Key Insights

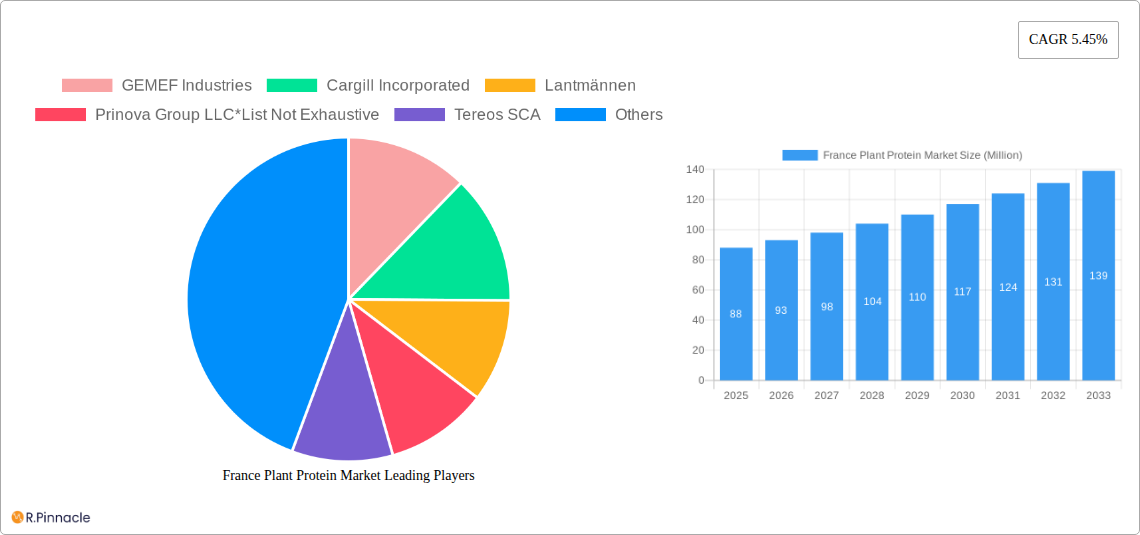

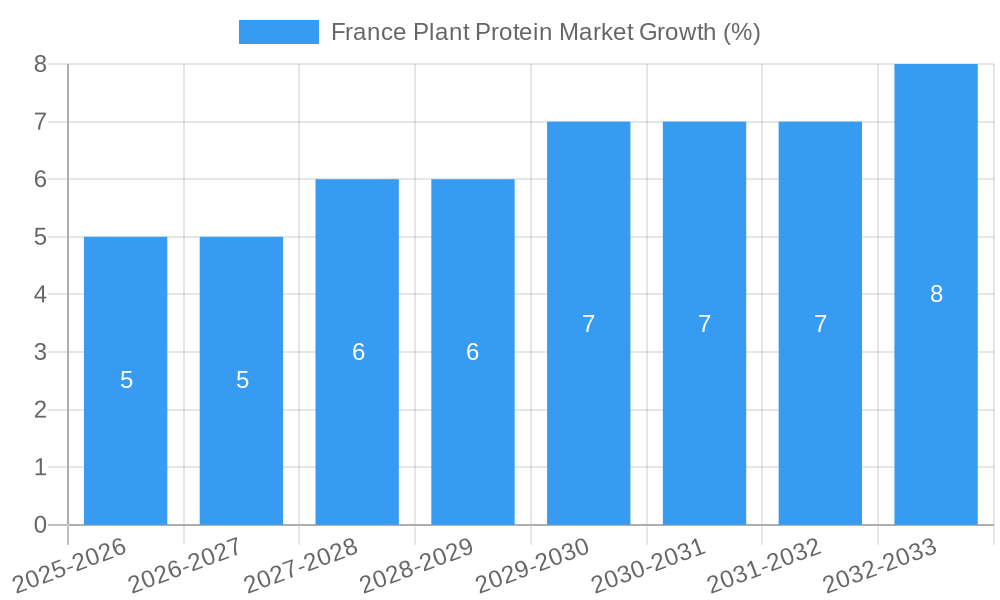

The French plant protein market, valued at €88 million in 2025, is projected to experience robust growth, driven by increasing consumer demand for plant-based alternatives and the rising popularity of vegan and vegetarian diets. This growth is further fueled by the expanding health and wellness sector, with consumers increasingly seeking protein sources that are perceived as healthier and more sustainable than traditional animal proteins. The market is segmented by protein type (hemp, oat, pea, potato, rice, soy, wheat, and other plant proteins) and end-user (animal feed, personal care and cosmetics, food and beverages, and supplements). Soy protein currently holds a significant market share due to its established presence and cost-effectiveness, although other protein types, particularly pea and oat protein, are experiencing rapid growth due to their functional properties and consumer appeal. The burgeoning food and beverage sector is a major driver, with plant proteins increasingly incorporated into meat alternatives, dairy substitutes, and protein bars. The regulatory landscape in France concerning food labeling and sustainability is also influencing market trends, favoring transparency and eco-friendly production practices.

While the market faces certain restraints, such as price volatility of raw materials and the development of new technologies to overcome challenges in taste and texture, the overall outlook remains positive. The projected Compound Annual Growth Rate (CAGR) of 5.45% from 2025 to 2033 indicates substantial expansion. Key players like Cargill, Roquette, and ADM are investing heavily in research and development to improve the functionality and consumer acceptability of plant proteins. Furthermore, increasing awareness of the environmental benefits associated with plant-based diets is expected to further stimulate market growth, creating opportunities for both established and emerging players in the French plant protein market. The forecast period of 2025-2033 indicates continued growth and a significant increase in market value. Regional variations within France might exist, with specific areas showing higher adoption rates based on consumer preferences and regional dietary habits.

This comprehensive report provides a detailed analysis of the France plant protein market, covering the period 2019-2033. It offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes within this rapidly expanding sector. The report leverages extensive market research and data analysis to provide actionable intelligence for strategic decision-making. The market is expected to reach xx Million by 2033.

France Plant Protein Market Market Structure & Innovation Trends

This section analyzes the structure of the France plant protein market, exploring market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers & acquisitions (M&A) activities. The market is characterized by a mix of established multinational corporations and smaller, specialized players.

- Market Concentration: The market exhibits a moderately concentrated structure, with key players holding significant market share. Precise figures are detailed within the full report, including market share data for companies like Roquette Frères, Cargill Incorporated, and others. The report also details the market concentration ratio (CR4/CR8).

- Innovation Drivers: The increasing consumer demand for plant-based alternatives to animal proteins, driven by health consciousness, environmental concerns, and ethical considerations, fuels innovation. Technological advancements in protein extraction and processing further enhance the market.

- Regulatory Framework: The French regulatory environment concerning food safety and labeling plays a crucial role in shaping market dynamics. This report details specific regulations and their impact.

- Product Substitutes: The report identifies existing and potential substitutes for plant proteins, analyzing their competitive advantages and market penetration.

- End-User Demographics: The report provides a detailed analysis of end-user demographics, including age, income, lifestyle, and dietary preferences, segmenting the market to reveal key consumer groups.

- M&A Activities: The report analyzes recent M&A activities within the French plant protein market, providing details on deal values and their strategic implications for market consolidation. For example, an acquisition valued at xx Million in 2022 significantly altered market dynamics.

France Plant Protein Market Market Dynamics & Trends

This section delves into the key market dynamics and trends shaping the France plant protein market. Factors impacting market growth include increasing consumer awareness of health benefits, expanding food and beverage applications, and rising demand from the animal feed industry.

The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration within specific end-user segments will also be examined, including the growth in plant-based meat alternatives and protein supplements. Technological disruptions, such as improvements in protein extraction and formulation, are also analyzed, alongside shifts in consumer preferences toward sustainable and ethically sourced ingredients. Competitive dynamics among key players, including pricing strategies, product differentiation, and marketing initiatives, are examined in detail.

Dominant Regions & Segments in France Plant Protein Market

This section identifies the leading regions and segments within the France plant protein market. While the report details regional variations, data suggests a relatively even distribution across France's key regions. However, specific regions might show higher growth rates based on factors like agricultural production, consumer preference and infrastructure development.

Key Drivers:

- Economic Policies: Government support for the agricultural sector and incentives for plant-based food production influence market growth.

- Infrastructure: Efficient transportation and logistics networks support the distribution and supply chain.

Dominant Segments: (Detailed analysis within the full report, including market size and growth projections for each segment)

- Protein Type: Pea protein, soy protein, and other plant proteins are expected to dominate this segment, with pea protein showing particularly strong growth due to its nutritional profile and sustainability.

- By End-User: The food and beverage sector is projected to be the largest end-user segment, followed by animal feed, and personal care and cosmetics.

France Plant Protein Market Product Innovations

Recent product developments have focused on improving the functional and nutritional properties of plant proteins, thereby addressing consumer demand for healthier, more sustainable food choices. The development of innovative formulations that enhance taste, texture, and nutritional profiles is key to driving market growth. Technological advancements such as improved extraction techniques and the creation of novel blends are shaping the market. These innovations aim to overcome limitations of certain plant proteins, such as off-flavors or low bioavailability.

Report Scope & Segmentation Analysis

This report segments the France plant protein market based on protein type (Hemp Protein, Oat Protein, Pea Protein, Potato Protein, Rice Protein, Soy Protein, Wheat Protein, Other Plant Protein) and end-user (Animal Feed, Personal Care and Cosmetics, Food and Beverages, Snacks & Supplements). Each segment is analyzed in detail, with market size estimates, growth projections, and competitive landscape analysis provided. Growth projections will vary by segment reflecting different market drivers and dynamics. For example, the animal feed segment may experience steady growth due to increasing demand for sustainable animal feed, while the food and beverage sector might show a slightly faster growth rate.

Key Drivers of France Plant Protein Market Growth

Several key factors are driving the growth of the France plant protein market. These include the increasing consumer demand for plant-based foods due to health concerns, environmental considerations and ethical preferences. Technological advances are allowing for the development of improved plant-based protein products with better taste, texture and functionality. Government support for the development of sustainable agricultural practices is also contributing to the growth of the plant protein market.

Challenges in the France Plant Protein Market Sector

The France plant protein market faces several challenges. These include the price competition from traditional animal protein sources, the relatively higher cost of producing some plant-based protein alternatives, and consumer perceptions related to the taste and texture of these products, as well as potential supply chain bottlenecks. Regulatory hurdles and inconsistent standards regarding labeling and claims in the food and beverage sector present further challenges.

Emerging Opportunities in France Plant Protein Market

Emerging opportunities in the France plant protein market include the development of new plant protein sources, the expansion of applications into new food and beverage categories, and the growth of the plant-based meat alternative market, driven by the rising popularity of vegetarian, vegan and flexitarian lifestyles. Opportunities also exist in functional foods and dietary supplements incorporating plant proteins for specific health benefits.

Leading Players in the France Plant Protein Market Market

- GEMEF Industries

- Cargill Incorporated

- Lantmännen

- Prinova Group LLC

- Tereos SCA

- DuPont de Nemours Inc

- Archer Daniels Midland Company

- Roquette Frères

- Kerry Group PLC

- Ingredion Incorporated

Key Developments in France Plant Protein Market Industry

- September 2021: Roquette Freres invested USD 13 Million in a new R&D center, boosting pea and wheat protein innovation.

- June 2022: Roquette launched NUTRALYS® rice protein, a high-quality, sustainable alternative.

- November 2022: Royal DSM introduced Vertis CanolaPRO, a premium canola protein isolate, expanding plant-based protein options.

Future Outlook for France Plant Protein Market Market

The France plant protein market is poised for significant growth, driven by sustained consumer demand for plant-based alternatives, technological advancements, and increased investments in research and development. Strategic partnerships, product diversification, and market expansion into new segments offer attractive growth opportunities for businesses in this dynamic market. The focus on sustainability and functional benefits will continue to shape the future of the plant protein market.

France Plant Protein Market Segmentation

-

1. Protein Type

- 1.1. Hemp Protein

- 1.2. Oat Protein

- 1.3. Pea Protein

- 1.4. Potato Protein

- 1.5. Rice Protein

- 1.6. Soy Protein

- 1.7. Wheat Protein

- 1.8. Other Protein Types

-

2. End User

- 2.1. Animal Feed

- 2.2. Personal Care and Cosmetics

-

2.3. Food and Beverages

- 2.3.1. Bakery

- 2.3.2. Breakfast Cereals

- 2.3.3. Condiments/Sauces

- 2.3.4. Confectionery

- 2.3.5. Dairy and Dairy Alternative Products

- 2.3.6. Meat/Poultry/Seafood and Meat Alternative Products

- 2.3.7. RTE/RTC Food Products

- 2.3.8. Snacks

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sports/Performance Nutrition

France Plant Protein Market Segmentation By Geography

- 1. France

France Plant Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidence of Obesity and Cadiovascular Diseases; Growing Trend of Veganism Drives the Market

- 3.3. Market Restrains

- 3.3.1. Associated Allergies With Plant Proteins

- 3.4. Market Trends

- 3.4.1. Increased Application of Pea Protein

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Plant Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 5.1.1. Hemp Protein

- 5.1.2. Oat Protein

- 5.1.3. Pea Protein

- 5.1.4. Potato Protein

- 5.1.5. Rice Protein

- 5.1.6. Soy Protein

- 5.1.7. Wheat Protein

- 5.1.8. Other Protein Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Food and Beverages

- 5.2.3.1. Bakery

- 5.2.3.2. Breakfast Cereals

- 5.2.3.3. Condiments/Sauces

- 5.2.3.4. Confectionery

- 5.2.3.5. Dairy and Dairy Alternative Products

- 5.2.3.6. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.3.7. RTE/RTC Food Products

- 5.2.3.8. Snacks

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sports/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 GEMEF Industries

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cargill Incorporated

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lantmännen

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Prinova Group LLC*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tereos SCA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DuPont de Nemours Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Archer Daniels Midland Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Roquette Frères

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kerry Group PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ingredion Incorporated

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 GEMEF Industries

List of Figures

- Figure 1: France Plant Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Plant Protein Market Share (%) by Company 2024

List of Tables

- Table 1: France Plant Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Plant Protein Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: France Plant Protein Market Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 4: France Plant Protein Market Volume K Tons Forecast, by Protein Type 2019 & 2032

- Table 5: France Plant Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: France Plant Protein Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 7: France Plant Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: France Plant Protein Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: France Plant Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: France Plant Protein Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: France Plant Protein Market Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 12: France Plant Protein Market Volume K Tons Forecast, by Protein Type 2019 & 2032

- Table 13: France Plant Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: France Plant Protein Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 15: France Plant Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: France Plant Protein Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Plant Protein Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the France Plant Protein Market?

Key companies in the market include GEMEF Industries, Cargill Incorporated, Lantmännen, Prinova Group LLC*List Not Exhaustive, Tereos SCA, DuPont de Nemours Inc, Archer Daniels Midland Company, Roquette Frères, Kerry Group PLC, Ingredion Incorporated.

3. What are the main segments of the France Plant Protein Market?

The market segments include Protein Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 88 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidence of Obesity and Cadiovascular Diseases; Growing Trend of Veganism Drives the Market.

6. What are the notable trends driving market growth?

Increased Application of Pea Protein.

7. Are there any restraints impacting market growth?

Associated Allergies With Plant Proteins.

8. Can you provide examples of recent developments in the market?

November 2022: Royal DSM introduced Vertis CanolaPRO, a premium canola protein isolate. According to the company, this innovative product elevates the protein content of plant-based foods and beverages while remaining free from major allergens. When incorporated into a protein blending strategy, Vertis CanolaPRO synergizes effectively with legume and cereal proteins, addressing gaps in essential amino acids.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Plant Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Plant Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Plant Protein Market?

To stay informed about further developments, trends, and reports in the France Plant Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence