Key Insights

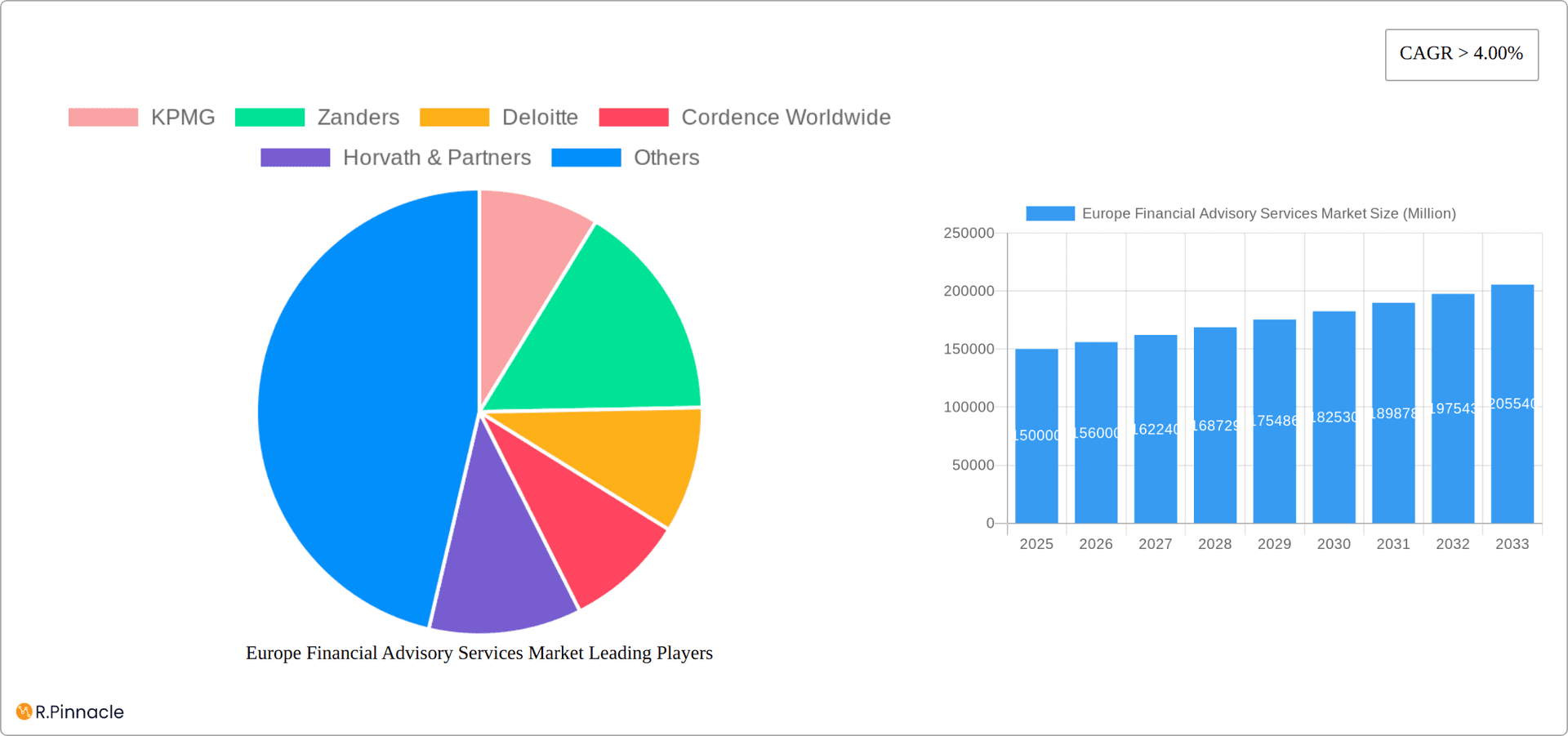

The European financial advisory services market is poised for significant expansion, driven by escalating regulatory complexities, the imperative for strategic navigation amidst economic volatility, and a heightened demand for specialized expertise across diverse industries. Projections indicate a robust compound annual growth rate (CAGR) of 4.5% from 2025 to 2033. This upward trajectory is underpinned by key trends, including the increasing integration of sustainable finance, the accelerated adoption of digital transformation within financial institutions, and the critical importance of robust risk management and regulatory compliance. Leading advisory firms are strategically positioned to leverage this growth by offering comprehensive solutions spanning mergers and acquisitions, wealth management, and corporate restructuring. Despite potential short-term economic headwinds, the long-term outlook remains exceptionally positive, fueled by the perpetual need for expert financial guidance in a dynamic global landscape. The market is expected to segment into areas such as investment banking, corporate finance, wealth management, and risk management, each presenting distinct growth opportunities and competitive dynamics.

Europe Financial Advisory Services Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained market growth, particularly in regions characterized by strong financial infrastructure and substantial business activity. Intense competition among established and emerging players will necessitate a focus on innovation, client-centric strategies, and the cultivation of specialized proficiencies. To secure a competitive advantage, market participants are prioritizing investments in advanced technology and data analytics to optimize service delivery and provide clients with impactful insights. Market success hinges on the ability to proactively address evolving client requirements, adapt to regulatory shifts, and strategically manage the intricacies of the global financial system. A geographically targeted approach, emphasizing key European economic hubs, will be instrumental for achieving sustained growth and market leadership. The market size is projected to reach approximately 184.8 billion in 2025, with continued expansion anticipated throughout the forecast period due to the aforementioned growth drivers.

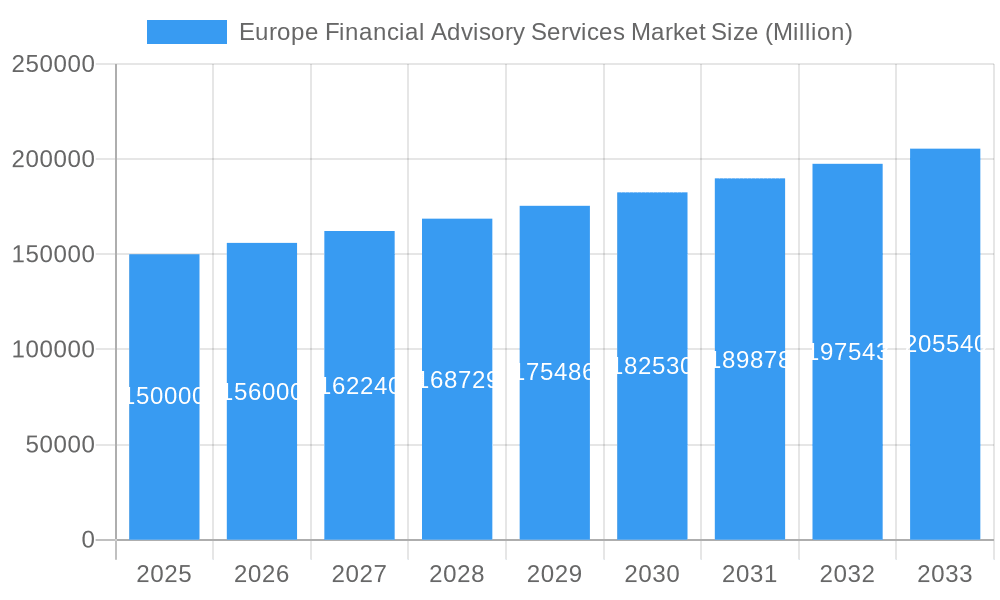

Europe Financial Advisory Services Market Company Market Share

Europe Financial Advisory Services Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Financial Advisory Services Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of current market dynamics and future growth trajectories. The market is estimated to be worth xx Million in 2025.

Europe Financial Advisory Services Market Structure & Innovation Trends

The European financial advisory services market exhibits a moderately concentrated structure, with several large multinational firms commanding significant market share. Key players include KPMG, Zanders, Deloitte, Cordence Worldwide, Horvath & Partners, Alvarez & Marsal, Coeus Consulting, McKinsey & Company, Mercer, and Delta Capita (list not exhaustive). Market share analysis reveals that the top five players account for approximately xx% of the total market revenue in 2024, indicating a competitive landscape with opportunities for both established players and emerging firms. Innovation is driven by the increasing demand for specialized services, technological advancements (e.g., AI, Big Data analytics), and evolving regulatory frameworks.

- Market Concentration: Top 5 players hold xx% market share (2024).

- M&A Activity: Significant M&A activity, with deal values totaling xx Million in 2024, reflects consolidation and expansion strategies.

- Regulatory Framework: Stringent regulations, particularly post-financial crisis, shape service offerings and compliance requirements.

- Product Substitutes: The rise of fintech companies and robo-advisors presents competitive challenges.

- End-User Demographics: The market caters to a diverse range of clients, including corporations, SMEs, high-net-worth individuals, and institutional investors.

Europe Financial Advisory Services Market Market Dynamics & Trends

The European financial advisory services market is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of [Insert Updated CAGR]% during the forecast period (2025-2033). This expansion is fueled by a confluence of factors. The increasing complexity of financial markets, coupled with stricter regulatory environments, is driving heightened demand for specialized advice across sectors such as corporate finance, mergers & acquisitions (M&A), risk management, and wealth management. Furthermore, technological advancements, including AI-powered solutions for portfolio optimization and risk assessment, are revolutionizing service delivery. The evolving preferences of both corporate and individual clients, who increasingly seek personalized and digitally-enabled services, further contribute to market growth. However, the market remains intensely competitive, demanding continuous innovation, strategic partnerships, and agile adaptation to maintain a leadership position. The penetration of digital advisory services is anticipated to reach [Insert Updated Percentage]% by 2033, signifying a significant shift in service delivery models.

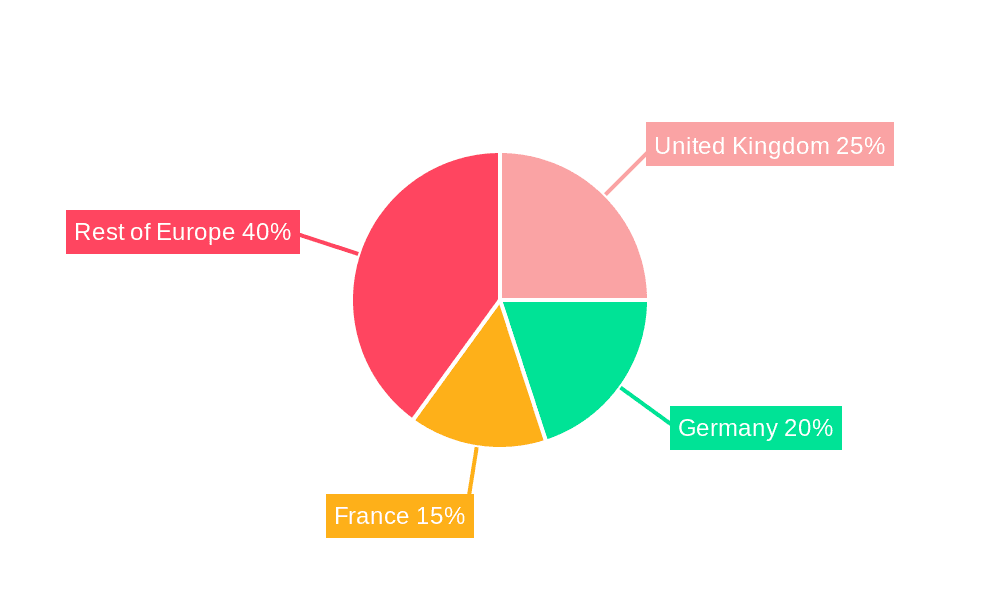

Dominant Regions & Segments in Europe Financial Advisory Services Market

The UK remains a dominant force in the European financial advisory services market, followed by Germany and France. This leadership position is attributable to several factors:

- UK: A highly developed financial ecosystem, a dense concentration of major financial institutions, and a sophisticated, albeit evolving, regulatory framework.

- Germany: A robust economy, substantial corporate activity, and a growing demand for specialized advisory services, particularly in areas like sustainability and digital transformation.

- France: A significant financial sector presence, increasing cross-border investments, and government initiatives fostering innovation within the financial services landscape.

Other key markets include the Netherlands, Switzerland, and the Scandinavian countries. Within the market, corporate finance, mergers and acquisitions (M&A), and wealth management consistently demonstrate strong growth, driven by both organic expansion and strategic acquisitions.

Europe Financial Advisory Services Market Product Innovations

Recent innovations focus on leveraging technology to enhance service offerings and improve efficiency. This includes the integration of AI and machine learning for data analysis, risk management, and portfolio optimization. Cloud-based platforms are also gaining traction, providing enhanced accessibility and scalability. These innovations aim to deliver personalized, data-driven advice, meeting the evolving needs of clients.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the market across various dimensions. It analyzes the market by service type (e.g., corporate finance, wealth management, risk management, ESG advisory), client type (e.g., multinational corporations, SMEs, high-net-worth individuals, institutional investors), and geographic region. Growth projections are provided for each segment, reflecting the unique market dynamics and demand drivers affecting each area. The competitive landscape within each segment is also meticulously analyzed, highlighting key players, their market strategies, and competitive advantages.

Key Drivers of Europe Financial Advisory Services Market Growth

Several factors are driving market growth, including:

- Increasing regulatory complexity: Demands for specialized advice to navigate compliance.

- Growth in cross-border M&A activity: Increased demand for advisory services in deal structuring and execution.

- Technological advancements: AI-powered tools and data analytics enhance decision-making and efficiency.

- Rising demand for wealth management services: Growing affluent population and increasing wealth necessitate financial planning.

Challenges in the Europe Financial Advisory Services Market Sector

The market faces challenges such as:

- Intense competition: Established players and new entrants compete fiercely for market share.

- Regulatory changes: Adapting to evolving regulations requires significant investment and expertise.

- Economic uncertainty: Economic downturns can reduce demand for advisory services, particularly in corporate finance.

- Talent acquisition: Securing and retaining skilled professionals is crucial for competitiveness.

Emerging Opportunities in Europe Financial Advisory Services Market

Several key opportunities are emerging within the European financial advisory services market:

- Sustainable and Responsible Finance: The burgeoning demand for Environmental, Social, and Governance (ESG) advisory services presents a significant growth opportunity. Financial institutions and corporations are increasingly seeking guidance on integrating ESG factors into their strategies and investments.

- Expansion into Underserved Markets: Significant untapped potential exists in certain Eastern European countries, offering opportunities for expansion and market penetration.

- Leveraging Technological Advancements: The adoption of innovative technologies, including blockchain, artificial intelligence (AI), and machine learning (ML), can create new service offerings and enhance efficiency, leading to improved client experiences and operational optimization.

- Increased Focus on Fintech Integration: Partnerships and collaborations with fintech companies can provide access to innovative solutions and improve service delivery.

Leading Players in the Europe Financial Advisory Services Market Market

- KPMG

- Zanders

- Deloitte

- Cordence Worldwide

- Horvath & Partners

- Alvarez & Marsal

- Coeus Consulting

- McKinsey & Company

- Mercer

- Delta Capita (List not exhaustive)

Key Developments in Europe Financial Advisory Services Market Industry

- February 2023: Deloitte expanded its capabilities in supporting start-ups and scale-ups through the acquisition of 27 Pilots, a German incubator, venture capitalist, and matchmaker, enhancing its offerings in the innovation ecosystem.

- January 2023: BearingPoint strengthened its presence in the French market by acquiring Levo Consultants, a Paris-based financial services consultancy, bolstering its expertise and client base.

- [Add more recent key developments with dates and brief descriptions]

Future Outlook for Europe Financial Advisory Services Market Market

The Europe Financial Advisory Services Market is poised for continued growth, driven by ongoing technological advancements, increasing regulatory complexity, and the evolving needs of businesses and individuals. Strategic acquisitions, partnerships, and the development of innovative service offerings will be crucial for companies seeking to capitalize on future opportunities. The market is expected to see continued consolidation, with larger firms acquiring smaller players to expand their service portfolios and geographic reach.

Europe Financial Advisory Services Market Segmentation

-

1. Type

- 1.1. Corporate Finance

- 1.2. Accounting Advisory

- 1.3. Tax Advisory

- 1.4. Transaction Services

- 1.5. Risk Management

- 1.6. Other Types

-

2. Organization Size

- 2.1. Large Enterprises

- 2.2. Small & Medium-Sized Enterprises

-

3. Industry Vertical

- 3.1. Bfsi

- 3.2. It And Telecom

- 3.3. Manufacturing

- 3.4. Retail And E-Commerce

- 3.5. Public Sector

- 3.6. Healthcare

- 3.7. Other Industry Verticals

Europe Financial Advisory Services Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Financial Advisory Services Market Regional Market Share

Geographic Coverage of Europe Financial Advisory Services Market

Europe Financial Advisory Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Tax Advisory by Financial Advisory Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corporate Finance

- 5.1.2. Accounting Advisory

- 5.1.3. Tax Advisory

- 5.1.4. Transaction Services

- 5.1.5. Risk Management

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Large Enterprises

- 5.2.2. Small & Medium-Sized Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. Bfsi

- 5.3.2. It And Telecom

- 5.3.3. Manufacturing

- 5.3.4. Retail And E-Commerce

- 5.3.5. Public Sector

- 5.3.6. Healthcare

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 KPMG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zanders

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Deloitte

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cordence Worldwide

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Horvath & Partners

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alvarez & Marsal

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Coeus Consulting

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 McKinsey & Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mercer

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Delta Capita**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 KPMG

List of Figures

- Figure 1: Europe Financial Advisory Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Financial Advisory Services Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 3: Europe Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 4: Europe Financial Advisory Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Europe Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 7: Europe Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 8: Europe Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Financial Advisory Services Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Europe Financial Advisory Services Market?

Key companies in the market include KPMG, Zanders, Deloitte, Cordence Worldwide, Horvath & Partners, Alvarez & Marsal, Coeus Consulting, McKinsey & Company, Mercer, Delta Capita**List Not Exhaustive.

3. What are the main segments of the Europe Financial Advisory Services Market?

The market segments include Type, Organization Size, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 184.8 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Tax Advisory by Financial Advisory Services.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Deloitte boosted its start-up and scale-up capabilities with the acquisition of 27 pilots, a Germany-based incubator, a venture capitalist, and a matchmaker. With 27 Pilots as part of its portfolio, Deloitte will be able to better serve its base of start-ups and scale-ups with a full range of services, from incubation and growth through to technology, infrastructure, and venture capital solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Financial Advisory Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Financial Advisory Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Financial Advisory Services Market?

To stay informed about further developments, trends, and reports in the Europe Financial Advisory Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence