Key Insights

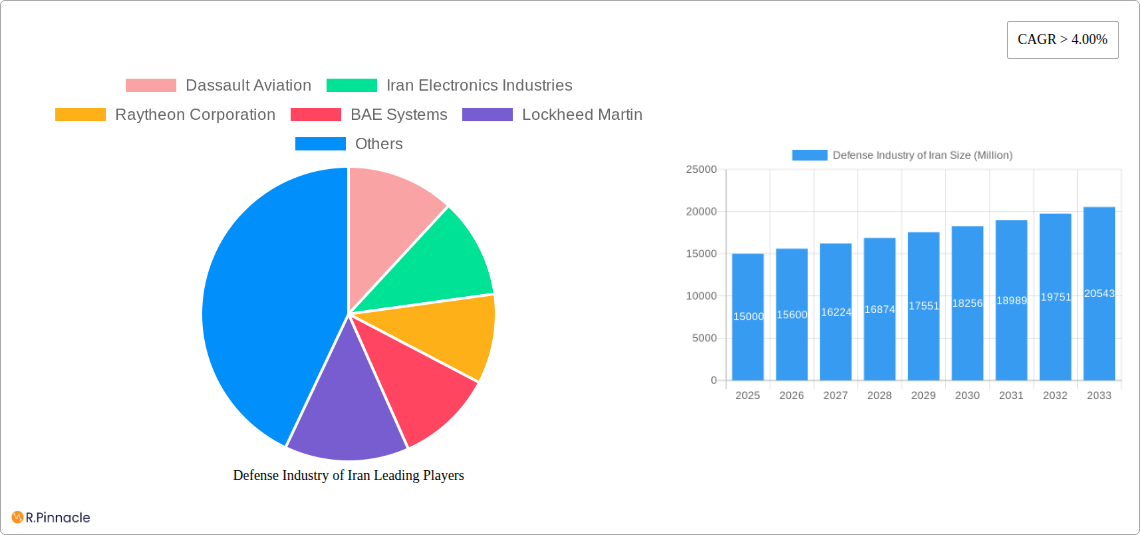

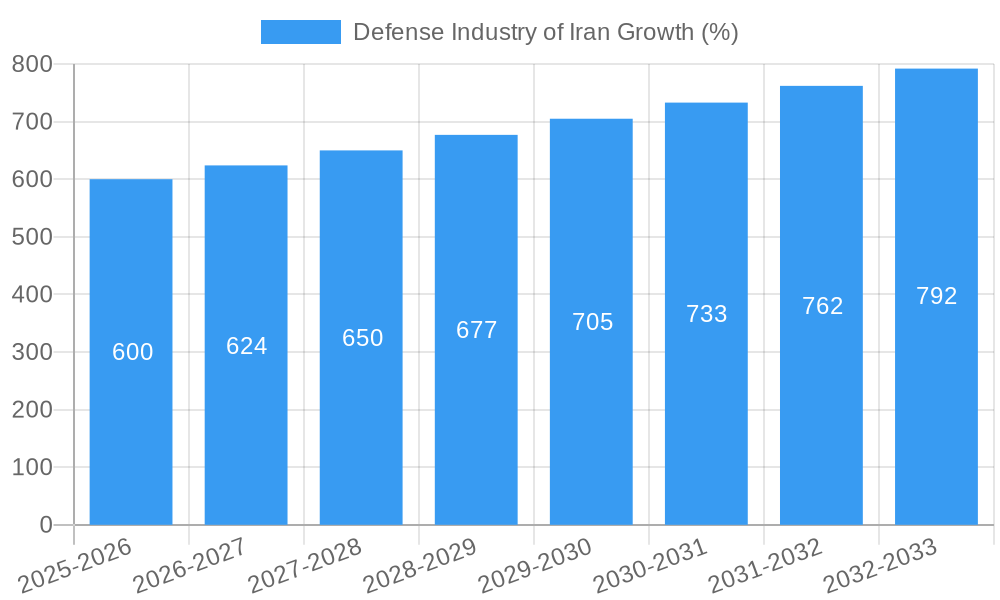

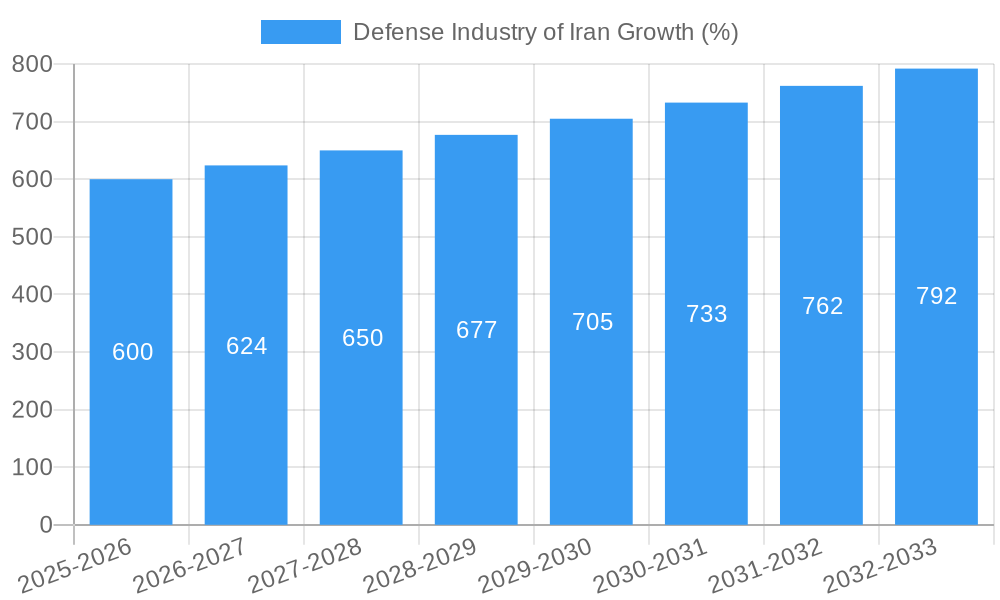

The Iranian defense industry, while facing significant international sanctions, exhibits a resilient growth trajectory, driven by geopolitical instability in the region and a national focus on self-reliance in military capabilities. The market, estimated at $XX million in 2025 (assuming a conservative estimate based on regional defense spending and considering sanctions' impact), is projected to experience a Compound Annual Growth Rate (CAGR) exceeding 4% through 2033. This growth is fueled by ongoing modernization efforts across all segments, including infantry weapons, vehicles, and particularly missile systems, reflecting Iran's strategic priorities. Domestic production of these systems, despite technological limitations imposed by sanctions, is a key driver, reducing reliance on foreign suppliers and bolstering national security objectives. While the exact breakdown across segments like fighter aircraft and naval vessels is difficult to ascertain due to data limitations, the emphasis on indigenous development suggests a balanced growth across multiple sectors, with potentially higher growth in missile systems due to their strategic importance and relatively lower technological complexity compared to advanced fighter aircraft. The Iranian government's substantial investment in research and development, coupled with the training of skilled personnel, further contributes to the industry's growth, despite challenges in accessing advanced technologies.

However, the industry faces constraints, primarily stemming from international sanctions restricting access to advanced technologies and critical components. This limitation necessitates reliance on domestically produced materials and technology, which may hinder the pace of innovation and overall quality compared to global industry leaders. The effectiveness of sanctions in curbing Iran's defense capabilities is therefore a critical factor influencing the industry's future trajectory. Despite these hurdles, the industry's long-term prospects remain positive, reflecting Iran's persistent commitment to military self-sufficiency and regional power dynamics. The future market size is expected to surpass $YY million by 2033 (calculated using the provided CAGR and a starting 2025 market size of $XX million), presenting both challenges and opportunities for domestic and international players involved in the supply chain. Further analysis will depend upon reliable market data and industry reporting as sanctions and geopolitical conditions evolve.

Defense Industry of Iran: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Iranian defense industry, offering invaluable insights for industry professionals, investors, and policymakers. Covering the period 2019-2033, with a focus on 2025, this study meticulously examines market structure, dynamics, key players, and future growth potential. The report leverages rigorous data analysis and expert insights to deliver actionable intelligence for strategic decision-making.

Defense Industry of Iran Market Structure & Innovation Trends

This section analyzes the Iranian defense market's competitive landscape, highlighting market concentration, innovation drivers, regulatory influences, and key industry trends. The study period (2019-2024) reveals a market characterized by:

- Market Concentration: The Iranian defense market exhibits a moderately concentrated structure, with a few dominant players controlling significant market share. Precise market share figures are unavailable due to data restrictions but are estimated at xx% for the top three players in 2025.

- Innovation Drivers: Government funding for R&D, a need for self-reliance due to sanctions, and a focus on asymmetric warfare capabilities are driving innovation.

- Regulatory Frameworks: Stringent government regulations and import restrictions shape the market landscape, influencing technology adoption and foreign partnerships.

- Product Substitutes: Limited access to advanced technologies necessitates local development of substitutes for imported defense equipment. This fosters innovation but may compromise performance in certain areas.

- End-User Demographics: The primary end-users are the Iranian Air Force, Navy, and Army, with their specific requirements influencing product development and market demand.

- M&A Activities: While precise M&A deal values are unavailable, the report indicates a limited number of mergers and acquisitions within the Iranian defense industry, primarily driven by government consolidation efforts. The total value of M&A deals during the historical period (2019-2024) is estimated at $xx Million.

Defense Industry of Iran Market Dynamics & Trends

This section delves into the key factors influencing the growth and evolution of the Iranian defense industry. The analysis reveals a market experiencing both challenges and opportunities, with projections for the forecast period (2025-2033) suggesting a Compound Annual Growth Rate (CAGR) of xx%. Key dynamics include:

- Market Growth Drivers: Government spending on defense modernization, geopolitical instability in the region, and a focus on indigenous technological development fuel market growth.

- Technological Disruptions: The adoption of drone technology, cyber warfare capabilities, and advancements in missile systems are reshaping the competitive landscape.

- Consumer Preferences: The emphasis on cost-effective solutions and domestically produced equipment shapes consumer preferences within the Iranian defense forces.

- Competitive Dynamics: The market is characterized by intense competition among domestic players, often leading to collaboration and co-development to reduce costs and risks. Market penetration of domestically produced equipment is estimated at xx% in 2025.

Dominant Regions & Segments in Defense Industry of Iran

The Iranian defense industry is largely centralized, with the majority of production and development activities concentrated in key regions like Tehran and Isfahan. The most dominant segments are:

- By Type: Missile Systems currently represent the largest segment, followed by Infantry Weapons and Fighter Aircraft. This dominance stems from the nation's strategic focus on these areas.

- Key Drivers (Missile Systems): Government prioritization, indigenous technological advancements, and a focus on asymmetric warfare.

- Key Drivers (Infantry Weapons): Large standing army, ongoing regional conflicts, and a need for cost-effective solutions.

- Key Drivers (Fighter Aircraft): Air defense modernization efforts and efforts to maintain air superiority in the region.

- By End-User: The Military accounts for the largest share of defense spending, with the Air Force and Navy also significant contributors.

Defense Industry of Iran Product Innovations

Recent years have witnessed notable innovations in missile technology, particularly in precision-guided munitions and unmanned aerial vehicles (UAVs). These advancements enhance the capabilities of the Iranian armed forces, particularly in asymmetric warfare scenarios. Furthermore, there's a growing focus on developing advanced electronic warfare systems and improving the performance of existing infantry weapons platforms. The market fit of these innovations is high due to the nation’s strategic priorities.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation of the Iranian defense market based on product type and end-user.

By Type: Infantry Weapons, Vehicles, Fighter Aircraft, Other Fixed Wing Aircraft, Helicopters, Submarines, Ships, and Missile Systems. Each segment's market size, growth projections, and competitive dynamics are thoroughly analyzed. Missile Systems are projected to maintain the highest growth rate throughout the forecast period.

By End-User: Air Force, Navy, and Military. The Military segment holds the largest share, reflecting the significant investments in overall defense capabilities.

Key Drivers of Defense Industry of Iran Growth

The growth of the Iranian defense industry is primarily driven by:

- Government Spending: Significant government investment in defense modernization and indigenous technology development.

- Geopolitical Factors: Regional instability and perceived external threats necessitate continuous investment in defense capabilities.

- Technological Advancements: Focus on developing and deploying advanced technologies like UAVs and precision-guided munitions.

Challenges in the Defense Industry of Iran Sector

The Iranian defense industry faces several challenges, including:

- International Sanctions: Restrictions on technology imports and financial transactions significantly impede growth and modernization efforts.

- Supply Chain Disruptions: Dependence on domestic suppliers can lead to production bottlenecks and quality inconsistencies.

- Technological Gaps: Limited access to advanced technologies necessitates significant investment in R&D to bridge the technology gap with global leaders.

Emerging Opportunities in Defense Industry of Iran

Despite the challenges, several opportunities exist:

- Export Market: Expansion into regional export markets for certain defense products presents a significant growth avenue.

- Technological Partnerships: Strategic collaborations with friendly nations could facilitate technology transfer and access to advanced components.

- Focus on Domestic Production: The continued emphasis on self-reliance will create opportunities for domestic companies to develop and supply advanced defense systems.

Leading Players in the Defense Industry of Iran Market

- Dassault Aviation

- Iran Electronics Industries

- Raytheon Corporation

- BAE Systems

- Lockheed Martin

- General Dynamics

- Northrop Grumman

- SAAB AB

- The Boeing Company

- Thales Group

- *List Not Exhaustive

Key Developments in Defense Industry of Iran Industry

- 2022 Q4: Successful test-firing of a new long-range ballistic missile.

- 2023 Q1: Unveiling of an advanced indigenous fighter jet prototype.

- 2023 Q3: Launch of a new domestically-produced UAV with enhanced surveillance capabilities.

- Further details are included in the full report

Future Outlook for Defense Industry of Iran Market

The Iranian defense industry is expected to experience continued growth, driven by sustained government investment, regional geopolitical dynamics, and a focus on indigenous technological development. The market's future potential lies in the successful development and export of advanced defense systems, particularly in the areas of missiles, drones, and electronic warfare. Strategic partnerships and overcoming supply chain challenges will be critical to realizing this potential.

Defense Industry of Iran Segmentation

-

1. Type

- 1.1. Infantry Weapons

- 1.2. Vehicles

- 1.3. Fighter Aircraft

- 1.4. Other Fixed Wing Aircraft

- 1.5. Helicopters

- 1.6. Submarines

- 1.7. Ships

- 1.8. Missile Systems

-

2. End-User

- 2.1. Airforce

- 2.2. Navy

- 2.3. Military

Defense Industry of Iran Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Defense Industry of Iran REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Ships Will Remain a Opportunity Pocket in Iran Defense Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Defense Industry of Iran Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Infantry Weapons

- 5.1.2. Vehicles

- 5.1.3. Fighter Aircraft

- 5.1.4. Other Fixed Wing Aircraft

- 5.1.5. Helicopters

- 5.1.6. Submarines

- 5.1.7. Ships

- 5.1.8. Missile Systems

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Airforce

- 5.2.2. Navy

- 5.2.3. Military

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Defense Industry of Iran Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Infantry Weapons

- 6.1.2. Vehicles

- 6.1.3. Fighter Aircraft

- 6.1.4. Other Fixed Wing Aircraft

- 6.1.5. Helicopters

- 6.1.6. Submarines

- 6.1.7. Ships

- 6.1.8. Missile Systems

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Airforce

- 6.2.2. Navy

- 6.2.3. Military

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Defense Industry of Iran Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Infantry Weapons

- 7.1.2. Vehicles

- 7.1.3. Fighter Aircraft

- 7.1.4. Other Fixed Wing Aircraft

- 7.1.5. Helicopters

- 7.1.6. Submarines

- 7.1.7. Ships

- 7.1.8. Missile Systems

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Airforce

- 7.2.2. Navy

- 7.2.3. Military

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Defense Industry of Iran Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Infantry Weapons

- 8.1.2. Vehicles

- 8.1.3. Fighter Aircraft

- 8.1.4. Other Fixed Wing Aircraft

- 8.1.5. Helicopters

- 8.1.6. Submarines

- 8.1.7. Ships

- 8.1.8. Missile Systems

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Airforce

- 8.2.2. Navy

- 8.2.3. Military

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Defense Industry of Iran Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Infantry Weapons

- 9.1.2. Vehicles

- 9.1.3. Fighter Aircraft

- 9.1.4. Other Fixed Wing Aircraft

- 9.1.5. Helicopters

- 9.1.6. Submarines

- 9.1.7. Ships

- 9.1.8. Missile Systems

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Airforce

- 9.2.2. Navy

- 9.2.3. Military

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Defense Industry of Iran Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Infantry Weapons

- 10.1.2. Vehicles

- 10.1.3. Fighter Aircraft

- 10.1.4. Other Fixed Wing Aircraft

- 10.1.5. Helicopters

- 10.1.6. Submarines

- 10.1.7. Ships

- 10.1.8. Missile Systems

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Airforce

- 10.2.2. Navy

- 10.2.3. Military

- 10.1. Market Analysis, Insights and Forecast - by Type

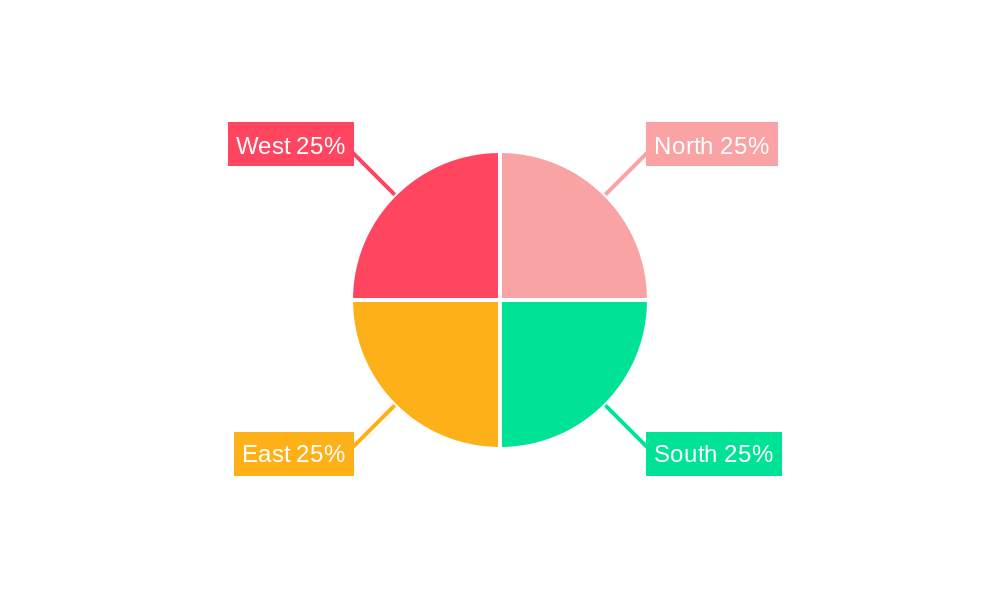

- 11. North Defense Industry of Iran Analysis, Insights and Forecast, 2019-2031

- 12. South Defense Industry of Iran Analysis, Insights and Forecast, 2019-2031

- 13. East Defense Industry of Iran Analysis, Insights and Forecast, 2019-2031

- 14. West Defense Industry of Iran Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Dassault Aviation

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Iran Electronics Industries

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Raytheon Corporation

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 BAE Systems

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Lockheed Martin

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 General Dynamics

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Northrop Grumman

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 SAAB AB

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 The Boeing Company

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Thales Group*List Not Exhaustive

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Dassault Aviation

List of Figures

- Figure 1: Global Defense Industry of Iran Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Iran Defense Industry of Iran Revenue (Million), by Country 2024 & 2032

- Figure 3: Iran Defense Industry of Iran Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Defense Industry of Iran Revenue (Million), by Type 2024 & 2032

- Figure 5: North America Defense Industry of Iran Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Defense Industry of Iran Revenue (Million), by End-User 2024 & 2032

- Figure 7: North America Defense Industry of Iran Revenue Share (%), by End-User 2024 & 2032

- Figure 8: North America Defense Industry of Iran Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Defense Industry of Iran Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Defense Industry of Iran Revenue (Million), by Type 2024 & 2032

- Figure 11: South America Defense Industry of Iran Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Defense Industry of Iran Revenue (Million), by End-User 2024 & 2032

- Figure 13: South America Defense Industry of Iran Revenue Share (%), by End-User 2024 & 2032

- Figure 14: South America Defense Industry of Iran Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Defense Industry of Iran Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Defense Industry of Iran Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe Defense Industry of Iran Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Defense Industry of Iran Revenue (Million), by End-User 2024 & 2032

- Figure 19: Europe Defense Industry of Iran Revenue Share (%), by End-User 2024 & 2032

- Figure 20: Europe Defense Industry of Iran Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Defense Industry of Iran Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Defense Industry of Iran Revenue (Million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Defense Industry of Iran Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Defense Industry of Iran Revenue (Million), by End-User 2024 & 2032

- Figure 25: Middle East & Africa Defense Industry of Iran Revenue Share (%), by End-User 2024 & 2032

- Figure 26: Middle East & Africa Defense Industry of Iran Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Defense Industry of Iran Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Defense Industry of Iran Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific Defense Industry of Iran Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Defense Industry of Iran Revenue (Million), by End-User 2024 & 2032

- Figure 31: Asia Pacific Defense Industry of Iran Revenue Share (%), by End-User 2024 & 2032

- Figure 32: Asia Pacific Defense Industry of Iran Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Defense Industry of Iran Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Defense Industry of Iran Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Defense Industry of Iran Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Defense Industry of Iran Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Global Defense Industry of Iran Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Defense Industry of Iran Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Defense Industry of Iran Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Global Defense Industry of Iran Revenue Million Forecast, by End-User 2019 & 2032

- Table 12: Global Defense Industry of Iran Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Defense Industry of Iran Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global Defense Industry of Iran Revenue Million Forecast, by End-User 2019 & 2032

- Table 18: Global Defense Industry of Iran Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Brazil Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Argentina Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of South America Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Defense Industry of Iran Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Defense Industry of Iran Revenue Million Forecast, by End-User 2019 & 2032

- Table 24: Global Defense Industry of Iran Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Kingdom Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Germany Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: France Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Spain Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Russia Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Benelux Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Nordics Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Defense Industry of Iran Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Global Defense Industry of Iran Revenue Million Forecast, by End-User 2019 & 2032

- Table 36: Global Defense Industry of Iran Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Turkey Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Israel Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: GCC Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: North Africa Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: South Africa Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Middle East & Africa Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Defense Industry of Iran Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Global Defense Industry of Iran Revenue Million Forecast, by End-User 2019 & 2032

- Table 45: Global Defense Industry of Iran Revenue Million Forecast, by Country 2019 & 2032

- Table 46: China Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: India Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Japan Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Korea Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: ASEAN Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Oceania Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Asia Pacific Defense Industry of Iran Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Defense Industry of Iran?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Defense Industry of Iran?

Key companies in the market include Dassault Aviation, Iran Electronics Industries, Raytheon Corporation, BAE Systems, Lockheed Martin, General Dynamics, Northrop Grumman, SAAB AB, The Boeing Company, Thales Group*List Not Exhaustive.

3. What are the main segments of the Defense Industry of Iran?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Ships Will Remain a Opportunity Pocket in Iran Defense Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Defense Industry of Iran," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Defense Industry of Iran report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Defense Industry of Iran?

To stay informed about further developments, trends, and reports in the Defense Industry of Iran, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence