Key Insights

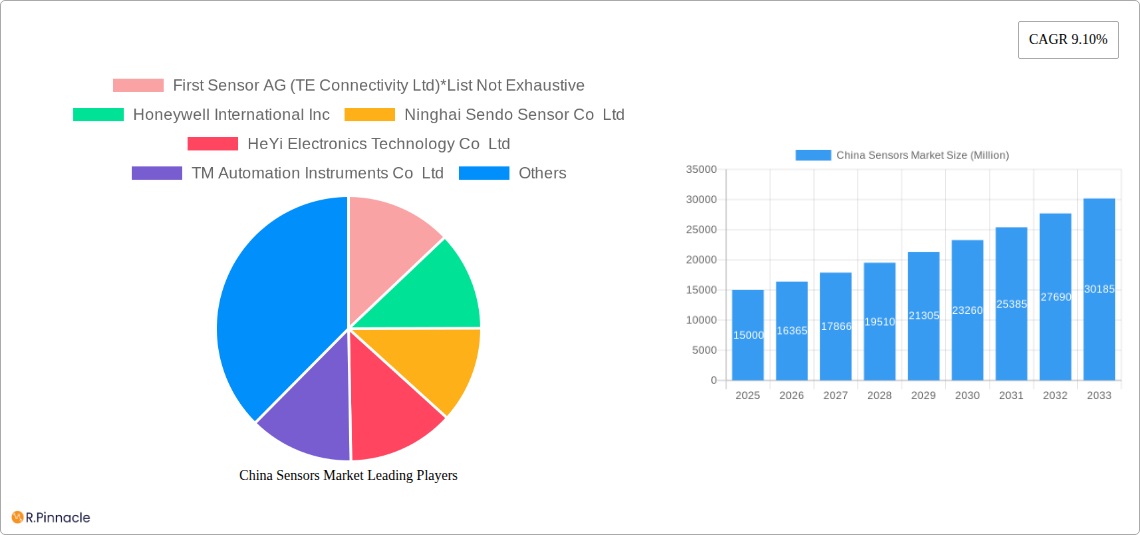

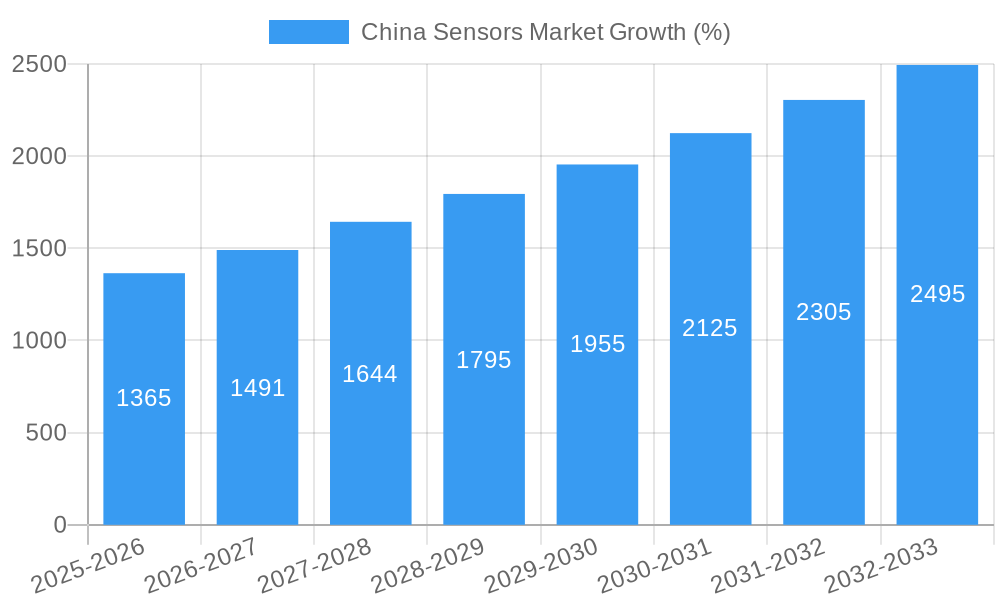

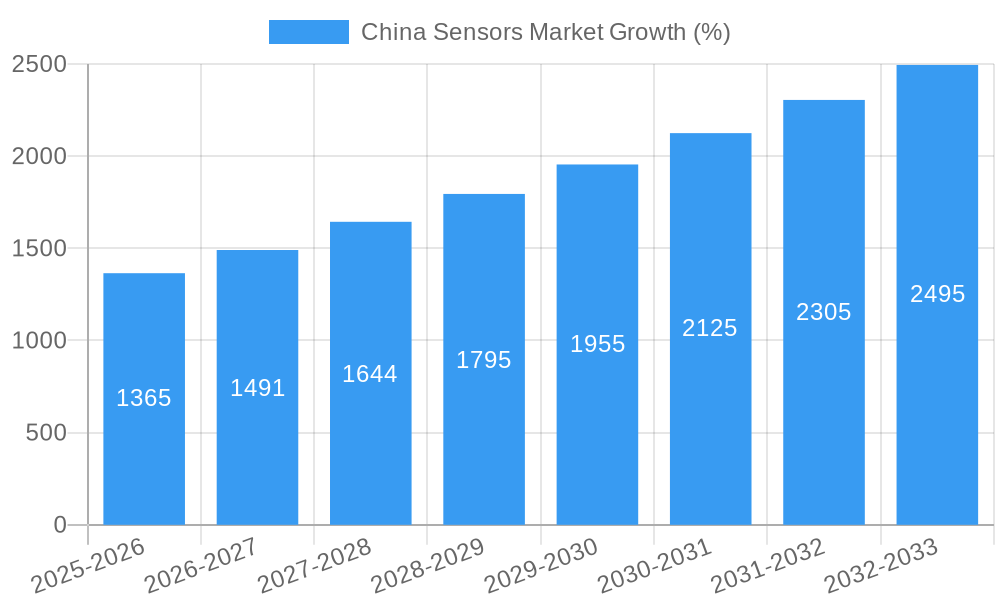

The China sensors market, exhibiting a robust Compound Annual Growth Rate (CAGR) of 9.10%, presents a significant opportunity for investors and businesses alike. Driven by the burgeoning automotive and consumer electronics sectors, coupled with increasing industrial automation and smart infrastructure development, the market is poised for substantial expansion. The strong growth is further fueled by advancements in sensor technology, including miniaturization, improved accuracy, and enhanced connectivity. Optical and electrical resistance sensors currently dominate the mode of operation segment, while temperature, pressure, and flow sensors are leading in terms of parameters measured. The significant government initiatives promoting technological advancement and domestic manufacturing within China also contribute to market expansion. While challenges remain in terms of supply chain complexities and potential regulatory hurdles, the overall positive market momentum suggests a bright outlook.

However, the market is not without its challenges. Competition is fierce, with both domestic and international players vying for market share. Maintaining technological innovation and adapting to rapidly evolving consumer preferences will be crucial for sustained success. Furthermore, reliance on specific materials or components could potentially lead to supply chain disruptions and price volatility. Despite these hurdles, the continued growth of key end-user industries, coupled with ongoing technological advancements and supportive government policies, strongly indicates that the China sensors market will maintain its upward trajectory throughout the forecast period. The diverse range of sensor types, from environmental and chemical sensors to inertial and magnetic sensors, reflects the versatility and wide applications of this critical technology across various industries, ensuring continued market growth.

China Sensors Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China Sensors Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a detailed examination spanning the period from 2019 to 2033 (Base Year: 2025, Forecast Period: 2025-2033), this report unveils the market's structure, dynamics, dominant segments, and future trajectory. The report encompasses a market size valuation of xx Million USD in 2025, projected to reach xx Million USD by 2033, exhibiting a robust CAGR of xx%.

China Sensors Market Structure & Innovation Trends

This section analyzes the competitive landscape of the China sensors market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report reveals the market share held by key players such as First Sensor AG (TE Connectivity Ltd), Honeywell International Inc, Ninghai Sendo Sensor Co Ltd, and others, highlighting their strategic initiatives and competitive advantages. We delve into the impact of government regulations and the prevalence of product substitution, further exploring the influence of end-user demographics on market growth.

- Market Concentration: The market exhibits a [Describe level of concentration - e.g., moderately concentrated] structure, with [Number] major players holding a combined market share of approximately xx%.

- Innovation Drivers: Significant investments in R&D, particularly in areas like LiDAR and solid-state sensors, are driving innovation. Government support for technological advancements also plays a crucial role.

- Regulatory Framework: [Describe the impact of relevant regulations, e.g., stringent quality standards and environmental regulations] influence market dynamics.

- M&A Activities: The report analyzes recent mergers and acquisitions, quantifying deal values where possible, to illustrate the strategic landscape and competitive positioning. [Example: Mention specific M&A deals and their impact, if available. If no specific data is available, state this explicitly].

China Sensors Market Market Dynamics & Trends

This section explores the key factors driving market growth, including technological advancements, evolving consumer preferences, and competitive pressures. We analyze the CAGR, market penetration rates for various sensor types, and the impact of emerging technologies on market segmentation. The interplay between supply and demand, pricing strategies, and technological disruption within the industry are also examined in detail.

[Insert a detailed paragraph (approximately 600 words) analyzing market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, including specific metrics like CAGR and market penetration. Use data and examples to support your analysis.]

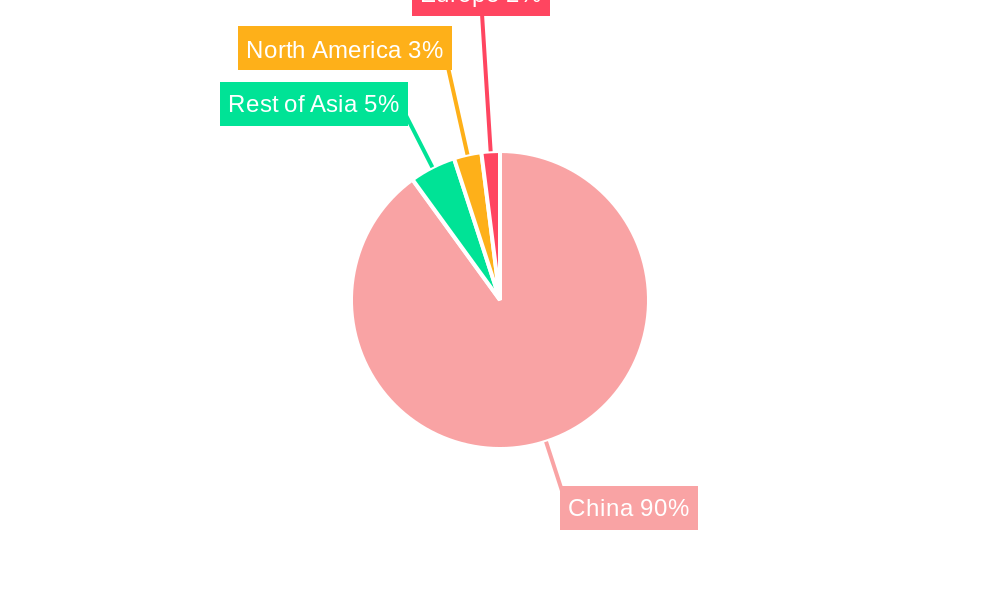

Dominant Regions & Segments in China Sensors Market

This section identifies the leading regions and segments within the China sensors market. We analyze dominance across three key segmentation categories: parameters measured, mode of operation, and end-user industry. The analysis highlights key growth drivers for each segment, detailing economic policies, infrastructure development, and other relevant factors.

By Parameters Measured: [Analyze dominance across Temperature, Pressure, Level, Flow, Proximity, Environmental, Chemical, Inertial, Magnetic, Vibration, Other Parameters Measured. Identify the leading segment and explain why].

- Key Drivers for the Leading Segment: [List bullet points explaining economic policies, infrastructure development, and other relevant factors].

By Mode of Operation: [Analyze dominance across Optical, Electrical Resistance, Biosensors, Piezoresistive, Image, Capacitive, Piezoelectric, Lidar, Radar, Other Modes of Operation. Identify the leading segment and explain why].

- Key Drivers for the Leading Segment: [List bullet points explaining economic policies, infrastructure development, and other relevant factors].

By End-user Industry: [Analyze dominance across Automotive, Consumer Electronics, Energy, Industrial and Other, Medical and Wellness, Construction, Agriculture, and Mining, Aerospace, Defense. Identify the leading segment and explain why].

- Key Drivers for the Leading Segment: [List bullet points explaining economic policies, infrastructure development, and other relevant factors].

[Insert detailed paragraphs explaining the dominance analysis for each segmentation category, supported by data and insights.]

China Sensors Market Product Innovations

The China sensors market witnesses continuous product innovation, driven by advancements in semiconductor technology and miniaturization. New sensor types with enhanced accuracy, sensitivity, and functionalities are regularly introduced. This innovation is responding to the growing demand for advanced sensor applications across various sectors, particularly in the automotive and consumer electronics industries. Technological trends like IoT, AI, and automation further fuel product innovation, creating new market opportunities and boosting competitive advantages.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the China sensors market based on parameters measured, mode of operation, and end-user industry. Each segment's growth projections, market sizes, and competitive dynamics are thoroughly examined. We offer detailed insights into the historical period (2019-2024), the base year (2025), and provide robust forecasts for the period 2025-2033.

[Insert paragraphs for each segment (Parameters Measured, Mode of Operation, End-user Industry), including growth projections, market sizes, and competitive dynamics.]

Key Drivers of China Sensors Market Growth

The growth of the China sensors market is fueled by several key factors. Technological advancements, such as the development of miniaturized, high-precision sensors, are driving adoption across numerous industries. Government initiatives promoting technological innovation and infrastructure development also contribute significantly. Furthermore, the increasing integration of sensors into smart devices, automobiles, and industrial automation systems further boosts market expansion.

Challenges in the China Sensors Market Sector

Despite the significant growth potential, the China sensors market faces certain challenges. Supply chain disruptions can impact production and pricing. Furthermore, intense competition from both domestic and international players creates pressure on margins and market share. Regulatory compliance and standardization requirements can also pose hurdles for some companies. [Quantify the impact of these challenges where possible, e.g., "Supply chain disruptions led to a xx% increase in sensor costs in 2024"].

Emerging Opportunities in China Sensors Market

The China sensors market presents several lucrative opportunities. The rising demand for sensors in emerging applications, such as smart agriculture, healthcare, and environmental monitoring, offers significant growth potential. Advancements in sensor technologies, such as LiDAR and biosensors, are opening new market avenues. Furthermore, increasing government support for technological innovation and the expansion of the IoT market provide a favorable environment for market expansion.

Leading Players in the China Sensors Market Market

- First Sensor AG (TE Connectivity Ltd)

- Honeywell International Inc

- Ninghai Sendo Sensor Co Ltd

- HeYi Electronics Technology Co Ltd

- TM Automation Instruments Co Ltd

- Novosense

- Trihero Group

- Cheemi Technology Co Ltd

- STMicroelectronics NV

- Amphenol Advanced Sensors

Key Developments in China Sensors Market Industry

- April 2022: Chinese meteorologists launched nationwide monitoring and assessment services for winter wheat distribution using remote sensing satellite technology, improving weather forecasting accuracy for grain production.

- January 2022: RoboSense showcased the world's first mass-produced automotive-grade solid-state LiDAR and the RS-Helios-5515, a 32-line LiDAR used in Alibaba's logistics robot, Xiaomanlv, at CES 2022.

Future Outlook for China Sensors Market Market

The future of the China sensors market looks promising. Continued technological advancements, increasing government support, and the expanding adoption of sensors across various sectors will drive market growth. Strategic partnerships, investments in R&D, and the development of innovative sensor applications will be crucial for companies to capitalize on emerging opportunities and maintain a competitive edge in this dynamic market.

China Sensors Market Segmentation

-

1. Parameters Measured

- 1.1. Temperature

- 1.2. Pressure

- 1.3. Level

- 1.4. Flow

- 1.5. Proximity

- 1.6. Environmental

- 1.7. Chemical

- 1.8. Inertial

- 1.9. Magnetic

- 1.10. Vibration

- 1.11. Other Parameters Measured

-

2. Mode of Operation

- 2.1. Optical

- 2.2. Electrical Resistance

- 2.3. Biosensors

- 2.4. Piezoresistive

- 2.5. Image

- 2.6. Capacitive

- 2.7. Piezoelectric

- 2.8. Lidar

- 2.9. Radar

- 2.10. Other Modes of Operation

-

3. End-user Industry

- 3.1. Automotive

-

3.2. Consumer Electronics

- 3.2.1. Smartphones

- 3.2.2. Tablets, Laptops, and Computers

- 3.2.3. Wearable Devices

- 3.2.4. Smart Appliances or Devices

- 3.2.5. Other Consumer Electronics

- 3.3. Energy

- 3.4. Industrial and Other

- 3.5. Medical and Wellness

- 3.6. Construction, Agriculture, and Mining

- 3.7. Aerospace

- 3.8. Defense

China Sensors Market Segmentation By Geography

- 1. China

China Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of Automation and Industry 4.; Technological Advancements and Decreasing Cost of Sensors

- 3.3. Market Restrains

- 3.3.1. High Initial Cost Involved

- 3.4. Market Trends

- 3.4.1. Automotive Industry is Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Sensors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Parameters Measured

- 5.1.1. Temperature

- 5.1.2. Pressure

- 5.1.3. Level

- 5.1.4. Flow

- 5.1.5. Proximity

- 5.1.6. Environmental

- 5.1.7. Chemical

- 5.1.8. Inertial

- 5.1.9. Magnetic

- 5.1.10. Vibration

- 5.1.11. Other Parameters Measured

- 5.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 5.2.1. Optical

- 5.2.2. Electrical Resistance

- 5.2.3. Biosensors

- 5.2.4. Piezoresistive

- 5.2.5. Image

- 5.2.6. Capacitive

- 5.2.7. Piezoelectric

- 5.2.8. Lidar

- 5.2.9. Radar

- 5.2.10. Other Modes of Operation

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Consumer Electronics

- 5.3.2.1. Smartphones

- 5.3.2.2. Tablets, Laptops, and Computers

- 5.3.2.3. Wearable Devices

- 5.3.2.4. Smart Appliances or Devices

- 5.3.2.5. Other Consumer Electronics

- 5.3.3. Energy

- 5.3.4. Industrial and Other

- 5.3.5. Medical and Wellness

- 5.3.6. Construction, Agriculture, and Mining

- 5.3.7. Aerospace

- 5.3.8. Defense

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Parameters Measured

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 First Sensor AG (TE Connectivity Ltd)*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ninghai Sendo Sensor Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 HeYi Electronics Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TM Automation Instruments Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Novosense

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Trihero Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cheemi Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 STMicroelectronics NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amphenol Advanced Sensors

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 First Sensor AG (TE Connectivity Ltd)*List Not Exhaustive

List of Figures

- Figure 1: China Sensors Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Sensors Market Share (%) by Company 2024

List of Tables

- Table 1: China Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Sensors Market Revenue Million Forecast, by Parameters Measured 2019 & 2032

- Table 3: China Sensors Market Revenue Million Forecast, by Mode of Operation 2019 & 2032

- Table 4: China Sensors Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: China Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: China Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Sensors Market Revenue Million Forecast, by Parameters Measured 2019 & 2032

- Table 8: China Sensors Market Revenue Million Forecast, by Mode of Operation 2019 & 2032

- Table 9: China Sensors Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 10: China Sensors Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Sensors Market?

The projected CAGR is approximately 9.10%.

2. Which companies are prominent players in the China Sensors Market?

Key companies in the market include First Sensor AG (TE Connectivity Ltd)*List Not Exhaustive, Honeywell International Inc, Ninghai Sendo Sensor Co Ltd, HeYi Electronics Technology Co Ltd, TM Automation Instruments Co Ltd, Novosense, Trihero Group, Cheemi Technology Co Ltd, STMicroelectronics NV, Amphenol Advanced Sensors.

3. What are the main segments of the China Sensors Market?

The market segments include Parameters Measured, Mode of Operation, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence of Automation and Industry 4.; Technological Advancements and Decreasing Cost of Sensors.

6. What are the notable trends driving market growth?

Automotive Industry is Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

High Initial Cost Involved.

8. Can you provide examples of recent developments in the market?

April 2022 - Chinese meteorologists launched monitoring and assessment services for winter wheat distribution nationwide based on remote sensing satellite technology. The new satellite-powered service could address the previous lack-of-precision problems in weather forecasts for grain production.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Sensors Market?

To stay informed about further developments, trends, and reports in the China Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence