Key Insights

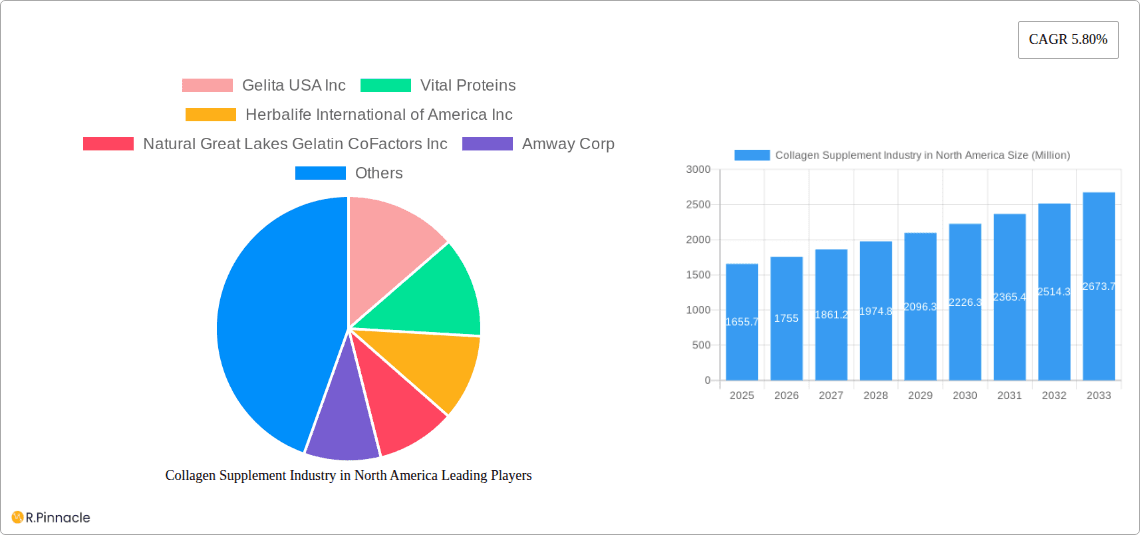

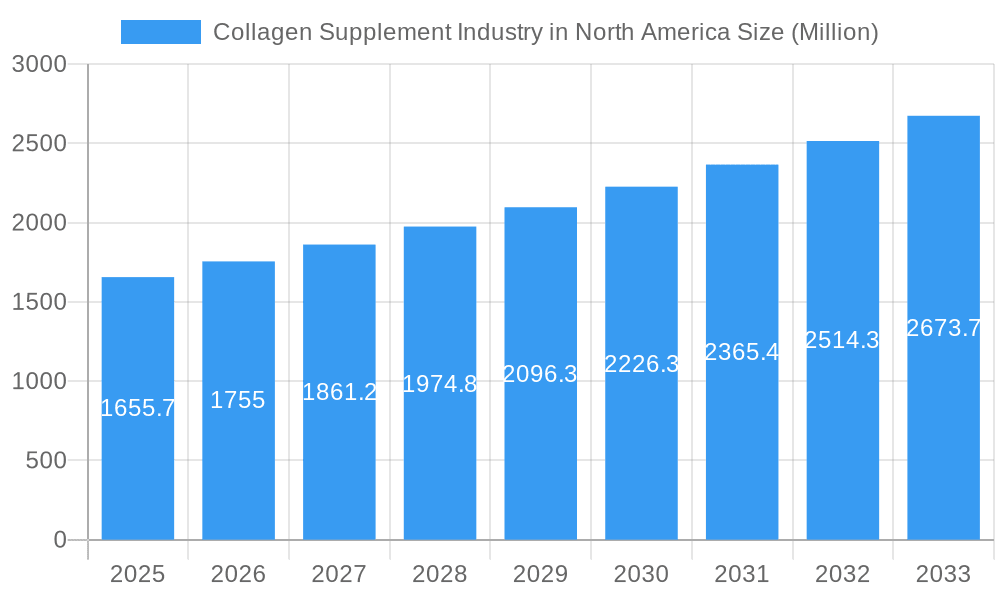

The North American collagen supplement market, valued at $1,655.7 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 5.80% from 2025 to 2033. This expansion is fueled by several key factors. The increasing awareness of collagen's crucial role in maintaining healthy skin, hair, and joints is driving consumer demand. The rising prevalence of age-related conditions, such as osteoarthritis, further contributes to market growth, as collagen supplements offer a potential natural remedy. Furthermore, the proliferation of convenient and palatable forms of collagen supplements, including powders, capsules, and gummies, is enhancing market accessibility and consumer adoption. The market segmentation reveals a strong preference for animal-based collagen sources, reflecting ingrained consumer perceptions of efficacy and purity. However, marine-based collagen is experiencing significant growth, driven by sustainability concerns and the increasing popularity of plant-based alternatives within the broader health and wellness sector. Major players like Gelita USA Inc, Vital Proteins, and Herbalife International of America Inc. are actively shaping market dynamics through innovative product development, strategic partnerships, and targeted marketing campaigns. Distribution channels are diversifying, with online retailers experiencing rapid growth, reflecting the evolving shopping habits of consumers. Future growth will likely be shaped by evolving consumer preferences towards specific collagen types (e.g., type I, type II), further innovation in delivery methods and formulations, and increased scientific evidence validating the purported health benefits of collagen supplementation.

Collagen Supplement Industry in North America Market Size (In Billion)

The continued growth in the North American market is largely driven by the increasing health-conscious population. This demographic is actively seeking natural and effective solutions to maintain their well-being and address aging-related concerns. The significant investments in research and development by key players are leading to innovative formulations and increased accessibility. This factor, coupled with the growing availability of convenient purchasing options such as e-commerce, is expanding market penetration. The competitive landscape is characterized by both established players and emerging brands, which fosters innovation and contributes to diverse product offerings. The ongoing focus on sourcing high-quality collagen, coupled with regulatory compliance, is paramount to maintaining consumer trust and driving the sustained growth of this dynamic market sector.

Collagen Supplement Industry in North America Company Market Share

Collagen Supplement Industry in North America: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North American collagen supplement market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The report leverages rigorous data analysis and expert forecasting to present a detailed understanding of market dynamics, growth drivers, challenges, and future opportunities.

Collagen Supplement Industry in North America Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of the North American collagen supplement market. We delve into market concentration, examining the market share held by key players such as Gelita USA Inc, Vital Proteins, Herbalife International of America Inc, Natural Great Lakes Gelatin CoFactors Inc, Amway Corp, Nutrawise Health & Beauty Corporation, and Natures Bounty (list not exhaustive). The report explores M&A activities within the industry, providing insights into deal values and their impact on market consolidation. Further analysis covers innovation drivers, including technological advancements in collagen extraction and formulation, and the regulatory frameworks governing the supplement industry. We also examine the influence of product substitutes and analyze end-user demographics, providing a comprehensive overview of market structure and dynamics. The estimated market size for 2025 is projected at $XX Million. The report also analyzes the impact of various factors such as consumer preference for specific collagen types (e.g., type I, type II) and the influence of health and wellness trends.

Collagen Supplement Industry in North America Market Dynamics & Trends

This section provides a detailed examination of market growth drivers, technological disruptions, consumer preferences, and competitive dynamics within the North American collagen supplement market. We project a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). The analysis explores factors influencing market penetration, such as increasing consumer awareness of collagen's benefits for skin, joint health, and gut health, and the expanding distribution channels. Furthermore, we discuss emerging technological disruptions, including the development of novel collagen extraction methods and advanced delivery systems, and their impact on market trends. The impact of key macro-economic factors, including consumer spending power and changes in lifestyle trends are also discussed. This section also examines the evolving competitive dynamics within the market, analyzing shifts in market share, and the strategic initiatives undertaken by major players. The anticipated market size in 2033 is projected to reach $XX Million.

Dominant Regions & Segments in Collagen Supplement Industry in North America

This section identifies the leading regions and segments within the North American collagen supplement market.

By Sources:

- Animal-Based Collagen: This segment dominates the market due to its established presence and readily available supply. Key drivers include its widespread acceptance by consumers and manufacturers. The segment’s projected market size for 2025 is $XX Million.

- Marine-Based Collagen: This segment is experiencing significant growth due to the rising demand for sustainable and hypoallergenic options. Key drivers include increasing consumer awareness of environmentally friendly products and the growing popularity of marine-based collagen in the beauty and wellness sectors. The segment’s projected market size for 2025 is $XX Million.

By Distribution Channel:

- Hypermarket/Supermarket: This channel benefits from its widespread accessibility and established customer base. Key drivers include its extensive reach and consumer convenience. The segment’s projected market size for 2025 is $XX Million.

- Pharmacies: This channel leverages the expertise and trust associated with healthcare professionals. Key drivers include increased consumer confidence in product quality and efficacy. The segment’s projected market size for 2025 is $XX Million.

- Internet Retailing: This rapidly growing channel benefits from its convenience and ability to target specific consumer groups. Key drivers include the increasing adoption of e-commerce and the accessibility of online purchasing. The segment’s projected market size for 2025 is $XX Million.

- Other Distribution Channels: This category includes specialized retailers, direct sales, and other channels. This segment shows consistent growth although it shows lower growth rate than the internet retailing. The segment’s projected market size for 2025 is $XX Million.

Collagen Supplement Industry in North America Product Innovations

The North American collagen supplement market is witnessing significant product innovation, driven by advancements in extraction technologies, formulation techniques, and delivery systems. New products incorporate various forms of collagen (types I, II, III), often combined with other beneficial ingredients such as hyaluronic acid or vitamin C. These innovations cater to diverse consumer needs and preferences, resulting in a wider range of products tailored to specific health goals and lifestyle choices. The focus on improved bioavailability and enhanced efficacy is a key driver of innovation, leading to the development of more effective and bioavailable collagen supplements.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the North American collagen supplement market based on source (animal-based, marine-based) and distribution channel (hypermarket/supermarket, pharmacies, internet retailing, other distribution channels). Each segment's analysis includes detailed growth projections, market sizes for the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). The competitive dynamics within each segment are also examined. The growth rate for each segment in the forecast period will be determined by numerous factors and is subject to change based on numerous market factors.

Key Drivers of Collagen Supplement Industry in North America Growth

Several factors contribute to the growth of the North American collagen supplement market. Increasing consumer awareness of collagen’s health benefits, fueled by media coverage and social media trends, is a major driver. The expanding availability of collagen supplements through various retail channels and increased demand from health and wellness-conscious individuals also contributes to this growth. Advances in collagen extraction and formulation technologies, leading to higher quality and more effective products, enhance the market's attractiveness to consumers.

Challenges in the Collagen Supplement Industry in North America Sector

The North American collagen supplement market faces challenges, including ensuring consistent product quality and addressing concerns regarding the sourcing and sustainability of collagen materials. Regulatory compliance and stringent labeling requirements can present hurdles for manufacturers. The increasing competitive intensity, with new entrants and established players vying for market share, also adds to the complexity of the market. Maintaining supply chain stability and mitigating the impacts of price fluctuations in raw materials are key challenges.

Emerging Opportunities in Collagen Supplement Industry in North America

Emerging opportunities include the development of novel collagen products targeting specific health conditions, such as osteoarthritis or gut health. The growing interest in personalized nutrition creates possibilities for tailored collagen supplement formulations. Expansion into new distribution channels, such as direct-to-consumer online sales and partnerships with healthcare providers, represent significant potential. The rising demand for sustainable and ethically sourced collagen presents further opportunities for innovation and market differentiation.

Leading Players in the Collagen Supplement Industry in North America Market

- Gelita USA Inc

- Vital Proteins

- Herbalife International of America Inc

- Natural Great Lakes Gelatin CoFactors Inc

- Amway Corp

- Nutrawise Health & Beauty Corporation

- Natures Bounty

*List Not Exhaustive

Key Developments in Collagen Supplement Industry in North America Industry

- 2022 Q4: Vital Proteins launches a new line of collagen peptides targeted for specific health needs.

- 2023 Q1: Gelita USA Inc announces a strategic partnership for the distribution of its collagen products in Canada.

- 2023 Q2: A major M&A activity occurs within the North American Collagen supplement market involving two of the leading companies (details not available at the time of writing).

(Further details about developments to be included in the final report)

Future Outlook for Collagen Supplement Industry in North America Market

The future of the North American collagen supplement market appears bright, driven by sustained consumer demand, ongoing product innovation, and increasing scientific evidence supporting collagen's health benefits. Expanding market penetration into newer consumer segments, along with the development of advanced collagen formulations and delivery systems, offers strong growth potential. Continued investment in research and development and strategic partnerships within the industry will shape future market dynamics.

Collagen Supplement Industry in North America Segmentation

-

1. Sources

- 1.1. Animal-Based Collagen

- 1.2. Marine-Based Collagen

-

2. Distribution Channel

- 2.1. Hypermarket/Supermarket

- 2.2. Pharmacies

- 2.3. Internet Retailing

- 2.4. Other Distribution Channels

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.1.3. Mexico

- 3.1.4. Rest of North America

-

3.1. North America

Collagen Supplement Industry in North America Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

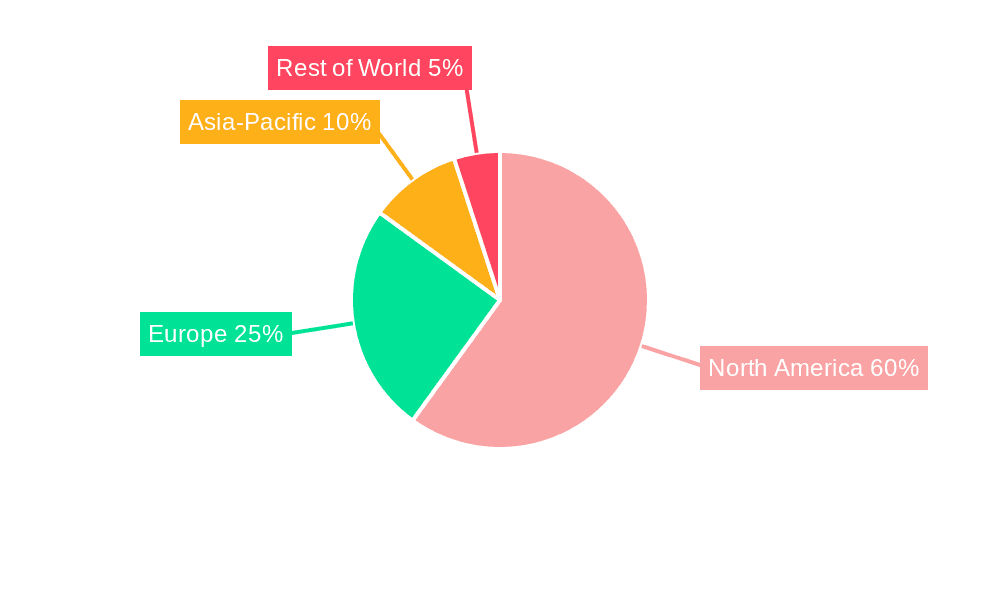

Collagen Supplement Industry in North America Regional Market Share

Geographic Coverage of Collagen Supplement Industry in North America

Collagen Supplement Industry in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. United States is the dominating the Overall Sales in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Collagen Supplement Industry in North America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sources

- 5.1.1. Animal-Based Collagen

- 5.1.2. Marine-Based Collagen

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarket/Supermarket

- 5.2.2. Pharmacies

- 5.2.3. Internet Retailing

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1.3. Mexico

- 5.3.1.4. Rest of North America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Sources

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Gelita USA Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vital Proteins

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Herbalife International of America Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Natural Great Lakes Gelatin CoFactors Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amway Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nutrawise Health & Beauty Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Natures Bounty*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Gelita USA Inc

List of Figures

- Figure 1: Collagen Supplement Industry in North America Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Collagen Supplement Industry in North America Share (%) by Company 2025

List of Tables

- Table 1: Collagen Supplement Industry in North America Revenue Million Forecast, by Sources 2020 & 2033

- Table 2: Collagen Supplement Industry in North America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Collagen Supplement Industry in North America Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Collagen Supplement Industry in North America Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Collagen Supplement Industry in North America Revenue Million Forecast, by Sources 2020 & 2033

- Table 6: Collagen Supplement Industry in North America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Collagen Supplement Industry in North America Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Collagen Supplement Industry in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Collagen Supplement Industry in North America?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Collagen Supplement Industry in North America?

Key companies in the market include Gelita USA Inc, Vital Proteins, Herbalife International of America Inc, Natural Great Lakes Gelatin CoFactors Inc, Amway Corp, Nutrawise Health & Beauty Corporation, Natures Bounty*List Not Exhaustive.

3. What are the main segments of the Collagen Supplement Industry in North America?

The market segments include Sources, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1,655.7 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

United States is the dominating the Overall Sales in the region.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Collagen Supplement Industry in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Collagen Supplement Industry in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Collagen Supplement Industry in North America?

To stay informed about further developments, trends, and reports in the Collagen Supplement Industry in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence