Key Insights

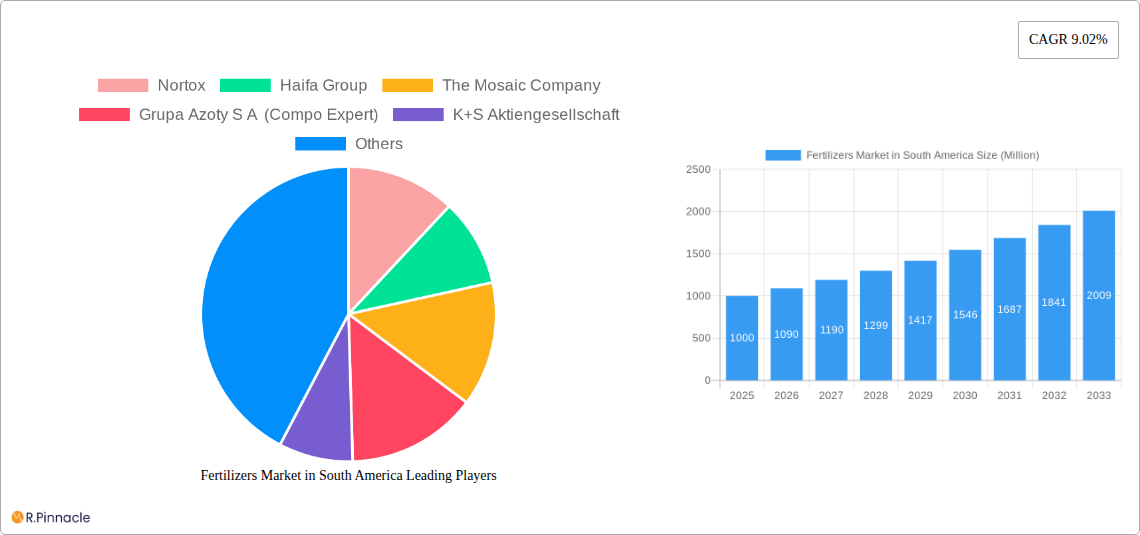

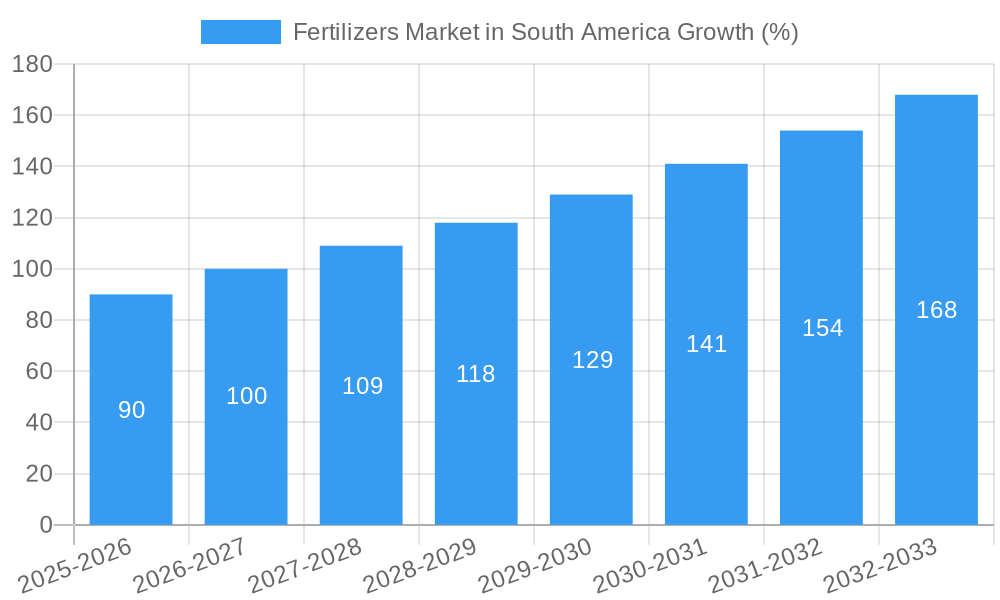

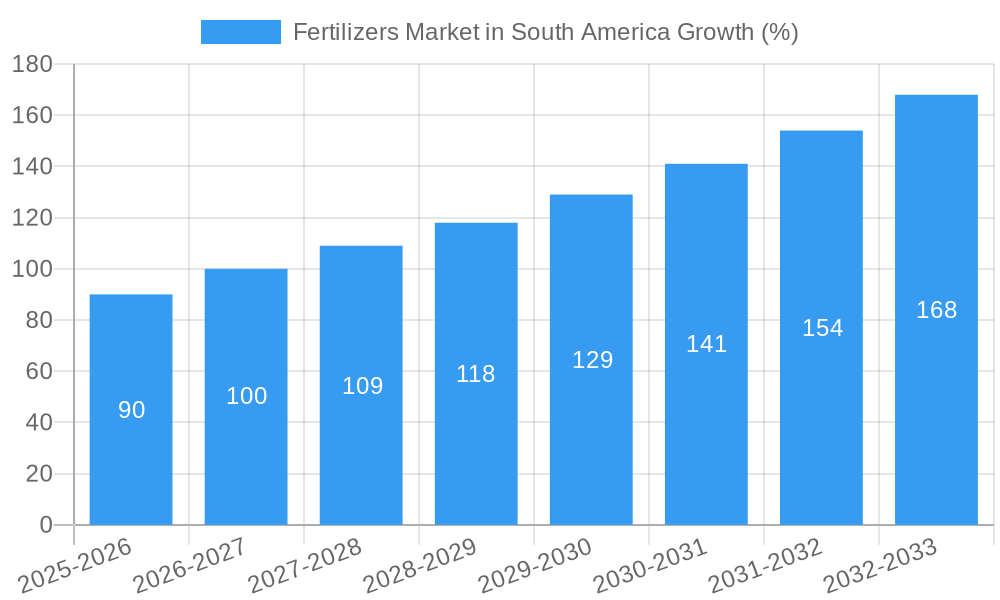

The South American fertilizers market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.02% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing agricultural production to meet rising food demands across the region is a primary factor. Brazil and Argentina, the largest economies in South America, are significant contributors to this growth, driven by their substantial agricultural sectors and government initiatives supporting agricultural modernization and efficiency. The shift towards high-yielding crop varieties and intensive farming practices further fuels fertilizer consumption. Moreover, favorable government policies aimed at boosting agricultural output and investments in irrigation infrastructure are creating a positive environment for market growth. However, the market faces challenges including price volatility of raw materials (like natural gas and potash), impacting fertilizer prices and potentially hindering accessibility for some farmers. Fluctuations in currency exchange rates also pose risks. Furthermore, concerns surrounding environmental sustainability and the potential negative impacts of excessive fertilizer use on soil health and water quality are prompting a shift towards more sustainable and efficient fertilizer application methods, such as fertigation. Segmentation reveals strong demand across various crop types (field crops, horticultural crops, and turf & ornamental) and application modes (fertigation, foliar, and soil application). Major players like Nortox, Haifa Group, and Yara International are actively shaping the market through strategic investments in production capacity, technological advancements, and distribution networks.

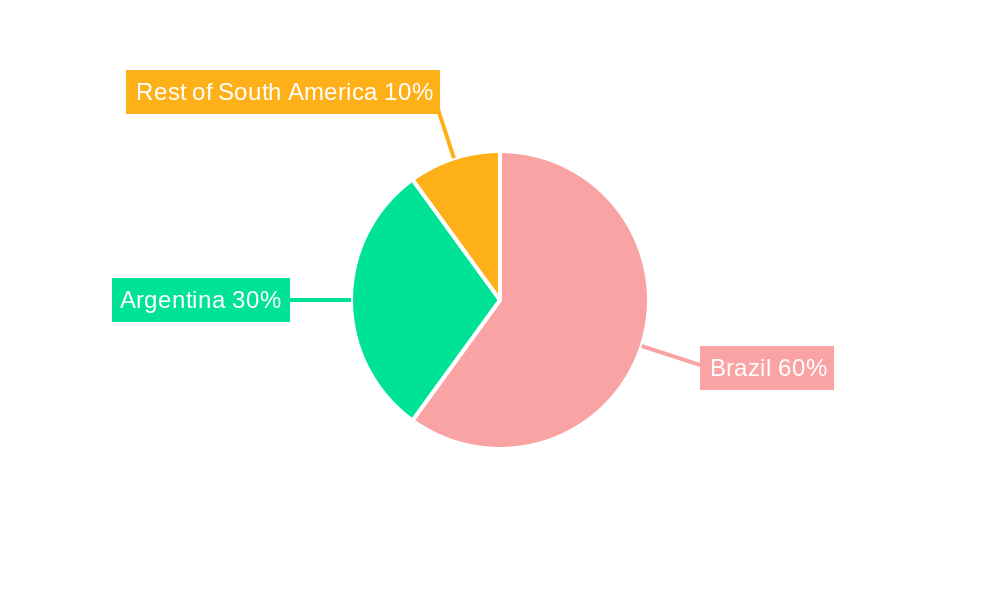

The market's segmentation provides further insights into its dynamism. The demand for complex fertilizers, offering a balanced mix of nutrients, is expected to remain strong, while the specialty fertilizer segment is anticipated to experience faster growth, driven by increasing demand for specialized nutrients tailored to specific crop needs and soil conditions. Growth in the horticultural crops segment reflects the expanding consumer preference for fresh produce and ornamental plants. Geographical distribution highlights Brazil as the largest market within South America, followed by Argentina and other South American countries. The forecast period, 2025-2033, promises continued expansion, with the market likely to witness significant advancements in technology related to precision farming and environmentally friendly fertilizers, further bolstering sustainable agricultural practices. Continued investment in research and development is also expected to play a crucial role in shaping the future of this dynamic market.

Fertilizers Market in South America: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Fertilizers Market in South America, covering the period 2019-2033. It offers invaluable insights into market dynamics, competitive landscapes, and future growth opportunities for industry professionals, investors, and stakeholders. The report leverages extensive data analysis and expert insights to present a clear and actionable understanding of this vital market.

Fertilizers Market in South America Market Structure & Innovation Trends

This section analyzes the South American fertilizer market's structure, highlighting key trends in innovation, regulation, and competitive activity. The market is characterized by a mix of multinational corporations and regional players, with varying levels of market concentration across different countries and segments. Key players like Nutrien Ltd, Yara International AS, and Mosaic Company hold significant market share, while regional players such as Nortox and Fertgrow cater to specific niches.

Market Concentration: The market exhibits moderate concentration, with a few dominant players and numerous smaller regional operators. The exact market share distribution varies across countries and segments. Brazil and Argentina dominate the market share due to their larger agricultural sectors and higher fertilizer consumption.

Innovation Drivers: The primary drivers of innovation include the growing demand for high-yield crops, increasing focus on sustainable agriculture practices, and the need for efficient nutrient management solutions. This has led to the development of advanced fertilizers, including specialty formulations and technologies like fertigation.

Regulatory Frameworks: Government regulations concerning environmental protection and fertilizer use vary across South American countries. These regulations influence the types of fertilizers used and their application methods, impacting market dynamics.

Product Substitutes: Organic fertilizers and bio-stimulants are emerging as substitutes for conventional chemical fertilizers, driven by increasing awareness of environmental sustainability.

End-User Demographics: The primary end-users are large-scale commercial farms, followed by smallholder farmers and horticultural businesses. Demand is influenced by factors such as crop yields, farm size, and access to technology.

M&A Activities: The fertilizer industry in South America has witnessed several mergers and acquisitions in recent years. Deal values vary considerably depending on the size and scope of the acquisition. For example, K+S's acquisition of a 75% share in ICH’s fertilizer business (April 2023) demonstrates strategic moves for expansion into new markets.

Fertilizers Market in South America Market Dynamics & Trends

The South American fertilizer market is experiencing dynamic growth, driven by several factors. Agricultural expansion, rising food demand, and government support for agricultural modernization are key drivers. The market exhibits a steady Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration varying across different segments and regions. Technological disruptions, such as precision farming techniques and data-driven insights, are improving fertilizer use efficiency, leading to enhanced crop yields and reduced environmental impact. Consumer preferences are shifting towards sustainable and environmentally friendly fertilizers. Intense competition among existing players and the entry of new players further shapes market dynamics.

Dominant Regions & Segments in Fertilizers Market in South America

Brazil is the dominant region, accounting for the largest market share due to its expansive agricultural sector and high fertilizer consumption. Argentina also holds a significant share.

Leading Region: Brazil

Leading Country: Brazil

Application Mode: Soil application remains the dominant method, due to its established practice and cost-effectiveness. However, fertigation is gaining popularity, driven by its precision and efficiency.

Crop Type: Field crops such as soybeans, corn, and sugarcane dominate fertilizer consumption due to their extensive cultivation.

Type: Complex fertilizers (NPK blends) have a wider market share than straight fertilizers, reflecting the demand for balanced nutrient solutions.

Form: Conventional fertilizers comprise a significant proportion of the market. However, specialty fertilizers are witnessing growth due to their targeted nutrient delivery and enhanced crop performance.

The dominance of Brazil is primarily driven by:

- Extensive arable land suitable for large-scale farming.

- Strong government support for the agricultural sector, including subsidies and infrastructure development.

- Favorable climatic conditions.

Fertilizers Market in South America Product Innovations

Recent innovations focus on specialty fertilizers with enhanced nutrient uptake efficiency and targeted nutrient delivery. These formulations are designed to optimize crop yields and minimize environmental impact. Technological advancements in fertilizer application, such as precision farming techniques and variable rate technology, are improving fertilizer use efficiency and reducing waste. The market is seeing increased adoption of bio-stimulants and organic fertilizers driven by sustainability concerns.

Report Scope & Segmentation Analysis

This report segments the South American fertilizer market by Application Mode (Fertigation, Foliar, Soil), Crop Type (Field Crops, Horticultural Crops, Turf & Ornamental), Country (Argentina, Brazil, Rest of South America), Type (Complex, Straight), and Form (Conventional, Specialty). Each segment's growth projections, market sizes, and competitive dynamics are analyzed individually. For example, the soil application segment will show steady growth projected at xx Million during the forecast period, while fertigation will demonstrate a higher CAGR due to increasing adoption of precision agriculture.

Key Drivers of Fertilizers Market in South America Growth

Key growth drivers include: increasing agricultural output to meet rising food demands, government initiatives to promote agricultural modernization, rising incomes and changing dietary habits increasing demand for agricultural products, and technological advancements leading to improved fertilizer efficiency and targeted nutrient application. The expanding use of precision agriculture techniques further boosts market growth.

Challenges in the Fertilizers Market in South America Sector

Challenges include: volatile raw material prices, stringent environmental regulations impacting fertilizer production and use, supply chain disruptions, and competitive pressures from both domestic and international players. These factors contribute to price fluctuations and potentially limit market growth in specific segments. Infrastructure limitations in some regions also impede efficient distribution and logistics.

Emerging Opportunities in Fertilizers Market in South America

Emerging opportunities include: increasing demand for sustainable and environmentally friendly fertilizers, growing adoption of precision farming technologies, and the expansion of the horticultural and turf & ornamental sectors. Focus on developing water-efficient fertilizers and bio-stimulants presents significant opportunities for market expansion.

Leading Players in the Fertilizers Market in South America Market

- Nortox

- Haifa Group

- The Mosaic Company

- Grupa Azoty S A (Compo Expert)

- K+S Aktiengesellschaft

- Yara International AS

- Nutrien Ltd

- ICL Group Ltd

- Sociedad Quimica y Minera de Chile SA

- Fertgrow

Key Developments in Fertilizers Market in South America Industry

- May 2022: ICL launched three new NPK formulations of Solinure, a product with increased trace elements to optimize yields. This reflects a push towards higher-efficiency specialty fertilizers.

- January 2023: ICL entered into a strategic partnership with General Mills, focusing on specialty phosphate solutions and international expansion, signifying increased collaboration and market reach.

- April 2023: K+S acquired a 75% share of the fertilizer business of Industrial Commodities Holdings (Pty) Ltd (ICH), expanding its African operations and potentially influencing its South American strategies.

Future Outlook for Fertilizers Market in South America Market

The South American fertilizer market is poised for continued growth, driven by factors such as rising agricultural production, increasing demand for food, and technological advancements. Opportunities lie in sustainable fertilization practices, precision agriculture, and the development of innovative fertilizer products. The market will likely experience consolidation and strategic partnerships among key players. The forecast suggests a positive outlook, indicating substantial market expansion in the coming years.

Fertilizers Market in South America Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Fertilizers Market in South America Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fertilizers Market in South America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.02% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Custom Product Development; Use of CROs for Regulatory Services

- 3.3. Market Restrains

- 3.3.1. Data and Cyber Security Concerns; Lack of Experts and Professionals in this Industry

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fertilizers Market in South America Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Fertilizers Market in South America Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Fertilizers Market in South America Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Fertilizers Market in South America Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Fertilizers Market in South America Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Fertilizers Market in South America Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Brazil Fertilizers Market in South America Analysis, Insights and Forecast, 2019-2031

- 12. Argentina Fertilizers Market in South America Analysis, Insights and Forecast, 2019-2031

- 13. Rest of South America Fertilizers Market in South America Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Nortox

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Haifa Group

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 The Mosaic Company

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Grupa Azoty S A (Compo Expert)

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 K+S Aktiengesellschaft

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Yara International AS

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Nutrien Ltd

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 ICL Group Ltd

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Sociedad Quimica y Minera de Chile SA

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Fertgrow

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Nortox

List of Figures

- Figure 1: Global Fertilizers Market in South America Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: South America Fertilizers Market in South America Revenue (Million), by Country 2024 & 2032

- Figure 3: South America Fertilizers Market in South America Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Fertilizers Market in South America Revenue (Million), by Production Analysis 2024 & 2032

- Figure 5: North America Fertilizers Market in South America Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 6: North America Fertilizers Market in South America Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 7: North America Fertilizers Market in South America Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 8: North America Fertilizers Market in South America Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 9: North America Fertilizers Market in South America Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 10: North America Fertilizers Market in South America Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 11: North America Fertilizers Market in South America Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 12: North America Fertilizers Market in South America Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 13: North America Fertilizers Market in South America Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 14: North America Fertilizers Market in South America Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Fertilizers Market in South America Revenue Share (%), by Country 2024 & 2032

- Figure 16: South America Fertilizers Market in South America Revenue (Million), by Production Analysis 2024 & 2032

- Figure 17: South America Fertilizers Market in South America Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 18: South America Fertilizers Market in South America Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 19: South America Fertilizers Market in South America Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 20: South America Fertilizers Market in South America Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 21: South America Fertilizers Market in South America Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 22: South America Fertilizers Market in South America Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 23: South America Fertilizers Market in South America Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 24: South America Fertilizers Market in South America Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 25: South America Fertilizers Market in South America Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 26: South America Fertilizers Market in South America Revenue (Million), by Country 2024 & 2032

- Figure 27: South America Fertilizers Market in South America Revenue Share (%), by Country 2024 & 2032

- Figure 28: Europe Fertilizers Market in South America Revenue (Million), by Production Analysis 2024 & 2032

- Figure 29: Europe Fertilizers Market in South America Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 30: Europe Fertilizers Market in South America Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 31: Europe Fertilizers Market in South America Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 32: Europe Fertilizers Market in South America Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 33: Europe Fertilizers Market in South America Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 34: Europe Fertilizers Market in South America Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 35: Europe Fertilizers Market in South America Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 36: Europe Fertilizers Market in South America Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 37: Europe Fertilizers Market in South America Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 38: Europe Fertilizers Market in South America Revenue (Million), by Country 2024 & 2032

- Figure 39: Europe Fertilizers Market in South America Revenue Share (%), by Country 2024 & 2032

- Figure 40: Middle East & Africa Fertilizers Market in South America Revenue (Million), by Production Analysis 2024 & 2032

- Figure 41: Middle East & Africa Fertilizers Market in South America Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 42: Middle East & Africa Fertilizers Market in South America Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 43: Middle East & Africa Fertilizers Market in South America Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 44: Middle East & Africa Fertilizers Market in South America Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 45: Middle East & Africa Fertilizers Market in South America Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 46: Middle East & Africa Fertilizers Market in South America Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 47: Middle East & Africa Fertilizers Market in South America Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 48: Middle East & Africa Fertilizers Market in South America Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 49: Middle East & Africa Fertilizers Market in South America Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 50: Middle East & Africa Fertilizers Market in South America Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East & Africa Fertilizers Market in South America Revenue Share (%), by Country 2024 & 2032

- Figure 52: Asia Pacific Fertilizers Market in South America Revenue (Million), by Production Analysis 2024 & 2032

- Figure 53: Asia Pacific Fertilizers Market in South America Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 54: Asia Pacific Fertilizers Market in South America Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 55: Asia Pacific Fertilizers Market in South America Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 56: Asia Pacific Fertilizers Market in South America Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 57: Asia Pacific Fertilizers Market in South America Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 58: Asia Pacific Fertilizers Market in South America Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 59: Asia Pacific Fertilizers Market in South America Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 60: Asia Pacific Fertilizers Market in South America Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 61: Asia Pacific Fertilizers Market in South America Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 62: Asia Pacific Fertilizers Market in South America Revenue (Million), by Country 2024 & 2032

- Figure 63: Asia Pacific Fertilizers Market in South America Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fertilizers Market in South America Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Fertilizers Market in South America Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Global Fertilizers Market in South America Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Global Fertilizers Market in South America Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Global Fertilizers Market in South America Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Global Fertilizers Market in South America Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Global Fertilizers Market in South America Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Fertilizers Market in South America Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Brazil Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Argentina Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of South America Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Fertilizers Market in South America Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 13: Global Fertilizers Market in South America Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 14: Global Fertilizers Market in South America Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 15: Global Fertilizers Market in South America Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 16: Global Fertilizers Market in South America Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 17: Global Fertilizers Market in South America Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Canada Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Fertilizers Market in South America Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 22: Global Fertilizers Market in South America Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 23: Global Fertilizers Market in South America Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 24: Global Fertilizers Market in South America Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 25: Global Fertilizers Market in South America Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 26: Global Fertilizers Market in South America Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Brazil Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Argentina Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of South America Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Fertilizers Market in South America Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 31: Global Fertilizers Market in South America Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 32: Global Fertilizers Market in South America Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 33: Global Fertilizers Market in South America Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 34: Global Fertilizers Market in South America Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 35: Global Fertilizers Market in South America Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United Kingdom Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Germany Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: France Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Italy Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Spain Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Russia Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Benelux Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Nordics Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Europe Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Fertilizers Market in South America Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 46: Global Fertilizers Market in South America Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 47: Global Fertilizers Market in South America Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 48: Global Fertilizers Market in South America Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 49: Global Fertilizers Market in South America Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 50: Global Fertilizers Market in South America Revenue Million Forecast, by Country 2019 & 2032

- Table 51: Turkey Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Israel Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: GCC Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: North Africa Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: South Africa Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Middle East & Africa Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Fertilizers Market in South America Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 58: Global Fertilizers Market in South America Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 59: Global Fertilizers Market in South America Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 60: Global Fertilizers Market in South America Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 61: Global Fertilizers Market in South America Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 62: Global Fertilizers Market in South America Revenue Million Forecast, by Country 2019 & 2032

- Table 63: China Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: India Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Japan Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: South Korea Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: ASEAN Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Oceania Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Rest of Asia Pacific Fertilizers Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fertilizers Market in South America?

The projected CAGR is approximately 9.02%.

2. Which companies are prominent players in the Fertilizers Market in South America?

Key companies in the market include Nortox, Haifa Group, The Mosaic Company, Grupa Azoty S A (Compo Expert), K+S Aktiengesellschaft, Yara International AS, Nutrien Ltd, ICL Group Ltd, Sociedad Quimica y Minera de Chile SA, Fertgrow.

3. What are the main segments of the Fertilizers Market in South America?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Need for Custom Product Development; Use of CROs for Regulatory Services.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Data and Cyber Security Concerns; Lack of Experts and Professionals in this Industry.

8. Can you provide examples of recent developments in the market?

April 2023: K+S acquired a 75% share of the fertilizer business of a South African trading company, Industrial Commodities Holdings (Pty) Ltd (ICH). In addition to expanding the core business, K+S is strengthening its operations in southern and eastern Africa as a result of this acquisition. The newly acquired fertilizer business in the future is to be operated in a joint venture under the name of FertivPty Ltd.January 2023: ICL has entered into a strategic partnership agreement with General Mills, in which it will be the supplier of strategic specialty phosphate solutions to General Mills. The long-term agreement will also focus on international expansion.May 2022: ICL launched three new NPK formulations of Solinure, a product with increased trace elements to optimize yields.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fertilizers Market in South America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fertilizers Market in South America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fertilizers Market in South America?

To stay informed about further developments, trends, and reports in the Fertilizers Market in South America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence