Key Insights

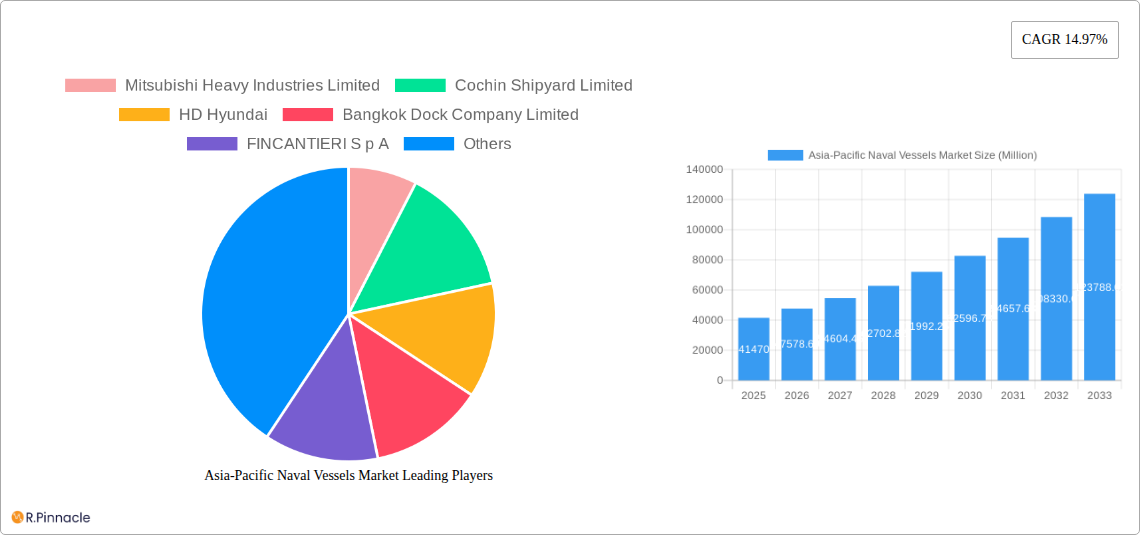

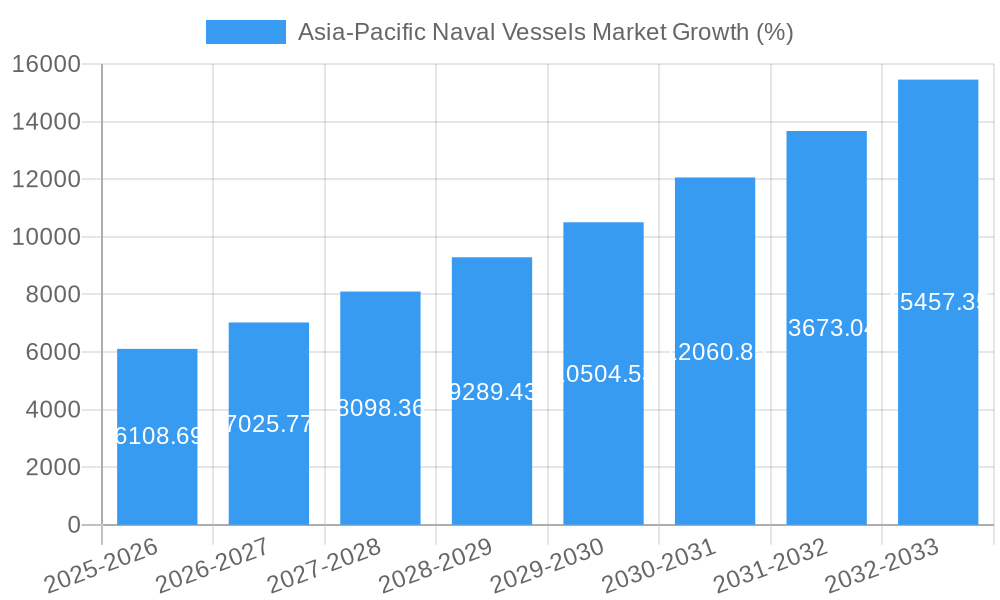

The Asia-Pacific naval vessels market is experiencing robust growth, projected to reach \$41.47 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 14.97% from 2025 to 2033. This expansion is driven by several key factors. Increased geopolitical tensions and territorial disputes in the region necessitate significant investments in naval modernization and expansion by various nations. Rising defense budgets across Asia-Pacific, particularly in countries like China, India, and Japan, fuel demand for advanced submarines, frigates, destroyers, aircraft carriers, and corvettes. Technological advancements, such as the development of stealth technology, AI-integrated systems, and unmanned surface vehicles, further stimulate market growth by enhancing the capabilities and effectiveness of naval vessels. The market is also segmented by vessel type, with submarines and destroyers likely commanding significant shares due to their strategic importance. Competition among major players like Mitsubishi Heavy Industries, Cochin Shipyard, HD Hyundai, and others contributes to market dynamism and technological innovation.

However, certain restraints affect market growth. The high cost of acquiring and maintaining advanced naval vessels can limit affordability for some countries in the region. Furthermore, fluctuating global economic conditions could influence defense spending and impact market growth. Despite these challenges, the long-term outlook remains positive, driven by persistent security concerns and the continuous modernization of naval fleets in the Asia-Pacific region. The increasing focus on regional maritime security cooperation and the development of indigenous shipbuilding capabilities are also shaping market dynamics, creating opportunities for both established players and emerging regional shipbuilders. The market's future growth is directly correlated to regional geopolitical stability and the commitment of nations to strengthening their naval capabilities.

Asia-Pacific Naval Vessels Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific naval vessels market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, dynamics, key players, and future growth potential. The report utilizes a robust methodology incorporating historical data (2019-2024), current estimations (2025), and future projections (2025-2033) to paint a comprehensive picture of this crucial sector.

Asia-Pacific Naval Vessels Market Structure & Innovation Trends

The Asia-Pacific naval vessels market exhibits a moderately concentrated structure, with key players holding significant market share. Mitsubishi Heavy Industries Limited, HD Hyundai, and China State Shipbuilding Corporation are among the leading companies, collectively accounting for an estimated xx% of the market in 2025. However, the market also features a number of smaller, regional players, contributing to a dynamic and competitive landscape.

- Market Concentration: Estimated xx% market share held by top 3 players in 2025.

- Innovation Drivers: Increasing demand for advanced technologies, such as AI-powered systems and autonomous capabilities, is driving innovation. Geopolitical instability and rising defense budgets are also significant factors.

- Regulatory Frameworks: Varying national regulations and procurement processes across the Asia-Pacific region influence market dynamics. Standardization efforts are ongoing, but fragmentation remains a challenge.

- Product Substitutes: Limited direct substitutes exist for specialized naval vessels, though technological advancements may lead to alternative solutions in the long term.

- End-User Demographics: The primary end-users are national navies across the Asia-Pacific region, with varying levels of technological sophistication and budgetary constraints influencing purchasing decisions.

- M&A Activities: The past five years have witnessed xx M&A deals, with a total estimated value of $xx Million, primarily focused on enhancing technological capabilities and expanding regional presence.

Asia-Pacific Naval Vessels Market Dynamics & Trends

The Asia-Pacific naval vessels market is experiencing robust growth, driven by several key factors. Rising geopolitical tensions, modernization of naval fleets, and increasing defense spending across the region are significant drivers. Technological disruptions, such as the adoption of unmanned systems and advanced sensors, are transforming the industry. Furthermore, evolving consumer preferences (i.e., navies) toward advanced capabilities and cost-effectiveness are shaping market dynamics. The market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching a market size of $xx Million by 2033. Market penetration of advanced technologies is projected to reach xx% by 2033. Competitive dynamics are marked by intense competition among established players and the emergence of new entrants, leading to strategic alliances, technological advancements, and price pressures.

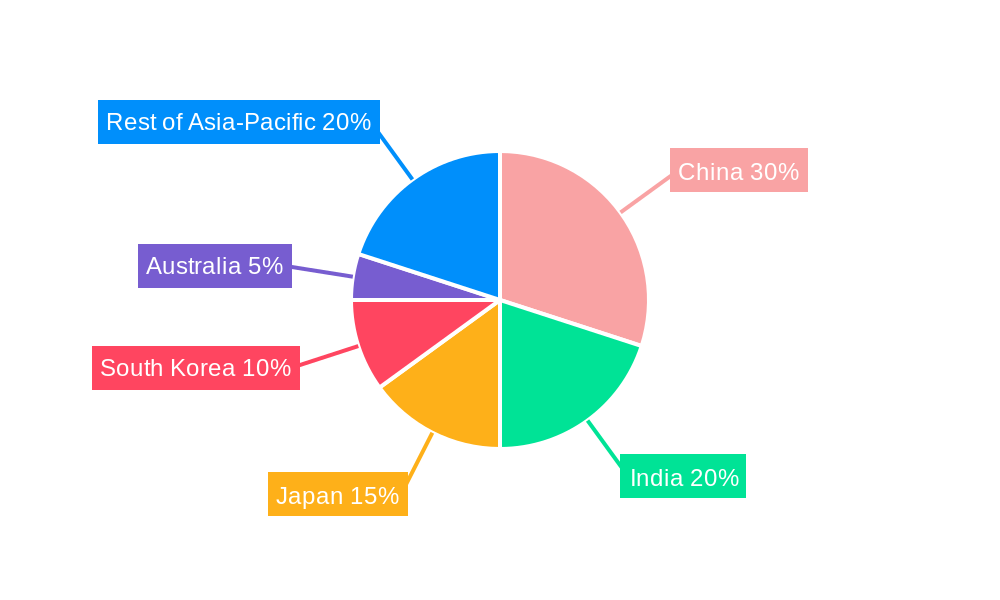

Dominant Regions & Segments in Asia-Pacific Naval Vessels Market

While the entire Asia-Pacific region demonstrates growth, India and China are currently the dominant markets, accounting for an estimated xx% and yy% of the overall market respectively, in 2025. This dominance is attributed to:

- India: Significant investments in indigenous naval vessel construction (e.g., the INS Vikrant), proactive defense modernization policies, and a large coastline.

- China: Substantial defense budget allocation, ambitious naval expansion plans, and a robust domestic shipbuilding industry.

Within vessel types, Frigates and Corvettes constitute the largest segments, driven by their versatility and cost-effectiveness. The Submarine segment is also experiencing growth, particularly in countries prioritizing underwater capabilities. Aircraft Carriers and Destroyers are smaller segments due to their higher costs and specialized nature.

- Key Drivers (India): "Make in India" initiative, increasing geopolitical concerns, and growing maritime security needs.

- Key Drivers (China): Stringent territorial claims, rapid economic expansion, and a strategic focus on naval power projection.

Asia-Pacific Naval Vessels Market Product Innovations

Recent years have witnessed significant product innovations, including the integration of advanced sensor systems, autonomous navigation capabilities, and improved stealth technologies. These innovations aim to enhance the operational effectiveness, survivability, and cost-efficiency of naval vessels. The market is witnessing a shift towards modular designs, enabling greater flexibility and customization to meet specific needs. This focus on technological advancements is enhancing the competitiveness of market players and expanding the applications of naval vessels beyond traditional roles.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific naval vessels market based on vessel type:

- Submarines: The submarine segment is witnessing steady growth driven by the need for underwater surveillance and strategic deterrence. Market size in 2025 is estimated at $xx Million, with a projected CAGR of xx%.

- Frigates: This segment represents a significant portion of the market due to their versatility and cost-effectiveness. Market size in 2025 is estimated at $xx Million, with a projected CAGR of xx%.

- Corvettes: Similar to frigates, Corvettes represent a significant portion of the market due to their versatility and cost-effectiveness. Market size in 2025 is estimated at $xx Million, with a projected CAGR of xx%.

- Aircraft Carriers: This segment is characterized by high capital costs and strategic importance. Market size in 2025 is estimated at $xx Million, with a projected CAGR of xx%.

- Destroyers: These vessels provide significant firepower and defense capabilities. Market size in 2025 is estimated at $xx Million, with a projected CAGR of xx%.

- Other Vessel Types: This segment includes various support vessels, patrol boats, and amphibious assault ships. Market size in 2025 is estimated at $xx Million, with a projected CAGR of xx%.

Key Drivers of Asia-Pacific Naval Vessels Market Growth

Several factors are driving the growth of the Asia-Pacific naval vessels market: increasing geopolitical tensions in the region, the modernization of existing naval fleets, rising defense budgets, and technological advancements in shipbuilding and naval warfare. The growing emphasis on maritime security and the need for robust naval capabilities are also contributing to this expansion.

Challenges in the Asia-Pacific Naval Vessels Market Sector

The Asia-Pacific naval vessels market faces several challenges, including fluctuating global defense spending, intense competition among domestic and international players, and complex procurement processes. Supply chain disruptions and the high cost of advanced technologies also pose significant barriers to entry and market expansion for certain players.

Emerging Opportunities in Asia-Pacific Naval Vessels Market

Emerging opportunities in this market include the increasing adoption of unmanned systems and AI-powered solutions, the development of hybrid and electric propulsion systems, and the growing demand for advanced cyber security technologies for naval vessels. Further, the focus on sustainability and the integration of renewable energy sources into naval vessel designs are presenting new avenues for innovation and market growth.

Leading Players in the Asia-Pacific Naval Vessels Market Market

- Mitsubishi Heavy Industries Limited

- Cochin Shipyard Limited

- HD Hyundai

- Bangkok Dock Company Limited

- FINCANTIERI S p A

- Garden Reach Shipbuilders and Engineers Limited

- thyssenkrupp AG

- Singapore Technologies Engineering Limited

- ASC Pty Ltd

- Mazagon Dock Shipbuilders Limited

- LARSEN & TOUBRO LIMITED

- Navantia S A SM E

- China State Shipbuilding Corporation

- Boustead Heavy Industries Corporation Berhad

- Kawasaki Heavy Industries Ltd

- PT PAL Indonesia

Key Developments in Asia-Pacific Naval Vessels Market Industry

- September 2022: India’s first indigenously built aircraft carrier, INS Vikrant, was commissioned into service under the Make in India initiative. This significantly boosted the domestic shipbuilding industry and showcased India's growing naval capabilities.

- April 2023: Hyundai Heavy Industries launched its Chungnam frigate (FFX) at its shipyard in Ulsan, South Korea. This launch signifies the ongoing modernization of the Republic of Korea Navy and highlights the advancements in frigate technology.

Future Outlook for Asia-Pacific Naval Vessels Market Market

The Asia-Pacific naval vessels market is poised for continued growth, driven by sustained defense spending, technological innovations, and geopolitical dynamics. Strategic partnerships, investments in research and development, and a focus on export markets will further shape the future landscape of this sector. The market's future potential lies in developing and integrating advanced technologies, such as AI, autonomous systems, and cyber security measures, into naval vessel designs to maintain a competitive edge.

Asia-Pacific Naval Vessels Market Segmentation

-

1. Vessel Type

- 1.1. Submarines

- 1.2. Frigates

- 1.3. Corvettes

- 1.4. Aircraft Carrier

- 1.5. Destroyers

- 1.6. Other Vessel Types

-

2. Geography

-

2.1. Asia-Pacific

- 2.1.1. China

- 2.1.2. India

- 2.1.3. Japan

- 2.1.4. South Korea

- 2.1.5. Australia

- 2.1.6. Singapore

- 2.1.7. Rest of Asia-Pacific

-

2.1. Asia-Pacific

Asia-Pacific Naval Vessels Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia

- 1.6. Singapore

- 1.7. Rest of Asia Pacific

Asia-Pacific Naval Vessels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Destroyers to Exhibit the Highest Growth Rate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vessel Type

- 5.1.1. Submarines

- 5.1.2. Frigates

- 5.1.3. Corvettes

- 5.1.4. Aircraft Carrier

- 5.1.5. Destroyers

- 5.1.6. Other Vessel Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Asia-Pacific

- 5.2.1.1. China

- 5.2.1.2. India

- 5.2.1.3. Japan

- 5.2.1.4. South Korea

- 5.2.1.5. Australia

- 5.2.1.6. Singapore

- 5.2.1.7. Rest of Asia-Pacific

- 5.2.1. Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vessel Type

- 6. China Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Mitsubishi Heavy Industries Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Cochin Shipyard Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 HD Hyundai

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bangkok Dock Company Limited

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 FINCANTIERI S p A

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Garden Reach Shipbuilders and Engineers Limited

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 thyssenkrupp AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Singapore Technologies Engineering Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 ASC Pty Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Mazagon Dock Shipbuilders Limited

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 LARSEN & TOUBRO LIMITED

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Navantia S A SM E

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 China State Shipbuilding Corporation

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Boustead Heavy Industries Corporation Berhad

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Kawasaki Heavy Industries Ltd

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 PT PAL Indonesia

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.1 Mitsubishi Heavy Industries Limited

List of Figures

- Figure 1: Asia-Pacific Naval Vessels Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Naval Vessels Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 3: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 14: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Singapore Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Naval Vessels Market?

The projected CAGR is approximately 14.97%.

2. Which companies are prominent players in the Asia-Pacific Naval Vessels Market?

Key companies in the market include Mitsubishi Heavy Industries Limited, Cochin Shipyard Limited, HD Hyundai, Bangkok Dock Company Limited, FINCANTIERI S p A, Garden Reach Shipbuilders and Engineers Limited, thyssenkrupp AG, Singapore Technologies Engineering Limited, ASC Pty Ltd, Mazagon Dock Shipbuilders Limited, LARSEN & TOUBRO LIMITED, Navantia S A SM E, China State Shipbuilding Corporation, Boustead Heavy Industries Corporation Berhad, Kawasaki Heavy Industries Ltd, PT PAL Indonesia.

3. What are the main segments of the Asia-Pacific Naval Vessels Market?

The market segments include Vessel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.47 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Destroyers to Exhibit the Highest Growth Rate During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

April 2023: Hyundai Heavy Industries launched its Chungnam frigate (FFX) at its shipyard in Ulsan, South Korea. The Chungnam is the first of six vessels that comprise the Ulsan-class FFX Batch III, which will be inducted into the Republic of Korea (ROK) Navy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Naval Vessels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Naval Vessels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Naval Vessels Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Naval Vessels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence