Key Insights

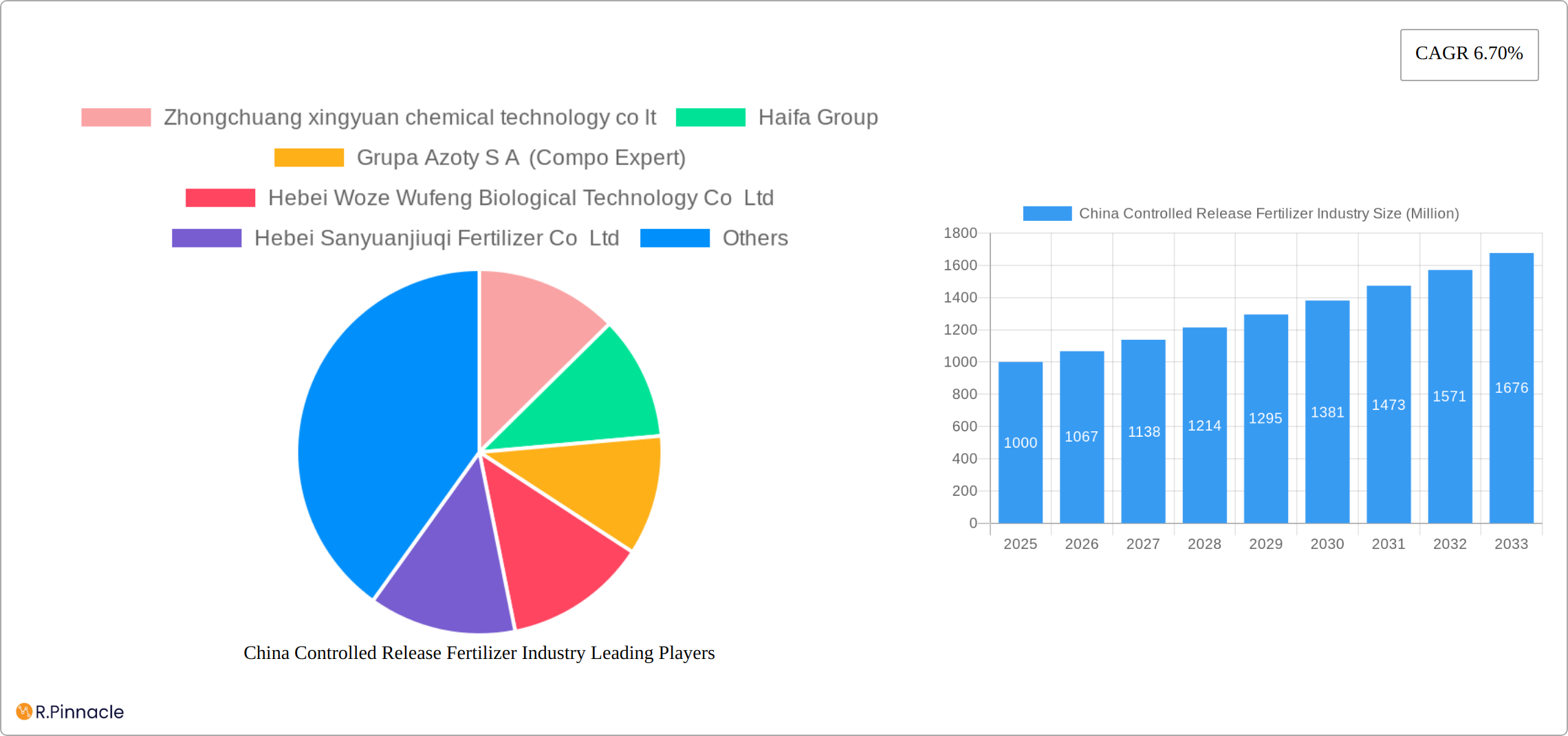

The China controlled-release fertilizer (CRF) market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.70% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing government initiatives promoting sustainable agriculture and precision farming in China are fostering the adoption of CRF, which offers improved nutrient use efficiency and reduced environmental impact compared to conventional fertilizers. Secondly, the growing demand for high-quality agricultural produce, especially in horticultural crops and field crops, necessitates the use of fertilizers that deliver nutrients precisely and effectively, minimizing nutrient losses. Thirdly, the expanding acreage under cultivation, coupled with the rising awareness among farmers regarding the benefits of controlled-release technology, further contributes to market growth. However, the high initial cost of CRF compared to conventional fertilizers and potential technological limitations in certain soil types remain as restraints to broader market penetration. The market is segmented by coating type (polymer-coated, polymer-sulfur coated, and others) and crop type (field crops, horticultural crops, and turf & ornamental), with polymer-coated fertilizers dominating the market due to their superior performance and cost-effectiveness. Key players like Zhongchuang Xingyuan Chemical Technology Co., Ltd., Haifa Group, Grupa Azoty S.A. (Compo Expert), and others are shaping the competitive landscape through product innovation and strategic partnerships.

The forecast period of 2025-2033 shows significant potential for the China CRF market. Continued investment in research and development of advanced CRF formulations will likely overcome some existing limitations, leading to broader adoption. Furthermore, the increasing availability of financing options and government subsidies for sustainable agricultural practices will play a crucial role in stimulating market growth. While challenges remain, the long-term outlook for the China CRF market remains positive, underpinned by the growing demand for efficient and environmentally friendly fertilizers in the agricultural sector. Competition is anticipated to intensify, with players focusing on enhancing product quality, expanding distribution networks, and developing tailored solutions for specific crop types and soil conditions.

China Controlled Release Fertilizer Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the China controlled release fertilizer industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. Key players like Zhongchuang xingyuan chemical technology co lt, Haifa Group, Grupa Azoty S A (Compo Expert), Hebei Woze Wufeng Biological Technology Co Ltd, and Hebei Sanyuanjiuqi Fertilizer Co Ltd are analyzed, alongside market segments by coating type (Polymer Coated, Polymer-Sulfur Coated, Others) and crop type (Field Crops, Horticultural Crops, Turf & Ornamental). Expect detailed market sizing (in Millions), CAGR projections, and competitive landscape assessments.

China Controlled Release Fertilizer Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the China controlled release fertilizer market. We examine market concentration, identifying leading players and their respective market share. Innovation drivers, such as technological advancements and government policies, are explored, along with an assessment of the regulatory framework governing the industry. The report also investigates the presence and impact of product substitutes, characterizing end-user demographics and analyzing past and potential future M&A activities within the sector, including deal values (in Millions). For example, the xx% market share held by Haifa Group following its 2019 expansion showcases the potential for significant growth through strategic acquisitions. The estimated value of M&A deals in the period 2019-2024 was xx Million, indicating robust consolidation within the industry.

China Controlled Release Fertilizer Industry Market Dynamics & Trends

The China controlled release fertilizer industry is experiencing robust growth, driven by a confluence of factors. Increasing agricultural intensification, a national push towards sustainable agriculture practices championed by the government, and escalating consumer demand for high-quality, sustainably produced food are key growth drivers. This expansion is further fueled by advancements in coating technologies, enabling more precise and efficient nutrient delivery, and the adoption of sophisticated precision application techniques. A notable shift in consumer preferences towards environmentally friendly fertilizers is significantly impacting market penetration, rewarding producers committed to sustainability. The competitive landscape is dynamic, characterized by diverse pricing strategies, product differentiation, and intense competition among major players. We project a substantial market expansion, with a Compound Annual Growth Rate (CAGR) of xx% anticipated from 2025 to 2033. Market penetration of controlled-release fertilizers is projected to reach xx% by 2033.

Dominant Regions & Segments in China Controlled Release Fertilizer Industry

Within the expansive Chinese market, specific regions and segments are demonstrating significant dominance in the controlled release fertilizer sector. Leading regions are identified based on a comprehensive analysis of economic activity, the extent of arable land, and the level of governmental support for agricultural innovation. Market segmentation is analyzed across two key categories: Coating Type and Crop Type.

- Coating Type: Polymer Coated fertilizers currently hold the largest market share, owing to their superior nutrient release properties and overall efficacy. Within this category, the Polymer-Sulfur Coated segment is poised for particularly rapid growth, reflecting the increasing demand for sulfur-enhanced fertilizers to optimize crop nutrition and soil health.

- Crop Type: Field crops constitute the largest segment, driven by the sheer scale of their cultivation. However, Horticultural Crops and Turf & Ornamental segments are exhibiting faster growth rates, reflecting the rising demand for premium quality produce and landscaping services that benefit from the controlled nutrient release offered by these fertilizers.

Several key factors underpin the dominance of these segments:

- Strong governmental support for sustainable agricultural practices through favorable policies and initiatives.

- Significant investments in agricultural infrastructure, encompassing irrigation systems and robust fertilizer distribution networks.

- A growing awareness among farmers regarding the numerous benefits associated with controlled-release fertilizers, leading to increased adoption.

China Controlled Release Fertilizer Industry Product Innovations

Recent innovations in controlled-release fertilizer technology focus on enhancing nutrient efficiency, improving environmental sustainability, and providing tailored solutions for specific crops. New formulations with improved coating materials, tailored nutrient ratios, and enhanced release kinetics offer advantages such as reduced nutrient leaching and optimized plant uptake. These innovations cater to the growing demand for sustainable and high-performing fertilizers, addressing the needs of environmentally conscious farmers and consumers.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation of the China controlled release fertilizer market, categorized by coating type (Polymer Coated, Polymer-Sulfur Coated, Others) and crop type (Field Crops, Horticultural Crops, Turf & Ornamental). The report offers a comprehensive analysis of each segment, including its market size (in Millions) and projected growth trajectory from 2025 to 2033. Competitive dynamics within each segment are also thoroughly examined.

Coating Type: Polymer Coated fertilizers are projected to remain the largest segment, followed by Polymer-Sulfur Coated and Others. The Polymer Coated segment is anticipated to reach a market value of xx Million by 2033.

Crop Type: Field Crops will continue to dominate due to the extensive scale of their cultivation. However, Horticultural Crops and Turf & Ornamental are expected to display considerably faster growth rates, reflecting the increasing adoption of controlled-release fertilizers in high-value farming and landscaping applications.

Key Drivers of China Controlled Release Fertilizer Industry Growth

The growth of the China controlled release fertilizer industry is driven by several factors:

- Government support for sustainable agriculture: Initiatives promoting efficient fertilizer use and environmental protection are stimulating demand for advanced fertilizers.

- Technological advancements: Innovations in coating technologies and precision application techniques are enhancing nutrient use efficiency and reducing environmental impact.

- Rising demand for high-quality produce: Consumers’ increasing preference for high-quality, sustainably produced food is driving demand for fertilizers that optimize crop growth and yield.

Challenges in the China Controlled Release Fertilizer Industry Sector

The China controlled release fertilizer industry faces challenges such as:

- High production costs: Advanced coating technologies can increase production costs, impacting price competitiveness.

- Supply chain complexities: Ensuring a reliable supply of raw materials and efficient distribution networks is crucial.

- Intense competition: The market is characterized by a diverse range of players, leading to competitive pricing pressures. This competition is estimated to decrease profit margins by xx% by 2033.

Emerging Opportunities in China Controlled Release Fertilizer Industry

The China controlled release fertilizer industry presents several compelling emerging opportunities for growth and innovation:

- Expansion into niche markets: Developing and marketing specialized controlled-release fertilizer solutions tailored to the unique needs of specific crops or geographic regions.

- Development of innovative coating technologies: Investing in research and development to enhance nutrient efficiency, sustainability, and reduce environmental impact.

- Leveraging digital technologies: Integrating precision agriculture techniques to optimize fertilizer application, improve yield management, and minimize waste.

- Sustainable sourcing and production: Focusing on environmentally friendly manufacturing processes and responsible sourcing of raw materials.

Leading Players in the China Controlled Release Fertilizer Industry Market

- Haifa Group

- Grupa Azoty S A (Compo Expert)

- Zhongchuang xingyuan chemical technology co lt

- Hebei Woze Wufeng Biological Technology Co Ltd

- Hebei Sanyuanjiuqi Fertilizer Co Ltd

Key Developments in China Controlled Release Fertilizer Industry Industry

- July 2018: Haifa Group launched a new range of coated micronutrients based on Multicote™ technology, enhancing all-season complete nutrition for crops.

- February 2019: Haifa Group opened a new trading company in China, expanding its market reach and offerings within the Chinese agricultural sector.

Future Outlook for China Controlled Release Fertilizer Industry Market

The China controlled release fertilizer market is poised for significant growth, driven by increasing demand for high-quality produce, government support for sustainable agriculture, and technological advancements in fertilizer formulation and application. Strategic opportunities exist for companies focusing on innovation, sustainability, and efficient supply chain management. The market is projected to reach xx Million by 2033, representing substantial growth potential for key players and new entrants.

China Controlled Release Fertilizer Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

China Controlled Release Fertilizer Industry Segmentation By Geography

- 1. China

China Controlled Release Fertilizer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Custom Product Development; Use of CROs for Regulatory Services

- 3.3. Market Restrains

- 3.3.1. Data and Cyber Security Concerns; Lack of Experts and Professionals in this Industry

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Controlled Release Fertilizer Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Zhongchuang xingyuan chemical technology co lt

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haifa Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Grupa Azoty S A (Compo Expert)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hebei Woze Wufeng Biological Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hebei Sanyuanjiuqi Fertilizer Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Zhongchuang xingyuan chemical technology co lt

List of Figures

- Figure 1: China Controlled Release Fertilizer Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Controlled Release Fertilizer Industry Share (%) by Company 2024

List of Tables

- Table 1: China Controlled Release Fertilizer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Controlled Release Fertilizer Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: China Controlled Release Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: China Controlled Release Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: China Controlled Release Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: China Controlled Release Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: China Controlled Release Fertilizer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China Controlled Release Fertilizer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: China Controlled Release Fertilizer Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: China Controlled Release Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: China Controlled Release Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: China Controlled Release Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: China Controlled Release Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: China Controlled Release Fertilizer Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Controlled Release Fertilizer Industry?

The projected CAGR is approximately 6.70%.

2. Which companies are prominent players in the China Controlled Release Fertilizer Industry?

Key companies in the market include Zhongchuang xingyuan chemical technology co lt, Haifa Group, Grupa Azoty S A (Compo Expert), Hebei Woze Wufeng Biological Technology Co Ltd, Hebei Sanyuanjiuqi Fertilizer Co Ltd.

3. What are the main segments of the China Controlled Release Fertilizer Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Need for Custom Product Development; Use of CROs for Regulatory Services.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Data and Cyber Security Concerns; Lack of Experts and Professionals in this Industry.

8. Can you provide examples of recent developments in the market?

February 2019: Haifa Group announced the opening of a new trading company in China. The establishment of the new Haifa subsidiary in China will enable the group to significantly expand its offerings to China agriculture sector.July 2018: Haifa Group introduced a novel range of coated micronutrients, enabling an all-season complete nutrition. Based on Multicote™ technology, the coated micronutrients provide your crops with all the benefits of controlled-release nutrition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Controlled Release Fertilizer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Controlled Release Fertilizer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Controlled Release Fertilizer Industry?

To stay informed about further developments, trends, and reports in the China Controlled Release Fertilizer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence