Key Insights

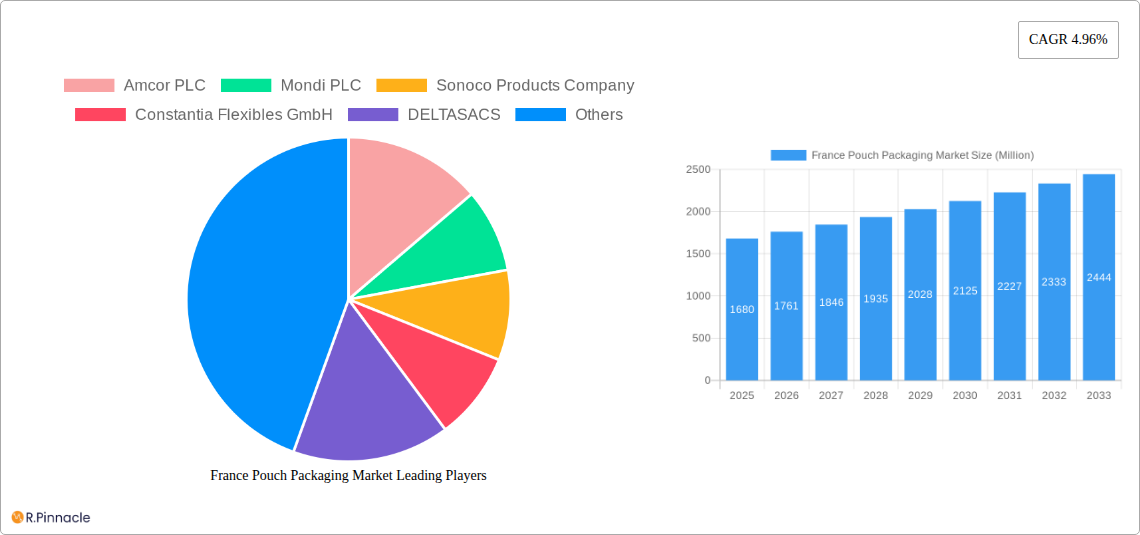

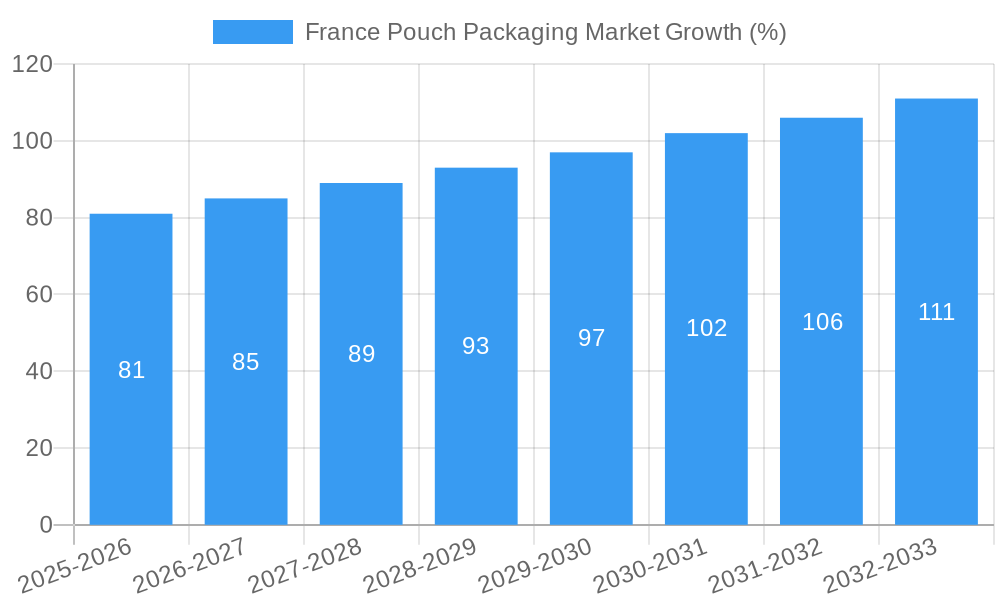

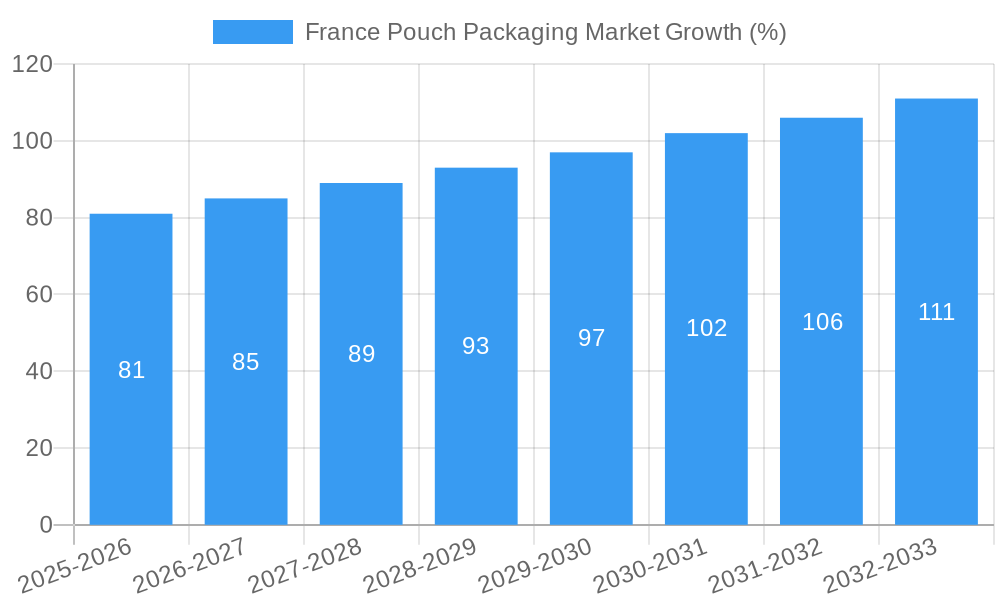

The France pouch packaging market, valued at €1.68 billion in 2025, is projected to experience robust growth, driven by the increasing demand for convenient and flexible packaging solutions across various food and beverage sectors. The market's Compound Annual Growth Rate (CAGR) of 4.96% from 2025 to 2033 indicates a steady expansion, fueled by factors such as the rising popularity of single-serve portions, the growing preference for sustainable and eco-friendly packaging materials, and the increasing adoption of advanced packaging technologies to enhance product shelf life and preservation. Key market segments likely include flexible pouches for food (e.g., snacks, sauces, ready meals), beverages (e.g., juice, coffee), and non-food items (e.g., cosmetics, pharmaceuticals). The competitive landscape is characterized by both large multinational players like Amcor PLC, Mondi PLC, and Sonoco Products Company, and smaller regional players catering to specific market niches. The market’s growth trajectory is influenced by the evolving consumer preferences towards on-the-go consumption, e-commerce expansion driving demand for efficient and tamper-evident packaging, and regulatory changes related to packaging material composition and recyclability.

While precise segment-specific data is unavailable, it’s reasonable to infer that the food and beverage sector accounts for the lion’s share of the market in France, owing to the high consumption of processed food and beverages. The growth in the non-food segment might be slightly slower, though still positive, primarily driven by the cosmetic and pharmaceutical industries. Strong growth within the market is likely constrained by factors such as fluctuating raw material prices, evolving consumer preference for certain sustainable materials, and stringent government regulations related to packaging waste management. Companies will likely need to invest in sustainable packaging solutions and adopt innovative technologies to maintain market competitiveness and meet consumer demand for environmentally friendly alternatives. A deeper market segmentation analysis focusing on material type (e.g., stand-up pouches, spouted pouches), packaging technology (e.g., retort pouches, vacuum pouches), and application would provide a more granular understanding of the France pouch packaging market.

This comprehensive report provides a detailed analysis of the France pouch packaging market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market trends, competitive landscapes, and future growth potential. The report leverages rigorous research methodologies and incorporates real-world data to deliver actionable intelligence.

France Pouch Packaging Market Structure & Innovation Trends

This section analyzes the structure of the France pouch packaging market, examining market concentration, innovation drivers, regulatory frameworks, and competitive dynamics. The market is characterized by a mix of large multinational corporations and smaller specialized players.

Market Concentration: The market exhibits a moderately concentrated structure with a few dominant players holding significant market share. Amcor PLC, Mondi PLC, and Sonoco Products Company are amongst the leading players, collectively holding an estimated xx% market share in 2025. Smaller players like DELTASACS, Coveris Management GmbH, and BERNHARDT Packaging & Process compete by focusing on niche segments or specialized packaging solutions.

Innovation Drivers: Sustainability concerns are driving significant innovation, with a focus on eco-friendly materials (e.g., biodegradable and compostable pouches) and reduced packaging weight. Technological advancements in flexible packaging materials and printing techniques are also influencing innovation.

Regulatory Framework: Stringent EU regulations regarding food safety and packaging waste are shaping the market. Compliance with these regulations is a key challenge for companies, prompting investments in sustainable and compliant solutions.

Product Substitutes: Rigid packaging (bottles, cans) and alternative flexible packaging formats pose a competitive threat to pouch packaging. However, the versatility and cost-effectiveness of pouches continue to ensure its significant market share.

End-User Demographics: The primary end-users include the food and beverage industry (especially for beverages, sauces, and ready-to-eat meals), personal care products, and pharmaceuticals. Growing consumer demand for convenience and on-the-go consumption fuels market growth across all segments.

M&A Activities: Recent mergers and acquisitions (M&A) activity, such as the Constantia Flexibles acquisition of a significant stake in Aluflexpack AG (February 2024), signal ongoing consolidation and expansion within the market. The value of these transactions is estimated to have totaled xx Million in the period 2019-2024.

France Pouch Packaging Market Market Dynamics & Trends

The France pouch packaging market is experiencing robust growth, driven by several key factors. From 2019 to 2024, the market witnessed a Compound Annual Growth Rate (CAGR) of xx%, reaching an estimated value of xx Million in 2025. The forecast period (2025-2033) projects continued growth, albeit at a slightly moderated CAGR of xx%, reaching xx Million by 2033.

Several factors contribute to this growth. Increased consumer demand for convenient and portable packaging, particularly within the food and beverage sector, is a primary driver. Technological advancements leading to improved barrier properties, extended shelf life, and enhanced printing capabilities are also boosting market growth. The growing preference for sustainable packaging options is driving demand for eco-friendly pouch materials, creating opportunities for manufacturers offering such solutions. Intense competition among manufacturers is further leading to price reductions and innovations, making pouch packaging an increasingly attractive option for various end-use industries. Market penetration within various segments, especially the food and beverage sector, remains high, exceeding xx% in 2025.

Dominant Regions & Segments in France Pouch Packaging Market

The Île-de-France region dominates the France pouch packaging market, accounting for approximately xx% of the total market value in 2025. This dominance is attributable to several factors:

Strong economic activity and high consumer spending: The region's robust economy and high disposable incomes drive demand for packaged goods.

Concentrated manufacturing base: A significant number of food and beverage processing plants are located within the region, creating substantial demand for packaging solutions.

Well-developed infrastructure: Efficient logistics and transportation networks facilitate smooth supply chain operations and distribution of packaged goods.

Other regions, such as Hauts-de-France and Auvergne-Rhône-Alpes, also contribute significantly to the market, but their market share remains smaller compared to Île-de-France. In terms of segments, the food and beverage industry is the largest end-user, followed by the personal care and pharmaceutical sectors.

France Pouch Packaging Market Product Innovations

Recent product developments have focused on sustainable and functional innovations. Biodegradable and compostable materials are gaining traction, along with improved barrier properties to extend shelf life. Advancements in printing techniques allow for enhanced branding and product differentiation. These innovations cater to the rising consumer demand for eco-friendly and convenient packaging solutions.

Report Scope & Segmentation Analysis

This report segments the France pouch packaging market based on material type (e.g., plastic, paper, foil), packaging type (e.g., stand-up pouches, spouted pouches), end-use industry (e.g., food and beverage, personal care, pharmaceuticals), and region. Each segment's growth projections, market sizes (in Million), and competitive dynamics are thoroughly analyzed. For example, the food and beverage segment is projected to maintain a significant market share throughout the forecast period, with a CAGR of xx%. Competitive intensity within this segment is high, with leading players focusing on differentiated offerings to gain a competitive edge.

Key Drivers of France Pouch Packaging Market Growth

Several factors contribute to the France pouch packaging market's growth. These include:

Growing demand for convenient packaging: Consumers increasingly prefer convenient and portable packaging formats.

Technological advancements: Innovations in materials and printing technologies enhance pouch functionality and appeal.

Favorable regulatory environment: While stringent, the regulatory environment encourages sustainable packaging practices, fostering innovation.

Challenges in the France Pouch Packaging Market Sector

Despite the growth opportunities, the France pouch packaging market faces challenges. These include:

Fluctuating raw material prices: Increases in the cost of raw materials can impact profitability.

Stringent environmental regulations: Meeting regulatory requirements for sustainable packaging adds to manufacturing costs.

Intense competition: Competition among established players and new entrants can pressure margins.

Emerging Opportunities in France Pouch Packaging Market

Several emerging opportunities exist within the France pouch packaging market. These include:

Growing demand for sustainable packaging: This presents opportunities for manufacturers offering eco-friendly solutions.

Expansion into niche markets: Specialized pouches for specific applications (e.g., medical, industrial) are creating new market segments.

Adoption of advanced technologies: Smart packaging technologies and digital printing offer opportunities for enhanced branding and product traceability.

Leading Players in the France Pouch Packaging Market Market

- Amcor PLC

- Mondi PLC

- Sonoco Products Company

- Constantia Flexibles GmbH

- DELTASACS

- Coveris Management GmbH

- BERNHARDT Packaging & Process

- Huhtamaki Oyj

Key Developments in France Pouch Packaging Market Industry

February 2024: Constantia Flexibles' acquisition of a significant stake in Aluflexpack AG strengthens its position in the French market. This move reflects the ongoing consolidation within the industry.

August 2023: Capri Sun's decision to reclaim sales and distribution in France highlights the increasing importance of brand control and direct-to-consumer strategies. This shift could influence pouch packaging demand.

Future Outlook for France Pouch Packaging Market Market

The France pouch packaging market is poised for continued growth, driven by innovation in sustainable materials, technological advancements, and increasing consumer demand for convenient and eco-friendly packaging. Strategic partnerships, investments in R&D, and expansion into niche markets are key factors determining future success for companies in this sector. The market's future growth is closely tied to the adoption of sustainable materials and innovative packaging designs, creating significant opportunities for companies that can effectively address the growing environmental concerns and consumer preferences.

France Pouch Packaging Market Segmentation

-

1. Material

-

1.1. Plastic

- 1.1.1. Polyethylene

- 1.1.2. Polypropylene

- 1.1.3. PET

- 1.1.4. PVC

- 1.1.5. EVOH

- 1.1.6. Other Resins

- 1.2. Paper

- 1.3. Aluminum

-

1.1. Plastic

-

2. Product

- 2.1. Flat (Pillow & Side-Seal)

- 2.2. Stand-up

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

France Pouch Packaging Market Segmentation By Geography

- 1. France

France Pouch Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Impact of Macroeconomic Factors Such as Demographics and Consumer Trends; Surge in Tourism Activity

- 3.3. Market Restrains

- 3.3.1. Impact of Macroeconomic Factors Such as Demographics and Consumer Trends; Surge in Tourism Activity

- 3.4. Market Trends

- 3.4.1. Stand-up Pouches to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Pouch Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.1.1. Polyethylene

- 5.1.1.2. Polypropylene

- 5.1.1.3. PET

- 5.1.1.4. PVC

- 5.1.1.5. EVOH

- 5.1.1.6. Other Resins

- 5.1.2. Paper

- 5.1.3. Aluminum

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Flat (Pillow & Side-Seal)

- 5.2.2. Stand-up

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Amcor PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mondi PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sonoco Products Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Constantia Flexibles GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DELTASACS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Coveris Management GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BERNHARDT Packaging & Process

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huhtamaki Oyj10 2 Heat Map Analysi

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Amcor PLC

List of Figures

- Figure 1: France Pouch Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Pouch Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: France Pouch Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Pouch Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: France Pouch Packaging Market Revenue Million Forecast, by Material 2019 & 2032

- Table 4: France Pouch Packaging Market Volume Billion Forecast, by Material 2019 & 2032

- Table 5: France Pouch Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 6: France Pouch Packaging Market Volume Billion Forecast, by Product 2019 & 2032

- Table 7: France Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 8: France Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 9: France Pouch Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: France Pouch Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: France Pouch Packaging Market Revenue Million Forecast, by Material 2019 & 2032

- Table 12: France Pouch Packaging Market Volume Billion Forecast, by Material 2019 & 2032

- Table 13: France Pouch Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: France Pouch Packaging Market Volume Billion Forecast, by Product 2019 & 2032

- Table 15: France Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 16: France Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 17: France Pouch Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: France Pouch Packaging Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Pouch Packaging Market?

The projected CAGR is approximately 4.96%.

2. Which companies are prominent players in the France Pouch Packaging Market?

Key companies in the market include Amcor PLC, Mondi PLC, Sonoco Products Company, Constantia Flexibles GmbH, DELTASACS, Coveris Management GmbH, BERNHARDT Packaging & Process, Huhtamaki Oyj10 2 Heat Map Analysi.

3. What are the main segments of the France Pouch Packaging Market?

The market segments include Material, Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Impact of Macroeconomic Factors Such as Demographics and Consumer Trends; Surge in Tourism Activity.

6. What are the notable trends driving market growth?

Stand-up Pouches to Witness Growth.

7. Are there any restraints impacting market growth?

Impact of Macroeconomic Factors Such as Demographics and Consumer Trends; Surge in Tourism Activity.

8. Can you provide examples of recent developments in the market?

February 2024: Constantia Flexibles, a global packaging manufacturer, agreed to purchase around 57% of Aluflexpack AG's shares from Montana Tech Components AG and Xoris GmbH. Aluflexpack, with its production sites primarily in France and other European nations, presents an appealing opportunity for Constantia to bolster its presence, especially in France.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Pouch Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Pouch Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Pouch Packaging Market?

To stay informed about further developments, trends, and reports in the France Pouch Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence