Key Insights

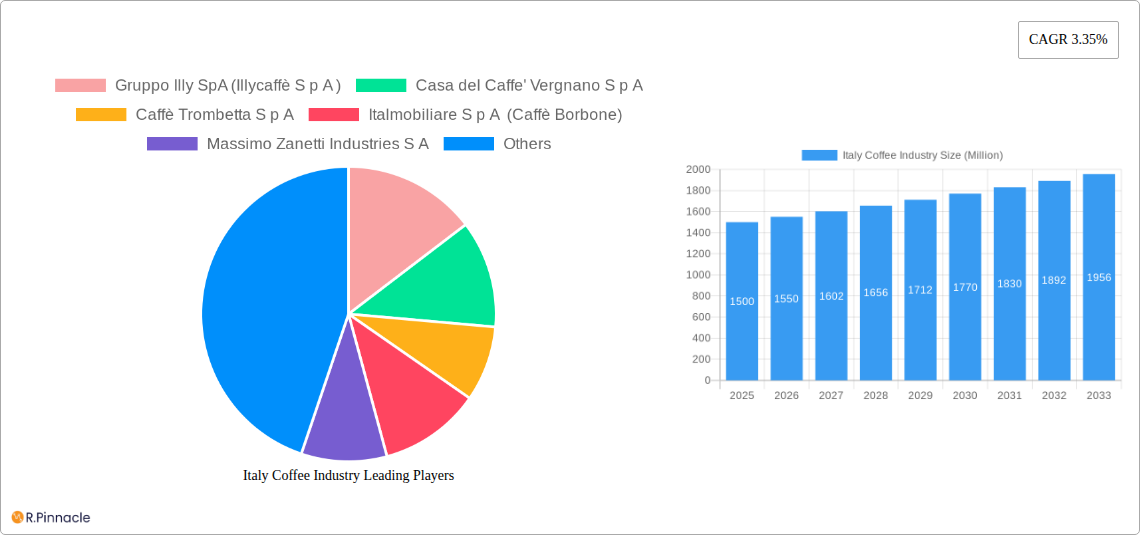

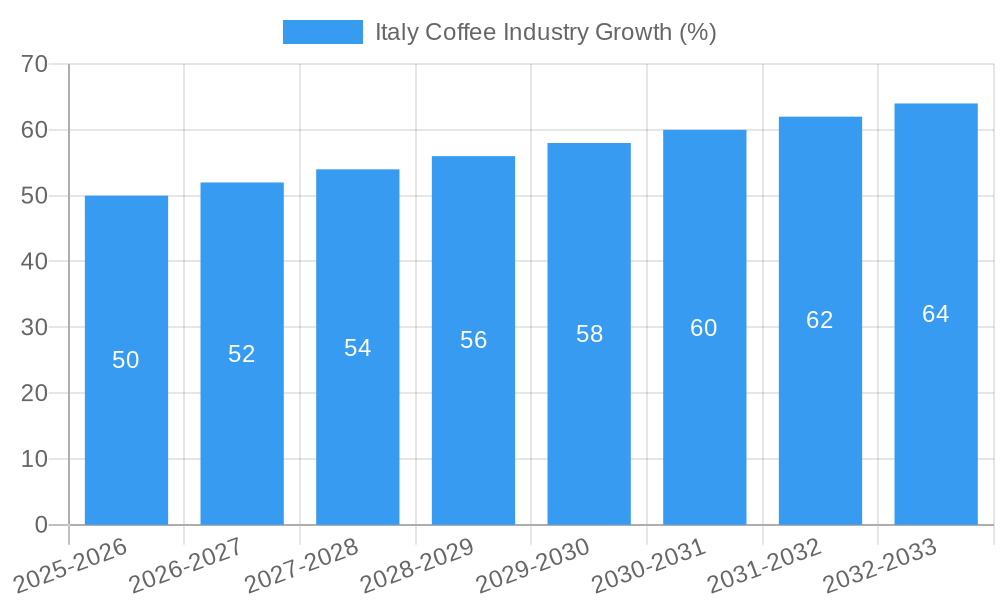

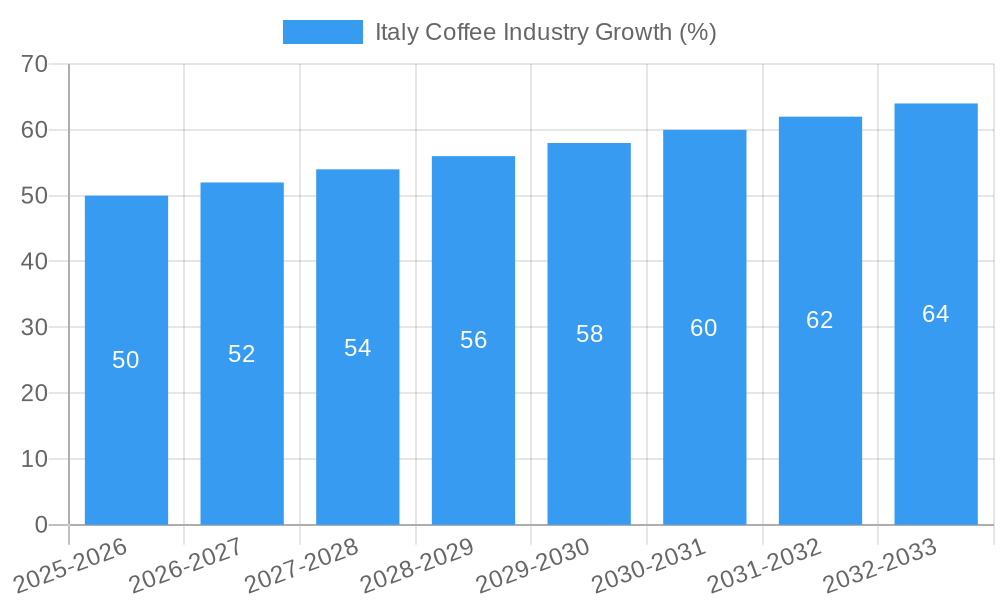

The Italian coffee market, a cornerstone of the nation's culture, exhibits robust growth potential. With a CAGR of 3.35% from 2019-2024, the market is projected to continue its expansion through 2033. This growth is fueled by several key drivers. Firstly, the enduring popularity of espresso-based beverages and a strong coffee culture contribute significantly to high consumption rates. Secondly, the rise of specialty coffee shops and the increasing availability of premium coffee beans and innovative brewing methods cater to evolving consumer preferences for high-quality experiences. Furthermore, the growth of the out-of-home consumption segment, encompassing cafes, bars, and restaurants, remains a powerful driver. However, economic fluctuations and potential increases in raw material costs could act as restraints. The market is segmented by product type (whole bean, ground, instant, pods/capsules) and distribution channel (on-trade, off-trade). The on-trade segment, heavily reliant on the hospitality industry, is susceptible to economic downturns, while the off-trade segment, dominated by grocery stores and supermarkets, offers more consistent sales. Leading players like Lavazza, Illy, and Gimoka, alongside international giants like Nestlé and Starbucks, compete fiercely, driving innovation and product diversification. The Italian market’s regional variations reflect differing consumption patterns, with major urban centers and tourist destinations exhibiting higher demand. Germany, France, and the UK represent significant export markets for Italian coffee producers, expanding the overall market reach and contributing to overall growth.

The competitive landscape is dynamic, characterized by both established Italian brands and international players vying for market share. Innovation plays a crucial role, with companies investing in sustainable sourcing practices, new brewing technologies, and convenient formats such as single-serve pods. The increasing demand for organic and ethically sourced coffee presents opportunities for companies to cater to conscious consumers. Future growth is expected to be driven by factors like the increasing popularity of cold brew coffee, personalized coffee experiences, and the continuing evolution of the specialty coffee segment. Understanding these trends is key for companies seeking to succeed in this lucrative and competitive market. The forecast period (2025-2033) anticipates continued growth, albeit potentially at a slightly moderated pace compared to the recent past, reflecting broader economic conditions and consumer spending patterns.

Italy Coffee Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Italy coffee industry, covering market structure, dynamics, leading players, and future growth prospects from 2019 to 2033. With a base year of 2025 and forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and anyone seeking to understand this dynamic market. The report leverages robust data analysis to deliver actionable insights and strategic recommendations. The market size is projected to reach xx Million by 2033.

Italy Coffee Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, highlighting market concentration, key innovation drivers, regulatory influences, and significant M&A activities within the Italian coffee industry. The report delves into the impact of substitute products and evolving end-user demographics on market trends.

Market Concentration: The Italian coffee market exhibits a moderate level of concentration, with a few dominant players and numerous smaller, regional brands. Luigi Lavazza S p A and Illycaffè S p A command significant market share, while other key players such as Gruppo Illy SpA (Illycaffè S p A), Casa del Caffè Vergnano S p A, and Kimbo S p A contribute substantially. The exact market share for each player is detailed in the full report.

Innovation Drivers: Sustainability initiatives, the rise of single-serve coffee pods and capsules, and technological advancements in brewing methods are driving innovation. The adoption of blockchain technology, as seen with Massimo Zanetti Beverage Group's Segafredo Storia launch, is a notable example of this.

Regulatory Framework: EU regulations concerning food safety, labeling, and sustainability significantly impact the industry. Detailed analysis of these regulations and their implications is included in the complete report.

M&A Activity: The report details significant mergers and acquisitions, including Coca-Cola Hellenic Bottling Company's acquisition of a 30% stake in Casa Del Caffè Vergnano in June 2021, illustrating the dynamic nature of the market. The total value of M&A deals within the period 2019-2024 is estimated at xx Million.

Italy Coffee Industry Market Dynamics & Trends

This section examines the factors driving market growth, including consumer preferences, technological advancements, and the competitive landscape. We analyze market penetration, CAGR, and other crucial metrics to present a comprehensive overview of Italy's coffee market dynamics.

The Italian coffee market displays a robust growth trajectory, fueled by several key factors. The rising disposable incomes, coupled with the enduring Italian coffee culture, drive consistent demand. The increasing popularity of specialty coffee, including single-origin beans and artisan roasts, further stimulates market expansion. Moreover, the continuous innovation in brewing technology and product formats – particularly the growth of convenient coffee pods and capsules – enhances market appeal.

Technological disruptions, such as the growing adoption of e-commerce platforms and the introduction of smart coffee machines, are transforming the distribution channels and consumer experience. The strong presence of both national and international coffee brands contributes to a competitive market environment, stimulating both innovation and price competition. The full report provides a detailed breakdown of the CAGR and market penetration rates across different segments for the historical period (2019-2024) and the forecast period (2025-2033).

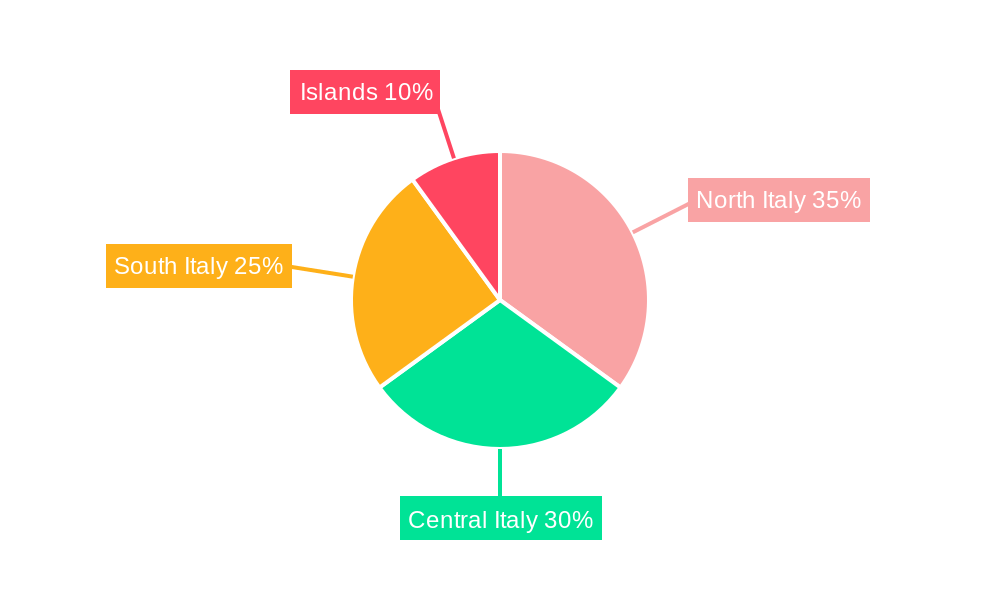

Dominant Regions & Segments in Italy Coffee Industry

This section identifies the leading regions and product segments within the Italian coffee market. We analyze factors driving dominance across both the on-trade (e.g., cafes, restaurants) and off-trade (e.g., supermarkets, online retailers) distribution channels.

Leading Regions: Northern Italy, specifically Lombardy and Piedmont, historically represent significant consumption and production centers due to favorable climatic conditions for coffee bean cultivation and a well-established coffee culture. Further analysis of regional variations is provided in the complete report.

Leading Product Types: Ground coffee retains a dominant market share, although the segment of coffee pods and capsules experiences rapid growth due to consumer preference for convenience. The market share breakdown for Whole-Bean, Ground Coffee, Instant Coffee, and Coffee Pods and Capsules are detailed in the report.

Leading Distribution Channels: The off-trade channel accounts for a significant proportion of the coffee market, fueled by the increasing popularity of grocery store sales and online deliveries. The on-trade segment, encompassing cafes, restaurants, and bars, maintains importance reflecting the vibrant Italian coffee culture.

Key Drivers: Factors such as strong consumer preference for quality coffee, high disposable incomes in certain regions, effective distribution networks, and government initiatives related to food and beverage industries influence regional and segment dominance.

Italy Coffee Industry Product Innovations

This section summarizes recent innovations in coffee products, highlighting new applications and the resulting competitive advantages for market players.

Recent innovations in the Italian coffee industry center on sustainability and convenience. The rise of single-serve coffee pods and capsules is noteworthy, offering consumers ease of use and reducing waste compared to traditional brewing methods. Sustainable sourcing of coffee beans and eco-friendly packaging are also gaining traction. Companies are investing in technology to enhance the overall coffee experience, including smart coffee machines and connected devices. The development of new coffee blends and flavors tailored to evolving consumer preferences further contributes to the innovative landscape.

Report Scope & Segmentation Analysis

This section details the market segmentation analysis of the Italy coffee industry, including growth projections, market sizes, and competitive dynamics for each segment.

Product Type: The report segments the market by Whole-Bean, Ground Coffee, Instant Coffee, and Coffee Pods and Capsules. Each segment's growth projections, market sizes, and competitive landscapes are analyzed in detail, revealing differences in market dynamics and growth rates.

Distribution Channel: The market is further segmented by distribution channels: On-Trade (cafes, restaurants, bars) and Off-Trade (supermarkets, hypermarkets, online retailers). The report provides a comprehensive breakdown of each channel's contribution to the overall market value, along with insights into growth prospects and competitive strategies.

Key Drivers of Italy Coffee Industry Growth

This section outlines the key factors driving growth in the Italian coffee market.

Several factors fuel the growth of the Italian coffee industry: strong domestic demand rooted in national coffee culture; the rise of specialty coffee and premium offerings; innovation in brewing technologies and packaging; and increasing disposable incomes. Government policies supporting the agricultural sector and food manufacturing also play a role. The expansion of e-commerce and the growth of convenience-focused coffee products (e.g., single-serve capsules) further amplify this positive market trajectory.

Challenges in the Italy Coffee Industry Sector

This section discusses the challenges faced by the Italian coffee industry.

The Italian coffee industry faces challenges such as the volatility of global coffee bean prices, intensifying competition from international brands, and concerns regarding sustainability and environmental impact. Changes in consumer preferences and the need to adapt to shifting demographics also present challenges. The industry must address sustainability concerns through sustainable sourcing practices and reduced waste.

Emerging Opportunities in Italy Coffee Industry

This section highlights emerging opportunities for growth in the Italian coffee market.

Opportunities abound in the Italian coffee market. The increasing popularity of specialty coffee and the growth of e-commerce provide avenues for expansion. Sustainability initiatives and the adoption of innovative packaging solutions offer competitive advantages. The rise of premium coffee offerings targeting a growing segment of discerning consumers represents significant growth potential. Expanding into new markets, both domestically and internationally, and capitalizing on evolving consumer demands will be key to continued success.

Leading Players in the Italy Coffee Industry Market

- Gruppo Illy SpA (Illycaffè S p A)

- Casa del Caffè Vergnano S p A

- Caffè Trombetta S p A

- Italmobiliare S p A (Caffè Borbone)

- Massimo Zanetti Industries S A

- Luigi Lavazza S p A

- Starbucks Corporation

- Kimbo S p A

- Maxingvest AG (Tchibo GmbH)

- Gruppo Gimoka S p a

- Nestlé S A

Key Developments in Italy Coffee Industry Industry

- January 2022: Starbucks opens its first drive-thru in Italy.

- June 2021: Coca-Cola Hellenic Bottling Company acquires a 30% stake in Casa Del Caffè Vergnano.

- March 2021: Massimo Zanetti Beverage Group launches Segafredo Storia, a sustainable coffee series utilizing blockchain technology.

Future Outlook for Italy Coffee Industry Market

The future of the Italian coffee market is promising, driven by sustained consumer demand, ongoing product innovation, and the growing preference for specialty coffee experiences. Continued investment in sustainable practices and technological advancements will further enhance the market's competitiveness and expansion. Opportunities for growth exist through targeted marketing strategies, the expansion of e-commerce channels, and the development of innovative products that meet the evolving needs of a diverse consumer base. The market is poised for robust growth over the next decade.

Italy Coffee Industry Segmentation

-

1. Product Type

- 1.1. Whole-Bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Coffee Pods and Capsules

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Supermarket/Hypermarket

- 2.2.2. Convenience Stores

- 2.2.3. Specialist Retailers

- 2.2.4. Other Distribution Channels

Italy Coffee Industry Segmentation By Geography

- 1. Italy

Italy Coffee Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Low Price and Easy Availability of Synthetic Phenethyl Alcohol

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Lifestyle and Culture Drives Coffee Market in Italy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Coffee Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole-Bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Coffee Pods and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarket/Hypermarket

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Specialist Retailers

- 5.2.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Italy Coffee Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Italy Coffee Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Italy Coffee Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Italy Coffee Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Italy Coffee Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Europe Italy Coffee Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Gruppo Illy SpA (Illycaffè S p A )

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Casa del Caffe' Vergnano S p A

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Caffè Trombetta S p A

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Italmobiliare S p A (Caffè Borbone)

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Massimo Zanetti Industries S A

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Luigi Lavazza S p A

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Starbucks Corporation*List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Kimbo S p A

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Maxingvest AG (Tchibo GmbH)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Gruppo Gimoka S p a

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Nestlé S A

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Gruppo Illy SpA (Illycaffè S p A )

List of Figures

- Figure 1: Italy Coffee Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Coffee Industry Share (%) by Company 2024

List of Tables

- Table 1: Italy Coffee Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Coffee Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Italy Coffee Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Italy Coffee Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Italy Coffee Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Italy Coffee Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Italy Coffee Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Italy Coffee Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Italy Coffee Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Italy Coffee Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Italy Coffee Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Coffee Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Italy Coffee Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Italy Coffee Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Coffee Industry?

The projected CAGR is approximately 3.35%.

2. Which companies are prominent players in the Italy Coffee Industry?

Key companies in the market include Gruppo Illy SpA (Illycaffè S p A ), Casa del Caffe' Vergnano S p A, Caffè Trombetta S p A, Italmobiliare S p A (Caffè Borbone), Massimo Zanetti Industries S A, Luigi Lavazza S p A, Starbucks Corporation*List Not Exhaustive, Kimbo S p A, Maxingvest AG (Tchibo GmbH), Gruppo Gimoka S p a, Nestlé S A.

3. What are the main segments of the Italy Coffee Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Low Price and Easy Availability of Synthetic Phenethyl Alcohol.

6. What are the notable trends driving market growth?

Lifestyle and Culture Drives Coffee Market in Italy.

7. Are there any restraints impacting market growth?

Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

In January 2022, Starbucks inaugurated its first drive-thru in Italy in Erbusco, Lombardy, as part of a new collaboration between Percassi, Starbucks' sole licensee partner in Italy, and the Q8 service station company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Coffee Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Coffee Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Coffee Industry?

To stay informed about further developments, trends, and reports in the Italy Coffee Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence