Key Insights

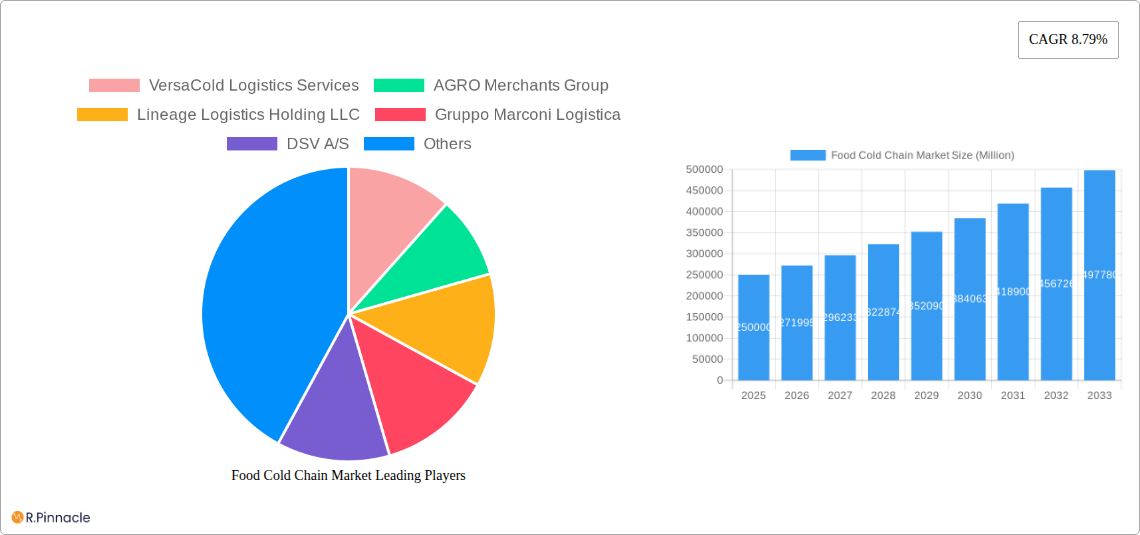

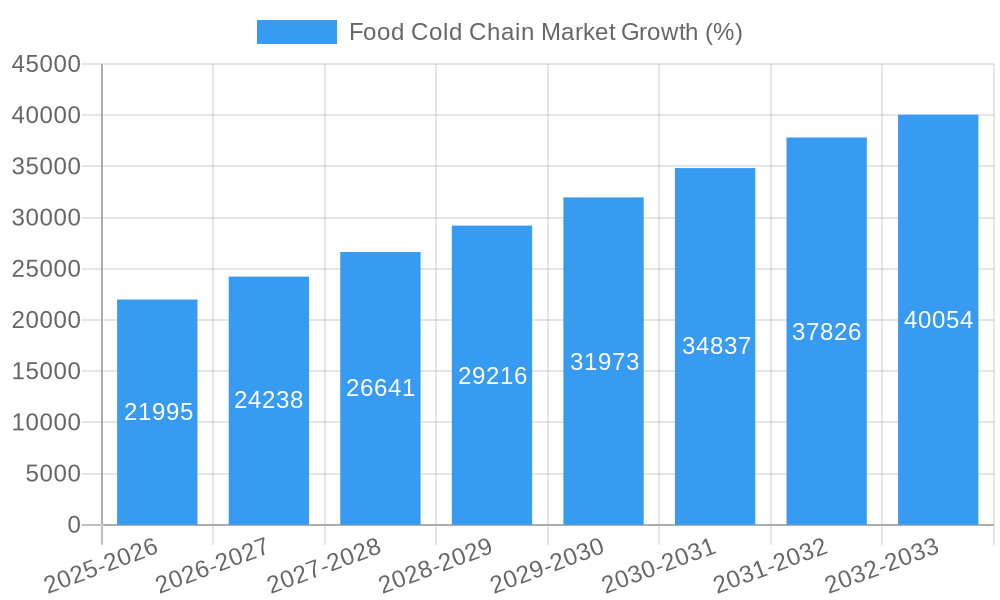

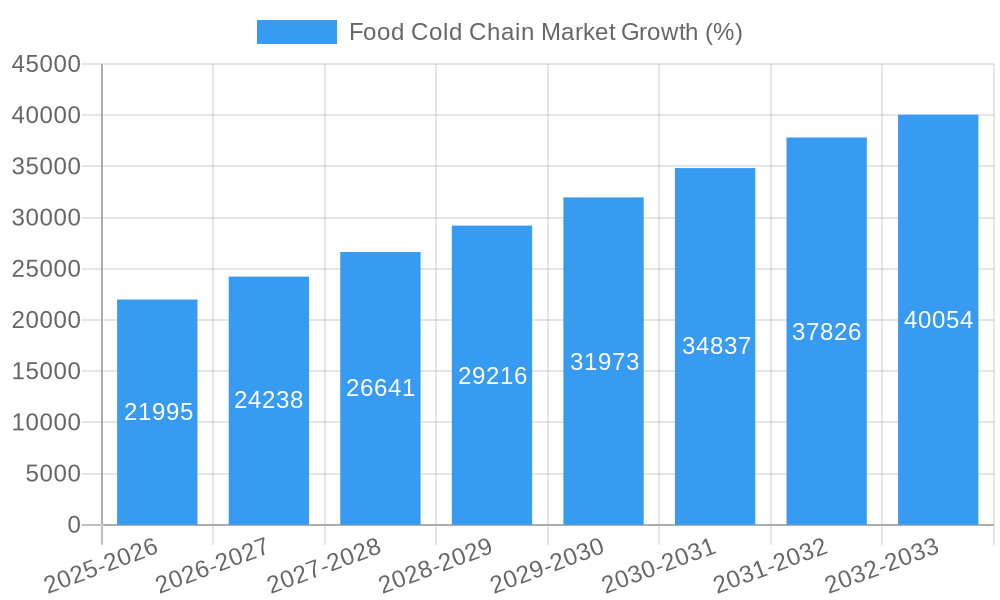

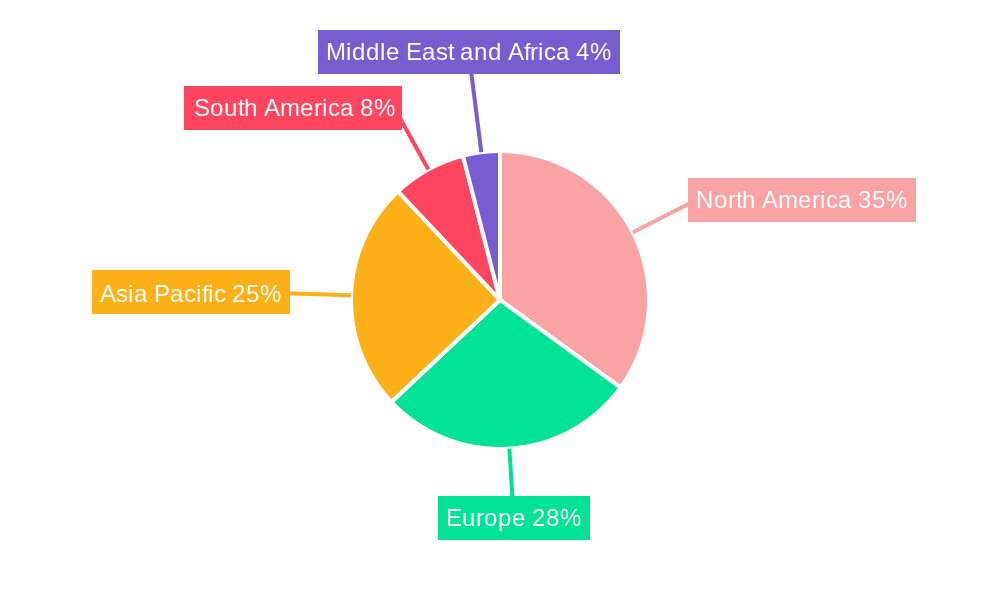

The global food cold chain market, encompassing storage and transportation of perishable goods, is experiencing robust growth, projected to reach a substantial size by 2033. A compound annual growth rate (CAGR) of 8.79% from 2019 to 2024 indicates a consistently expanding market driven by several key factors. Rising consumer demand for fresh and processed food products, particularly in developing economies with burgeoning middle classes, is a significant driver. Furthermore, the increasing emphasis on food safety and reducing food waste through efficient cold chain management is fueling market expansion. Growth is also spurred by technological advancements in refrigeration, transportation logistics, and monitoring systems, enhancing the efficiency and effectiveness of the cold chain. The market is segmented by type (cold chain storage and transport) and application (fruits & vegetables, meat & seafood, dairy, bakery, ready-to-eat meals, and others). While growth is widespread, regional variations exist, with North America and Europe currently holding significant market shares, though the Asia-Pacific region is poised for rapid expansion due to its growing population and increasing disposable incomes.

However, the market faces certain challenges. High infrastructure costs associated with establishing and maintaining cold chain facilities, particularly in remote or underdeveloped regions, pose a significant restraint. Fluctuating energy prices and stringent regulatory requirements related to food safety and environmental concerns also impact profitability. Furthermore, maintaining consistent temperature control throughout the entire cold chain, from farm to consumer, presents logistical complexities. Despite these restraints, the long-term outlook remains positive, driven by the continuous rise in demand for high-quality, safe, and readily available food products globally. The leading players in this market are strategically investing in advanced technologies and expanding their geographical reach to capitalize on growth opportunities, leading to a competitive yet dynamic landscape.

Food Cold Chain Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global Food Cold Chain Market, offering invaluable insights for industry professionals, investors, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data and expert analysis to illuminate current market dynamics and future growth trajectories. The report covers key market segments, including Cold Chain Storage and Cold Chain Transport, across various applications like Fruits and Vegetables, Meat and Seafood, Dairy and Frozen Desserts, Bakery and Confectionery, Ready-to-Eat Meals, and Other Applications. Leading players such as VersaCold Logistics Services, AGRO Merchants Group, Lineage Logistics Holding LLC, and others are profiled, highlighting their strategies and market positions.

Food Cold Chain Market Structure & Innovation Trends

The Food Cold Chain Market exhibits a moderately concentrated structure, with a few large players holding significant market share. Lineage Logistics, AmeriCold Logistics, and others dominate the landscape, though regional players exert considerable influence within their respective territories. Market share data indicates that the top five players collectively hold approximately xx% of the market (2024 estimate). The market is characterized by ongoing innovation, driven by the need for enhanced efficiency, reduced waste, and improved food safety. Technological advancements such as IoT sensors, AI-powered predictive maintenance, and blockchain solutions are transforming supply chain operations. Stringent regulatory frameworks governing food safety and hygiene standards influence market practices and create opportunities for specialized service providers. Product substitutes, such as alternative preservation technologies, pose a limited threat, while M&A activity, as exemplified by Lineage Logistics' acquisition of Grupo Fuentes, continues to shape the competitive landscape, with deal values exceeding xx Million in recent years. The end-user demographic is broad, encompassing food producers, distributors, retailers, and food service providers, impacting market growth and demand.

Food Cold Chain Market Dynamics & Trends

The Food Cold Chain Market is experiencing robust growth, driven by increasing consumer demand for fresh and processed food, expanding e-commerce penetration in grocery, and rising disposable incomes in emerging markets. The Compound Annual Growth Rate (CAGR) is projected at xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of automation and smart technologies, are improving efficiency and traceability. Changing consumer preferences towards convenient and healthier food options influence demand for specific cold chain services. Intense competitive dynamics, characterized by consolidation and innovation, shape market strategies. Market penetration of advanced cold chain technologies is steadily increasing, with a projected xx% penetration rate by 2033.

Dominant Regions & Segments in Food Cold Chain Market

While the global market exhibits growth across all regions, North America and Europe currently dominate the Food Cold Chain Market. This dominance stems from established infrastructure, advanced technological adoption, and strong regulatory frameworks. Asia-Pacific shows significant growth potential, fueled by rising incomes and expanding food processing industries.

- Leading Regions: North America, Europe, and Asia-Pacific.

- Key Drivers (North America): Robust infrastructure, high technological adoption, stringent food safety regulations.

- Key Drivers (Europe): Established cold chain networks, high consumer demand for fresh produce, favorable government policies.

- Key Drivers (Asia-Pacific): Rapid economic growth, rising disposable incomes, expanding food processing and retail sectors.

Within segments, Cold Chain Storage currently holds the largest market share, driven by the need for efficient storage of temperature-sensitive goods. Meat and Seafood, and Dairy and Frozen Desserts are the most significant application segments, followed by Fruits and Vegetables, and Ready-to-Eat Meals.

Food Cold Chain Market Product Innovations

Recent product innovations include smart refrigeration units with real-time monitoring capabilities, automated warehouse systems, and integrated logistics platforms that optimize transportation and delivery. These developments provide enhanced temperature control, reduced spoilage, improved traceability, and increased efficiency. The market is witnessing a move towards sustainable and eco-friendly solutions, with a focus on reducing carbon emissions and minimizing environmental impact. These innovations are largely driven by the need for increased efficiency and cost-effectiveness while maintaining superior food quality and safety.

Report Scope & Segmentation Analysis

This report segments the Food Cold Chain Market based on Type (Cold Chain Storage and Cold Chain Transport) and Application (Fruits and Vegetables, Meat and Seafood, Dairy and Frozen Dessert, Bakery and Confectionery, Ready-to-Eat Meal, Other Applications). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. For example, the Cold Chain Storage segment is projected to grow at a CAGR of xx%, driven by the increasing demand for efficient storage solutions, whereas the Meat and Seafood application segment is expected to witness substantial growth due to the rising consumption of these products globally. This comprehensive segmentation provides granular insights into the market’s diverse landscape and its future trajectory.

Key Drivers of Food Cold Chain Market Growth

Several factors drive the growth of the Food Cold Chain Market. Technological advancements in refrigeration and transportation technologies are enabling efficient and cost-effective cold chain solutions. The rising demand for fresh and processed food, especially in developing economies, fuels market growth. Stringent government regulations and increased focus on food safety enhance the need for robust cold chain infrastructure. Furthermore, the rise of e-commerce platforms for grocery delivery is driving significant demand for reliable cold chain logistics.

Challenges in the Food Cold Chain Market Sector

Significant challenges hinder growth. Maintaining consistent temperature control throughout the cold chain, particularly in developing countries, remains a challenge, leading to spoilage and waste. High infrastructure costs and the need for specialized equipment pose financial barriers, particularly for smaller businesses. Regulatory compliance and ensuring traceability add to the complexity. The impact of these factors on revenue and profitability is substantial, and many companies struggle to maintain high efficiency within these limitations. Increased competition and fluctuating energy costs also affect profitability.

Emerging Opportunities in Food Cold Chain Market

Several emerging opportunities exist. The increasing adoption of IoT and AI technologies offers potential for enhanced efficiency, predictive maintenance, and improved inventory management. The development of sustainable and eco-friendly cold chain solutions caters to growing environmental concerns. Expansion into emerging markets, with a growing middle class and increased demand for processed foods, presents significant growth potential. The development of specialized cold chain solutions for specific food products, such as pharmaceuticals, further unlocks opportunities for increased market share.

Leading Players in the Food Cold Chain Market

- VersaCold Logistics Services

- AGRO Merchants Group

- Lineage Logistics Holding LLC

- Gruppo Marconi Logistica

- DSV A/S

- AmeriCold Logistics LLC

- Kloosterboer Group BV

- Henningsen Cold Storage Co

- Celsius Logistics

- Nichirei Corporation

Key Developments in Food Cold Chain Market Industry

- September 2022: Celsius Logistics launched a smart last-mile delivery platform in India.

- September 2022: Lineage Logistics acquired Grupo Fuentes, expanding its European footprint.

- August 2021: GeoTab unveiled cold chain vans with advanced refrigeration capabilities.

Future Outlook for Food Cold Chain Market

The Food Cold Chain Market is poised for continued growth, driven by technological innovation, increasing consumer demand, and expansion into emerging markets. Strategic opportunities lie in investing in advanced technologies, focusing on sustainability, and expanding into new geographic regions. The market's future hinges on adapting to evolving consumer preferences and technological advancements, ensuring robust and efficient cold chain solutions that preserve food quality and minimize waste. The focus on maintaining and growing market share rests heavily on these adaptive innovations.

Food Cold Chain Market Segmentation

-

1. Type

- 1.1. Cold Chain Storage

- 1.2. Cold Chain Transport

-

2. Application

- 2.1. Fruits and Vegetables

- 2.2. Meat and Seafood

- 2.3. Dairy and Frozen Dessert

- 2.4. Bakery and Confectionery

- 2.5. Ready-to-Eat Meal

- 2.6. Other Applications

Food Cold Chain Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Food Cold Chain Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.79% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularity of Convenient and On the Go Snacking Options; Product Differentiation Playing a Key Role in Market Expansion

- 3.3. Market Restrains

- 3.3.1. Associated Health Risks; Easy Availability of Healthy Substitutes

- 3.4. Market Trends

- 3.4.1. Growing Investments in Cold Chain Infrastructure

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cold Chain Storage

- 5.1.2. Cold Chain Transport

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fruits and Vegetables

- 5.2.2. Meat and Seafood

- 5.2.3. Dairy and Frozen Dessert

- 5.2.4. Bakery and Confectionery

- 5.2.5. Ready-to-Eat Meal

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cold Chain Storage

- 6.1.2. Cold Chain Transport

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Fruits and Vegetables

- 6.2.2. Meat and Seafood

- 6.2.3. Dairy and Frozen Dessert

- 6.2.4. Bakery and Confectionery

- 6.2.5. Ready-to-Eat Meal

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cold Chain Storage

- 7.1.2. Cold Chain Transport

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Fruits and Vegetables

- 7.2.2. Meat and Seafood

- 7.2.3. Dairy and Frozen Dessert

- 7.2.4. Bakery and Confectionery

- 7.2.5. Ready-to-Eat Meal

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cold Chain Storage

- 8.1.2. Cold Chain Transport

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Fruits and Vegetables

- 8.2.2. Meat and Seafood

- 8.2.3. Dairy and Frozen Dessert

- 8.2.4. Bakery and Confectionery

- 8.2.5. Ready-to-Eat Meal

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cold Chain Storage

- 9.1.2. Cold Chain Transport

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Fruits and Vegetables

- 9.2.2. Meat and Seafood

- 9.2.3. Dairy and Frozen Dessert

- 9.2.4. Bakery and Confectionery

- 9.2.5. Ready-to-Eat Meal

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cold Chain Storage

- 10.1.2. Cold Chain Transport

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Fruits and Vegetables

- 10.2.2. Meat and Seafood

- 10.2.3. Dairy and Frozen Dessert

- 10.2.4. Bakery and Confectionery

- 10.2.5. Ready-to-Eat Meal

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 Spain

- 12.1.4 France

- 12.1.5 Italy

- 12.1.6 Rest of Europe

- 13. Asia Pacific Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 Rest of Asia Pacific

- 14. South America Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Food Cold Chain Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 Saudi Arabia

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 VersaCold Logistics Services

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 AGRO Merchants Group

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Lineage Logistics Holding LLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Gruppo Marconi Logistica

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 DSV A/S

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 AmeriCold Logistics LLC

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Kloosterboer Group BV

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Henningsen Cold Storage Co

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Celsius Logistics*List Not Exhaustive

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Nichirei Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 VersaCold Logistics Services

List of Figures

- Figure 1: Global Food Cold Chain Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Food Cold Chain Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Food Cold Chain Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Food Cold Chain Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Food Cold Chain Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Food Cold Chain Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Food Cold Chain Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Food Cold Chain Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Food Cold Chain Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Food Cold Chain Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific Food Cold Chain Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific Food Cold Chain Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Food Cold Chain Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Food Cold Chain Market Revenue (Million), by Type 2024 & 2032

- Figure 31: South America Food Cold Chain Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: South America Food Cold Chain Market Revenue (Million), by Application 2024 & 2032

- Figure 33: South America Food Cold Chain Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: South America Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 35: South America Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Food Cold Chain Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Food Cold Chain Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Food Cold Chain Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa Food Cold Chain Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa Food Cold Chain Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Food Cold Chain Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Food Cold Chain Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Food Cold Chain Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Food Cold Chain Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Food Cold Chain Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Brazil Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Argentina Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of South America Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: South Africa Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Saudi Arabia Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Middle East and Africa Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Food Cold Chain Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Global Food Cold Chain Market Revenue Million Forecast, by Application 2019 & 2032

- Table 33: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of North America Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Food Cold Chain Market Revenue Million Forecast, by Type 2019 & 2032

- Table 39: Global Food Cold Chain Market Revenue Million Forecast, by Application 2019 & 2032

- Table 40: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: Germany Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: United Kingdom Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Spain Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: France Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Italy Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Europe Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Food Cold Chain Market Revenue Million Forecast, by Type 2019 & 2032

- Table 48: Global Food Cold Chain Market Revenue Million Forecast, by Application 2019 & 2032

- Table 49: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: China Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Japan Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: India Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Australia Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Food Cold Chain Market Revenue Million Forecast, by Type 2019 & 2032

- Table 56: Global Food Cold Chain Market Revenue Million Forecast, by Application 2019 & 2032

- Table 57: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Brazil Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Argentina Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of South America Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Food Cold Chain Market Revenue Million Forecast, by Type 2019 & 2032

- Table 62: Global Food Cold Chain Market Revenue Million Forecast, by Application 2019 & 2032

- Table 63: Global Food Cold Chain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 64: South Africa Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Saudi Arabia Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of Middle East and Africa Food Cold Chain Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Cold Chain Market?

The projected CAGR is approximately 8.79%.

2. Which companies are prominent players in the Food Cold Chain Market?

Key companies in the market include VersaCold Logistics Services, AGRO Merchants Group, Lineage Logistics Holding LLC, Gruppo Marconi Logistica, DSV A/S, AmeriCold Logistics LLC, Kloosterboer Group BV, Henningsen Cold Storage Co, Celsius Logistics*List Not Exhaustive, Nichirei Corporation.

3. What are the main segments of the Food Cold Chain Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Popularity of Convenient and On the Go Snacking Options; Product Differentiation Playing a Key Role in Market Expansion.

6. What are the notable trends driving market growth?

Growing Investments in Cold Chain Infrastructure.

7. Are there any restraints impacting market growth?

Associated Health Risks; Easy Availability of Healthy Substitutes.

8. Can you provide examples of recent developments in the market?

September 2022: Celcius Logistics, India's fastest-growing cold-chain marketplace startup, launched its smart last-mile delivery platform that addresses and fixes the most pertinent pain points in India's fragile cold supply chains. The brand has also partnered with vehicle owners and automotive manufacturers to create a robust on-ground network of reefer vehicles that will be integrated with the smart platform created with a unique Inventory Management System (IMS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Cold Chain Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Cold Chain Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Cold Chain Market?

To stay informed about further developments, trends, and reports in the Food Cold Chain Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence