Key Insights

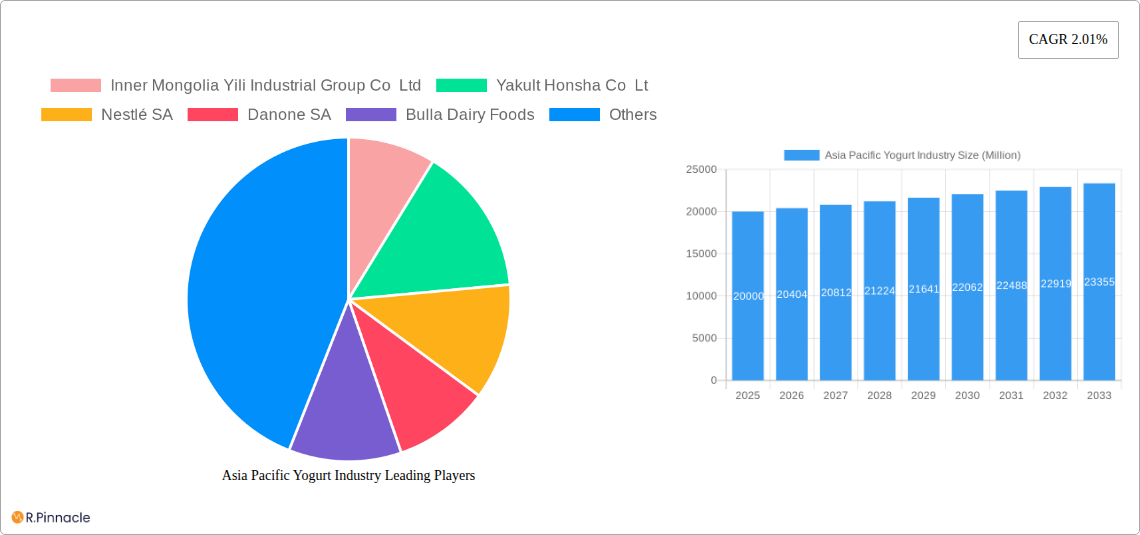

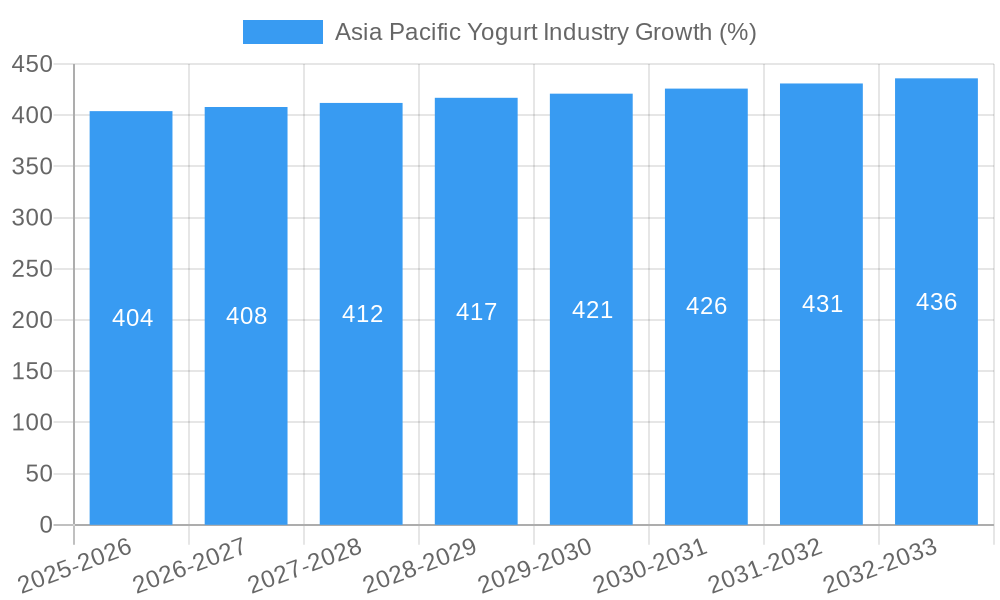

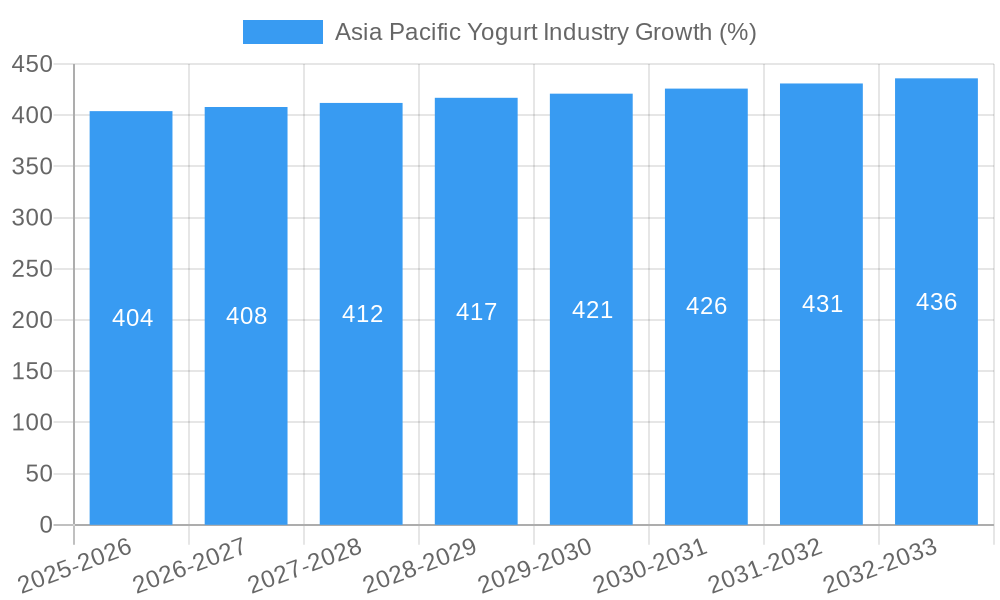

The Asia-Pacific yogurt market, valued at approximately $XX million in 2025, is projected to experience steady growth, driven by increasing health consciousness, rising disposable incomes, and the growing popularity of convenient, on-the-go snack options. The market's 2.01% CAGR suggests a consistent, albeit moderate, expansion throughout the forecast period (2025-2033). Key growth drivers include the increasing demand for functional foods enriched with probiotics and vitamins, coupled with innovative product launches like flavored yogurts catering to diverse palates. The burgeoning middle class in countries like India and China is significantly contributing to this market expansion. However, factors such as price sensitivity in certain regions and the availability of cheaper alternatives might act as restraints. The market is segmented by product type (flavored and unflavored yogurt) and distribution channel (off-trade, on-trade, and others). Major players like Yili, Yakult, Nestlé, Danone, and local dairy companies are actively shaping the market through strategic expansions, product diversification, and marketing initiatives. The dominance of specific regions within Asia Pacific will likely depend on factors such as consumer preferences, economic development, and regulatory frameworks. While China and India are expected to be major contributors to overall market growth, other countries in the region also offer significant potential. The competitive landscape is intensely dynamic, with both international and regional players vying for market share through product innovation and brand building.

The forecast for the Asia-Pacific yogurt market indicates continued expansion, albeit at a moderate pace. This steady growth is expected to be fueled by rising health awareness and the increasing adoption of yogurt as a healthy snack option. The segment of flavored yogurts is anticipated to maintain its market leadership due to its appeal to a broader consumer base. Online and modern retail channels will likely see increased adoption, supplementing the traditional off-trade distribution channels. Companies will need to leverage digital marketing and strategic partnerships to maintain competitive advantage. While the market shows promise, careful consideration of regional variations in consumer preferences and economic conditions is crucial for companies aiming to achieve sustainable growth in this sector. A deeper understanding of consumer preferences regarding ingredients, flavors, and packaging will be vital for long-term success.

Asia Pacific Yogurt Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Pacific yogurt industry, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, and future prospects. The report leverages extensive data analysis to provide a clear and actionable understanding of this dynamic market.

Asia Pacific Yogurt Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of the Asia Pacific yogurt market. We examine market concentration, identifying key players like Inner Mongolia Yili Industrial Group Co Ltd, Yakult Honsha Co Lt, Nestlé SA, Danone SA, Bulla Dairy Foods, Meiji Dairies Corporation, Gujarat Co-operative Milk Marketing Federation Ltd, FAGE International SA, and China Mengniu Dairy Company Ltd and their respective market shares (exact figures unavailable, estimated at xx Million USD each for the top 5 in 2025). The report also details M&A activity, including deal values (estimated at xx Million USD annually in the historical period) and their impact on market consolidation. Innovation drivers, such as the increasing demand for healthier food options and functional yogurts, are analyzed alongside regulatory frameworks and the influence of product substitutes (e.g., plant-based alternatives). End-user demographics and their evolving preferences are also considered, providing a holistic view of the market structure.

- Market Concentration: Highly fragmented with a few dominant players.

- Innovation Drivers: Health and wellness trends, functional ingredients.

- Regulatory Frameworks: Varying across countries, impacting product labeling and standards.

- M&A Activity: Significant consolidation expected, driven by market expansion strategies.

Asia Pacific Yogurt Industry Market Dynamics & Trends

This section delves into the key market dynamics influencing the Asia Pacific yogurt industry. We analyze market growth drivers, including rising disposable incomes, changing consumer lifestyles, and increasing health awareness. Technological disruptions, such as the adoption of advanced manufacturing and packaging technologies, are also assessed, along with their impact on production efficiency and product quality. Consumer preferences, evolving towards healthier and more convenient options, are considered alongside competitive dynamics, such as pricing strategies, product differentiation, and brand loyalty. The report projects a CAGR (Compound Annual Growth Rate) of xx% for the forecast period (2025-2033), with market penetration varying significantly across countries.

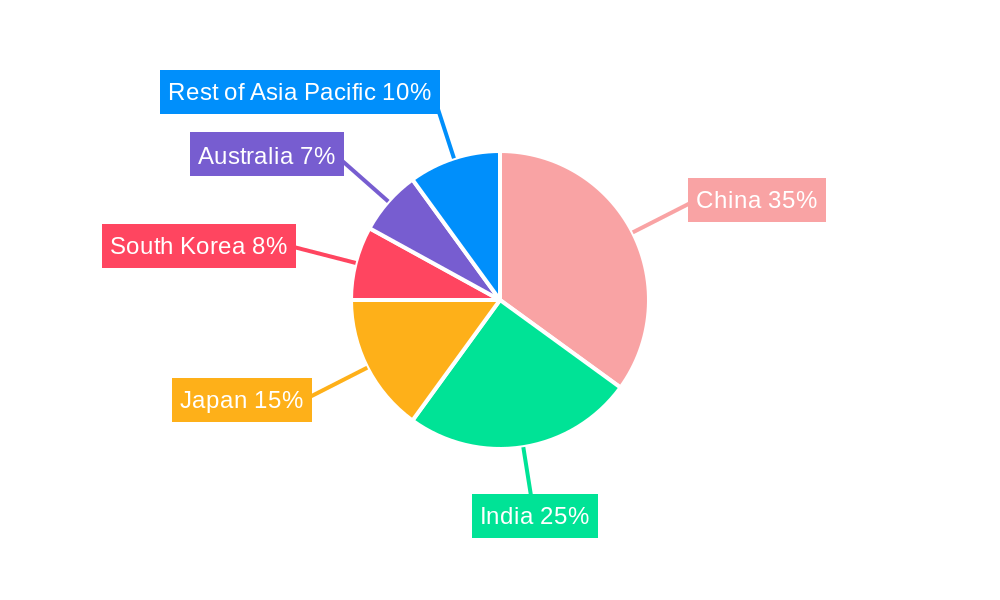

Dominant Regions & Segments in Asia Pacific Yogurt Industry

This section pinpoints the leading regions and segments within the Asia Pacific yogurt market. Among the countries (Australia, China, India, Indonesia, Japan, Malaysia, New Zealand, Pakistan, South Korea, Rest of Asia Pacific), China and India are projected to be the dominant markets due to their large populations and rising consumption. Within product types, flavored yogurt is expected to hold a larger market share than unflavored yogurt in 2025, driven by diverse taste preferences. The off-trade channel (supermarkets, hypermarkets) dominates distribution, with a growing contribution from the others (warehouse clubs, gas stations etc.) and online channels.

Key Drivers:

- China & India: Large populations, rising disposable incomes, and increasing health consciousness.

- Flavored Yogurt: Wide appeal across diverse consumer demographics and preferences.

- Off-Trade Channel: Established distribution networks and wide product reach.

Asia Pacific Yogurt Industry Product Innovations

This section highlights recent innovations in yogurt products, focusing on technological advancements that enhance product quality, shelf life, and consumer appeal. The report emphasizes the introduction of functional yogurts enriched with probiotics and other health-enhancing ingredients, along with innovative packaging solutions to improve convenience and reduce environmental impact. The competitive advantage is derived from unique product offerings that cater to specific consumer segments and trends, aligning with the overarching market dynamics.

Report Scope & Segmentation Analysis

This report segments the Asia Pacific yogurt market by product type (Flavored Yogurt, Unflavored Yogurt), distribution channel (Off-Trade, On-Trade, Others), and country (Australia, China, India, Indonesia, Japan, Malaysia, New Zealand, Pakistan, South Korea, Rest of Asia Pacific). Each segment's growth projections, market size (in Million USD), and competitive dynamics are detailed. The analysis covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033).

Key Drivers of Asia Pacific Yogurt Industry Growth

Several factors fuel the growth of the Asia Pacific yogurt industry, including rising health consciousness, increasing disposable incomes, the growing popularity of convenient food options, and government support for the dairy industry. Technological advancements in production and packaging also contribute to efficiency and product innovation. Changes in consumer preferences, toward healthier and more diverse yogurt options, further drive market expansion.

Challenges in the Asia Pacific Yogurt Industry Sector

The Asia Pacific yogurt industry faces challenges including intense competition, fluctuating raw material prices, and stringent regulatory requirements across different countries. Supply chain disruptions, particularly in times of economic uncertainty, impact the availability and affordability of raw materials, affecting production costs and profitability. These factors are estimated to reduce the market growth by xx% during the forecast period.

Emerging Opportunities in Asia Pacific Yogurt Industry

The Asia Pacific yogurt market offers significant growth potential. Emerging opportunities include the rising demand for functional yogurts with added health benefits, the expansion into newer markets with growing middle classes, and the growing popularity of online retail channels. Innovations in packaging and product formats cater to evolving consumer preferences.

Leading Players in the Asia Pacific Yogurt Industry Market

- Inner Mongolia Yili Industrial Group Co Ltd

- Yakult Honsha Co Lt

- Nestlé SA

- Danone SA

- Bulla Dairy Foods

- Meiji Dairies Corporation

- Gujarat Co-operative Milk Marketing Federation Ltd

- FAGE International SA

- China Mengniu Dairy Company Ltd

Key Developments in Asia Pacific Yogurt Industry

- July 2022: Amul invested USD 60 Million in a new dairy plant in Rajkot, expanding milk, yogurt, and buttermilk production.

- September 2021: Bulla Dairy Foods launched Australian Style Yogurt in 100g cups through food service distributors.

- July 2021: Miss Fresh partnered with China Mengniu Dairy to offer 70 dairy products via its app and WeChat Mini Program.

Future Outlook for Asia Pacific Yogurt Industry Market

The Asia Pacific yogurt market is poised for sustained growth, driven by several factors. The increasing health consciousness among consumers, coupled with the expanding middle class and rising disposable incomes, will significantly contribute to market expansion. The continued innovation in product development and the adoption of advanced technologies will further propel the industry's growth, creating new opportunities for both established players and emerging businesses. The market's future success depends on adapting to evolving consumer preferences and successfully navigating the competitive landscape.

Asia Pacific Yogurt Industry Segmentation

-

1. Product Type

- 1.1. Flavored Yogurt

- 1.2. Unflavored Yogurt

-

2. Distribution Channel

-

2.1. Off-Trade

-

2.1.1. By Sub Distribution Channels

- 2.1.1.1. Convenience Stores

- 2.1.1.2. Online Retail

- 2.1.1.3. Specialist Retailers

- 2.1.1.4. Supermarkets and Hypermarkets

- 2.1.1.5. Others (Warehouse clubs, gas stations, etc.)

-

2.1.1. By Sub Distribution Channels

- 2.2. On-Trade

-

2.1. Off-Trade

Asia Pacific Yogurt Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Yogurt Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.01% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Supplement Nutrition; Growing Casein Application in Processed Food Products

- 3.3. Market Restrains

- 3.3.1. Competition from Vegan/Plant-based Protein Powders

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Flavored Yogurt

- 5.1.2. Unflavored Yogurt

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. By Sub Distribution Channels

- 5.2.1.1.1. Convenience Stores

- 5.2.1.1.2. Online Retail

- 5.2.1.1.3. Specialist Retailers

- 5.2.1.1.4. Supermarkets and Hypermarkets

- 5.2.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.1.1. By Sub Distribution Channels

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia Pacific Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Inner Mongolia Yili Industrial Group Co Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Yakult Honsha Co Lt

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Nestlé SA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Danone SA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Bulla Dairy Foods

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Meiji Dairies Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Gujarat Co-operative Milk Marketing Federation Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 FAGE International SA

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 China Mengniu Dairy Company Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Inner Mongolia Yili Industrial Group Co Ltd

List of Figures

- Figure 1: Asia Pacific Yogurt Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Yogurt Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Yogurt Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Yogurt Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Asia Pacific Yogurt Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Asia Pacific Yogurt Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Pacific Yogurt Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Pacific Yogurt Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Asia Pacific Yogurt Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Asia Pacific Yogurt Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia Pacific Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Yogurt Industry?

The projected CAGR is approximately 2.01%.

2. Which companies are prominent players in the Asia Pacific Yogurt Industry?

Key companies in the market include Inner Mongolia Yili Industrial Group Co Ltd, Yakult Honsha Co Lt, Nestlé SA, Danone SA, Bulla Dairy Foods, Meiji Dairies Corporation, Gujarat Co-operative Milk Marketing Federation Ltd, FAGE International SA, China Mengniu Dairy Company Ltd.

3. What are the main segments of the Asia Pacific Yogurt Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Supplement Nutrition; Growing Casein Application in Processed Food Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Vegan/Plant-based Protein Powders.

8. Can you provide examples of recent developments in the market?

July 2022: Amul announced an investment of USD 60 million to build a new dairy plant in Rajkot to expand its production capabilities across milk, yogurt, and buttermilk products.September 2021: Bulla Dairy Foods launched its Australian Style Yogurt in 100g cups through food service distributors.July 2021: Miss Fresh partnered with China Mengniu Dairy to offer the full range of Mengniu's 70 high-quality dairy products to bring more nutritious and healthy choices to the MissFresh app and WeChat Mini Program users.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Yogurt Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Yogurt Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Yogurt Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Yogurt Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence