Key Insights

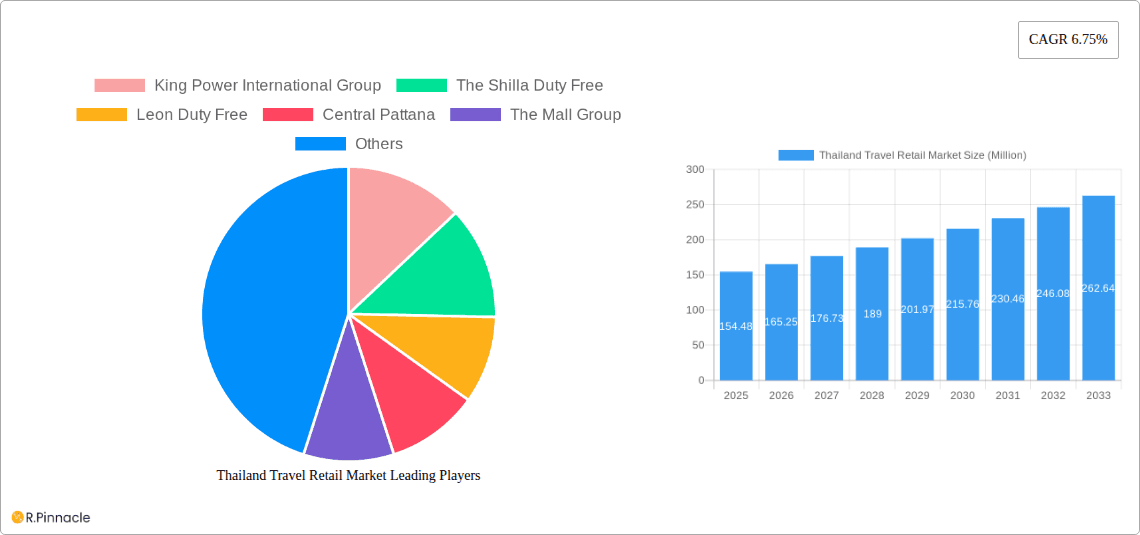

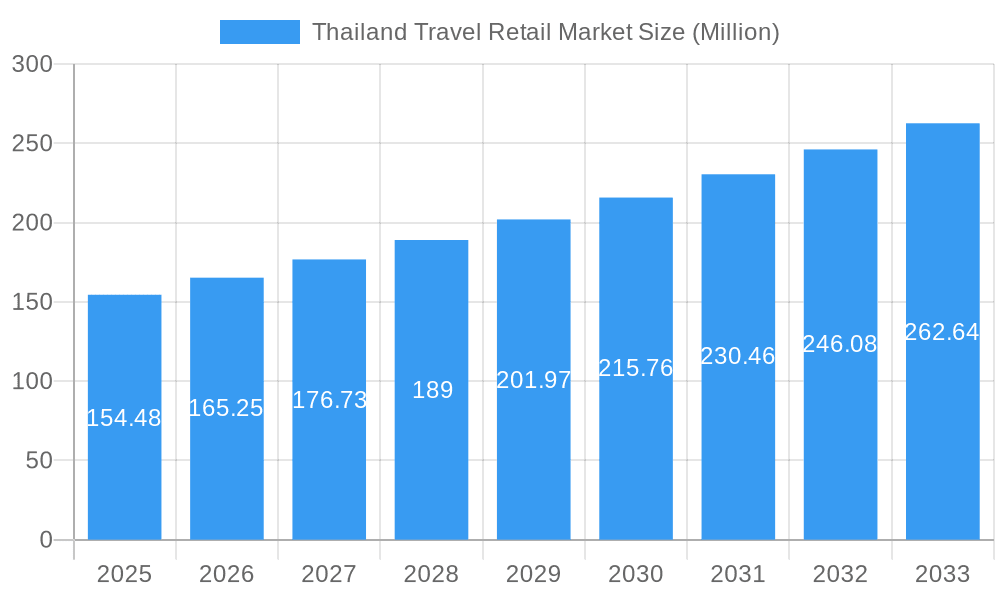

The Thailand travel retail market, valued at $154.48 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.75% from 2025 to 2033. This expansion is fueled by several key factors. The resurgence of international tourism following the pandemic is a significant driver, with Thailand's attractive destinations and improving infrastructure attracting a large influx of travelers. Furthermore, the increasing disposable incomes of both domestic and international tourists, coupled with a growing preference for luxury goods and experiences, are boosting demand. The strategic expansion of duty-free shops at key airports and tourist hubs, along with innovative marketing strategies employed by major players like King Power International Group and The Shilla Duty Free, are further contributing to market growth. However, economic fluctuations, potential changes in government regulations concerning tourism and import/export duties, and the increasing prevalence of online shopping for luxury goods present challenges to sustained growth. The market is segmented by product category (e.g., cosmetics, perfumes, liquor, tobacco), distribution channel (airport, cruise ships, border shops), and tourist demographics, with further analysis required to understand segment-specific growth trajectories.

Thailand Travel Retail Market Market Size (In Million)

The competitive landscape is characterized by both established industry giants and emerging players, showcasing a dynamic interplay of market strategies and innovation. Key players such as King Power International Group and The Shilla Duty Free are leveraging their established brand reputation and extensive retail networks to maintain market dominance. However, smaller companies are also making inroads through strategic partnerships, unique product offerings, and focus on niche segments. The market’s future success will hinge on the ability of companies to adapt to evolving consumer preferences, effectively manage supply chain complexities, and maintain a competitive edge in a rapidly evolving global landscape. Continued investment in infrastructure and strategic collaborations with tourism boards are vital for sustained and inclusive growth within the Thai travel retail sector.

Thailand Travel Retail Market Company Market Share

Thailand Travel Retail Market: 2019-2033 Report

Unlocking Growth Opportunities in Thailand's Thriving Travel Retail Sector

This comprehensive report provides a detailed analysis of the Thailand travel retail market, covering the period 2019-2033. With a focus on actionable insights and key performance indicators, this report is an indispensable resource for industry professionals, investors, and strategic planners seeking to navigate this dynamic market. The report leverages extensive research and data analysis to deliver a clear understanding of market dynamics, key players, and future growth potential. The base year for this report is 2025, with estimates and forecasts extending to 2033.

Thailand Travel Retail Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of Thailand's travel retail market. We examine market concentration, identifying key players and their respective market shares. For example, King Power International Group holds a significant market share, estimated at xx%, while other major players like The Shilla Duty Free and Central Pattana also command substantial portions of the market. Furthermore, the report delves into M&A activities, including deal values (estimated at xx Million USD for the period 2019-2024), and their impact on market structure.

- Market Concentration: High, with a few dominant players controlling a significant portion of the market.

- Innovation Drivers: Growing tourist arrivals, increasing disposable incomes, and the adoption of new technologies in retail experiences are key drivers.

- Regulatory Framework: Government policies concerning tourism and retail operations significantly influence market dynamics.

- Product Substitutes: The emergence of online retail channels and alternative shopping destinations presents a degree of substitution.

- End-User Demographics: The market is driven by a diverse range of tourists and domestic travelers with varying preferences and spending habits.

- M&A Activities: Several mergers and acquisitions have shaped the competitive landscape, particularly in the consolidation of airport retail operations.

Thailand Travel Retail Market Market Dynamics & Trends

This section examines the factors driving market growth, technological advancements, and changing consumer preferences. We project a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033), driven by factors such as rising tourism, increasing consumer spending, and the ongoing expansion of airport infrastructure. Market penetration in key segments, like duty-free goods and luxury items, is expected to reach xx% by 2033. The report also explores technological disruptions, such as the integration of e-commerce and mobile payment solutions, impacting consumer behavior and retail strategies. Competitive dynamics are further analyzed, highlighting the strategies employed by key players to maintain their market position.

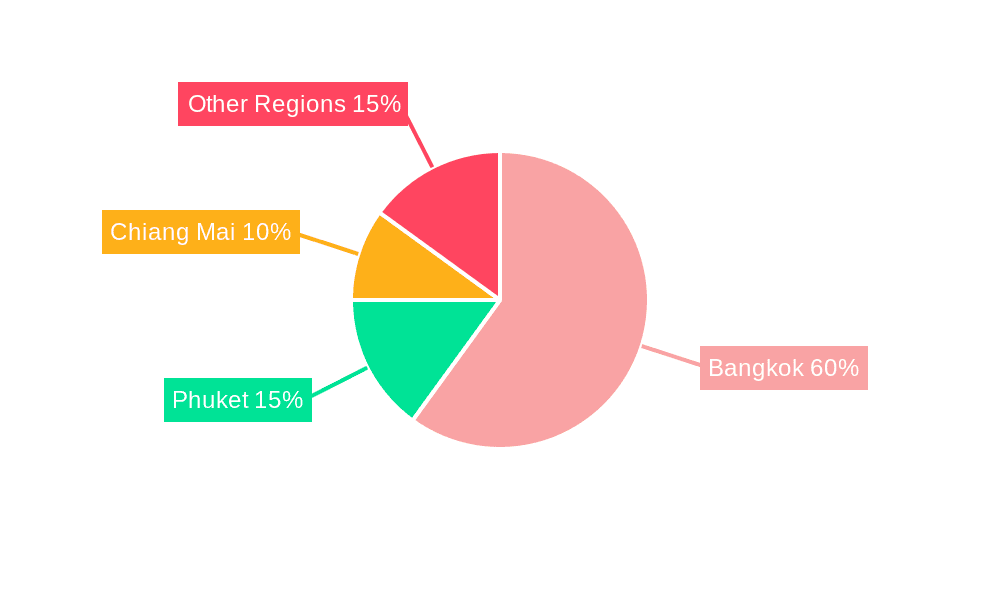

Dominant Regions & Segments in Thailand Travel Retail Market

This section identifies the leading regions and segments within the Thailand travel retail market. Bangkok, with its extensive airport infrastructure and high tourist influx, holds the dominant position, accounting for xx% of the market. The duty-free segment is also the leading segment, driven by high demand for luxury goods and tax-free shopping.

- Key Drivers for Bangkok's Dominance:

- High tourist arrival numbers.

- Strategic location and extensive airport infrastructure (Suvarnabhumi and Don Mueang).

- Presence of major luxury brands and retail outlets.

- Government support for tourism development.

- Duty-Free Segment Dominance:

- High demand from international tourists.

- Attractive pricing due to tax exemptions.

- Wide product range, catering to diverse consumer preferences.

Thailand Travel Retail Market Product Innovations

The market shows a trend towards experiential retail, personalized services, and technology integration. New product categories are emerging, focusing on health, beauty, and technology, driven by consumer demand. Brands are increasingly using digital technology to enhance the shopping experience. Recent developments, such as Foreo's expansion into Don Mueang Airport, demonstrate a focus on expanding reach and creating a more integrated retail presence.

Report Scope & Segmentation Analysis

The report segments the market by product category (cosmetics, perfumes, liquor, tobacco, etc.), distribution channel (airport, downtown stores), and customer segment (domestic and international tourists). Each segment's market size, growth projection, and competitive landscape are analyzed. For instance, the cosmetics segment is projected to experience a CAGR of xx%, while the downtown store channel is predicted to show a xx% CAGR during the forecast period. Competitive analysis reveals distinct strategies employed by different players in each segment.

Key Drivers of Thailand Travel Retail Market Growth

Several factors contribute to the market's growth trajectory. The rise in tourism, particularly from high-spending tourists from China and other Asian countries, fuels demand. Government initiatives supporting tourism and infrastructure development further boost growth. Economic expansion in Thailand leads to increased consumer spending, driving market expansion. Innovative retail technologies enhance customer experience and drive sales.

Challenges in the Thailand Travel Retail Market Sector

The market faces challenges including intense competition, economic fluctuations impacting tourist spending, and regulatory changes affecting operations. Supply chain disruptions and currency fluctuations also pose challenges, potentially impacting profitability and market stability. The market share of traditional retailers may face pressure from growing e-commerce channels.

Emerging Opportunities in Thailand Travel Retail Market

Emerging opportunities include leveraging digital technologies for personalized marketing and omnichannel retail strategies. Expanding into new product categories like health and wellness products presents significant potential. Growing domestic tourism and regional expansion offer additional growth opportunities. Further development of smart airport facilities and improvements in logistics can further enhance market expansion.

Leading Players in the Thailand Travel Retail Market Market

- King Power International Group

- The Shilla Duty Free

- Leon Duty Free

- Central Pattana

- The Mall Group

- Jaidee Duty Free

- SIAM Gems Group

- Paradise Duty Free

- Regent Plaza Group

- Bangkok Airways

- The Airways International

- Airports of Thailand

- JR Duty Free

Key Developments in Thailand Travel Retail Market Industry

- October 2023: Foreo launches a new outlet at Don Mueang Airport in collaboration with King Power.

- November 2023: PTT Oil and Retail Business announces a $900 Million investment to expand its operations across Southeast Asia.

Future Outlook for Thailand Travel Retail Market Market

The Thailand travel retail market is poised for continued growth, driven by factors such as rising tourism, increased consumer spending, and technological advancements. Strategic investments in infrastructure, innovative retail concepts, and expansion into new market segments will be crucial for success. The continued integration of digital technologies into the consumer experience will be critical for market leaders. Opportunities exist for companies to focus on enhancing customer loyalty through personalized services and innovative shopping experiences.

Thailand Travel Retail Market Segmentation

-

1. Product Type

- 1.1. Beauty and Personal Care

- 1.2. Wines and Spirits

- 1.3. Tobacco

- 1.4. Eatables

- 1.5. Fashion Accessories and Hard Luxury

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Airports

- 2.2. Airlines

- 2.3. Ferries

- 2.4. Other Distribution Channels (Borders, Downtown)

Thailand Travel Retail Market Segmentation By Geography

- 1. Thailand

Thailand Travel Retail Market Regional Market Share

Geographic Coverage of Thailand Travel Retail Market

Thailand Travel Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growth of the Tourism Industry in Thailand is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Travel Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beauty and Personal Care

- 5.1.2. Wines and Spirits

- 5.1.3. Tobacco

- 5.1.4. Eatables

- 5.1.5. Fashion Accessories and Hard Luxury

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Airports

- 5.2.2. Airlines

- 5.2.3. Ferries

- 5.2.4. Other Distribution Channels (Borders, Downtown)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 King Power International Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Shilla Duty Free

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Leon Duty Free

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Central Pattana

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Mall Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jaidee Duty Free

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SIAM Gems Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Paradise Duty Free

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Regent Plaza Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bangkok Airways

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Airways International

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Airports of Thailand

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 JR Duty Free**List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 King Power International Group

List of Figures

- Figure 1: Thailand Travel Retail Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Thailand Travel Retail Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Travel Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Thailand Travel Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Thailand Travel Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Thailand Travel Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Thailand Travel Retail Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Thailand Travel Retail Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Thailand Travel Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Thailand Travel Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: Thailand Travel Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Thailand Travel Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Thailand Travel Retail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Thailand Travel Retail Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Travel Retail Market?

The projected CAGR is approximately 6.75%.

2. Which companies are prominent players in the Thailand Travel Retail Market?

Key companies in the market include King Power International Group, The Shilla Duty Free, Leon Duty Free, Central Pattana, The Mall Group, Jaidee Duty Free, SIAM Gems Group, Paradise Duty Free, Regent Plaza Group, Bangkok Airways, The Airways International, Airports of Thailand, JR Duty Free**List Not Exhaustive.

3. What are the main segments of the Thailand Travel Retail Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 154.48 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growth of the Tourism Industry in Thailand is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2023, Foreo broadens its presence in Thailand's travel retail sector with a new outlet at Don Mueang Airport. This expansion, in collaboration with King Power, builds upon Foreo's existing launches at Suvarnabhumi and Phuket airports, along with its presence in King Power Rangnam, King Power Srivaree Complex, and King Power Phuket downtown stores.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Travel Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Travel Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Travel Retail Market?

To stay informed about further developments, trends, and reports in the Thailand Travel Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence