Key Insights

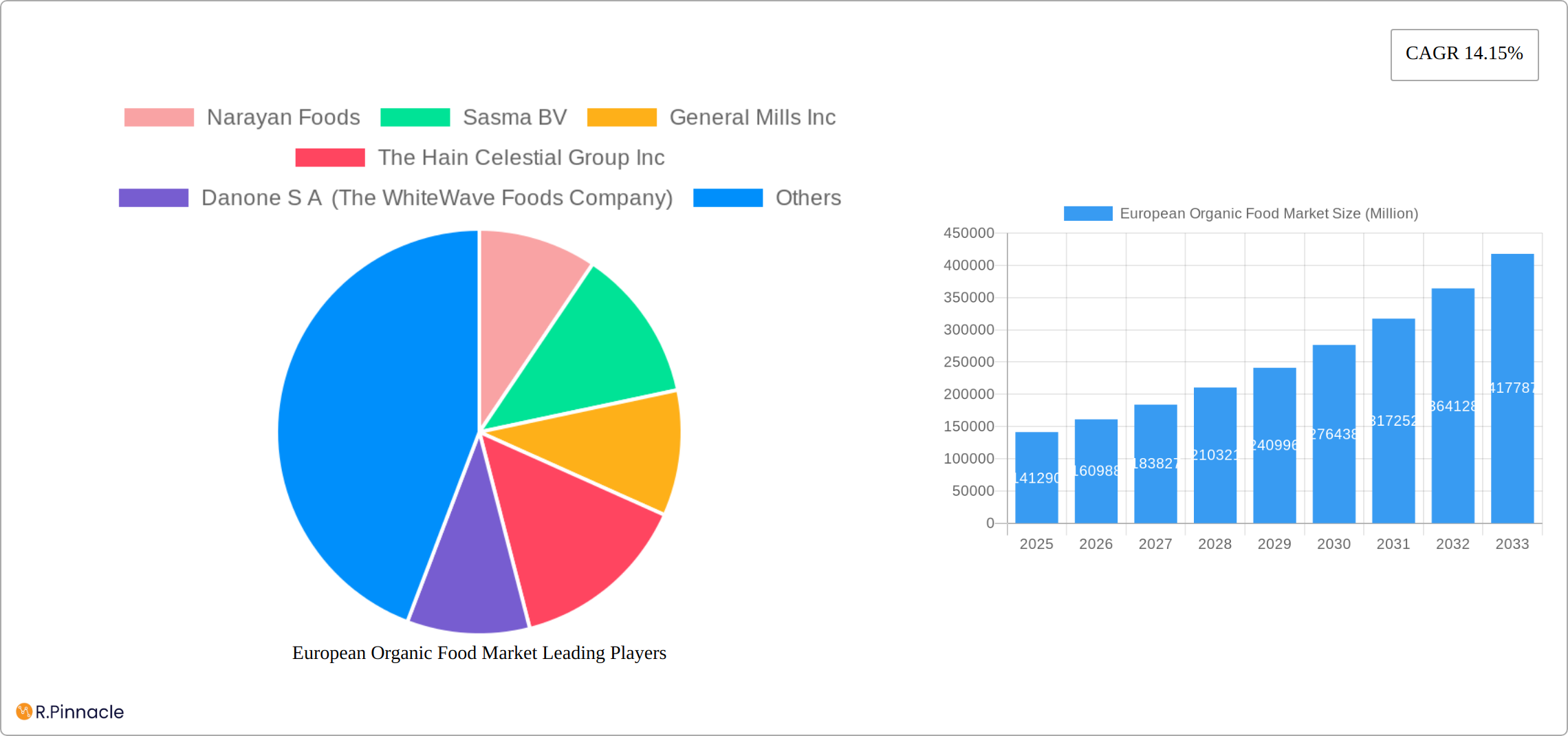

The European organic food market, valued at €141.29 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 14.15% from 2025 to 2033. This surge is driven by several key factors. Increasing consumer awareness of health and wellness, coupled with a growing preference for sustainably produced food, fuels demand for organic products. Furthermore, stricter regulations regarding food safety and the rising incidence of food-related illnesses are encouraging consumers to opt for organic alternatives perceived as safer and healthier. The increasing availability of organic products across diverse distribution channels, including supermarkets, convenience stores, specialist health food stores, and rapidly expanding online retail platforms, further contributes to market expansion. Germany, France, Italy, and the United Kingdom represent significant market segments within Europe, reflecting strong consumer demand and established distribution networks within these countries. The market segmentation by product type (organic foods and beverages) allows for targeted marketing strategies, while the distribution channel segmentation provides insights into consumer purchasing habits and preferences. Leading players like Nestlé, Danone, General Mills, and smaller specialized organic brands are actively competing to capture market share.

The market's growth trajectory is anticipated to be influenced by several factors. Sustained consumer interest in ethical and sustainable consumption practices will continue to support the market. However, potential restraints include price sensitivity among some consumers, as organic products often command a higher price premium compared to conventional options. Furthermore, ensuring consistent supply chain sustainability and addressing potential challenges related to organic farming practices and certification will be crucial for maintaining long-term market growth. The market's future success will depend on addressing these potential restraints while continuing to innovate and cater to the evolving preferences of health-conscious consumers seeking both quality and ethical sourcing.

European Organic Food Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European organic food market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market trends, growth drivers, challenges, and future opportunities within this dynamic sector. The report leverages extensive data analysis and incorporates recent key developments to provide actionable intelligence. Expected market size for 2025 is estimated at xx Million.

European Organic Food Market Market Structure & Innovation Trends

The European organic food market is characterized by a moderately concentrated structure. Key multinational corporations such as Nestlé S.A., General Mills Inc., and Danone S.A. (through its subsidiary, The WhiteWave Foods Company) command a substantial portion of the market share. Complementing these giants are a diverse array of smaller, specialized companies, including Narayan Foods and Sasma BV, which are pivotal in driving market diversity and fostering innovation. Market share analyses from 2025 indicate that the top five entities collectively account for approximately [Insert Market Share Percentage]% of the market, with the remaining [Insert Market Share Percentage]% distributed among a multitude of smaller players and burgeoning brands.

Innovation within this dynamic market is propelled by several interconnected factors:

- Evolving Consumer Demand: A heightened consumer awareness concerning health benefits and environmental sustainability acts as a primary catalyst for innovation. This growing consciousness encourages the development of novel and ethically sourced organic products that align with consumer values.

- Technological Advancements: Continuous progress in agricultural methodologies, sophisticated processing techniques, and pioneering packaging solutions are instrumental in elevating the quality, extending the shelf-life, and enhancing the accessibility of organic food products across the continent.

- Robust Regulatory Frameworks: Stringent regulations governing organic certification and transparent labeling are compelling companies to actively innovate and adopt more environmentally conscious and sustainable operational practices.

- Rise of Product Substitutes: The increasing availability and appeal of plant-based alternatives and functional foods present compelling substitutes for conventional organic offerings. This competitive landscape spurs innovation and differentiation among organic producers.

- Shifting End-User Demographics: An expanding middle class with increasing disposable income and a pronounced inclination towards health and wellness is a significant growth driver, fueling market expansion and demand for premium organic options.

Mergers and acquisitions (M&A) remain a prominent feature within the European organic food sector. These activities underscore the strategic imperative for larger corporations to broaden their organic product portfolios and solidify their market presence. The aggregate value of M&A transactions in the European organic food market between 2019 and 2024 is estimated to be around [Insert M&A Value] Million Euros.

European Organic Food Market Market Dynamics & Trends

The European organic food market is demonstrating robust and sustained growth, propelled by a confluence of compelling drivers. A preeminent factor is the escalating consumer preference for food that is not only healthier but also produced through sustainable means, thereby driving increased demand for organic products across a wide spectrum of categories. The market is witnessing a notable shift towards convenient and ready-to-eat organic meal solutions, a trend largely influenced by increasingly demanding lifestyles and the ongoing trend of urbanization. Technological innovations in farming practices, advanced processing methodologies, and cutting-edge packaging solutions are playing a crucial role in enhancing operational efficiency, product quality, and extending the shelf life of organic offerings, thereby contributing to market expansion. The market's Compound Annual Growth Rate (CAGR) is estimated to have been [Insert CAGR Percentage]% from 2019 to 2024, and this upward trajectory is anticipated to persist, with a projected CAGR of [Insert Projected CAGR Percentage]% for the period between 2025 and 2033. Market penetration of organic food products in Europe is steadily increasing, surpassing [Insert Market Penetration Percentage]% in several key European nations by 2025. Competitive dynamics are intensifying, with both established industry leaders and agile emerging brands actively vying for market share through strategic product innovation, forging impactful partnerships, and deploying aggressive marketing campaigns. Pricing strategies are becoming increasingly sophisticated, with a pronounced emphasis on delivering value-added offerings and adopting premium pricing for niche and specialized organic products.

Dominant Regions & Segments in European Organic Food Market

The German market currently holds a leading position in the European organic food sector, driven by robust consumer demand and a well-established organic farming infrastructure. Other key markets include France, the UK, and Italy, with significant growth potential observed in several Eastern European countries.

Key Drivers of Regional Dominance:

- Germany: Strong consumer awareness, established organic farming sector, supportive government policies.

- France: Significant organic agriculture, focus on traditional products, increasing consumer demand.

- UK: Growing consumer interest in health and sustainability, large retail market.

- Italy: Strong tradition of agriculture, expanding organic farming practices.

Dominant Segments:

- Product Type: Organic foods currently account for a larger market share compared to organic beverages, though both segments are experiencing strong growth. Within organic foods, ready-to-eat meals and snacks witness higher growth rates than other segments.

- Distribution Channel: Supermarkets/hypermarkets dominate the distribution landscape, followed by specialist stores and online retailing, which are experiencing rapid growth due to increased e-commerce penetration. Convenience stores' role in the organic food sector is increasing.

European Organic Food Market Product Innovations

Recent product innovations in the European organic food market reflect a focus on convenience, health, and sustainability. Examples include ready-to-eat organic meals, plant-based alternatives to traditional products (like MeliBio's plant-based honey), and innovative packaging solutions to extend shelf life and reduce environmental impact. The introduction of new product formats and flavors also drives market dynamism, catering to evolving consumer preferences and lifestyles. Technological advancements in food processing and preservation techniques play a pivotal role in expanding the range of available organic products and extending their shelf-life. This focus on improved product functionality and enhanced consumer experience fosters market growth.

Report Scope & Segmentation Analysis

This report meticulously segments the European organic food market across several critical dimensions to provide a comprehensive market overview:

Product Type: The market is categorized into Organic Foods (encompassing fruits, vegetables, grains, dairy, meat, and more) and Organic Beverages (including juices, teas, soft drinks, and other liquid refreshments). The organic food segment is projected to exhibit a notably faster growth rate within this classification.

Distribution Channel: Key distribution channels analyzed include Supermarkets/Hypermarkets (currently holding the largest market share), Convenience Stores (experiencing a growing share), Specialist Organic Stores (maintaining a significant presence), and Online Retailing (undergoing rapid growth). The influence of online retail is continuously expanding, particularly for niche and specialized organic product offerings.

Detailed growth projections and market size estimates for each segment are thoroughly elaborated within the comprehensive report, taking into full consideration the intricate competitive dynamics that shape each distribution channel.

Key Drivers of European Organic Food Market Growth

Several factors fuel the growth of the European organic food market:

- Increasing consumer awareness: Consumers are increasingly aware of the health and environmental benefits of organic food.

- Rising disposable incomes: Higher disposable incomes enable more consumers to afford organic products, a premium category.

- Government regulations and subsidies: Supportive policies promote organic farming and production.

- Technological advancements: Innovation in farming and processing leads to improved efficiency and product quality.

Challenges in the European Organic Food Market Sector

The European organic food market faces several challenges:

- Higher production costs: Organic farming often involves higher costs compared to conventional farming, impacting pricing and affordability.

- Supply chain complexities: Maintaining the integrity of the organic supply chain presents logistical challenges.

- Competition from conventional products: Competitive pressure from cheaper, conventionally produced food restricts market expansion.

- Seasonal variations: Production cycles can lead to periodic price fluctuations and supply shortages.

Emerging Opportunities in European Organic Food Market

The European organic food market presents significant opportunities:

- Expansion in Eastern Europe: Untapped potential exists in emerging markets within Eastern Europe.

- Growth in plant-based and vegan products: Consumer demand for plant-based alternatives boosts market expansion.

- Development of functional organic foods: Increasing interest in health-boosting foods drives innovation.

- Sustainable packaging solutions: Eco-friendly packaging provides competitive advantages.

Leading Players in the European Organic Food Market Market

- Narayan Foods

- Sasma BV

- General Mills Inc.

- The Hain Celestial Group Inc.

- Danone S.A. (The WhiteWave Foods Company)

- Clipper Teas

- Amy's Kitchen Inc

- Starbucks Corporation

- PureOrganic Drinks Limited

- Nestlé S.A.

Key Developments in European Organic Food Market Industry

- November 2022: Narayan Foods has forged a strategic partnership with MeliBio, leading to the successful launch of plant-based honey across 75,000 European retail outlets. This development underscores the burgeoning consumer and industry interest in pioneering and sustainable food alternatives.

- November 2022: Ocado and Planet Organic have collaborated to introduce the allplants plant-based meal brand. This initiative highlights the expanding market opportunities for convenient, plant-based organic meal solutions designed for modern consumers.

- July 2021: The Hain Celestial Group Inc. has announced the introduction of its latest range of organic snacks and teas. This move exemplifies the continuous commitment to innovation and product development within the dynamic organic food sector.

Future Outlook for European Organic Food Market Market

The European organic food market is poised for continued growth, driven by evolving consumer preferences, technological advancements, and supportive regulatory frameworks. Strategic partnerships, product diversification, and focus on sustainable practices will be crucial for companies seeking to capitalize on the market's significant potential. The market is expected to witness accelerated growth due to the confluence of these factors, presenting significant opportunities for both established players and new entrants.

European Organic Food Market Segmentation

-

1. Product Type

-

1.1. Organic Foods

- 1.1.1. Fruit & Vegetables

- 1.1.2. Meat, Fish & Poultry

- 1.1.3. Dairy Products

- 1.1.4. Frozen & Processed Foods

- 1.1.5. Other Product Types

-

1.2. Organic Beverages

-

1.2.1. Alcoholic

- 1.2.1.1. Wine

- 1.2.1.2. Beer

- 1.2.1.3. Spirits

-

1.2.2. Non-alcoholic

- 1.2.2.1. Fruit and Vegetable Juices

- 1.2.2.2. Dairy Beverages

- 1.2.2.3. Coffee

- 1.2.2.4. Tea

- 1.2.2.5. Carbonated Beverages

- 1.2.2.6. Other Non-alcoholic Beverages

-

1.2.1. Alcoholic

-

1.1. Organic Foods

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Stores

- 2.4. Online Retailing

- 2.5. Other Distribution Channels

European Organic Food Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Italy

- 5. Russia

- 6. Spain

- 7. Rest of Europe

European Organic Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.15% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Towards Reduced Sugar and Healthier Snacking Options; Surge in Demand for Organic Food Products

- 3.3. Market Restrains

- 3.3.1. Availability of Cheaper Snacking Options

- 3.4. Market Trends

- 3.4.1. Growing Demand for Clean-label Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Organic Food Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Organic Foods

- 5.1.1.1. Fruit & Vegetables

- 5.1.1.2. Meat, Fish & Poultry

- 5.1.1.3. Dairy Products

- 5.1.1.4. Frozen & Processed Foods

- 5.1.1.5. Other Product Types

- 5.1.2. Organic Beverages

- 5.1.2.1. Alcoholic

- 5.1.2.1.1. Wine

- 5.1.2.1.2. Beer

- 5.1.2.1.3. Spirits

- 5.1.2.2. Non-alcoholic

- 5.1.2.2.1. Fruit and Vegetable Juices

- 5.1.2.2.2. Dairy Beverages

- 5.1.2.2.3. Coffee

- 5.1.2.2.4. Tea

- 5.1.2.2.5. Carbonated Beverages

- 5.1.2.2.6. Other Non-alcoholic Beverages

- 5.1.2.1. Alcoholic

- 5.1.1. Organic Foods

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Stores

- 5.2.4. Online Retailing

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. France

- 5.3.3. Germany

- 5.3.4. Italy

- 5.3.5. Russia

- 5.3.6. Spain

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom European Organic Food Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Organic Foods

- 6.1.1.1. Fruit & Vegetables

- 6.1.1.2. Meat, Fish & Poultry

- 6.1.1.3. Dairy Products

- 6.1.1.4. Frozen & Processed Foods

- 6.1.1.5. Other Product Types

- 6.1.2. Organic Beverages

- 6.1.2.1. Alcoholic

- 6.1.2.1.1. Wine

- 6.1.2.1.2. Beer

- 6.1.2.1.3. Spirits

- 6.1.2.2. Non-alcoholic

- 6.1.2.2.1. Fruit and Vegetable Juices

- 6.1.2.2.2. Dairy Beverages

- 6.1.2.2.3. Coffee

- 6.1.2.2.4. Tea

- 6.1.2.2.5. Carbonated Beverages

- 6.1.2.2.6. Other Non-alcoholic Beverages

- 6.1.2.1. Alcoholic

- 6.1.1. Organic Foods

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialist Stores

- 6.2.4. Online Retailing

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. France European Organic Food Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Organic Foods

- 7.1.1.1. Fruit & Vegetables

- 7.1.1.2. Meat, Fish & Poultry

- 7.1.1.3. Dairy Products

- 7.1.1.4. Frozen & Processed Foods

- 7.1.1.5. Other Product Types

- 7.1.2. Organic Beverages

- 7.1.2.1. Alcoholic

- 7.1.2.1.1. Wine

- 7.1.2.1.2. Beer

- 7.1.2.1.3. Spirits

- 7.1.2.2. Non-alcoholic

- 7.1.2.2.1. Fruit and Vegetable Juices

- 7.1.2.2.2. Dairy Beverages

- 7.1.2.2.3. Coffee

- 7.1.2.2.4. Tea

- 7.1.2.2.5. Carbonated Beverages

- 7.1.2.2.6. Other Non-alcoholic Beverages

- 7.1.2.1. Alcoholic

- 7.1.1. Organic Foods

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialist Stores

- 7.2.4. Online Retailing

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Germany European Organic Food Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Organic Foods

- 8.1.1.1. Fruit & Vegetables

- 8.1.1.2. Meat, Fish & Poultry

- 8.1.1.3. Dairy Products

- 8.1.1.4. Frozen & Processed Foods

- 8.1.1.5. Other Product Types

- 8.1.2. Organic Beverages

- 8.1.2.1. Alcoholic

- 8.1.2.1.1. Wine

- 8.1.2.1.2. Beer

- 8.1.2.1.3. Spirits

- 8.1.2.2. Non-alcoholic

- 8.1.2.2.1. Fruit and Vegetable Juices

- 8.1.2.2.2. Dairy Beverages

- 8.1.2.2.3. Coffee

- 8.1.2.2.4. Tea

- 8.1.2.2.5. Carbonated Beverages

- 8.1.2.2.6. Other Non-alcoholic Beverages

- 8.1.2.1. Alcoholic

- 8.1.1. Organic Foods

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialist Stores

- 8.2.4. Online Retailing

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy European Organic Food Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Organic Foods

- 9.1.1.1. Fruit & Vegetables

- 9.1.1.2. Meat, Fish & Poultry

- 9.1.1.3. Dairy Products

- 9.1.1.4. Frozen & Processed Foods

- 9.1.1.5. Other Product Types

- 9.1.2. Organic Beverages

- 9.1.2.1. Alcoholic

- 9.1.2.1.1. Wine

- 9.1.2.1.2. Beer

- 9.1.2.1.3. Spirits

- 9.1.2.2. Non-alcoholic

- 9.1.2.2.1. Fruit and Vegetable Juices

- 9.1.2.2.2. Dairy Beverages

- 9.1.2.2.3. Coffee

- 9.1.2.2.4. Tea

- 9.1.2.2.5. Carbonated Beverages

- 9.1.2.2.6. Other Non-alcoholic Beverages

- 9.1.2.1. Alcoholic

- 9.1.1. Organic Foods

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialist Stores

- 9.2.4. Online Retailing

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia European Organic Food Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Organic Foods

- 10.1.1.1. Fruit & Vegetables

- 10.1.1.2. Meat, Fish & Poultry

- 10.1.1.3. Dairy Products

- 10.1.1.4. Frozen & Processed Foods

- 10.1.1.5. Other Product Types

- 10.1.2. Organic Beverages

- 10.1.2.1. Alcoholic

- 10.1.2.1.1. Wine

- 10.1.2.1.2. Beer

- 10.1.2.1.3. Spirits

- 10.1.2.2. Non-alcoholic

- 10.1.2.2.1. Fruit and Vegetable Juices

- 10.1.2.2.2. Dairy Beverages

- 10.1.2.2.3. Coffee

- 10.1.2.2.4. Tea

- 10.1.2.2.5. Carbonated Beverages

- 10.1.2.2.6. Other Non-alcoholic Beverages

- 10.1.2.1. Alcoholic

- 10.1.1. Organic Foods

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Specialist Stores

- 10.2.4. Online Retailing

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Spain European Organic Food Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Organic Foods

- 11.1.1.1. Fruit & Vegetables

- 11.1.1.2. Meat, Fish & Poultry

- 11.1.1.3. Dairy Products

- 11.1.1.4. Frozen & Processed Foods

- 11.1.1.5. Other Product Types

- 11.1.2. Organic Beverages

- 11.1.2.1. Alcoholic

- 11.1.2.1.1. Wine

- 11.1.2.1.2. Beer

- 11.1.2.1.3. Spirits

- 11.1.2.2. Non-alcoholic

- 11.1.2.2.1. Fruit and Vegetable Juices

- 11.1.2.2.2. Dairy Beverages

- 11.1.2.2.3. Coffee

- 11.1.2.2.4. Tea

- 11.1.2.2.5. Carbonated Beverages

- 11.1.2.2.6. Other Non-alcoholic Beverages

- 11.1.2.1. Alcoholic

- 11.1.1. Organic Foods

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Supermarkets/Hypermarkets

- 11.2.2. Convenience Stores

- 11.2.3. Specialist Stores

- 11.2.4. Online Retailing

- 11.2.5. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe European Organic Food Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Organic Foods

- 12.1.1.1. Fruit & Vegetables

- 12.1.1.2. Meat, Fish & Poultry

- 12.1.1.3. Dairy Products

- 12.1.1.4. Frozen & Processed Foods

- 12.1.1.5. Other Product Types

- 12.1.2. Organic Beverages

- 12.1.2.1. Alcoholic

- 12.1.2.1.1. Wine

- 12.1.2.1.2. Beer

- 12.1.2.1.3. Spirits

- 12.1.2.2. Non-alcoholic

- 12.1.2.2.1. Fruit and Vegetable Juices

- 12.1.2.2.2. Dairy Beverages

- 12.1.2.2.3. Coffee

- 12.1.2.2.4. Tea

- 12.1.2.2.5. Carbonated Beverages

- 12.1.2.2.6. Other Non-alcoholic Beverages

- 12.1.2.1. Alcoholic

- 12.1.1. Organic Foods

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Supermarkets/Hypermarkets

- 12.2.2. Convenience Stores

- 12.2.3. Specialist Stores

- 12.2.4. Online Retailing

- 12.2.5. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Germany European Organic Food Market Analysis, Insights and Forecast, 2019-2031

- 14. France European Organic Food Market Analysis, Insights and Forecast, 2019-2031

- 15. Italy European Organic Food Market Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom European Organic Food Market Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands European Organic Food Market Analysis, Insights and Forecast, 2019-2031

- 18. Sweden European Organic Food Market Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe European Organic Food Market Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Narayan Foods

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Sasma BV

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 General Mills Inc

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 The Hain Celestial Group Inc

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Danone S A (The WhiteWave Foods Company)

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Clipper Teas

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Amy's Kitchen Inc

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Starbucks Corporation

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 PureOrganic Drinks Limited*List Not Exhaustive

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 Nestlé S A

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.1 Narayan Foods

List of Figures

- Figure 1: European Organic Food Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: European Organic Food Market Share (%) by Company 2024

List of Tables

- Table 1: European Organic Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: European Organic Food Market Volume Tons Forecast, by Region 2019 & 2032

- Table 3: European Organic Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: European Organic Food Market Volume Tons Forecast, by Product Type 2019 & 2032

- Table 5: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: European Organic Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: European Organic Food Market Volume Tons Forecast, by Region 2019 & 2032

- Table 9: European Organic Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: European Organic Food Market Volume Tons Forecast, by Country 2019 & 2032

- Table 11: Germany European Organic Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany European Organic Food Market Volume (Tons) Forecast, by Application 2019 & 2032

- Table 13: France European Organic Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France European Organic Food Market Volume (Tons) Forecast, by Application 2019 & 2032

- Table 15: Italy European Organic Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy European Organic Food Market Volume (Tons) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom European Organic Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom European Organic Food Market Volume (Tons) Forecast, by Application 2019 & 2032

- Table 19: Netherlands European Organic Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands European Organic Food Market Volume (Tons) Forecast, by Application 2019 & 2032

- Table 21: Sweden European Organic Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Sweden European Organic Food Market Volume (Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe European Organic Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe European Organic Food Market Volume (Tons) Forecast, by Application 2019 & 2032

- Table 25: European Organic Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: European Organic Food Market Volume Tons Forecast, by Product Type 2019 & 2032

- Table 27: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2019 & 2032

- Table 29: European Organic Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: European Organic Food Market Volume Tons Forecast, by Country 2019 & 2032

- Table 31: European Organic Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 32: European Organic Food Market Volume Tons Forecast, by Product Type 2019 & 2032

- Table 33: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 34: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2019 & 2032

- Table 35: European Organic Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: European Organic Food Market Volume Tons Forecast, by Country 2019 & 2032

- Table 37: European Organic Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 38: European Organic Food Market Volume Tons Forecast, by Product Type 2019 & 2032

- Table 39: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2019 & 2032

- Table 41: European Organic Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: European Organic Food Market Volume Tons Forecast, by Country 2019 & 2032

- Table 43: European Organic Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 44: European Organic Food Market Volume Tons Forecast, by Product Type 2019 & 2032

- Table 45: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 46: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2019 & 2032

- Table 47: European Organic Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: European Organic Food Market Volume Tons Forecast, by Country 2019 & 2032

- Table 49: European Organic Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 50: European Organic Food Market Volume Tons Forecast, by Product Type 2019 & 2032

- Table 51: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 52: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2019 & 2032

- Table 53: European Organic Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: European Organic Food Market Volume Tons Forecast, by Country 2019 & 2032

- Table 55: European Organic Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 56: European Organic Food Market Volume Tons Forecast, by Product Type 2019 & 2032

- Table 57: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 58: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2019 & 2032

- Table 59: European Organic Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: European Organic Food Market Volume Tons Forecast, by Country 2019 & 2032

- Table 61: European Organic Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 62: European Organic Food Market Volume Tons Forecast, by Product Type 2019 & 2032

- Table 63: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 64: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2019 & 2032

- Table 65: European Organic Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: European Organic Food Market Volume Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Organic Food Market?

The projected CAGR is approximately 14.15%.

2. Which companies are prominent players in the European Organic Food Market?

Key companies in the market include Narayan Foods, Sasma BV, General Mills Inc, The Hain Celestial Group Inc, Danone S A (The WhiteWave Foods Company), Clipper Teas, Amy's Kitchen Inc, Starbucks Corporation, PureOrganic Drinks Limited*List Not Exhaustive, Nestlé S A.

3. What are the main segments of the European Organic Food Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 141.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Inclination Towards Reduced Sugar and Healthier Snacking Options; Surge in Demand for Organic Food Products.

6. What are the notable trends driving market growth?

Growing Demand for Clean-label Products.

7. Are there any restraints impacting market growth?

Availability of Cheaper Snacking Options.

8. Can you provide examples of recent developments in the market?

In November 2022, in a partnership with Narayan Foods, a renowned player in organic foods, MeliBio, the first company that claims to produce real honey without bees, announced that it raised an extra USD 2.2 million in funding and planned to sell its products in 75,000 European stores. Through the partnership, Narayan Foods announced its plans to market MeliBio's plant-based honey under the Better Foodie brand, starting in early 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Organic Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Organic Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Organic Food Market?

To stay informed about further developments, trends, and reports in the European Organic Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence