Key Insights

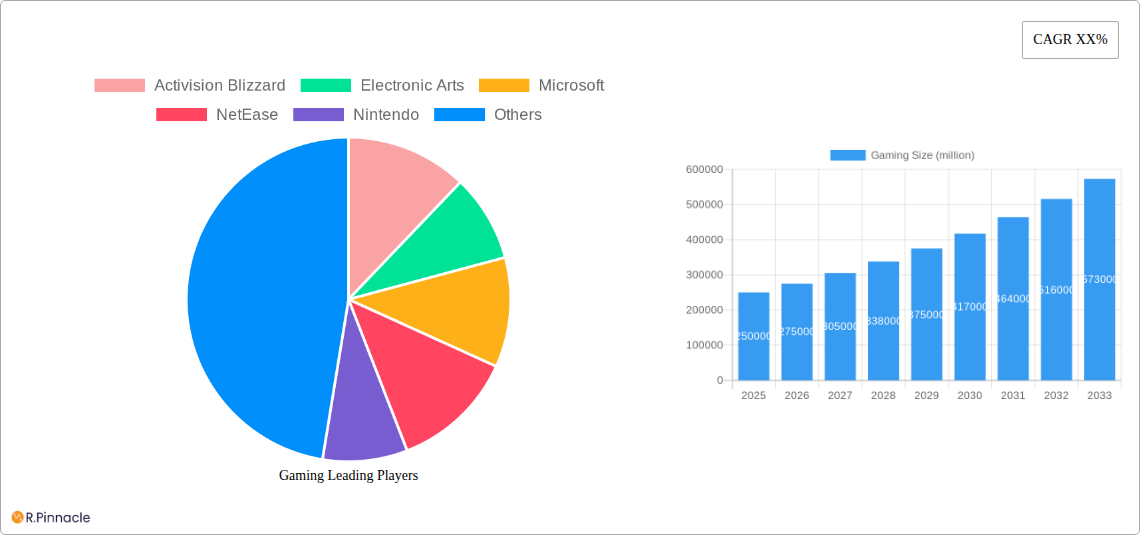

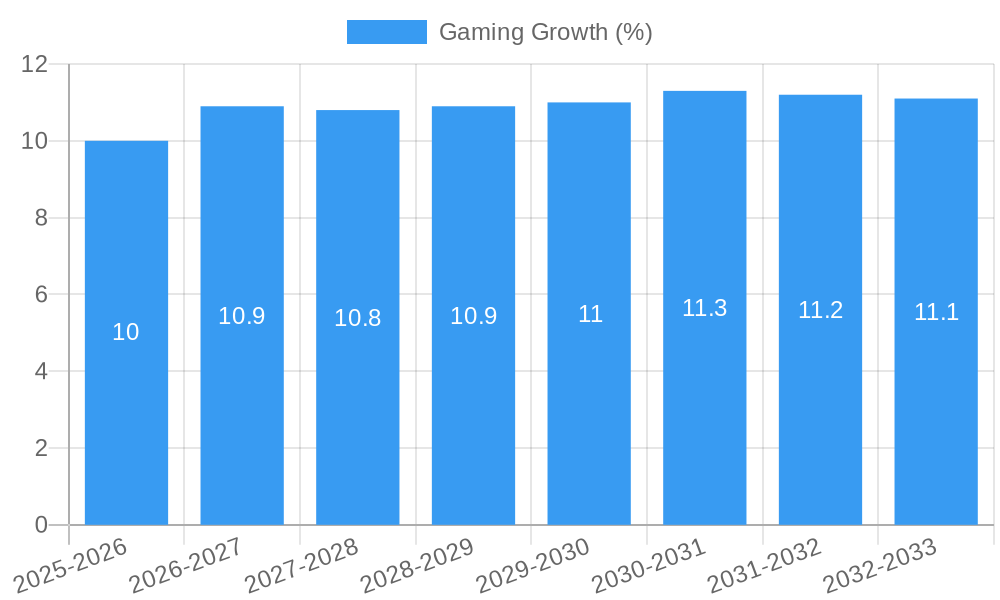

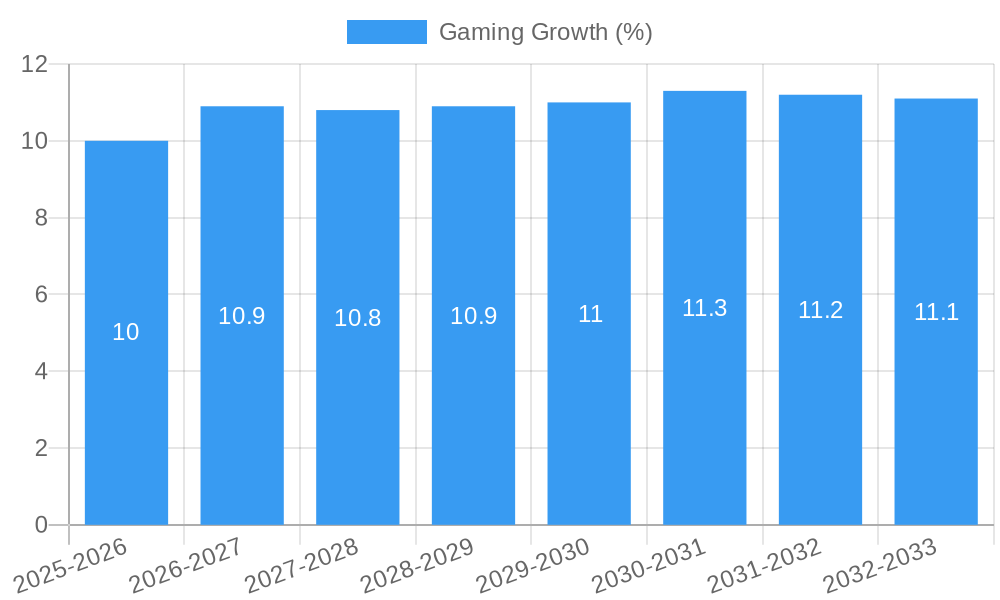

The global gaming market is experiencing robust growth, projected to reach approximately USD 250 billion by 2025, with a significant Compound Annual Growth Rate (CAGR) of around 10-12% anticipated throughout the forecast period (2025-2033). This expansion is primarily fueled by the increasing accessibility of high-speed internet and mobile devices, alongside the ever-evolving landscape of game development and content creation. The professional segment, encompassing esports and competitive gaming, is a key driver, attracting substantial investment and viewership. Furthermore, the proliferation of cloud gaming services and the integration of augmented reality (AR) and virtual reality (VR) technologies are broadening the appeal of gaming to a wider demographic, transcending traditional gamer archetypes. The market is also witnessing a surge in user-generated content and the rise of social gaming experiences, fostering strong community engagement and prolonged player retention.

The gaming industry's dynamism is further underscored by the diverse range of applications and types catering to distinct player preferences. From immersive console and PC gaming experiences to the widespread adoption of mobile gaming, the market caters to both casual and dedicated enthusiasts. Key market restraints include the rising costs of game development and potential concerns around intellectual property rights and cybersecurity. However, the innovative strategies employed by major players like Activision Blizzard, Electronic Arts, Microsoft, Sony, and Tencent, coupled with burgeoning markets in the Asia Pacific region, are expected to propel the industry forward. Emerging trends such as the metaverse, play-to-earn (P2E) models, and the continued evolution of esports infrastructure will undoubtedly shape the future trajectory of this multi-billion dollar industry.

This comprehensive report offers an in-depth analysis of the global Gaming market, providing actionable insights and strategic guidance for industry professionals. Covering the period from 2019 to 2033, with a base year of 2025, this study delves into market structure, dynamics, regional dominance, product innovations, growth drivers, challenges, and emerging opportunities. Leveraging high-ranking keywords and detailed segmentation, this report is your essential resource for navigating the evolving landscape of interactive entertainment.

Gaming Market Structure & Innovation Trends

The global Gaming market, projected to exceed XXX million by 2033, is characterized by a dynamic structure influenced by both established giants and agile newcomers. Market concentration is significant, with key players like Tencent, Sony, and Microsoft holding substantial shares, particularly in console and PC gaming. Innovation is primarily driven by advancements in graphical fidelity, virtual and augmented reality (VR/AR) technologies, and the continuous evolution of game engines. Regulatory frameworks, while varying by region, are increasingly focusing on issues such as data privacy, loot box mechanics, and age verification, impacting development and distribution strategies. Product substitutes, including streaming services and other forms of digital entertainment, exert a consistent pressure, necessitating continuous engagement and novel gameplay experiences. End-user demographics are broadening, with a substantial increase in the adoption of gaming among older demographics and a growing professional esports segment. Mergers and Acquisitions (M&A) activity remains robust, with an estimated XXX million in deal values over the historical period, driven by a desire to acquire talent, intellectual property, and expand market reach. For instance, the acquisition of Activision Blizzard by Microsoft significantly reshaped the industry's competitive landscape.

- Market Concentration: Dominated by a few key players in PC and Console segments.

- Innovation Drivers: VR/AR, AI in game development, cloud gaming infrastructure.

- Regulatory Frameworks: Focus on player protection and fair monetization practices.

- Product Substitutes: Streaming video, social media, other digital entertainment.

- End-User Demographics: Increasingly diverse, with growth in casual and older gamer segments.

- M&A Activities: Significant deal values driven by IP acquisition and market consolidation.

Gaming Market Dynamics & Trends

The Gaming market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX.X% from 2025 to 2033. This robust expansion is fueled by a confluence of factors, including increasing disposable incomes, wider internet penetration, and the proliferation of affordable gaming devices, particularly in emerging economies. Technological disruptions are at the forefront, with cloud gaming services like Xbox Cloud Gaming and PlayStation Now democratizing access to high-fidelity gaming experiences, lowering the barrier to entry for many consumers. The advent of 5G technology is further accelerating this trend, enabling seamless gameplay on mobile devices and reducing latency for online multiplayer experiences. Consumer preferences are rapidly evolving, with a growing demand for live-service games, user-generated content, and immersive storytelling. The rise of the metaverse concept is also influencing development, with companies exploring persistent virtual worlds that blend gaming, social interaction, and commerce. Competitive dynamics are intensifying, with both traditional publishers and new entrants vying for market share. The free-to-play (F2P) model, coupled with in-game purchases and battle passes, continues to be a dominant revenue stream, appealing to a broad audience. Esports, in particular, is experiencing exponential growth, transforming from a niche hobby into a mainstream spectator sport with substantial prize pools and sponsorship deals, attracting millions of viewers worldwide. This dynamic ecosystem encourages continuous innovation and strategic partnerships among companies like Tencent, Activision Blizzard, and Electronic Arts, all seeking to capture a larger portion of the expanding global gaming audience. Market penetration, especially in mobile gaming, has reached an estimated XX% globally, with significant room for growth in professional and niche segments.

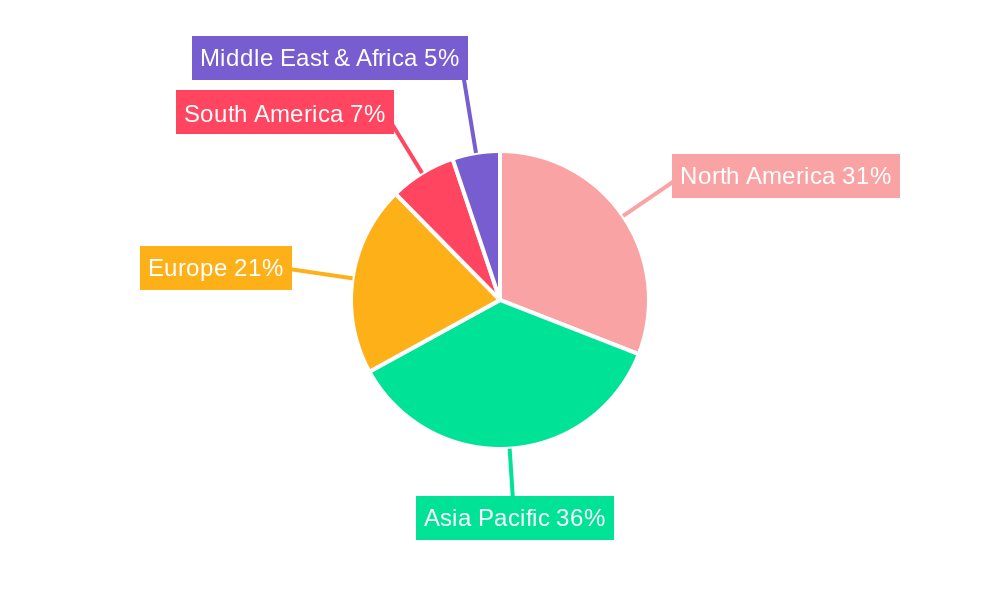

Dominant Regions & Segments in Gaming

The Asia Pacific region stands as the undisputed leader in the global Gaming market, driven by robust economic growth, a vast and tech-savvy population, and significant investment in gaming infrastructure. China, in particular, is a dominant force, contributing a substantial portion of global gaming revenue through its leading companies like Tencent and NetEase. This dominance is underpinned by strong government support for the digital economy, widespread smartphone adoption facilitating mobile gaming's unparalleled penetration, and a highly engaged player base receptive to innovative gaming experiences.

In terms of Application, the Amateur segment overwhelmingly leads the market, accounting for an estimated XX% of the total. This is largely due to the accessibility and widespread availability of casual and mobile games, which appeal to a broad demographic seeking entertainment and social interaction. The Professional segment, encompassing esports and competitive gaming, is experiencing rapid growth and is projected to expand significantly throughout the forecast period, fueled by increasing prize pools, professional leagues, and media coverage.

Analyzing by Types, Mobile Gaming commands the largest market share, estimated at XX%. The accessibility of smartphones as gaming devices, coupled with the free-to-play model and continuous release of engaging mobile titles, makes it the most accessible and widely adopted gaming format. Console Gaming remains a significant segment, driven by dedicated gamers and the immersive experiences offered by platforms from Sony and Microsoft, with an estimated market share of XX%. PC Gaming continues to hold a strong position, particularly in the hardcore and esports communities, with a market share estimated at XX%, benefiting from high-performance hardware and a vast library of titles.

Key drivers for regional and segment dominance include:

- Economic Policies: Government initiatives promoting digital industries and technological development in regions like Asia Pacific.

- Infrastructure: Widespread availability of high-speed internet and mobile network coverage, crucial for online gaming.

- Consumer Preferences: A strong cultural inclination towards gaming and social digital engagement, particularly in Asian markets.

- Technological Advancements: Continuous innovation in mobile hardware, graphics processing, and cloud gaming infrastructure.

- Investment: Significant R&D spending and M&A activities by major players to acquire intellectual property and talent.

Gaming Product Innovations

The Gaming sector is witnessing a relentless wave of product innovations, fundamentally reshaping gameplay and user experience. Key developments include the integration of Artificial Intelligence (AI) for more dynamic NPC behavior and personalized game worlds, alongside the maturation of Virtual Reality (VR) and Augmented Reality (AR) technologies, offering unparalleled immersion. Cloud gaming platforms are expanding, democratizing access to AAA titles and reducing hardware dependency. Advancements in game engines and development tools are enabling more visually stunning and interactive experiences. Competitive advantages are being forged through unique gameplay mechanics, compelling narrative designs, and the creation of persistent, social metaverse-like environments. The focus is shifting towards cross-platform compatibility and player-generated content, fostering vibrant gaming communities and extending the lifecycle of titles.

Report Scope & Segmentation Analysis

This report meticulously segments the global Gaming market across key dimensions to provide granular insights. The Application segmentation divides the market into Amateur and Professional segments. The Amateur segment, representing the vast majority of gamers, focuses on entertainment and casual play, projected to grow at a steady pace of XX.X% annually. The Professional segment, encompassing competitive gaming and esports, is experiencing hyper-growth, with an estimated CAGR of XX.X%, driven by increasing investment and professionalization.

The Types segmentation analyzes the market across Mobile Gaming, Console Gaming, and PC Gaming. Mobile Gaming, projected to maintain its lead with an estimated market size of XXX million by 2033, benefits from widespread device adoption and accessibility. Console Gaming, expected to reach XXX million by 2033, continues to attract a dedicated user base with its high-fidelity experiences. PC Gaming, projected at XXX million by 2033, remains a crucial segment for hardcore gamers and esports, driven by performance and flexibility. Competitive dynamics within each segment are characterized by intense innovation and strategic partnerships.

Key Drivers of Gaming Growth

The global Gaming market's sustained growth is propelled by a synergistic interplay of technological, economic, and social factors. Technological advancements, particularly in mobile device capabilities, high-speed internet infrastructure (5G), and cloud computing, are democratizing access to sophisticated gaming experiences. Economic factors such as rising disposable incomes in developing nations and increased leisure time contribute to greater consumer spending on entertainment, with gaming being a prime beneficiary. Social trends like the growing acceptance of gaming as a mainstream hobby, the rise of the creator economy around gaming content, and the increasing integration of gaming into social platforms are also significant growth accelerators.

- Technological Advancements: Ubiquitous smartphone penetration, 5G deployment, and cloud gaming infrastructure.

- Economic Factors: Rising disposable incomes, particularly in emerging markets, and increased leisure spending.

- Social Trends: Mainstreaming of gaming, influencer culture, and the rise of esports as a spectator sport.

- Regulatory Support: Favorable government policies in some regions promoting digital industries.

Challenges in the Gaming Sector

Despite its robust growth trajectory, the Gaming sector faces several significant challenges that could impede its expansion. Regulatory hurdles, including evolving legislation around in-game purchases, data privacy, and content moderation, can create compliance burdens and uncertainties for developers and publishers. Supply chain disruptions, particularly for hardware components like GPUs and gaming consoles, can lead to production delays and inflated pricing, impacting availability and consumer access. Intense competitive pressures, with a constant influx of new titles and platforms, necessitate significant investment in marketing and innovation to capture and retain player attention. Furthermore, the increasing cost of game development and the challenge of monetizing games effectively in a crowded market are persistent concerns.

- Regulatory Scrutiny: Evolving laws on monetization, data privacy, and player protection.

- Hardware Shortages: Global supply chain issues impacting console and component availability.

- Market Saturation: High competition for player attention and revenue.

- Development Costs: Escalating budgets for AAA game production.

Emerging Opportunities in Gaming

The Gaming market is brimming with emerging opportunities, driven by technological innovation and evolving consumer behavior. The continued expansion of the metaverse concept presents a significant frontier for persistent, interactive virtual worlds that blend gaming, social interaction, and commerce. Advancements in Artificial Intelligence (AI) are opening doors for hyper-personalized gaming experiences and more sophisticated game design. The growth of cloud gaming is set to further democratize access, reaching new audiences and geographies. Furthermore, the increasing demand for inclusive gaming experiences and the potential of VR/AR technologies to create truly immersive entertainment present substantial growth avenues. The burgeoning esports market also offers significant opportunities for sponsorship, media rights, and talent development.

- Metaverse Development: Creation of persistent virtual worlds for social interaction and commerce.

- AI Integration: Advanced AI for personalized gameplay and dynamic content generation.

- Cloud Gaming Expansion: Reaching new markets and demographics through accessible streaming.

- VR/AR Immersion: Development of highly engaging and interactive virtual experiences.

Leading Players in the Gaming Market

- Activision Blizzard

- Electronic Arts

- Microsoft

- NetEase

- Nintendo

- Sony

- Tencent

- ChangYou

- DeNA

- GungHo

- Apple

- Nexon

- Sega

- Warner Bros

- Namco Bandai

- Ubisoft

- Square Enix

- Take-Two Interactive

- King Digital Entertainment

Key Developments in Gaming Industry

- 2019: Release of highly anticipated titles like Call of Duty: Modern Warfare and Death Stranding, showcasing advancements in graphics and gameplay. Launch of Apple Arcade, expanding the mobile gaming subscription model.

- 2020: The COVID-19 pandemic led to a surge in gaming engagement, with significant revenue growth across all segments. Launch of next-generation consoles PlayStation 5 and Xbox Series X/S.

- 2021: Continued growth of the esports scene with major tournament viewership and prize pools. Increased investment in cloud gaming platforms and infrastructure. Acquisition rumors and consolidation discussions intensified.

- 2022: Microsoft's acquisition of Activision Blizzard announced, a landmark deal significantly reshaping the industry landscape. Growing discourse around the metaverse and Web3 gaming.

- 2023: Advancements in AI for game development and content creation became more prominent. Continued expansion of cross-platform play and progression.

- 2024: Focus on refining cloud gaming capabilities and exploring new monetization strategies beyond traditional models. Increased emphasis on player retention through live-service games and community engagement.

Future Outlook for Gaming Market

The future outlook for the Gaming market remains exceptionally bright, characterized by sustained innovation and expansive growth. The continued integration of advanced technologies like AI and VR/AR will unlock unprecedented levels of immersion and personalized gameplay, attracting a broader audience. The metaverse, as it matures, is expected to become a significant new platform for gaming, social interaction, and digital economies. Cloud gaming's reach will expand, further democratizing access to high-quality gaming experiences. Strategic partnerships and potential M&A activities among major players will continue to shape the competitive landscape, driving consolidation and the pursuit of intellectual property. The esports sector is projected for continued exponential growth, evolving into a mainstream entertainment powerhouse. Overall, the market is poised to become even more dynamic, accessible, and integral to global entertainment consumption.

Gaming Segmentation

-

1. Application

- 1.1. Amateur

- 1.2. Professional

-

2. Types

- 2.1. Mobile Gaming

- 2.2. Console Gaming

- 2.3. PC Gaming

Gaming Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Gaming REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gaming Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Amateur

- 5.1.2. Professional

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Mobile Gaming

- 5.2.2. Console Gaming

- 5.2.3. PC Gaming

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Gaming Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Amateur

- 6.1.2. Professional

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Mobile Gaming

- 6.2.2. Console Gaming

- 6.2.3. PC Gaming

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Gaming Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Amateur

- 7.1.2. Professional

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Mobile Gaming

- 7.2.2. Console Gaming

- 7.2.3. PC Gaming

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Gaming Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Amateur

- 8.1.2. Professional

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Mobile Gaming

- 8.2.2. Console Gaming

- 8.2.3. PC Gaming

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Gaming Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Amateur

- 9.1.2. Professional

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Mobile Gaming

- 9.2.2. Console Gaming

- 9.2.3. PC Gaming

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Gaming Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Amateur

- 10.1.2. Professional

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Mobile Gaming

- 10.2.2. Console Gaming

- 10.2.3. PC Gaming

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Activision Blizzard

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Electronic Arts

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Microsoft

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NetEase

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nintendo

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sony

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tencent

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ChangYou

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DeNA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GungHo

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Apple

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Google

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Nexon

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sega

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Warner Bros

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Namco Bandai

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Ubisoft

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Square Enix

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Take-Two Interactive

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 King Digital Entertainment

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Activision Blizzard

List of Figures

- Figure 1: Global Gaming Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Gaming Revenue (million), by Application 2024 & 2032

- Figure 3: North America Gaming Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Gaming Revenue (million), by Types 2024 & 2032

- Figure 5: North America Gaming Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Gaming Revenue (million), by Country 2024 & 2032

- Figure 7: North America Gaming Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Gaming Revenue (million), by Application 2024 & 2032

- Figure 9: South America Gaming Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Gaming Revenue (million), by Types 2024 & 2032

- Figure 11: South America Gaming Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Gaming Revenue (million), by Country 2024 & 2032

- Figure 13: South America Gaming Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Gaming Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Gaming Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Gaming Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Gaming Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Gaming Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Gaming Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Gaming Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Gaming Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Gaming Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Gaming Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Gaming Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Gaming Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Gaming Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Gaming Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Gaming Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Gaming Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Gaming Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Gaming Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Gaming Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Gaming Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Gaming Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Gaming Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Gaming Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Gaming Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Gaming Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Gaming Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Gaming Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Gaming Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Gaming Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Gaming Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Gaming Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Gaming Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Gaming Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Gaming Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Gaming Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Gaming Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Gaming Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Gaming Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Gaming Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gaming?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Gaming?

Key companies in the market include Activision Blizzard, Electronic Arts, Microsoft, NetEase, Nintendo, Sony, Tencent, ChangYou, DeNA, GungHo, Apple, Google, Nexon, Sega, Warner Bros, Namco Bandai, Ubisoft, Square Enix, Take-Two Interactive, King Digital Entertainment.

3. What are the main segments of the Gaming?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gaming," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gaming report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gaming?

To stay informed about further developments, trends, and reports in the Gaming, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence