Key Insights

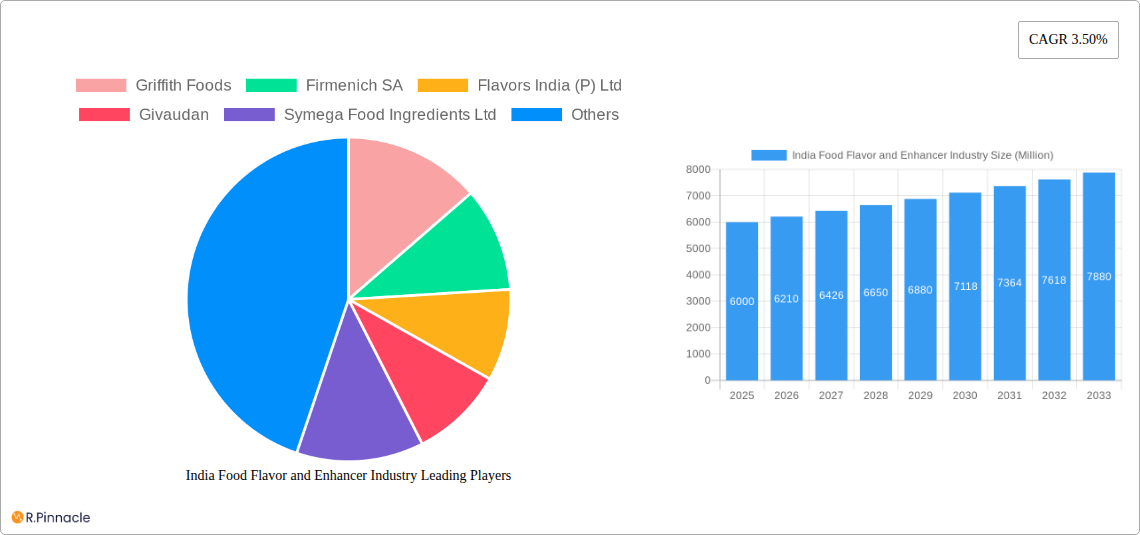

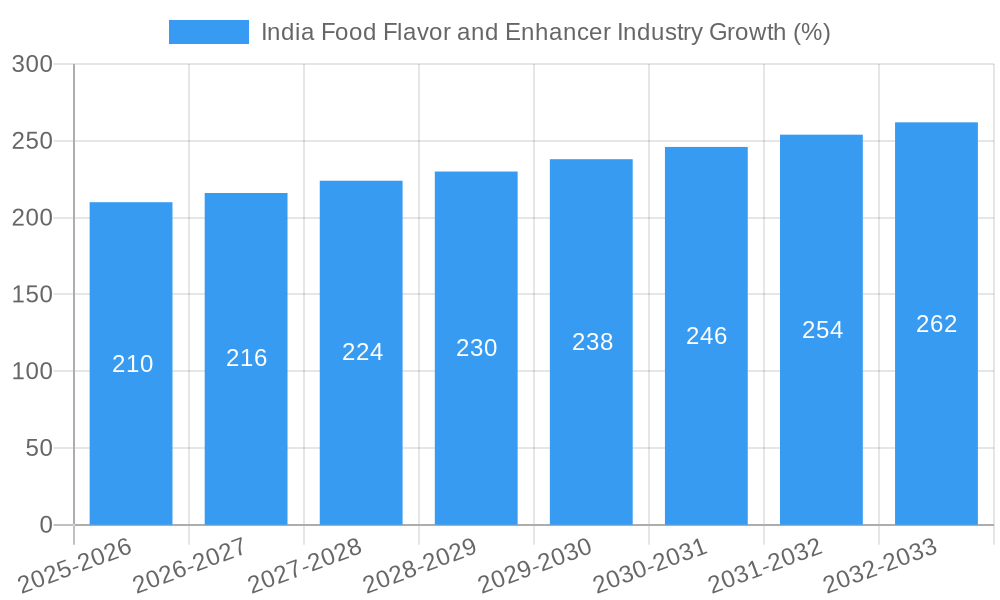

The India food flavor and enhancer market exhibits robust growth, driven by expanding food processing and consumption patterns, particularly within the confectionery, dairy, and beverage sectors. The increasing demand for processed and convenient foods fuels the market's expansion, with a preference for enhanced taste and flavor profiles. The market's segmentation reveals a strong presence of natural and nature-identical flavors, reflecting a growing consumer awareness of health and natural ingredients. While synthetic flavors maintain a significant share, the trend indicates a gradual shift towards natural alternatives. The projected CAGR of 3.50% suggests a steady growth trajectory over the forecast period (2025-2033). Key players, including international giants and domestic companies, are strategically investing in research and development to innovate flavor profiles and cater to evolving consumer preferences. The market's growth is also influenced by factors like rising disposable incomes, changing lifestyles, and increased urbanization, which collectively contribute to higher spending on processed and packaged food products. Competition is intense, with both global and local players vying for market share through product diversification and strategic partnerships. Despite potential restraints such as fluctuating raw material prices and stringent regulatory norms, the overall outlook for the India food flavor and enhancer market remains positive, anticipating continued expansion in the coming years. The Asia-Pacific region, especially India, is expected to be a key growth driver due to increasing demand and rising population.

Considering a base year market size (2025) estimation requires assumptions. Let's assume a conservative figure of ₹50 Billion (approximately $6 Billion USD) for the Indian Food Flavor and Enhancer market in 2025. This figure aligns with the growth rates seen in similar emerging markets and the substantial contribution of the food processing industry to India's GDP. Using the 3.5% CAGR, we can project reasonable growth for the years following 2025. The presence of multinational companies like Givaudan, Firmenich, and IFF suggests a market of substantial size and sophistication.

India Food Flavor and Enhancer Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India food flavor and enhancer industry, offering invaluable insights for industry professionals, investors, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive market research to deliver actionable intelligence. The report covers key market segments, competitive landscape, growth drivers, challenges, and future outlook, providing a 360-degree view of this dynamic market projected to be worth xx Million by 2033.

India Food Flavor and Enhancer Industry Market Structure & Innovation Trends

This section analyzes the structure of the Indian food flavor and enhancer market, examining market concentration, innovation drivers, regulatory frameworks, and competitive activities. The market is characterized by a mix of large multinational corporations and domestic players. Key players like Griffith Foods, Firmenich SA, Flavors India (P) Ltd, Givaudan, Symega Food Ingredients Ltd, International Flavors & Fragrances Inc, BASF SE, Mane SA, Flavaroma Flavours and Fragrances Pvt Ltd, Kerry Group PLC, Symrise AG, and Sonarome compete for market share.

- Market Concentration: The market exhibits a moderately concentrated structure with a few major players holding significant market share. Exact figures are unavailable, but estimates place the top 5 players at approximately xx% combined market share.

- Innovation Drivers: Growing consumer demand for diverse flavors, increasing health consciousness (driving demand for natural flavors), and technological advancements in flavor creation are key drivers of innovation.

- Regulatory Framework: Indian food safety regulations, including FSSAI guidelines, significantly influence product development and market access.

- Product Substitutes: Naturally occurring spices and herbs act as substitutes for certain flavor enhancers.

- End-User Demographics: The expanding middle class and changing dietary habits within India fuel market growth across various application segments.

- M&A Activities: The industry has witnessed several mergers and acquisitions in recent years, though precise deal values remain undisclosed.

India Food Flavor and Enhancer Industry Market Dynamics & Trends

The Indian food flavor and enhancer market is experiencing robust growth, driven by factors such as rising disposable incomes, changing consumer preferences, and the booming food processing industry. The market is witnessing a shift towards natural and clean-label ingredients, influencing product development strategies of key players. Technological advancements, including precision fermentation and bio-based ingredients, are also reshaping the competitive landscape. The market exhibits a CAGR of xx% during the forecast period (2025-2033), driven primarily by the growth of processed foods and beverages. Market penetration of natural flavors is increasing steadily, projected to reach xx% by 2033.

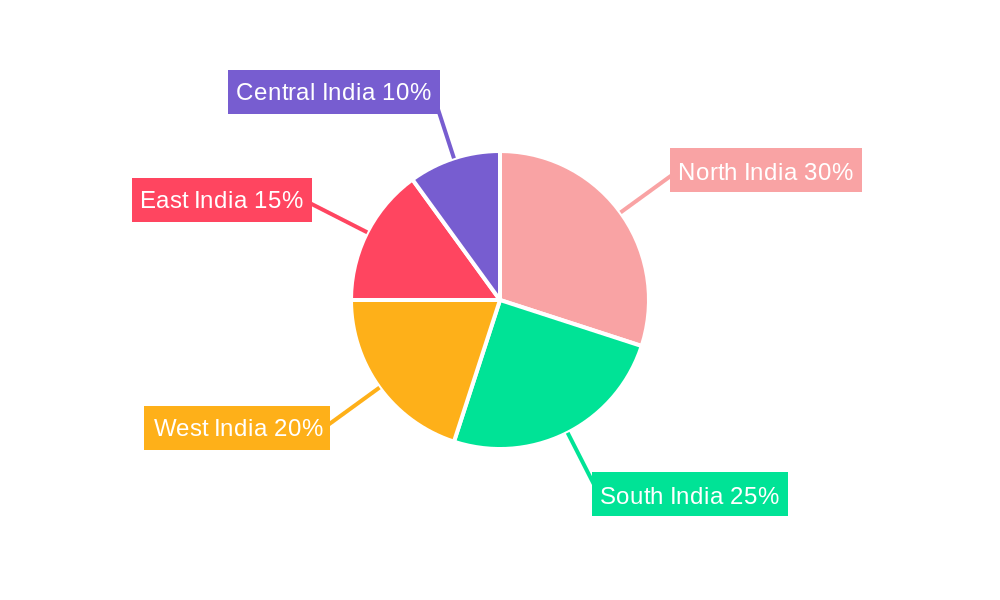

Dominant Regions & Segments in India Food Flavor and Enhancer Industry

The Indian food flavor and enhancer market is geographically diverse, with significant growth in major metropolitan areas and urban centers. Within segments:

Type: The demand for natural flavors is surging, driven by health consciousness. Synthetic flavors remain a significant segment due to their cost-effectiveness. Nature-identical flavorings hold a niche market, catering to specific product requirements. Flavor enhancers contribute a significant portion of the market due to their application in processed foods.

Application: The processed food segment is the dominant application area, followed by beverages, dairy, bakery, and confectionery. The growth in the processed food segment is driven by urbanization and changing lifestyle patterns.

Key Drivers (Bullet Points):

- Rising disposable incomes

- Urbanization

- Growth of food processing and F&B industries

- Favorable government policies supporting the food processing sector

- Increasing adoption of westernized diets

India Food Flavor and Enhancer Industry Product Innovations

Recent innovations focus on clean-label ingredients, natural flavor profiles, and customized solutions tailored to specific food applications. Companies are investing in research and development to develop sustainable and cost-effective flavor solutions. Technological advancements, such as advanced extraction techniques for natural flavors, are driving innovation and improving the quality and efficiency of flavor production.

Report Scope & Segmentation Analysis

This report segments the India food flavor and enhancer market by type (Natural Flavor, Synthetic Flavor, Nature Identical Flavoring, Flavor Enhancers) and application (Dairy, Bakery, Confectionery, Processed Food, Beverage, Other Applications). Each segment's market size, growth projections, and competitive dynamics are analyzed. The processed food application segment is expected to register the highest CAGR during the forecast period, driven by the booming processed food industry in India.

Key Drivers of India Food Flavor and Enhancer Industry Growth

Key growth drivers include the rising demand for processed food and beverages, increasing disposable incomes, urbanization, and favorable government policies. Technological advancements in flavor creation and the increasing adoption of clean-label ingredients are further propelling market growth. The expansion of the food processing industry and the introduction of new product formats are also significant contributing factors.

Challenges in the India Food Flavor and Enhancer Industry Sector

Challenges include stringent food safety regulations, fluctuations in raw material prices, and intense competition. Supply chain complexities and the need to balance cost and quality also pose challenges. The increasing preference for natural flavors presents both an opportunity and a challenge, requiring investment in R&D and sustainable sourcing practices.

Emerging Opportunities in India Food Flavor and Enhancer Industry

Emerging opportunities lie in the growing demand for customized flavor solutions, innovative product formats, and clean-label ingredients. The expanding market for functional foods and beverages creates opportunities for flavor enhancers with added health benefits. Exploring niche markets and regional flavor profiles represents significant growth potential.

Leading Players in the India Food Flavor and Enhancer Industry Market

- Griffith Foods

- Firmenich SA

- Flavors India (P) Ltd

- Givaudan

- Symega Food Ingredients Ltd

- International Flavors & Fragrances Inc

- BASF SE

- Mane SA

- Flavaroma Flavours and Fragrances Pvt Ltd

- Kerry Group PLC

- Symrise AG

- Sonarome

Key Developments in India Food Flavor and Enhancer Industry

- November 2022: Mane SA launched a flavor innovation center in Hyderabad.

- September 2022: Griffith Foods announced plans to introduce a range of sauces to the Indian market.

- May 2022: Symega Food Ingredients Ltd launched "Cuisinary," a line of culinary solutions.

Future Outlook for India Food Flavor and Enhancer Industry Market

The future outlook for the India food flavor and enhancer market is positive, driven by continued growth in the food processing sector, changing consumer preferences, and technological advancements. Strategic investments in R&D, sustainable sourcing, and product diversification will be key for success in this dynamic market. The market is poised for substantial growth, with opportunities for both established players and new entrants.

India Food Flavor and Enhancer Industry Segmentation

-

1. Type

- 1.1. Natural Flavor

- 1.2. Synthetic Flavor

- 1.3. Nature Identical Flavoring

- 1.4. Flavor Enhancers

-

2. Application

- 2.1. Dairy

- 2.2. Bakery

- 2.3. Confectionery

- 2.4. Processed Food

- 2.5. Beverage

- 2.6. Other Applications

India Food Flavor and Enhancer Industry Segmentation By Geography

- 1. India

India Food Flavor and Enhancer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Convenient Ready-to-Eat Food Products; Growing Affinity Toward Ethnic and Organic Frozen Ready Meals

- 3.3. Market Restrains

- 3.3.1. Rising Concerns Over Food Safety and Quality

- 3.4. Market Trends

- 3.4.1. Increased Production of Processed Foods Using Indian Flavors

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Food Flavor and Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural Flavor

- 5.1.2. Synthetic Flavor

- 5.1.3. Nature Identical Flavoring

- 5.1.4. Flavor Enhancers

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy

- 5.2.2. Bakery

- 5.2.3. Confectionery

- 5.2.4. Processed Food

- 5.2.5. Beverage

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China India Food Flavor and Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan India Food Flavor and Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 8. India India Food Flavor and Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea India Food Flavor and Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan India Food Flavor and Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia India Food Flavor and Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific India Food Flavor and Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Griffith Foods

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Firmenich SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Flavors India (P) Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Givaudan

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Symega Food Ingredients Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 International Flavors & Fragrances Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 BASF SE

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Mane SA

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Flavaroma Flavours and Fragrances Pvt Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Kerry Group PLC

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Symrise AG

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Sonarome

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Griffith Foods

List of Figures

- Figure 1: India Food Flavor and Enhancer Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Food Flavor and Enhancer Industry Share (%) by Company 2024

List of Tables

- Table 1: India Food Flavor and Enhancer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Food Flavor and Enhancer Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Food Flavor and Enhancer Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: India Food Flavor and Enhancer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Food Flavor and Enhancer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China India Food Flavor and Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan India Food Flavor and Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India India Food Flavor and Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea India Food Flavor and Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan India Food Flavor and Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia India Food Flavor and Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific India Food Flavor and Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: India Food Flavor and Enhancer Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: India Food Flavor and Enhancer Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: India Food Flavor and Enhancer Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Food Flavor and Enhancer Industry?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the India Food Flavor and Enhancer Industry?

Key companies in the market include Griffith Foods, Firmenich SA, Flavors India (P) Ltd, Givaudan, Symega Food Ingredients Ltd, International Flavors & Fragrances Inc, BASF SE, Mane SA, Flavaroma Flavours and Fragrances Pvt Ltd, Kerry Group PLC, Symrise AG, Sonarome.

3. What are the main segments of the India Food Flavor and Enhancer Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Convenient Ready-to-Eat Food Products; Growing Affinity Toward Ethnic and Organic Frozen Ready Meals.

6. What are the notable trends driving market growth?

Increased Production of Processed Foods Using Indian Flavors.

7. Are there any restraints impacting market growth?

Rising Concerns Over Food Safety and Quality.

8. Can you provide examples of recent developments in the market?

In November 2022, Mane SA announced the launch of a flavor innovation center in Hyderabad. The innovation center is in the Hitech City, spread out over 13,900 sq. ft, and will concentrate on end-to-end taste development to serve the food and beverage markets in India and other Asia-Pacific regions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Food Flavor and Enhancer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Food Flavor and Enhancer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Food Flavor and Enhancer Industry?

To stay informed about further developments, trends, and reports in the India Food Flavor and Enhancer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence