Key Insights

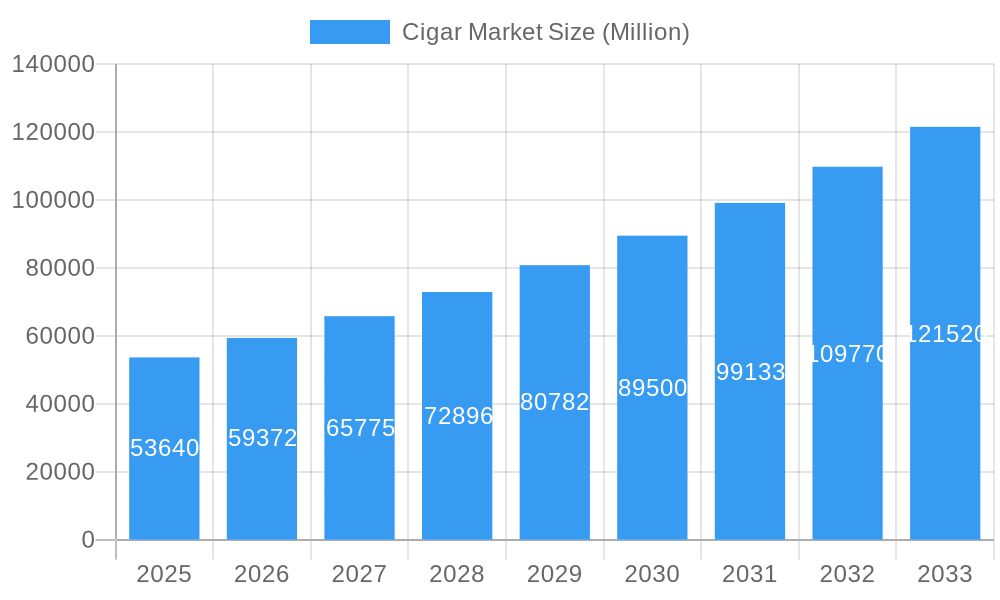

The global cigar market, valued at $53.64 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 10.48% from 2025 to 2033. This expansion is driven by several key factors. The increasing disposable incomes in developing economies, coupled with a growing preference for premium and handcrafted cigars among affluent consumers, fuels significant demand. Furthermore, innovative product offerings, such as flavored cigars and cigarillos, cater to evolving consumer preferences and broaden the market appeal. Effective marketing campaigns focusing on the sophisticated image and social aspects associated with cigar consumption also contribute to market growth. However, the market faces challenges including stringent regulations on tobacco products in several countries, increasing health concerns related to smoking, and the rising cost of raw materials. The competitive landscape is dominated by established players like Oettinger Davidoff AG, Swisher International Inc., and Imperial Brands Inc., alongside regional players catering to niche segments. The market is segmented by product type (conventional and premium cigars) and distribution channel (offline and online retail stores). The premium cigar segment is anticipated to witness faster growth owing to its appeal to high-income consumers. Online retail channels are projected to gain market share due to their convenience and expanding reach. Regional analysis indicates that North America and Europe currently hold significant market shares, but the Asia-Pacific region is poised for substantial growth due to increasing affluence and changing lifestyle patterns.

Cigar Market Market Size (In Billion)

The strategic focus of major players involves enhancing product portfolios, expanding distribution networks, and implementing targeted marketing strategies. Companies are investing in premiumization, offering limited-edition cigars and curated experiences to retain and attract high-value customers. The growing popularity of online platforms also compels companies to enhance their e-commerce capabilities to cater to digitally savvy consumers. Despite the regulatory hurdles and health concerns, the long-term outlook for the cigar market remains positive, fueled by the enduring appeal of cigars as a luxury and social product, particularly within specific demographic segments. The market's future growth trajectory will depend significantly on how effectively companies navigate the regulatory environment, address health concerns, and cater to evolving consumer demands.

Cigar Market Company Market Share

Cigar Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global cigar market, offering actionable insights for industry professionals and investors. Covering the period from 2019 to 2033, with a focus on 2025, this report forecasts significant growth and outlines key trends shaping the industry's future. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Cigar Market Structure & Innovation Trends

The global cigar market is moderately concentrated, with key players like Oettinger Davidoff AG, Swisher International Inc, Imperial Brands Inc, and Scandinavian Tobacco Group AS holding significant market share. However, regional players and smaller niche brands also contribute significantly. Market share fluctuates based on product launches, marketing campaigns, and economic factors. The M&A landscape shows a moderate level of activity, with deal values ranging from xx Million to xx Million in recent years, primarily driven by efforts to expand product portfolios and geographic reach. Innovation is fueled by consumer demand for premium cigars with unique flavor profiles and novel packaging. Regulatory frameworks, including taxation and advertising restrictions, vary significantly across regions, influencing market dynamics and profitability. Substitute products, such as vaping alternatives, pose a growing threat, particularly among younger consumers. End-user demographics are shifting, with a growing focus on discerning consumers seeking higher-quality, premium products.

- Market Concentration: Moderately concentrated.

- M&A Activity: Moderate, with deal values between xx Million and xx Million.

- Innovation Drivers: Premiumization, unique flavor profiles, novel packaging.

- Regulatory Frameworks: Vary significantly across regions.

- Substitute Products: Growing threat from vaping and other alternatives.

- End-User Demographics: Shift toward discerning, premium-focused consumers.

Cigar Market Dynamics & Trends

The cigar market is influenced by several interconnected factors driving growth or presenting challenges. Premiumization continues as a major trend, with consumers increasingly willing to pay for high-quality, artisanal cigars. Technological advancements in cultivation, processing, and packaging are improving both quality and efficiency. Consumer preferences are evolving, favoring complex flavor profiles, unique formats, and sustainable practices. Competitive dynamics are shaped by both established global players and smaller, artisanal brands, creating a diverse and dynamic market landscape. Market penetration of premium cigars remains significant, but growth is influenced by economic conditions and health concerns. Further expansion hinges on successfully navigating changing consumer preferences and retaining market share in the face of competition.

Dominant Regions & Segments in Cigar Market

The North American market is currently the dominant region, driven by strong consumer demand for premium cigars and established distribution networks. Europe also represents a substantial market segment, particularly for premium brands with established heritage. However, the Asia-Pacific region demonstrates notable growth potential, spurred by increasing disposable incomes and evolving consumer preferences.

Key Drivers by Segment:

- Product Type:

- Premium Cigar: Driven by increasing consumer demand for high-quality, artisanal cigars and a willingness to pay a premium for unique flavour profiles.

- Conventional Cigar: Market maturity with a focus on value and affordability, with potential for growth in specific emerging markets.

- Distribution Channel:

- Offline Retail Stores: Remains the primary sales channel, especially for premium cigars, due to in-person experience and expertise.

- Online Retail Stores: Shows significant growth potential, offering convenience and wider product selection, though it faces challenges with authentication and shipping regulations.

Cigar Market Product Innovations

Recent innovations highlight a focus on premiumization and enhanced consumer experience. Drew Estate's launch of the Chateau Real brand, exclusively available online, showcases a shift towards direct-to-consumer sales and targeted marketing in the premium sector. Imperial Brands' Trinidad Espiritu No. 3 launch demonstrates a focus on flavour complexity and premium packaging. Technological advancements are improving the growing and processing of tobacco, leading to consistent product quality and potentially enhanced flavour.

Report Scope & Segmentation Analysis

This report segments the cigar market by product type (conventional and premium cigars) and distribution channel (offline and online retail stores). Growth projections for each segment vary based on factors such as consumer preferences, pricing strategies, and regulatory changes. Market sizes are estimated based on sales data, considering variations in per-unit pricing and regional differences. Competitive dynamics within each segment are influenced by the number of players, their market share, and their respective competitive advantages.

Product Type:

- Premium Cigars: xx Million in 2025, xx Million projected in 2033.

- Conventional Cigars: xx Million in 2025, xx Million projected in 2033.

Distribution Channel:

- Offline Retail Stores: xx Million in 2025, xx Million projected in 2033.

- Online Retail Stores: xx Million in 2025, xx Million projected in 2033.

Key Drivers of Cigar Market Growth

Several factors fuel cigar market growth. The increasing demand for premium cigars is significant. Technological advancements in cultivation and production enhance quality and efficiency. Effective marketing campaigns highlighting the sensory experience and social aspects of cigar consumption further propel the market. Strategic partnerships and mergers & acquisitions expand market reach and product offerings.

Challenges in the Cigar Market Sector

The cigar market faces several obstacles. Stricter health regulations and increased taxation negatively impact sales and profitability. Supply chain disruptions and fluctuations in raw material costs threaten market stability. Intense competition, particularly from substitute products like vapes, requires continuous innovation and brand differentiation. Economic downturns reduce consumer spending on discretionary goods like premium cigars.

Emerging Opportunities in Cigar Market

Emerging markets in Asia and other regions represent a significant growth opportunity. Technological innovations such as personalized cigar recommendations based on flavour preferences create new market avenues. The rising demand for sustainably sourced and ethically produced cigars presents a niche opportunity for environmentally conscious brands. Focusing on experiential marketing initiatives enhance consumer engagement and brand loyalty.

Leading Players in the Cigar Market Market

- Oettinger Davidoff AG

- Swisher International Inc

- Imperial Brands Inc

- Scandinavian Tobacco Group AS

- China National Tobacco Corporation

- Japan Tobacco Inc

- Manifatture Sigaro Toscano SPA

- JC Newman Cigar Co

- Philip Morris International Inc

- Altria Group Inc

Key Developments in Cigar Market Industry

- November 2023: Drew Estate launched the Chateau Real brand exclusively for online retailers, packaged in 20-count boxes, demonstrating a move towards digital distribution and premium packaging in the premium segment.

- September 2023: Imperial Brands’ Altadis U.S.A. launched the Trinidad Espiritu No. 3 in five sizes, showcasing continued innovation in premium cigar offerings with varying price points catering to different consumer segments.

- November 2022: China National Tobacco Corp released a limited-edition Year of the Rabbit cigar, highlighting the ongoing trend of limited-edition releases and culturally-relevant branding.

Future Outlook for Cigar Market Market

The cigar market is poised for continued growth, driven by premiumization, innovation, and the expansion into new markets. Strategic partnerships, targeted marketing, and the integration of technology will shape the industry's future. Adapting to evolving consumer preferences and effectively addressing regulatory challenges will be crucial for sustained success.

Cigar Market Segmentation

-

1. Product Type

- 1.1. Conventional Cigar

- 1.2. Premium Cigar

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

Cigar Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Cigar Market Regional Market Share

Geographic Coverage of Cigar Market

Cigar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cigar as a Status Symbol; Premiumization & Product Differentiation Play a Key Role

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations & Health Factors; Stiff Competition From Substitutes

- 3.4. Market Trends

- 3.4.1. Offline Retail Channels are the Widely Preferred Distribution Channel

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cigar Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Conventional Cigar

- 5.1.2. Premium Cigar

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Cigar Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Conventional Cigar

- 6.1.2. Premium Cigar

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Cigar Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Conventional Cigar

- 7.1.2. Premium Cigar

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Cigar Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Conventional Cigar

- 8.1.2. Premium Cigar

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Cigar Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Conventional Cigar

- 9.1.2. Premium Cigar

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Cigar Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Conventional Cigar

- 10.1.2. Premium Cigar

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Offline Retail Stores

- 10.2.2. Online Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Oettinger Davidoff AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Swisher International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Imperial Brands Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Scandinavian Tobacco Group AS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China National Tobacco Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Japan Tobacco Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Manifatture Sigaro Toscano SPA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 JC Newman Cigar Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Philip Morris International Inc *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Altria Group Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Oettinger Davidoff AG

List of Figures

- Figure 1: Global Cigar Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cigar Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Cigar Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Cigar Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Cigar Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Cigar Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Cigar Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Cigar Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Cigar Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Cigar Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Cigar Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Cigar Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Cigar Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Cigar Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Cigar Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Cigar Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Cigar Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Cigar Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Cigar Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Cigar Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: South America Cigar Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Cigar Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Cigar Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Cigar Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Cigar Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Cigar Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Cigar Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Cigar Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Cigar Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Cigar Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Cigar Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cigar Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Cigar Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Cigar Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Cigar Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Cigar Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Cigar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Cigar Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Cigar Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Cigar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Cigar Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global Cigar Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Cigar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Cigar Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Global Cigar Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Cigar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Cigar Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 36: Global Cigar Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Cigar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cigar Market?

The projected CAGR is approximately 10.48%.

2. Which companies are prominent players in the Cigar Market?

Key companies in the market include Oettinger Davidoff AG, Swisher International Inc, Imperial Brands Inc, Scandinavian Tobacco Group AS, China National Tobacco Corporation, Japan Tobacco Inc, Manifatture Sigaro Toscano SPA, JC Newman Cigar Co, Philip Morris International Inc *List Not Exhaustive, Altria Group Inc.

3. What are the main segments of the Cigar Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.64 Million as of 2022.

5. What are some drivers contributing to market growth?

Cigar as a Status Symbol; Premiumization & Product Differentiation Play a Key Role.

6. What are the notable trends driving market growth?

Offline Retail Channels are the Widely Preferred Distribution Channel.

7. Are there any restraints impacting market growth?

Stringent Government Regulations & Health Factors; Stiff Competition From Substitutes.

8. Can you provide examples of recent developments in the market?

November 2023: Drew Estate’s Chateau Real brand was exclusively made available at Drew Diplomat Digital retailers, and its products were packaged in 20-count boxes. Drew Estate launched this brand specifically for the Drew Diplomat online premium cigar retailers. The Drew Estate Chateau Real brand was claimed to be a luxurious blend of premium cigars crafted to highlight the cigar’s compelling Connecticut Shade-forward flavor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cigar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cigar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cigar Market?

To stay informed about further developments, trends, and reports in the Cigar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence