Key Insights

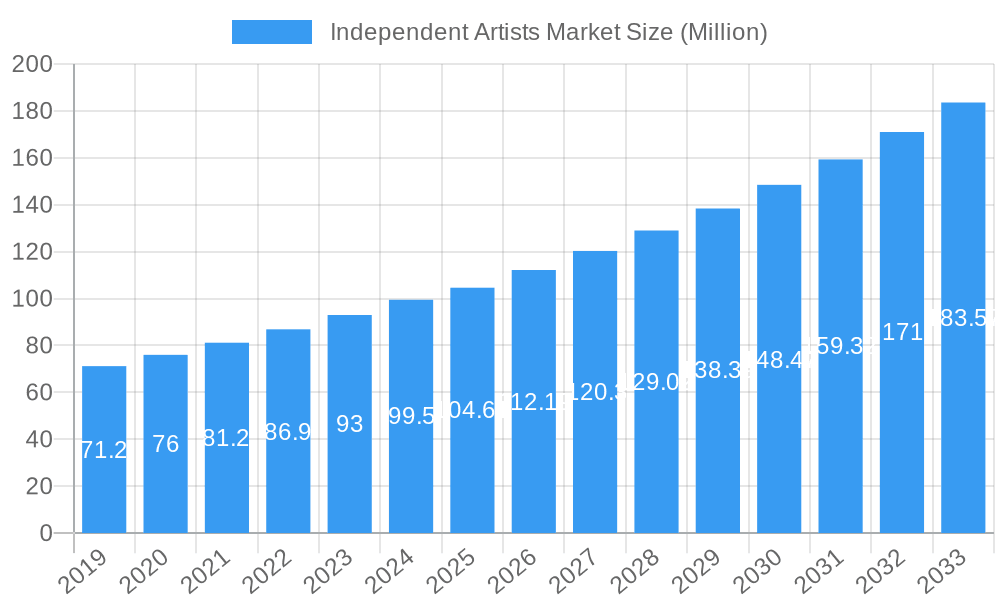

The Independent Artists Market is projected for robust expansion, reaching an estimated 104.61 million units by 2025. This growth is fueled by a significant Compound Annual Growth Rate (CAGR) of 7.46%, indicating a dynamic and expanding landscape for independent creatives across visual and performing arts. The market's expansion is driven by increasing digital accessibility for artists, allowing for direct engagement with audiences and monetization of their work through online platforms, social media, and direct sales. The burgeoning creator economy and a rising consumer appetite for unique, authentic artistic experiences further propel this growth. Individual users are a significant segment, actively seeking out independent artists for personalized commissions, digital art, and unique performances. Concurrently, commercial users, including galleries, businesses seeking bespoke artwork, and event organizers, are increasingly tapping into the independent artist pool for innovative and distinctive creative solutions.

Independent Artists Market Market Size (In Million)

Looking ahead, the market is anticipated to witness sustained positive momentum through to 2033. Emerging trends include the rise of decentralized autonomous organizations (DAOs) in the art world, offering new models for collective ownership and funding of artistic projects. Augmented reality (AR) and virtual reality (VR) are also creating novel avenues for independent artists to showcase and sell their work, expanding the reach and immersive potential of their creations. While the market enjoys strong drivers, potential restraints such as intellectual property protection challenges in the digital space and the need for artists to continually adapt to evolving technological platforms and marketing strategies will require strategic navigation. However, the fundamental demand for original artistic expression and the empowering tools available to independent creators position the market for continued thriving growth and innovation.

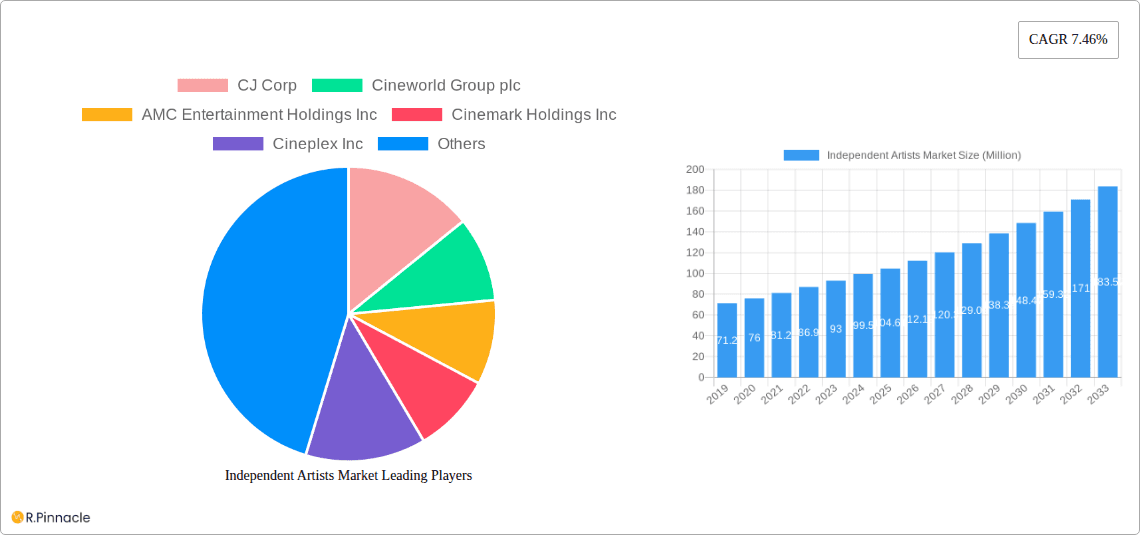

Independent Artists Market Company Market Share

Independent Artists Market Report: Navigating a Dynamic Landscape of Creative Expression & Commercialization (2019-2033)

This comprehensive report offers in-depth analysis of the Independent Artists Market, providing actionable insights for industry professionals seeking to understand evolving trends, market dynamics, and growth opportunities. Leveraging high-ranking keywords relevant to visual arts, performing arts, individual users, and commercial users, this report is optimized for maximum search visibility and engagement. The study encompasses a detailed examination of the market from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, building upon historical data from 2019–2024.

Independent Artists Market Market Structure & Innovation Trends

The Independent Artists Market exhibits a moderately fragmented structure, with a significant number of individual creators alongside established entities. Innovation in this sector is primarily driven by the adoption of digital platforms for creation, distribution, and sales, alongside evolving aesthetic sensibilities in both visual and performing arts. Regulatory frameworks are relatively nascent, often varying by region and art form, posing both challenges and opportunities for market participants. Product substitutes are diverse, ranging from commercially produced art and entertainment to user-generated content, necessitating a constant drive for unique value propositions from independent artists. End-user demographics are expanding, encompassing both individual patrons and commercial entities seeking bespoke artistic solutions. Mergers and acquisitions (M&A) activity, while not as concentrated as in some other industries, is present, particularly in the consolidation of art platforms and talent agencies. The total M&A deal value is estimated to be in the range of XXX Million, with an estimated market share concentration of XX% held by the top five players.

- Market Concentration: Moderate fragmentation with a mix of individual artists and emerging platforms.

- Innovation Drivers: Digitalization of art creation and distribution, evolving audience engagement models, and niche market specialization.

- Regulatory Frameworks: Varied by region and art form; potential for increased standardization in digital rights and licensing.

- Product Substitutes: Diverse, including mass-produced art, commercial entertainment, and user-generated content.

- End-User Demographics: Growing segments of individual collectors, businesses seeking unique brand experiences, and institutions.

- M&A Activities: Focused on digital platforms, talent management, and niche art market consolidation.

Independent Artists Market Market Dynamics & Trends

The Independent Artists Market is experiencing robust growth, fueled by several key dynamics. The burgeoning digital economy has democratized access to creation tools and global audiences, significantly lowering barriers to entry. Technological disruptions, including AI-powered creative tools and blockchain for provenance and sales, are reshaping how art is conceived, produced, and monetized. Consumer preferences are increasingly leaning towards authentic, personalized, and ethically produced art, directly benefiting independent creators who often embody these values. The rise of online marketplaces and social media platforms has facilitated direct artist-to-consumer engagement, bypassing traditional gatekeepers.

Key growth drivers include the increasing demand for unique and personalized artistic expressions in both visual arts (e.g., custom portraits, bespoke installations) and performing arts (e.g., independent theatre productions, niche music genres). The penetration of streaming services and online galleries has made artistic content more accessible than ever before. Competitive dynamics are characterized by a blend of intense individual competition among artists and the strategic maneuvering of platforms seeking to attract and retain talent and buyers. The market is also witnessing a growing appreciation for diverse cultural narratives and underrepresented artistic voices, creating new avenues for growth. The estimated Compound Annual Growth Rate (CAGR) for the Independent Artists Market is projected to be XX% between 2025 and 2033. Market penetration is anticipated to reach XX% by 2033, driven by increased digital adoption and a growing appreciation for independent creative output.

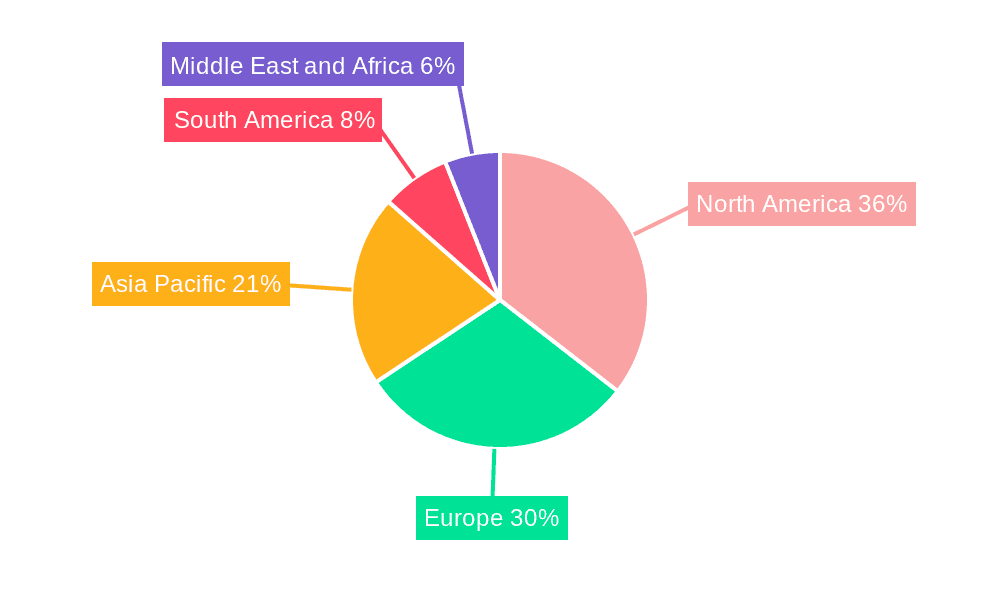

Dominant Regions & Segments in Independent Artists Market

The Independent Artists Market is experiencing dominant growth across several key regions and segments, driven by a confluence of economic policies, infrastructure development, and cultural appreciation for the arts. North America, particularly the United States, stands out as a leading region due to its well-established art infrastructure, significant disposable income for art acquisition, and a vibrant ecosystem of galleries, performance venues, and digital platforms. Within North America, cities like New York, Los Angeles, and Chicago are epicenters for both visual and performing arts, attracting talent and investment.

- Leading Region: North America, with the United States at the forefront.

- Key Drivers: Robust economic policies supporting creative industries, advanced digital infrastructure, strong collector base, and a high concentration of prominent art institutions.

- Dominant Segment (Type): Visual Arts. This segment benefits from the widespread accessibility of digital tools for creation and the burgeoning online art market, allowing artists to reach global audiences without traditional gallery representation.

- Key Drivers: Growth in digital art, NFTs, online print sales, and the demand for personalized visual content for commercial and individual use.

- Dominant Segment (End User): Individual Users. This segment represents a significant portion of the market, driven by a desire for unique home décor, personalized gifts, and a direct connection with artists.

- Key Drivers: Increased disposable income, growing interest in art as an investment and a form of personal expression, and the convenience of online purchasing.

- Emerging Dominance: Performing Arts is witnessing significant growth, particularly in independent theatre and niche music genres, facilitated by digital ticketing and streaming platforms.

- Key Drivers: Experiential economy trends, demand for unique live performances, and innovative digital distribution models for recorded performances.

Independent Artists Market Product Innovations

Product innovations in the Independent Artists Market are largely characterized by the integration of technology and a focus on unique value propositions. Digital platforms are enabling artists to offer interactive art experiences, customizable digital prints, and even personalized performances delivered virtually. The development of AI-powered tools is assisting artists in generating novel concepts and refining their creative processes. Blockchain technology is increasingly being adopted for digital art to ensure authenticity, provenance, and secure transactions. These innovations provide independent artists with enhanced creative capabilities and new avenues for monetization, offering distinct competitive advantages in a crowded market.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Independent Artists Market across its primary segmentations: Type and End User. The segmentation provides granular insights into market dynamics and growth projections for each category.

- Type: Visual Arts. This segment encompasses paintings, sculptures, digital art, photography, and other visual mediums. Growth projections are robust, driven by online sales and increasing demand for unique decorative and collectible art. Market size is estimated at XXX Million in 2025, with significant competitive dynamics evolving around digital marketplaces and artist branding.

- Type: Performing Arts. This segment includes theatre, dance, music, and live performance art. Growth is anticipated to be driven by the recovery of live events and the expansion of digital streaming and virtual performance options. Market size is projected at XXX Million in 2025. Competitive dynamics are shaped by unique production concepts and direct audience engagement strategies.

- End User: Individual Users. This segment comprises consumers purchasing art for personal enjoyment, collection, or gifting. This segment is expected to see sustained growth as art appreciation broadens and online accessibility improves. Market size is estimated at XXX Million in 2025. Competitive dynamics focus on artist accessibility, pricing, and building direct relationships with patrons.

- End User: Commercial Users. This segment includes businesses, corporations, and institutions acquiring art for various purposes, such as office décor, branding, or public installations. Growth is linked to economic expansion and corporate investment in creative placemaking. Market size is projected at XXX Million in 2025. Competitive dynamics revolve around bespoke commissions, corporate art consulting, and large-scale installations.

Key Drivers of Independent Artists Market Growth

The Independent Artists Market is propelled by several powerful drivers. Technological advancements, particularly the proliferation of user-friendly digital creation tools and accessible online distribution platforms, have significantly lowered barriers to entry for artists. The increasing global demand for unique, authentic, and personalized artistic experiences, a direct contrast to mass-produced goods, is a major economic factor. Furthermore, evolving consumer preferences, with a growing appreciation for diverse cultural narratives and individual creative voices, are creating new market niches. Regulatory support in some regions, focusing on intellectual property rights and digital art authentication, also contributes to a more favorable operating environment.

Challenges in the Independent Artists Market Sector

Despite its growth, the Independent Artists Market faces significant challenges. Intense competition among a vast number of artists can lead to saturation in certain niches, making it difficult for emerging talents to gain visibility. Regulatory hurdles, particularly concerning copyright enforcement in the digital realm and inconsistent international trade policies for art, can impede growth. Supply chain issues, while less pronounced than in manufacturing, can still affect the availability and cost of physical materials for visual artists. Marketplaces can also impose high commission rates, impacting artists' profitability. The inherent instability of income for many independent artists remains a persistent barrier, coupled with the constant need for self-promotion and business management alongside creative work.

Emerging Opportunities in Independent Artists Market

The Independent Artists Market is rife with emerging opportunities. The continued growth of the digital art market, including NFTs, presents new avenues for monetization and ownership verification. Experiential art, blending physical and digital elements, is gaining traction, offering immersive audience engagement. The increasing demand for art in corporate and public spaces, driven by a desire for unique branding and community enrichment, opens doors for large-scale commissions. Furthermore, the rise of decentralized autonomous organizations (DAOs) focused on art curation and investment offers novel funding and collaborative models for independent artists. Expanding into niche markets and catering to specific cultural or thematic interests also presents significant potential for differentiation.

Leading Players in the Independent Artists Market Market

- CJ Corp

- Cineworld Group plc

- AMC Entertainment Holdings Inc

- Cinemark Holdings Inc

- Cineplex Inc

- The Metropolitan Opera Association

- Broadway Theatre

- Bolshoi Theatre

- Poly Culture Group Corporation

- New Jersey Performing Arts Center

- Sydney Opera House

- American Ballet Theatre

- Roundabout Theatre

- Lyric Opera of Chicago

Key Developments in Independent Artists Market Industry

- January 2023: AMC Entertainment Holdings, Inc., the largest theatrical exhibitor globally, announced a transition from a management and investment role in the Saudi Cinema Company (SCC) to a pure licensing relationship in Saudi Arabia, following the successful launch of movie theatre operations. This signifies a strategic shift in global exhibition models.

- December 2022: Kinepolis Group NV acquired Les Cinémas Pathé Gaumont from Pathé SAS. This acquisition significantly consolidated the cinema exhibition market in France, with Kinepolis France operating 15 Kinepolis cinemas and one Arthouse cinema named Klub, boasting 176 screens and over 40,000 seats.

Future Outlook for Independent Artists Market Market

The future outlook for the Independent Artists Market is exceptionally promising, characterized by sustained growth and evolving paradigms. The continued integration of advanced technologies, including AI and AR/VR, will unlock new creative possibilities and consumption experiences for both visual and performing arts. The increasing digitization of the global economy will further democratize access to markets, empowering independent artists to reach wider audiences and establish direct patronage. The growing emphasis on authentic, ethically sourced, and culturally diverse artistic expressions will continue to fuel demand for independent creators. Strategic opportunities lie in the development of robust digital infrastructure, innovative monetization models, and collaborative ecosystems that support artist development and market access, ensuring a dynamic and expanding future for the independent arts sector.

Independent Artists Market Segmentation

-

1. Type

- 1.1. Visual Arts

- 1.2. Performing Arts

-

2. End User

- 2.1. Individual Users

- 2.2. Commercial Users

Independent Artists Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Independent Artists Market Regional Market Share

Geographic Coverage of Independent Artists Market

Independent Artists Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Visual Arts Segment Dominated the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Independent Artists Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Visual Arts

- 5.1.2. Performing Arts

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Individual Users

- 5.2.2. Commercial Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Independent Artists Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Visual Arts

- 6.1.2. Performing Arts

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Individual Users

- 6.2.2. Commercial Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Independent Artists Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Visual Arts

- 7.1.2. Performing Arts

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Individual Users

- 7.2.2. Commercial Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Independent Artists Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Visual Arts

- 8.1.2. Performing Arts

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Individual Users

- 8.2.2. Commercial Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Independent Artists Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Visual Arts

- 9.1.2. Performing Arts

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Individual Users

- 9.2.2. Commercial Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Independent Artists Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Visual Arts

- 10.1.2. Performing Arts

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Individual Users

- 10.2.2. Commercial Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CJ Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cineworld Group plc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AMC Entertainment Holdings Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cinemark Holdings Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cineplex Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Metropolitan Opera Association

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Broadway Theatre

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bolshoi Theatre

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Poly Culture Group Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 New Jersey Performing Arts Center

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sydney Opera House

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 American Ballet Theatre

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Roundabout Theatre

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Lyric Opera of Chicago**List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 CJ Corp

List of Figures

- Figure 1: Global Independent Artists Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Independent Artists Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Independent Artists Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Independent Artists Market Volume (Billion), by Type 2025 & 2033

- Figure 5: North America Independent Artists Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Independent Artists Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Independent Artists Market Revenue (Million), by End User 2025 & 2033

- Figure 8: North America Independent Artists Market Volume (Billion), by End User 2025 & 2033

- Figure 9: North America Independent Artists Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Independent Artists Market Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Independent Artists Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Independent Artists Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Independent Artists Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Independent Artists Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Independent Artists Market Revenue (Million), by Type 2025 & 2033

- Figure 16: Europe Independent Artists Market Volume (Billion), by Type 2025 & 2033

- Figure 17: Europe Independent Artists Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Independent Artists Market Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Independent Artists Market Revenue (Million), by End User 2025 & 2033

- Figure 20: Europe Independent Artists Market Volume (Billion), by End User 2025 & 2033

- Figure 21: Europe Independent Artists Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: Europe Independent Artists Market Volume Share (%), by End User 2025 & 2033

- Figure 23: Europe Independent Artists Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Independent Artists Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Independent Artists Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Independent Artists Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Independent Artists Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Asia Pacific Independent Artists Market Volume (Billion), by Type 2025 & 2033

- Figure 29: Asia Pacific Independent Artists Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Independent Artists Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Pacific Independent Artists Market Revenue (Million), by End User 2025 & 2033

- Figure 32: Asia Pacific Independent Artists Market Volume (Billion), by End User 2025 & 2033

- Figure 33: Asia Pacific Independent Artists Market Revenue Share (%), by End User 2025 & 2033

- Figure 34: Asia Pacific Independent Artists Market Volume Share (%), by End User 2025 & 2033

- Figure 35: Asia Pacific Independent Artists Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Independent Artists Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Independent Artists Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Independent Artists Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Independent Artists Market Revenue (Million), by Type 2025 & 2033

- Figure 40: South America Independent Artists Market Volume (Billion), by Type 2025 & 2033

- Figure 41: South America Independent Artists Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America Independent Artists Market Volume Share (%), by Type 2025 & 2033

- Figure 43: South America Independent Artists Market Revenue (Million), by End User 2025 & 2033

- Figure 44: South America Independent Artists Market Volume (Billion), by End User 2025 & 2033

- Figure 45: South America Independent Artists Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: South America Independent Artists Market Volume Share (%), by End User 2025 & 2033

- Figure 47: South America Independent Artists Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Independent Artists Market Volume (Billion), by Country 2025 & 2033

- Figure 49: South America Independent Artists Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Independent Artists Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Independent Artists Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East and Africa Independent Artists Market Volume (Billion), by Type 2025 & 2033

- Figure 53: Middle East and Africa Independent Artists Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Independent Artists Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Independent Artists Market Revenue (Million), by End User 2025 & 2033

- Figure 56: Middle East and Africa Independent Artists Market Volume (Billion), by End User 2025 & 2033

- Figure 57: Middle East and Africa Independent Artists Market Revenue Share (%), by End User 2025 & 2033

- Figure 58: Middle East and Africa Independent Artists Market Volume Share (%), by End User 2025 & 2033

- Figure 59: Middle East and Africa Independent Artists Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Independent Artists Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East and Africa Independent Artists Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Independent Artists Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Independent Artists Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Independent Artists Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global Independent Artists Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Independent Artists Market Volume Billion Forecast, by End User 2020 & 2033

- Table 5: Global Independent Artists Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Independent Artists Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Independent Artists Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Independent Artists Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Global Independent Artists Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Global Independent Artists Market Volume Billion Forecast, by End User 2020 & 2033

- Table 11: Global Independent Artists Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Independent Artists Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Independent Artists Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Independent Artists Market Volume Billion Forecast, by Type 2020 & 2033

- Table 15: Global Independent Artists Market Revenue Million Forecast, by End User 2020 & 2033

- Table 16: Global Independent Artists Market Volume Billion Forecast, by End User 2020 & 2033

- Table 17: Global Independent Artists Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Independent Artists Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global Independent Artists Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Independent Artists Market Volume Billion Forecast, by Type 2020 & 2033

- Table 21: Global Independent Artists Market Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global Independent Artists Market Volume Billion Forecast, by End User 2020 & 2033

- Table 23: Global Independent Artists Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Independent Artists Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Independent Artists Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Independent Artists Market Volume Billion Forecast, by Type 2020 & 2033

- Table 27: Global Independent Artists Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Independent Artists Market Volume Billion Forecast, by End User 2020 & 2033

- Table 29: Global Independent Artists Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Independent Artists Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Global Independent Artists Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Independent Artists Market Volume Billion Forecast, by Type 2020 & 2033

- Table 33: Global Independent Artists Market Revenue Million Forecast, by End User 2020 & 2033

- Table 34: Global Independent Artists Market Volume Billion Forecast, by End User 2020 & 2033

- Table 35: Global Independent Artists Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Independent Artists Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Independent Artists Market?

The projected CAGR is approximately 7.46%.

2. Which companies are prominent players in the Independent Artists Market?

Key companies in the market include CJ Corp, Cineworld Group plc, AMC Entertainment Holdings Inc, Cinemark Holdings Inc, Cineplex Inc, The Metropolitan Opera Association, Broadway Theatre, Bolshoi Theatre, Poly Culture Group Corporation, New Jersey Performing Arts Center, Sydney Opera House, American Ballet Theatre, Roundabout Theatre, Lyric Opera of Chicago**List Not Exhaustive.

3. What are the main segments of the Independent Artists Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 104.61 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Visual Arts Segment Dominated the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: AMC Entertainment Holdings, Inc., the largest theatrical exhibitor in the United States, in Europe & the Middle East, and the world, announced that following the successful launch of movie theatre operations in the Kingdom of Saudi Arabia in partnership with Saudi Entertainment Ventures (SEVEN), the Company has reached an agreement to transition from a management and investment role in the Saudi Cinema Company (SCC) to a pure licensing relationship.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is " Independent Artists Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Independent Artists Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Independent Artists Market?

To stay informed about further developments, trends, and reports in the Independent Artists Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence