Key Insights

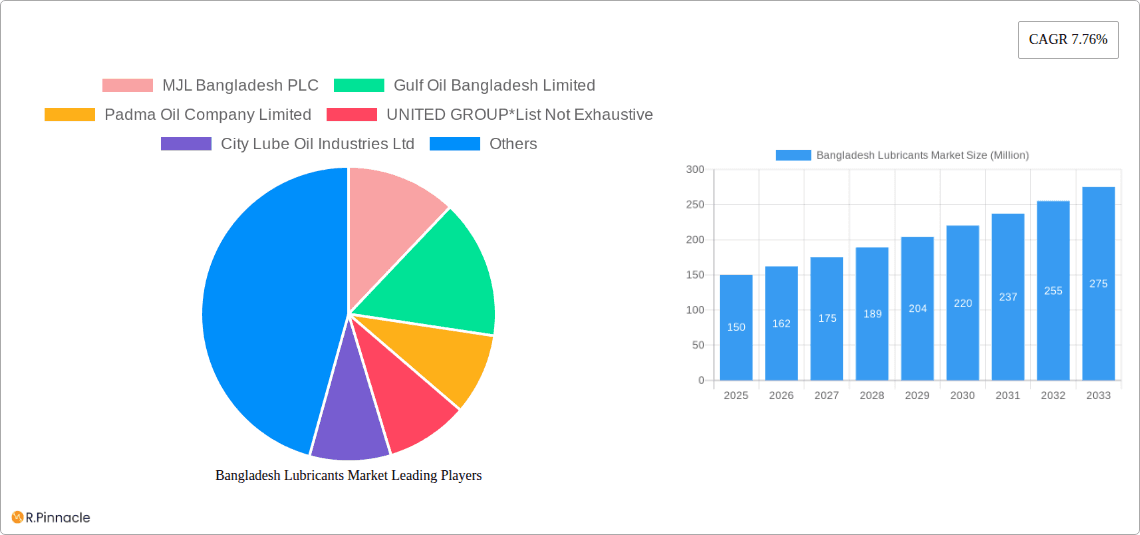

The Bangladesh lubricants market is poised for substantial growth, projected to reach $4 billion by 2033 from its 2024 valuation. This expansion is fueled by a rapidly developing automotive sector, increasing industrialization, and enhanced power generation capacity. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 3.5% from 2024 to 2033. Key market segments include engine oils, which hold the largest share due to extensive vehicle and machinery usage, followed by transmission and gear oils, and hydraulic fluids. The automotive and transportation sectors are the primary end-users, reflecting the high vehicle density and demand for premium lubricants. Government initiatives promoting infrastructure development and economic diversification further stimulate industrial growth and lubricant demand. However, fluctuations in crude oil prices and potential import restrictions present market challenges. The competitive landscape features global brands such as BP and Shell alongside local entities like MJL Bangladesh PLC and Padma Oil Company Limited.

Bangladesh Lubricants Market Market Size (In Billion)

The forecast period (2024-2033) anticipates steady market expansion, with engine oils and the automotive end-user segment spearheading growth. Strategic priorities for market players include product innovation, brand enhancement, and strategic alliances to secure market share. The increasing focus on environmentally friendly lubricants and stringent emission standards will significantly influence product development and market positioning. Substantial growth potential offers attractive investment prospects for both domestic and international companies capable of navigating market complexities and leveraging growth drivers. A thorough understanding of the regulatory environment and consumer preferences is crucial for success in this dynamic market.

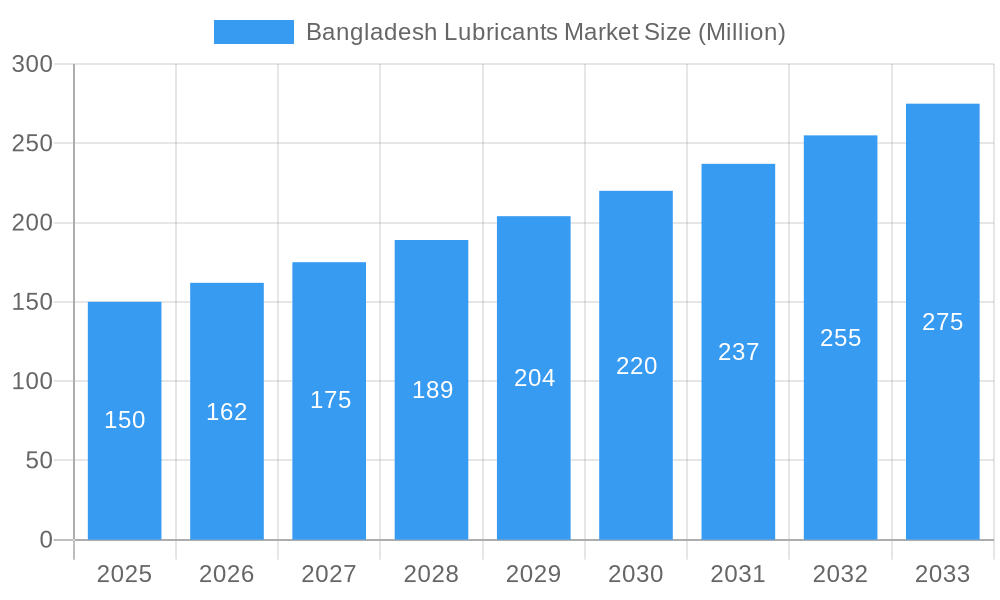

Bangladesh Lubricants Market Company Market Share

This comprehensive report delivers an in-depth analysis of the Bangladesh lubricants market, providing critical insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2024 to 2033, with a base year of 2024, this report details market dynamics, emerging trends, and future potential. The analysis includes detailed segmentation by product type (Engine Oil, Transmission and Gear Oils, Hydraulic Fluids, Metalworking Fluids, Greases, and Other Product Types) and end-user industry (Power Generation, Automotive and Other Transportation, Heavy Equipment, Metallurgy and Metalworking, and Other End-user Industries). Key players such as MJL Bangladesh PLC, Gulf Oil Bangladesh Limited, and Padma Oil Company Limited are profiled, offering a complete view of the competitive arena.

Bangladesh Lubricants Market Structure & Innovation Trends

This section analyzes the competitive intensity of the Bangladesh lubricants market, exploring market concentration, innovation drivers, regulatory frameworks, the presence of substitute products, end-user demographics, and merger and acquisition (M&A) activities. We examine market share distribution among key players and delve into the value of significant M&A deals concluded within the study period. The report also explores the impact of government regulations on market growth and innovation.

- Market Concentration: The market exhibits a [xx]% concentration ratio, indicating [Describe the level of concentration: e.g., a moderately concentrated market].

- Innovation Drivers: [Describe key drivers, e.g., increasing demand for high-performance lubricants, government initiatives promoting energy efficiency, etc.].

- Regulatory Framework: [Discuss relevant regulations and their impact, e.g., environmental regulations, import/export policies].

- Product Substitutes: [Analyze substitute products and their market impact].

- End-User Demographics: [Analyze the demographic trends influencing lubricant demand].

- M&A Activities: [Discuss significant M&A activities, including deal values and their impact on market structure. Example: "In 2022, a significant merger between X and Y resulted in a combined market share of xx%, reshaping the competitive landscape."]

Bangladesh Lubricants Market Market Dynamics & Trends

This section delves into the factors driving market growth, technological disruptions, evolving consumer preferences, and competitive dynamics. We present a detailed analysis of the Compound Annual Growth Rate (CAGR) and market penetration rates for various lubricant types across different end-user industries. [Insert detailed paragraph analysis of market growth drivers (e.g., rising vehicle ownership, industrialization, infrastructure development), technological disruptions (e.g., advancements in lubricant technology, adoption of digital tools), consumer preferences (e.g., preference for eco-friendly lubricants, demand for higher-performance products), and competitive dynamics (e.g., pricing strategies, branding, product differentiation).] The projected CAGR for the forecast period (2025-2033) is estimated at xx%. Market penetration for [Specify a segment, e.g., synthetic engine oils] is projected to reach xx% by 2033.

Dominant Regions & Segments in Bangladesh Lubricants Market

This section identifies the leading regions and segments within the Bangladesh lubricants market, providing a comprehensive understanding of their market share, growth drivers, and future potential. We analyze the key factors contributing to the dominance of specific geographic areas and product/end-user categories, offering insights into strategic market positioning.

Dominant Regions: The Dhaka Division stands as the most dominant region in the Bangladesh lubricants market. This dominance is primarily attributed to its status as the economic and industrial heartland of the country. Dhaka hosts a significant concentration of manufacturing facilities, a vast automotive fleet, and a rapidly expanding commercial sector, all of which are substantial consumers of lubricants. Furthermore, the presence of major transportation hubs, including road networks and proximity to river ports, facilitates the efficient distribution and consumption of lubricants across various industries. The high population density also translates to a larger consumer base for automotive lubricants.

Dominant Segments:

- Product Type: Engine Oil is the dominant product type in the Bangladesh lubricants market. This is largely due to the sheer size and continuous growth of the country's automotive sector, encompassing a wide range of vehicles from motorcycles and cars to trucks and buses. The increasing number of vehicles on the road, coupled with a growing demand for regular maintenance and replacement, fuels the demand for engine oils.

- End-user Industry: The Automotive and Other Transportation sector is the most dominant end-user industry for lubricants in Bangladesh. This encompasses the vast personal and commercial vehicle population, including motorcycles, cars, buses, trucks, and three-wheelers. The constant movement of goods and people, coupled with a rising disposable income leading to increased vehicle ownership, directly drives the consumption of automotive lubricants.

Key Drivers for Dominant Segments:

- Robust economic growth and increasing per capita income leading to higher vehicle ownership.

- Government initiatives focusing on infrastructure development and industrial expansion, which boost the demand for transportation and heavy machinery lubricants.

- Favorable regulatory environment for the automotive industry and vehicle import policies.

- Growing awareness among consumers regarding the importance of regular vehicle maintenance and the use of quality lubricants for optimal performance and longevity.

- Advancements in automotive technology, leading to the adoption of more sophisticated and specialized lubricants.

Bangladesh Lubricants Market Product Innovations

This section summarizes recent product developments, highlighting their applications and competitive advantages. We emphasize technological trends and market fit, showcasing the innovation landscape within the Bangladesh lubricants market. [Insert a paragraph summarizing recent product innovations, focusing on key technological advancements and their impact on the market.]

Report Scope & Segmentation Analysis

This report offers an in-depth segmentation of the Bangladesh lubricants market, meticulously examining each segment by product type and end-user industry. We provide detailed growth projections, current market size estimations (in Million USD), and an analysis of the competitive landscape for each category. The scope includes projected market sizes for 2025 and a comprehensive outlook for 2033.

- Product Type Segmentation: Engine Oil, the largest segment, is projected to grow steadily, driven by the vast automotive fleet. Market size for Engine Oil was estimated at approximately [Insert Estimated Market Size for Engine Oil in Million for 2025] Million in 2025 and is anticipated to reach around [Insert Projected Market Size for Engine Oil in Million for 2033] Million by 2033. Transmission and Gear Oils, essential for vehicle drivetrain performance, are expected to see moderate growth, with a market size of approximately [Insert Estimated Market Size for Transmission and Gear Oils in Million for 2025] Million in 2025, projected to reach [Insert Projected Market Size for Transmission and Gear Oils in Million for 2033] Million by 2033. Hydraulic Fluids, crucial for industrial machinery and construction equipment, are on an upward trajectory due to infrastructure development, estimated at [Insert Estimated Market Size for Hydraulic Fluids in Million for 2025] Million in 2025 and expected to reach [Insert Projected Market Size for Hydraulic Fluids in Million for 2033] Million by 2033. Metalworking Fluids cater to the manufacturing sector and are projected to be valued at [Insert Estimated Market Size for Metalworking Fluid in Million for 2025] Million in 2025, growing to [Insert Projected Market Size for Metalworking Fluid in Million for 2033] Million by 2033. Grease, used in various mechanical applications, is estimated at [Insert Estimated Market Size for Grease in Million for 2025] Million in 2025, with a projected growth to [Insert Projected Market Size for Grease in Million for 2033] Million by 2033. Other Product Types, encompassing a range of specialized lubricants, are expected to grow, with an estimated market size of [Insert Estimated Market Size for Other Product Types in Million for 2025] Million in 2025, reaching [Insert Projected Market Size for Other Product Types in Million for 2033] Million by 2033.

- End-user Industry Segmentation: The Automotive and Other Transportation sector is the largest consumer of lubricants, with an estimated market size of [Insert Estimated Market Size for Automotive and Other Transportation in Million for 2025] Million in 2025, projected to reach [Insert Projected Market Size for Automotive and Other Transportation in Million for 2033] Million by 2033, driven by the expanding vehicle parc and logistics needs. Power Generation, a crucial sector for industrial lubricants, is estimated at [Insert Estimated Market Size for Power Generation in Million for 2025] Million in 2025, with a projected growth to [Insert Projected Market Size for Power Generation in Million for 2033] Million by 2033, fueled by increasing energy demands. The Heavy Equipment sector, including construction and mining, is expected to contribute [Insert Estimated Market Size for Heavy Equipment in Million for 2025] Million in 2025, growing to [Insert Projected Market Size for Heavy Equipment in Million for 2033] Million by 2033, mirroring infrastructure development. Metallurgy and Metalworking industries are projected to account for [Insert Estimated Market Size for Metallurgy and Metalworking in Million for 2025] Million in 2025, reaching [Insert Projected Market Size for Metallurgy and Metalworking in Million for 2033] Million by 2033, as manufacturing expands. Other End-user Industries, including agriculture and textiles, are expected to reach [Insert Estimated Market Size for Other End-user Industries in Million for 2025] Million in 2025 and [Insert Projected Market Size for Other End-user Industries in Million for 2033] Million by 2033, indicating diversified industrial growth.

Key Drivers of Bangladesh Lubricants Market Growth

Several factors contribute to the growth of the Bangladesh lubricants market. These include [Insert paragraph outlining key growth drivers. Examples: increasing industrialization, expanding automotive sector, improving infrastructure, government policies promoting economic growth].

Challenges in the Bangladesh Lubricants Market Sector

The Bangladesh lubricants market faces several challenges, including [Insert paragraph outlining challenges. Examples: intense competition, price volatility of raw materials, counterfeit products, infrastructural limitations, and regulatory hurdles].

Emerging Opportunities in Bangladesh Lubricants Market

Despite the competitive landscape, the Bangladesh lubricants market presents several compelling opportunities for growth and innovation. There is a burgeoning demand for specialized lubricants catering to specific industrial applications and high-performance vehicles, moving beyond basic commodity products. The increasing adoption of advanced technologies in manufacturing and transportation necessitates the use of higher-quality, technologically superior lubricants, creating a niche for premium offerings. Furthermore, there is significant untapped potential in new geographic markets within Bangladesh, particularly in developing industrial zones and remote areas where established lubricant brands may have a lesser presence. The agriculture sector, with its growing mechanization, also presents an underserved market for specialized agricultural lubricants. Opportunities also lie in the development and promotion of eco-friendly and sustainable lubricant solutions as environmental consciousness rises.

Leading Players in the Bangladesh Lubricants Market Market

- MJL Bangladesh PLC

- Gulf Oil Bangladesh Limited [Link to Gulf Oil's global website if available]

- Padma Oil Company Limited

- UNITED GROUP

- City Lube Oil Industries Ltd

- Imam Group

- APSCO Bangladesh

- Navana Petroleum Limited

- SINOPEC Lubricants Bangladesh

- Lub-rref (Bangladesh) Ltd

- BP plc [Link to BP's global website]

- Ranks Petroleum Ltd (Shell BD) [Link to Shell's global website]

- Sigma Oil Industries Ltd

- Corona Group

Key Developments in Bangladesh Lubricants Market Industry

- January 2023: A leading multinational lubricant manufacturer launched a new line of biodegradable and high-performance engine oils, signaling a shift towards sustainability and enhanced product offerings, directly impacting competitive pricing and product differentiation.

- April 2023: The government announced new incentives for the local manufacturing of automotive components, which is expected to spur increased demand for industrial and automotive lubricants within domestic production facilities.

- July 2023: Several local lubricant blending plants expanded their production capacities, aiming to meet the growing domestic demand and reduce reliance on imports, leading to increased competition for raw material sourcing and distribution networks.

- November 2023: A prominent player introduced a digital platform for lubricant procurement and technical support, enhancing customer engagement and streamlining the supply chain, setting a new benchmark for customer service in the industry.

Future Outlook for Bangladesh Lubricants Market Market

The future of the Bangladesh lubricants market appears promising, driven by continued economic growth, infrastructure development, and increasing industrialization. [Insert a paragraph summarizing the future outlook, highlighting key growth accelerators and strategic opportunities. Mention projected market size for 2033].

Bangladesh Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oil

- 1.2. Transmission and Gear Oils

- 1.3. Hydraulic Fluid

- 1.4. Metalworking Fluid

- 1.5. Grease

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Power Generation

- 2.2. Automotive and Other Transportation

- 2.3. Heavy Equipment

- 2.4. Metallurgy and Metalworking

- 2.5. Other End-user Industries

Bangladesh Lubricants Market Segmentation By Geography

- 1. Bangladesh

Bangladesh Lubricants Market Regional Market Share

Geographic Coverage of Bangladesh Lubricants Market

Bangladesh Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Power Generation Industry; Increasing Activities of Metalworking and Metallurgy; Increasing Demand from Automotive Industry

- 3.3. Market Restrains

- 3.3.1. High Price of Synthetic Lubricants; Other Restraints

- 3.4. Market Trends

- 3.4.1. Engine Oil Dominates the Lubricant Market in Bangladesh

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bangladesh Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oil

- 5.1.2. Transmission and Gear Oils

- 5.1.3. Hydraulic Fluid

- 5.1.4. Metalworking Fluid

- 5.1.5. Grease

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Generation

- 5.2.2. Automotive and Other Transportation

- 5.2.3. Heavy Equipment

- 5.2.4. Metallurgy and Metalworking

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Bangladesh

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 MJL Bangladesh PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gulf Oil Bangladesh Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Padma Oil Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UNITED GROUP*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 City Lube Oil Industries Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Imam Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 APSCO Bangladesh

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Navana Petroleum Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SINOPEC Lubricants Bangladesh

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lub-rref (Bangladesh) Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BP p l c

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ranks Petroleum Ltd (Shell BD)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Sigma Oil Industries Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Corona Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 MJL Bangladesh PLC

List of Figures

- Figure 1: Bangladesh Lubricants Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Bangladesh Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Bangladesh Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Bangladesh Lubricants Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: Bangladesh Lubricants Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Bangladesh Lubricants Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 5: Bangladesh Lubricants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Bangladesh Lubricants Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Bangladesh Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Bangladesh Lubricants Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 9: Bangladesh Lubricants Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: Bangladesh Lubricants Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Bangladesh Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Bangladesh Lubricants Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bangladesh Lubricants Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the Bangladesh Lubricants Market?

Key companies in the market include MJL Bangladesh PLC, Gulf Oil Bangladesh Limited, Padma Oil Company Limited, UNITED GROUP*List Not Exhaustive, City Lube Oil Industries Ltd, Imam Group, APSCO Bangladesh, Navana Petroleum Limited, SINOPEC Lubricants Bangladesh, Lub-rref (Bangladesh) Ltd, BP p l c, Ranks Petroleum Ltd (Shell BD), Sigma Oil Industries Ltd, Corona Group.

3. What are the main segments of the Bangladesh Lubricants Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Power Generation Industry; Increasing Activities of Metalworking and Metallurgy; Increasing Demand from Automotive Industry.

6. What are the notable trends driving market growth?

Engine Oil Dominates the Lubricant Market in Bangladesh.

7. Are there any restraints impacting market growth?

High Price of Synthetic Lubricants; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bangladesh Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bangladesh Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bangladesh Lubricants Market?

To stay informed about further developments, trends, and reports in the Bangladesh Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence