Key Insights

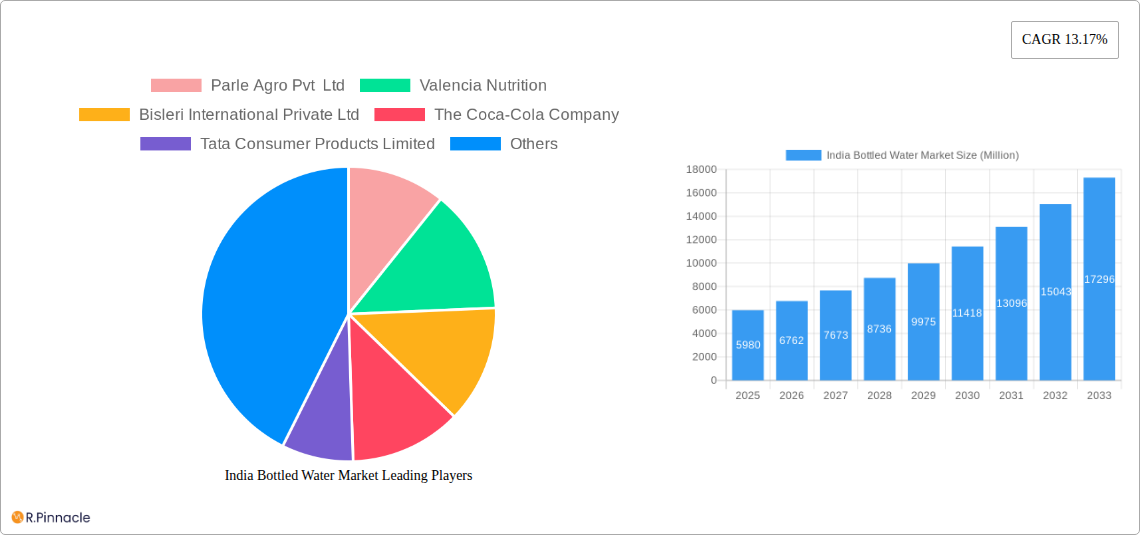

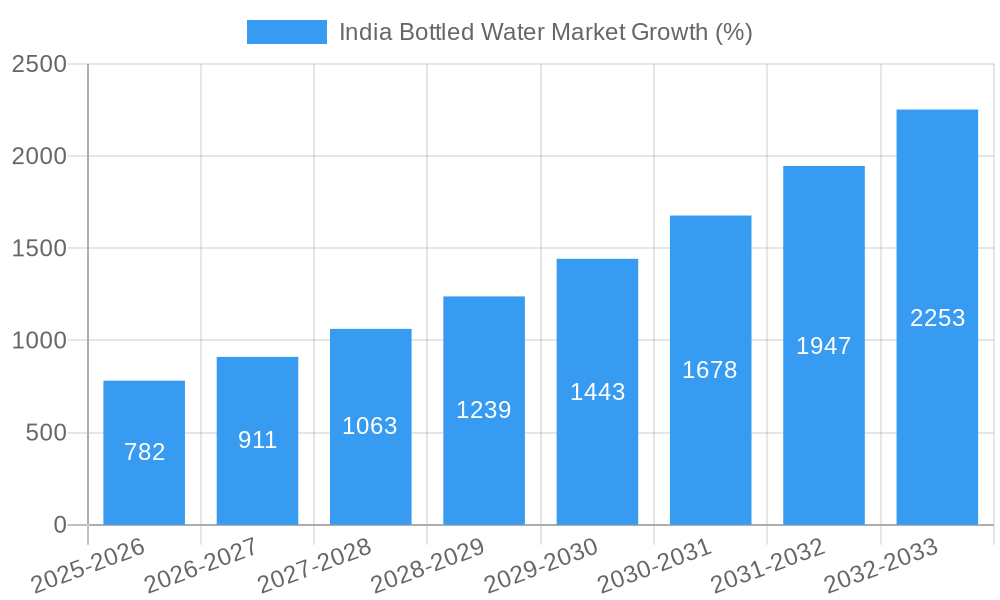

The India bottled water market, valued at $5.98 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 13.17% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes, particularly within the burgeoning middle class, are increasing consumer spending on packaged goods, including bottled water. Increasing health consciousness and awareness of the importance of hydration are also significant factors, driving demand for convenient and safe drinking water alternatives, especially in urban areas with unreliable tap water. Furthermore, the growing prevalence of lifestyle diseases and the associated need for healthier hydration options contribute to this market's upward trajectory. Government initiatives promoting better sanitation and hygiene further support the market's growth. The market is segmented by product type (still, sparkling, flavored), packaging size, distribution channel (retail, online, food service), and region. Leading players like Parle Agro, Bisleri, Coca-Cola, and PepsiCo are aggressively competing through product innovation, brand building, and strategic distribution networks.

However, challenges remain. Fluctuating raw material prices, particularly plastic, can impact profitability. Environmental concerns related to plastic waste generation necessitate sustainable packaging solutions and responsible disposal practices. Competitive intensity from both established players and new entrants requires ongoing innovation and differentiation strategies. Regional variations in infrastructure and distribution networks also pose logistical hurdles. Addressing these constraints through sustainable practices, strategic partnerships, and effective supply chain management will be crucial for sustained market growth. The forecast period of 2025-2033 suggests a significant market expansion, driven by continued urbanization, rising disposable incomes, and ongoing health and wellness trends.

India Bottled Water Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India bottled water market, offering invaluable insights for industry professionals, investors, and strategists. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's dynamics, trends, and future potential. The report is meticulously structured to offer actionable insights, featuring detailed segmentation analysis, key player profiles, and an examination of recent industry developments. The market size is projected to reach xx Million by 2033.

India Bottled Water Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and market dynamics within the Indian bottled water market.

The market exhibits a moderately concentrated structure, with key players like Bisleri International Private Ltd, and The Coca-Cola Company holding significant market share. However, several regional and smaller players contribute to the overall market dynamism. Market share data for 2024 indicates that Bisleri holds approximately xx% market share, while Coca-Cola holds approximately xx%. The remaining market share is distributed amongst numerous players, reflecting a fragmented yet competitive environment.

Innovation Drivers: Growing health consciousness, increasing disposable incomes, and rising demand for convenient hydration solutions are major drivers of innovation. Companies are focusing on functional waters, enhanced flavors, and sustainable packaging to cater to evolving consumer preferences.

Regulatory Framework: Stringent regulations concerning water quality, labeling, and packaging are shaping industry practices. Compliance with these regulations is crucial for market participation.

Product Substitutes: Other beverages, including juices, soft drinks, and even tap water (where access and quality are improving), pose as competitive substitutes.

End-User Demographics: The market caters to a wide demographic, ranging from individual consumers to the HoReCa sector (Hotels, Restaurants, and Catering). Growth is particularly strong within urban areas and among younger demographics.

M&A Activities: The market has witnessed moderate M&A activity in recent years, primarily focused on expanding distribution networks and acquiring smaller regional brands. The total value of M&A deals within the historical period (2019-2024) is estimated at xx Million.

India Bottled Water Market Dynamics & Trends

The Indian bottled water market is experiencing robust growth, fueled by several key factors. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, and is projected to remain strong at xx% during the forecast period (2025-2033). Market penetration is currently estimated at xx% and is expected to increase significantly as consumer preferences evolve.

Rising disposable incomes, particularly within urban areas, are driving higher consumption. Growing awareness of health and wellness is also a significant factor, with consumers increasingly choosing bottled water as a healthier alternative to sugary drinks. Technological advancements in packaging, such as eco-friendly alternatives, are also influencing market dynamics. Intense competition among established players and emerging brands has led to product innovation, aggressive marketing, and strategic partnerships. The competitive landscape is further shaped by changing consumer preferences, price sensitivity, and the rising popularity of functional and flavored waters.

Dominant Regions & Segments in India Bottled Water Market

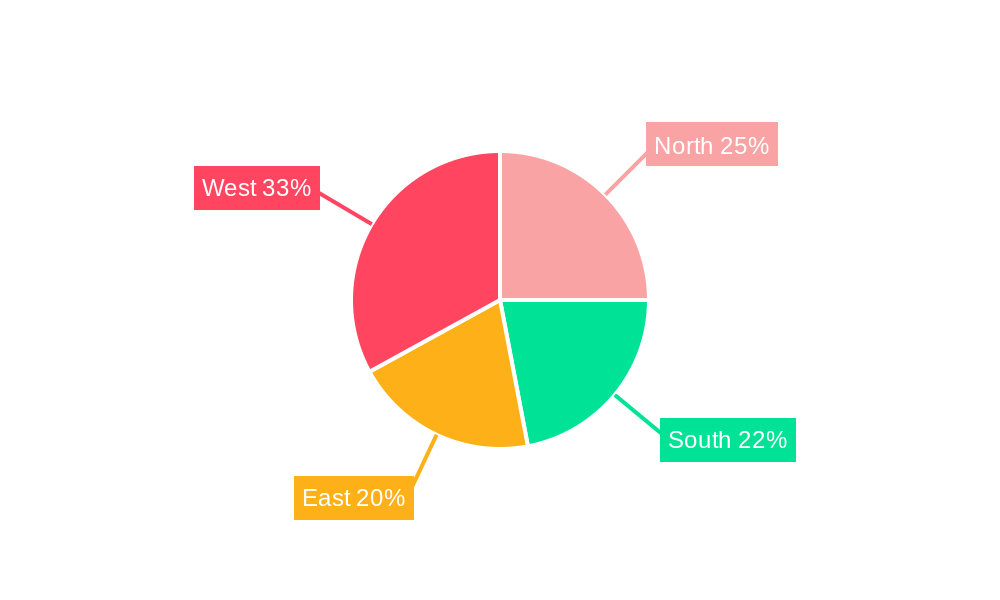

The Indian bottled water market shows significant regional variations in consumption patterns. Urban areas, particularly in major metropolitan cities, exhibit higher per capita consumption due to factors like higher disposable incomes, increased awareness, and greater accessibility.

- Key Drivers in Dominant Regions:

- Urban Centers: High population density, higher disposable incomes, and better infrastructure facilitate distribution and consumption.

- Tier 1 & 2 Cities: Growing middle class and rising urbanization contribute to market expansion.

- Tourist Destinations: High tourist influx increases demand.

While detailed regional market share data requires further analysis, the southern and western regions are projected to hold significant market shares. The market is segmented by product type (still, sparkling, functional), packaging (PET bottles, glass bottles), and distribution channel (retail, wholesale, online). The PET bottle segment currently dominates due to cost-effectiveness and convenience.

India Bottled Water Market Product Innovations

The Indian bottled water market is witnessing significant product innovation, driven by evolving consumer preferences and technological advancements. Companies are introducing functional waters enriched with vitamins, minerals, and electrolytes to cater to health-conscious consumers. There is also a growing trend towards eco-friendly packaging solutions, such as biodegradable and recyclable materials, aligning with sustainable practices. Innovative packaging designs, such as smaller, on-the-go sizes, are also gaining popularity. This push for innovation aims to enhance product differentiation and attract new customer segments, leading to a competitive advantage in the market.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation of the Indian bottled water market based on various factors including product type (still, sparkling, flavored, functional), packaging size (500ml, 1L, 2L, etc.), distribution channel (retail, food service, online), and region. Each segment’s market size, growth projections, and competitive dynamics are analyzed thoroughly. Detailed market sizes for each segment within the forecast period are detailed within the main report.

Key Drivers of India Bottled Water Market Growth

Several key factors drive the growth of the Indian bottled water market. The rising disposable incomes among the expanding middle class and growing urbanization contribute significantly to increased consumption. Growing health consciousness and awareness of the importance of hydration fuel demand for healthier beverage options. Moreover, improved infrastructure and distribution networks expand market reach and accessibility. The increasing prevalence of lifestyle diseases also positively impacts demand, as bottled water is seen as a healthier alternative to sugary drinks.

Challenges in the India Bottled Water Market Sector

Despite the growth potential, the Indian bottled water market faces several challenges. Fluctuations in raw material prices, specifically PET plastic, can impact production costs and profitability. The stringent regulatory framework necessitates substantial investments in compliance, especially concerning water quality and packaging standards. Intense competition from established players and the rise of new entrants create pressures on pricing and margins. Furthermore, environmental concerns related to plastic waste necessitate a move towards sustainable packaging solutions, presenting a considerable operational challenge. Supply chain inefficiencies and logistical complexities in a vast and diverse geographical landscape also pose significant challenges.

Emerging Opportunities in India Bottled Water Market

The Indian bottled water market presents several attractive opportunities for growth and innovation. The increasing popularity of functional and flavored waters opens avenues for product diversification and premiumization. The growing demand for sustainable and eco-friendly packaging creates opportunities for companies that can offer innovative and environmentally conscious solutions. Expanding market reach into rural and semi-urban areas holds significant potential. Further, leveraging digital platforms and e-commerce channels can unlock new customer segments and expand market penetration. The increasing focus on health and wellness provides an opportunity for introducing value-added products.

Leading Players in the India Bottled Water Market Market

- Parle Agro Pvt Ltd

- Valencia Nutrition

- Bisleri International Private Ltd

- The Coca-Cola Company

- Tata Consumer Products Limited

- PepsiCo Inc

- DS Group

- The Manikchand Group

- AV Organics Private Ltd

- Narang Group

- List Not Exhaustive

Key Developments in India Bottled Water Market Industry

- August 2024: Bisleri International became the Official Hydration Partner for the Professional Golf Tour of India (PGTI), boosting brand visibility and reinforcing its market leadership.

- August 2024: EVOCUS significantly expanded its reach into the HoReCa sector through partnerships with major hotel chains and hospitality groups, establishing a presence in over 250 outlets.

- September 2024: Bisleri International partnered with the Goa government for a CSR initiative ('Bottles for Change') focused on improving plastic waste management, enhancing its brand image and contributing to environmental sustainability.

Future Outlook for India Bottled Water Market Market

The future of the Indian bottled water market looks promising, driven by sustained economic growth, urbanization, and evolving consumer preferences. Continued innovation in product offerings, packaging, and distribution will be crucial for success. A focus on sustainability and environmentally responsible practices will be increasingly important for attracting environmentally conscious consumers. Strategic partnerships and expansion into untapped markets will further fuel market expansion. The market is poised for substantial growth, with opportunities for both established players and new entrants to capitalize on emerging trends and consumer demands.

India Bottled Water Market Segmentation

-

1. Product Type

- 1.1. Still Water

- 1.2. Sparkling Water

- 1.3. Functional/Fortified/Flavoured Water

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience/Grocery Stores

- 2.2.3. Online Retail Stores

India Bottled Water Market Segmentation By Geography

- 1. India

India Bottled Water Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.17% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Tourism and Hospitality Sectors; Scarcity of Safe Drinking Water

- 3.3. Market Restrains

- 3.3.1. Expanding Tourism and Hospitality Sectors; Scarcity of Safe Drinking Water

- 3.4. Market Trends

- 3.4.1. Still Water Is In High Demand In India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Still Water

- 5.1.2. Sparkling Water

- 5.1.3. Functional/Fortified/Flavoured Water

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience/Grocery Stores

- 5.2.2.3. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Parle Agro Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Valencia Nutrition

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bisleri International Private Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Coca-Cola Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tata Consumer Products Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PepsiCo Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DS Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Manikchand Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AV Organics Private Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Narang Group*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Parle Agro Pvt Ltd

List of Figures

- Figure 1: India Bottled Water Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Bottled Water Market Share (%) by Company 2024

List of Tables

- Table 1: India Bottled Water Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Bottled Water Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: India Bottled Water Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: India Bottled Water Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 5: India Bottled Water Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: India Bottled Water Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 7: India Bottled Water Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Bottled Water Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: India Bottled Water Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: India Bottled Water Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 11: India Bottled Water Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: India Bottled Water Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 13: India Bottled Water Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: India Bottled Water Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Bottled Water Market?

The projected CAGR is approximately 13.17%.

2. Which companies are prominent players in the India Bottled Water Market?

Key companies in the market include Parle Agro Pvt Ltd, Valencia Nutrition, Bisleri International Private Ltd, The Coca-Cola Company, Tata Consumer Products Limited, PepsiCo Inc, DS Group, The Manikchand Group, AV Organics Private Ltd, Narang Group*List Not Exhaustive.

3. What are the main segments of the India Bottled Water Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Tourism and Hospitality Sectors; Scarcity of Safe Drinking Water.

6. What are the notable trends driving market growth?

Still Water Is In High Demand In India.

7. Are there any restraints impacting market growth?

Expanding Tourism and Hospitality Sectors; Scarcity of Safe Drinking Water.

8. Can you provide examples of recent developments in the market?

September 2024: Bisleri International partnered with the Goa government to enhance plastic waste management in Mormugao. The collaboration, solidified at the Green Goa Summit 2024, aims to improve waste collection, segregation, and recycling processes under the CSR initiative, 'Bottles for Change'.August 2024: Bisleri International forged a strategic partnership with the Professional Golf Tour of India (PGTI) to become the Official Hydration Partner. The collaboration spans across 15 tournaments in India at some of the most challenging and prestigious golf courses.August 2024: As part of its expansion, EVOCUS partnered with prominent hotel chains, including Marriott, Radisson, Taj, Hyatt, and Accor. Additionally, the company collaborated with hospitality groups such as Impresario Entertainment and Hospitality and Specialty Restaurants. Through these strategic partnerships, EVOCUS broadened its market reach, establishing a presence in over 250 HoReCa outlets throughout India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Bottled Water Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Bottled Water Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Bottled Water Market?

To stay informed about further developments, trends, and reports in the India Bottled Water Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence