Key Insights

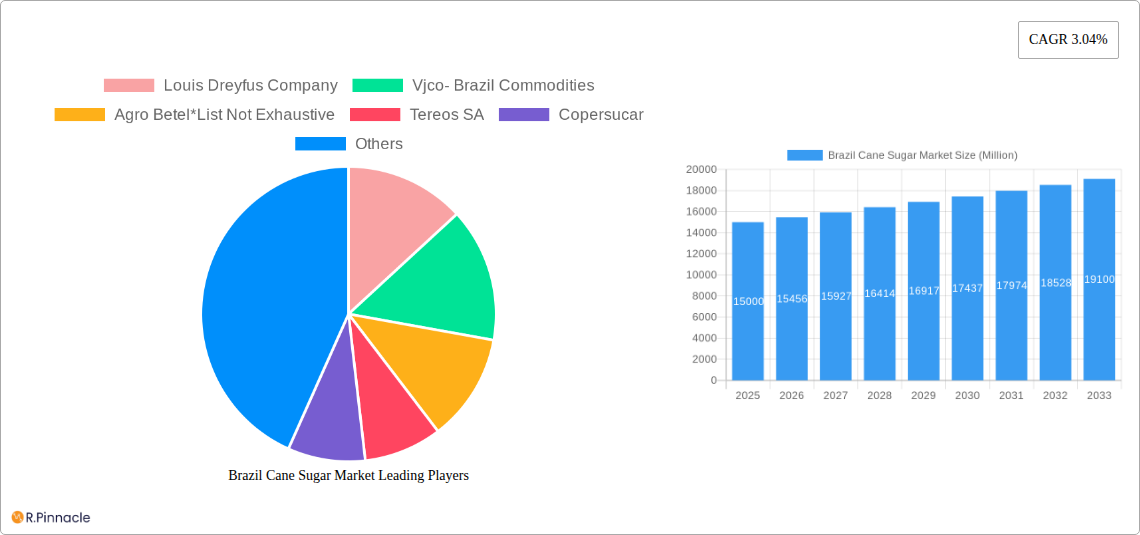

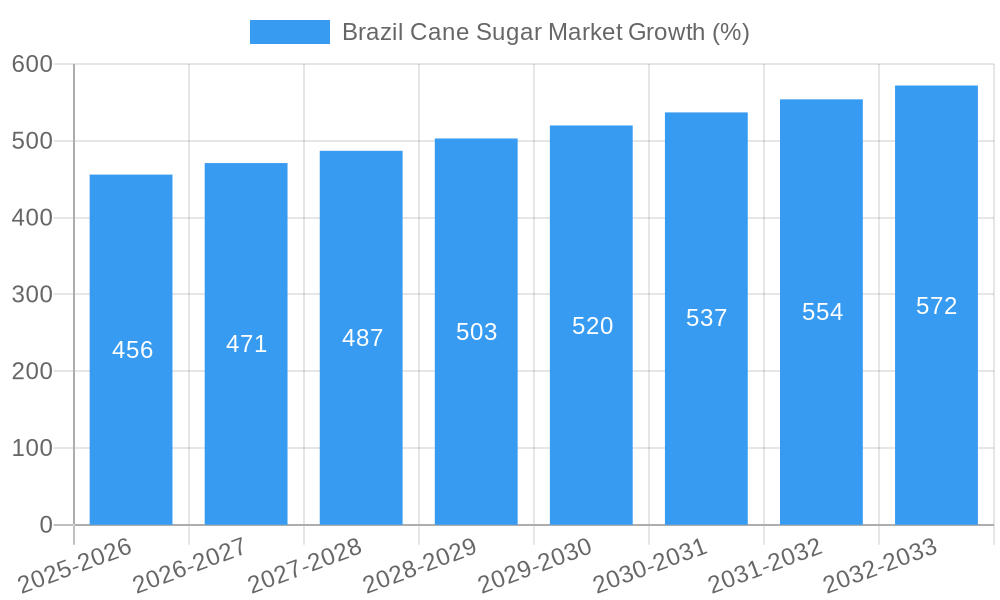

The Brazil cane sugar market, valued at approximately $XX million in 2025 (assuming a logical estimation based on the provided CAGR and market size data), is projected to experience steady growth at a Compound Annual Growth Rate (CAGR) of 3.04% from 2025 to 2033. This growth is driven primarily by the robust domestic demand from the food and beverage industry, a significant consumer base, and increasing use in other applications like pharmaceuticals and industrial processes. Furthermore, Brazil's favorable climate and established sugarcane cultivation infrastructure contribute to its leading position as a global sugar exporter. However, factors such as fluctuating global sugar prices, potential adverse weather conditions impacting sugarcane yields, and increasing competition from other sweeteners could pose challenges to sustained market expansion. The market is segmented by type (crystallized and liquid sugar) and application (food and beverage, pharmaceuticals, industrial, and others), with the food and beverage sector currently dominating market share. Key players, including Louis Dreyfus Company, Vjco-Brazil Commodities, Tereos SA, Copersucar, Tate & Lyle PLC, Cosan Limited, Cevasa, Sao Martinho SA, and DWL International Food Inc., are strategically positioned to capitalize on market opportunities and enhance their competitive edge through innovation, vertical integration, and strategic partnerships.

The projected market size for 2033 can be estimated by applying the CAGR to the 2025 value. While precise figures are unavailable without the initial 2025 market size value (XX), assuming a reasonable market size for 2025 allows projection for future years. Growth is expected to be relatively consistent throughout the forecast period, although it's important to note that unforeseen global economic shifts or changes in consumer preferences could influence market dynamics. The Brazilian government's policies concerning sugar production and trade will also play a crucial role in shaping the market's trajectory in the coming years. Continuous monitoring of these variables is essential for accurate future market assessment.

Brazil Cane Sugar Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil cane sugar market, offering valuable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, key players, and future outlook. Benefit from detailed segmentation by type (crystallized and liquid sugar) and application (food & beverage, pharmaceuticals, industrial, and other) to make informed strategic decisions.

Brazil Cane Sugar Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Brazilian cane sugar market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report delves into the market share of key players such as Louis Dreyfus Company, Vjco- Brazil Commodities, Agro Betel, Tereos SA, Copersucar, Tate & Lyle PLC, Cosan Limited, Cevasa, Sao Martinho SA, and DWL International Food Inc. (list not exhaustive). We analyze the impact of mergers and acquisitions, estimating their value at approximately xx Million, driving consolidation and reshaping the market structure. The influence of government regulations, the availability of substitute sweeteners, and evolving consumer preferences are also explored. Innovation in areas like CRISPR-modified sugarcane and automation are assessed for their impact on production efficiency and cost reduction.

Brazil Cane Sugar Market Dynamics & Trends

This section examines the key growth drivers, technological disruptions, and competitive dynamics shaping the Brazilian cane sugar market. The report projects a CAGR of xx% during the forecast period (2025-2033), driven by factors such as rising global demand for sugar, increasing ethanol production, and growth in the food and beverage industry. Technological advancements, such as automation and CRISPR gene editing in sugarcane, are analyzed for their potential to enhance yields and reduce production costs. The report further analyzes consumer preferences for different types of sugar and the impact of these preferences on market segmentation and growth. The competitive intensity within the market is also explored. Market penetration analysis for various sugar types and applications is included, with estimated figures for 2025 at xx Million.

Dominant Regions & Segments in Brazil Cane Sugar Market

This section identifies the leading regions and segments within the Brazilian cane sugar market. Analysis focuses on regional variations in production, consumption, and market dynamics. The dominant segments by type (crystallized vs. liquid sugar) and application (food & beverage, pharmaceuticals, industrial, other) are detailed, including projections for market size and growth rates.

- Key Drivers for Dominant Segments:

- Food & Beverage: Growing demand for processed foods and beverages.

- Crystallized Sugar: Traditional preference in various applications.

- Specific Regions: [Insert Region Name(s)] due to [reasons, e.g., favorable climatic conditions, established infrastructure].

The report provides a detailed analysis of the factors contributing to the dominance of these segments, considering economic policies, infrastructure development, and consumer behavior.

Brazil Cane Sugar Market Product Innovations

Recent product innovations in the Brazilian cane sugar market are discussed, highlighting the introduction of CRISPR-modified sugarcane varieties (Flex I and Flex II) enhancing ethanol production and bioproduct extraction. This section examines the competitive advantages offered by these innovations, focusing on improvements in efficiency, yield, and sustainability.

Report Scope & Segmentation Analysis

This report segments the Brazilian cane sugar market by type (crystallized sugar and liquid sugar) and application (food and beverage, pharmaceuticals, industrial, and other applications). Each segment’s market size, growth projections, and competitive dynamics are detailed.

- Crystallized Sugar: [Describe market size and growth projection for 2025-2033, including competitive dynamics].

- Liquid Sugar: [Describe market size and growth projection for 2025-2033, including competitive dynamics].

- Food & Beverage: [Describe market size and growth projection for 2025-2033, including competitive dynamics].

- Pharmaceuticals: [Describe market size and growth projection for 2025-2033, including competitive dynamics].

- Industrial: [Describe market size and growth projection for 2025-2033, including competitive dynamics].

- Other Applications: [Describe market size and growth projection for 2025-2033, including competitive dynamics].

Key Drivers of Brazil Cane Sugar Market Growth

The growth of the Brazilian cane sugar market is driven by several factors, including increasing global demand for sugar and ethanol, advancements in sugarcane cultivation and processing technologies (e.g., CRISPR gene editing and automation), and supportive government policies promoting biofuel production. The expanding food and beverage industry also significantly contributes to market growth.

Challenges in the Brazil Cane Sugar Market Sector

The Brazilian cane sugar market faces several challenges, including weather variability impacting sugarcane yields, fluctuating global sugar prices, and intense competition from other sweeteners. Supply chain disruptions and regulatory changes can also create uncertainty and affect profitability.

Emerging Opportunities in Brazil Cane Sugar Market

Emerging opportunities exist in the development of value-added products from sugarcane, such as bioplastics and other bio-based materials. Expanding into new export markets and adopting sustainable farming practices to address environmental concerns represent significant opportunities. Technological advancements and diversification into related industries can drive further growth.

Leading Players in the Brazil Cane Sugar Market

- Louis Dreyfus Company

- Vjco- Brazil Commodities

- Agro Betel

- Tereos SA

- Copersucar

- Tate & Lyle PLC

- Cosan Limited

- Cevasa

- Sao Martinho SA

- DWL International Food Inc

Key Developments in Brazil Cane Sugar Market Industry

- February 2021: Raizen's acquisition of Biosev SA expanded ethanol production capacity.

- February 2022: Development of CRISPR-modified sugarcane (Flex I and Flex II) improved ethanol production and bioproduct extraction.

- September 2022: Tereos's investment in automation and digitization enhanced efficiency and supply chain management.

Future Outlook for Brazil Cane Sugar Market

The future of the Brazilian cane sugar market appears promising, driven by continued global demand, technological innovation, and diversification into bio-based products. Strategic partnerships and investments in sustainable practices will be key for long-term success. The market is poised for steady growth, driven by both domestic consumption and increased exports, contributing to the nation's economic development.

Brazil Cane Sugar Market Segmentation

-

1. Type

- 1.1. Crystallized Sugar

- 1.2. Liquid Sugar

-

2. Application

- 2.1. Food and Beverage

- 2.2. Pharmaceuticals

- 2.3. Industrial

- 2.4. Other Applications

Brazil Cane Sugar Market Segmentation By Geography

- 1. Brazil

Brazil Cane Sugar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth

- 3.4. Market Trends

- 3.4.1. Large Production Base in the Country Supporting Demand Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Cane Sugar Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Crystallized Sugar

- 5.1.2. Liquid Sugar

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.2. Pharmaceuticals

- 5.2.3. Industrial

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Louis Dreyfus Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vjco- Brazil Commodities

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Agro Betel*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tereos SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Copersucar

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tate & Lyle PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cosan Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cevasa

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sao Martinho SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DWL International Food Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Louis Dreyfus Company

List of Figures

- Figure 1: Brazil Cane Sugar Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Cane Sugar Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Cane Sugar Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Cane Sugar Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Brazil Cane Sugar Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Brazil Cane Sugar Market Volume Million Forecast, by Type 2019 & 2032

- Table 5: Brazil Cane Sugar Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Brazil Cane Sugar Market Volume Million Forecast, by Application 2019 & 2032

- Table 7: Brazil Cane Sugar Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Brazil Cane Sugar Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Brazil Cane Sugar Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brazil Cane Sugar Market Volume Million Forecast, by Country 2019 & 2032

- Table 11: Brazil Cane Sugar Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Brazil Cane Sugar Market Volume Million Forecast, by Type 2019 & 2032

- Table 13: Brazil Cane Sugar Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Brazil Cane Sugar Market Volume Million Forecast, by Application 2019 & 2032

- Table 15: Brazil Cane Sugar Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Brazil Cane Sugar Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Cane Sugar Market?

The projected CAGR is approximately 3.04%.

2. Which companies are prominent players in the Brazil Cane Sugar Market?

Key companies in the market include Louis Dreyfus Company, Vjco- Brazil Commodities, Agro Betel*List Not Exhaustive, Tereos SA, Copersucar, Tate & Lyle PLC, Cosan Limited, Cevasa, Sao Martinho SA, DWL International Food Inc.

3. What are the main segments of the Brazil Cane Sugar Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth.

6. What are the notable trends driving market growth?

Large Production Base in the Country Supporting Demand Growth.

7. Are there any restraints impacting market growth?

Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth.

8. Can you provide examples of recent developments in the market?

September 2022: Tereos invested heavily in automation and digitization of operations to handle the different processes, improve agricultural monitoring, reduce costs, and enhance the procurement chain and relationship with suppliers. Major projects are in Brazil, and a key focus is laid on supply chain and procurement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Cane Sugar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Cane Sugar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Cane Sugar Market?

To stay informed about further developments, trends, and reports in the Brazil Cane Sugar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence