Key Insights

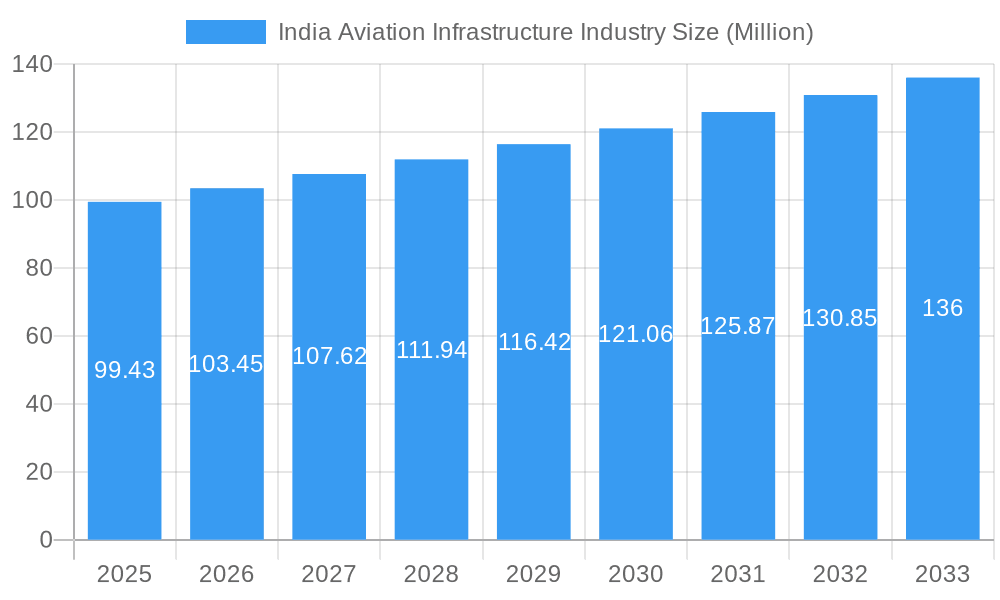

The Indian aviation infrastructure market, valued at $99.43 million in 2025, is projected to experience robust growth, driven by increasing air passenger traffic, government initiatives promoting regional connectivity, and the expansion of both domestic and international air travel. A Compound Annual Growth Rate (CAGR) of 4.00% from 2025 to 2033 indicates a significant market expansion, with substantial investment opportunities across various segments. Key drivers include the modernization of existing airports, the development of new greenfield airports to cater to rising demand, and a focus on enhancing passenger experience through improved infrastructure and services. The burgeoning middle class and rising disposable incomes fuel this growth, further supported by government policies aimed at boosting tourism and regional connectivity schemes. While challenges exist, such as land acquisition complexities and regulatory hurdles, the overall market outlook remains positive, with significant potential for growth in areas like airport construction, technological upgrades (e.g., smart airports), and specialized infrastructure like cargo handling facilities.

India Aviation Infrastructure Industry Market Size (In Million)

The market is segmented by airport type (commercial, military, general aviation), infrastructure type (terminals, control towers, runways, aprons, hangars), and construction type (greenfield, brownfield). Major players like Adani Group, L&T Construction, GVK Industries, and GMR Infrastructure are actively shaping the market landscape through strategic partnerships and investments. Regional variations exist, with potentially higher growth in regions experiencing rapid urbanization and economic development. The forecast period (2025-2033) presents significant opportunities for both domestic and international players seeking to capitalize on India's expanding aviation sector and the government's ambitious infrastructure development plans. Further research into specific sub-segments like air traffic management systems and sustainable airport infrastructure would reveal more granular insights into investment opportunities.

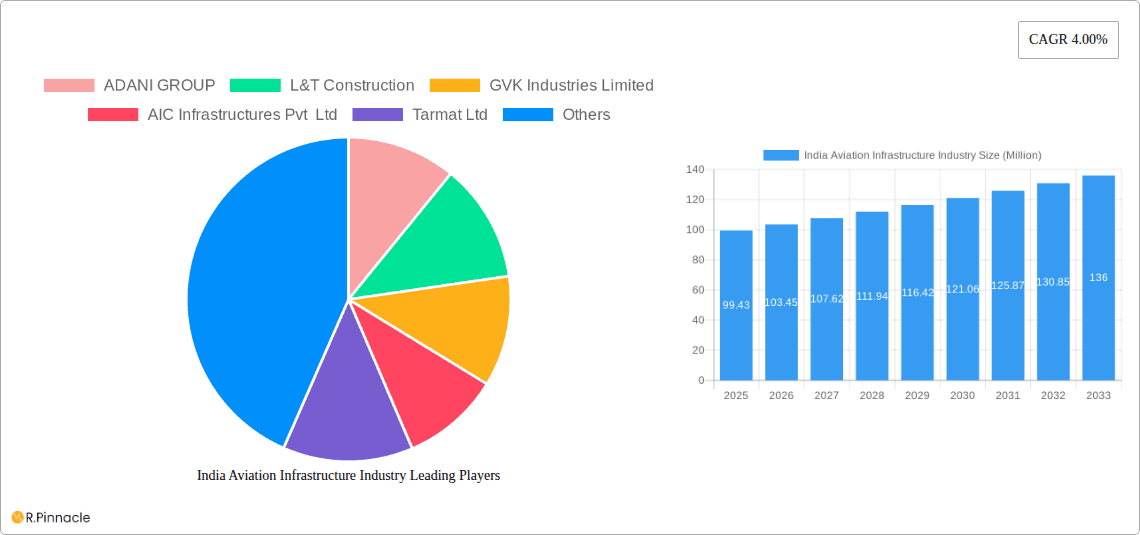

India Aviation Infrastructure Industry Company Market Share

India Aviation Infrastructure Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Indian aviation infrastructure industry, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report presents a granular view of market dynamics, key players, and future growth prospects. The report leverages extensive data analysis to provide actionable intelligence, focusing on market size, growth rate, and key trends across various segments.

India Aviation Infrastructure Industry Market Structure & Innovation Trends

The Indian aviation infrastructure market is characterized by a dynamic interplay of established players and emerging companies. Market concentration is moderate, with a few large players like ADANI GROUP and L&T Construction holding significant market share, estimated at xx% and xx% respectively in 2025. However, the presence of numerous smaller companies, including AIC Infrastructures Pvt Ltd and Tarmat Ltd, ensures a competitive landscape. M&A activity has been significant, with deal values totaling approximately XX Million in the period 2019-2024. Innovation is driven by the need for improved efficiency, enhanced passenger experience, and increased safety standards. Regulatory frameworks, while evolving, play a crucial role in shaping industry practices. Product substitutes, such as improved road and rail networks, present a competitive challenge, necessitating continuous innovation in airport infrastructure and services. End-user demographics are diverse, encompassing domestic and international travelers, cargo operators, and military entities.

- Market Share (2025, estimated):

- ADANI GROUP: xx%

- L&T Construction: xx%

- Others: xx%

- M&A Deal Value (2019-2024): Approximately XX Million

India Aviation Infrastructure Industry Market Dynamics & Trends

The Indian aviation infrastructure market exhibits robust growth, driven by surging air passenger traffic, increasing government investment in airport modernization, and the expansion of air connectivity to underserved regions. The CAGR for the forecast period (2025-2033) is projected to be xx%, fueled by factors such as increasing disposable incomes, the rise of low-cost carriers, and the government's focus on infrastructure development. Technological disruptions, such as the adoption of advanced technologies in airport operations and air traffic management, are enhancing efficiency and safety. Consumer preferences are shifting towards seamless travel experiences, with a demand for improved airport facilities and enhanced connectivity. Competitive dynamics are shaped by the ongoing investments and expansion plans of major players, coupled with the entry of new entrants into the market. Market penetration of Greenfield airports is expected to increase significantly, with an estimated xx% market penetration by 2033.

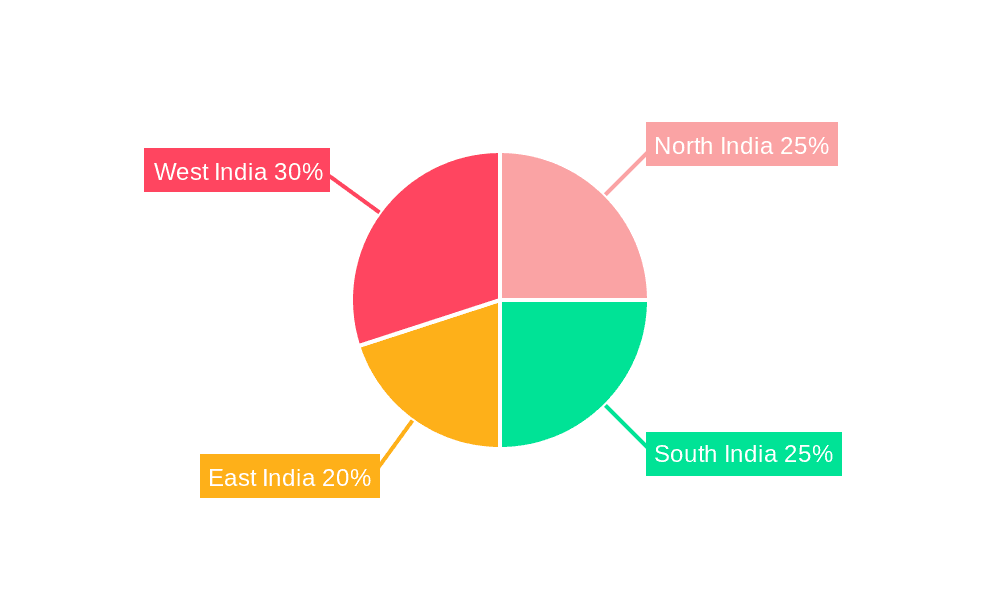

Dominant Regions & Segments in India Aviation Infrastructure Industry

While the entire country is witnessing growth, certain regions and segments are experiencing faster expansion. The southern and western regions of India demonstrate significant dominance, fueled by rapid economic growth and high passenger traffic.

Key Drivers:

- Economic Growth: Robust GDP growth in specific regions drives increased demand for air travel.

- Government Policies: Favorable government policies promoting infrastructure development are crucial.

- Tourism: Growing tourism contributes to the demand for enhanced airport infrastructure.

Dominant Segments:

- Airport Type: Commercial airports constitute the largest segment, accounting for xx% of the market in 2025. This is driven by the rising number of air travelers.

- Infrastructure Type: Terminals hold the largest share within infrastructure types, followed by Taxiways and Runways. The demand for modern and efficient terminals is particularly high.

- Airport Construction Type: Brownfield airport development currently dominates, reflecting the expansion and upgrades of existing facilities. However, Greenfield airport construction is expected to experience significant growth during the forecast period.

India Aviation Infrastructure Industry Product Innovations

Recent innovations focus on improving operational efficiency, enhancing passenger experience, and maximizing sustainability. Smart airport technologies, advanced air traffic management systems, and sustainable infrastructure designs are gaining traction. These innovations aim to optimize resource utilization, reduce operational costs, and improve overall airport efficiency. Companies are focusing on integrating technologies to provide seamless passenger journeys, from check-in to baggage claim, improving customer satisfaction and loyalty. The market fit for these innovations is high due to the increasing demand for efficient and sustainable airport infrastructure in India.

Report Scope & Segmentation Analysis

This report comprehensively segments the Indian aviation infrastructure market based on airport type (Commercial, Military, General Aviation), infrastructure type (Terminal, Control Tower, Taxiway & Runway, Apron, Hangar, Other), and airport construction type (Greenfield, Brownfield). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. The commercial airport segment is projected to experience the highest growth rate, followed by the Greenfield airport construction segment. The report also includes detailed analysis of individual infrastructure types within each airport segment.

Key Drivers of India Aviation Infrastructure Industry Growth

The growth of the Indian aviation infrastructure industry is primarily driven by a confluence of factors. These include significant increases in air passenger traffic, coupled with supportive government policies focused on infrastructure development. The expansion of low-cost carriers and the rising middle class are major contributors to increased travel demand. Technological advancements like AI-driven solutions further improve efficiency and enhance the overall passenger experience. Favorable economic policies designed to stimulate infrastructure investments also play a crucial role in industry growth.

Challenges in the India Aviation Infrastructure Industry Sector

The industry faces challenges including land acquisition complexities, regulatory hurdles, and the need for substantial investment in infrastructure development. Supply chain disruptions can also impact project timelines and costs. Competition among existing players and the potential entry of new players add further complexity. These challenges often lead to project delays and increased costs, impacting profitability and overall market growth. For example, land acquisition for new airports has consistently proven a significant hurdle, delaying projects and raising costs.

Emerging Opportunities in India Aviation Infrastructure Industry

Significant opportunities exist for players to capitalize on the growth of air travel and the increasing demand for sophisticated airport infrastructure. This includes opportunities in developing new airports, upgrading existing facilities, and providing advanced technological solutions. The focus on sustainability and eco-friendly infrastructure presents a crucial area of opportunity. The increasing use of data analytics and AI can greatly optimize airport operations and passenger experiences, paving the way for improved service delivery.

Leading Players in the India Aviation Infrastructure Industry Market

- ADANI GROUP

- L&T Construction

- GVK Industries Limited

- AIC Infrastructures Pvt Ltd

- Tarmat Ltd

- GMR Infrastructure Limited

- Taneja Aerospace & Aviation Ltd

- AIRPORTS AUTHORITY OF INDIA

- Gujarat State Aviation Infrastructure Company Limited

- Tata Sons Private Limited

Key Developments in India Aviation Infrastructure Industry

- 2022-Oct: ADANI GROUP secures a major airport privatization deal.

- 2023-Feb: New Greenfield airport project announced in [Location].

- 2024-May: L&T Construction wins contract for runway expansion at [Airport Name].

- (Further developments will be added in the final report)

Future Outlook for India Aviation Infrastructure Industry Market

The Indian aviation infrastructure market is poised for sustained growth, driven by increasing passenger traffic and government investments. The adoption of new technologies and improved operational efficiencies will further fuel expansion. Strategic partnerships and collaborations will play a critical role in driving innovation and sustainable development. The future holds significant opportunities for both established players and new entrants to participate in this dynamic and growing market. The continued focus on enhancing connectivity and providing a superior passenger experience will shape the market's future trajectory.

India Aviation Infrastructure Industry Segmentation

-

1. Airport Construction Type

- 1.1. Greenfield Airport

- 1.2. Brownfield Airport

-

2. Airport Type

- 2.1. Commercial Airport

- 2.2. Military Airport

- 2.3. General Aviation Airport

-

3. Infrastructure Type

- 3.1. Terminal

- 3.2. Control Tower

- 3.3. Taxiway and Runway

- 3.4. Apron

- 3.5. Hangar

- 3.6. Other Infrastructure Type

India Aviation Infrastructure Industry Segmentation By Geography

- 1. India

India Aviation Infrastructure Industry Regional Market Share

Geographic Coverage of India Aviation Infrastructure Industry

India Aviation Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Terminal Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Construction Type

- 5.1.1. Greenfield Airport

- 5.1.2. Brownfield Airport

- 5.2. Market Analysis, Insights and Forecast - by Airport Type

- 5.2.1. Commercial Airport

- 5.2.2. Military Airport

- 5.2.3. General Aviation Airport

- 5.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.3.1. Terminal

- 5.3.2. Control Tower

- 5.3.3. Taxiway and Runway

- 5.3.4. Apron

- 5.3.5. Hangar

- 5.3.6. Other Infrastructure Type

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Airport Construction Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADANI GROUP

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 L&T Construction

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GVK Industries Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AIC Infrastructures Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tarmat Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GMR Infrastructure Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Taneja Aerospace & Aviation Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AIRPORTS AUTHORITY OF INDIA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gujarat State Aviation Infrastructure Company Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tata Sons Private Limite

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADANI GROUP

List of Figures

- Figure 1: India Aviation Infrastructure Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Aviation Infrastructure Industry Share (%) by Company 2025

List of Tables

- Table 1: India Aviation Infrastructure Industry Revenue Million Forecast, by Airport Construction Type 2020 & 2033

- Table 2: India Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 3: India Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 4: India Aviation Infrastructure Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: India Aviation Infrastructure Industry Revenue Million Forecast, by Airport Construction Type 2020 & 2033

- Table 6: India Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 7: India Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 8: India Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Aviation Infrastructure Industry?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the India Aviation Infrastructure Industry?

Key companies in the market include ADANI GROUP, L&T Construction, GVK Industries Limited, AIC Infrastructures Pvt Ltd, Tarmat Ltd, GMR Infrastructure Limited, Taneja Aerospace & Aviation Ltd, AIRPORTS AUTHORITY OF INDIA, Gujarat State Aviation Infrastructure Company Limited, Tata Sons Private Limite.

3. What are the main segments of the India Aviation Infrastructure Industry?

The market segments include Airport Construction Type, Airport Type, Infrastructure Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 99.43 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Terminal Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Aviation Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Aviation Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Aviation Infrastructure Industry?

To stay informed about further developments, trends, and reports in the India Aviation Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence