make them a preferred choice for large-scale commercial entities.

Application: Restaurants & Hotels

- Key Drivers: Significant generation of organic waste, direct impact on operational costs, and increasing consumer demand for eco-friendly practices.

- Dominance Analysis: The restaurant and hotel industry represents a major application segment. These establishments generate a considerable amount of food waste daily, from kitchen scraps to pre-consumer waste. The need for efficient, odorless, and space-saving waste management solutions makes decomposers highly attractive. Furthermore, the growing trend of "green certifications" and customer preference for environmentally responsible businesses are pushing hotels and restaurants to adopt sustainable waste disposal methods.

Sales Channel: Direct Sales

- Key Drivers: Personalized technical support, customized solutions, and direct relationship building with key clients.

- Dominance Analysis: Direct sales channels are crucial, especially for larger, more complex installations. Manufacturers can provide tailored solutions, on-site consultations, and post-sales technical support, which are vital for ensuring optimal performance and customer satisfaction. This approach allows for better understanding of specific client needs and the ability to offer integrated solutions.

Capacity: Medium-Scale

- Key Drivers: Ideal balance between processing capacity and cost-effectiveness for a wide range of commercial establishments.

- Dominance Analysis: Medium-scale decomposers cater to a broad spectrum of businesses, including medium-sized restaurants, catering services, and smaller food processing units. They offer a good compromise between the processing capacity of large-scale units and the affordability and space requirements of small-scale models, making them a popular choice for a significant portion of the commercial sector.

Capacity: Large-Scale

- Key Drivers: High-volume waste management needs for large industrial players and institutional facilities.

- Dominance Analysis: While medium-scale is dominant in terms of numbers of establishments, large-scale decomposers are critical for major players in the food processing industry, large hotel chains, and institutional kitchens. Their ability to handle massive volumes is essential for compliance and efficient waste management at an industrial level.

India Commercial Food Waste Decomposer Market Product Innovations

Product innovations in the India Commercial Food Waste Decomposer Market are primarily focused on enhancing efficiency, reducing operational footprints, and improving user-friendliness. Manufacturers are developing advanced technologies for faster decomposition cycles, odor control, and energy generation. Key competitive advantages lie in the integration of smart features, such as IoT connectivity for remote monitoring and automated operational adjustments. The development of compact, modular designs also caters to space-constrained urban commercial environments. Furthermore, innovations are geared towards maximizing the quality of compost produced, making it a valuable resource for agricultural applications.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the India Commercial Food Waste Decomposer Market, segmented across key parameters to offer granular insights.

Machine Type: The market is analyzed based on Continuous Composters and Batch Composters. Continuous composters are expected to witness higher growth due to their suitability for large-scale, consistent waste streams, while batch composters remain relevant for smaller, intermittent waste generation.

Application: Segmentation includes Agricultural, Restaurants & Hotels, and Food Processing Industries. Restaurants & Hotels and Food Processing Industries are projected to be the largest segments due to substantial organic waste generation. The agricultural sector presents a growing opportunity as demand for organic fertilizers increases.

Sales Channel: The market is examined through Direct Sales and Distributor channels. Direct sales are crucial for complex systems and large clients, offering personalized service. Distributors play a vital role in reaching a wider customer base and smaller businesses.

Capacity: The market is segmented into Small-Scale, Medium-Scale, and Large-Scale capacities. Medium-scale solutions are anticipated to capture a significant market share due to their versatility, serving a broad range of commercial needs effectively. Large-scale systems will remain important for industrial giants.

Key Drivers of India Commercial Food Waste Decomposer Market Growth

The India Commercial Food Waste Decomposer Market is propelled by several critical growth drivers. Increasing environmental regulations and government initiatives promoting waste segregation and management are compelling businesses to adopt sustainable solutions. The rising volume of commercial food waste, coupled with growing awareness of its ecological impact, creates a strong demand for effective decomposition technologies. Technological advancements leading to more efficient, automated, and cost-effective decomposers further fuel market expansion. The economic benefits, such as potential for compost generation and reduced waste disposal fees, also contribute significantly.

Challenges in the India Commercial Food Waste Decomposer Market Sector

Despite robust growth prospects, the India Commercial Food Waste Decomposer Market faces several challenges. High initial capital investment for advanced decomposer systems can be a barrier for small and medium-sized enterprises. Inadequate infrastructure and awareness in Tier-2 and Tier-3 cities can hinder widespread adoption. Maintaining optimal operating conditions, such as temperature and moisture levels, requires consistent monitoring and can be challenging for some users. Furthermore, the availability of cheaper, albeit less sustainable, waste disposal alternatives continues to pose competitive pressure.

Emerging Opportunities in India Commercial Food Waste Decomposer Market

Emerging opportunities in the India Commercial Food Waste Decomposer Market are abundant. The increasing focus on the circular economy presents a significant avenue, with potential for generating valuable compost and biogas as by-products. Smart and IoT-enabled decomposers offering remote monitoring and predictive maintenance are gaining traction. The expansion of the market into developing regions and smaller commercial establishments through innovative, cost-effective solutions offers substantial growth potential. Partnerships between technology providers and waste management companies can streamline adoption and create integrated waste solutions.

Leading Players in the India Commercial Food Waste Decomposer Market Market

- Zigma Machinery & Equipment Solutions

- Kings Industries

- Gurukrupa Enterprises

- Riteways Enviro Pvt Ltd

- Envipure Solution

- Vakratund Invention India Private Limited

- Reva Engineering Enterprises

- Ecopollutech Engineers

- Greenrich Grow India Private Limited

- Greenshield Enviro

Key Developments in India Commercial Food Waste Decomposer Market Industry

- September 2023: InSinkErator introduced new garbage disposals in the market. The new garbage disposal aims to grind a variety of wastes quickly and provide environmentally friendly solutions for managing food waste.

- April 2022: Whirlpool Corporation acquired InSinkErator. This acquisition aimed to purchase the company's whole product line of food waste disposers to expand its services to end users.

Future Outlook for India Commercial Food Waste Decomposer Market Market

The future outlook for the India Commercial Food Waste Decomposer Market is exceptionally promising, driven by strong underlying trends and evolving market dynamics. The increasing stringency of environmental regulations, coupled with a palpable shift in consumer and corporate consciousness towards sustainability, will continue to be the primary growth accelerators. Investments in research and development will yield more efficient, automated, and cost-effective decomposition technologies, making them accessible to a wider range of businesses. The potential for resource recovery through composting and biogas generation will further enhance the economic viability of these systems. Strategic opportunities lie in expanding market reach into underserved regions, developing niche solutions for specific industries, and fostering collaborations to build robust waste management ecosystems. The market is expected to witness sustained high growth throughout the forecast period.

India Commercial Food Waste Decomposer Market Segmentation

-

1. Machine Type

- 1.1. Continuous Composters

- 1.2. Batch Composters

-

2. Application

- 2.1. Agricultural

- 2.2. Restaurants & Hotels

- 2.3. Food Processing Industries

-

3. Sales Channel

- 3.1. Direct Sales

- 3.2. Distributor

-

4. Capacity

- 4.1. Small-Scale

- 4.2. Medium-Scale

- 4.3. Large-Scale

India Commercial Food Waste Decomposer Market Segmentation By Geography

- 1. India

India Commercial Food Waste Decomposer Market Regional Market Share

Geographic Coverage of India Commercial Food Waste Decomposer Market

India Commercial Food Waste Decomposer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumer Awareness for Organic Products; Adoption of Sustainable Waste Management Practices

- 3.3. Market Restrains

- 3.3.1. Growing Consumer Awareness for Organic Products; Adoption of Sustainable Waste Management Practices

- 3.4. Market Trends

- 3.4.1. Growing Food Service Industry Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Commercial Food Waste Decomposer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Continuous Composters

- 5.1.2. Batch Composters

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Agricultural

- 5.2.2. Restaurants & Hotels

- 5.2.3. Food Processing Industries

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Direct Sales

- 5.3.2. Distributor

- 5.4. Market Analysis, Insights and Forecast - by Capacity

- 5.4.1. Small-Scale

- 5.4.2. Medium-Scale

- 5.4.3. Large-Scale

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zigma Machinery & Equipment Solutions

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kings Industries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gurukrupa Enterprises

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Riteways Enviro Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Envipure Solution

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vakratund Invention India Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Reva Engineering Enterprises

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ecopollutech Engineers

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Greenrich Grow India Private Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Greenshield Enviro**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Zigma Machinery & Equipment Solutions

List of Figures

- Figure 1: India Commercial Food Waste Decomposer Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Commercial Food Waste Decomposer Market Share (%) by Company 2025

List of Tables

- Table 1: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 2: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Machine Type 2020 & 2033

- Table 3: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Application 2020 & 2033

- Table 5: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 6: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Sales Channel 2020 & 2033

- Table 7: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 8: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Capacity 2020 & 2033

- Table 9: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Region 2020 & 2033

- Table 11: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 12: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Machine Type 2020 & 2033

- Table 13: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Application 2020 & 2033

- Table 15: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 16: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Sales Channel 2020 & 2033

- Table 17: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 18: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Capacity 2020 & 2033

- Table 19: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Commercial Food Waste Decomposer Market?

The projected CAGR is approximately 1.15%.

2. Which companies are prominent players in the India Commercial Food Waste Decomposer Market?

Key companies in the market include Zigma Machinery & Equipment Solutions, Kings Industries, Gurukrupa Enterprises, Riteways Enviro Pvt Ltd, Envipure Solution, Vakratund Invention India Private Limited, Reva Engineering Enterprises, Ecopollutech Engineers, Greenrich Grow India Private Limited, Greenshield Enviro**List Not Exhaustive.

3. What are the main segments of the India Commercial Food Waste Decomposer Market?

The market segments include Machine Type, Application, Sales Channel, Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 620.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumer Awareness for Organic Products; Adoption of Sustainable Waste Management Practices.

6. What are the notable trends driving market growth?

Growing Food Service Industry Drives the Market.

7. Are there any restraints impacting market growth?

Growing Consumer Awareness for Organic Products; Adoption of Sustainable Waste Management Practices.

8. Can you provide examples of recent developments in the market?

September 2023: InSinkErator introduced new garbage disposals in the market. The new garbage disposal aims to grind a variety of wastes quickly and provide environmentally friendly solutions for managing food waste.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Commercial Food Waste Decomposer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Commercial Food Waste Decomposer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Commercial Food Waste Decomposer Market?

To stay informed about further developments, trends, and reports in the India Commercial Food Waste Decomposer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence