Key Insights

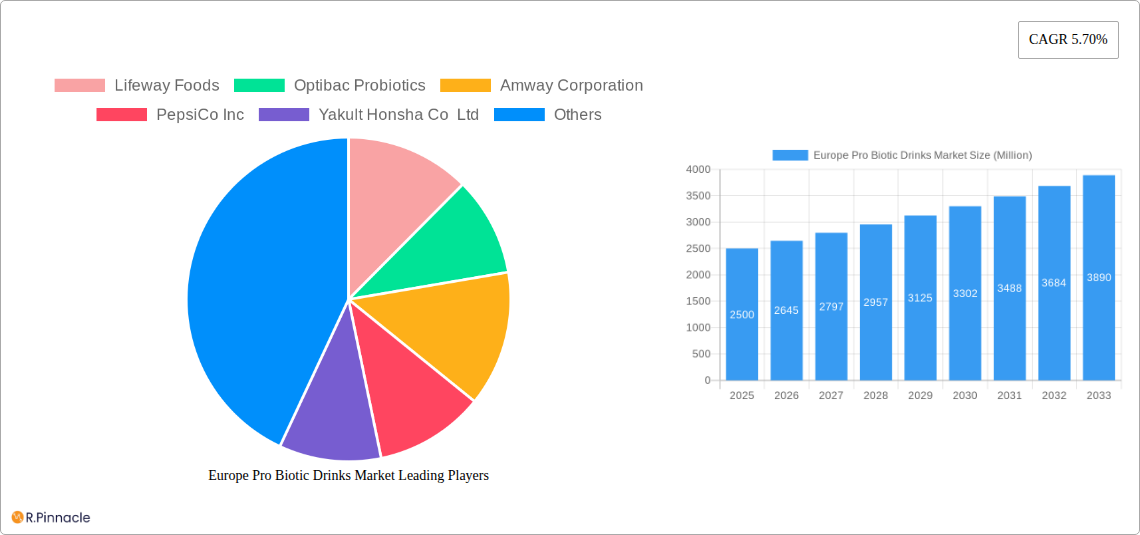

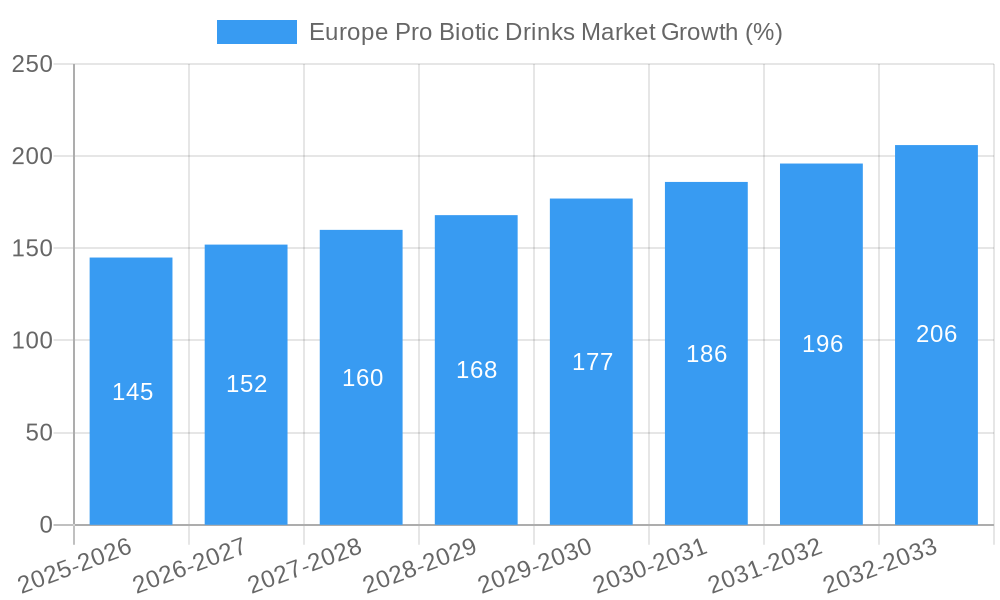

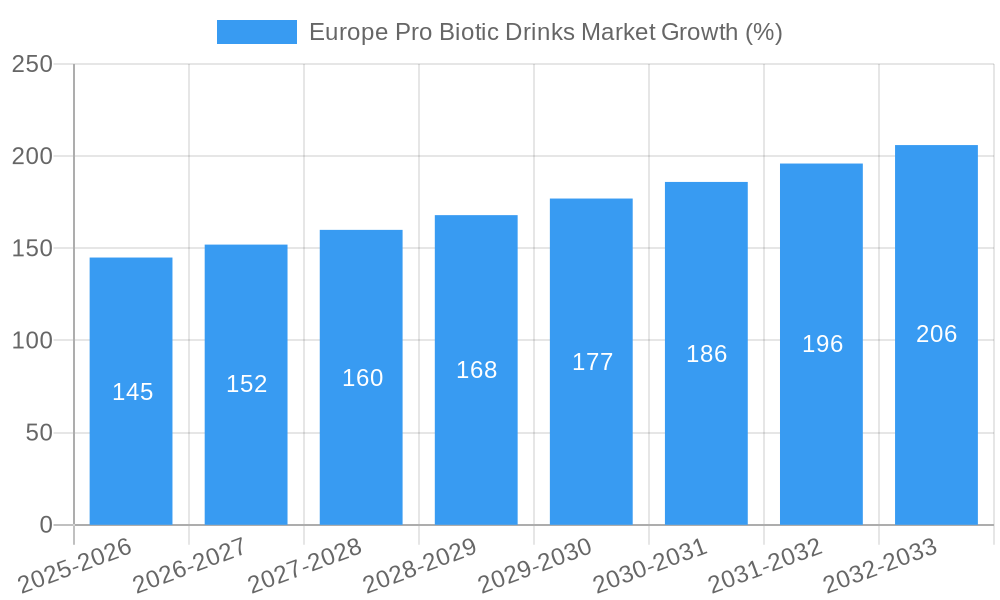

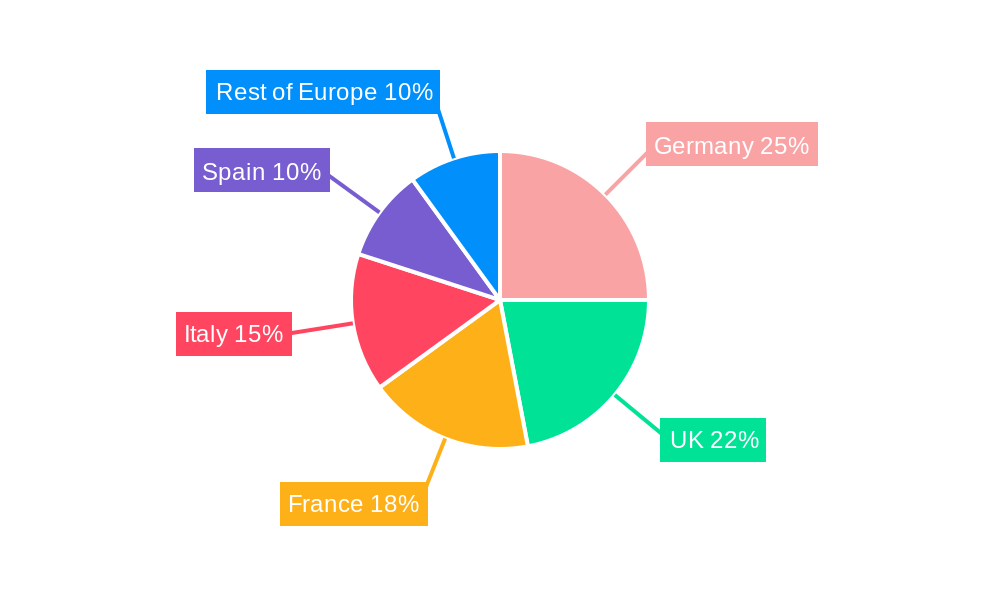

The European probiotic drinks market, valued at approximately €X billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.70% from 2025 to 2033. This expansion is driven by several key factors. Increasing consumer awareness of gut health and the associated benefits of probiotics is a primary driver. The rising prevalence of digestive issues and a growing preference for functional beverages contribute significantly to market growth. Furthermore, the market is fueled by the increasing availability of diverse product offerings, including yogurt drinks, kefir, kombucha, and probiotic juices, catering to a wide range of consumer preferences. The market segmentation demonstrates a strong preference for yogurt drinks and fermented milk drinks, representing the largest market share. Germany, the United Kingdom, and France are the leading national markets within Europe, reflecting high consumer spending on health and wellness products. However, market growth faces some challenges, including price sensitivity among consumers and the potential for inconsistent product quality impacting consumer trust. Nevertheless, the consistent expansion of online retail channels and strategic partnerships between probiotic drink manufacturers and health food retailers further fuel market growth. The ongoing research and development focused on improving product efficacy and taste are vital for sustaining the market's positive trajectory.

The distribution channel analysis indicates that supermarkets/hypermarkets currently dominate sales, followed by convenience stores and pharmacies/health stores. The growing popularity of online shopping presents a significant opportunity for expansion, particularly targeting younger demographics. Key players like Danone S.A., Yakult Honsha Co. Ltd., and Lifeway Foods are significantly impacting the market through brand recognition, product innovation, and strategic marketing campaigns. The market's continued growth trajectory is expected to be influenced by factors such as innovative product development, particularly in the areas of flavor profiles and enhanced nutritional value, along with increasing penetration into emerging markets within Europe. The strategic alliances between probiotic drink manufacturers and health and wellness companies further enhance market opportunities.

Europe Probiotic Drinks Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe probiotic drinks market, offering invaluable insights for industry professionals, investors, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a complete overview of market trends, growth drivers, challenges, and opportunities. The market is segmented by type (Yogurt Drinks, Fermented Milk Drinks, Kefir, Kombucha, Probiotic Juices, Others), distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Pharmacies/Health Stores, Online Stores, Other Distribution Channels), and country (United Kingdom, Germany, Spain, France, Italy, Russia, Rest of Europe). Key players analyzed include Lifeway Foods, Optibac Probiotics, Amway Corporation, PepsiCo Inc, Yakult Honsha Co Ltd, Nourish Kefir, Archer Daniels Midland Company, Yeo Valley Group Limited, Danone S.A, Novozymes A/S, Bio-K Plus International Inc, and GT's Living Foods. The report projects a market size of xx Million by 2033.

Europe Probiotic Drinks Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of the European probiotic drinks market. We examine market concentration, identifying leading players and their respective market shares. The report also explores the influence of M&A activities, including deal values and their impact on market dynamics. Furthermore, we delve into innovation drivers such as consumer demand for healthier beverages, technological advancements in probiotic cultivation, and evolving regulatory frameworks. The impact of product substitutes and end-user demographics is also considered, providing a holistic view of the market structure.

- Market Concentration: The market is characterized by a mix of large multinational corporations and smaller, specialized companies. xx% of the market share is held by the top 5 players, while the remaining xx% is distributed amongst numerous smaller companies.

- M&A Activities: Recent M&A activity includes [insert specific examples if available, otherwise state "limited recent activity observed"]. Average deal value estimated at xx Million.

- Innovation Drivers: Increased consumer awareness of gut health, demand for functional beverages, and advancements in probiotic strain development are driving innovation.

- Regulatory Framework: The European Union's regulations regarding food safety and labeling significantly influence the market.

Europe Probiotic Drinks Market Dynamics & Trends

This section examines the market's growth trajectory, analyzing key factors influencing expansion. We explore growth drivers, such as increasing health consciousness, rising disposable incomes, and the expanding popularity of functional foods and beverages. Technological disruptions, including advancements in production processes and packaging technologies, are also assessed. Consumer preferences for natural, organic, and convenient products are analyzed, alongside competitive dynamics, including pricing strategies and brand positioning. The report projects a CAGR of xx% from 2025 to 2033. Market penetration in key segments will also be analyzed.

Dominant Regions & Segments in Europe Probiotic Drinks Market

This section identifies the leading regions, countries, and product segments within the European probiotic drinks market. Detailed analysis is provided for each segment, exploring key growth drivers and market dominance factors. The UK, Germany and France are expected to be leading markets.

- Leading Region: [Insert leading region and supporting data, e.g., "Western Europe dominates the market due to high consumer awareness of health benefits and established distribution channels."]

- Leading Country: [Insert leading country and supporting data, e.g., "The UK holds the largest market share due to strong consumer demand and a well-developed retail infrastructure."]

- Leading Segment (Type): [Insert leading type and supporting data, e.g., "Yogurt drinks hold the largest market share owing to their widespread familiarity and established consumer base."]

- Leading Segment (Distribution Channel): [Insert leading distribution channel and supporting data, e.g., "Supermarkets/hypermarkets dominate distribution due to their extensive reach and established presence."]

- Key Drivers (for each dominant region/segment): (Bulleted list will detail economic policies, infrastructure, consumer preferences etc. for each dominant region and segment.)

Europe Probiotic Drinks Market Product Innovations

Recent innovations in the probiotic drinks market focus on enhancing product taste, extending shelf life, and delivering targeted health benefits. New product formats, improved packaging, and the use of novel probiotic strains are notable trends. These innovations are driven by consumer demand for convenient, healthy, and enjoyable options. The market is witnessing a shift towards premium, organic, and functional probiotic drinks.

Report Scope & Segmentation Analysis

This report comprehensively segments the European probiotic drinks market by type, distribution channel, and country. For each segment, we provide detailed analysis of growth projections, market sizes, and competitive dynamics. Specific details on market share and growth rates for each segment are included. [Insert details of market size, growth projections, competitive dynamics for each segment: Type, Distribution Channel and Country].

Key Drivers of Europe Probiotic Drinks Market Growth

The growth of the European probiotic drinks market is fueled by several key factors, including the increasing consumer awareness of gut health and its connection to overall well-being. The growing demand for functional foods and beverages, coupled with rising disposable incomes, further propels market expansion. Furthermore, supportive regulatory frameworks and advancements in probiotic technology contribute to the market's upward trajectory.

Challenges in the Europe Probiotic Drinks Market Sector

The market faces several challenges, including stringent regulatory compliance requirements that impact product development and launch timelines. Supply chain disruptions can affect ingredient availability and pricing, while intense competition among established and emerging players necessitates continuous innovation and strategic positioning. Consumer education on the benefits of probiotics remains crucial for fostering market growth.

Emerging Opportunities in Europe Probiotic Drinks Market

The market presents several compelling opportunities, including the development of novel probiotic strains with targeted health benefits. Expansion into new markets and product categories, particularly within niche segments, offers significant growth potential. Leveraging e-commerce channels and focusing on sustainable and eco-friendly packaging will also attract environmentally conscious consumers.

Leading Players in the Europe Probiotic Drinks Market Market

- Lifeway Foods

- Optibac Probiotics

- Amway Corporation

- PepsiCo Inc

- Yakult Honsha Co Ltd

- Nourish Kefir

- Archer Daniels Midland Company

- Yeo Valley Group Limited

- Danone S.A

- Novozymes A/S

- Bio-K Plus International Inc

- GT's Living Foods

Key Developments in Europe Probiotic Drinks Market Industry

- October 2022: Purity Brewing Company launched Pure Booch, its first kombucha range.

- August 2022: Yeo Valley Organic expanded its kefir 'Love Your Gut' range in the UK with three new drink flavors.

- February 2022: Remedy Kombucha launched a new Wild Berry flavor in the UK.

Future Outlook for Europe Probiotic Drinks Market Market

The future of the European probiotic drinks market looks promising, driven by sustained consumer interest in health and wellness. Further innovations in probiotic strains, product formats, and delivery systems will drive growth. The market's potential is vast, with opportunities for expansion into new product categories and geographical markets. Strategic partnerships and acquisitions will shape the competitive landscape.

Europe Pro Biotic Drinks Market Segmentation

-

1. Type

- 1.1. Yogurt Drinks

- 1.2. Fermented Milk Drinks

- 1.3. Kefir

- 1.4. Kombucha

- 1.5. Probiotic Juices

- 1.6. Others

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Pharmacies/Health Stores

- 2.4. Online Stores

- 2.5. Other Distribution Channels

Europe Pro Biotic Drinks Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Pro Biotic Drinks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications of Oils and Fats in Different End-Use Industries; Government Initiatives and Key Players Adopting Innovative Market Expansion Strategies

- 3.3. Market Restrains

- 3.3.1. Volatility in Imports and Supply Chain of Oils

- 3.4. Market Trends

- 3.4.1. Rising Demand For Functional Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pro Biotic Drinks Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Yogurt Drinks

- 5.1.2. Fermented Milk Drinks

- 5.1.3. Kefir

- 5.1.4. Kombucha

- 5.1.5. Probiotic Juices

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Pharmacies/Health Stores

- 5.2.4. Online Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Pro Biotic Drinks Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Pro Biotic Drinks Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Pro Biotic Drinks Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Pro Biotic Drinks Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Pro Biotic Drinks Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Pro Biotic Drinks Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Pro Biotic Drinks Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Lifeway Foods

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Optibac Probiotics

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Amway Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 PepsiCo Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Yakult Honsha Co Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Nourish Kefir

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Archer Daniels Midland Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Yeo Valley Group Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Danone S A

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Novozymes A/S

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Bio-K Plus International Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 GT'S Living Foods

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Lifeway Foods

List of Figures

- Figure 1: Europe Pro Biotic Drinks Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Pro Biotic Drinks Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Pro Biotic Drinks Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Pro Biotic Drinks Market Volume K Liters Forecast, by Region 2019 & 2032

- Table 3: Europe Pro Biotic Drinks Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Europe Pro Biotic Drinks Market Volume K Liters Forecast, by Type 2019 & 2032

- Table 5: Europe Pro Biotic Drinks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Europe Pro Biotic Drinks Market Volume K Liters Forecast, by Distribution Channel 2019 & 2032

- Table 7: Europe Pro Biotic Drinks Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Pro Biotic Drinks Market Volume K Liters Forecast, by Region 2019 & 2032

- Table 9: Europe Pro Biotic Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Pro Biotic Drinks Market Volume K Liters Forecast, by Country 2019 & 2032

- Table 11: Germany Europe Pro Biotic Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 13: France Europe Pro Biotic Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 15: Italy Europe Pro Biotic Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Pro Biotic Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Pro Biotic Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Pro Biotic Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Sweden Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Pro Biotic Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 25: Europe Pro Biotic Drinks Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Europe Pro Biotic Drinks Market Volume K Liters Forecast, by Type 2019 & 2032

- Table 27: Europe Pro Biotic Drinks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Europe Pro Biotic Drinks Market Volume K Liters Forecast, by Distribution Channel 2019 & 2032

- Table 29: Europe Pro Biotic Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Pro Biotic Drinks Market Volume K Liters Forecast, by Country 2019 & 2032

- Table 31: United Kingdom Europe Pro Biotic Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: United Kingdom Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 33: Germany Europe Pro Biotic Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Germany Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 35: France Europe Pro Biotic Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 37: Italy Europe Pro Biotic Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Italy Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 39: Spain Europe Pro Biotic Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Spain Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 41: Netherlands Europe Pro Biotic Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Netherlands Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 43: Belgium Europe Pro Biotic Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Belgium Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 45: Sweden Europe Pro Biotic Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Sweden Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 47: Norway Europe Pro Biotic Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Norway Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 49: Poland Europe Pro Biotic Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Poland Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 51: Denmark Europe Pro Biotic Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Denmark Europe Pro Biotic Drinks Market Volume (K Liters) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pro Biotic Drinks Market?

The projected CAGR is approximately 5.70%.

2. Which companies are prominent players in the Europe Pro Biotic Drinks Market?

Key companies in the market include Lifeway Foods, Optibac Probiotics, Amway Corporation, PepsiCo Inc, Yakult Honsha Co Ltd, Nourish Kefir, Archer Daniels Midland Company, Yeo Valley Group Limited, Danone S A, Novozymes A/S, Bio-K Plus International Inc, GT'S Living Foods.

3. What are the main segments of the Europe Pro Biotic Drinks Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications of Oils and Fats in Different End-Use Industries; Government Initiatives and Key Players Adopting Innovative Market Expansion Strategies.

6. What are the notable trends driving market growth?

Rising Demand For Functional Beverages.

7. Are there any restraints impacting market growth?

Volatility in Imports and Supply Chain of Oils.

8. Can you provide examples of recent developments in the market?

In October 2022, Purity Brewing Company launched a range of authentically slow-brewed 'pure' kombucha drinks, called Pure Booch. This is companies first venture outside the beer market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Liters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pro Biotic Drinks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pro Biotic Drinks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pro Biotic Drinks Market?

To stay informed about further developments, trends, and reports in the Europe Pro Biotic Drinks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence