Key Insights

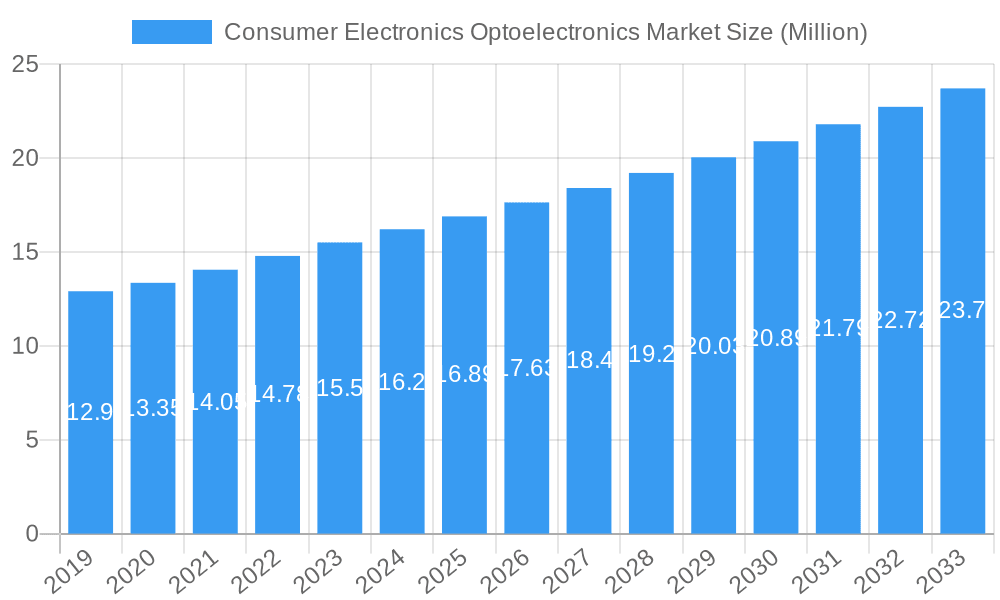

The global Consumer Electronics Optoelectronics Market is poised for robust expansion, projected to reach USD 16.89 billion by 2025, driven by a healthy CAGR of 4.70% over the forecast period of 2025-2033. This growth is fundamentally fueled by the insatiable consumer demand for sophisticated and visually immersive electronic devices. Key market drivers include the accelerating adoption of advanced display technologies, such as OLED and micro-LED, which offer superior color reproduction, energy efficiency, and slimmer form factors, thereby revolutionizing smartphones, televisions, and wearable devices. Furthermore, the burgeoning Internet of Things (IoT) ecosystem necessitates an increasing deployment of optoelectronic components for sensing, communication, and data transfer, creating significant opportunities. The continuous miniaturization and performance enhancement of image sensors, vital for the proliferation of high-resolution cameras in mobile devices and smart home security systems, also contribute significantly to market momentum.

Consumer Electronics Optoelectronics Market Market Size (In Million)

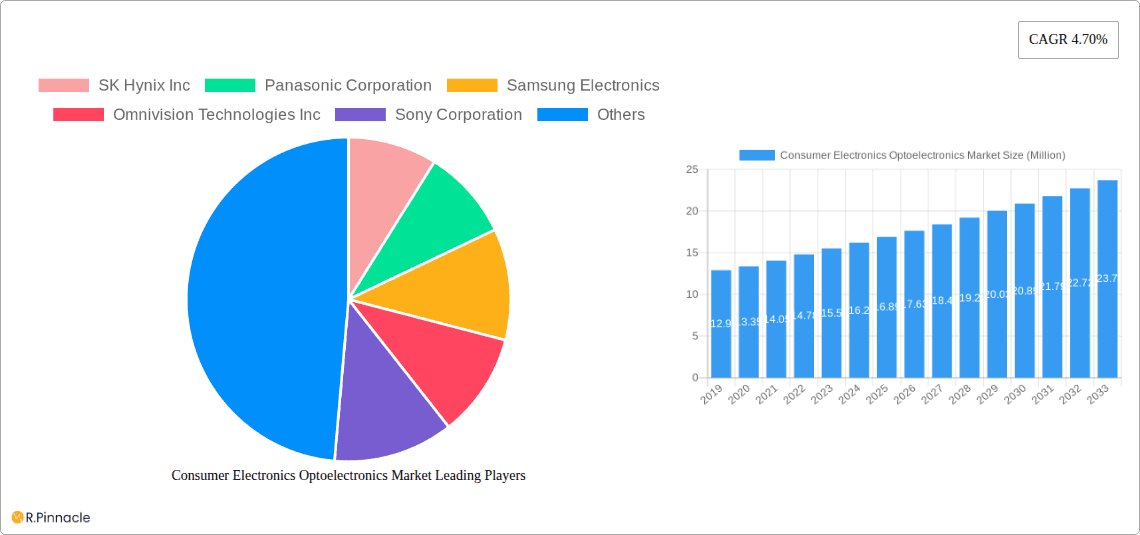

The market landscape is characterized by intense innovation and a dynamic competitive environment, with leading companies like Samsung Electronics, Sony Corporation, and SK Hynix Inc. at the forefront of developing next-generation optoelectronic solutions. The market is segmented across various device types, including LED, Laser Diode, Image Sensors, Optocouplers, and Photovoltaic cells, each catering to distinct application areas within consumer electronics. Emerging trends such as the integration of advanced optical technologies in augmented and virtual reality (AR/VR) devices, coupled with the growing demand for energy-efficient lighting solutions in smart homes, are expected to further propel market growth. While the market benefits from strong demand, potential restraints include the high cost of advanced manufacturing processes and the ongoing global supply chain complexities that could impact component availability and pricing. Geographically, Asia-Pacific, particularly China and South Korea, is expected to dominate due to its strong manufacturing base and high consumer spending on electronics, with significant contributions also anticipated from North America and Europe.

Consumer Electronics Optoelectronics Market Company Market Share

Consumer Electronics Optoelectronics Market Report: Unveiling Growth, Innovation, and Future Trends (2019-2033)

Gain unparalleled insights into the dynamic Consumer Electronics Optoelectronics Market with this comprehensive report. Spanning from 2019 to 2033, with a detailed focus on the base year 2025 and a robust forecast period from 2025 to 2033, this analysis delves deep into the intricate landscape of optoelectronic components driving innovation in consumer devices. Discover critical market dynamics, technological advancements, and the strategic imperatives shaping the future of image sensors, LEDs, laser diodes, and more. This report is meticulously crafted for industry professionals, investors, and strategists seeking to capitalize on emerging opportunities and navigate the competitive currents of this rapidly evolving sector.

Consumer Electronics Optoelectronics Market Market Structure & Innovation Trends

The Consumer Electronics Optoelectronics Market exhibits a moderately concentrated structure, with a few dominant players controlling a significant portion of the market share. Innovation is the primary driver of market growth, fueled by relentless research and development in areas such as miniaturization, increased efficiency, and enhanced functionality of optoelectronic components. Regulatory frameworks, while generally supportive of technological advancement, can influence product development and adoption, particularly concerning energy efficiency standards and safety regulations. Product substitutes, though present in some applications, often fall short of the performance and integration capabilities offered by dedicated optoelectronic solutions. The end-user demographics are broad, encompassing tech-savvy consumers, early adopters, and mass-market segments, each with distinct preferences and purchasing power. Mergers and acquisitions (M&A) activities play a crucial role in market consolidation and the expansion of technological portfolios. Recent M&A deals are valued in the hundreds of millions of dollars, indicating a strong appetite for strategic integration and market dominance. For instance, the acquisition of specialized technology firms by larger conglomerates aims to secure intellectual property and accelerate new product development, thereby influencing overall market concentration and competitive dynamics.

Consumer Electronics Optoelectronics Market Market Dynamics & Trends

The Consumer Electronics Optoelectronics Market is experiencing robust growth, driven by an insatiable consumer demand for smarter, more sophisticated, and visually immersive electronic devices. The compound annual growth rate (CAGR) is estimated at a significant xx%, reflecting the ubiquitous integration of optoelectronic components across a wide spectrum of consumer electronics. This growth is propelled by several key factors, including the relentless advancement in smartphone camera technology, the expanding adoption of smart home devices, the burgeoning augmented reality (AR) and virtual reality (VR) markets, and the increasing prevalence of wearable technology. Technological disruptions are a constant feature, with breakthroughs in LED efficiency, laser diode precision, and image sensor resolution continuously redefining product capabilities. For example, the development of backside-illuminated (BSI) CMOS sensors has dramatically improved low-light performance in mobile devices, while advancements in micro-LED technology are paving the way for next-generation displays with superior brightness and color accuracy. Consumer preferences are increasingly oriented towards enhanced user experiences, leading to a higher demand for features such as high-resolution imaging, advanced gesture recognition, and personalized visual feedback. This shift is directly fueling the demand for sophisticated optoelectronic solutions. The competitive landscape is characterized by intense rivalry among established semiconductor giants and agile, specialized component manufacturers. Companies are actively investing in R&D to gain a competitive edge through product differentiation and cost optimization. Market penetration is expanding as optoelectronic components become more affordable and integrated into a wider range of consumer electronics, moving beyond high-end devices into mainstream products. The proliferation of connected devices, enabled by advancements in optical communication technologies, further contributes to market expansion.

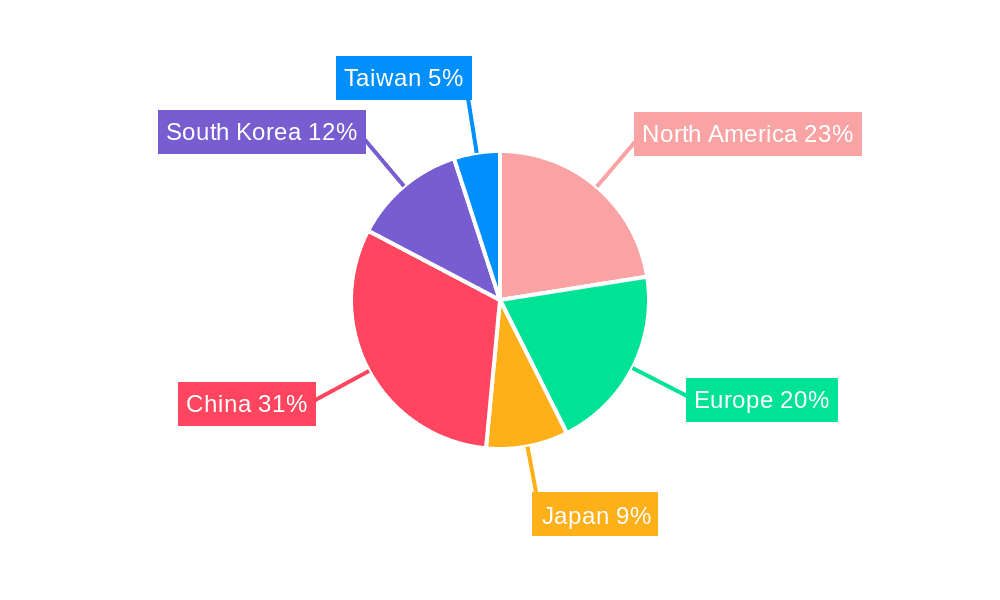

Dominant Regions & Segments in Consumer Electronics Optoelectronics Market

The Consumer Electronics Optoelectronics Market is witnessing significant dominance from the Asia Pacific region, largely attributed to its robust manufacturing infrastructure, substantial consumer base, and proactive government support for the technology sector. Countries like China, South Korea, Japan, and Taiwan are at the forefront of both production and consumption of optoelectronic components.

Key Drivers for Regional Dominance:

- Manufacturing Prowess: Extensive semiconductor fabrication facilities and a well-established supply chain ecosystem enable high-volume production at competitive costs.

- Consumer Demand: A massive and growing middle class with a strong appetite for the latest consumer electronics, from smartphones and televisions to wearables and smart home appliances.

- Government Initiatives: Favorable policies, research grants, and incentives promoting technological innovation and domestic manufacturing capabilities.

- R&D Hubs: Presence of leading research institutions and corporate R&D centers driving advancements in optoelectronic technologies.

Within the Device Type segmentation, Image Sensors currently hold the largest market share and are projected to maintain their dominance throughout the forecast period. The relentless pursuit of higher resolution, better low-light performance, and advanced computational photography in smartphones, digital cameras, and automotive applications are the primary catalysts for this segment's growth.

- Image Sensors: Driven by the burgeoning smartphone industry and the increasing adoption of advanced driver-assistance systems (ADAS) in vehicles. The demand for higher pixel counts, larger sensor sizes, and specialized functionalities like depth sensing is a constant.

- LED (Light Emitting Diode): Continues to be a significant segment, propelled by the widespread adoption in display backlighting, general lighting, automotive lighting, and indicator lights. The transition to energy-efficient lighting solutions further bolsters LED market penetration.

- Laser Diode: Experiencing steady growth due to its applications in optical storage, barcode scanners, laser pointers, industrial applications, and increasingly, in advanced sensing and communication systems.

- Optocouplers: Essential for electrical isolation in various consumer electronics, these components see consistent demand across a broad range of applications where signal transmission with isolation is critical.

- Photovoltaic Cells: While primarily associated with renewable energy, their integration into consumer electronics for trickle charging or powering small devices is a growing niche, though not as dominant as other segments.

The interplay between these segments, supported by the regional manufacturing strengths and consumer demand, defines the current and future trajectory of the Consumer Electronics Optoelectronics Market.

Consumer Electronics Optoelectronics Market Product Innovations

Product innovation in the Consumer Electronics Optoelectronics Market is characterized by a relentless drive towards enhanced performance, miniaturization, and integration. Recent advancements in image sensors, exemplified by OMNIVISION's OV50K40 with TheiaCel technology, are enabling smartphones to capture images with human-eye-like dynamic range in a single exposure, setting new benchmarks for flagship cameras. Similarly, onsemi's strategic shift towards internal CMOS image sensor (CIS) production signifies a commitment to vertical integration and control over cutting-edge manufacturing processes. These innovations offer consumers superior visual experiences, enabling more detailed and vibrant photography and videography. The competitive advantage lies in delivering components that empower next-generation consumer devices with advanced functionalities and improved user interaction.

Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the Consumer Electronics Optoelectronics Market, segmented by Device Type: LED, Laser Diode, Image Sensors, Optocouplers, Photovoltaic cells, and Other Device Types.

- LED: This segment is expected to witness steady growth driven by energy-efficient lighting solutions and expanding applications in displays and automotive.

- Laser Diode: Forecasted to show robust growth due to increasing demand in advanced sensing, communication, and industrial applications.

- Image Sensors: Dominates the market and is projected to continue its upward trajectory, fueled by smartphone advancements, automotive safety features, and emerging AR/VR technologies.

- Optocouplers: Maintains consistent demand due to their critical role in electrical isolation across a wide range of consumer electronics.

- Photovoltaic Cells: While a smaller segment within consumer electronics, it is expected to experience niche growth with increasing integration for portable device power solutions.

- Other Device Types: This category encompasses emerging optoelectronic components and specialized sensors, expected to grow as new applications emerge.

Key Drivers of Consumer Electronics Optoelectronics Market Growth

The Consumer Electronics Optoelectronics Market is propelled by several interconnected growth drivers. The ubiquitous demand for smartphones with advanced camera capabilities is a primary accelerator, pushing innovation in image sensors and related optical components. The burgeoning Internet of Things (IoT) ecosystem, encompassing smart home devices, wearables, and connected appliances, relies heavily on various optoelectronic sensors for functionality. The rapid evolution of the automotive sector, particularly the push towards autonomous driving and advanced driver-assistance systems (ADAS), necessitates sophisticated optical and sensor technologies for environmental perception and safety. Furthermore, the expanding market for Augmented Reality (AR) and Virtual Reality (VR) devices creates a significant demand for high-performance display components, sensors, and optical tracking systems. Economic factors, such as increasing disposable incomes in emerging economies, further fuel consumer spending on electronic devices incorporating these technologies.

Challenges in the Consumer Electronics Optoelectronics Market Sector

Despite the strong growth trajectory, the Consumer Electronics Optoelectronics Market faces several challenges. Intense competition among manufacturers can lead to significant price pressures, impacting profit margins, especially for commoditized components. Supply chain disruptions, as witnessed in recent years, can hinder production and lead to extended lead times. Stringent regulatory requirements related to product safety, environmental impact, and data privacy can add complexity and cost to product development and compliance. Rapid technological obsolescence necessitates continuous and substantial investment in research and development to stay competitive, posing a significant financial burden. Moreover, the increasing demand for sophisticated optoelectronic components requires specialized manufacturing processes and skilled labor, which can be a bottleneck for expansion.

Emerging Opportunities in Consumer Electronics Optoelectronics Market

The Consumer Electronics Optoelectronics Market is ripe with emerging opportunities. The expanding metaverse and AR/VR markets present a significant frontier for advanced display technologies, high-precision sensors, and optical tracking systems. The automotive industry's ongoing transition to electric and autonomous vehicles will continue to drive demand for advanced LiDAR, radar, and camera-based optoelectronic solutions. The miniaturization of devices and the growth of wearable technology open avenues for ultra-compact and energy-efficient optoelectronic components. Furthermore, the increasing integration of AI and machine learning in consumer electronics will drive demand for more intelligent optical sensors capable of advanced data processing and pattern recognition. The development of novel optoelectronic materials and manufacturing techniques offers the potential for disruptive innovations and new market applications.

Leading Players in the Consumer Electronics Optoelectronics Market Market

- SK Hynix Inc

- Panasonic Corporation

- Samsung Electronics

- Omnivision Technologies Inc

- Sony Corporation

- Ams Osram AG

- Signify Holding

- Vishay Intertechnology Inc

- Texas Instruments Inc

- LITE-ON Technology Corporation

- Rohm Company Limited

- Mitsubishi Electric Corporation

- Broadcom Inc

- Sharp Corporation

Key Developments in Consumer Electronics Optoelectronics Market Industry

- March 2024: OMNIVISION, a prominent global semiconductor solutions developer, unveiled its latest innovation, the OV50K40. This cutting-edge smartphone image sensor, powered by TheiaCel technology, achieves a high dynamic range (HDR) comparable to the human eye in a single exposure. The OV50K40 is poised to redefine industry standards, particularly for flagship rear-facing main cameras.

- November 2023: Onsemi announced a strategic shift to commence the internal production of CMOS image sensors (CIS) in 2024. This move is a notable departure from its traditional approach of relying on external partners for manufacturing.

Future Outlook for Consumer Electronics Optoelectronics Market Market

The future outlook for the Consumer Electronics Optoelectronics Market is exceptionally bright, characterized by sustained innovation and expanding application frontiers. Growth accelerators include the continued miniaturization and increasing power efficiency of optoelectronic components, making them integral to a broader range of consumer devices. The accelerating adoption of 5G technology will further drive demand for high-performance optical components in communication infrastructure and end-user devices. The development of advanced AI-powered imaging solutions and the growth of the AR/VR ecosystem will unlock significant market potential. Strategic partnerships and acquisitions are expected to continue shaping the market landscape, fostering technological convergence and accelerating product development. Companies focusing on delivering differentiated solutions with superior performance, energy efficiency, and enhanced functionality are well-positioned to capitalize on the evolving demands of the global consumer electronics market.

Consumer Electronics Optoelectronics Market Segmentation

-

1. Device Type

- 1.1. LED

- 1.2. Laser Diode

- 1.3. Image Sensors

- 1.4. Optocouplers

- 1.5. Photovoltaic cells

- 1.6. Other Device Types

Consumer Electronics Optoelectronics Market Segmentation By Geography

- 1. United States

- 2. Europe

- 3. Japan

- 4. China

- 5. South Korea

- 6. Taiwan

Consumer Electronics Optoelectronics Market Regional Market Share

Geographic Coverage of Consumer Electronics Optoelectronics Market

Consumer Electronics Optoelectronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Demand for 5G Smartphones

- 3.2.2 and Laptops; Technology Advancements

- 3.2.3 and AI Developments will Drive the Growth

- 3.3. Market Restrains

- 3.3.1 Growing Demand for 5G Smartphones

- 3.3.2 and Laptops; Technology Advancements

- 3.3.3 and AI Developments will Drive the Growth

- 3.4. Market Trends

- 3.4.1. Image Sensors are Expected to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Consumer Electronics Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. LED

- 5.1.2. Laser Diode

- 5.1.3. Image Sensors

- 5.1.4. Optocouplers

- 5.1.5. Photovoltaic cells

- 5.1.6. Other Device Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.2.2. Europe

- 5.2.3. Japan

- 5.2.4. China

- 5.2.5. South Korea

- 5.2.6. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. United States Consumer Electronics Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. LED

- 6.1.2. Laser Diode

- 6.1.3. Image Sensors

- 6.1.4. Optocouplers

- 6.1.5. Photovoltaic cells

- 6.1.6. Other Device Types

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Europe Consumer Electronics Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. LED

- 7.1.2. Laser Diode

- 7.1.3. Image Sensors

- 7.1.4. Optocouplers

- 7.1.5. Photovoltaic cells

- 7.1.6. Other Device Types

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Japan Consumer Electronics Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. LED

- 8.1.2. Laser Diode

- 8.1.3. Image Sensors

- 8.1.4. Optocouplers

- 8.1.5. Photovoltaic cells

- 8.1.6. Other Device Types

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. China Consumer Electronics Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. LED

- 9.1.2. Laser Diode

- 9.1.3. Image Sensors

- 9.1.4. Optocouplers

- 9.1.5. Photovoltaic cells

- 9.1.6. Other Device Types

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. South Korea Consumer Electronics Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 10.1.1. LED

- 10.1.2. Laser Diode

- 10.1.3. Image Sensors

- 10.1.4. Optocouplers

- 10.1.5. Photovoltaic cells

- 10.1.6. Other Device Types

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 11. Taiwan Consumer Electronics Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Device Type

- 11.1.1. LED

- 11.1.2. Laser Diode

- 11.1.3. Image Sensors

- 11.1.4. Optocouplers

- 11.1.5. Photovoltaic cells

- 11.1.6. Other Device Types

- 11.1. Market Analysis, Insights and Forecast - by Device Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 SK Hynix Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Panasonic Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Samsung Electronics

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Omnivision Technologies Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Sony Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Ams Osram AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Signify Holding

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Vishay Intertechnology Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Texas Instruments Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 LITE-ON Technology Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Rohm Company Limited

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Mitsubishi Electric Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Broadcom Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Sharp Corporatio

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 SK Hynix Inc

List of Figures

- Figure 1: Global Consumer Electronics Optoelectronics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Consumer Electronics Optoelectronics Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: United States Consumer Electronics Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 4: United States Consumer Electronics Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 5: United States Consumer Electronics Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 6: United States Consumer Electronics Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 7: United States Consumer Electronics Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 8: United States Consumer Electronics Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 9: United States Consumer Electronics Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: United States Consumer Electronics Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Consumer Electronics Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 12: Europe Consumer Electronics Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 13: Europe Consumer Electronics Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 14: Europe Consumer Electronics Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 15: Europe Consumer Electronics Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Consumer Electronics Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Europe Consumer Electronics Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Consumer Electronics Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Japan Consumer Electronics Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 20: Japan Consumer Electronics Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 21: Japan Consumer Electronics Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 22: Japan Consumer Electronics Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 23: Japan Consumer Electronics Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Japan Consumer Electronics Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Japan Consumer Electronics Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Japan Consumer Electronics Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 27: China Consumer Electronics Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 28: China Consumer Electronics Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 29: China Consumer Electronics Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 30: China Consumer Electronics Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 31: China Consumer Electronics Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 32: China Consumer Electronics Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 33: China Consumer Electronics Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: China Consumer Electronics Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 35: South Korea Consumer Electronics Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 36: South Korea Consumer Electronics Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 37: South Korea Consumer Electronics Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 38: South Korea Consumer Electronics Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 39: South Korea Consumer Electronics Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 40: South Korea Consumer Electronics Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 41: South Korea Consumer Electronics Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South Korea Consumer Electronics Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Taiwan Consumer Electronics Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 44: Taiwan Consumer Electronics Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 45: Taiwan Consumer Electronics Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 46: Taiwan Consumer Electronics Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 47: Taiwan Consumer Electronics Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Taiwan Consumer Electronics Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Taiwan Consumer Electronics Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Taiwan Consumer Electronics Optoelectronics Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 3: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 6: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 7: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 10: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 11: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 14: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 15: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 18: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 19: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 22: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 23: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 26: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 27: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Consumer Electronics Optoelectronics Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the Consumer Electronics Optoelectronics Market?

Key companies in the market include SK Hynix Inc, Panasonic Corporation, Samsung Electronics, Omnivision Technologies Inc, Sony Corporation, Ams Osram AG, Signify Holding, Vishay Intertechnology Inc, Texas Instruments Inc, LITE-ON Technology Corporation, Rohm Company Limited, Mitsubishi Electric Corporation, Broadcom Inc, Sharp Corporatio.

3. What are the main segments of the Consumer Electronics Optoelectronics Market?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for 5G Smartphones. and Laptops; Technology Advancements. and AI Developments will Drive the Growth.

6. What are the notable trends driving market growth?

Image Sensors are Expected to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Growing Demand for 5G Smartphones. and Laptops; Technology Advancements. and AI Developments will Drive the Growth.

8. Can you provide examples of recent developments in the market?

March 2024: OMNIVISION, a prominent global semiconductor solutions developer, unveiled its latest innovation, the OV50K40. This cutting-edge smartphone image sensor, powered by TheiaCel technology, achieves a high dynamic range (HDR) comparable to the human eye in a single exposure. The OV50K40 is poised to redefine industry standards, particularly for flagship rear-facing main cameras.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Consumer Electronics Optoelectronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Consumer Electronics Optoelectronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Consumer Electronics Optoelectronics Market?

To stay informed about further developments, trends, and reports in the Consumer Electronics Optoelectronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence