Key Insights

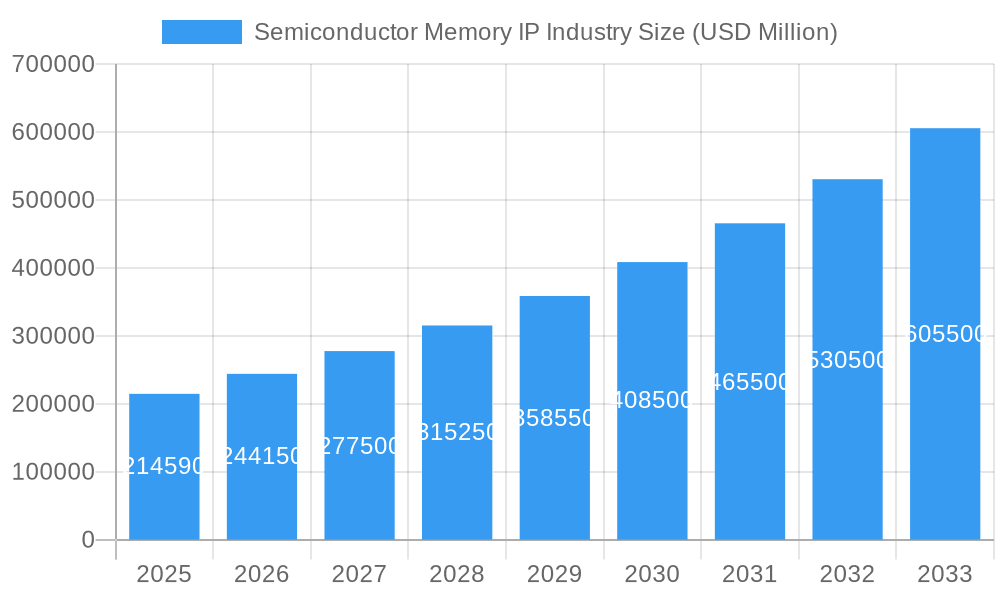

The Semiconductor Memory IP market is poised for significant expansion, projected to reach an estimated USD 214.59 billion in 2025. This robust growth is driven by the insatiable demand for data storage and processing capabilities across a multitude of industries, from the ever-expanding consumer electronics sector to the critical automotive and industrial applications. The market's impressive compound annual growth rate (CAGR) of 13.8% from 2019 to 2033 underscores the accelerating pace of innovation and adoption of advanced memory IP solutions. Key drivers include the increasing complexity of applications, the proliferation of AI and machine learning workloads, and the ongoing miniaturization and efficiency improvements in semiconductor design. The market's trajectory is further propelled by the growing integration of sophisticated memory technologies within networking infrastructure, enabling higher bandwidth and lower latency communications.

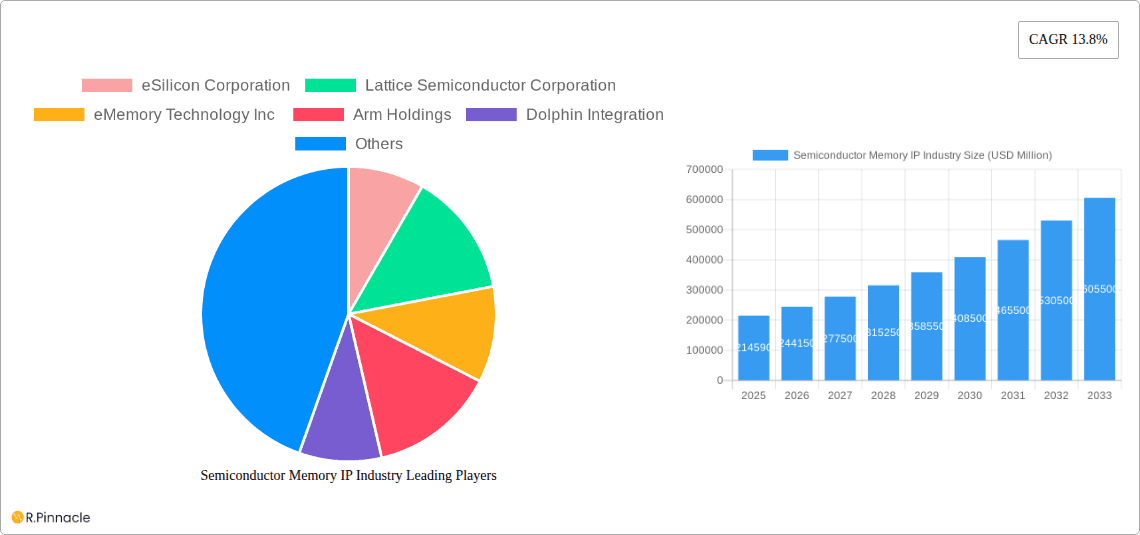

Semiconductor Memory IP Industry Market Size (In Billion)

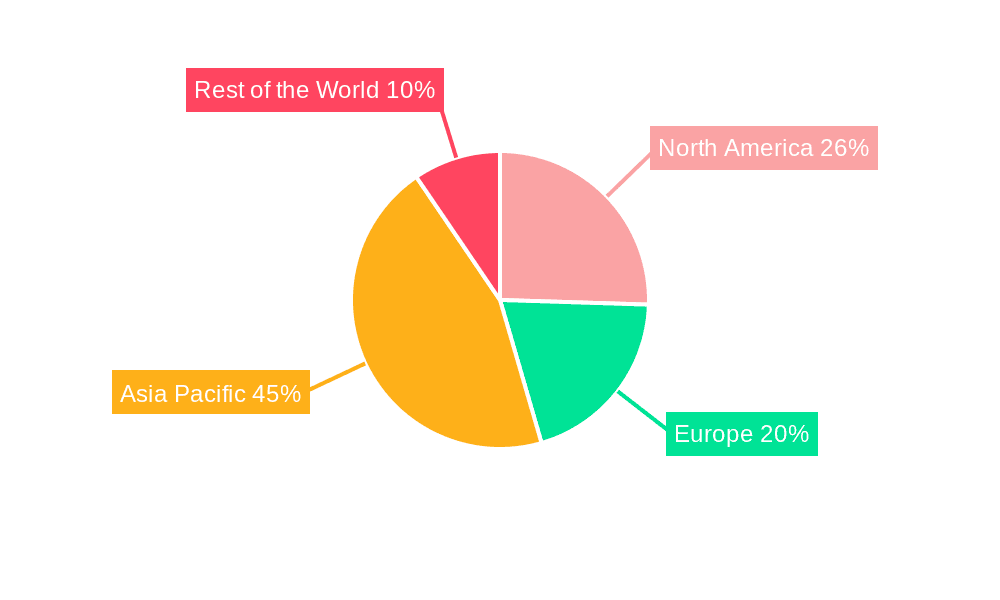

The strategic importance of Non-Volatile Memory (NVM) and Volatile Memory IP is amplified by their integral role in powering next-generation devices and systems. While the market benefits from strong demand, certain restraints, such as the high cost of research and development and the ongoing global semiconductor supply chain challenges, could moderate the pace of growth. However, the continuous evolution of memory architectures, including advancements in high-bandwidth memory (HBM) and emerging memory technologies, alongside strategic investments by key players like Arm Holdings, Synopsys Inc., and Cadence Design Systems Inc., are expected to overcome these hurdles. The dominance of the Asia Pacific region, particularly China, Japan, and South Korea, is anticipated to continue due to their strong manufacturing base and significant R&D investments in semiconductor technology. North America and Europe also represent substantial markets, driven by innovation hubs and demand from advanced industrial and automotive sectors.

Semiconductor Memory IP Industry Company Market Share

This in-depth report provides a definitive analysis of the global Semiconductor Memory IP industry, offering unparalleled insights into its current landscape, evolutionary trends, and future trajectory. Covering the extensive study period from 2019 to 2033, with a base year of 2025 and a robust forecast period from 2025 to 2033, this report is an essential resource for stakeholders seeking to navigate this dynamic and high-growth market. We leverage an extensive dataset, including historical performance from 2019-2024, to deliver actionable intelligence and strategic foresight.

Semiconductor Memory IP Industry Market Structure & Innovation Trends

The Semiconductor Memory IP industry exhibits a moderately concentrated market structure, driven by a core group of established players and a growing number of specialized innovators. Key innovation drivers include the relentless demand for higher data densities, lower power consumption, and faster access speeds across diverse applications, from consumer electronics to cutting-edge AI and automotive systems. Emerging regulatory frameworks, particularly concerning data security and energy efficiency, are shaping product development and market entry strategies. While direct product substitutes for core memory technologies are limited, advancements in alternative storage and processing architectures present indirect competitive pressures. End-user demographics are increasingly sophisticated, with a strong emphasis on performance, reliability, and cost-effectiveness. Mergers and acquisitions (M&A) activity, valued in the billions, continues to be a significant factor in market consolidation and talent acquisition, with deal values projected to grow significantly by 2025. The total market share of leading companies is expected to remain dynamic, influenced by innovation cycles and strategic partnerships.

Semiconductor Memory IP Industry Market Dynamics & Trends

The Semiconductor Memory IP industry is poised for substantial growth, driven by a confluence of powerful market dynamics and evolving technological trends. The Compound Annual Growth Rate (CAGR) is projected to be robust, fueled by the exponential increase in data generation and consumption worldwide. Key growth accelerators include the proliferation of Internet of Things (IoT) devices, the insatiable demand for high-performance computing in AI and machine learning applications, and the burgeoning automotive sector's reliance on advanced memory solutions for autonomous driving and in-car infotainment. Technological disruptions, such as the advancements in non-volatile memory technologies like NAND flash and emerging memory types, are reshaping the competitive landscape and creating new market opportunities. Consumer preferences are increasingly dictating the adoption of memory IP that offers a superior balance of performance, power efficiency, and cost. Competitive dynamics are characterized by intense innovation cycles, strategic collaborations, and fierce price competition. Market penetration for advanced memory IP is expected to surge across all end-user industries as device complexity and data requirements continue to escalate. The industry is also witnessing a significant shift towards specialized memory solutions tailored for specific applications, moving beyond a one-size-fits-all approach. The continuous need for faster data processing and storage in complex systems, from cloud computing infrastructure to edge devices, ensures a sustained demand for innovative memory IP solutions. Furthermore, the growing emphasis on data integrity and security is driving the development of memory IP with enhanced error correction and resilience capabilities.

Dominant Regions & Segments in Semiconductor Memory IP Industry

The Asia Pacific region is unequivocally the dominant force in the Semiconductor Memory IP industry, with countries like Taiwan, South Korea, and China leading in manufacturing, research, and development. This dominance is underpinned by robust government initiatives supporting the semiconductor ecosystem, substantial foreign direct investment, and a highly skilled workforce. The region's advanced manufacturing infrastructure and established supply chains provide a critical advantage.

Within the Product segmentation, Non-Volatile Memory is currently the leading segment and is projected to maintain its stronghold throughout the forecast period. This is driven by the widespread adoption of NAND flash in solid-state drives (SSDs), mobile devices, and cloud storage solutions. Its non-volatility and increasing density make it indispensable. However, Volatile Memory, particularly DRAM, remains crucial for high-speed processing and will see sustained demand, especially in high-performance computing and gaming.

In terms of End-User Industry, Consumer Electronics continues to be the largest market, fueled by the constant demand for smartphones, tablets, wearables, and smart home devices. The Automotive sector is emerging as a significant growth engine, with the increasing complexity of vehicles requiring substantial memory for infotainment systems, advanced driver-assistance systems (ADAS), and autonomous driving functionalities. The Networking sector also represents a substantial and growing market, as the infrastructure for 5G and beyond necessitates high-speed, high-capacity memory solutions. The Industrial sector, with its growing adoption of automation, IoT, and smart manufacturing, also contributes significantly to the demand for reliable and robust memory IP.

Key drivers for regional and segment dominance include:

- Economic Policies: Proactive government incentives, R&D funding, and favorable trade agreements in Asia Pacific.

- Infrastructure: Advanced semiconductor fabrication facilities, robust supply chain networks, and strong logistics in dominant regions.

- Technological Adoption: High consumer adoption rates of advanced electronic devices and rapid integration of memory IP in emerging technologies like AI and autonomous vehicles.

- Talent Pool: Availability of skilled engineers and researchers specializing in semiconductor design and manufacturing.

Semiconductor Memory IP Industry Product Innovations

Product innovations in Semiconductor Memory IP are primarily focused on enhancing performance, power efficiency, and density. Advancements in NAND flash and emerging non-volatile memory technologies are pushing the boundaries of storage capacity while reducing physical footprint. The development of low-power DRAM variants is critical for battery-constrained mobile and IoT devices. Competitive advantages are being gained through novel architectures, advanced manufacturing processes, and intellectual property licensing that enables specialized functionalities like enhanced data retention and faster read/write speeds.

Report Scope & Segmentation Analysis

This report meticulously segments the Semiconductor Memory IP market across key parameters. The Product segmentation includes Volatile Memory, Non-Volatile Memory, and Other Products, each analyzed for market size, growth projections, and competitive dynamics. The End-User Industry segmentation further breaks down the market into Consumer Electronics, Industrial, Automotive, Networking, and Other End-user Industries. Growth projections for each segment are detailed, highlighting the market share and specific demand drivers, such as increasing device complexity in Consumer Electronics, the rise of smart manufacturing in Industrial, the expansion of ADAS in Automotive, and the deployment of 5G infrastructure in Networking.

Key Drivers of Semiconductor Memory IP Industry Growth

The growth of the Semiconductor Memory IP industry is propelled by several interconnected factors. Technologically, the exponential increase in data generation, the advancements in AI and machine learning requiring high-speed data processing, and the proliferation of IoT devices are paramount. Economically, the expanding digital economy, the growing adoption of cloud computing, and increasing disposable incomes worldwide fuel demand for electronic devices. Regulatory factors, such as the push for energy-efficient computing and data privacy mandates, also drive the development of specialized memory IP.

Challenges in the Semiconductor Memory IP Industry Sector

Despite its robust growth, the Semiconductor Memory IP industry faces significant challenges. Regulatory hurdles, including evolving trade policies and export controls, can impact global supply chains and market access. Supply chain disruptions, as evidenced by recent global shortages, pose a constant threat to production and lead times. Competitive pressures, particularly on pricing and the rapid obsolescence of older technologies, necessitate continuous innovation and efficient cost management. Intellectual property disputes and the high cost of R&D also present barriers to entry and sustainable growth for smaller players.

Emerging Opportunities in Semiconductor Memory IP Industry

Emerging opportunities lie in the continuous advancements in memory technologies, such as the development of next-generation non-volatile memory (e.g., ReRAM, MRAM) offering unique advantages in speed and endurance. The burgeoning edge computing market presents a significant opportunity for low-power, high-performance memory IP. The increasing demand for specialized memory solutions for AI accelerators and data centers also opens up new avenues for growth. Furthermore, the growing trend of memory-centric computing architectures, where computation happens closer to data, is a disruptive force creating novel IP development.

Leading Players in the Semiconductor Memory IP Industry Market

- eSilicon Corporation

- Lattice Semiconductor Corporation

- eMemory Technology Inc

- Arm Holdings

- Dolphin Integration

- ARM Limited

- Rambus Inc

- Synopsys Inc

- Mentor Graphics Corporation

- Cadence Design Systems Inc

Key Developments in Semiconductor Memory IP Industry Industry

- 2023/2024: Launch of new low-power DDR5 and LPDDR5 memory IP, catering to the increasing demand for energy-efficient mobile and IoT devices.

- 2023/2024: Increased investment in R&D for emerging non-volatile memory technologies like Resistive RAM (ReRAM) and Magnetoresistive RAM (MRAM) by major IP providers.

- 2023: Significant mergers and acquisitions activity focused on acquiring specialized memory IP expertise and expanding product portfolios, with deal values reaching into the billions.

- 2022/2023: Enhanced focus on security features within memory IP, including advanced encryption and data protection mechanisms, driven by rising cybersecurity concerns.

- 2022: Introduction of specialized memory IP solutions optimized for AI and machine learning workloads, enabling faster data processing and reduced latency in neural network applications.

- 2021/2022: Continued growth in licensing agreements for embedded memory IP, particularly for automotive and industrial applications where high reliability is paramount.

Future Outlook for Semiconductor Memory IP Industry Market

The future outlook for the Semiconductor Memory IP industry is exceptionally bright, characterized by sustained high growth and continuous innovation. The relentless digital transformation across all sectors will ensure an ever-increasing demand for sophisticated memory solutions. Strategic opportunities lie in developing highly specialized IP for emerging applications such as quantum computing, advanced robotics, and immersive augmented/virtual reality experiences. The industry will likely witness further consolidation through strategic partnerships and acquisitions, as companies seek to bolster their IP portfolios and market reach. The focus on sustainability and energy efficiency will also intensify, driving the development of ultra-low-power memory technologies.

Semiconductor Memory IP Industry Segmentation

-

1. Product

- 1.1. Volatile Memory

- 1.2. Non - Volatile Memory

- 1.3. Other Products

-

2. End -user Industry

- 2.1. Consumer Electronics

- 2.2. Industrial

- 2.3. Automotive

- 2.4. Networking

- 2.5. Other End-user Industries

Semiconductor Memory IP Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. Taiwan

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Semiconductor Memory IP Industry Regional Market Share

Geographic Coverage of Semiconductor Memory IP Industry

Semiconductor Memory IP Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Complex Chip Design and Multi core Technologies; Increasing Investments in the Semiconductor Industry

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Systems

- 3.4. Market Trends

- 3.4.1. Consumer Electronics is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Semiconductor Memory IP Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Volatile Memory

- 5.1.2. Non - Volatile Memory

- 5.1.3. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End -user Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Industrial

- 5.2.3. Automotive

- 5.2.4. Networking

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Semiconductor Memory IP Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Volatile Memory

- 6.1.2. Non - Volatile Memory

- 6.1.3. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End -user Industry

- 6.2.1. Consumer Electronics

- 6.2.2. Industrial

- 6.2.3. Automotive

- 6.2.4. Networking

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Semiconductor Memory IP Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Volatile Memory

- 7.1.2. Non - Volatile Memory

- 7.1.3. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End -user Industry

- 7.2.1. Consumer Electronics

- 7.2.2. Industrial

- 7.2.3. Automotive

- 7.2.4. Networking

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Semiconductor Memory IP Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Volatile Memory

- 8.1.2. Non - Volatile Memory

- 8.1.3. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End -user Industry

- 8.2.1. Consumer Electronics

- 8.2.2. Industrial

- 8.2.3. Automotive

- 8.2.4. Networking

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Rest of the World Semiconductor Memory IP Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Volatile Memory

- 9.1.2. Non - Volatile Memory

- 9.1.3. Other Products

- 9.2. Market Analysis, Insights and Forecast - by End -user Industry

- 9.2.1. Consumer Electronics

- 9.2.2. Industrial

- 9.2.3. Automotive

- 9.2.4. Networking

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 eSilicon Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Lattice Semiconductor Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 eMemory Technology Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Arm Holdings

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Dolphin Integration

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ARM Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Rambus Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Synopsys Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Mentor Graphics Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Cadence Design Systems Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 eSilicon Corporation

List of Figures

- Figure 1: Global Semiconductor Memory IP Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Semiconductor Memory IP Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Semiconductor Memory IP Industry Revenue (undefined), by Product 2025 & 2033

- Figure 4: North America Semiconductor Memory IP Industry Volume (K Unit), by Product 2025 & 2033

- Figure 5: North America Semiconductor Memory IP Industry Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Semiconductor Memory IP Industry Volume Share (%), by Product 2025 & 2033

- Figure 7: North America Semiconductor Memory IP Industry Revenue (undefined), by End -user Industry 2025 & 2033

- Figure 8: North America Semiconductor Memory IP Industry Volume (K Unit), by End -user Industry 2025 & 2033

- Figure 9: North America Semiconductor Memory IP Industry Revenue Share (%), by End -user Industry 2025 & 2033

- Figure 10: North America Semiconductor Memory IP Industry Volume Share (%), by End -user Industry 2025 & 2033

- Figure 11: North America Semiconductor Memory IP Industry Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Semiconductor Memory IP Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Semiconductor Memory IP Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Semiconductor Memory IP Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Semiconductor Memory IP Industry Revenue (undefined), by Product 2025 & 2033

- Figure 16: Europe Semiconductor Memory IP Industry Volume (K Unit), by Product 2025 & 2033

- Figure 17: Europe Semiconductor Memory IP Industry Revenue Share (%), by Product 2025 & 2033

- Figure 18: Europe Semiconductor Memory IP Industry Volume Share (%), by Product 2025 & 2033

- Figure 19: Europe Semiconductor Memory IP Industry Revenue (undefined), by End -user Industry 2025 & 2033

- Figure 20: Europe Semiconductor Memory IP Industry Volume (K Unit), by End -user Industry 2025 & 2033

- Figure 21: Europe Semiconductor Memory IP Industry Revenue Share (%), by End -user Industry 2025 & 2033

- Figure 22: Europe Semiconductor Memory IP Industry Volume Share (%), by End -user Industry 2025 & 2033

- Figure 23: Europe Semiconductor Memory IP Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Semiconductor Memory IP Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Semiconductor Memory IP Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Semiconductor Memory IP Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Semiconductor Memory IP Industry Revenue (undefined), by Product 2025 & 2033

- Figure 28: Asia Pacific Semiconductor Memory IP Industry Volume (K Unit), by Product 2025 & 2033

- Figure 29: Asia Pacific Semiconductor Memory IP Industry Revenue Share (%), by Product 2025 & 2033

- Figure 30: Asia Pacific Semiconductor Memory IP Industry Volume Share (%), by Product 2025 & 2033

- Figure 31: Asia Pacific Semiconductor Memory IP Industry Revenue (undefined), by End -user Industry 2025 & 2033

- Figure 32: Asia Pacific Semiconductor Memory IP Industry Volume (K Unit), by End -user Industry 2025 & 2033

- Figure 33: Asia Pacific Semiconductor Memory IP Industry Revenue Share (%), by End -user Industry 2025 & 2033

- Figure 34: Asia Pacific Semiconductor Memory IP Industry Volume Share (%), by End -user Industry 2025 & 2033

- Figure 35: Asia Pacific Semiconductor Memory IP Industry Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Semiconductor Memory IP Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Semiconductor Memory IP Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Semiconductor Memory IP Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Rest of the World Semiconductor Memory IP Industry Revenue (undefined), by Product 2025 & 2033

- Figure 40: Rest of the World Semiconductor Memory IP Industry Volume (K Unit), by Product 2025 & 2033

- Figure 41: Rest of the World Semiconductor Memory IP Industry Revenue Share (%), by Product 2025 & 2033

- Figure 42: Rest of the World Semiconductor Memory IP Industry Volume Share (%), by Product 2025 & 2033

- Figure 43: Rest of the World Semiconductor Memory IP Industry Revenue (undefined), by End -user Industry 2025 & 2033

- Figure 44: Rest of the World Semiconductor Memory IP Industry Volume (K Unit), by End -user Industry 2025 & 2033

- Figure 45: Rest of the World Semiconductor Memory IP Industry Revenue Share (%), by End -user Industry 2025 & 2033

- Figure 46: Rest of the World Semiconductor Memory IP Industry Volume Share (%), by End -user Industry 2025 & 2033

- Figure 47: Rest of the World Semiconductor Memory IP Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Rest of the World Semiconductor Memory IP Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Rest of the World Semiconductor Memory IP Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the World Semiconductor Memory IP Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by End -user Industry 2020 & 2033

- Table 4: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by End -user Industry 2020 & 2033

- Table 5: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 8: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by End -user Industry 2020 & 2033

- Table 10: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by End -user Industry 2020 & 2033

- Table 11: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 18: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 19: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by End -user Industry 2020 & 2033

- Table 20: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by End -user Industry 2020 & 2033

- Table 21: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Germany Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Germany Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: France Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: France Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 32: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 33: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by End -user Industry 2020 & 2033

- Table 34: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by End -user Industry 2020 & 2033

- Table 35: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: China Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: China Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Japan Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Japan Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: South Korea Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: South Korea Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Taiwan Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Taiwan Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Rest of Asia Pacific Semiconductor Memory IP Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Semiconductor Memory IP Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 48: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 49: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by End -user Industry 2020 & 2033

- Table 50: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by End -user Industry 2020 & 2033

- Table 51: Global Semiconductor Memory IP Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 52: Global Semiconductor Memory IP Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Semiconductor Memory IP Industry?

The projected CAGR is approximately 13.8%.

2. Which companies are prominent players in the Semiconductor Memory IP Industry?

Key companies in the market include eSilicon Corporation, Lattice Semiconductor Corporation, eMemory Technology Inc , Arm Holdings, Dolphin Integration, ARM Limited, Rambus Inc, Synopsys Inc, Mentor Graphics Corporation, Cadence Design Systems Inc.

3. What are the main segments of the Semiconductor Memory IP Industry?

The market segments include Product, End -user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Complex Chip Design and Multi core Technologies; Increasing Investments in the Semiconductor Industry.

6. What are the notable trends driving market growth?

Consumer Electronics is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; High Cost of Systems.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Semiconductor Memory IP Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Semiconductor Memory IP Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Semiconductor Memory IP Industry?

To stay informed about further developments, trends, and reports in the Semiconductor Memory IP Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence