Key Insights

The global glasses market, valued at $178.98 million in 2025, is projected to experience robust growth, driven by several key factors. Increasing prevalence of refractive errors like myopia and hyperopia, coupled with a rising aging population requiring vision correction, significantly fuels market expansion. The burgeoning demand for fashionable eyewear, particularly sunglasses and designer spectacles, further contributes to this growth. Technological advancements in lens technology, including progressive lenses and photochromic lenses, offer enhanced visual comfort and functionality, boosting consumer preference. Moreover, the expanding e-commerce sector provides convenient access to a wider range of products and brands, facilitating market penetration. Online retailers are increasingly offering virtual try-on tools and personalized recommendations, improving the customer experience and driving sales. The market is segmented by distribution channels (offline and online) and product types (spectacles, sunglasses, contact lenses, and other products). Offline channels currently dominate, but online channels are rapidly gaining traction, reflecting evolving consumer preferences and the increased accessibility of e-commerce platforms. Major players like EssilorLuxottica, Johnson & Johnson, and Safilo Group are shaping market dynamics through innovation, brand building, and strategic acquisitions. While pricing pressures and the availability of cheaper alternatives present some challenges, the overall market outlook remains positive, driven by the consistent need for vision correction and the continuously evolving fashion trends in eyewear.

Glasses Market Market Size (In Million)

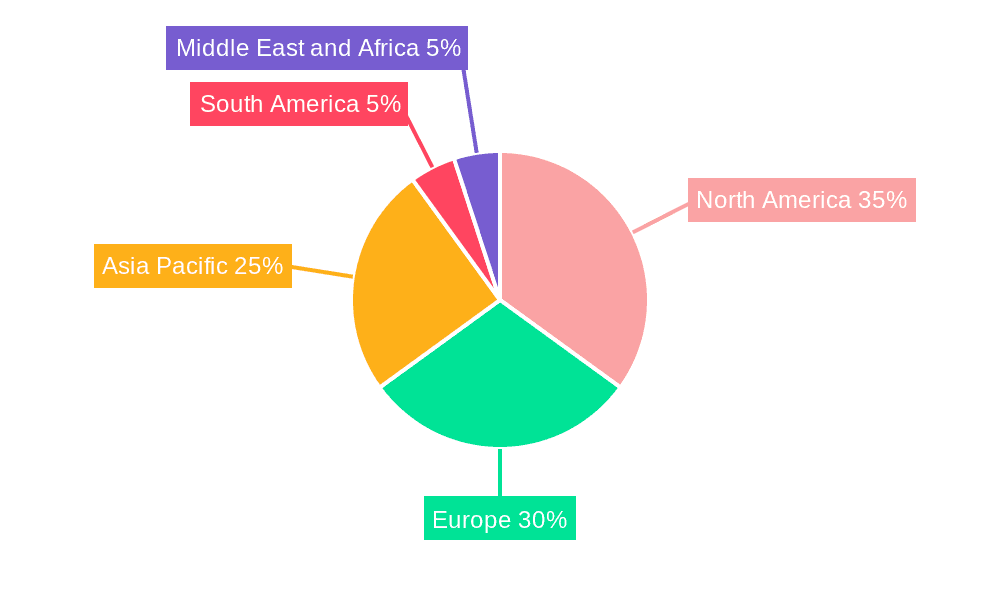

The geographical distribution of the glasses market reveals significant regional variations. North America and Europe currently hold substantial market shares, attributable to high disposable incomes and established healthcare infrastructure. However, the Asia-Pacific region is poised for considerable growth, fueled by a large and rapidly expanding population, rising middle-class incomes, and increased awareness of eye health. Emerging markets in South America and the Middle East and Africa also present significant growth opportunities, albeit with varying degrees of market penetration and infrastructure development. Future market growth will depend on factors such as the continued adoption of innovative lens technologies, the expansion of e-commerce penetration, and the successful penetration of underserved regions. Sustained investment in eye health awareness campaigns will further contribute to market expansion by raising consumer awareness of the need for proper vision correction and eye care.

Glasses Market Company Market Share

Glasses Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the global Glasses Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025, this report projects a market valued at xx Million by the estimated year and xx Million by 2033. The study meticulously examines market structure, dynamics, segmentation, key players, and future outlook, incorporating recent industry developments to provide a holistic understanding of this dynamic sector.

Glasses Market Structure & Innovation Trends

The Glasses Market is characterized by a mix of large multinational corporations and smaller, specialized players. Market concentration is moderate, with EssilorLuxottica SA and Safilo Group SpA holding significant market share, though precise figures are proprietary and vary by segment. Innovation is driven by advancements in lens technology (e.g., progressive lenses, blue light filtering), frame materials (e.g., lightweight plastics, sustainable materials), and smart eyewear integration. Regulatory frameworks concerning safety and labeling vary across regions, impacting product development and market access. Product substitutes include contact lenses and refractive surgeries, exerting competitive pressure. The end-user demographic is broad, encompassing all age groups, with specific needs driving product diversification. M&A activity has been significant, with deal values exceeding xx Million in recent years, consolidating market share and driving innovation through technology transfer and market expansion. Examples include:

- High-Value Mergers & Acquisitions: While precise deal values are often confidential, significant M&A activity signals market consolidation and innovation. Analysis indicates a trend towards larger players acquiring smaller, specialized firms.

- Market Share Distribution: EssilorLuxottica SA and Safilo Group SpA hold substantial market shares, but a fragmented landscape exists with many smaller players competing in niche segments.

Glasses Market Dynamics & Trends

The Glasses Market demonstrates robust growth, driven by factors such as increasing prevalence of refractive errors, rising disposable incomes in emerging economies, and the growing adoption of fashionable eyewear. Technological disruptions, such as the integration of smart technologies in eyewear and the rise of personalized lens solutions, are reshaping the market landscape. Shifting consumer preferences towards stylish, functional, and technologically advanced eyewear are key drivers. Intense competition, particularly among large players, is leading to strategic partnerships, product diversification, and aggressive marketing campaigns. The market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033), with significant market penetration in developing regions. Furthermore, the rise of online sales channels is transforming distribution dynamics and consumer behavior.

Dominant Regions & Segments in Glasses Market

The global Glasses Market is characterized by diverse regional dynamics and segment preferences. While granular data is detailed within the comprehensive report, North America and Europe are anticipated to maintain their strong market positions, fueled by high disposable incomes and sophisticated healthcare systems. The Asia-Pacific region is set for substantial growth, propelled by an expanding middle class and a growing emphasis on accessible and advanced eye care solutions.

-

Leading Segment: Spectacles continue to lead the market, followed by sunglasses, contact lenses, and other eyewear categories. The enduring popularity of spectacles stems from their essential role in vision correction for a broad demographic.

-

Distribution Channel Dominance: The offline channel currently commands the largest market share. This is attributed to established retail networks, the invaluable service of personalized fitting, and a consumer preference for professional eye assessments. Nevertheless, the online channel is experiencing accelerated growth, driven by increasingly sophisticated e-commerce platforms, greater product accessibility, and the inherent convenience it offers.

-

Key Regional Drivers:

- North America: Elevated per capita income and a robust, advanced healthcare infrastructure.

- Europe: A mature eye care market with high adoption rates for innovative eyewear technologies and a strong consumer demand for specialized vision solutions.

- Asia-Pacific: A rapidly expanding middle class, burgeoning disposable incomes, and a significant rise in awareness regarding the importance of eye health and regular check-ups.

Glasses Market Product Innovations

Recent years have seen significant innovation in glasses, driven by technological advancements and changing consumer preferences. Smart glasses integrating augmented reality features, personalized lens designs offering customized vision correction, and sustainable frame materials are some of the notable advancements. The market is also witnessing the growth of customizable eyewear, catering to individual preferences and style. These innovations aim to enhance user experience, address specific vision needs, and align with growing environmental consciousness.

Report Scope & Segmentation Analysis

This report meticulously segments the Glasses Market by distribution channel (Offline Channel, Online Channel) and product type (Spectacles, Sunglasses, Contact Lenses, Other Product Types). Each segment is rigorously analyzed, incorporating historical performance, current market valuations, future growth trajectories, and the competitive landscape. Precise market size estimations and Compound Annual Growth Rate (CAGR) projections for every segment are comprehensively detailed in the full report.

-

Distribution Channel Segmentation: Both the Offline and Online channels are dissected individually, taking into account their respective market sizes, growth rates, evolving consumer behaviors, and the strategic approaches employed in their distribution.

-

Product Type Segmentation: Every product category—Spectacles, Sunglasses, Contact Lenses, and Other Product Types—undergoes in-depth examination, evaluating market size, growth dynamics, and specific innovations or trends influencing each sub-segment.

Key Drivers of Glasses Market Growth

Several key factors contribute to the robust growth of the Glasses Market. Technological advancements in lens technology, including progressive lenses and blue light filtering, provide better vision correction and eye protection, driving demand. Rising disposable incomes in developing economies fuel the adoption of eyewear, particularly in emerging markets with increasing awareness of eye health. Government initiatives promoting eye care access also contribute to market expansion.

Challenges in the Glasses Market Sector

The Glasses Market faces challenges such as intense competition, especially from established players, and the complexities of supply chains, potentially leading to price fluctuations and delays. Regulatory hurdles in certain regions, concerning safety standards and labeling, pose constraints on market expansion. Counterfeit products represent a significant threat, impacting both consumer safety and brand reputation.

Emerging Opportunities in Glasses Market

The Glasses Market is brimming with exciting new opportunities, particularly within emerging economies where eye care awareness is on a significant upswing. The seamless integration of smart technologies into eyewear, encompassing augmented reality (AR) and virtual reality (VR) functionalities, represents a potent avenue for future growth. Furthermore, the development of sustainable and eco-friendly eyewear solutions is gaining traction, catering to a growing segment of environmentally conscious consumers.

Leading Players in the Glasses Market Market

- Burberry Group PLC

- Carl-Zeiss-Stiftung

- Fielmann AG

- EssilorLuxottica SA

- De Rigo Vision SpA

- Bausch Health Companies Inc

- Johnson & Johnson Services Inc

- Alcon Laboratories Inc

- Charmant Group

- Safilo Group SpA

- The Cooper Companies Inc

Key Developments in Glasses Market Industry

- January 2024: Pair Eyewear's partnership with National Vision Inc. expands its reach and affordability.

- September 2023: Ray-Ban's launch of Meta smart glasses showcases technological advancements in the market.

- March 2022: Web Eyewear's new sunglasses collection demonstrates ongoing design innovation.

Future Outlook for Glasses Market Market

The Glasses Market is positioned for sustained and robust expansion, propelled by continuous technological advancements, heightened consumer awareness regarding ocular health, and the ongoing development of eye care infrastructure in developing regions. The increasing adoption of smart eyewear and personalized vision solutions will undoubtedly continue to shape market trends, fostering innovation in product development and strategies for market penetration. A growing emphasis on sustainable materials and ethical manufacturing practices will also be pivotal in defining the future trajectory of this dynamic and evolving market.

Glasses Market Segmentation

-

1. Product Type

- 1.1. Spectacles

- 1.2. Sunglasses

- 1.3. Contact Lenses

- 1.4. Other Product Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Unisex

-

3. Distribution Channel

- 3.1. Offline Channel

- 3.2. Online Channel

Glasses Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Glasses Market Regional Market Share

Geographic Coverage of Glasses Market

Glasses Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.08% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Vegan and Cruelty-free Products; Influence of Social Media on Young Adults

- 3.3. Market Restrains

- 3.3.1. Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Growing Popularity of Sports Sunglasses

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Glasses Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Spectacles

- 5.1.2. Sunglasses

- 5.1.3. Contact Lenses

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Unisex

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Channel

- 5.3.2. Online Channel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Glasses Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Spectacles

- 6.1.2. Sunglasses

- 6.1.3. Contact Lenses

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Unisex

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Offline Channel

- 6.3.2. Online Channel

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Glasses Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Spectacles

- 7.1.2. Sunglasses

- 7.1.3. Contact Lenses

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Unisex

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Offline Channel

- 7.3.2. Online Channel

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Glasses Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Spectacles

- 8.1.2. Sunglasses

- 8.1.3. Contact Lenses

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Unisex

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Offline Channel

- 8.3.2. Online Channel

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Glasses Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Spectacles

- 9.1.2. Sunglasses

- 9.1.3. Contact Lenses

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Unisex

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Offline Channel

- 9.3.2. Online Channel

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Glasses Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Spectacles

- 10.1.2. Sunglasses

- 10.1.3. Contact Lenses

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Men

- 10.2.2. Women

- 10.2.3. Unisex

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Offline Channel

- 10.3.2. Online Channel

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Burberry Group PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Carl-Zeiss-Stiftung

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fielmann AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 EssilorLuxottica SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 De Rigo Vision SpA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bausch Health Companies Inc *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson & Johnson Services Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Alcon Laboratories Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Charmant Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Safilo Group SpA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 The Cooper Companies Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Burberry Group PLC

List of Figures

- Figure 1: Global Glasses Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Glasses Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Glasses Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Glasses Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Glasses Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Glasses Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Glasses Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Glasses Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Glasses Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Glasses Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Glasses Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Glasses Market Revenue (Million), by End User 2025 & 2033

- Figure 13: Europe Glasses Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: Europe Glasses Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: Europe Glasses Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Glasses Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Glasses Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Glasses Market Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Glasses Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Glasses Market Revenue (Million), by End User 2025 & 2033

- Figure 21: Asia Pacific Glasses Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: Asia Pacific Glasses Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Glasses Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Glasses Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Glasses Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Glasses Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: South America Glasses Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Glasses Market Revenue (Million), by End User 2025 & 2033

- Figure 29: South America Glasses Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Glasses Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: South America Glasses Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Glasses Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Glasses Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Glasses Market Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Middle East and Africa Glasses Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East and Africa Glasses Market Revenue (Million), by End User 2025 & 2033

- Figure 37: Middle East and Africa Glasses Market Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East and Africa Glasses Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Middle East and Africa Glasses Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East and Africa Glasses Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Glasses Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Glasses Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Glasses Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Glasses Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Glasses Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Glasses Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Glasses Market Revenue Million Forecast, by End User 2020 & 2033

- Table 7: Global Glasses Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Glasses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Glasses Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Glasses Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Glasses Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Glasses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Spain Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Germany Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: France Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Italy Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Russia Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Glasses Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 25: Global Glasses Market Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Global Glasses Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Glasses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: China Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Japan Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: India Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Australia Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Glasses Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Global Glasses Market Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global Glasses Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Glasses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Glasses Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 41: Global Glasses Market Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global Glasses Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global Glasses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: South Africa Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Saudi Arabia Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East and Africa Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Glasses Market?

The projected CAGR is approximately 5.08%.

2. Which companies are prominent players in the Glasses Market?

Key companies in the market include Burberry Group PLC, Carl-Zeiss-Stiftung, Fielmann AG, EssilorLuxottica SA, De Rigo Vision SpA, Bausch Health Companies Inc *List Not Exhaustive, Johnson & Johnson Services Inc, Alcon Laboratories Inc, Charmant Group, Safilo Group SpA, The Cooper Companies Inc.

3. What are the main segments of the Glasses Market?

The market segments include Product Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 178.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Vegan and Cruelty-free Products; Influence of Social Media on Young Adults.

6. What are the notable trends driving market growth?

Growing Popularity of Sports Sunglasses.

7. Are there any restraints impacting market growth?

Counterfeit Products.

8. Can you provide examples of recent developments in the market?

January 2024: Pair Eyewear, the direct-to-consumer customizable eyewear brand, unveiled a new partnership with National Vision Inc., the second-largest optical retailer in America. The brand stated that this partnership helps introduce affordable bundles, including Pair’s customizable, stylish, and accessible eyewear.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Glasses Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Glasses Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Glasses Market?

To stay informed about further developments, trends, and reports in the Glasses Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence