Key Insights

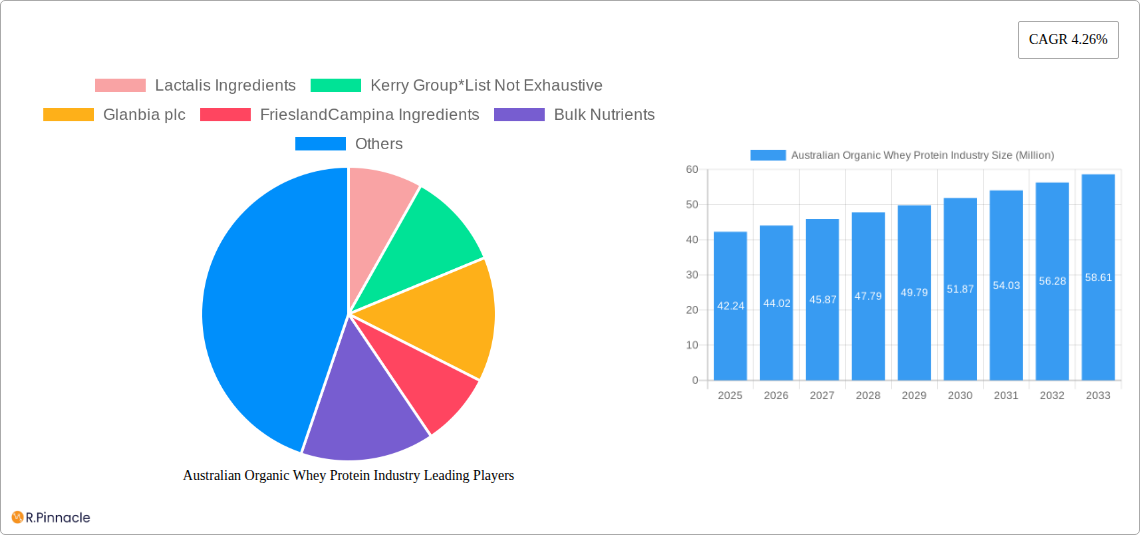

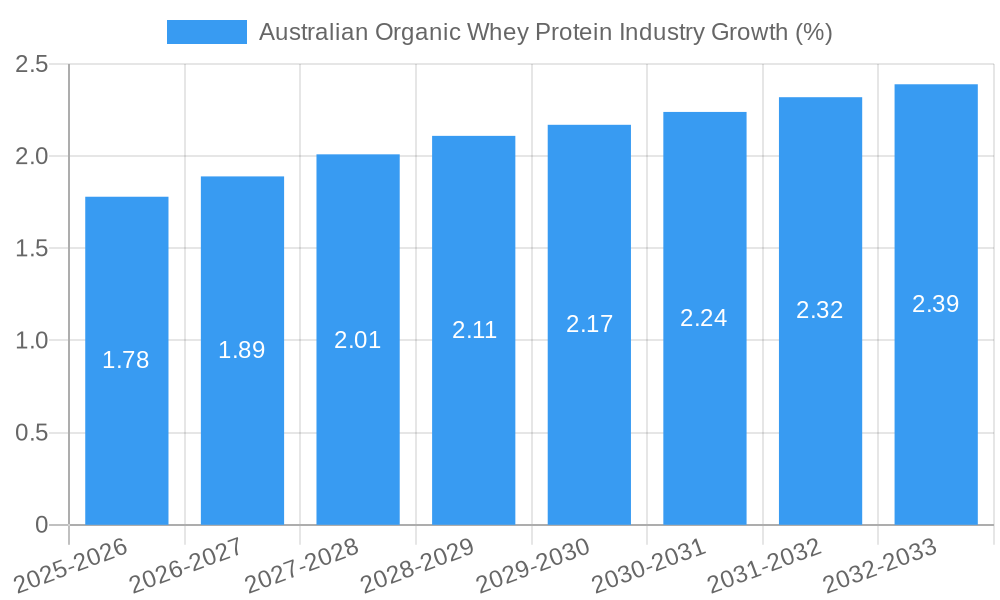

The Australian organic whey protein market, valued at approximately $42.24 million in 2025, is poised for steady growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 4.26% from 2025 to 2033. This growth is fueled by several key factors. The rising popularity of health and wellness, particularly among fitness enthusiasts and health-conscious consumers, significantly drives demand for organic whey protein as a clean and high-quality protein source. Increasing awareness of the benefits of organic products, coupled with a growing preference for natural and sustainable food choices, further contributes to market expansion. The diverse applications of organic whey protein across sports nutrition, infant formula, and functional foods broaden its market appeal, attracting diverse consumer segments. Leading players like Lactalis Ingredients, Kerry Group, and Glanbia plc are strategically expanding their organic product lines to cater to this burgeoning demand. While pricing pressures and competition from conventional whey protein may pose some challenges, the inherent premium associated with organic certification and the growing consumer preference for premium ingredients are mitigating these restraints. The market segmentation reflects a strong demand for whey protein concentrates and isolates, highlighting the emphasis on purity and bioavailability.

The forecast for the Australian organic whey protein market is optimistic, indicating a continuous rise in demand over the next decade. Growth will be further influenced by innovative product development, including the introduction of novel organic whey protein blends tailored to specific consumer needs. Strategic partnerships between producers and retailers, focused on enhancing distribution and marketing efforts, will also play a crucial role in market penetration. The continued emphasis on sustainability and transparency within the organic food sector is expected to further propel the growth of the Australian organic whey protein market. This positive trajectory presents considerable opportunities for businesses operating in this space, underpinned by strong consumer demand and favorable market dynamics.

Australian Organic Whey Protein Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Australian organic whey protein industry, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report reveals market dynamics, growth drivers, challenges, and future opportunities within this rapidly evolving sector. The report meticulously examines market segmentation by type (Whey Protein Concentrates, Isolates, Hydrolyzed Whey Proteins) and application (Sports Nutrition, Infant Formula, Functional Foods), providing detailed market sizing and forecasting.

Australian Organic Whey Protein Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of the Australian organic whey protein market. The market exhibits a moderately concentrated structure, with key players such as Lactalis Ingredients, Kerry Group, Glanbia plc, FrieslandCampina Ingredients, Bulk Nutrients, Arla Foods Ingredients Group P/S, Milkiland, AB Rokiskio suris, Protein Supplies Australia, and Bega Cheese Limited holding significant market share. However, the market also features numerous smaller players, reflecting a dynamic and competitive environment.

- Market Concentration: The top five players account for approximately xx% of the market (2025 estimate). Further analysis reveals significant variations in market share across different segments.

- Innovation Drivers: Growing consumer demand for clean-label, functional foods, and the increasing popularity of sports nutrition are key drivers of innovation. Investment in research and development, particularly in areas like HMO-enriched whey protein, is further fueling innovation.

- Regulatory Framework: Stringent regulations surrounding organic certification and food safety standards significantly influence market dynamics and necessitate compliance for all players. Changes in these regulations can lead to shifts in market share and operational costs.

- Product Substitutes: Plant-based protein sources, such as pea and soy protein, pose a significant competitive threat, particularly among consumers seeking alternative dietary options.

- End-User Demographics: The primary end-users are health-conscious consumers, athletes, and infants, each with distinct requirements and preferences that influence product development and marketing strategies.

- M&A Activities: The industry has witnessed several mergers and acquisitions in recent years, with deal values averaging approximately xx Million AUD annually (2019-2024). These activities often result in consolidation, expansion of product portfolios and enhanced market reach.

Australian Organic Whey Protein Industry Market Dynamics & Trends

The Australian organic whey protein market is experiencing robust growth, driven by several key factors. The rising health consciousness among consumers, coupled with a growing preference for organic and natural food products, fuels demand. Furthermore, increased participation in sports and fitness activities, along with the expanding infant formula market, supports market growth. Technological advancements, such as the development of novel whey protein formulations with added functional benefits, are further driving market expansion. The market's Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Market penetration in key segments like sports nutrition and infant formula continues to grow as awareness and affordability improve. Competitive dynamics are characterized by both intense rivalry and strategic collaborations, driving innovation and diversification within the market.

Dominant Regions & Segments in Australian Organic Whey Protein Industry

The Australian organic whey protein market demonstrates regional variations in consumption patterns and market size. While a precise ranking of regions isn't available without specific data, it is anticipated that major population centers and regions with a strong focus on agriculture and dairy would show the highest consumption.

- Type: Whey protein isolates are expected to command the largest market share due to their higher protein content and purity, followed by concentrates and then hydrolyzed whey proteins. This is driven by consumer preference and price points within those markets.

- Application: Sports and performance nutrition is projected as the leading application segment, followed by infant formula and functional/fortified foods. This is driven by the larger existing markets and greater penetration amongst specific demographics.

Key Drivers:

- Economic Policies: Government support for the dairy industry and initiatives promoting healthy eating habits positively influence market growth.

- Infrastructure: Efficient logistics and supply chain networks support the distribution of products across Australia.

Australian Organic Whey Protein Industry Product Innovations

Recent years have witnessed significant innovations in the Australian organic whey protein market. FrieslandCampina's launch of Aequival 2'-fucosyl lactose, an ingredient incorporating HMOs for infant formula, exemplifies the focus on functional benefits. Kerry Group's investment in a new innovation center further underscores the industry's commitment to developing advanced whey-based ingredients. These innovations cater to the growing consumer demand for products with enhanced nutritional and functional properties, thereby securing a strong market fit and competitive advantage.

Report Scope & Segmentation Analysis

This report covers the Australian organic whey protein market from 2019 to 2033. The base year is 2025, with the forecast period spanning 2025-2033 and historical data from 2019-2024. The market is segmented by type (Whey Protein Concentrates, Isolates, Hydrolyzed Whey Proteins) and application (Sports and Performance Nutrition, Infant Formula, Functional/Fortified Food). Each segment displays unique growth projections, market sizes, and competitive dynamics. The Whey Protein Isolates segment is forecast to experience higher growth than Concentrates, driven by increased demand for products with high protein concentration. The Sports Nutrition segment is projected to capture the most significant market share overall.

Key Drivers of Australian Organic Whey Protein Industry Growth

Several factors contribute to the growth of the Australian organic whey protein market. The increasing prevalence of health-conscious consumers who are prioritising high-protein diets is a primary driver. Government support for the dairy industry and organic farming initiatives provide additional impetus. Further growth comes from advancements in processing technologies that produce high-quality, organic whey proteins efficiently. Finally, technological innovation produces new whey protein applications across diverse food segments.

Challenges in the Australian Organic Whey Protein Industry Sector

The Australian organic whey protein industry faces challenges like fluctuations in raw material prices and the stringent regulations required to maintain organic certification. Supply chain disruptions can impact production and distribution. Intense competition from both domestic and international players exerts pressure on pricing and market share. These issues can create uncertainty and constrain market growth to some degree.

Emerging Opportunities in Australian Organic Whey Protein Industry

The Australian organic whey protein industry presents numerous promising opportunities. The growing demand for functional foods, particularly those containing added health benefits, opens new avenues for product development and market expansion. The increasing popularity of plant-based protein blends may lead to opportunities to incorporate organic whey proteins into hybrid products. Innovative marketing strategies and increasing consumer awareness could further unlock the market's potential.

Leading Players in the Australian Organic Whey Protein Industry Market

- Lactalis Ingredients

- Kerry Group

- Glanbia plc

- FrieslandCampina Ingredients

- Bulk Nutrients

- Arla Foods Ingredients Group P/S

- Milkiland

- AB Rokiskio suris

- Protein Supplies Australia

- Bega Cheese Limited

Key Developments in Australian Organic Whey Protein Industry Industry

- November 2022: FrieslandCampina launched Aequival 2'-fucosyl lactose, a whey protein ingredient with HMOs for infant formula, significantly impacting the infant nutrition segment.

- November 2022: Kerry Ingredients invested USD 2.5 Million in a new innovation center, boosting its capacity for developing advanced whey-based ingredients and strengthening its market position.

- January 2018: Fonterra Co-operative invested AUD 165 million (USD 120.45 million) in expanding its Australian operations, increasing production capacity and efficiency.

Future Outlook for Australian Organic Whey Protein Industry Market

The Australian organic whey protein market is poised for continued growth, driven by increasing consumer demand for healthy and convenient protein sources. Innovation in product development, particularly in functional foods and specialized sports nutrition products, will be key to sustaining this growth. Strategic partnerships and mergers and acquisitions will continue to shape the industry landscape, increasing efficiency and potentially market share. The market's future potential is significant, with substantial opportunities for expansion and diversification.

Australian Organic Whey Protein Industry Segmentation

-

1. Type

- 1.1. Whey Protein Concentrates

- 1.2. Whey Protein Isolates

- 1.3. Hydrolyzed Whey Proteins

-

2. Application

- 2.1. Sports and Performance Nutrition

- 2.2. Infant Formula

- 2.3. Functional/Fortified Food

Australian Organic Whey Protein Industry Segmentation By Geography

- 1. Australia

Australian Organic Whey Protein Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing awareness towards fitness among consumers; Demand for convenient fortified foods

- 3.3. Market Restrains

- 3.3.1. Increasing vegan culture in the market

- 3.4. Market Trends

- 3.4.1. Increasing awareness towards health among consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australian Organic Whey Protein Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Whey Protein Concentrates

- 5.1.2. Whey Protein Isolates

- 5.1.3. Hydrolyzed Whey Proteins

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Sports and Performance Nutrition

- 5.2.2. Infant Formula

- 5.2.3. Functional/Fortified Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Lactalis Ingredients

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kerry Group*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Glanbia plc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FrieslandCampina Ingredients

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bulk Nutrients

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arla Foods Ingredients Group P/S

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Milkiland

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AB Rokiskio suris

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Protein Supplies Australia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bega Cheese Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Lactalis Ingredients

List of Figures

- Figure 1: Australian Organic Whey Protein Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australian Organic Whey Protein Industry Share (%) by Company 2024

List of Tables

- Table 1: Australian Organic Whey Protein Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australian Organic Whey Protein Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Australian Organic Whey Protein Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Australian Organic Whey Protein Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 5: Australian Organic Whey Protein Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Australian Organic Whey Protein Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: Australian Organic Whey Protein Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Australian Organic Whey Protein Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Australian Organic Whey Protein Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Australian Organic Whey Protein Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Australian Organic Whey Protein Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Australian Organic Whey Protein Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 13: Australian Organic Whey Protein Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Australian Organic Whey Protein Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 15: Australian Organic Whey Protein Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Australian Organic Whey Protein Industry Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australian Organic Whey Protein Industry?

The projected CAGR is approximately 4.26%.

2. Which companies are prominent players in the Australian Organic Whey Protein Industry?

Key companies in the market include Lactalis Ingredients, Kerry Group*List Not Exhaustive, Glanbia plc, FrieslandCampina Ingredients, Bulk Nutrients, Arla Foods Ingredients Group P/S, Milkiland, AB Rokiskio suris, Protein Supplies Australia, Bega Cheese Limited.

3. What are the main segments of the Australian Organic Whey Protein Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 42240 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing awareness towards fitness among consumers; Demand for convenient fortified foods.

6. What are the notable trends driving market growth?

Increasing awareness towards health among consumers.

7. Are there any restraints impacting market growth?

Increasing vegan culture in the market.

8. Can you provide examples of recent developments in the market?

November 2022: FrieslandCampina unveiled a groundbreaking whey protein ingredient known as Aequival 2'-fucosyl lactose. This remarkable component includes Human Milk Oligosaccharides (HMOs) that create an optimal environment for nurturing beneficial gut bacteria in infants, thereby fostering healthy infant development. This innovative ingredient finds application in the production of infant formula.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australian Organic Whey Protein Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australian Organic Whey Protein Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australian Organic Whey Protein Industry?

To stay informed about further developments, trends, and reports in the Australian Organic Whey Protein Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence